The biggest crypto story of 2021 has undoubtedly been the rise of serious competition for Ethereum. Among the new crop of contenders vying to knock it from its throne as the largest ecosystem of decentralised apps is Avalanche.

The layer 1, Proof of Stake smart contract blockchain launched its mainnet in September 2020.

Its main focus is on providing smart contract functionality for decentralised finance at faster speeds and lower costs than Ethereum, while also being compatible with that blockchain. Avalanche is EVM and Solidity-compatible, which means that Ethereum-based apps can easily migrate to the chain.

The blockchain is split into three main sub-layers, called “subnets” in Avalanche terminology. The C-Chain or Contract Chain is used for DeFi applications. The X-Chain or Exchange Chain is used for asset transfers, while the P-Chain or Platform Chain is used for staking.

The ultimate goal for the perfect blockchain is to be able to run a network that is broadly decentralised, with bulletproof security, while also able to process internet-scale transaction throughput.

Founder Emin Gün Sirer’s method with Avalanche is to separate out blockchain security mechanisms from other functions like computation and data storage.

The fastest smart contract blockchain?

Avalanche claims to be the fastest smart contract blockchain on the market today, as measured by time-to-finality.

Instead of asking each node in the network to independently verify the correct copy of the ledger of transactions, the Avalanche Consensus Protocol uses random subsampling of nodes in the network to build confidence that the entire set is valid.

AVAX token

Avalanche’s internal currency is the AVAX token. It is used to pay transaction fees on the network and in staking. As a Proof of Stake blockchain, Avalanche offers staking rewards to users who lock up their tokens. At present those staking rewards for delegators are in excess of 9% yield, with 9.5% available for validating nodes [https://www.stakingrewards.com/earn/avalanche/].

AVAX is also, like Ethereum, deflationary over time. 720 million tokens were created at launch and AVAX is burned (removed from circulation) whenever:

- a transaction takes place

- assets are created

- subnets are created

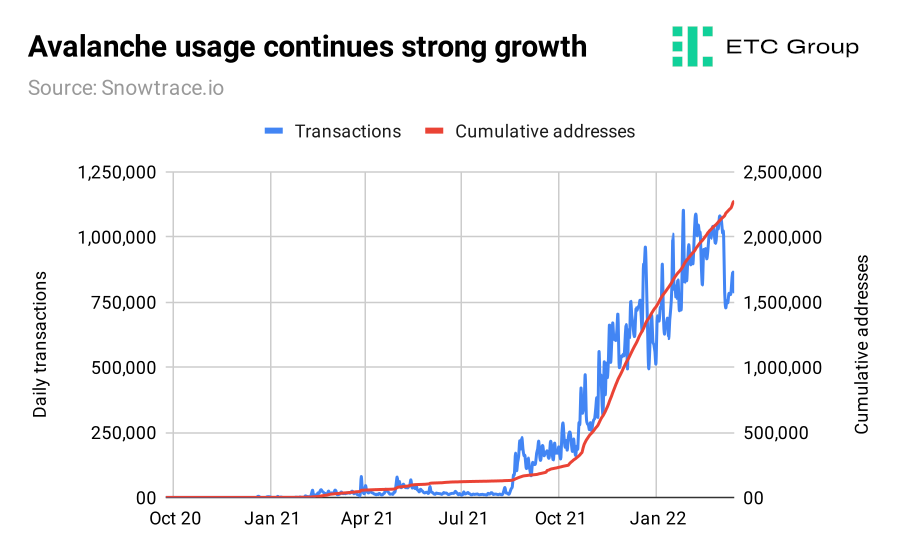

The inflection point for Avalanche’s network growth was October 2021. By then, around 250,000 distinct addresses were using Avalanche, and growth was in the 1,000-1,500 range. In the weeks that followed, the growth turned from a trickle into an exponential curve.

One of the main things that Avalanche has managed to do is to make its UI easy to grasp and simple to use. With Snowtrace.io [https://snowtrace.io/] it has a blockchain explorer to rival Ethereum’s Etherscan [https://etherscan.io/], providing backdated statistics and analytics that show precisely where and how operations are growing.

Rival blockchains could learn much from this user-centric design.

Additionally, there are many, many blockchain projects to choose from, so it is important for investors to note which ones users are actually paying to use. Cryptofees.info shows that [https://cryptofees.info/] Avalanche has the fourth-highest daily revenue total after Ethereum, Uniswap and Binance Smart Chain.

At more than $630,000 daily, the average amount of fees paid to Avalanche are nearly double that of Bitcoin, and 10 times more than smart contract DeFi competitors Solana and Fantom.

Outlook

Avalanche’s clear focus is scaling and DeFi. Sub-second transaction finality is a key feature, and user growth has clearly been rapid. Avalanche’s success in attracting 180+ DeFi protocols to its stable sets it up well for 2022.

If DeFi continues to grow in scale and complexity, then it stands to reason that Avalanche will grow in the same way. Avalanche’s innovation in time-to-finality makes it perfectly suited to complex financial interactions using smart contracts, and we suggest that it could continue to build and capture market share from Ethereum.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

About Bitwise

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.