1. Executive Summary

- The bottom is in and the bull market is back - for now

- Macro strength, FOMO catapults crypto markets back above $1T

- Only China outperforms Bitcoin as global growth revised up

- NFT ‘Trojan Horse’ theory bears fruit as Amazon signals digital asset launch

- DeFi, NFTs return to boost ETH fees, switch network deflationary

- Ethereum fundamentals improving faster than Bitcoin, suggesting diverging paths in 2023

- Metaverse, digital asset equities enjoy swift rebound

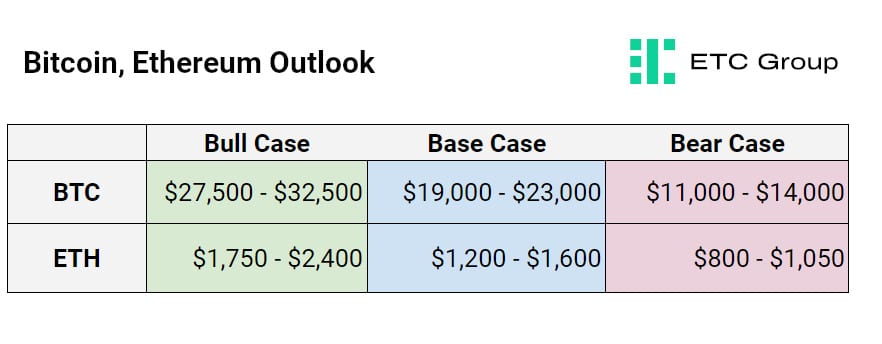

- Bull case sees BTC at $32.5k, ETH at $2.4k

2. Overview

With 2022 a year to forget for risk assets like equities and crypto, markets appeared to turn a corner in the first month of the new year.

It is worth recalling that global markets posted the worst first half to a year in more than 50 years in H1 2022, with more than $13 trillion wiped off the value of the MSCI World Index.

Any respite from this lower base would seem positive. And yet in the second half of the year, crypto markets were hit by lending provider collapses, the whiff of contagion, and fallout from alleged criminal actions of those running the world's second-largest crypto derivatives exchange, along with ongoing economic worries relating to 40-year high inflation readings.

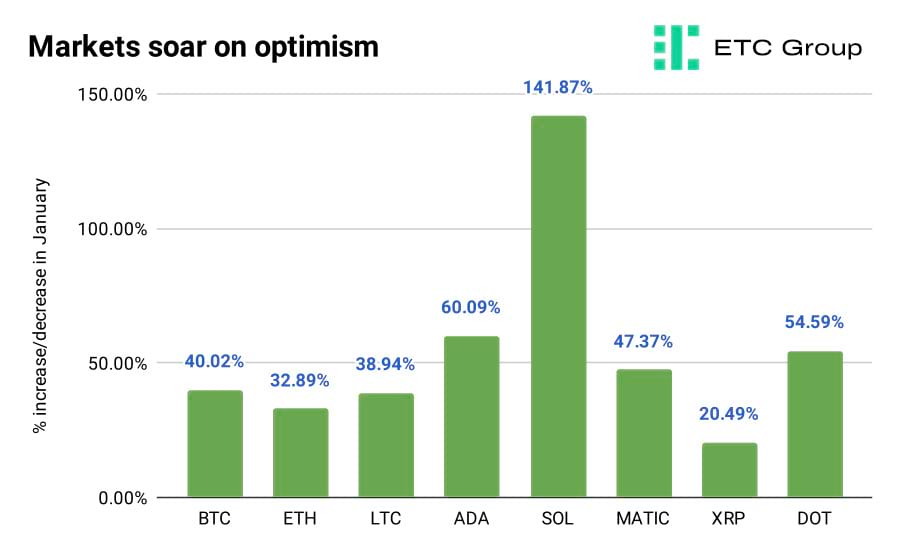

However, in the post-FTX period investors witnessed a heartening sea of green, and markets flew higher across January in a bullish turnaround marked by higher volatility in asset pricing, with Bitcoin up by more than 40% and Ethereum climbing by over 32%.

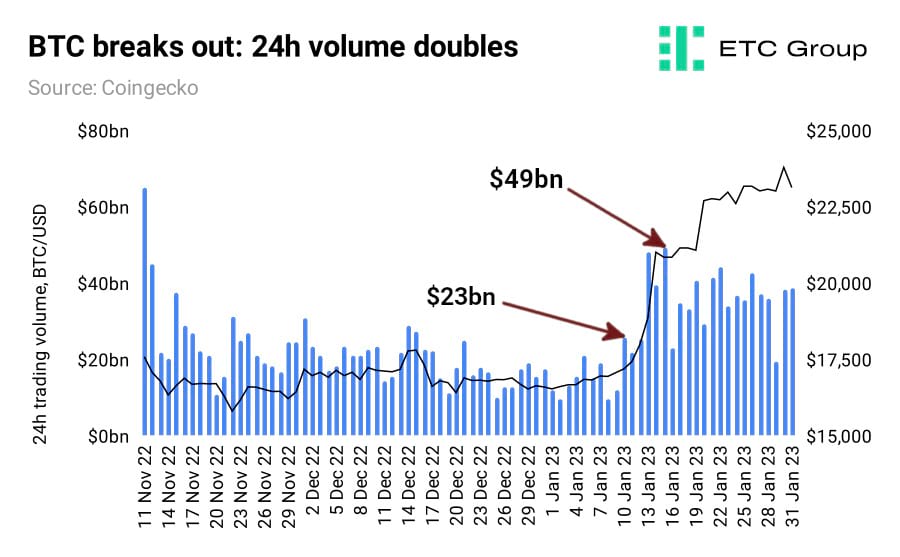

As volatility and traders returned to the market, trading volume shot back up to historic averages from the lows of December. 24-hour trading volume doubled over the course of a couple of days in mid-January, from $23bn to $49bn.

With daily average trading volume returning to $29.8bn in January from the 24-month low of $19.3bn in December, it is clear that interest is picking back up in crypto from a broad range of investors.

And with trading volume in general 10 times higher than it was during the last crypto bear market, the stage is set for a generalised rebound in asset prices throughout 2023.

Volume has now settled at an average of $38.6bn per day.

In general, high beta risk assets were pulled higher through a combination of better-than-expected US and European macro data on jobs and economic growth, China's reopening to global trade, more positive derivatives market positioning and improved support for Bitcoin miners through better market prices for their most prized commodity.

Initially, short squeezes were behind much of the euphoric upward swings in altcoins like Solana (SOL) and Cardano (ADA). Traders found themselves positioned heavily offside and forced to buy these assets back at new higher prices when markets moved substantially against them. This had the associated effect of switching deep and historic negativity back to optimism as January wore on.

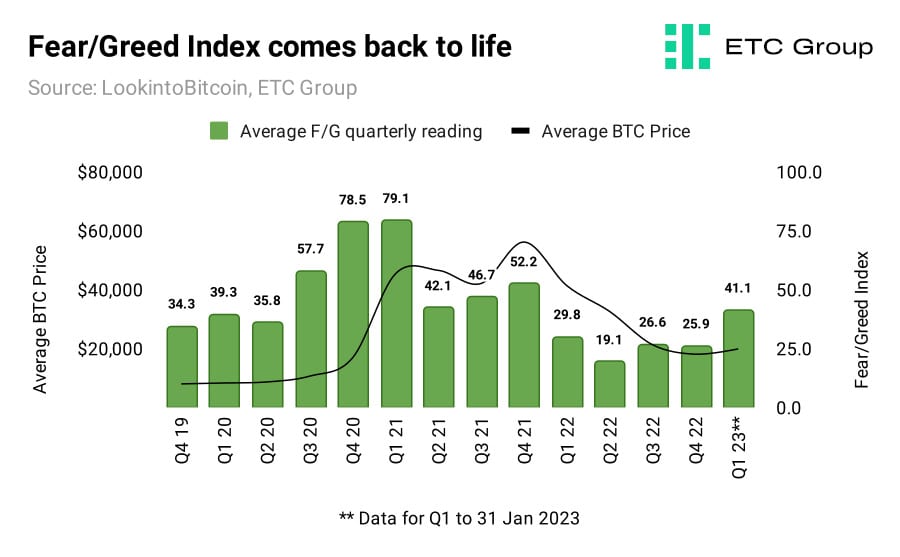

We can see this most clearly in the Fear and Greed Index for Bitcoin.

Fear replaced by Greed as markets come back to life

Bitcoin's Fear and Greed Index provides a simplified overview of the state of momentum and general upside/downside sentiment in the market. A reading of 100 implies full bore, freewheeling risk-on sentiment, while the opposite end of the scale is, well, the opposite.

When we look at the data and average out the values on both monthly and quarterly bases, it adds more fuel to the assessment that June 2022 was the local bottom for markets in this cycle, with an historic low in confidence reached.

In the days before the FTX revelations in early November 2022, Bitcoin's F/G indicator had cracked 40 for the first time since August, suggesting that optimism was starting to return to markets in the form of improving sentiment. That would be short lived, as US institutional investors and the most frequent-trading hedge funds took huge hits on the collapse of the second-largest derivatives exchange. The fallout would last for months, with revelations of increasing offensiveness to well-run companies.

As of 31 January 2023, the Bitcoin Fear and Greed Index has turned around markedly to hit a daily reading of 61, the highest since 16 November 2021. That previous high watermark of market confidence came eight days after Bitcoin reached its record all time high daily close price of $67,492.

The quarterly average to date of 41.1 represents a four-quarter high.

Is the crypto market bottom in?

Could this mean that the long-awaited bottom is in? It would be hard to find a harsher or more fraught playing field for risk assets as mid-to-late 2022, and it is difficult to imagine either Bitcoin or Ethereum revisiting their 2022 lows - $15,782 and $993 respectively.

There are simply more bullish catalysts available to both digital assets today than there were in the midst of all that madness. Some are structural, such as the growing demand for blockspace and associated fees on Ethereum, some are crypto-cyclical, such as the upcoming Bitcoin halving, while others relate more broadly to the prevailing macroeconomic picture of the day. This latter point may reveal cryptoassets to be a better portfolio diversifier than many had anticipated.

Our Bull Case, Base Case and Bear Case for Bitcoin and Ethereum is reliant on a combination of all of these factors, as well as taking into account option strike pricing in derivative markets for the top two cryptoassets. See the end of this report for those figures.

Eagle-eyed readers will note the wide variance in price ranges in each of these cases. That is in part because of the associated volatility of both assets having risen substantially in January 2023.

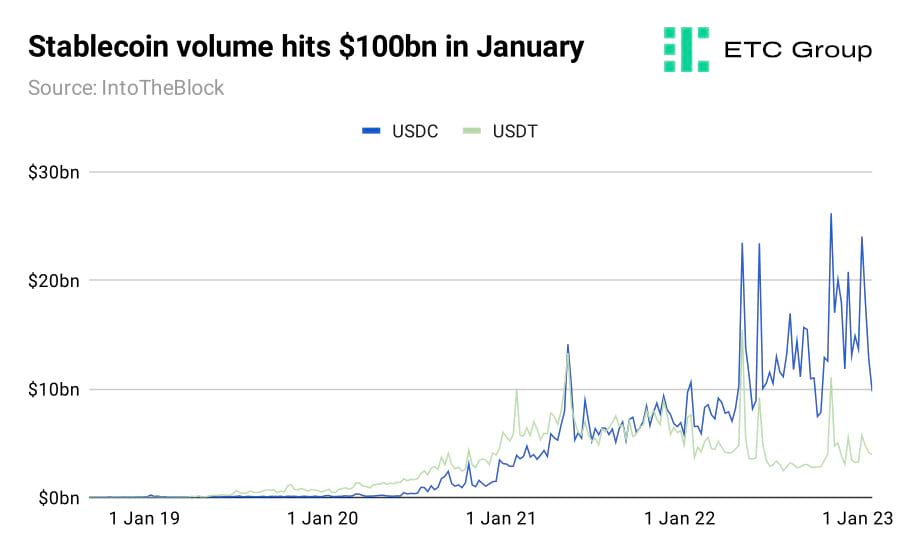

Stablecoin volume up 25% in January

Improved stablecoin supply growth suggests better liquidity in crypto markets as a whole, and the growth of supply is broadly beneficial. More accessible trading routes, higher adoption and more stable and efficient trading are among these rewards. Recent increases in the market cap and transaction value of the most popular stablecoins: USDC, USDT have a direct impact on increased market depth and liquidity.

Climbing stablecoin transaction volume has pushed total weekly volume of USDC and USDT from 75.7bn in December 2022 to $100.1bn across January 2023.

One additional point to note on stablecoins is that there will be increased institutional adoption in the coming months. On 26 January 2023 Bloomberg reported that the credit ratings agency Moody's was developing a scoring system for stablecoins, such as Circle's USDC and Tether (USDT) based on the quality of their attestations on the reserves that back each coin. Ratings akin to those provided elsewhere by Moody's is highly likely to establish more legitimacy for crypto's most traded tokens.

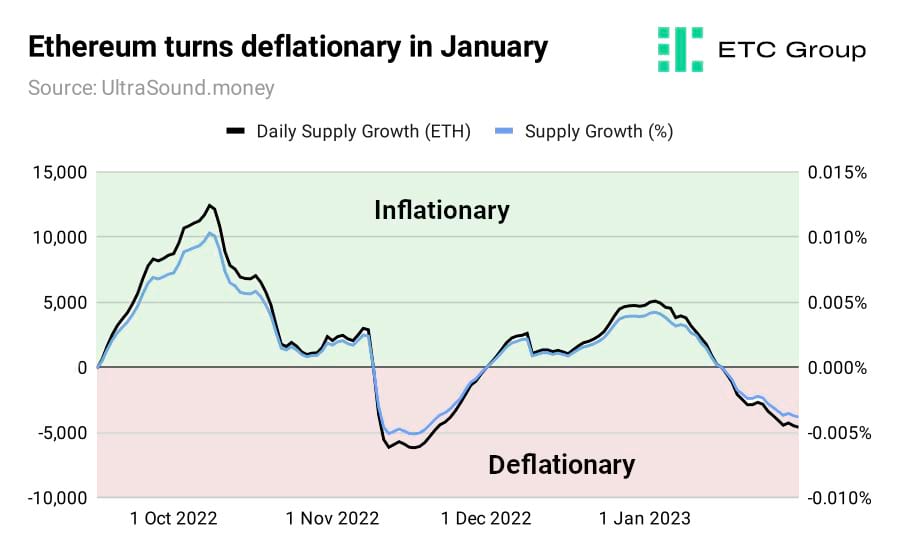

ETH turns deflationary again

The state of Ethereum more than four months since the Merge is setting the stage for a potentially huge bull run in the second-largest cryptoasset.

Driving the shift in Ethereum's deflationary turn are four main points.

- The after-effects of The Merge, which moved the network from Proof of Work to Proof of Stake and started to reduce supply. Under Proof of Work, miners were issued approximately 13,000 ETH per day. Stakers under the new system are instead issued ~1,700 ETH per day, cutting new issuance by around 88%.

- Increased ETH burn: This fluctuates according to network demand.

- Higher NFT trading volumes and DeFi TVL, shown by rising gas fees and increasing the associated ETH burn (where Ethereum tokens are deleted from circulation).

- Ethereum's upcoming Shanghai hard fork, which will allow stakers to withdraw locked ETH for the first time

- Bullish headwinds in the crypto market more generally.

We said in previous research that ETH would pick up more Store of Value credentials from its deflationary turn, as DeFi volume and NFT markets pick back up and demand for blockspace returns to the smart contract blockchain. That has proved to be precisely the case.

As of 31 January, Ethereum's inflation rate was minus 0.003%, with 4,614 ETH being removed from the ~120 million circulating supply over the course of the previous 24 hours.

After August 2021's London hard fork, in an upgrade widely known as EIP-1559, part of Ethereum's transaction fee required to process operations on the blockchain (such as NFT sales, DeFi trades or for moving ETH between wallets) is now deleted from circulation permanently.

Bitcoin, by direct contrast, is disinflationary, rather than deflationary, meaning that its inflation rate is falling over time but is still positive. Until the fourth Bitcoin halving scheduled sometime in August 2024, Bitcoin's currency inflation rate will be 1.78%, falling to 1.1% after the halving.

Shanghai fork poses more positive ETH catalysts

One other key positive catalyst for ETH holders is the Shanghai hard fork, which is scheduled for March 2023. This is the most significant technical development since The Merge in September 2022, and will enable users to withdraw Ethereum deposits and rewards that have been accrued since staking went live on the Beacon Chain in December 2020.

On 24 January, Ethereum developers announced the successful deployment of a shadow fork as a precursor to Shanghai.

Shadow forks are created to test readiness, test design flaws, and circumvent any issues that could crop up when such a backwards-incompatible network upgrade goes live. In a nutshell, a copy of the blockchain is created to serve as a technological sandbox for developers to stress-test features.

Currently, the Ethereum network has $26 billion worth of ETH staked on the network that users will be able to access progressively.

This, we must recall, was one of, if not the largest and most complex changes to any cryptocurrency network in history.

The Merge, on 15 September 2022, was the result of seven years of work, changing the network's consensus mechanism from the energy-intensive Proof of Work mining structure favoured by Bitcoin.

This massive upgrade reduced the electricity consumption and carbon footprint of Ethereum overnight by 99.988% and 99.992% respectively.

According to the Crypto Carbon Ratings Institute, Ethereum's electricity consumption immediately dropped from 22,900,320 MWh/year to 2,600 MWh/year, while its CO2-equivalent emissions fell from 11,016,000 tons to 869.78 tons.

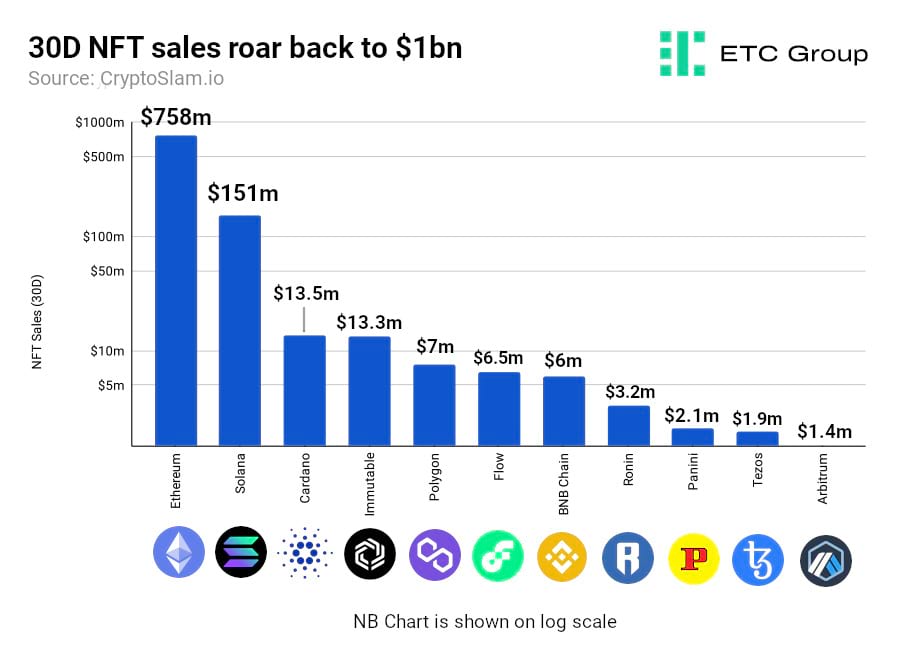

NFTs reach ~$1bn in sales in January, up 34%

One of the best ways to track speculative interest in crypto markets is to look at its frothier elements, NFTs and DeFi.

NFT sales across the major blockchains advanced to almost $1bn in January 2023, an average 33.83% rise across the top 12 chains. Ethereum again led the way.

It's worth noting that not every blockchain is designed to be a Layer 1 chain for transactions in Web3. On the Tik Tok-adopted ImmutableX, for example, users can only do three basic things: buy NFTs, sell NFTs and hold NFTs. Compare this to Ethereum, which can compute any type of arbitrary code and hold the state data of all the smart contracts being used on its platform at any time.

Panini is also starting to see decent returns from its investment into a Sawtooth Hyperledger-based blockchain, with the toy brand starting to make inroads into the largely crypto-native market in January. Just as with other market participants, Panini NFTs are packaged in the same way as physical trading cards, with NFTs minted and then randomly placed into packs or set up for auction on the Panini website.

Four of the top 10 are Ethereum-based chains, in line with that blockchain's dominance of the NFT market. NFTs on Ethereum registered $758m in sales in the 30 days to 31 January 2023, with Solana taking second place with $151m.

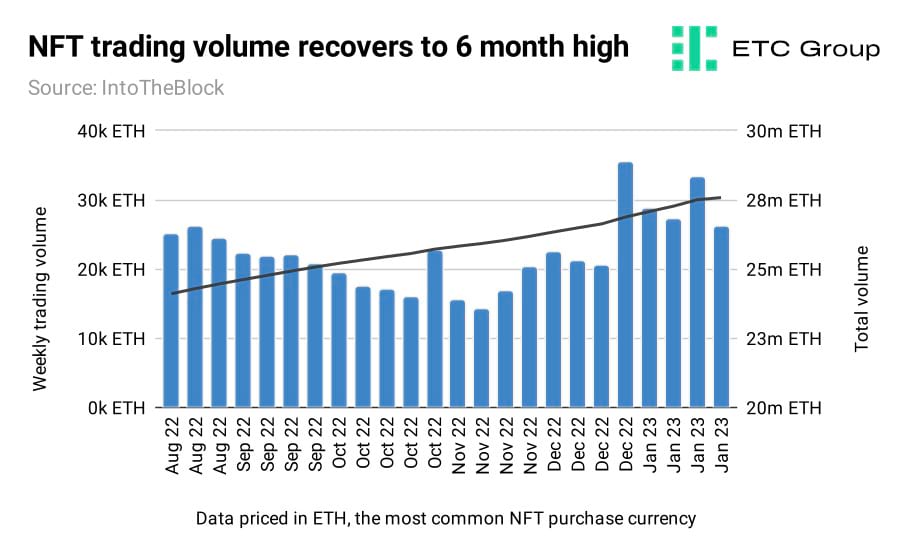

Other associated statistics compiled during the month suggest that NFTs may not be the albatross around investor's necks that mainstream media reports tend to suggest. Trading volume is starting to recover and across January 2023 rebounded to a six-month high.

There will be some concerning elements to watch for Ethereum holders: including the rise of alternative Layer 1 blockchains. We heard in late January that Doodles, a popular NFT release, would move away from Ethereum to launch on the Flow blockchain.

The decentralised exchange Uniswap V3, which currently provides the second-largest amount of ETH burn on Ethereum, will launch on the BNB Chain after a community UNI tokenholders vote saw it reach an 80% threshold.

However: the definition of NFTs has now expanded far beyond their initial use case as digital art, into game items, digital identity and even digital collateral for loans. In a sector crying out for standardised reporting and data availability, portable and self-sovereign digital identity - a key portion of Web3 over Web2 - is starting to make its voice heard.

ETC Group first estimated in Q3 2021 that Ethereum-based NFTs would be the 'trojan horse' to take crypto to its first billion users, and we are now very confident that this estimate may materialise.

Users, transactions and holders of non-fungible tokens are continuing to rise. As IntotheBlock's Lucas Outmoura noted in mid-January, the number of daily NFT sales recently neared its all time high of 140,000 transfers.

Reddit's avatar marketplace has brought 4 million new NFT addresses to the table, without once mentioning NFTs. Starbucks' beta test of its Polygon-based Odyssey platform, released in limited early form on 8 December 2022, will allow users to earn NFTs that unlock additional features and customer benefits. These are called ‘journey stamps', in Starbucks press material, and do not mention Polygon, Ethereum or NFTs. Instagram has been testing the waters for creators to sell NFTs directly.

Household names such as Nike have already profited heavily from introducing users to Web3 and NFTs: in August 2022 the sports apparel giant reported $185m in sales from NFTs, making it the highest earning NFT brand in the world at the time.

We would expect this trend to continue, as NFT markets are still immature and penetration remains in a fairly nascent state.

Amazon to enter NFTs?

A late-January report by Blockworks (citing five unnamed sources) injected an extra frisson of excitement into the mix. It suggested that Amazon, the world's fifth largest company, was preparing to start using NFTs in gaming products. These would be focused on Amazon's main consumer-facing platform, rather than its infrastructural backbone Amazon Web Services (AWS). AWS has officially supported Ethereum since March 2021 via the Amazon Managed Blockchain, and offers full node services for developers.

This retail-focused entry into NFTs is an entirely different infrastructure beast, however. It would open up the $1 trillion market cap company- the third-largest by revenue globally - and its estimated 300 million customers to blockchain-based assets.

Ethereum Nightfall opens door to vast new markets: enterprise privacy

On 18 January 2023 EY released Nightfall D3, an upgrade to the public domain source code for scaling Ethereum for enterprise applications using Polygon. Crucially, Nightfall is a privacy system that allows businesses to shield the content of transactions while still using the public Ethereum blockchain.

The upgrade includes two major changes. First, the code can now be deployed on a fully decentralised basis to prevent control by any one organisation or group. Second, to prevent anonymous usage (while still maintaining an open and permissionless model) users who wish to deposit or withdraw funds are required to have an enterprise-class X.509 identification certificate. X.509 is a global standard public-private key pair that allows registered users to digitally sign documents, messages and transactions.

EY made its first move to start scaling Ethereum in 2019 by releasing the first version of Nightfall. Polygon's co-founder responsible for the project, Antoni Martin, said: “The move to update Nightfall in the public domain is a major milestone in scaling the Ethereum ecosystem and will open up new use cases for enterprises in Web3.“

Paul Brody, the outspoken leader of EY's Global Blockchain division, added that Nightfall D3 had undergone six months of testnet operations before the January launch, and that his team considered the project in “production beta”, ready for client supply chain and business operations.

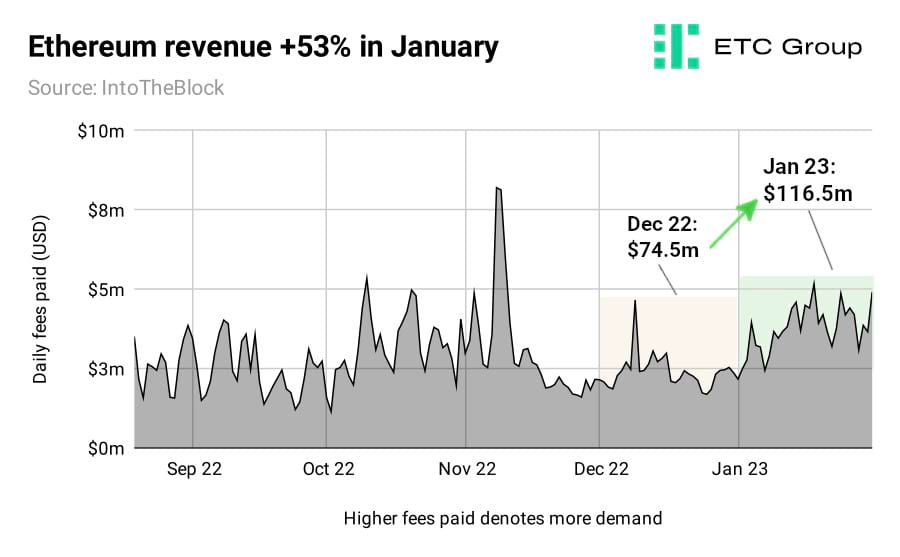

Ethereum fee rebound sets stage for further growth

Ethereum fees (revenue) are a useful gauge for both the short-term and long-term demand for Ethereum blockspace. As demand for blockspace increases, so do Ethereum fees. Over a longer timeframe, increasing network fees indicate a growing and more highly utilised network, creating an associated upturn in demand for ETH to access Ethereum blockspace.

Demand for blockspace naturally leads to greater fees being paid for inclusion in those blocks. While demand has not returned to the heights of the 2021 bull run, it has nevertheless started to pick back up again and has been increasing in general since July 2022.

Ethereum fees moved 26.89% higher across January 2023 compared to the previous month. The total fees collected by the Ethereum network for apps using its blockspace in December was $74.5m, compared to $115.3m in January 2023.

More fees paid over a given period adds more support and security to the network and means that ETH asset price appreciation does not outstrip underlying revenue growth.

This fundamental strength could bolster Ethereum to outperform Bitcoin as investors look beyond the hype - and a potentially faltering rally - to see which chains are producing notable utility and value.

3. Macro Signals

80 central banks have hiked rates at incredible speeds throughout 2022 in response to what they believe is inflationary pressure.

But it is clear that just as quickly as interest rates rose in 2022, they will have to fall in the second half of 2023.

Typically, interest rates fall in recessions as demand for credit slows, companies cut jobs and capital expenditures, the demand for protective store of value long-dated government bonds rise (and hence, yields fall).

The Federal Reserve's Open Markets Committee (FOMC) meeting on 1 February delivered precisely what the market expected: a 25 basis point rate hike to a target of 4.75% to 5%.

Traders had positioned themselves almost exclusively towards the lower rate with 98.9% of bets placed on this figure. Earlier in the year, 67.8% were geared towards 25bps. As strong jobs reports and slackening demand in services started to hit, inflation expectations broadly fell.

A weakening US dollar has aided Bitcoin and Ethereum to a large degree, improving the risk-adjusted returns from the top two cryptoassets.

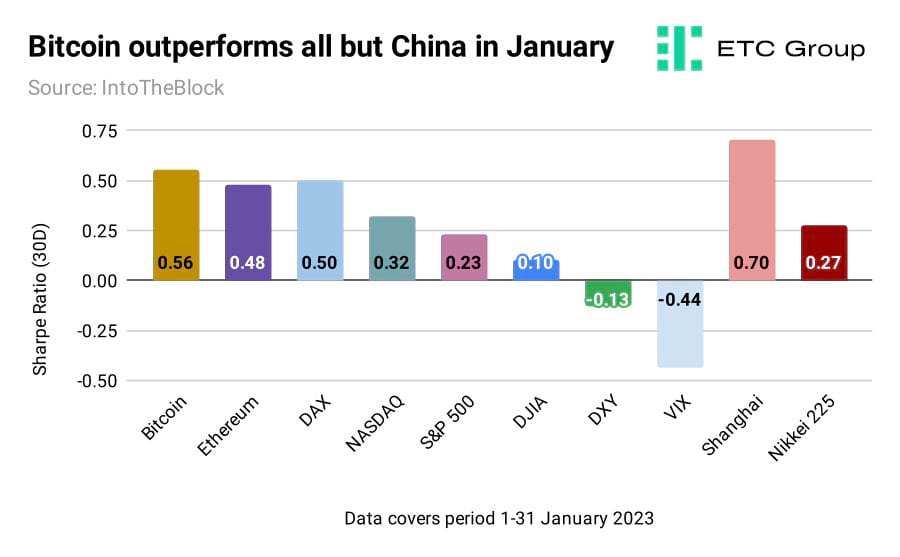

Only China beats Bitcoin

The below chart is a comparison of the risk adjusted returns of cryptoassets compared to traditional financial benchmarks. Used here, the Sharpe Ratio is calculated by dividing the return of an asset by the standard deviation of its daily performance over the selected time period.

The chart below shows the 30-day Sharpe Ratio of Bitcoin, Ethereum and select equity market benchmarks between 1 and 31 January 2023. A higher ratio indicates better risk-adjusted returns.

At times of economic stress, all markets tend to move as one into a flight to safety, namely towards the US dollar. When DXY, the US dollar Index, starts to lose traction, funds start to flow into those asset classes from where it has come. Investors start to look more closely at adding riskier and more volatile assets to their portfolios (equities, crypto, commodities) as markets move away from this flight to safety, as we have seen throughout January, crypto is a natural beneficiary.

Of all the benchmarks covered, only the Shanghai Composite (0.70) outperformed Bitcoin (0.56) and only the Shanghai Composite and the European benchmark the DAX (0.50) outperformed Ethereum (0.48).

This is perhaps to be expected, given China the huge scale of optimism unleashed in China from the end of its nearly three-year Covid restrictions, whereby the country officially reopened its land and sea borders to global trade.

This was a long-awaited move from Xi Jinping which will have wide-scale growth impacts. In fact, the 8 January move to end its zero-Covid policy by the Chinese premier caused the IMF to raise its outlook for global growth.

The International Monetary Fund said in a 31 January release that demand, real GDP and growth in the US and Europe were all “surprisingly strong”, with economists upping their forecast from October 2022 by 0.2 percentage points, to see global growth at 3.4% in 2022, falling to 2.9% in 2023 before rising back to 3.1% in 2024.

This reflects “positive surprises and greater-than-expected resilience in numerous economies,” the IMF said. “Negative growth in global GDP-which often happens when there is a global recession- is not expected.”

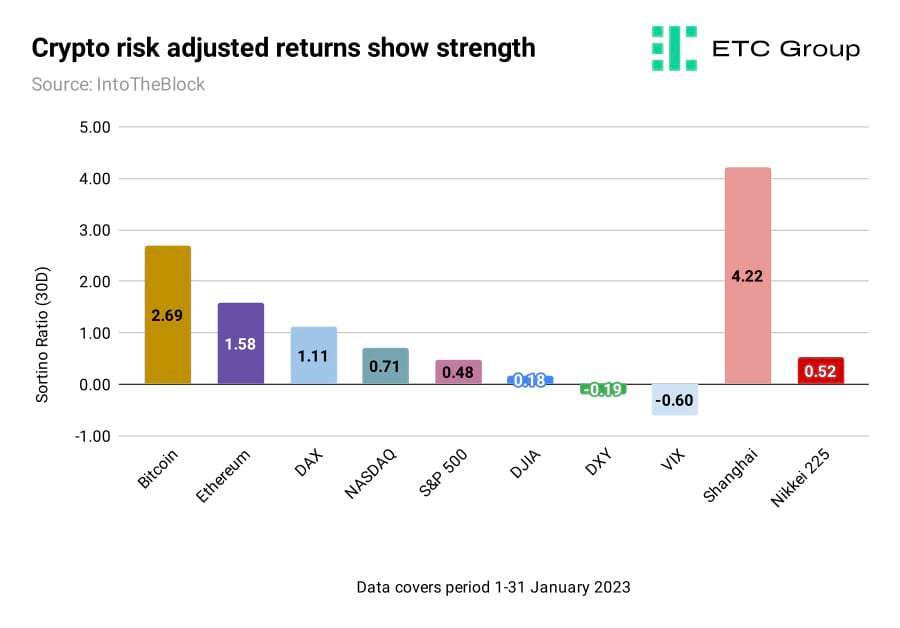

Additionally, Bitcoin and Ethereum both outperformed global stock market benchmarks in January when we take into account the Sortino Ratio, which places more emphasis on downside risk. The Sortino Ratio, named for famed economist Frank A. Sortino, looks at an asset's return but compares its performance relative to downside deviation, instead of the overall standard deviation of returns.

The higher the Sortino Ratio, the greater the expectation of risk-adjusted returns, all other things being equal.

Bitcoin (2.69) again outperformed every US stock market benchmark, including the Dow Jones Industrial Average (0.18) and the tech-focused NASDAQ 100 (0.71). It was only surpassed in terms of risk-adjusted returns by the Shanghai Composite (4.22). On this measure, Ethereum (1.58) also came in a healthy third place behind its larger cousin and the Chinese index.

JP Morgan's recent Long-term Capital Market Assumptions report puts this within a broad structural trend, noting that alternative asset classes like crypto “still offer appealing diversification benefits [with alternatives] offering alpha and inflation protection.”

“In all financial alternatives categories, we continue to see improving alpha trends that are likely to benefit further as dry powder meets the capex demand that we anticipate picking up in the 2020s,” the investment bank's analysts said.

The scale of Bitcoin's return to prominence is perhaps not unexpected, given the amount of time that institutional confidence in the digital assets sector have remained under par, firstly in the bear market of 2022, amid the crash of Terra Luna in May of last year, and then the FTX debacle six months later.

It is also clear that institutional confidence - and a healthy dose of FOMO - returned to markets in the latter stages of January 2023.

Euro ETP flows bounce back

Institutional buyers of Bitcoin and Ethereum investment products rejoined in their droves, as ETC Group internal data shows.

In the 30 days to 27 January, the flagship Bitcoin investment product BCTE saw inflows of $143.7m, bringing its AUM to $413m, a 53.4% increase. This is higher than any digital asset exchange traded product (ETP) in Europe.

More broadly, Bitcoin and Ethereum ETPs are beginning to strengthen after the declining price of Bitcoin impacted the dollar value of assets under management. The combined AUM of Bitcoin spot products globally now stands at $2.1bn, with inflows in January contributing almost a third of this figure.

In the short term we expect some natural profit taking as crypto market investors realise gains of between 30%-140% on their assets.

Central banks and rate rises lead the way

As highly rate-sensitive instruments, Bitcoin and Ethereum have been buoyed by vision on the horizon of a slowing pace of rate hikes - and an eventual pivot to start cutting rates - by the US Federal Reserve and by the European Central Bank: crypto's two largest Western markets.

98% of bond market traders were pricing in the possibility of a 25bps increase to the US Federal Funds Rate on 1 February and so it came to pass ,with crypto markets declining slightly on the news. This was to be expected, as the overwhelming majority of positioning in the lead up

As of 31 January, the Bank of England was poised to raise interest rates by 50 basis points, from 3.5% to 4, its 10th such increase in a row.

ECB rate hikes - where next?

The European Central Bank will increase interest rates by 50 basis points in both February and March 2023, according to the Dutch central bank president Klaas Knot. In an interview with the Dutch broadcast WNL, Knot said it was “too early to tell” whether the ECB should slow the pace of its rate hikes by this summer.

The majority of the ECBs policy committee has agreed on a 50bps jump in rates over a more aggressive 75bps hike in February. The ECB has already lifted rates by 2.5% since summer 2022, while markets are pricing in a terminal rate of 3.2% by August 2023.

More tough talk is expected out of the EU central bank chiefs until inflation starts to come under control.

"Expect us to raise rates by 0.5% in February and March and expect us to not be done by then and that more steps will follow in May and June," Knot said.

The German government revised up its forecasts for the rest of 2023, noting on 25 January that as a whole the country would avoid sliding into recession this year. In its annual economic report German analysts said GDP would grow by 0.2%, compared to a -0.4% fall forecast in Q3 2022.

Year on year inflation is pegged at 6% for 2023, down from the previous 7% forecast, as energy prices ease following the crisis triggered by the Ukraine war, Reuters said.

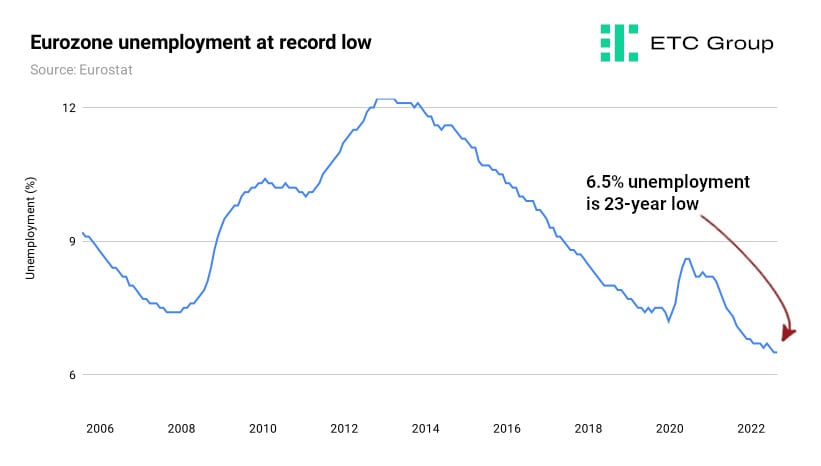

Figures from the EU have continued to confound bearish economists.

More positive noises started to bleed out of official EU surveys in mid-January, with consumer expectations of inflation 12 months ahead declining substantially from 5.4% to 5.0%, while expectations for income growth gained.

Key expectations for economic growth over the next 12 months to January 2024 increased from -2.6% in October 2022 to -2.0%, while consumer expectations for the unemployment rate over the same period also edged down from 12.5% to 12.4%.

As ETC Group showed in recent research, a 6.5% EU-wide unemployment rate is the lowest datapoint on record, for a dataset that started counting 23 years ago.

This has augmented the position taken by Goldman Sachs economists who suggested on 10 January that Europe would avoid recession entirely and instead grow by 0.6% in 2023.

The median inflation rate held steady across the EU at 9.9% in January 2023. Perceived access to credit is perhaps an under-counted metric as regards its potential impact on crypto markets. This clearly loosened under the recent ECB Consumer Expectations Survey. Bitcoin is currently treated as a risk-on asset with demand for its use in portfolio diversification higher when times are less strained. With more favourable economic data in hand, markets are likely to price Bitcoin's value higher when there is more positive economic data from the largest global markets.

The expectation of better credit access across the bloc - even if it does not end up matching reality - ties in with the surge in speculative and risk assets like equities and crypto in the first month of the year.

4. Regulatory Signals

Europe

In terms of regulatory clarity, a final vote by the European Parliament to ratify the EU's upcoming MiCA (Markets in Crypto Assets) legislation was due in February 2023, but was on 17 January delayed until April, with the reasoning given that negotiators had difficulty in translating the text of the bill into 24 languages. EU procedures require that all legislation is made available across all the languages that make up the bloc.

Europe has long led the world in terms of clear-eyed legislation to support high-quality cryptoasset companies, and the surety that comes with bloc-wide rules will be no exception. MiCA is still expected to come into force in 2024.

Key elements of MiCA remain:

- Improving customer security and protection when interacting with digital assets

- Forcing exchanges to register

- Regulating the use of stablecoins

In truth, MiCA simply brings European standards in line with what asset managers like ETC Group are already doing: ensuring the safe segregation of customer funds in third-party cold storage and being as transparent as possible about the assets that underlie their products.

United States

US regulatory clarity - not least on which regulator out of the CFTC or the SEC will have control of the crypto spot market - seems further and further away as the year wears on. There had been hopes that a Democrat-controlled Senate, and a Republican-controlled House of Congress would mean that bills with broad bipartisan support would make it into law in 2023. These include the Senate-led Responsible Financial Innovation Act (S.4356), submitted in June 2022 by Democrat Kirsten Gillibrand and noted Bitcoin advocate Republican Cynthia Lummis.

The Act would set new tax rules for crypto investors and shift oversight to the more-favoured Commodity Futures Trading Commission, which already oversees the Bitcoin futures market. In addition, the RFIA would add common-sense de minimis rules allowing people to make small purchases using digital currencies without having to account for and report income.

But partisan infighting within the Republican party, a surprisingly razor-thin majority and the failure of Republican House Speaker Kevin McCarthy to win broad support within his own ranks mean that legislative progress is likely to be slower than expected.

Fights over the US debt ceiling - a limit on the amount of money the federal government can borrow - are likely to consume Congress until June 2023 with crypto-related regulatory bills pushed into the background.

As ever, the US continues to risk falling behind Europe and other regions as regards cryptoasset regulation. Consumers and businesses are still having to rely on piecemeal state-level regulation and this is thwarting the ability of the sector to grow.

UK

The UK for its part has been speaking more clearly about crypto regulation in past months, and on 1 February 2023 released its long-awaited consultation over plans to regulate the crypto industry.

This follows Prime Minister Rishi Sunak's thread which began in April 2022. Not content to allow their European cousins to create a strangehold on institutional crypto markets without a fight, Sunak (then Chancellor of the Exchequer) said at the time: “It's my ambition to make the UK a global hub for cryptoasset technology, and the measures we've outlined will help to ensure firms can invest, innovate and scale up in this county.”

Included in the new crypto market framework are plans to “enable a new and exciting sector to flourish and grow,” Sunak said.

These include

- Placing the responsibility on crypto trading venues to define requirements for admission as well as disclosure requirements

- Strengthening the rules around custody

- Setting out a proposed crypto market abuse regime

- Bringing cryptoassets in line with traditional finance rules

A three month consultation period has now been launched, closing on 30 April 2023. After this point, the government will work to draft legislation, finally consulting with the market regulator, the Financial Conduct Authority, to produce detailed rules.

Last year the country's tax authority, HMRC, passed new rules to include cryptoassets in the Investment Manager's Exemption (IME). The IME effectively aims to cut the UK tax take on investment transactions, thereby attracting foreign investment funds to London. The UK capital has long been a centre of the fund management industry globally and UK tax treatments are designed to attract foreign investment funds to use UK fund managers. Regulated funds are not considered to be UK tax resident, even if their management “abides” in the UK. But The City has been badly hurt by Brexit, with the finance sector losing most of its access to the European Union, its largest export partner. This was confirmed by Square Mile policy chief Catherine McGuinness in 2022.

Make no mistake, the UK's adoption of a new cryptoasset regime is bullish on all timelines for the sector at large.

5. On-Chain Signals

Bitcoin

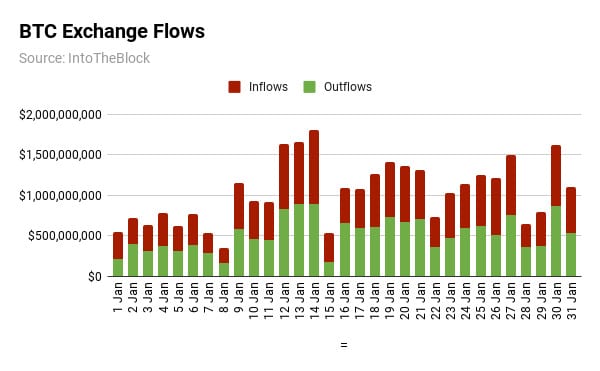

Liquidity demand: Exchange Flows

Bitcoin outflows trumped inflows in January with $16.2 billion worth of BTC leaving exchanges compared to $15.9 billion entering. This metric suggests the number of Bitcoins moved into self-custody exceeded the amount sent to exchanges, where BTC can be sold. Bullish Bitcoin

Futures Activity

Bitcoin futures volume shot up to $700 billion in January. This figure represents a rise of almost 90% from the $371 billion worth of futures trades recorded in December 2022. Bullish Bitcoin

HODLer Behaviour

Because Bitcoin is overwhelmingly used as a store of value, rather than the alternative global payment system its creator(s) intended, we can tease out investor behaviours by looking at what percentage of BTC moves on-chain.

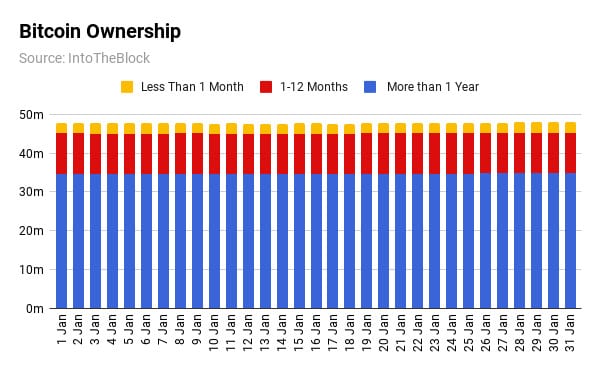

As of the end of January 2023, 65% of Bitcoin's circulating supply of 19.2 million coins had not moved in more than a year. This is an all time high. This implies that millions of BTC remain either in exchange wallets or in cold storage while investors wait for higher prices ahead.

The total number of unique accounts holding Bitcoin around the world hit 48 million in January.

Meanwhile, users holding Bitcoin for more than a year increased by 0.9% from 34.5 million to 34.8 million. Bullish Bitcoin.

Institutional Demand

Bitcoin-based European ETP flows reversed course in the first month of 2023 after the declining price of Bitcoin last year negatively impacted the dollar value of institutional funds.

It is worth recalling that 2022 was an annus horribilis for risk assets, especially with regard to institutional flows. So, it was heartening to see that in the 30 days to 27 January 2023, institutional investors pumped $679.4 million into institutional-focused Bitcoin products in Europe. This now puts the total AUM of European Bitcoin ETP products at more than $2.1 billion. Bullish Bitcoin

Ethereum

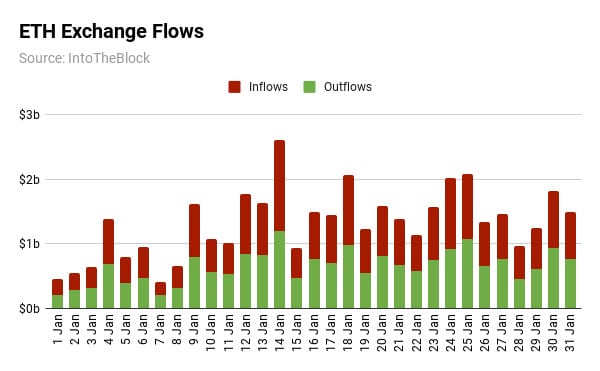

Liquidity demand: Exchange Flows

Ethereum inflows eclipsed outflows in January. Investors shifted $20.6 billion worth of ETH to exchanges, compared to the $20 billion added to cold or hardware wallets. The data suggests a number of holders may be looking to sell their ETH as they review their market positions before the Shanghai hard fork planned for March. Neutral Ethereum

Futures Activity

Ethereum futures activity climbed by more than 40% to $530 billion in January. Binance dominated trading volumes with other centralised exchanges like OKX and ByBit claiming smaller shares. Bullish Ethereum.

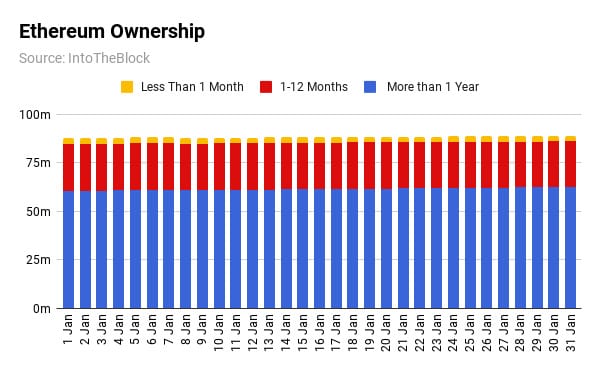

HODLer Behaviour

Ethereum accounts totalled 88 million in January. The number of addresses holding ETH for more than a year expanded from 60.5 million at the beginning of the month to 62.5 million by its end – an increase of 3%. Bullish Ethereum

Institutional Demand

Appetite for Ethereum investment products returned in January with European ETPs pulling in $297 million worth of capital from investors. This brings the total AUM of spot Ethereum funds in Europe to $1.1 billion. Bullish Ethereum

6. Altcoin Brief

Cardano

Cardano's algorithmic stablecoin project Djed hit the blockchain's mainnet on 31 January 2023, signalling a faster product rollout than ADA holders have previously been used to.

Djed has so far attracted 27 million ADA tokens as a reserve backing and has an overcollateralisation ratio of 600%, Coindesk reported.

At the same time, Djed could also invite increased regulatory scrutiny toward for the smart contract-enabled blockchain.

Memories are long as regards the catastrophic failure of the Do Kwon's TerraUSD algorithmic stablecoin, which collapsed taking the Luna chain with it in May 2022. That episode soured the waters for the adoption of such technology.

Litecoin

LTC's asset price appreciation continued to approach the key $100 level in January, with the payments blockchain having seen a secular bull trend since Q4 of 2022. The upcoming halving is a key supply/demand catalyst. This once-in-four-years upgrade, which will cut LTC block reward issuance from 12.5 LTC to 6.25 LTC is scheduled for around 10 August 2023, at block height 2,520,000.

Data aggregator Santiment suggested that: “Culprits for the surge of the 11+ year old coin include addresses holding 100 - 10,000 LTC, who have added 1.15 million more coins in the past six months, a 4.92% increase.”

Solana

$151m of NFT sales volume came Solana's way in January 2023, signifying increased interest from retail into the beleaguered smart contract blockchain.

On 27 January, Solana unveiled the app store for its Saga phone. Unlike Apple's App Store, the marketplace will be free and will use Solana Pay for transactions.

7. Digital Asset Equities

Key digital asset equities enjoyed a rebound across January 2023 as risk-on sentiment led markets upwards.

Nvidia (NASDAQ:NVDA) recorded $7.6 billion worth of revenue in the fourth quarter of 2022. This took its annual revenue for the year to $26.9 billion – up 61% YoY.

A large part of this revenue came from gaming. The company added over 65 games to its popular cloud gaming service GeForce NOW in Q4. It also announced collaborations with AT&T over priority membership to the service and Samsung for integration with Smart TVs.

Nvidia has previously said that it expects to generate an astounding $150bn in revenue through the ‘per-seat' software subscription model for the enterprise use of its Omniverse platform, which is aimed at engineers, professional designers and creators attempting to build and simulate objects in three-dimensional VR space.

Block (NYSE:SQ) has benefited from the introduction of Bitcoin transactions – via the Lightning Network – on its Cash App. The Lightning Network is a Layer-2 that enables expedited Bitcoin transactions without the use of the Bitcoin blockchain. Over 47 million Cash App users in the US can now send as well as receive BTC directly into their accounts.

Block has also welcomed innovative payment methods using traditional fiat. In September 2022, Block came together with the fintech company Afterpay to provide a “Buy Now, Pay Later” (BNPL) service to merchants using its service in Canada.

Coinbase (NASDAQ:COIN) experienced a significant turnaround in 2023 after its share price reached an all-time low in December 2022.

Bitcoin's ascent in the new year has meant that Coinbase can continue to rely on its main source of revenue – trading fees. Coinbase stock is up 72% in the year to date as public companies operating in the digital asset space benefit from Bitcoin's rally.

The company is also undergoing a wide-scale restructuring: CEO Brian Armstrong confirmed in a 10 January statement that Coinbase would cut 950 jobs - following a similar headcount reduction of 1,100 in June 2022 - in a bid to cut operating expenses by 25%.

Financial institutions remain confident in the long-term success of Coinbase given its cash flows, executive level staff, and ability to slash workforce numbers when necessary.

As a separate ETC Group investigation reported in January, the regulatory woes surrounding Binance also suggest that Coinbase could be the last major exchange left standing in 2023.

8. Into The Metaverse

Metaverse-related crypto tokens have enjoyed rocketing prices across January 2023, with Sandbox (SAND) climbing 74.35% and Decentraland (MANA) more than doubling to record an uplift of 134.25%.

Related equities also saw substantial gains, with the post-Covid slump of user activity starting to rebound.

According to the Roblox (NYSE: RBLX) key metrics report for December 2022, daily active users on the gaming platform were at 61.5 million users – an 18% increase year on year.

Its estimated revenue was between $189 million and $199 million. Daily active users were 61.5 million – 18% increase year on year. We will know more when Q4 2022 financial results are released on 15 February, but the teen-focused gaming platform recorded 208 million downloads in 2022. It ranked third for most downloads worldwide on both iOS and Google Play.

China's reopening for business poses a better state of play for its leading metaverse stocks, such as Tencent. The gaming and e-commerce giant has rebounded 19% in the year to date and a remarkable 92% since its share price crashed to $25.25 in October last year.

China has also hinted that it will be putting an end to its crackdown against leading domestic tech firms.

The detente between the state and big tech was reflected in the government's recent decision to grant publishing licences to 88 online games, including titles belonging to Tencent.

The entry of Apple (NYSE:AAPL) entry into metaverse markets posed a clear competitor for Meta (NYSE:FB) as 2023 opened, with reports suggesting the software and hardware giant was building ‘the iPhone of the metaverse' in the form of a retail-focused mixed reality headset combining both augmented reality and virtual reality.

According to an 8 January Bloomberg report, Apple will unveil the headset - dubbed ‘Reality Pro' internally - before the Worldwide Developers Conference in June 2023. Third-party developers are already being allowed access to work on apps to broaden out Apple's metaverse ambitions.

9. Outlook

A swathe of positive catalysts are impacting on cryptoasset and digital asset equity markets as of the end of January 2023. These include:

- A more favourable macro environment for risk assets, including the slowing pace of rate hikes from central banks

- Trading volumes on exchanges rebounding from December 2022 lows

- Futures activity and institutional fund inflows gaining ground

- Technical upgrades on Ethereum, plus demand for blockspace (as well as fees) returning with NFT markets coming back to life

- Bullish on-chain signals from both Bitcoin and Ethereum

- The pace of cross-market regulation improving in Europe and the UK

As such, ETC Group's outlook for the rest of the year remains that both BTC and ETH will witness price appreciation in 2023.

On a technical basis Bitcoin's run up to ~$23,400 represents a significant area of resistance, from where BTC was rejected, setting the stage for a potential deflation in the exuberant rally that has consumed most of January.

We expect profit-taking to dominate the conversation in the first weeks of February, possibly with an over-reaction to the downside to see Bitcoin at around $20,500.

Taking into account historical price action and futures market liquidation data, the rally in BTC and ETH appears to be topping out, and we forecast a slowing down of the rally that has consumed most of January.

However, with more positive economic situations on the horizon and the reduction of bearish outlooks for recession in Europe and GDP growth in the US, we expect medium term that the rally will continue apace in Q2 2023.

Markets are essentially forward looking and that should be borne out as participants look ahead to terminal interest rates of around 5.125% in the US and 3.5% in Europe before central bankers begin their pivot and begin to bring interest rates down to an historical average.

If macro presumptions on the turnaround point for central banks (July/August for the Fed and the ECB especially) turn out to be unfounded, or rate rises continue much further than the end of Q3 2023, then we could see more bearish outlooks injected into the narrative.

China's reopening from a macro perspective unlocks a lot of trade doors which have been closed for the past three years.

Bitcoin's price is starting to move ahead of key on-chain metrics, such as its Network Value to Transaction Ratio. This could set the stage for a reversal in Bitcoin's fortunes. However, Bitcoin has remained below its 200-week moving average only four times in seven years. At $24,600 that metric will switch back to positive. Any purchases up to this point remain historically cheap for buyers.

By the same token, Ethereum's fundamentals are improving at a faster rate than Bitcoin. These include its fee revenue increases and demand for blockspace, along with the upcoming bullish narrative of the Shanghai hard fork and ETH staking withdrawals. As such we expect Ethereum to outperform Bitcoin in the coming months.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer