ETC Group Crypto Minutes Week #26

Market prices for crypto might show the sector in a lull, but deal activity on the private side is absolutely exploding

Market prices for crypto might show the sector in a lull, but deal activity on the private side is absolutely exploding

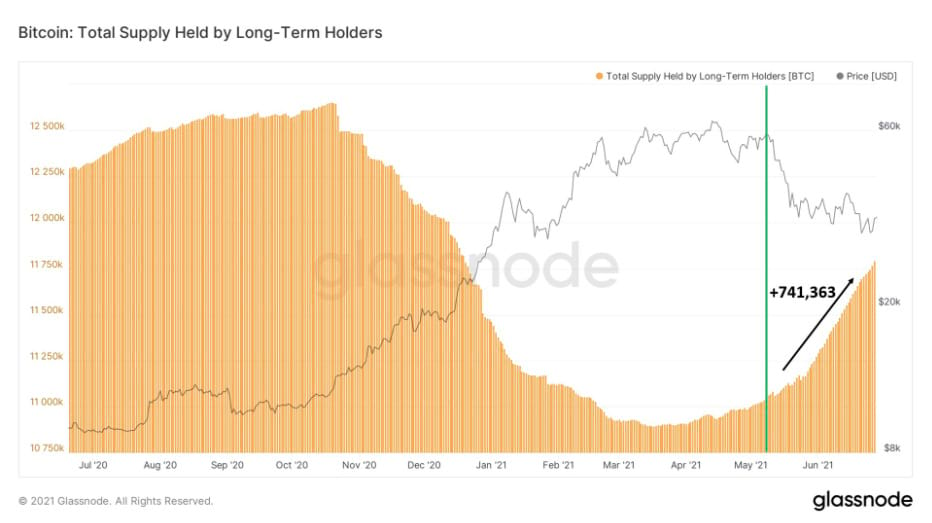

Figures produced by blockchain analytics firm Glassnode show that long-term Bitcoin holders have added substantial sums of BTC since markets dropped by nearly half since the middle of April 2021.

This suggests that investor dollar-cost (or pound-cost, or euro-cost) averaging into the world’s largest cryptocurrency has intensified, not weakened after its fall from the heady all time highs of $64,181.

Long-term holders added 741,363 BTC (~$21.1bn) to their holdings since the initial price drawdown in April. Glassnode, incidentally, classifies a Long Term Holder as an address which has not spent its bitcoin within 155 days.

Bitcoin is cheap and Long-Term BTC Holders know it.

— William Clemente III (@WClementeIII) June 28, 2021

They've added 741,363 BTC to their holdings since the initial price drawdown in late May.

*note: some of this is STHs aging into LTHs pic.twitter.com/1PfiHotjOK

For context, Bitcoin breached $30,000 for the first time in its history on 2 January 2021. The cryptocurrency broke through the $20,000 barrier for the first time on 16 December 2020.

The 2021 bull run has dwarfed 2017, which was Bitcoin’s first real exposure to the mainstream.

Market prices might show the sector in a lull, but deal activity on the private side is absolutely exploding. This week, Andreessen Horowitz (a16z) launched a $2.2bn fund to invest in cryptoassets and startups in the space.

Early reports suggested a16z was targeting a $2bn total for Crypto Fund III — by far the largest on record and an absolutely massive capital accumulation — but the final figure still came in a 10% over that mark.

For reference, the venture giant’s last major investment was Crypto Fund II, launched in April 2020, and extended to $515m. So this announcement more than quadruples a16z’s total investment just 12 months on.

We believe that the next wave of computing innovation will be driven by crypto. We are radically optimistic about crypto’s potential to restore trust and enable new kinds of governance…The history of crypto shows that asset prices may fluctuate but innovation continues to increase through each cycle. The size of this fund speaks to the size of the opportunity before us: crypto is not only the future of finance but, as with the internet in the early days, is poised to transform all aspects of our lives. Chris Dixon, Katie Haun, Ali Yahya, a16z Crypto Fund III announcement

As per usual, we don’t look to spot prices or retail to tell us where the space is headed. We look to the deal-makers, the movers and the shakers: those putting their hands in their pockets and finding billions to build infrastructure.

Bloomberg reported how the investment figures stacked up against previous years, as cash cascades into the space. According to Pitchbook data, VC funds have already put $17bn into crypto companies so far in 2021.

For a sense of how big everything crypto has become, you can, of course, just take a look at coin and token prices. But for a more stable measure of the industry’s growth, consider this: venture capital funds have already poured $17bn this year into companies that operate in the space. Brandon Kochkodin, Bloomberg Crypto

This is by far the most invested in a single year, and almost equal to the total raised in all previous years combined.

The largest deal, of course, runs back to May 2021 when a new $10bn capital raise by the likes of billionaires Peter Thiel and Alan Howard, along with Galaxy Digital and Nomura, backed Bullish Global, a cryptoasset exchange with a focus on DeFi.

That 11-figure sum is the largest raise in industry history, according to the Financial Times.

I’m of the opinion that everyone will own crypto, it’s just a matter of what price they get in. We’re still at the protocol phase, we know that there’s something here, you just can’t picture what it’ll exactly look like. Ian Rogers, Chief Experience Officer, Ledger

Hardware wallet producer Ledger had the second-largest raise of the year, with $380m added by backers led by Connecticut’s 10T Holdings.

And even ignoring the $10bn raise, the remaining $7.2bn that has flowed into the space in VC funds would already be on par with the previous record of $7.4bn raised in 2018, with six months still to go in the year, Bloomberg noted.

Former chief of the US federal bank regulator, Brian Brooks, always had a tough job on his hands when he switched from poacher to gamekeeper, turning away from government to private enterprise to become the head of Binance US.

Binance is one of the world’s largest retail cryptocurrency exchanges by trading volume, as it repeatedly points out. It has bought out industry-standard data provider CoinmarketCap.com on its quest for world domination. And the Cayman Islands-registered business that started in China has been running trading services across the globe without the explicit permission of regulators.

The strategy of ‘ask for forgiveness, not permission’ works well — until it doesn’t. Then all hell breaks loose.

Still, it was something of a shock to see the UK market watchdog, the Financial Conduct Authority, slap an explicit ban on Binance this week. The regulator noted:

The Binance Group appear to be offering UK customers a range of products and services via...Binance.com. Binance Markets Limited is not currently permitted to undertake any regulated activities without the prior written consent of the FCA. No other entity in the Binance Group holds any form of authorisation, registration or licence to conduct regulated activity in the UK. FCA, 26 June 2021

UK Binance customers have been blocked from making cash withdrawals after the exchange suspended the use of Faster Payments, The Telegraph reported on 29 June. Faster Payments is a convenient and popular fiat-to-crypto on-ramp. It is a UK fintech innovation and one the major payment channels used by banks to process near-instant payments.

These legal grey areas have been very lucrative for Binance to date, as it grows market share without taking on the legal (and some might say moral) costs of running a regulated exchange offering. ETPs and ETFs, by contrast, tend to be listed on regulated exchanges, with permission from powerful financial regulators, and contain all the standard legal protections for investors you might expect.

Japan’s Financial Services Authority also issued a warning to Binance this week that it was providing financial services to Japanese citizens without authorisation. Days later, Binance announced it would pull out of offering services in Canada’s highest-population province of Ontario, after the regulator accused exchanges like Poloniex, Kucoin and Bybit of breaking securities laws.

Earlier in June, Binance lost the services of crypto-friendly Silvergate Bank amid wider reports by Bloomberg that the company was subject to a joint probe by the US tax authority, the Commodity Futures Trading Commission, and the Department of Justice.

Yes, Bitcoin and cryptoassets are supra-national. By definition, they are cross-border assets. But this does not mean that entities that offer investment products in cryptoassets, and yet spend multiple years avoiding their responsibilities and evading regulators, will go unpunished.

BTC/USD

An 8.1% dip to a $28,759 intraday low represents the cheapest price point that Bitcoin has seen since 4 January. This, in itself, proved a catalyst for a momentum shift for BTC/USD, as traders shrugged off downwards impetus, capitalising on stronger buying. After a strong reaction to this lower low, and a second dip, possibly from short-term profit-taking, prices then climbed steadily throughout the rest of the week to retake first $30,000, then key support at $32,000 and on beyond $35,000. By the end of the week, Bitcoin had added nearly $8,000 at a 26.6% lift from its lows. All eyes are now on whether Bitcoin retests support/resistance at the $37,500 mark.

ETH/USD

Beginning at $1,856.29, Ether showed a clear rejection of an intraday dip 8.3% lower at $1,701, following a more bullish higher lows-higher highs pattern as the trading week went on. A straight four-day gain cycle took ETH up to $2,235.59, and 20.4% shift to the positive and a full 31.4% peak above the week’s low point.

LTC/USD

Of the three main cryptoassets covered here, Litecoin has struggled the most to regain the kinds of daily price points it was posting earlier this year. LTC did not, however, miss out on what appeared to be wider market optimism returning, as the payments coin slipped less than ETH or BTC against the US dollar in naked percentage terms. Its resurgence, just shy of $150 to end the week, represents a 24.3% seven-day overall gain, and an endpoint over 42.2% from its lows.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

Bitwise est l'un des leaders mondiaux dans la gestion de crypto-actifs. Des milliers de conseillers financiers, de family offices et d'investisseurs institutionnels globaux se sont associés à nous pour saisir et exploiter les opportunités offertes par les crypto-monnaies. Depuis 2017, Bitwise affiche un palmarès impressionnant en matière de gestion de solutions indicielles et actives pour les ETP, les comptes gérés séparés, les fonds privés et les stratégies de hedge funds, tant aux États-Unis qu'en Europe.

En Europe, Bitwise (anciennement ETC Group) a développé au cours des quatre dernières années l'une des familles de produits crypto-ETP les plus vastes et les plus innovantes, dont le plus grand et le plus liquide ETP Bitcoin d'Europe.

Cette offre de produits crypto-ETP est domiciliée en Allemagne et autorisée par la BaFin. Nous travaillons exclusivement avec des entreprises réputées du secteur financier traditionnel et veillons à ce que 100 % des actifs soient stockés en toute sécurité hors ligne (cold storage) chez des dépositaires réglementés.

Nos produits européens comprennent une gamme d'instruments financiers soigneusement structurés qui s'intègrent parfaitement dans tout portefeuille professionnel et offrent une exposition globale à la classe d'actifs crypto. L'accès est simple via les principales bourses européennes, avec une cotation principale sur Xetra, la bourse la plus liquide pour le négoce d'ETF en Europe. Les investisseurs privés bénéficient d'un accès facile via de nombreux courtiers DIY, en combinaison avec notre structure ETP physique robuste et sûre, qui comprend également une fonction de paiement.