Ethereum hitting new highs

While much investor interest in cryptoassets to date has been hyper-focused on Bitcoin, it is the second largest cryptoasset by market cap and daily trading volume, Ethereum, that is now attracting greater attention.

While much investor interest in cryptoassets to date has been hyper-focused on Bitcoin, it is the second largest cryptoasset by market cap and daily trading volume, Ethereum, that is now attracting greater attention.

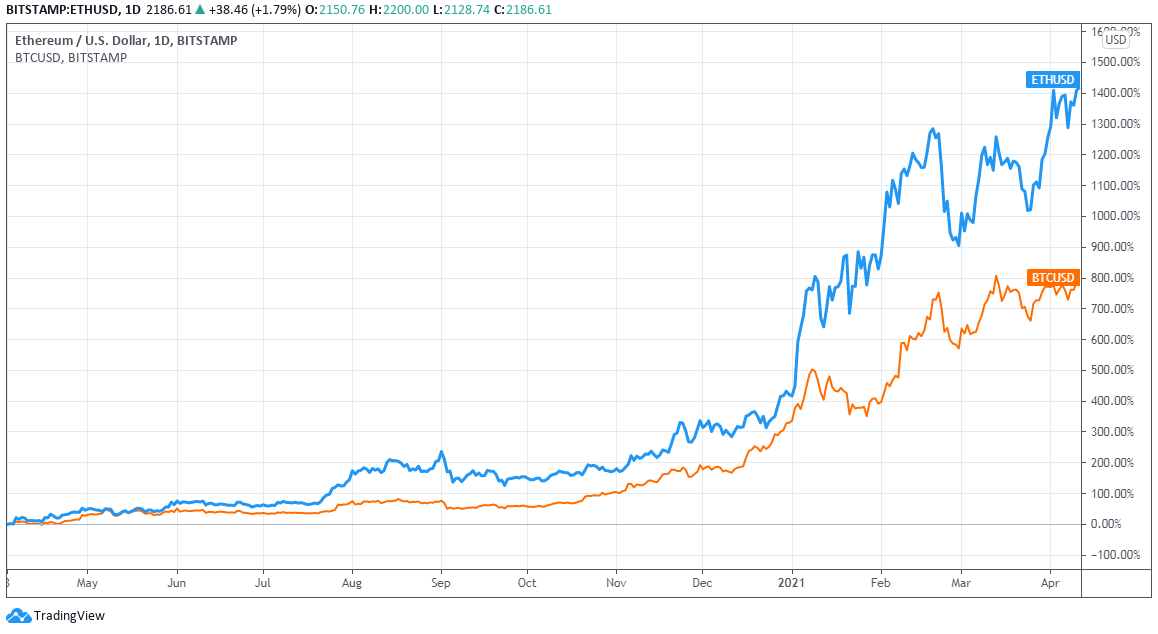

Over the last year, from April 2020 to April 2021, ETH/USD has outperformed BTC/USD by a significant margin. BTC returned 785.38% against the US dollar, while ETH/USD has returned 1,425.21%.

And in the last few days, Ether has seen its price reach a new all-time high of $2,197 following Visa's decision to allow cryptocurrency for transactions on its platform.

Ethereum uses a native currency called Ether (ETH) which can be transferred or traded just like bitcoin (BTC). But the true genius of Ethereum is that it is not simply another Bitcoin clone. The growing conviction around Ethereum as an asset class relies on its utility.

Ethereum’s broad practical application as a foundational computing framework means that investors are now looking to Ethereum as a potentially more valuable asset to track.

The launch of cash-settled ETH futures by CME Group on 8 February 2021 also points to a maturing market with ETH traded by institutions as any other common asset class, alongside gold, BTC or commodity metals. Commenting on the launch, CME Group’s global head of equity index and alternative investment products Tim McCourt said:

Based on increasing client demand and robust growth in our Bitcoin futures and options markets, we believe the addition of Ether futures will provide our clients with a valuable tool to trade and hedge this growing cryptocurrency.

In terms of the technology, we can think of Ethereum’s blockchain as a base layer upon which a whole host of computing functions and programmes can be built. The key analogy here is that of the TCP/IP tech stack that underpinned the creation of the internet, along with all the various protocols that were built on top of it.

The initial infrastructure of TCP/IP, created in 1983, allowed for computers to be networked and linked together. Later protocols like IMAP (created in 1986) and HTTP (created in 1991) were built to sit on top of this base layer, allowing for world-changing applications like email and interlinked website pages.

In the same way, Ethereum’s blockchain is the foundation layer upon which innovative financial applications are created. And it is responsible for all of today’s fastest-growth niche cryptoasset markets: namely decentralised finance (DeFi) and non-fungible tokens (NFT). These applications are powered by Ethereum’s smart contracts, which are self-executing pieces of code which complete when a certain set of conditions are met.

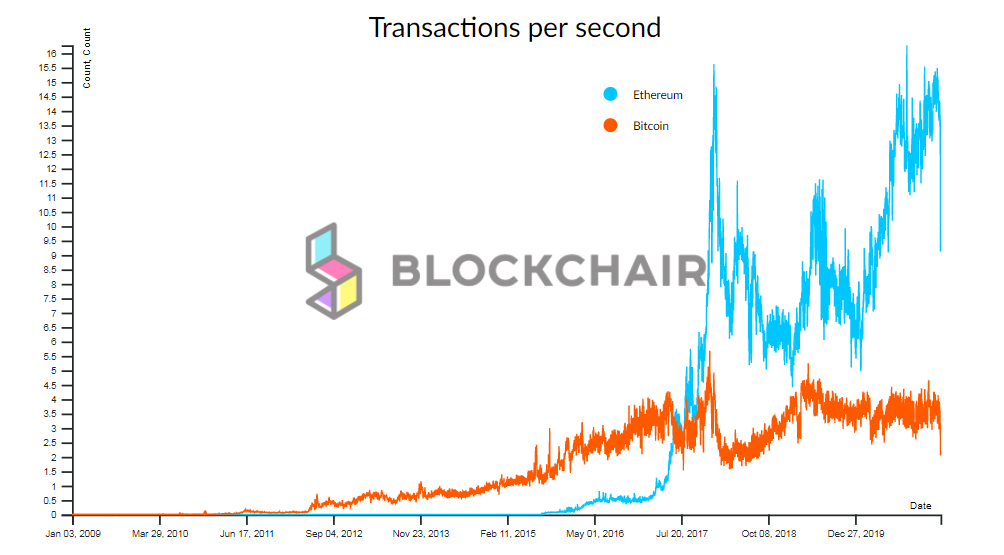

And while Bitcoin’s code is relatively inflexible, Ethereum is subject to regular ongoing development, meaning its use cases can expand and react to innovation. Metrics like improved transactions per second (Tx/s) are one way to track this. According to on-chain analytics site Blockchair, while Bitcoin has remained mostly static at an average of 3.2Tx/s since 2018, over the same time period Ethereum has improved its Tx/s from 4Tx/s to 14Tx/s.

As the number and breadth of Ethereum’s use cases grow, and its adoption continues, this too drives demand for the network’s ETH currency.

2017 was arguably the year that cryptoassets crossed over into the mainstream, and while most market attention was focused on BTC, which increased 14x across the year, ETH’s price performance was significantly greater, rising 100x.

In the 12 months from April 2020 to April 2021, BTC returned 785.38% against the US dollar, while ETH/USD has returned 1,425.21%. Here we use the price reference data from Luxembourg cryptoexchange Bitstamp, one of five exchanges upon whose data the Bitcoin Reference Rate (BRR) is compiled. The BRR is a registered benchmark under the 2016 European Benchmarks Regulation and powers CME Group’s Bitcoin futures contracts.

The utility of the Ethereum network, its developer-friendly programming language Solidity, its smart contracts (see below) and use case as a basis for almost all decentralised financial applications are largely responsible for the growth of the wider cryptoasset market.

Institutional investors are now demanding regulated crypto products that are secure, liquid and central counterparty cleared and ETC Group is building products that adhere to the complex and exacting standards of the institutional investor. Bradley Duke, CEO, ETC Group

Instead of creating a novel form of digital money, like Bitcoin, Ethereum’s raison d’etre is to be used for programming new applications, backed by smart contracts. Smart contracts refers to a set of promises written out in code, which are irreversible once conditions are met, and allow two parties to come to an agreement automatically, without the need for third party verification

As the Ethereum Foundation describes:

Any program that runs on the Ethereum Virtual Machine is commonly referred to as a smart contract.

Most smart contracts are written using Ethereum’s Solidity programming language, which was inspired by C++, Python and Javascript.

The technology actually pre-dates the invention of cryptocurrency by around 15 years: computer scientist Nick Szabo coined the term in 1994. But it is the addition of recording smart contracts on an immutable and tamper-resistant distributed ledger like blockchain that has seen the technology really come to prominence. Ethereum was the first to allow anyone to write and distribute sophisticated smart contracts on a blockchain.

Since its creation in 2015 Ethereum has birthed several niche subsectors that have changed the retail utility of blockchain and cryptoassets. The most popular of these is DeFi, which could accurately be called the first truly mass-market application for Ethereum. It allows users to lend or borrow funds and crucially, earn interest on their cryptoassets. Before DeFi, crypto could accurately be called a non-yielding asset like gold. Through DeFi, however, users can stake their cryptoassets on various platforms and earn an annual percentage back in return.

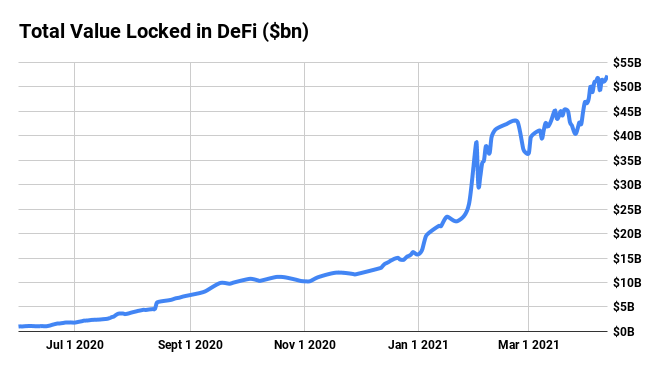

Virtually all — 79 out of the 80 largest — DeFi marketplaces are built on Ethereum, ranging from options and futures markets to asset staking and decentralised exchanges, and they are climbing in value.

The main metric used to determine market size is the ‘Total Value Locked’ in DeFi smart contracts, as recorded by industry data site DeFiPulse.com.

Since crossing the $1bn-mark in late June 2020, the market has grown 50 times larger, surpassing $52.3bn by 12 April 2021. DeFi tokens like Aave (AAVE), Uniswap (UNI) and Cosmos (ATOM) have quickly risen into the top 30 list of the world’s most valuable crypto projects.

Another fast-growth retail market that uses Ethereum’s system of smart contracts triggering predefined agreements are ‘non-fungible tokens’ or NFTs. Fungibility is one of the key properties of money, in that one unit of currency is interchangeable for any other identical unit. Non-fungible tokens, by contrast, represent an individual and unique claim on a physical asset like an artwork, the ownership record for the piece of real estate or a digital collectible property, for example. In February 2021 Christie’s became the first recognised auction house to sell digital art with ownership represented by NFT tokens recorded on the Ethereum blockchain.

Encoded in the terms of the smart contract was the stipulation that the artist’s heirs would receive 10% of any future value transfer.

Speaking to Art Market Monitor, Noah Davis, a specialist in post-war and contemporary art said:

We’re still at the very infancy of how this technology is going to impact the art world. We’re at this moment in time where there could be a drastic shift - a demographic shift, a generational shift. Christie’s as an organization is really excited about a moment in time where you see $3.5 million of sales just organically appear out of thin air. That’s something we want to capitalize on.

Market data site nonfungible.com recorded that by March 2021 NFT trading volume had surpassed 21,000ETH (~$38.3m) per week. This wide-scale usage, and the exponential growth of both DeFi and NFT helps to boost the viability and longevity of Ethereum’s network.

Smart contracts with values recorded on the Ethereum blockchain underpin both markets, but the use cases for smart contracts have expanded far beyond finance to nearly every other industry from agriculture to healthcare. The determination of internationally recognised ISO standards for blockchain has helped the industry to mature, with a report published by the ISO through Technical Committee 307 (Blockchain and Distributed Ledger Technologies) describing the functions of smart contracts and how they interact with one another. This will be the basis for a future Technical Specification.

Smart contracts themselves are also becoming part of the legal fabric of world economies, with clear regulatory boundaries helping to aid adoption.

Chinese courts have already started to implement smart contracts for automated case and outcome filing, for example. One other particularly significant ruling came in November 2019 when the UK’s Jurisdictional Taskforce confirmed the region’s key focus on financial services and technology, reporting that smart contracts were capable of satisfying valid contracts under English law. For the decision, this panel of senior barristers and solicitors sought advice from the Bank of England, Her Majesty’s Treasury, the Financial Conduct Authority, as well as clearinghouse Euroclear and the London Stock Exchange, noting in their opinion that smart contracts could be enforced in court and that cryptoassets formed property under law.

Announcing the decision, the Chancellor of the High Court, Sir Geoffrey Vos, said:

I believe that this morning is a watershed moment for English law and UK jurisdictions. The objective, of course, is to provide much needed market confidence and a degree of legal certainty as regards English common law in an area that is critical to the successful development of cryptoassets and smart contracts in the global financial services industry and beyond.

One of the largest recent signals of the value of Ethereum to modern applications is Amazon Web Services’ announcement that its Managed Blockchain now supports the technology. Ethereum is only the second blockchain after the IBM and Intel-backed Hyperledger Fabric to gain support from AWS.

AWS specifically cited DeFi as a major factor behind the decision.

[Ethereum] enables popular use cases such as decentralized finance (DeFi)...With this launch, AWS customers can easily provision Ethereum nodes in minutes and connect to the public Ethereum main network and test networks.... In addition to DeFi applications, customers building analytical products such as smart contract monitoring tools and fraud detection software can also benefit from this scalable, highly available, and fully managed Ethereum service.

It is this kind of mainstream technological support that will expand the Ethereum developer base and open up new applications for use cases in the Ethereum ecosystem.

Ethereum’s core development team are constantly proposing and enacting EIPs , or Ethereum Improvement Protocols, to make changes to how the blockchain runs, for example altering the UI to make it easier to use, upgrading its security, or removing bottlenecks to enhance its performance. In their functionality they are similar to patches or bugfixes in mainstream software applications.

The most consequential of these is EIP 1559. It does two very important things. Firstly, it greatly simplifies transaction fees, and secondly turns Ethereum from an inflationary asset into a deflationary one.

The cost of completing a transaction on Ethereum is called a ‘gas’ fee. These are paid in fractions of the ETH currency called ‘gwei’, a similar notation to how fractions of bitcoin are called ‘satoshis’.

Transaction fees have long been a source of contention for Ethereum users. Under periods of network congestion — more likely the more popular the blockchain’s use becomes — fees can rise as high as $30 per transaction. Fees this high make systems borderline unworkable for the average user. EIP 1559 switches the system away from a scenario where users pay a variable fee to miners to get their transactions recorded on the blockchain, which leaves gas fees subject to rising quickly under extreme demand.

Under EIP 1559, gas fees will instead be sent to the network in a new fee structure called a ‘basefee’, which is algorithmically controlled. This puts forward an easier-to-understand fee structure for users, and allows them to check if they are paying a fair fee or not.

Secondly, and more importantly, EIP 1559 ‘burns’ a small amount of ETH every time that the currency is used to pay transaction fees. In effect this creates a major shift in the way that users transact using Ethereum.

It is baked into the design of Bitcoin that new units of the cryptocurrency are created at a gradually decreasing rate. 86% of all the Bitcoin that will ever be created is already in existence, with a hard cap of 21 million BTC. Between now and 2140 approximately 2 million more BTC will be mined into existence, but at such a negligible rate that the money supply is effectively fixed from 2025 onwards.

The effect of EIP 1559, which is to be bundled into a set of upgrades due to come into force in July 2021, is to change Ethereum from an inflationary asset into a deflationary one, mimicking the value proposition of Bitcoin as a global hedge.

Alongside EIPs, Ethereum is currently in the first stages of a planned multi-year shift away from a ‘Proof of Work’ consensus algorithm, like that employed by Bitcoin, to a model called ‘Proof of Stake’.

The nature of the Proof of Work consensus mechanism — the method by which the Bitcoin network is secured — means that cryptoasset miners compete to validate blocks of transactions by using computing power to solve increasingly-difficult cryptographic tests.

But the unintended consequence of Bitcoin’s Proof of Work algorithm is its extreme energy requirement: as the popularity of the cryptoasset has grown, and the rewards for confirming transactions repeatedly reduced, miners are forced to run an ever-greater number of more powerful machines that can calculate vast reams of mathematical puzzles more quickly.

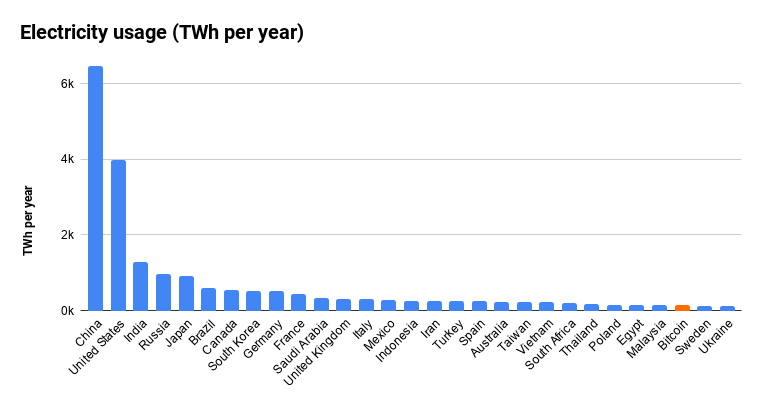

According to the Cambridge Centre for Alternative Finance, across 2019 the Bitcoin network consumed around 63.95 TWh of energy, and these figures have continued to grow sharply. By 12 April 2021, the Bitcoin network’s electricity consumption had more than doubled to 143.54TWh per year , making it more power-hungry than either Sweden (131.80TWh annual consumption) or Ukraine (128.806Twh). These figures are based on the latest available data from the US Energy Information Administration.

Georg Kamiya, writing for the International Energy Agency’s Bitcoin Energy Use: Mined the Gap report, explains:

The energy use of the Bitcoin network is...both a security feature and a side effect” of relying on Proof of Work. As the popular saying goes, it’s a feature, not a bug.

Because it removes miners from the equation and instead relies on validators who already own a stake in the cryptoasset they are seeking to secure, Proof of Stake effectively curtails this struggle for ever-greater computing power.

Ethereum’s switch away from intensive Proof of Work also matches up with ESG factors now playing an ever greater role in institutional investment decision making.

Ethereum’s transition to Proof of Stake began on 1 December 2020.

Ethereum’s development team decided that a minimum threshold of 524,288ETH should be staked in ETH 2.0 contracts before the process could start. As TheBlockCrypto reported on 10 February 2021, over 3 million ETH worth $5.3bn has now been locked into ETH 2.0 contracts, which will provide an approximate 23% return for stakers, with deposits able to be withdrawn during phase 1.5 scheduled for 2022.

As such, this represents a large vote of confidence in the medium-term future of Ethereum.

Among the inter-governmental organisations to spotlight Ethereum is the influential OECD. In a report prepared for and presented to the meeting of G20 finance minister and central bank governors on 14 October 2020, the authors write that the shift to Proof of Stake will help Ethereum to reduce its energy intensity, adding that focusing on securing the blockchain with staking instead of mining

could help to reduce energy use while also addressing scalability and latency issues.

At time of writing, ETH stands with a market cap of over $249bn with a per coin price of $2,150, just 2.1% shy of its all time high of $2,197 recorded in early trading on 12 April 2021.

Overall optimistic market sentiment continues to drive cryptoasset markets higher.

And while investment banks like JP Morgan and Citi have yet to make bullish multi-year price predictions for ETH in the same way as their widely-reported BTC targets of $146,000 and $318,000 , there are signals of growing support for ETH to breach fresh all-time highs.

According to the Bloomberg Intelligence (BI) Crypto Outlook report from February 2021 Ethereum’s outperformance of Bitcoin in 2020 was

indicative of the enduring nature of fintech in a world increasingly dominated by zero or negative rates and quantitative easing.

In the report Bloomberg senior commodity strategist Mike McGlone notes:

Ethereum is likely in the process of turning $1,000 resistance into support, as it did at about $100 in 2017...Ethereum appears in a similar advance phase as in 1Q17, which we believe makes it ripe for record highs.

In the longer term, peer-reviewed research is starting to collate striking differences between the way traders and investors treat bitcoin and ether. As a Singaporean research team assert in ‘Behavioural structure of users in cryptocurrency market’ published in the PLOS ONE journal on 12 January 2021:

While bitcoin has positioned itself as an alternative monetary system in the financial market, ethereum has mostly focused on monetising smart contracts...the behaviour of ethereum users is observed to be more stable as these users are more optimistic of the market. In contrast, the behaviour of the bitcoin users tend to fluctuate according to the trend of the market, with a loss of optimism when the market goes down.

Again, it is perhaps Ethereum’s wide-scale utility that supports this kind of long-term optimism.

Ethereum is newer than Bitcoin and its blockchain continues to undergo highly consequential system-wide transformation. Therefore, traditional methods to place value on Ethereum and its ETH currency remain in a constant state of flux. This brings with it risks, of course, but opportunities too.

Recent changes proposed in EIP 1559, and anticipation of the multi-year shift to ETH 2.0 have seen the Ether currency rebound to fresh all-time highs with market analysts now proposing near-term targets well above $2,000. The addition of major cross-sector support for Ethereum development by Amazon Web Services is perhaps one of the strongest signals yet that the asset has truly crossed over into the mainstream.

As such, today’s Ethereum is much improved from just a few years ago, in its usability, scalability and internal economics. And if investors can consider Ethereum not as a static asset, but as a constantly evolving base layer upon which scores of applications both financial and non-financial can be built, its true value case starts to become clear.

From its inception, Bitcoin took 8 years to amass a $200bn market capitalization. Ethereum has achieved that feat in less than 6. With its mass-market applications experiencing rapid growth, recent alterations creating a deflationary formula, and wider structural improvements on the horizon, it is not outside the realms of possibility that Ethereum’s market value could overtake that of Bitcoin in the long run.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

ETC Group has been created to provide investors with the tools to access the investment opportunities of the digital assets' and blockchain ecosystem. The company develops innovative digital asset-backed securities including ETC Group Physical Bitcoin (BTCE) and ETC Group Physical Ethereum (ZETH) which are listed on European exchanges including XETRA, Euronext, SIX, AQUIS UK and Wiener Börse.

With a track record of over three years, ETC Group is made up of an exceptional team of financial services professionals and entrepreneurs with experience spanning both digital assets and regulated markets. With product quality and safety at the core of our product creation approach, the company aims to continuously launch best-in-class institutional-grade exchange traded products.

As a company, ETC Group has previously launched BTCE - the world’s first centrally cleared Bitcoin exchange traded product on Deutsche Börse XETRA, the largest ETF trading venue in Europe, and also listed DA20, the world’s first crypto ETP tracking an MSCI index signalling a move towards investment management products. DA20 provides broad market exposure to investors by tracking an index of 20 cryptocurrencies which cover 85% of the total crypto market capitalisation.