ETC Group Crypto Minutes Week #19

Inflows to digital asset ETPs topped $373m last week, as inflation concerns rippled through the market and pointed high-net-worth and institutional investors to bitcoin, ether and litecoin ETPs

Inflows to digital asset ETPs topped $373m last week, as inflation concerns rippled through the market and pointed high-net-worth and institutional investors to bitcoin, ether and litecoin ETPs

It has been difficult to focus on much more than the Ethereum price this week, given how the smart contract blockchain has boomed in the last seven days, showing irrepressible strength and leaving the rest of the market scrambling in its wake.

February's burst through $2,000 was a serious marker laid down by the programmable money blockchain, followed by its first ever breach of $3,000 on 3 May. That ETH is now holding steady above $4,000 is entirely new territory.

With only two months to go until the scheduled London hard fork that will implement a new deflationary structure for the ETH currency, it is perhaps not surprising that institutions are looking to increase their exposure. The supply constraints imposed by DeFi also appear to be contributing to this dizzying rally. After several weeks of faster growth the total value locked in DeFi contracts as recorded by DeFiPulse is now approaching $100bn.

As we note in our research report Valuing Ethereum, Vitalik Buterin's cryptoasset achieved a $200bn valuation in just six years: Bitcoin took eight years to reach this point. And now, with a market cap approaching half a billion dollars, Ethereum is worth more than Siemens (ETR: SIE),Shopify (NYSE: SHOP), and Astrazeneca (LSE: AZN) combined.

If it were a traditional publicly traded company, Ethereum would be the 14th largest in the world, snapping at the valuation heels of JP Morgan Chase (NYSE: JPM) and Visa(NYSE: V).

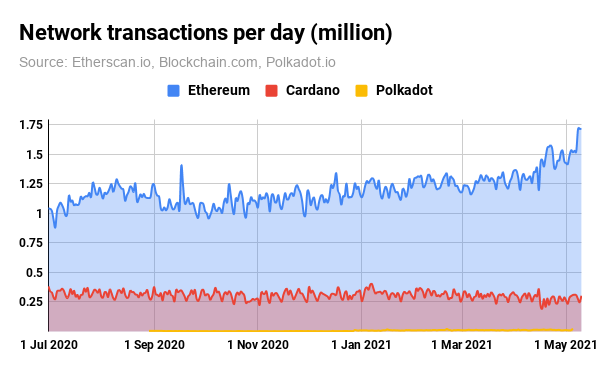

The attention on Ethereum has been intense in recent days, with daily transactions hitting a 1.7 million per-day all-time high.

Compare that figure to two other self-styled 'Ethereum-killers' gunning for the title of the best smart contract blockchain.

On one side is the $55bn-rated Cardano, the seventh-largest blockchain by market cap, and on the other is the highly-touted $32bn interoperability blockchain Polkadot. Both these self-styled rivals have Ethereum co-founders as their lead.

But the narrative unwinds somewhat when we look at their actual utility. Polkadot, for its part, is high on promise but low on delivery as yet, and with average daily transactions since its 2020 launch of 10,000-15,000, isn't really in the same universe.

News of increasingly costly exploits on the Binance Smart Chain blockchain may have helped reinforce the security message to institutions interested in DeFi, too.

Binance's Uniswap clone Uranium Finance suffered a breach and irretrievable loss of $50m in late April, according to Coindesk. Days later the BSC-based decentralised synthetic asset protocol Spartan was hacked for more than $30m, according to a Medium post by cybersecurity analysts Peckshield.

Inflows to digital asset ETPs topped $373m last week, as inflation concerns rippled through the market and pointed high-net-worth and institutional investors to bitcoin, ether and litecoin ETPs.

Inflation-watchers need only look at China's factory gate prices, which this month climbed at the fastest speed in more than three years, after being stuck in negative territory for much of 2020.

The country's producer price index, a measure of industrial profitability, surged 6.8% in April, driven by higher commodity prices, according to Reuters and the South China Morning Post. The index has long been seen as a harbinger of prices to come.

And as we hit Tuesday 10 May, world stock markets were on track for their worst day of 2021. A general retracement in tech stocks, paired with these inflation concerns, saw indices slide across the board. The FTSE 100 dipped more than 2%, Japan's Nikkei fell 3% and the Stoxx 600 was down 2% in mid-morning trading following the Nasdaq's 2.6% dive on Monday 9 May

Analysts suggested the sell down in equities was long overdue, after surging post-Covid optimism caused weeks of relentless bid-up price action.

Global equities have suffered an ugly shift in sentiment after US stocks declined sharply, led by the tech-heavy Nasdaq 100 index, which suffered one of its worst sessions this year and closed at is lowest in over a month. The weak sentiment spilled over into Asia, with the Nikkei declining sharply towards major support. Russ Mould, investment director, AJ Bell

One of the few US tech stocks to beat the drop was big data analytics provider Palantir (NYSE: PLTR). Peter Thiel's firm climbed not so much from its Q1 reported earnings, which met Wall Street expectations, but the reveal that it now accepts bitcoin and plans to join the growing list of multinationals to add the cryptoasset to its balance sheet.

Overall market movements were generally bullish this week, with 37 of the top 50 coins (excluding stablecoins) generating a positive weekly performance. A handful of heavily-hyped altcoins in the lower-end of this market cap list lost out, however, while large-cap altcoins Ethereum and Litecoin continued to extend their 2021 outperformance.

With the overriding focus on Ethereum, Bitcoin had a rather quiet week and remained largely flat, trading in a fairly tight range from a low of $53006.74. The largest cryptoasset by market cap clung on to its $1trn+ valuation, but failed to climb further and was soundly rejected just south of $60,000. Overall it gained just 2.62%.

BTC/USD

Ethereum took the prize for the most talked-about asset of the week, scoring a 33% rise before falling back from its new record high of $4209.22.

ETH/USD

Litecoin too added strength in depth with it's rise peaking at 53.18% midweek, topping out 10.62% beyond its previous all time high from December 2017 of $372. The payments blockchain could not hold on to all of its gains, edging back a little to finish the week at $374.66.

LTC/USD

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.