Markets

Trading volumes in both spot and derivative markets fell in August to their lowest levels in more than two years. Combined spot and derivatives volume dropped to $2.09 trillion, CCData reported, with monthly spot volumes of $475bn marking the lowest recorded since March 2019.

Bitcoin prices had been effectively flat for 9 solid weeks between 21 June and 16 August, holding a range between $29.2k and $31.1k with neither bulls nor bears able to exert control.

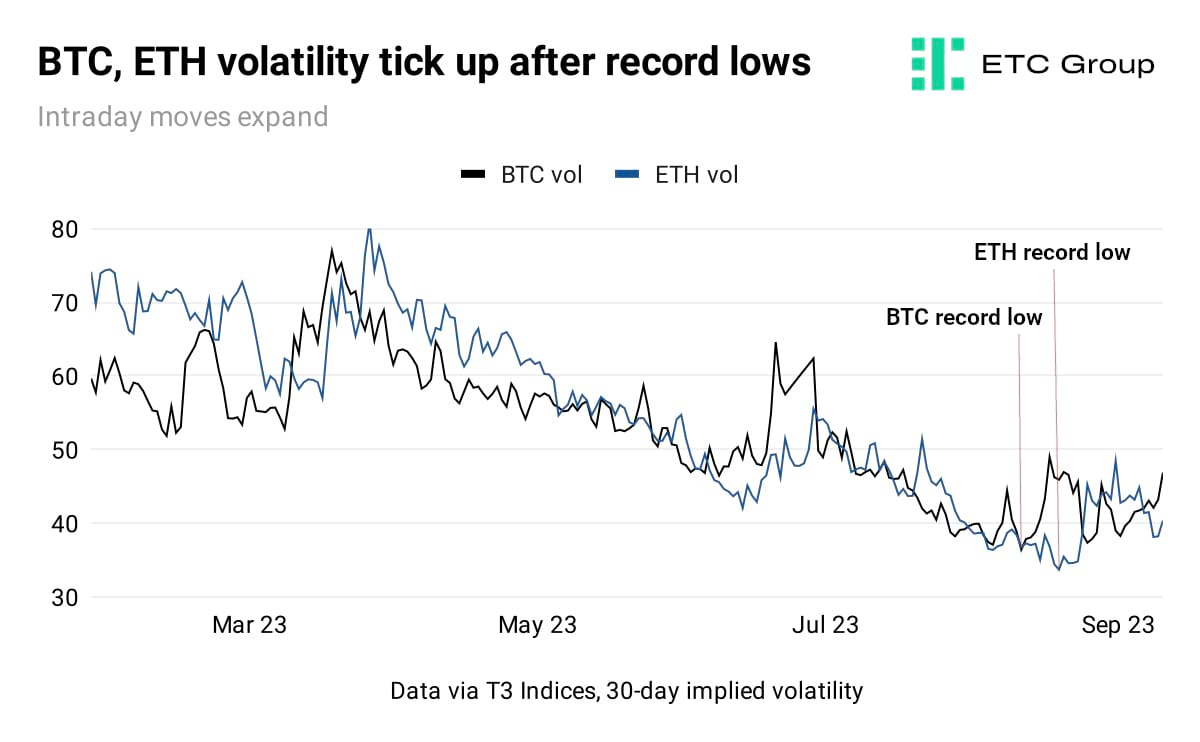

But with the long and languid summer holidays drawing to a close, volatility in crypto markets ticked up above their record lows, signalling the seasonal doldrums may be over.

It is worth repeating the message from a recent State Street research paper that financial markets appear to follow the first law of thermodynamics: “[Volatility] cannot be created or destroyed. If volatility appears low, that's because it has been suppressed in the present and will reappear in the future.”

When this suppressed volatility reappeared, it did so with a vengeance, notably at the confluence of several interconnected market events.

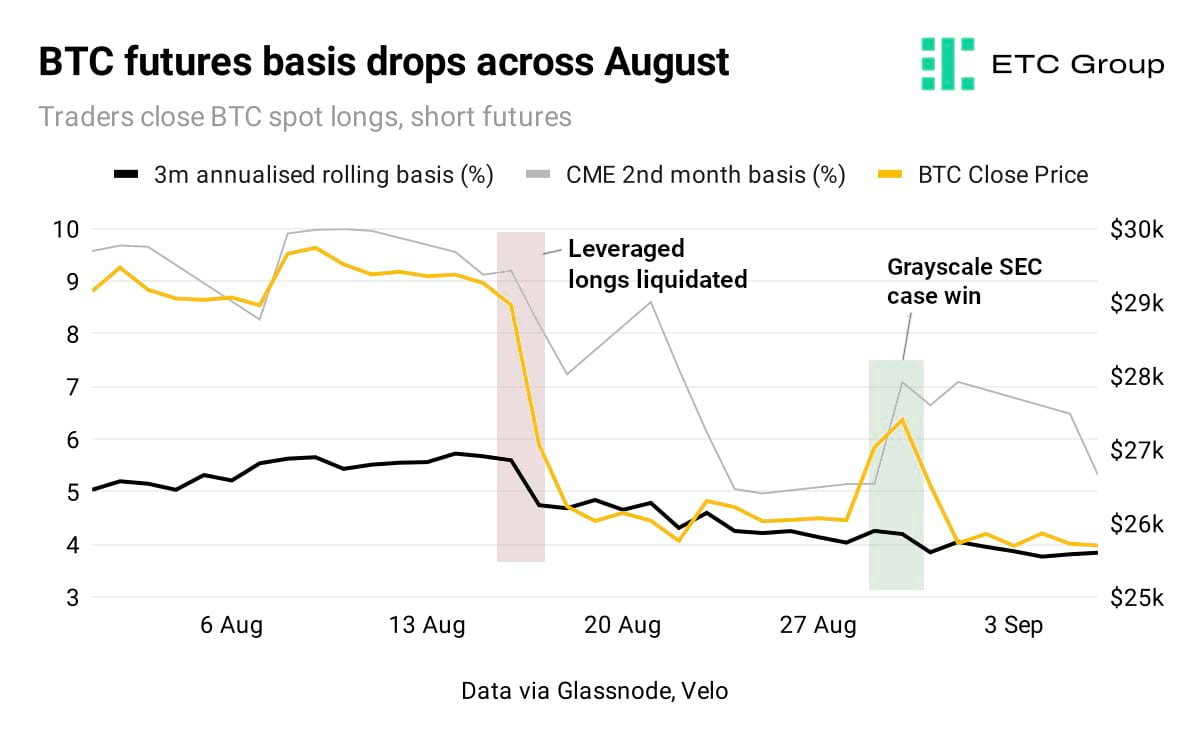

As shown in the chart, the 3-month annualised rolling basis across crypto-native exchanges Deribit, Binance and OKEX, as well as the CME second-month basis, both dropped precipitously in mid-August.

For the majority of its life, Bitcoin has traded in contango: that is, the price of futures contracts tends to be higher than daily spot market prices. When the spread is particularly high, traders can book profits by shorting futures while taking out long positions in the underlying spot market and waiting for the prices to converge.

The drop effectively showed us that traders were closing their long BTC positions (alongside short futures positions) as they started to realise profits on the carry trade.

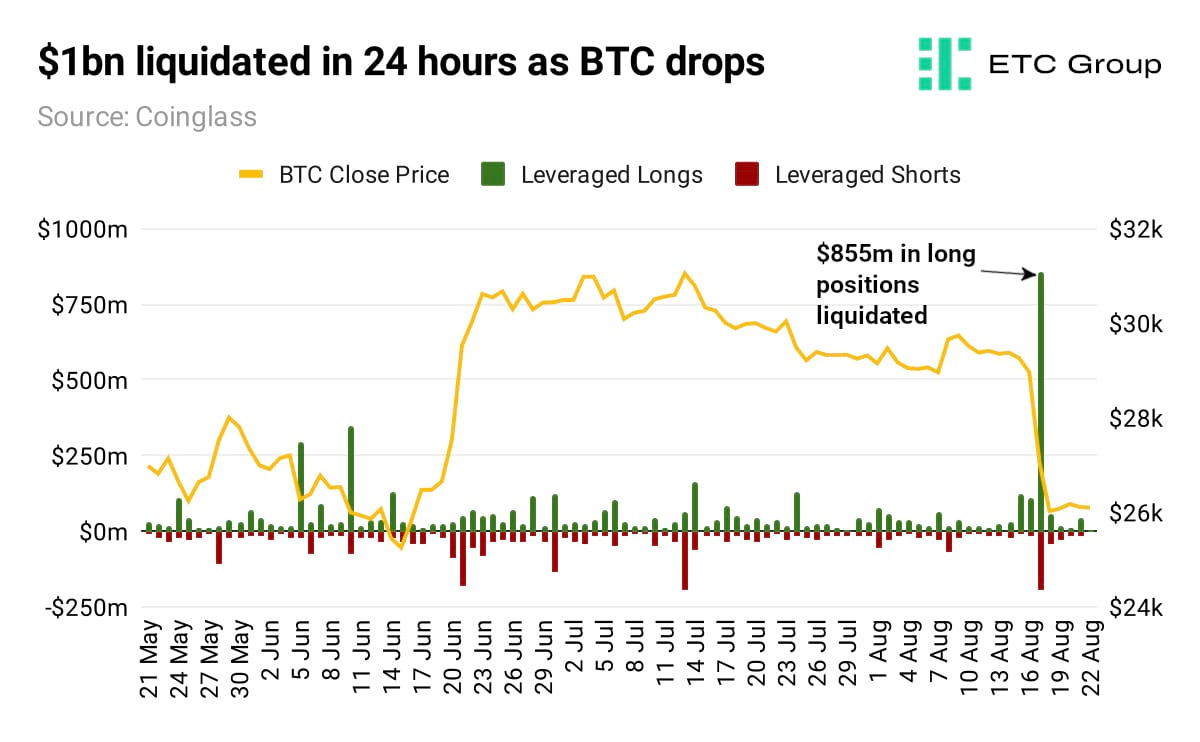

The story would be incomplete without mentioning another seismic liquidation event on crypto-native exchanges on 17 August, with traders seeing a total of more than $1bn in leveraged positions forcibly exited.

Liquidations of this kind are rare in such speed and magnitude: the largest in recent memory came around the collapse of FTX in November 2022 when over $1.2 billion in long positions were auto-closed, pushing Bitcoin prices to $16.6k, then the lowest spot price point since November 2020.

It is also worth noting that, despite the introduction of institutional-grade trading infrastructure, alongside innovative products like perpetual futures contracts over the last 5 years, there remain pockets of substantial inefficiency in fragmented crypto derivatives markets. This makes cryptoassets still prone to exaggerated moves over short time-frames.

Macro

Foiled expectations and multiple data revisions were the macro order of the day in August, with China also failing to ride to the rescue of global growth.

China's failure to (re)launch after its COVID-reopening, seeing its real estate sector haunted by the spectre of the massive indebtedness of developers Evergrande and Country Garden, and the yuan at 16 year lows added to fears of global macroeconomic weakness.

Another shock move, predicted by Bloomberg economist, said the US would need to double its economic growth forecast, leading to fewer rate cuts in late 2023 and early 2024.

The Bloomberg dollar index, which started recording data in 2005, was on track to post its longest ever stretch of increases as of the first week of September. The index rises when the dollar gains value against a basket of other key currencies: the euro, the yen, British pounds, Canadian dollars, the Swedish krona and the Swiss franc.

Because the world's commodities (and cryptoassets) are generally priced in US dollars, and the currency has the most purchasing power globally, extended periods of dollar strength have historically depressed global trade.

Current economic data means traders are betting that interest rates in the world's major economies will maintain interest rates higher for longer. So any assets or funds where investors can park their cash and collect simple 'risk-free' yields are seeing a rush of inflows.

By the same token, both retail and institutional money market funds continued to suck up assets, with the Investment Company Institute again recording a record high of $5.68 trillion of assets under custody as of the end of August.

These factors, along with surprising US dollar strength, and higher government bond yields have been driving investors away from risk assets and into money market funds and fixed income.

However it appears that markets are underpricing the potential impact of the approval of almost a dozen spot Bitcoin ETFs, lodged with the US regulator. Unlike futures-based ETFs, spot Bitcoin ETFs must hold physical Bitcoin in order to fulfil their regulatory obligations to accurately track the price of Bitcoin.

Bitcoin

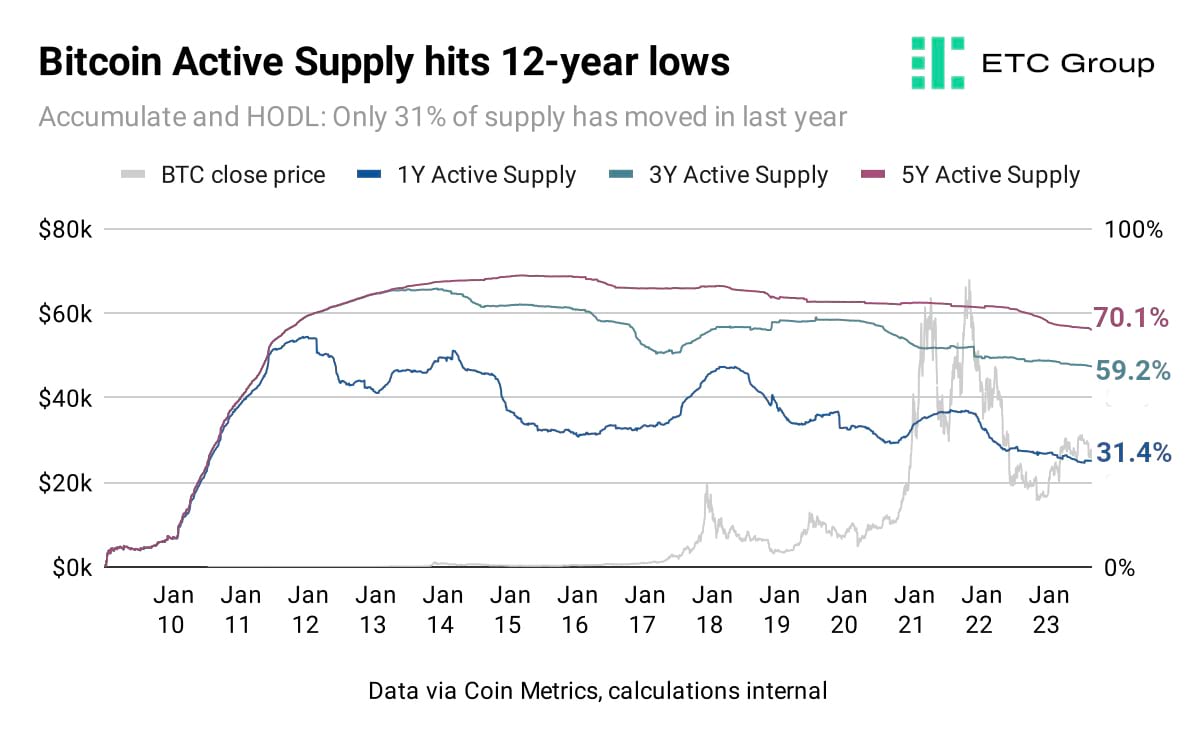

The active supply of the Bitcoin cryptocurrency has reached 12 year lows, according to data analysed by ETC Group, showing that long-term Bitcoin holders have been unmoved by recent price action and are increasingly holding and accumulating coins.

Active supply refers to coins that have been moved or transacted at least once over a period of time.

Data sourced from Coin Metrics shows that as of 6 September 2023, 6 million coins or 31.4% of total supply has moved in the last 12 months, leaving a record 68.6% unmoved in the same period.

As rival data provider Glassnode notes: “As investors accumulate and store coins for longer periods of time, we categorise them based on how long it has been since they last moved on-chain.”

59.2% of the total 19.47m supply has been transacted at least once in the last three years, leaving 41.8% of the Bitcoin supply untouched over that period.

We can infer from this that 40% investors (retail or institutional) who purchased Bitcoin in the run up to its November 2021 all time high of $67,413 have still not sold those coins, despite current market prices sitting at around $26,000.

Active supply tends to spike amid periods of rapid price appreciation, as tends to occur during bull markets, as holders move their coins to exchanges for sale in order to take profits.

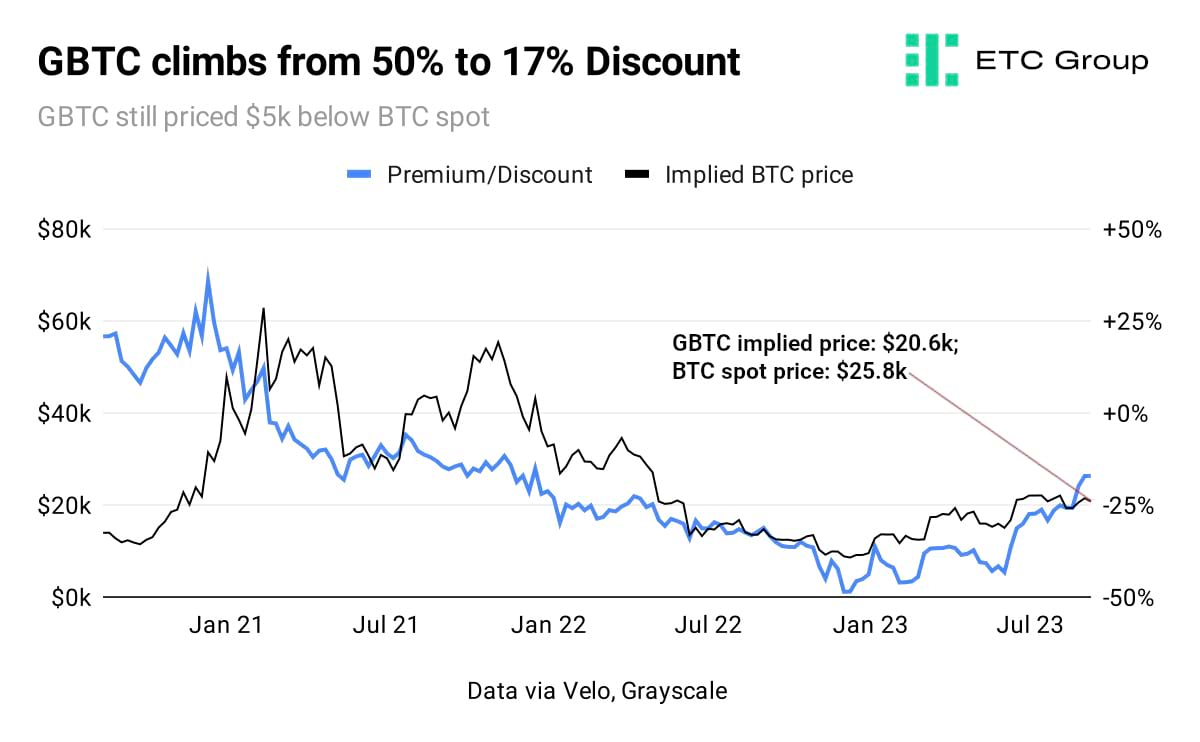

The end of the month, continued into the first week of September, saw an upshift in the BTC spot price and the basis, driven by a 29 August regulatory win for Grayscale in its bid to convert the decade-old, $16bn GBTC Bitcoin Trust into a dramatically more liquid ETF structure.

For those readers needing a quick overview, ETC Group research produced this explainer piece.

The GBTC Premium/Discount to its Net Asset Value (NAV) of underlying Bitcoin has been a sore point for Grayscale investors ever since it became obvious that the trust structure was a highly inefficient way to get Bitcoin exposure.

The SEC case win impacted immediately on GBTC, narrowing the discount from 28% to 17%, a position far better than the 50% discount to NAV (with an implied BTC price of less than $9k) that GBTC holders suffered at the turn of 2023.

The situation as of early September still leaves GBTC holders hanging on to shares with an implied price of $20,600, while spot BTC trades at $25,800, so shares trading at a discount to NAV are not necessarily the bargain they may seem.

This is especially true given there is no guarantee on when, if at all, the SEC will approve the conversion.

Perhaps Grayscale simply joins the growing queue of disgruntled participants awaiting Gary Gensler's long hoped-for ousting around the time of the 2024 US Presidential election.

Ethereum

Asset manager Van Eck had filed for what would be the US market's first spot Ether ETF way back in May 2021. This fact seemed conveniently forgotten when breathless media headlines reported that Cathie Wood's ARK Invest had applied to open America's first Ether spot ETF.

Still, despite the journalistic snafu, the upshot is the general market realisation that ETH is now following BTC in how it is becoming further institutionalised.

There were two quite obvious expressions of this fact across the month.

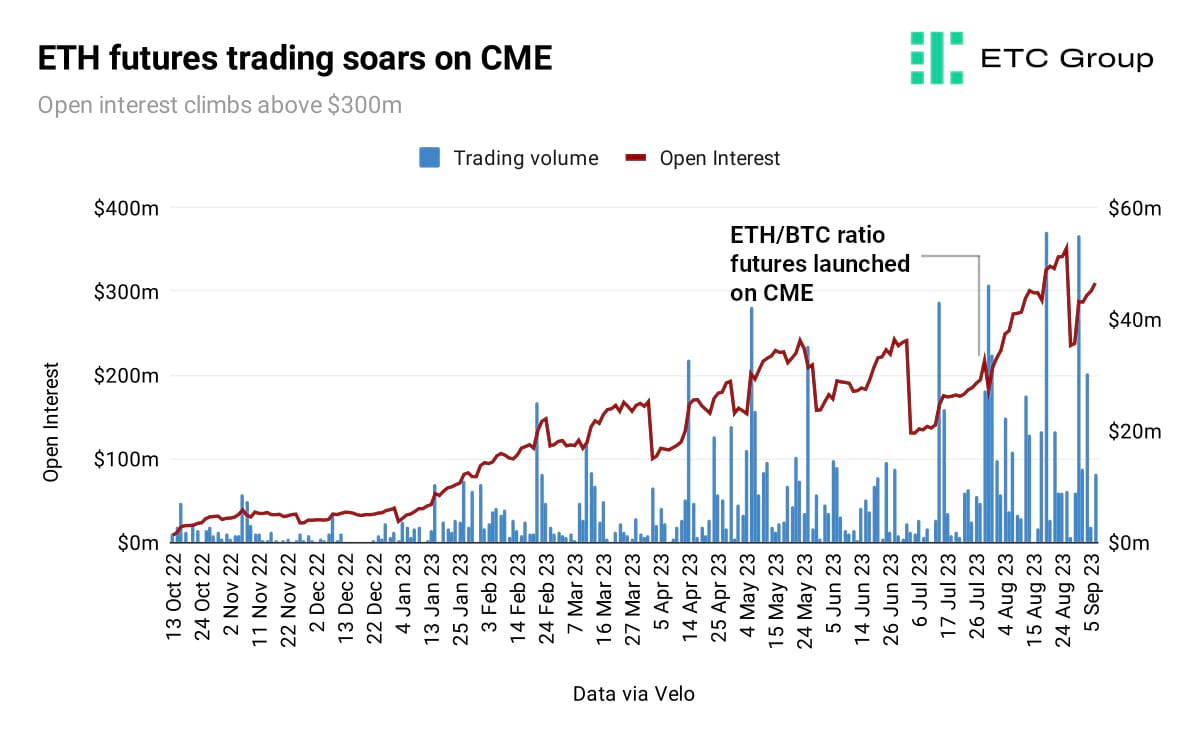

First was the substantial record of cumulative trading volume of ETH CME futures of over $363m in August. The second was the launch of a new product: ETH to BTC ratio futures.

The launch of ETH/BTC ratio futures on CME is in line with the derivatives exchange giant's increasingly faster pace of crypto product development and “cogent with the evolution of demand for exposure to the two largest cryptoassets by market cap”, said a CF Benchmarks blog post.

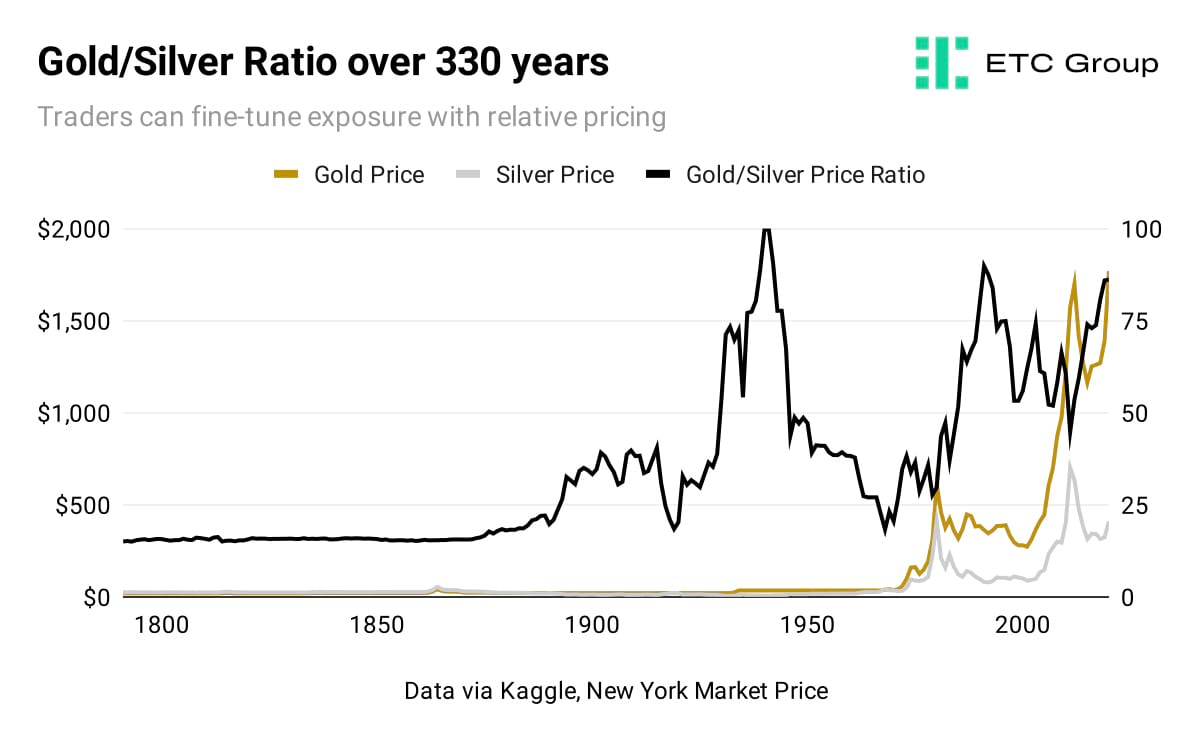

Institutional ETH is growing in popularity and being able to fine-tune exposures and hedging to this extent marks a definitive shift. These kinds of relative value trades are common in institutional capital markets, for example in the gold/silver ratio.

If we take this relative pricing, for example, we can see how traders could express a perspective on which side of an asset trade may fall or rise in response to global macro factors, new metals discoveries, changes to the refining process or other market specific developments.

Of course, gold and silver have been traded over a much longer period than Ether and Bitcoin, but the point remains valid.

While ETH volume and open interest lags BTC, which regularly sees CME daily trading volume of $2bn or more, it has been encouraging to see the institutional take up for trading strategies for the second-largest cryptoasset by market cap.

Altcoins

Two blockchain projects in particular registered the biggest PR wins outside the blue-chip Bitcoin and Ethereum in August. First was Chainlink, which completed a pilot project with interbank network SWIFT.

As SWIFT noted in a June 2023 release: “Institutional investors increasingly are considering investments in tokenised assets as they seek new forms of value - but they face a complex challenge.

“These investments are tracked on a diverse range of blockchain networks that are not interoperable - each has its own functionality or liquidity profile, which creates significant overhead and friction in managing and trading the assets.”

Chainlink was used as an enterprise abstraction layer to securely connect SWIFT to the Ethereum Sepolia testnet. Sepolia is a testing ground which mimic's Ethereum's live environment, where developers can test their smart contracts for free.

In a 31 August summary of the successful pilot, SWIFT noted that 97% of institutional investors believe that tokenisation would revolutionise asset management. The interbank payments network collaborated with major financial institutions across the globe, including the world's largest custodian bank BNY Mellon, Euroclear, Switzerland's SIX Digital Exchange and the DTCC, which clears around $2.15 quadrillion in trades every year.

When in 2017 the DTCC accelerated from T+3 (three-day) trade settlement to T+2, it saved the industry $1.36bn in margin requirements, freeing up that collateral for use elsewhere.

The DTCC has been working on an even shorter settlement cycle of T+1 since 2020. Ethereum's globally synchronised public record of asset holdings and transactions promises a near-instant settlement process of T+0.

That means that the total addressable market for Ethereum - the dominant in-use public blockchain for this type of activity - is absolutely vast.

The next altcoin to make waves in August was Solana.

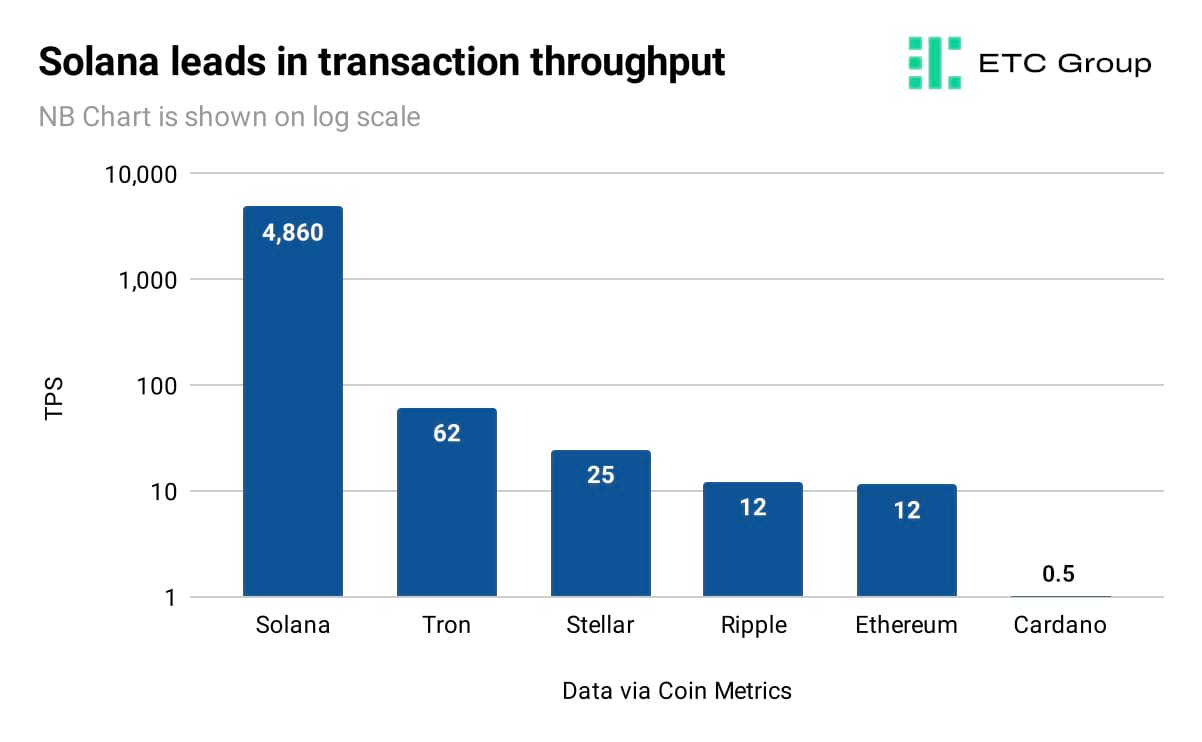

The world's 11th largest company, global payments giant Visa (NYSE:V), announced it would expand its stablecoin settlement capabilities to Solana after beginning an experiment with Ethereum last year.

Visa said it will use the Solana blockchain to settle USDC transactions with merchant card payment processors Nuvei (TSX:NVEI) and Worldpay.

The latest data shows the Solana blockchain produces an average of 4,870 transactions per second (TPS) and has a block confirmation time of around 400 milliseconds.

Critics have long derided the perceived lack of real-world use cases for digital assets and blockchains, but one suspects given the mass institutional appreciation for blockchain technology that they simply have not been paying close enough attention.

The Visa move has huge implications outside of crypto, as noted by Bitcoin writer and Castle Island Ventures partner Nic Carter: “This is a huge deal,” he said. “Writing on the wall, [stablecoins] will become the de facto interbank settlement solution via card networks.”

USDC is a US dollar-denominated stablecoin. 1 USDC is equal to $1 and is backed 1:1 by cash and cash-equivalents.

While rapid, digital cross-border settlement has been possible since Bitcoin was created in 2009, newer blockchains like Solana have focused on making this process near-instant. Due to their smart contract capabilities, blockchains like Ethereum and Solana can host and settle stablecoin transactions as well as those of their own native currencies.

Visa said it had already moved millions of USDC between partners using Solana and Ethereum.

When consumers use Visa cards to make a purchase, their payment authorisation is near-instant, “but what they don't see is that the funds need to move between their bank and the merchant's bank,” said its Head of Crypto Cuy Sheffield.

“By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we're helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa's treasury.”

Solana is the tenth-largest cryptoasset by market cap, valued at $8.01bn. It was launched in August 2020. The network prioritises low fees and fast time-to-finality, but is not considered as structurally robust as the lower-TPS Ethereum.

Regulation

A New York court defined both Bitcoin and Ethereum as commodities, in dismissing an investor suit against the decentralised exchange Uniswap. This continues the piecemeal accumulation of legal verdicts mounting against the description of top-tier cryptoassets as securities.

Oman is the latest country to step with both feet into crypto, announcing a $1.1bn investment into 11MW of Bitcoin mining capacity. While Dubai has long sought to be considered as the centre of the crypto universe in the Middle East, other jurisdictions are now attempting to diversify their oil-rich economies and gain a slice of the growing crypto pie for themselves.

Mining remains at an embryonic stage in the Gulf state, with the Cambrige Bitcoin Electricity Consumption Index indicating that its operation contribute just 0.1% to global hashrate. However, Oman has some of the lowest electricity costs in the world with an average of just $0.026/kW, indicating that Bitcoin mining could be a profitable enterprise for the country.

As has been amply demonstrated in Texas, Bitcoin mining facilities in Oman may be able to prevent its energy grid from wasting oversupply; Bitcoin mining operations can quickly adjust intensity, and unlike power plants that take more than 48 hours to power down, mining rigs can be turned off and on almost instantly, lowering stress on power grids.

Research by ESG analyst Daniel Batten has demonstrated that 52% of the energy used in Bitcoin mining is sourced from sustainable sources while Bitcoin emissions were cut in half between 2019 and 2023: from roughly 600 g/kWh to 296 g/kWh.

A recent KPMG report echoed this viewpoint as it emphasised Bitcoin mining's benefits across an ESG framework by harnessing renewable energy and by helping stabilise energy grids. In Scandinavia, hydroelectric and wind sources dominate the Bitcoin mining energy mix in Sweden and Norway.

Oman too intends to tap into sustainable sources of energy to power its mining programme with designs to tap into hydro sources and flare gas that would otherwise go to waste during oil extraction processes central to the economy.

Outlook

Signs of life have reappeared in portions of the crypto market, with volatility suppression winding up, institutions delving further and faster into blockchain integrations, and the clamour for both Bitcoin and Ethereum spot ETFs becoming overwhelming.

With global asset managers filing to offer these recognisable crypto investment vehicles (both spot and futures-based) left, right and centre, it appears that we have reached a tipping point in the institutional acceptance of crypto and digital assets.

Europe has been ahead of this particular game for over three years, with physical crypto products gathering billions of dollars in AUM since their launches began in 2020.

However, the importance of opening the US market to spot Bitcoin exchange-traded funds is hard to understate, given that there remain large pools of institutional capital unable to access crypto exposure without the recognisable ETF structure.

What happens now is simply a matter of timing. The US cannot ignore the groundswell of investor clamour - expressed in the swathes of ETF proposals by BlackRock, Invesco, Wisdomtree etc - for ever.

It is also entirely possible that the market is under-pricing the impact that such ETF launches would have on cryptoasset pricing.

Heavy BTC accumulation will be necessary to open spot ETFs, since these financial products require physical Bitcoin to be held in custody to back these price-tracking investment products vehicles.

Certainly the addition of a swathe of new US spot Bitcoin ETFs would aid that move: If BlackRock alone were to invest 1% of its assets under management into Bitcoin, that would reckon on $800bn to $900bn of new assets coming into the space - almost double the BTC market cap as early September 2023.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer