Will Coinbase be the last big crypto exchange standing?

Coinbase (NASDAQ:COIN), one of crypto's most recognisable public faces, has had a difficult last 12 months.

The exchange's main source of revenue, retail trading fees, saw a significant decline in 2022 as trading volume slowed and investor trust was tested across the industry.

The company's share price is hovering above post-IPO lows and the company has had to enact a campaign of cost-cutting measures. In separate announcements, Coinbase has said that it will reduce its headcount by 20% and discontinue its services in Japan. It only gained its operating licence from Japan's Financial Services Agency regulator two years prior.

Coinbase is not the only crypto-native exchange feeling the whiplash of ambitious over-expansion triggered by the euphoria of the 2020-21 bull cycle. Kraken, a competitor it has vied with for American market share, has also put a pause on trading in Japan in an effort to scale back capital expenditure.

Gemini also looks to be on the brink with customers unable to withdraw around $900 million in deposits from its defunct high-yield programme Gemini Earn. It administered the platform with crypto lender Genesis that has now filed for Chapter 11 bankruptcy. The SEC has levelled securities fraud charges against both parties.

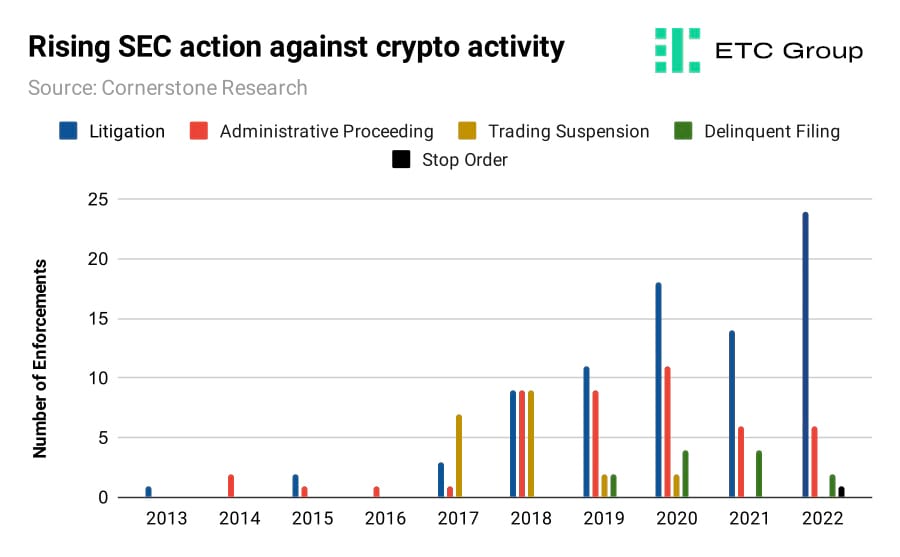

Regulators have been on a war footing against crypto exchanges in the wake of the implosion of FTX. The Department of Justice (DoJ) sent the market into a brief panic last week after it announced it was taking punitive action against a crypto company engaged in money laundering. The panic turned out to be short-lived after it surfaced that the target was Bitzlato, a largely unheard of Russian-owned exchange with only $11,000 -worth of user deposits on it.

But the message was clear enough: regulation hawks are coming after crypto exchanges functioning in the US.

In contrast, digital asset management firms like ETC Group offer European investors exposure to digital assets via regulated exchange-traded products (ETPs).

ETC Group investors don't have to worry about losing access to their funds as our ETPs are 100% physically collateralised and stored with whitelisted custodians in cold storage.

It is no secret that the world's largest crypto exchange, Binance, has been on the DoJ's hit list for some time now. The Department of Justice began its criminal investigation into Binance in 2018 over concerns that it was failing to comply with US anti-money laundering laws and sanctions.

Binance commands the largest spot trading volumes in the world and its strong balance sheet has opened the path to strategic takeovers of struggling firms in regional markets. It recently gained a licence to operate in Japan after it acquired Sakura Exchange BitCoin, an exchange registered with Japan's market watchdog.

According to Reuters, the DoJ has been dragging its feet on prosecuting the exchange because it is split on whether to act on its present findings or to continue to review the case it has built. If Binance is brought to court, it could lose the airtight grip on the crypto industry it gained after the upending of rival exchange FTX.

However, financial institutions remain more confident in the long-term fortunes of Coinbase, given its legitimacy as a publicly-listed company in America with a proven record of regulatory compliance, specifically with regard to its yield-bearing Earn programme.

Investment bank Oppenheimer has underlined that Coinbase has the makings to be “one of the few long-term survivors” in the cryptoasset space on the basis of its cash flows, executive level staff, and ability to slash workforce numbers when necessary.

Coinbase is a part owner of USDC, a stablecoin pegged to the US Dollar that is the fifth largest digital asset by market cap. This is a supplementary source of revenue for the exchange that collects interest payments on the stablecoin's reserves. In Q3 2022, Coinbase received $101 million in interest income from USDC in light of rising interest rates.

The asset management firm Ark Invest have been long-term believers in disruptive companies like Coinbase and spent most of December accumulating COIN shares at lowered valuations. After buying more than 300,000 shares of the exchange in December, Ark purchased another 158,000 shares for $34.78 on 30 December.

At the time, this was worth almost $5.5 million. Fast-forward three weeks and the same haul is worth around $8 million.

The recent cryptoasset market rally has fuelled the stock price of Coinbase and other companies with exposure to crypto. Investors that bought Coinbase shares before the New Year would easily be in the green with its stock up 59% YTD in an impressive turnaround.

If Coinbase survives this bear market, it will be one of the biggest players left standing. Coinbase has legitimacy as a public company with a proactive approach to regulatory compliance (unlike, as should be abundantly clear, Binance).

Macro data ignites market surge

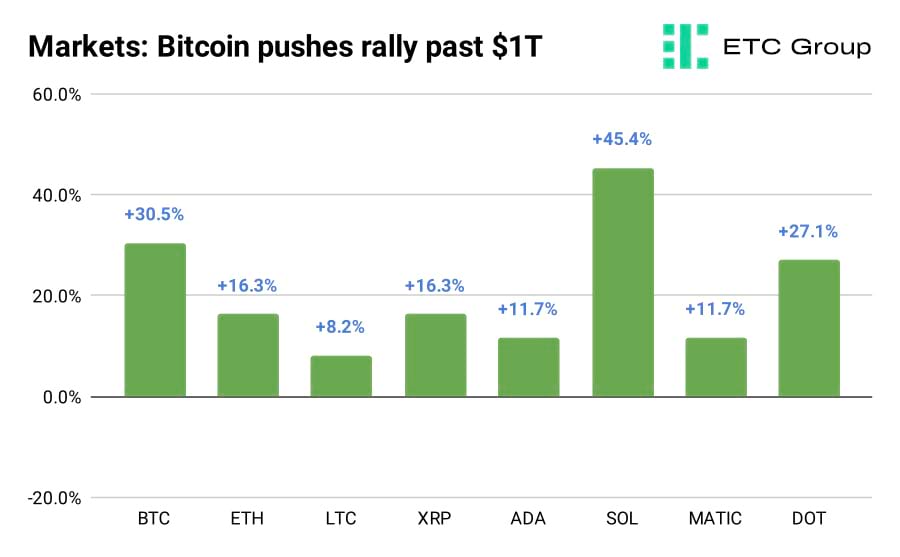

The overall crypto market cap has recaptured $1 trillion in the last two weeks, an increase of 28% across the fortnight.

The developments come following positive macroeconomic data from the US. On 6 January, the Bureau of Labor Statistics report showed that the country created 223,000 jobs in December 2022 and data produced by the ISM (Institute for Supply Management) showed industrial prices contracting for the first time since May 2020 – indicating a slowdown in a sector that accounts for more than 65% of US economic activity.

A strong jobs market, and less intense pricing in the non-manufacturing services sector suggests the US is in a more favourable economic position than previously thought, dampening fears of rising inflation, and suggesting the outcome of a potentially less severe recession.

To this end, fresh data from the US released on 12 January showed that in December, consumer prices (CPI) growth had slowed to 6.5% annually, down from a high of 9.1% in June 2022. This has added more fuel to the claim that America could receive a ‘soft landing': where inflation falls to normalised levels without an accompanying severe economic slowdown.

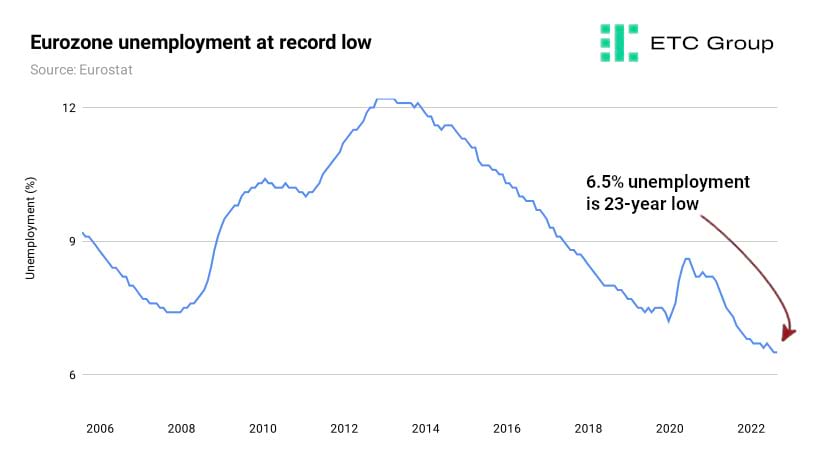

Figures from the EU have also confounded bearish economists, with the bloc's latest jobs report showing unemployment at 6.5%, a 23-year low. This has augmented the position taken by Goldman Sachs economists who have suggested that Europe would avoid recession entirely and instead grow by 0.6% in 2023.

Meanwhile, after three years of heavy restrictions, China has re-opened its land and sea borders and removed Covid testing requirements for inbound visitors, bolstering positivity that the world's largest marketplace was now finally fully open for business.

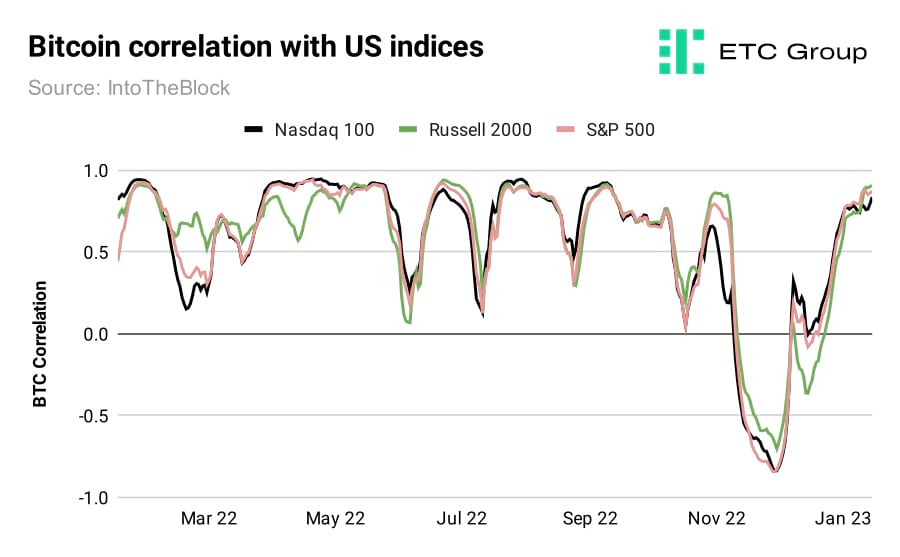

Bitcoin is currently treated as a risk-on asset, with demand for its use in portfolio diversification higher when times are less strained. With more favourable economic data in hand, markets are likely to price Bitcoin's value higher when there is more positive economic data from the largest global markets.

Bitcoin's price has travelled by 37% in January alone and prevailing sentiment indicates that the digital asset's recovery has been fuelled by the same macro data that has propelled other risk-on equities like tech stocks. At this time, BTC correlation with major indices is at the highest levels it has been at since 2022.

Bond market futures traders are pricing a 99% chance of a 25 basis point (bps) rate hike on 1 February. This is a dovish departure from the spate of aggressive hikes seen in 2022 that saw the Fed raise interest rates by 75bps on four straight occasions.

The fact that 25bps is seen as a virtual certainty signals that traders and investors are offered some predictability as they navigate the market and look to price in the next rate increase.

It will also bring the Fed one step closer to the terminal rate they want to achieve by Q3 this year, from which point on they may consider tapering interest rates.

Ethereum's Shadow Fork

Ethereum core developers have announced the successful deployment of a shadow fork as a precursor to the Shanghai hard fork.

The milestone will allow users to withdraw Ethereum deposits and rewards that have been accrued since staking went live on the Beacon Chain in December 2020.

Shadow forks are created to test readiness, test design flaws, and circumvent any issues that could crop up when the Shanghai hard fork goes live. In a nutshell, a copy of the blockchain has been created to serve as a technological sandbox.

The Shanghai hard fork is expected to launch in March. Currently, the Ethereum network has $26 billion worth of ETH staked on the network that users will be able to access progressively.

Shanghai will be the first major update since the Merge that saw Ethereum transition from Proof of Work to Proof of Stake as its consensus mechanism in September. The Merge drastically reduced the network's energy usage and offered Ethereum holders the chance to earn interest in return for verifying transactions on the blockchain.

Releasing Ethereum locked up in the Beacon Chain has been a special priority for Ethereum developers, who have sacrificed other system upgrades in order to concentrate on this endeavour.

Shanghai is temporarily abandoning upgrades like proto-danksharding that would make Layer-2 transactions more scalable, along with sought-after improvements to the Ethereum Virtual Machine (EVM) – the smart contract infrastructure that allows developers to design smart contracts and decentralised applications.

A dissenting minority of Ethereum developers believe the launch of the Shanghai hard fork is being rushed because of public pressure and that its implementation should be delayed by a few weeks. The encoding method of the Shanghai fork has become a sticking point for these developers as they believe the omission of some tweaks could lead to a lasting impact on the network.

But the prevailing opinion among developers is to wrap up the release of staked Ethereum as soon as possible. This is because the team can work on meeting other targets on Ethereum's long-term roadmap.

Getting Shanghai done also demonstrates to market participants that Ethereum developers are reliable and capable of delivering products on time.

The launch is expected to boost staking participation. At present, only 13% of the total circulating supply of Ethereum has been staked by holders. As well as providing more network security and attack resistance, more ETH stakers will likely lead to more decentralisation and give more users a share in participating in decisions that influence the network.

Markets

Bitcoin's burst to $22.5k in the wake of macro data suggesting fewer inflationary pressures -- and hence a higher chance of slowing rate hikes from key central banks, means a more positive potential outlook for equities, tech, startups and crypto.

This 30.5% move helped to drag high beta risk assets forward in the last two weeks as markets recaptured the much-vaunted $1 trillion mark.

Another technical upgrade for Ethereum, this time a 'shadow' fork to test out March's Shanghai fork aided the smart contract blockchain to a 16.34% gain. This poses a brighter future for the yield-bearing asset, as it sets the stage for more institutional and retail capital to enter the network.

Litecoin managed to hold its halving-induced rally with August 2023 now mere months away. Again, the inevitable tokenomic mechanics of supply and demand appear to be working in the alt-currency's favour. Solana again outperformed, this time with a 40.5% leap as feverish trading encountered weaker-than-average liquidity.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer