1. Executive Summary

- Markets digest strongest January: bulls overtake bears on-chain

- Bitcoin NFTs race past 200,000 mints: sparks biggest debate in years

- ETH deflation, revenue spikes as blockspace demand returns

- Base: Coinbase launches Ethereum Layer 2 promising 1 billion users

- Institutional moves show increased appetite for both crypto, tokenisation

2. Overview

Markets settled back to equilibrium in February after the strongest first month of the year in more than half a decade. Bitcoin’s return of 39.63% last month was its largest January gain since 2018, so it was natural to expect some consolidation at these higher levels.

Over the course of February, Bitcoin gained a modest 2.5% to finish the month at $23.1k, while Ethereum added 4.8% to close out at $1.6k.

Is on-chain data bearish or bullish?

As the month closed out, mixed macroeconomic data and sliding equities weighed on crypto prices, but the total crypto market cap held firm above $1 trillion.

While traders generally sold into rallies, markets showed little appetite for a substantial sell off to bring prices back towards the cycle low of $15.8k Bitcoin in November 2022.

Just a quick aside, here.

It’s worth explaining what we mean by ‘on-chain’ data. Just like other financial industries, crypto brings with it a huge set of jargon and new metrics to consider.

ETC Group’s popular Crypto Handbook outlines the basics for new starters, but analysts may still perceive readers as more advanced in decoding terminology than they actually are. With that in mind, ETC Group has committed to being clear and distinct in our reporting and education.

‘On-chain’ data refers to the multitude of datapoints that blockchains produce from their daily usage.

This covers everything from transactions between wallets, to the dollar value moving through the network, to the number of holders of a particular coin or token. Analysis of this information can tell us how those numbers are changing over time and allow us to infer both certain usage statistics and general market trends.

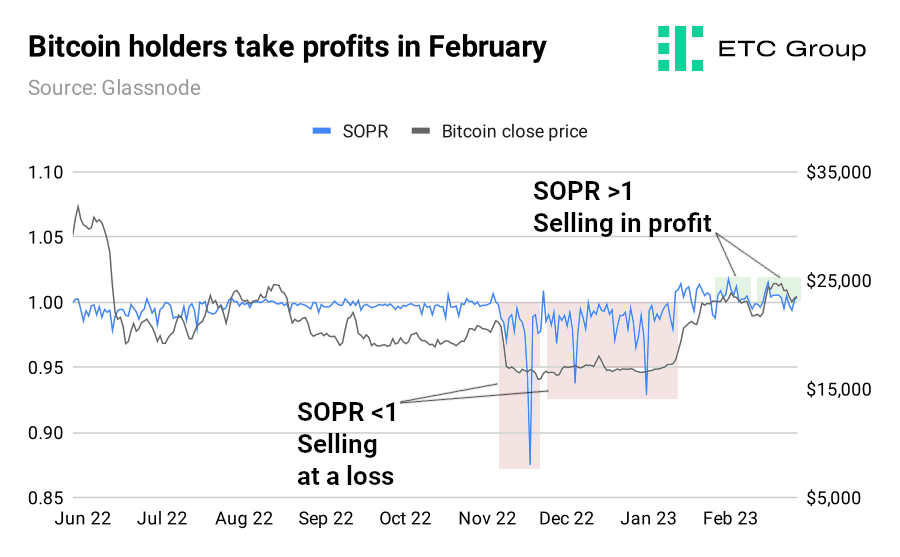

SOPR: Price sold vs price paid

One particularly useful metric which shows how traders are treating their Bitcoin holdings is SOPR, or Spent Output Profit Ratio. SOPR was created in 2019 by Glassnode analyst turned NFT-collector Renato Shirakashi.

It helps us to understand the state of economics in the Bitcoin ecosystem, acting as a proxy for the overall profit and loss in the market. SOPR is calculated using Bitcoin’s UTXO transaction model, by dividing the ‘realised value’ of a Bitcoin spent output, by the value when a Bitcoin output was created.

Values fluctuate around 1, with those above 1 indicating that Bitcoin holders are (on average) selling at a profit, because the Bitcoin price when sold, or realised, is higher than the price paid. Values below 1 implies the opposite, that holders are (on average) selling at a loss.

More simply, SOPR tracks price sold versus price paid.

The lowest value on record of 0.8749 came on 18 November 2022 amid the FTX collapse, and given the number of hedge funds and speculative traders caught up in that debacle, it suggests at the time that traders were having to cover margin calls, with the associated flood of crypto inventory onto the market sparking panic selling from weak hands.

By contrast, after January’s 39.6% run up in the Bitcoin price, February has been characterised by market players taking profits, with SOPR values generally well above 1.

When values remain above 1 after a long period below the line, we expect profit taking to dominate market proceedings.

As such, we categorise recent selling as profit skimming and not part of a structural downside trend.

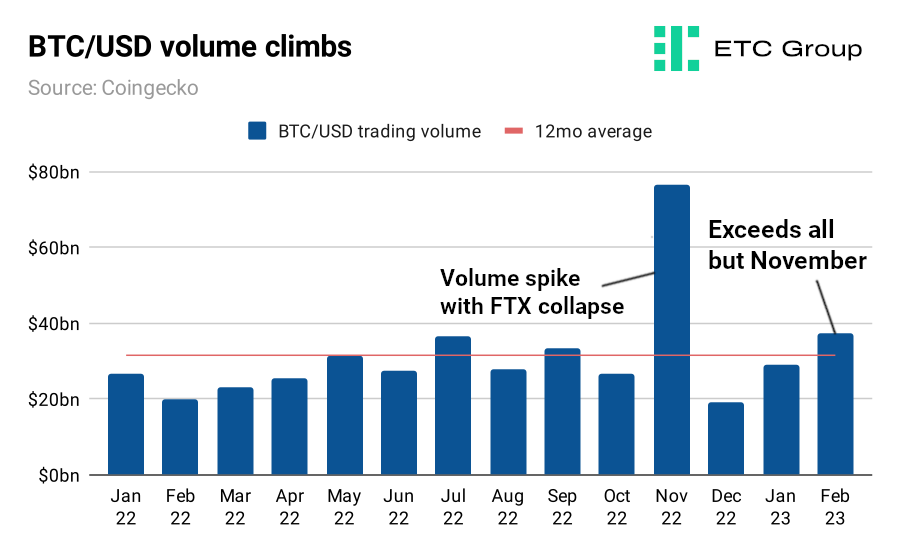

Daily spot BTC/USD volumes also remain well above their 12 month average.

Back in November, as the Bitcoin price dropped to its cycle low of $15,874, there was a rush to capitalise on both long and short positions, and traders pushed the daily average trading volume on exchanges to $76.7m.

February’s daily average trading volume hit $37.4m, an 28.9% increase from January ($29m) and greater than 12 of the last 13 months.

20 February’s close price of $24,787 remains the peak of Bitcoin’s pricing in the year to date.

Bitcoin NFTs race past 200,000 mints: sparks biggest debate in years

Aside from a digital gold-like store of value, a new use case has suddenly appeared for Bitcoin. Anyone with an interest in the space has surely heard of Bitcoin Ordinals by now. If not, here’s the rundown.

Ordinals are a new standard to track individual satoshis — the smallest unit of BTC — which can be used to inscribe arbitrary quantities of data into the Bitcoin blockchain. Arbitrary in this context just means ‘any amount’, rather than ‘a random amount’.

The main complaint levelled at the Bitcoin network in its earliest incarnation was that it could only host one type of asset: BTC.

When Ethereum arrived on the scene in 2015, it did so with a stated intent to be able to host any type of asset on its platform: birthing the ERC-20 standard that allows developers to launch a token relying on Ethereum’s security model, thereby growing their market share and network effects without having to build or run their own blockchain.

The following Cambrian explosion in development produced tokens with tens of billions of dollars of market cap, including Circle’s USDC stablecoin ($42bn), Uniswap ($5.1bn) and Chainlink ($3.1bn), all of which sit in the top 20 assets by market cap as of 28 February 2023.

The use of Bitcoin’s network to host alternative assets other than BTC has proved controversial among Bitcoin maximalists. This group believes that Bitcoin is a public good and a monetary asset, and so its blockspace should be reserved only for transaction data.

Placing arbitrary data like text, pictures of penguins and videos into blocks is a waste of space and contrary to Satoshi Nakamoto’s original vision, they say.

The argument is not without merit, but it does ignore the fact that Bitcoin has greatly changed over time, and while today it still exists as a counterparty risk-free way of sending value across borders, its main use case has developed as digital gold. The velocity of money on the Bitcoin network has dropped significantly over time, suggesting that more holders see Bitcoin’s value rising in future than wish to spend it.

As Bitcoin Ordinals creator Casey Rodarmor tweeted: “I understand the argument that NFTs are lame and stupid, but I don't understand the argument that NFTs are somehow *illegitimate*. Bitcoin has transcended its original creator and purpose. Bitcoin is not *for* some things and *not for* other things. It just is.”

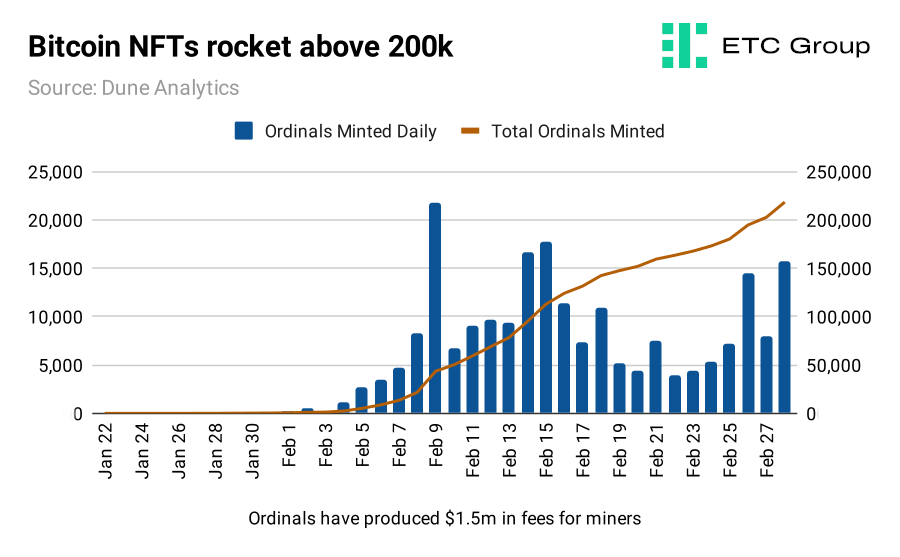

The introduction of NFT-like assets on Bitcoin have enthused developers and brought forward an enticing new revenue stream to miners. Data from Dune Analytics shows that mints have climbed to 228,000 as of 28 February 2023, producing almost $1.5m in new revenue for Bitcoin miners.

As a reminder, users of the Bitcoin blockchain pay fees to miners to have their transactions or data included in the next block. Once added, blocks cannot be removed from the Bitcoin blockchain, creating an indelible record that cannot be altered.

Pages like this are very helpful for live-tracking the use of Bitcoin Ordinals. As of the end of February, more than 59 BTC had been paid to include Ordinals in Bitcoin blocks.

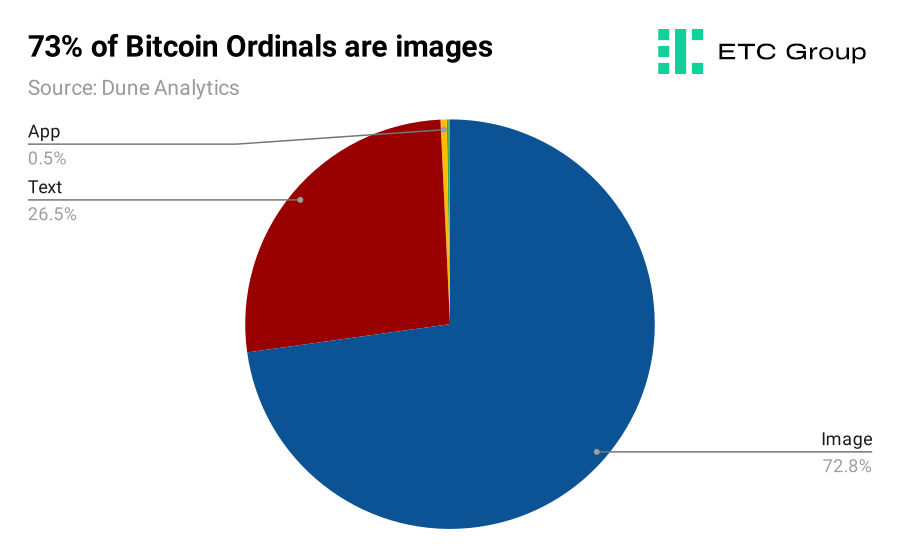

The vast majority of Bitcoin Ordinals — more than 160,000 of the total — are images like NFT-style collections. However, as interest and usage of Bitcoin Ordinals grows we expect the additional use cases to grow in volume. It is also possible to inscribe individual satoshis with text, video clips, GIFs, audio files and even JSON applications.

The creation of Bitcoin Ordinals requires a high degree of technical knowledge, and trading generally occurs OTC in disparate Discord servers instead of in public marketplaces.

But Bitcoin Ordinals have taken some of the wind out of Ethereum’s NFT sails and are growing so quickly that, over time, they may even delay The Flippening — the putative point at which Ethereum overtakes Bitcoin to become the largest crypto by market cap value.

Recent developments suggest that chain-agnostic market participants see long-tail value in Bitcoin Ordinals. Those early NFTs on Ethereum like CryptoPunks and Art Blocks now regularly sell for millions of dollars and there is hope that those collecting the first set of Bitcoin NFTs could be in for a similarly gigantic future windfall.

For example, the Bitcoin mining pool Luxor, creators of the hash price metric, snapped up the Bitcoin NFT marketplace Ordinals Hub on 20 February.

NFT projects such as TaprootWizards, Ordinal Loops and PunksonBitcoin have already seen sale prices in excess of 10 BTC ($237,000), Luxor said.

Yuga Labs, the company behind CryptoPunks and Bored Ape Yacht Club, also made moves in the latter part of February, releasing its first collection of Bitcoin Ordinals. Amid the first NFT craze of 2021, a seed funding round gave the company a monster $4bn valuation.

Anticipating the level of future growth in Bitcoin NFTs is difficult, and analysts should be wary of arrow-flight projections, suggesting that any market will grow upwards in a linear fashion indefinitely.

However, with almost 60 BTC in fees already paid to miners for inscribing Ordinals, this provides a new revenue stream for miners looking ahead to the 2024 Bitcoin halving, where block rewards will be sliced in half from 6.25 BTC per block to 3.125 BTC.

Halvings occur approximately once every four years. As part of Bitcoin’s fourth halving event, the amount of BTC created daily will drop from around 900 BTC per day to around 450 BTC per day.

ETH deflation, revenue spikes as blockspace demand returns

Blockchains are a delicate balance of incentives: ask users to pay more fees and the network is more secure from attack and resistant to spam, and its supporters receive more valuable rewards, proportionally.

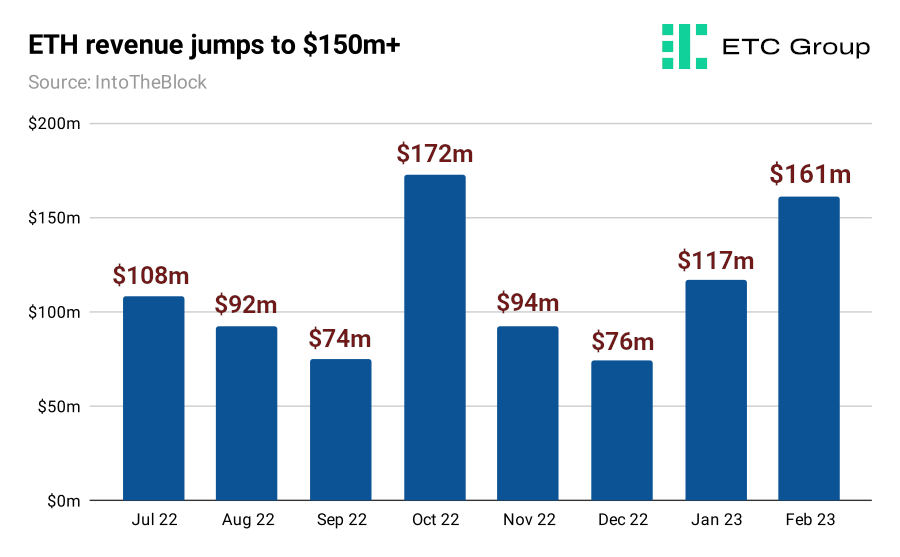

The average fees paid to stakers and validators on Ethereum have tripled since November 2022 with $161m in fee revenue recorded across February. That represents the largest monthly spend since October.

Despite being a shorter month, February 2023’s total fees outpaced seven of the previous eight months.

And Ethereum’s deflationary supply tokenomics continue.

Data reviewed by ETC Group in February shows that Ethereum token supply is deflating at its fastest ever rate.

Driving the shift are:

- The after-effects of The Merge, which moved the network from Proof of Work to Proof of Stake and started to reduce supply. Under Proof of Work, miners were issued approximately 13,000 ETH per day. Stakers under the new system are instead issued ~1,700 ETH per day, cutting new issuance by around 88%.

- Increased ETH burn: This fluctuates according to network demand.

- Higher NFT trading volumes and DeFi TVL, shown by rising gas fees and increasing the associated ETH burn (where Ethereum tokens are deleted from circulation).

- Ethereum’s upcoming Shanghai hard fork, which will allow stakers to withdraw locked ETH for the first time

- Bullish headwinds in the crypto market more generally.

In the 165 days since The Merge, 40,550 ETH has been deleted from supply.

Liquid staking overtakes DeFi lending

Liquid staking tokens have had a meteoric growth spurt, and with ETH unstaking just around the corner, Coindesk reports that the total value locked (TVL) in liquid staking protocols like Lido and Rocketpool has soared to outpace the TVL in DeFi lending and borrowing markets.

Lido first appeared on the market in December 2021, offering liquid staking on Ethereum. By depositing ETH into Lido’s protocol, users are given both a yield on their stake, akin to buying a dividend stock, as well as being given tokens as derivatives representing their ETH stake, called stETH.

Each protocol or platform offers its own version. For example, Coinbase offers ETH stakers a derivative token called cbETH, while Lido gives out stETH tokens in reward for staking ETH through their platform.

They can then take those derivative tokens and deposit them into other apps and markets, potentially earning additional yield. Lido’s governance token LDO has rocketed by more than 200% in 2023.

What does Liquid Staking mean?

There are two main limits to access staking for Ethereum token holders:

- Having a minimum deposit of 32 ETH

- Locking up staked ETH until withdrawals are made available after Shanghai

Liquid staking derivatives like cbETH and stETH solve the initial problem by pooling together ETH deposits from multiple holders — akin to owning fractional shares — so that they can participate in validating blocks of transactions.

Lido, Coinbase, Kraken and others also allow ETH holders to stake without having the technical difficulty of running a validator node. The ETH tokens staked are also not available to use anywhere else: until the Shanghai upgrade comes into force in March.

Lido, Coinbase, Kraken and others offer these users liquid staking derivatives that they can take into the broader market, thereby utilising the value of their Ether, even if they don’t have the original tokens, which are now locked up.

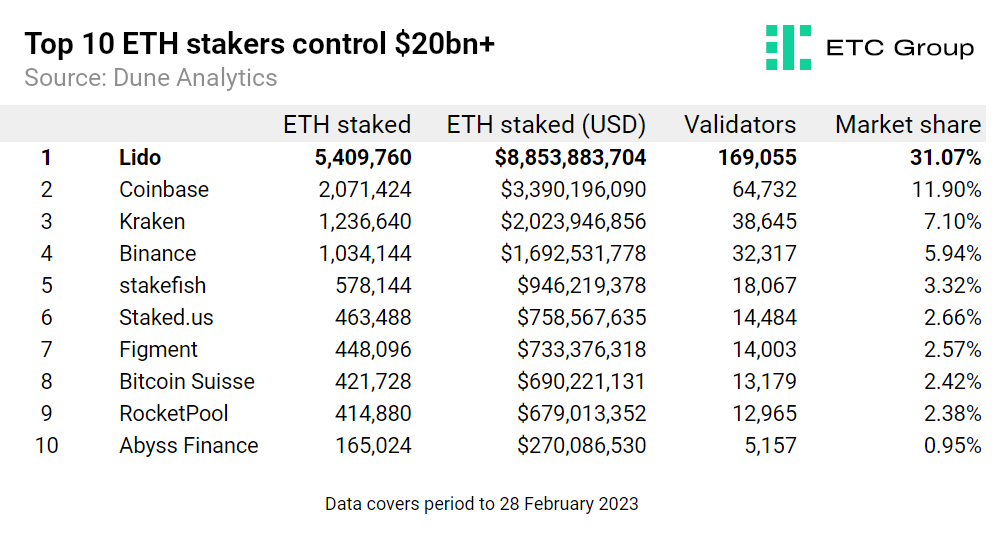

Top 10 Ethereum staking protocols reach $20bn

With 17.4 million ETH deposited into Ethereum staking services as of 28 February 2023, the top 10 Ethereum staking protocols and platforms now account for more than $20bn in deposits, the latest updates show.

While this concentration is something of a concern, the number of validators has also accelerated to almost 550,000 ahead of the Shanghai hard fork, ensuring Ethereum network security, and showing that interest in the blockchain is as high as it has ever been.

Base: Coinbase launches Layer 2 promising 1 billion users

It became something of a cliche to hear that bear markets are times for teams to build without having to worry about token prices. But one marker that investors are coming out of the worst of the downturn is the arrival of new products and features onto the market.

What institutions and corporates cannot do amid waning prices and falling interest is to launch new products and deploy large amounts of capital.

Simply, teams have been waiting until retail and institutional interest returns before debuting high-value projects on which they have been working.

Coinbase revealed the arrival of its Layer 2 (L2) Ethereum scaling solution Base at the end of February. The testnet for Base first went live earlier in the month and the mainnet will be rolled out in the coming months.

Base is meant to be an open ecosystem where developers can build decentralised applications (dApps) while taking advantage of the security offered by the Ethereum network. The end goal is to make it easier for developers to make decentralised applications more easily.

It will be powered by Optimism’s open-source OP stack and be incubated inside Coinbase with it acting as a primary developer until it is completely decentralised. Base will be interoperable with other blockchains that have EVM compatibility like Avalanche or Fantom.

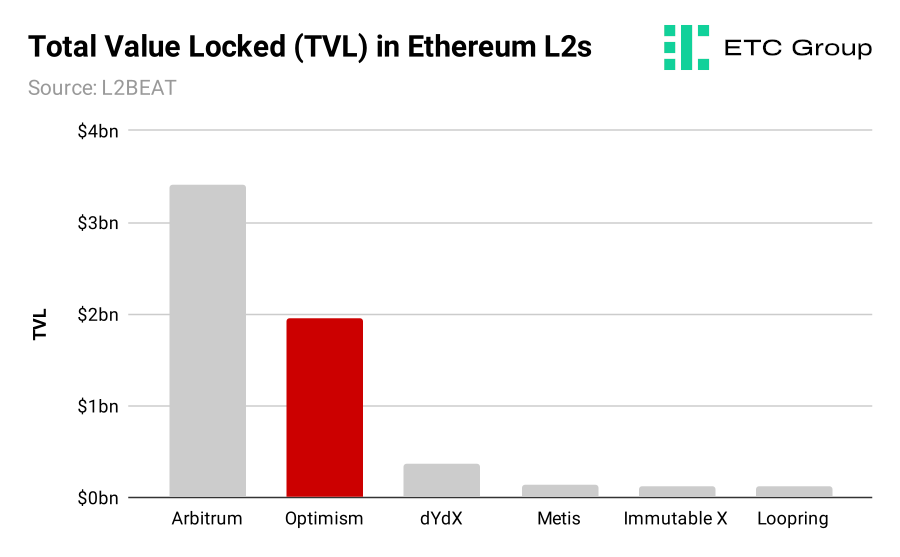

There is a total of $6.3 billion worth of digital assets locked in Layer 2 applications inhabiting the Ethereum ecosystem. From these, Arbitrum dominates the L2 arena with its 54% market share that amounts to $3.4 billion. There are over 20 scaling products using rollup technology in the Ethereum environment.

It will serve as an onramp for Coinbase’s on-chain products to the exchange’s 100 million strong verified user base. But anyone will be allowed to use Base as it is a permissionless network and does not require any KYC.

This means that this could drastically increase the amount of users interacting with the Ethereum network, as Coinbase looks to move a large mass of off-chain users on chain by seeing them interact with Ethereum products without using intermediaries and setting up addresses.

There are no plans to issue a token for Base just yet. Base will use ETH as its native asset and users will pay for gas fees in ETH. Although, it is likely that Base will launch its own token at some point.

The Ethereum L2 Optimism initially launched its network without a token and it has since airdropped OP governance tokens to early adopters of the network. Arbitrum is tipped to be planning the same thing.

Optimism and Arbitrum are both optimistic rollups. They reduce congestion on the Ethereum network by processing transactions off-chain which makes transactions faster and cheaper. After the transactions are executed off-chain, the data is posted on the mainnet.

Optimistic rollups are separate to zero-knowledge rollups that also execute bundles of transactions off-chain but publish cryptographic proofs of validity for off-chain transactions.

They also produce validity proofs to prove the correctness of their changes. The validity proof demonstrates with cryptographic certainty that the proposed changes to Ethereum's state are truly the end-result of executing all the transactions in the batch.

The news of Base using Optimism’s open-source technology led to rallies for tokens that belong to the Optimism ecosystem. Optimism’s OP token, VELO, the native token of the Optimism-based decentralised exchange Velodrome Finance, and OPX, the governance and utility token of OPX Finance, all saw gains.

Aside from Base, projects like Metis and Boba Network also use Optimism’s code base.

The popularity of Optimism can be reflected in the dollar value of gas fees paid to make transactions on its platform. On average, users spend a total of $91,000 every week to carry out transactions on Optimism. This is compared to the $66,000 spent on Polygon transaction fees and the $81,000 spent on gas fees to carry out trades on the Ethereum-powered stablecoin exchange Curve.

Institutional moves suggest increasing appetite

According to CryptoCompare, the total assets under management for all cryptoasset investment products in February climbed by 5% compared to January. This is the third monthly increase in a row, and the figure of $28.3bn marks the largest AUM recorded since May 2022.

It seems that the dip-buying mentality is starting to extend out from retail towards institutions, too.

One survey released this month by deVere Group indicates that since the start of 2023, 82% of high net worth investors had asked their financial advisors about Bitcoin and other digital assets. “Interestingly, this typically more conservative group were not deterred by the bear market and adverse market conditions,” the report reads. “Instead, they were looking to either start including or increasing their exposure to crypto.”

Improved appetite and positive sentiment among institutions did not only extend to buying, trading and holding individual cryptoassets. Also coming into vogue is the extended use of Ethereum for asset tokenisation projects.

One EU report which came out in late February showed that $33bn per year could be saved from bond issuances by using public blockchains like Ethereum.

A survey by HSBC and Northern Trust this month suggested that by 2030, between 5% and 10% of all assets would be tokenised.

February also saw a flurry of moves from governments and institutions in this regard. Siemens was the latest corporate to join the digital securities revolution, using the Polygon blockchain to conduct a , while Deutsche Bank tested a tokenised fund using a private blockchain.

3. On-chain Signals

Bitcoin

Liquidity demand: Exchange flows

The amount of Bitcoin travelling between exchanges and on-chain wallets declined by 14% in February. Outflows and inflows together amounted to 27.4 billion worth of Bitcoin in February against $32.1 billion for the month of January.

This reflects the stable price of Bitcoin which has caused holders to largely retain positions instead of responding to volatility by moving funds between off-chain and on-chain addresses.

Bitcoin exchange inflows marginally beat outflows. Inflows capped off at $13.8 billion while outflows totalled $13.6 billion. Neutral Bitcoin

Futures Activity

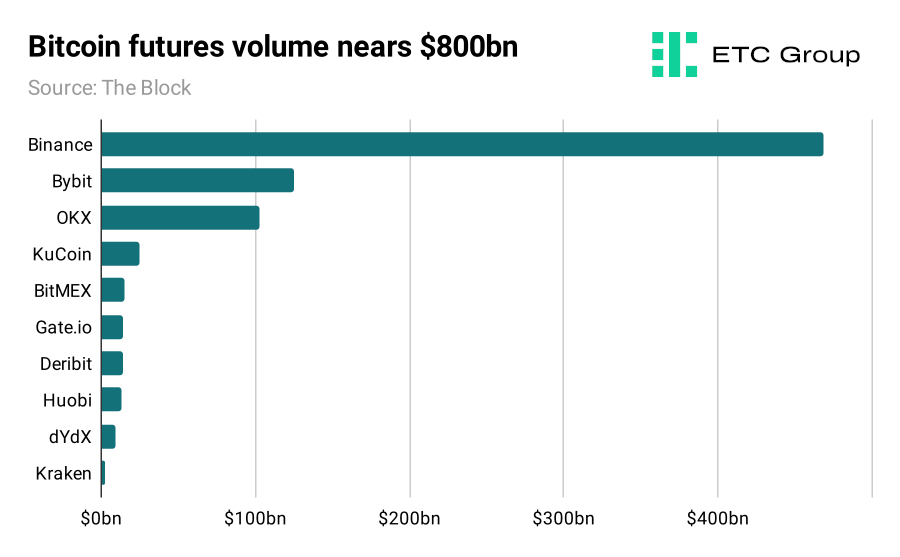

Bitcoin futures volume rose by 12% to $787 billion in February. This is the highest figure recorded since October 2022. Traders are returning to the Bitcoin futures market in size after despondent conditions caused apprehension towards the end of last year. Bullish Bitcoin

Institutional Demand

Inflows into Bitcoin-based investment products in Europe saw a cooldown in February after the massive influx of institutional capital that flooded in last month.

In the 30 days to 24 February, $114 million entered spot Bitcoin ETPs with 19% of this breaking into ETC Group’s flagship Bitcoin product (Ticker: BTCE). Bullish Bitcoin

Ethereum

Liquidity Demand: Exchange Flows

Total flows in February reached $41.1 billion worth of Ethereum and saw no real change compared to January. Exchange outflows of $20.7 billion and inflows of $20.4 billion cancelled one another out.

This metric signals there is no clear buy or sell sentiment among investors that are still waiting to see how the market reacts to the withdrawal of staked Ethereum from the Beacon Chain in March.

Traders tend to move digital assets onto exchanges when they experience selling pressure and shift them to self-custody wallets when they seek to conserve their holdings. Neutral Ethereum

Futures Activity

Ethereum futures transactions were worth $530 billion in February and rivalled the healthy futures volume seen in January. The majority of Ethereum futures trading took place on crypto exchanges registered outside the USA like Binance and OKX. Bullish Ethereum

4. Into the Metaverse

Japan has sealed the deal on a ‘Metaverse Economic Zone’ which will use a combination of gaming, fintech and IT to build an open metaverse for enterprises. Subtitled ‘Launching industrial applications for a digital twin society’, a 28 February release details how a group of banks including SMBG, Resona and MUFG joins industry titans like IT services group Fujitsu and car manufacturer Mitsubishi.

Together they will build out content that “takes on the form of a moving city, castle or vehicle that roams around that virtual world”, with users engaging in a role-playing game-like experience.

While it’s often difficult to separate press-release-speak for real-world action, what is clear is that Japan’s largest finance companies are taking on key elements of Web3.

The platform “automatically learns each avatar’s behaviour as a digital twin and can provide personalised information on health care and hobbies”, while payments and authentication will be handled by a Multi-Magic Passport (MMP) created by JCB, Japan’s only international payment brand. The MMP can register NFTs, avatar skins and other game-like items and should allow users to travel and spend between metaverse services. This sounds a lot like a decentralised identity feature, one of the key elements of Web3.

Merging the open metaverse and Web3

Decentralised identity (DID) is one of the foundational elements of Web3, moving users from Web2’s ‘read+write’ to ‘read+write+own’. It relies on cryptography to provide an unambiguous descriptor so that users can control their digital identity without relying on a specific provider, like Twitter, or Google. In July 2022 DID became an official Web standard.

Digital twins

One of the more intriguing parts of the metaverse concerns its industrial, rather than retail use case. Digital ‘twins’ — digitise versions of real-world supply lines, ports and factory floors — are gaining in popularity due to the operational cost savings that can be made from using augmented reality digital overlays on real world objects, speeding up manufacturing and identifying issues more quickly.

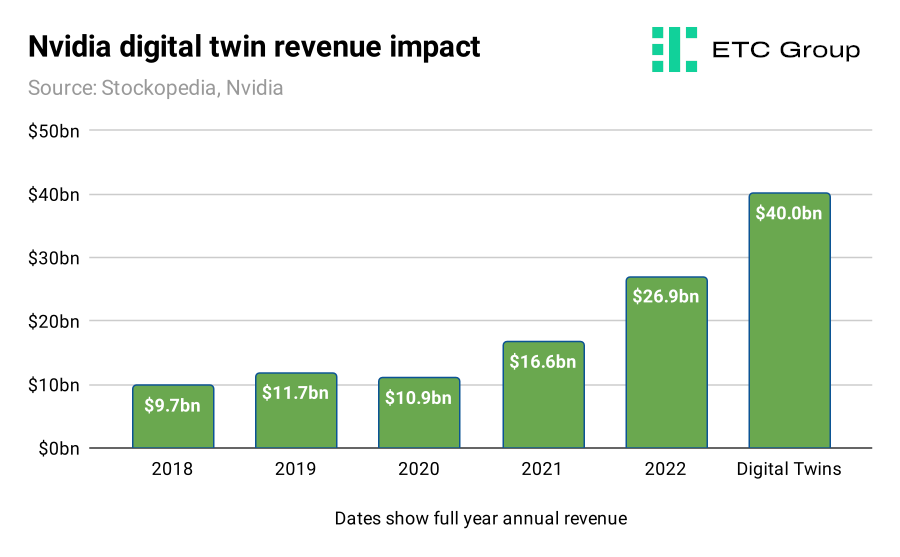

Nvidia CEO Jensen Huang has said that he sees digital twins alone as a $40bn per year revenue opportunity. The comments, made during the semiconductor giant’s fiscal Q3 2022 update suggested that its Avatars product, part of the company’s Omniverse software suite, suggest the scale of the opportunity available.

Huang said: “I demonstrated probably the largest application of robots in the future, and it’s avatars. We built Omniverse Avatars to make it easy for people to integrate some amazing technology, for speech recognition, natural language [processing], facial animation and speech synthesis, all of that integrated into one system and running in real time.” The Avatars software is available on a subscription basis and costs $1,000 per year per user.

And just as cryptocurrencies battle it out to become the industry standards in transferring assets and value, so a similar war is waging to create and install the standards of the metaverse.

Nvidia put forward its USD filetype for building and composing 3D assets in August 2022, based on the Universal Scene Descriptor language originally created by animation studio Pixar.

Elsewhere in key metaverse equities: Meta released figures showing total revenue was 1% down in 2022: $116.6 billion from $117.9 billion in 2021. Despite the fall in revenue, the tech conglomerate’s stock is up 40% year-to-date.

Investor confidence in the company has seen a renewal after CEO Mark Zuckerberg called for a “year of efficiency” that will see the company curtail spending on costly R&D projects.

Instead, Meta is determined to generate profit from its bread and butter products. Meta is launching a new service called Meta Verified, a subscription package available on social media platforms Instagram and Facebook.

It promises to allow users to authenticate accounts with badges, provides improved account support, and strengthens visibility and engagement on the platforms. The service is presently undergoing a pilot phase in Australia and New Zealand.

(NASDAQ:RBLX) had perhaps the best month of all metaverse equities, integrating generative AI into its codebase to help users build games faster and more effectively.

The California-based company defied forecasts that user interest in its products could wane after the lifting of COVID restrictions in 2022. Average daily users amounted to 54 million (up 23% Y-o-Y) and total company revenue was $2.2 billion (up 16% Y-o-Y).

An increasing number of household brands from Spotify to the NFL are using Roblox to engage with a worldwide customer base. The user-generated content platform reached partnerships with more than 100 brands in 2022.

More than 90% of all items published in the Roblox marketplace are now made by independent creators. Roblox’s economy is now a stone’s throw away from being entirely supported by user-generated content.

Finally, we turn to Qualcomm.

The graphic chips and wireless technology firm’s stock has added 16% YTD in spite of its last earnings report showing revenue was down year-over-year.

Qualcomm supplies chipsets that are used in virtual and extended reality headsets to a number of retail manufacturers like Meta. More recently, Samsung announced it will be integrating Qualcomm chips in devices that will allow clients to enter the Metaverse.

Qualcomm has also reiterated that it will continue to produce 5G chipsets for Apple’s new iPhone that will be released to the end of the year.

5. Digital Asset Equities

In terms of the critical equities supporting cryptoasset industries, there are few bigger than semiconductor company Advanced Micro Devices. AMD posted revenue figures of $5.6 billion for the fourth quarter of 2022 – a year-over-year increase of 16%.

AMD specialises in computing, visualisation, and graphics through products like graphic processing units (GPUs) and central processing units (CPUs). But in 2022 growth was chiefly driven by its data centres.

Growth in this vertical was driven by deepening industrial interest in cloud computing services and products, for which AMD has become a hub. AMD ended 2022 with $23.6 billion in revenue, of which $1.3 billion constituted net income.

NVIDIA closed 2022 with $27 billion in revenue, flat from the previous year. The computer hardware company is pivoting itself toward AI technology with plans for new AI-powered supercomputers underway.

In December, NVIDIA announced a partnership with Deutsche Bank to accelerate the adoption of AI in financial services. This is expected to allow banks to automate functions like risk evaluation that will be played out over multiple simulations and preclude the need for manual supervision.

NVIDIA also announced a collaboration with Lockheed Martin to build a digital simulation of global weather conditions so it can help frontline workers like firefighters or the coast guard train for and detect extreme weather conditions with more certainty.

Microchip Technology had record sales of $2.1 billion in the three months to 31 December 2022 – up 23% from a year ago – as demand for graphic processing chips continues to heighten.

The semiconductor company serves industries ranging from computing and industrial to defence and aerospace. Microchip shares have added 18% since the start of the year against 4% for the S&P 500.

6. Outlook

There are multiple bullish themes emerging in March and beyond, and we expect those to collide headlong into macroeconomic and liquidity considerations.

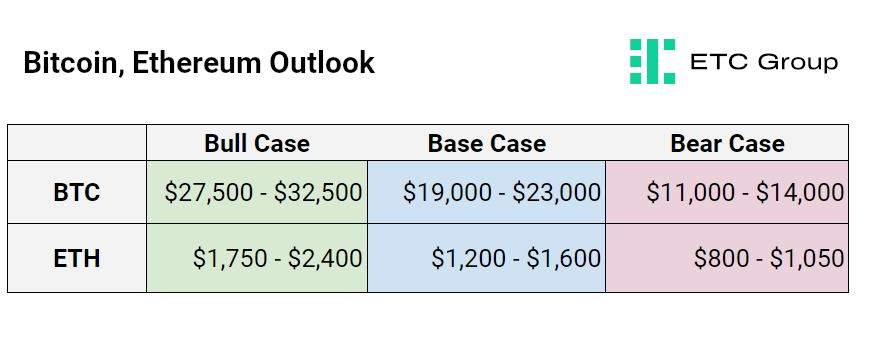

With Bitcoin rejecting $25k and Ethereum holding steady in the $1.6k region, industry dynamics are in flux, awaiting the next major move to the upside or downside.

We expect ETH unstaking to bring much more institutional capital into Ethereum, rather than less, and we do not see the ‘rush to the exits’ playing out as has been suggested in other quarters.

The deployment of Layer 2 protocols on Ethereum is a positive sign of its health and development. There are a number of L2s battling for blockspace on Ethereum and it will be important to track which ones will be the biggest winners.

Until now, there has been no index products to map out and track the value of the disparate Layer 2 protocols inhabiting the Ethereum blockchain. As the ecosystem is inhabited with more protocols built on top of it – and the total value locked in them –, the space is calling out for a product that can provide exposure to the L2s with the most utility and value in the Ethereum space.

Macroeconomic considerations will play a part in the coming weeks and months, and certainly the suggestion of higher US rates for longer has weighed on equities. A pivot point for central banks — including the Fed and the ECB — starting to reduce interest rates now looks to be further out than expected at the start of this year. Bond market futures suggest this disinflationary period will be pushed out to September/October instead of July/August.

However: with crypto correlations to equities and commodities diving lower across the month, this infers that Bitcoin and Ethereum are less sensitive than they normally would be to macro data releases.

As we suggested in our January 2023 Digital Assets and Metaverse Monthly Review:

On a technical basis Bitcoin’s run up to ~$23,400 represents a significant area of resistance, from where BTC was rejected, setting the stage for a potential deflation in the exuberant rally that has consumed most of January.

“We expect profit-taking to dominate the conversation in the first weeks of February, possibly with an over-reaction to the downside to see Bitcoin at around $20,500.”

This thesis has proven to be largely correct: albeit Bitcoin has not taken the downside as far as we expected. This is in part attributable to the sudden rise of Bitcoin Ordinals.

On-chain data clearly suggests that recent pullbacks in Bitcoin relate to profit taking, rather than a broader structural downturn in sentiment. Relatively higher BTC/USD spot volume than the 12 month average, and the largest amount since November 2022, indicates growing interest in the asset class from retail participants.

Add to this increasing venture dry powder being deployed, a number of significant product launches, an entirely new revenue stream for Bitcoin using Ordinals, and the frothier elements of the market in DeFi and NFTs seeing uptake, and we see more positives than negatives in the outlook for the rest of the quarter.

As such, we leave our Bitcoin and Ethereum price projections unchanged.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer