The biggest crypto story of 2021 has undoubtedly been the rise of serious competition for Ethereum. Among the new crop of contenders vying to knock it from its throne as the largest ecosystem of decentralised apps is Avalanche.

The layer 1, Proof of Stake smart contract blockchain launched its mainnet in September 2020.

Its main focus is on providing smart contract functionality for decentralised finance at faster speeds and lower costs than Ethereum, while also being compatible with that blockchain. Avalanche is EVM and Solidity-compatible, which means that Ethereum-based apps can easily migrate to the chain.

The blockchain is split into three main sub-layers, called “subnets” in Avalanche terminology. The C-Chain or Contract Chain is used for DeFi applications. The X-Chain or Exchange Chain is used for asset transfers, while the P-Chain or Platform Chain is used for staking.

The ultimate goal for the perfect blockchain is to be able to run a network that is broadly decentralised, with bulletproof security, while also able to process internet-scale transaction throughput.

Founder Emin Gün Sirer’s method with Avalanche is to separate out blockchain security mechanisms from other functions like computation and data storage.

The fastest smart contract blockchain?

Avalanche claims to be the fastest smart contract blockchain on the market today, as measured by time-to-finality.

Instead of asking each node in the network to independently verify the correct copy of the ledger of transactions, the Avalanche Consensus Protocol uses random subsampling of nodes in the network to build confidence that the entire set is valid.

AVAX token

Avalanche’s internal currency is the AVAX token. It is used to pay transaction fees on the network and in staking. As a Proof of Stake blockchain, Avalanche offers staking rewards to users who lock up their tokens. At present those staking rewards for delegators are in excess of 9% yield, with 9.5% available for validating nodes [https://www.stakingrewards.com/earn/avalanche/].

AVAX is also, like Ethereum, deflationary over time. 720 million tokens were created at launch and AVAX is burned (removed from circulation) whenever:

- a transaction takes place

- assets are created

- subnets are created

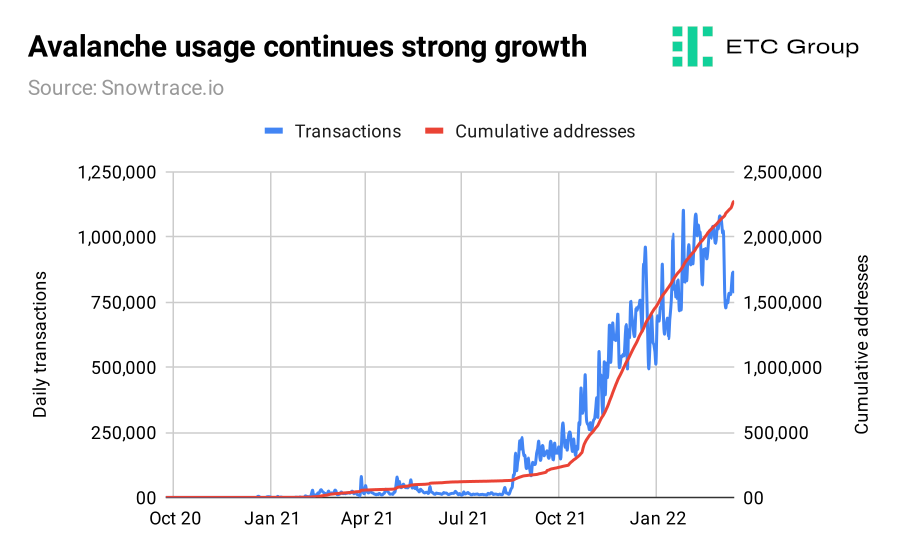

The inflection point for Avalanche’s network growth was October 2021. By then, around 250,000 distinct addresses were using Avalanche, and growth was in the 1,000-1,500 range. In the weeks that followed, the growth turned from a trickle into an exponential curve.

One of the main things that Avalanche has managed to do is to make its UI easy to grasp and simple to use. With Snowtrace.io [https://snowtrace.io/] it has a blockchain explorer to rival Ethereum’s Etherscan [https://etherscan.io/], providing backdated statistics and analytics that show precisely where and how operations are growing.

Rival blockchains could learn much from this user-centric design.

Additionally, there are many, many blockchain projects to choose from, so it is important for investors to note which ones users are actually paying to use. Cryptofees.info shows that [https://cryptofees.info/] Avalanche has the fourth-highest daily revenue total after Ethereum, Uniswap and Binance Smart Chain.

At more than $630,000 daily, the average amount of fees paid to Avalanche are nearly double that of Bitcoin, and 10 times more than smart contract DeFi competitors Solana and Fantom.

Outlook

Avalanche’s clear focus is scaling and DeFi. Sub-second transaction finality is a key feature, and user growth has clearly been rapid. Avalanche’s success in attracting 180+ DeFi protocols to its stable sets it up well for 2022.

If DeFi continues to grow in scale and complexity, then it stands to reason that Avalanche will grow in the same way. Avalanche’s innovation in time-to-finality makes it perfectly suited to complex financial interactions using smart contracts, and we suggest that it could continue to build and capture market share from Ethereum.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

À propos de ETC Group

ETC Group développe des instruments financiers innovants adossés à des actifs numériques, notamment l'ETC Group Physical Bitcoin (BTCE) et l'ETC Group Physical Ethereum (ZETH), qui sont cotés sur des échanges européens, comme le XETRA, Euronext, SIX, AQUIS UK et Wiener Börse.

ETC Group a lancé le premier produit négocié en bourse (exchange traded product- ETP) Bitcoin à compensation centralisée au monde en juin 2020 sur la Deutsche Börse XETRA, la plus grande plateforme de cotation d'ETF d'Europe.

ETC Group travaille en permanence à l'élargissement de sa gamme d'ETPs garantis par des crypto-monnaies, de qualité institutionnelle, offrant aux investisseurs la possibilité de s'exposer au Bitcoin, à l'Ethereum, au Cardano, au Solana et à d'autres actifs numériques populaires sur les principales bourses européennes.