- Bitcoin reaches its highest price since May 2022 on the back of ongoing ETF optimism; Grayscale’s NAV discount continues to narrow

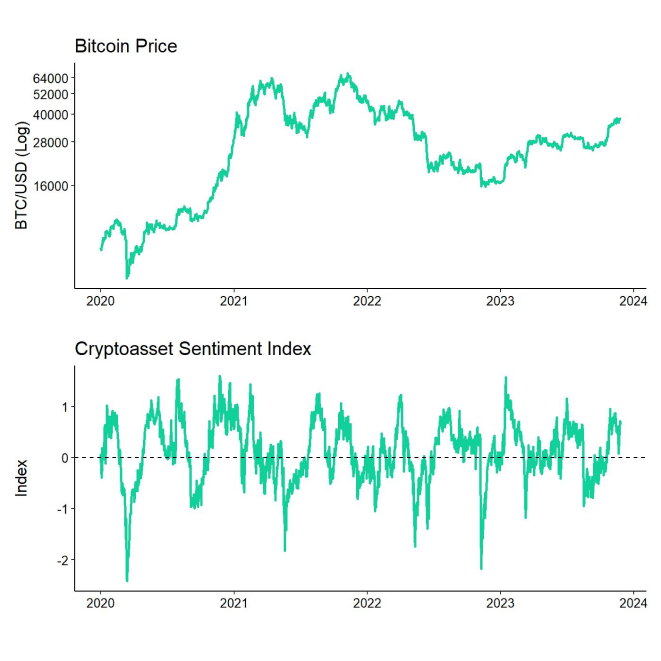

- Our in-house “Cryptoasset Sentiment Index” briefly declined but stays at elevated levels

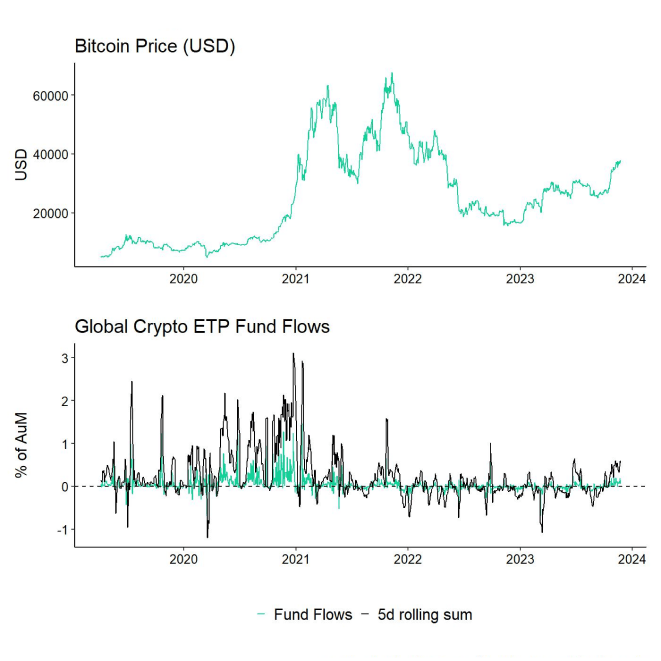

- Weekly global cryptoasset ETP net inflows reached the highest level year-to-date with over 300 mn USD last week

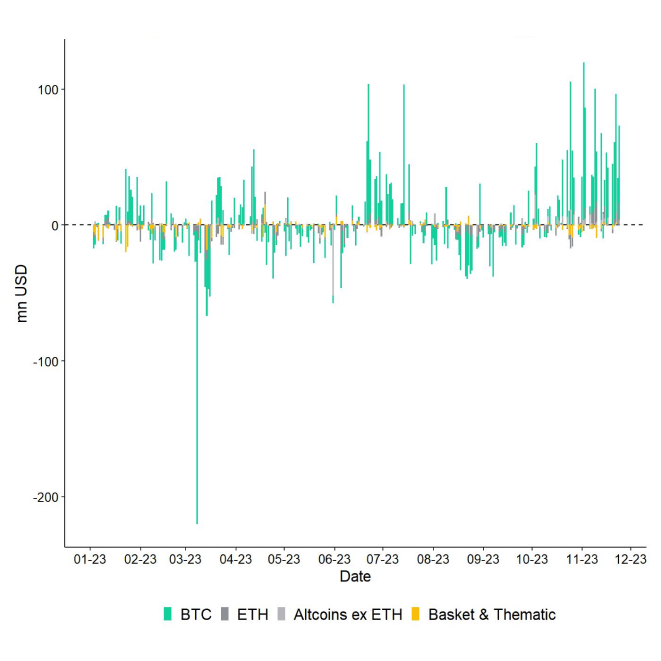

Chart of the Week

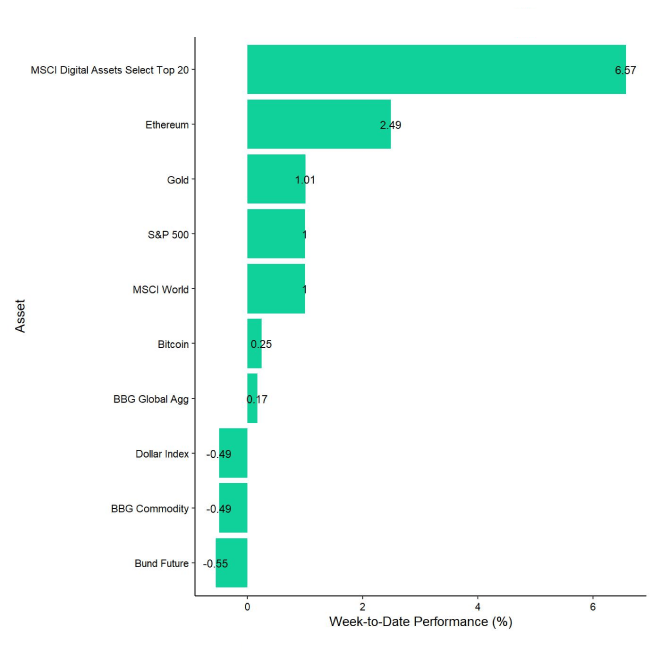

Performance

Last week, cryptoassets managed to outperform traditional assets like equities on the back of ongoing optimism for a Bitcoin spot ETF approval in the US. Binance's 4.3 bn USD settlement with the DOJ combined with a planned complete exit of Binance from the US market have significantly increased the odds of an ultimate ETF approval as Binance's US operations were generally seen as a significant thorn in the side of the SEC.

This ongoing optimism was also accompanied by significant fund inflows.

In fact, weekly global crypto ETP flows reached their highest level year-to-date last week with over 300 mn USD in net inflows (Chart of the Week). Grayscale Bitcoin Trust's NAV discount also narrowed significantly last week signalling an increased probability of an ETF approval.

At the same time, there was a pick-up in altcoin outperformance due to an increase in risk appetite and as some idiosyncratic news fuelled optimism for Ethereum and Layer 2s like Blast in particular.

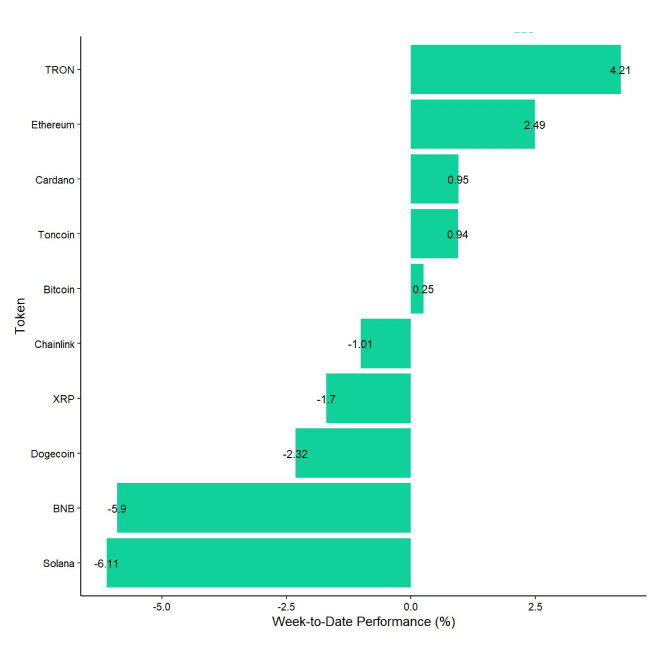

Among the top 10 crypto assets, TRON, Ethereum, and Cardano were the relative outperformers.

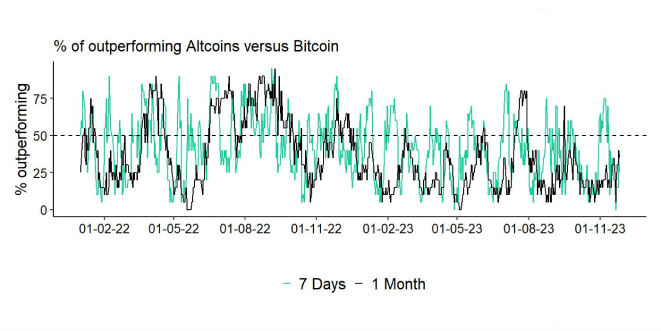

However, altcoin outperformance vis-à-vis Bitcoin picked up against the prior week but remains in early stages. Still only 25% of our tracked altcoins managed to outperform Bitcoin on a weekly basis.

Sentiment

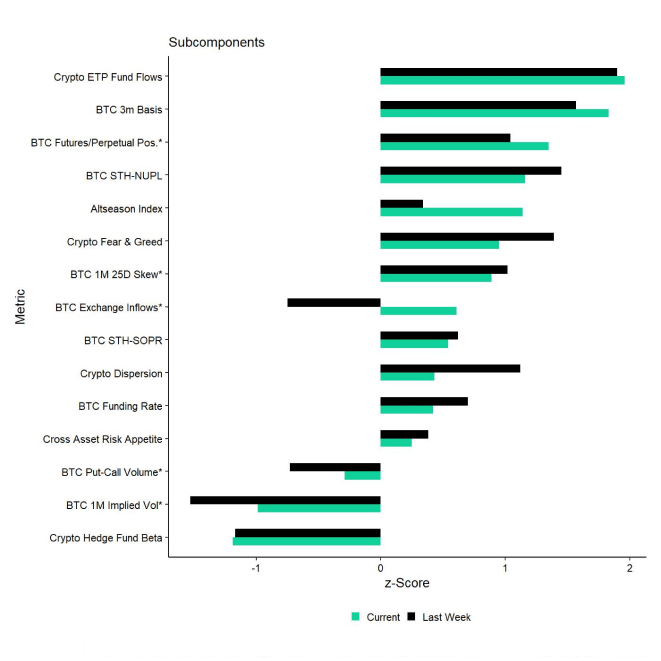

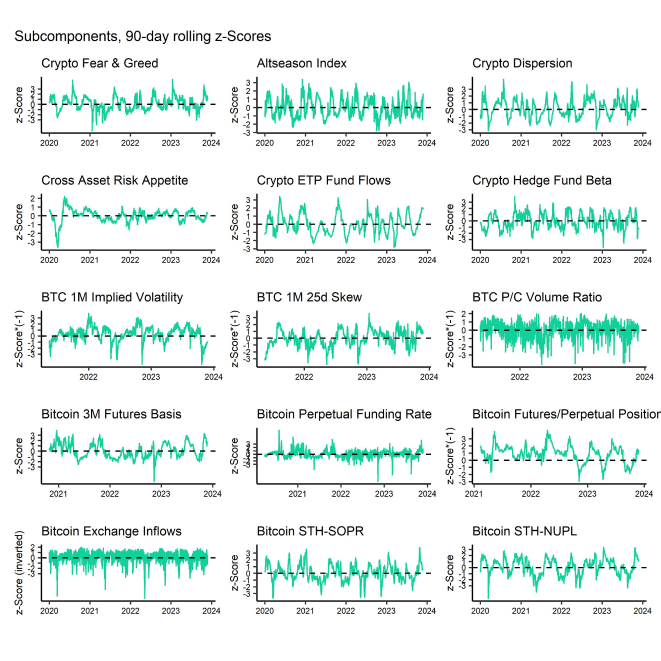

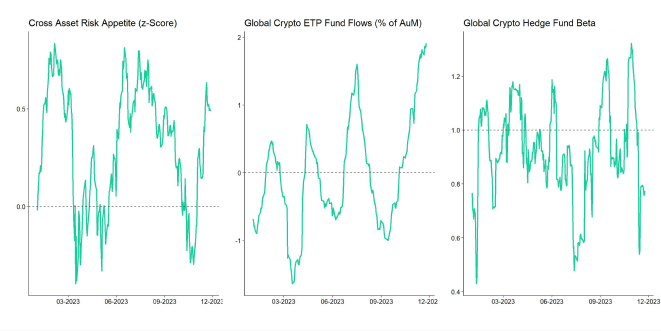

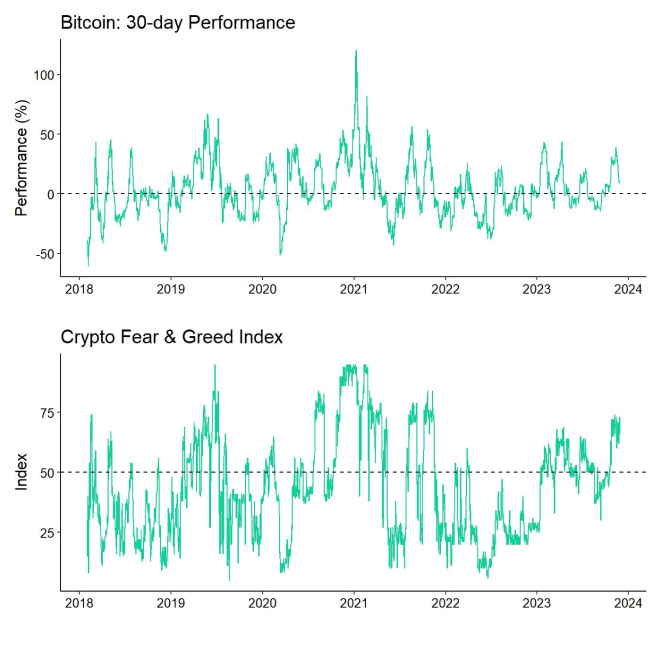

Our in-house Cryptoasset Sentiment Index has briefly declined but stays relatively elevated. At the moment , 12 out of 15 indicators are above their short-term trend.

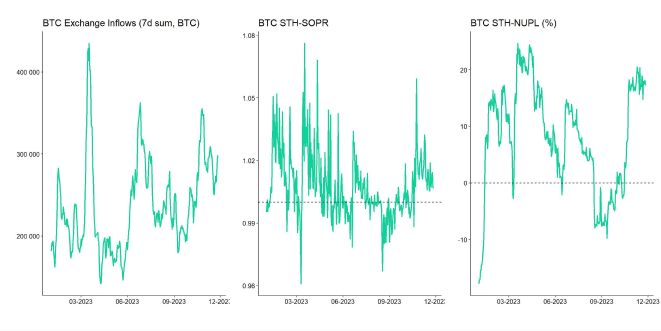

Compared to last week, we saw major reversals in the Altseason index and BTC Exchange Inflows, which declined.

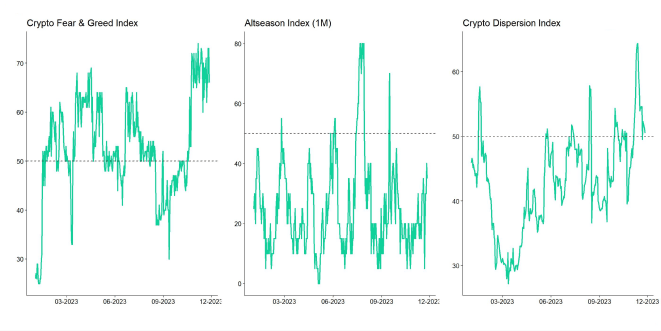

The Crypto Fear & Greed Index also remains in "Greed" territory as of this morning.

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) also remains positive implying a positive sentiment in traditional financial markets.

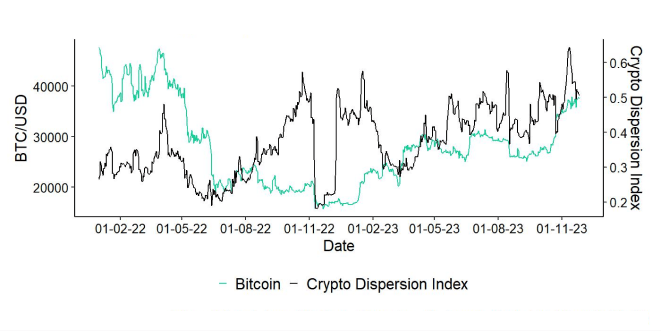

Performance dispersion among cryptoassets has declined significantly compared to last week but continues to be relatively high . In general, high-performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, although there has been a pick-up in altcoin outperformance last week compared to the week prior, altcoin outperformance has continued to be low with only 25% of altcoins outperforming Bitcoin on a weekly basis. In general, low altcoin outperformance is a sign of low-risk appetite within cryptoasset markets.

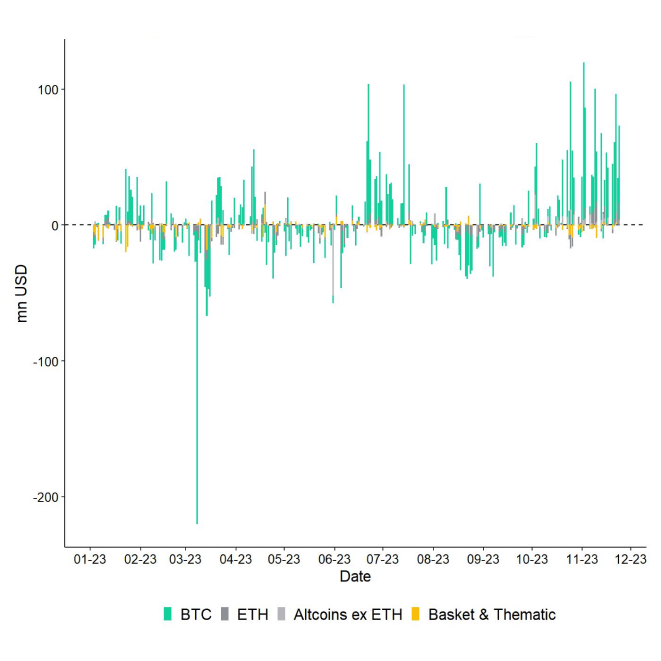

Flows

Last week, we saw the highest amount of net fund inflows into global cryptoasset ETPs year-to-date.

In aggregate, we saw net fund inflows in the amount of +302.9 mn USD (week ending Friday).

The large majority of these inflows focused on Bitcoin ETPs (+275.4 mn USD) and Ethereum ETPs (+26.6 mn USD). Altcoin ex ETH ETPs attracted +1.3 mn USD in net fund inflows last week.

In contrast, thematic & basket crypto ETPs experienced minor net fund outflows (-0.5 mn USD) last week.

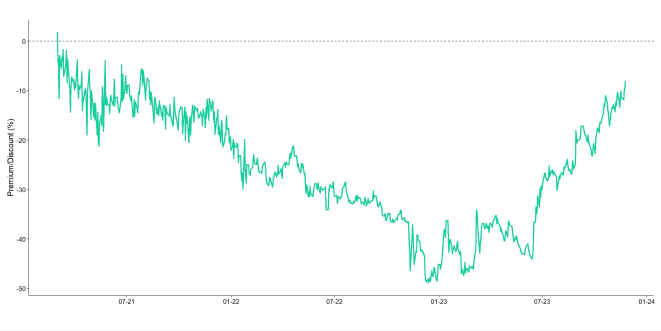

The NAV discount of the biggest Bitcoin fund in the world - Grayscale Bitcoin Trust (GBTC) – continued to narrow significantly last week to around -8%. In other words, investors are assigning a probability of around 92% that the Trust will ultimately be converted into a Spot Bitcoin ETF.

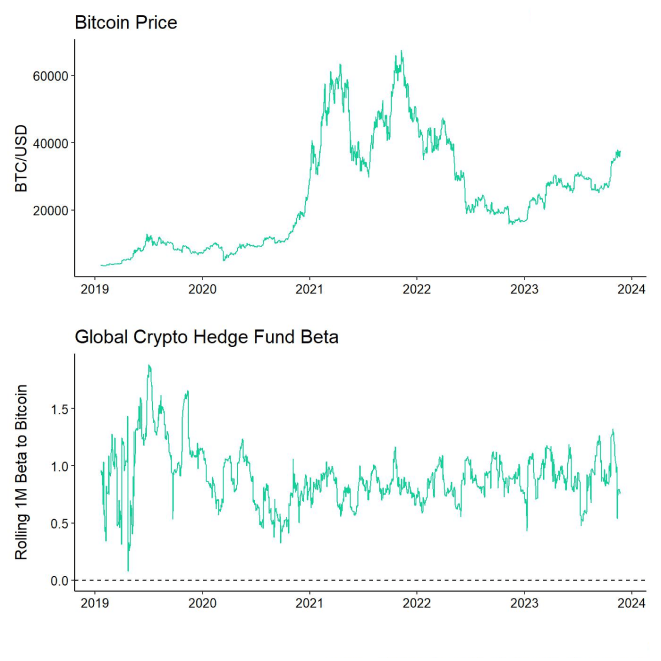

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remains relatively low with slightly less than 0.8, implying that global crypto hedge funds remain under-exposed to Bitcoin market risks.

On-Chain

Overall, on-chain activity in Bitcoin has declined somewhat last week but still remains very high.

For instance, the congestion in the mempool has eased somewhat as the mempool transaction count has declined as have mean fees and the number of coins waiting to be transferred. The mempool represents the queue of unconfirmed Bitcoin transactions. A high number of transactions in the mempool usually indicates high demand for Bitcoin transactions and block space in general.

Nonetheless, the mean number of transactions per block is still hovering near all-time highs around 4000 transactions per block and the daily total number of transactions has reached an all-time high. UTXO growth on the Bitcoin blockchain is also very high with more than 500k new UTXOs being currently created on a daily basis.

In that context, inscriptions remain very dominant on the Bitcoin blockchain with still above 60% transaction share, most of which are text-based.

Meanwhile, Bitcoin's hash rate has also been hovering near its all-time highs with currently around ~500 EH/s.

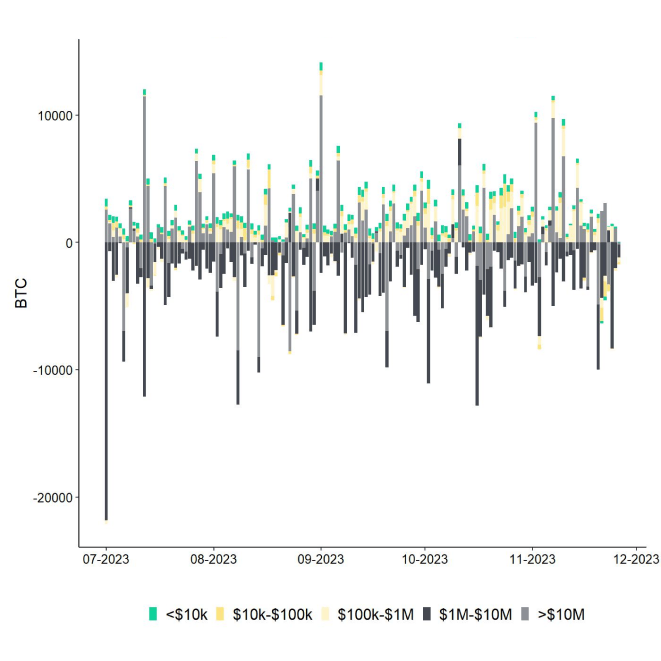

Moreover, bitcoins continued to flow out of exchanges last week. Around -25k BTC have flown out of exchanges last week on an aggregate basis according to data compiled by Glassnode. It is important to note that the bulk of these exchange outflows happened in wallets with sizes in excess of 1 mn USD.

Some Korean exchanges experienced more significant outflows which signalled some institutional buying interest in that region.

Furthermore, the negative news flow around exchange behemoth Binance resulted in around -18k BTC exchange outflows over the past week. So, Binance accounted for the bulk of aggregate BTC exchange outflows last week. Binance's BTC exchange balances have reached their lowest level since March 2023 and Binance's ETH exchange balances even reached their lowest level since January 2021.

Meanwhile, both Coinbase's BTC and ETH exchange balances remained relatively stable over the course of last week.

On a positive note, accumulation activity across various BTC wallet cohorts still remains near the strongest observed year-to-date.

Ethereum was also buoyed by increased Layer 2 on-chain activity last week. Most notably, Blast experienced a very sharp increase in its Total-Value-Locked (TVL). By November 26, 2023, Blast had more than $500 million in TVL. DefiLlama data shows that this was a substantial rise from its previous results, with approximately 512 mn USD poured into its contract. Interestingly, Blast raised its first 100 mn USD in TVL in less than twenty-four hours following launch, a sign of a receptive market and keen investor interest.

Derivatives

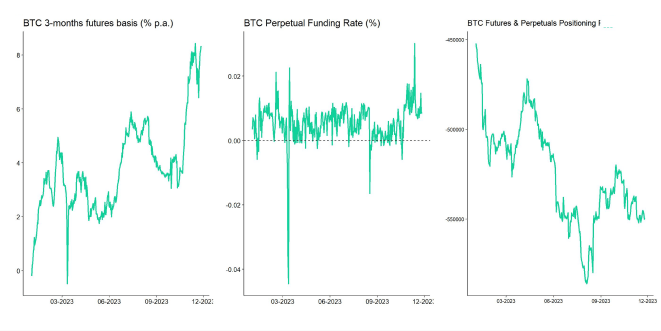

Open interest in both BTC futures and perpetuals mainly went sideways last week. CME still remains the biggest futures market in terms of open interest ahead of Binance this week.

The 3-months annualized rolling basis in BTC futures has increased again compared to last week and remains near year-to-date highs of around 8.3% p.a.

BTC perpetual funding rates have mostly remained positive throughout the week across various exchanges.

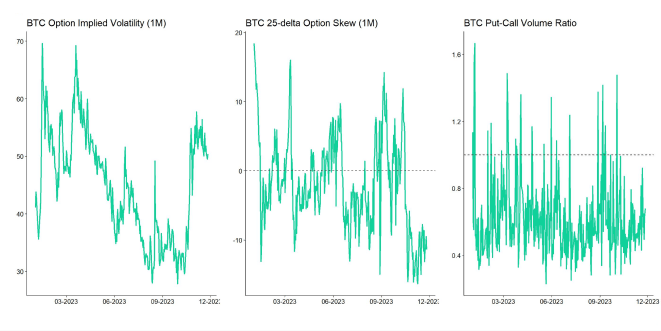

On the other hand, BTC options open interest have declined significantly in BTC-terms following the expiries last Friday. BTC options open interest have declined by almost -100k BTC compared to levels observed last Thursday. With that decline, we saw a significant decline in put open interest relative to call open interest as well. The BTC put-call ratio has reached the lowest level since February 2023 signalling a very low appetite for downside protection at the moment and, hence, a heightened sentiment.

BTC 1-month 25-delta option skew also remains biased towards calls at the moment with the skew still hovering near year-to-date lows. BTC 1-month option investors pay around 11% p.a. implied volatility premium for delta-equivalent calls relative to puts.

Bottom Line

- Bitcoin reaches its highest price since May 2022 on the back of ongoing ETF optimism; Grayscale’s NAV discount continues to narrow

- Our in-house “Cryptoasset Sentiment Index” briefly declined but stays at elevated levels

- Weekly global cryptoasset ETP net inflows reached the highest level year-to-date with over 300 mn USD last week

Appendix

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer