ETC Group Crypto Minutes Week #26

Market prices for crypto might show the sector in a lull, but deal activity on the private side is absolutely exploding

Market prices for crypto might show the sector in a lull, but deal activity on the private side is absolutely exploding

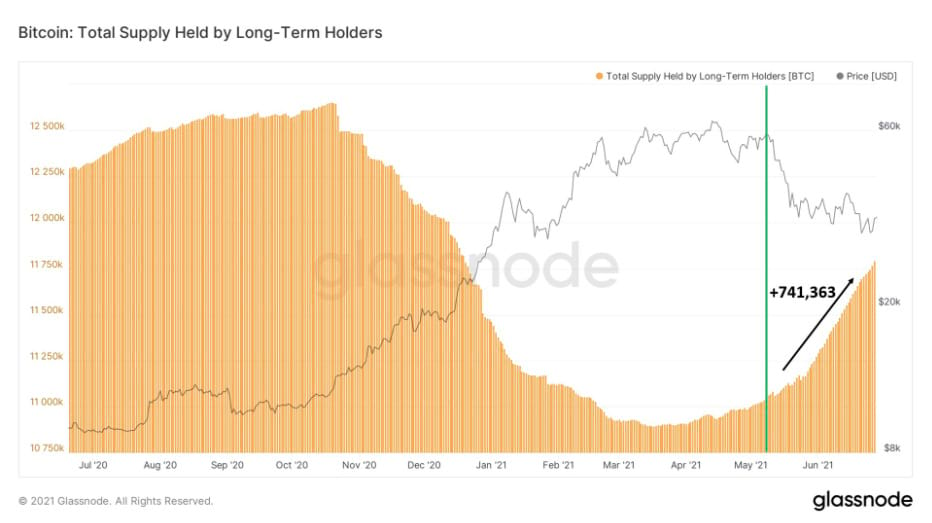

Figures produced by blockchain analytics firm Glassnode show that long-term Bitcoin holders have added substantial sums of BTC since markets dropped by nearly half since the middle of April 2021.

This suggests that investor dollar-cost (or pound-cost, or euro-cost) averaging into the world’s largest cryptocurrency has intensified, not weakened after its fall from the heady all time highs of $64,181.

Long-term holders added 741,363 BTC (~$21.1bn) to their holdings since the initial price drawdown in April. Glassnode, incidentally, classifies a Long Term Holder as an address which has not spent its bitcoin within 155 days.

Bitcoin is cheap and Long-Term BTC Holders know it.

— William Clemente III (@WClementeIII) June 28, 2021

They've added 741,363 BTC to their holdings since the initial price drawdown in late May.

*note: some of this is STHs aging into LTHs pic.twitter.com/1PfiHotjOK

For context, Bitcoin breached $30,000 for the first time in its history on 2 January 2021. The cryptocurrency broke through the $20,000 barrier for the first time on 16 December 2020.

The 2021 bull run has dwarfed 2017, which was Bitcoin’s first real exposure to the mainstream.

Market prices might show the sector in a lull, but deal activity on the private side is absolutely exploding. This week, Andreessen Horowitz (a16z) launched a $2.2bn fund to invest in cryptoassets and startups in the space.

Early reports suggested a16z was targeting a $2bn total for Crypto Fund III — by far the largest on record and an absolutely massive capital accumulation — but the final figure still came in a 10% over that mark.

For reference, the venture giant’s last major investment was Crypto Fund II, launched in April 2020, and extended to $515m. So this announcement more than quadruples a16z’s total investment just 12 months on.

We believe that the next wave of computing innovation will be driven by crypto. We are radically optimistic about crypto’s potential to restore trust and enable new kinds of governance…The history of crypto shows that asset prices may fluctuate but innovation continues to increase through each cycle. The size of this fund speaks to the size of the opportunity before us: crypto is not only the future of finance but, as with the internet in the early days, is poised to transform all aspects of our lives. Chris Dixon, Katie Haun, Ali Yahya, a16z Crypto Fund III announcement

As per usual, we don’t look to spot prices or retail to tell us where the space is headed. We look to the deal-makers, the movers and the shakers: those putting their hands in their pockets and finding billions to build infrastructure.

Bloomberg reported how the investment figures stacked up against previous years, as cash cascades into the space. According to Pitchbook data, VC funds have already put $17bn into crypto companies so far in 2021.

For a sense of how big everything crypto has become, you can, of course, just take a look at coin and token prices. But for a more stable measure of the industry’s growth, consider this: venture capital funds have already poured $17bn this year into companies that operate in the space. Brandon Kochkodin, Bloomberg Crypto

This is by far the most invested in a single year, and almost equal to the total raised in all previous years combined.

The largest deal, of course, runs back to May 2021 when a new $10bn capital raise by the likes of billionaires Peter Thiel and Alan Howard, along with Galaxy Digital and Nomura, backed Bullish Global, a cryptoasset exchange with a focus on DeFi.

That 11-figure sum is the largest raise in industry history, according to the Financial Times.

I’m of the opinion that everyone will own crypto, it’s just a matter of what price they get in. We’re still at the protocol phase, we know that there’s something here, you just can’t picture what it’ll exactly look like. Ian Rogers, Chief Experience Officer, Ledger

Hardware wallet producer Ledger had the second-largest raise of the year, with $380m added by backers led by Connecticut’s 10T Holdings.

And even ignoring the $10bn raise, the remaining $7.2bn that has flowed into the space in VC funds would already be on par with the previous record of $7.4bn raised in 2018, with six months still to go in the year, Bloomberg noted.

Former chief of the US federal bank regulator, Brian Brooks, always had a tough job on his hands when he switched from poacher to gamekeeper, turning away from government to private enterprise to become the head of Binance US.

Binance is one of the world’s largest retail cryptocurrency exchanges by trading volume, as it repeatedly points out. It has bought out industry-standard data provider CoinmarketCap.com on its quest for world domination. And the Cayman Islands-registered business that started in China has been running trading services across the globe without the explicit permission of regulators.

The strategy of ‘ask for forgiveness, not permission’ works well — until it doesn’t. Then all hell breaks loose.

Still, it was something of a shock to see the UK market watchdog, the Financial Conduct Authority, slap an explicit ban on Binance this week. The regulator noted:

The Binance Group appear to be offering UK customers a range of products and services via...Binance.com. Binance Markets Limited is not currently permitted to undertake any regulated activities without the prior written consent of the FCA. No other entity in the Binance Group holds any form of authorisation, registration or licence to conduct regulated activity in the UK. FCA, 26 June 2021

UK Binance customers have been blocked from making cash withdrawals after the exchange suspended the use of Faster Payments, The Telegraph reported on 29 June. Faster Payments is a convenient and popular fiat-to-crypto on-ramp. It is a UK fintech innovation and one the major payment channels used by banks to process near-instant payments.

These legal grey areas have been very lucrative for Binance to date, as it grows market share without taking on the legal (and some might say moral) costs of running a regulated exchange offering. ETPs and ETFs, by contrast, tend to be listed on regulated exchanges, with permission from powerful financial regulators, and contain all the standard legal protections for investors you might expect.

Japan’s Financial Services Authority also issued a warning to Binance this week that it was providing financial services to Japanese citizens without authorisation. Days later, Binance announced it would pull out of offering services in Canada’s highest-population province of Ontario, after the regulator accused exchanges like Poloniex, Kucoin and Bybit of breaking securities laws.

Earlier in June, Binance lost the services of crypto-friendly Silvergate Bank amid wider reports by Bloomberg that the company was subject to a joint probe by the US tax authority, the Commodity Futures Trading Commission, and the Department of Justice.

Yes, Bitcoin and cryptoassets are supra-national. By definition, they are cross-border assets. But this does not mean that entities that offer investment products in cryptoassets, and yet spend multiple years avoiding their responsibilities and evading regulators, will go unpunished.

BTC/USD

An 8.1% dip to a $28,759 intraday low represents the cheapest price point that Bitcoin has seen since 4 January. This, in itself, proved a catalyst for a momentum shift for BTC/USD, as traders shrugged off downwards impetus, capitalising on stronger buying. After a strong reaction to this lower low, and a second dip, possibly from short-term profit-taking, prices then climbed steadily throughout the rest of the week to retake first $30,000, then key support at $32,000 and on beyond $35,000. By the end of the week, Bitcoin had added nearly $8,000 at a 26.6% lift from its lows. All eyes are now on whether Bitcoin retests support/resistance at the $37,500 mark.

ETH/USD

Beginning at $1,856.29, Ether showed a clear rejection of an intraday dip 8.3% lower at $1,701, following a more bullish higher lows-higher highs pattern as the trading week went on. A straight four-day gain cycle took ETH up to $2,235.59, and 20.4% shift to the positive and a full 31.4% peak above the week’s low point.

LTC/USD

Of the three main cryptoassets covered here, Litecoin has struggled the most to regain the kinds of daily price points it was posting earlier this year. LTC did not, however, miss out on what appeared to be wider market optimism returning, as the payments coin slipped less than ETH or BTC against the US dollar in naked percentage terms. Its resurgence, just shy of $150 to end the week, represents a 24.3% seven-day overall gain, and an endpoint over 42.2% from its lows.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.