$42 trillion custodian bank BNY Mellon unlocks massive Bitcoin buy side

At a sprightly 238 years old, BNY Mellon is America’s oldest bank. It’s also the newest upstart in crypto custody. BNY Mellon, or Bony as it’s known in the trade, went public on 11 October to launch their custody business, holding Bitcoin and Ethereum initially.

In its announcement, the bank said it will be able to store and transfer BTC and ETH and provide bookkeeping services equivalent to those offered to fund managers in traditional assets.

This is a deal more than two years in the making, and BNY Mellon is the most trusted institution on the custody front in TradFi, so it represents an enormous leap forward for the industry.

This is certainly one of, if not the most important institutional developments we have ever witnessed.

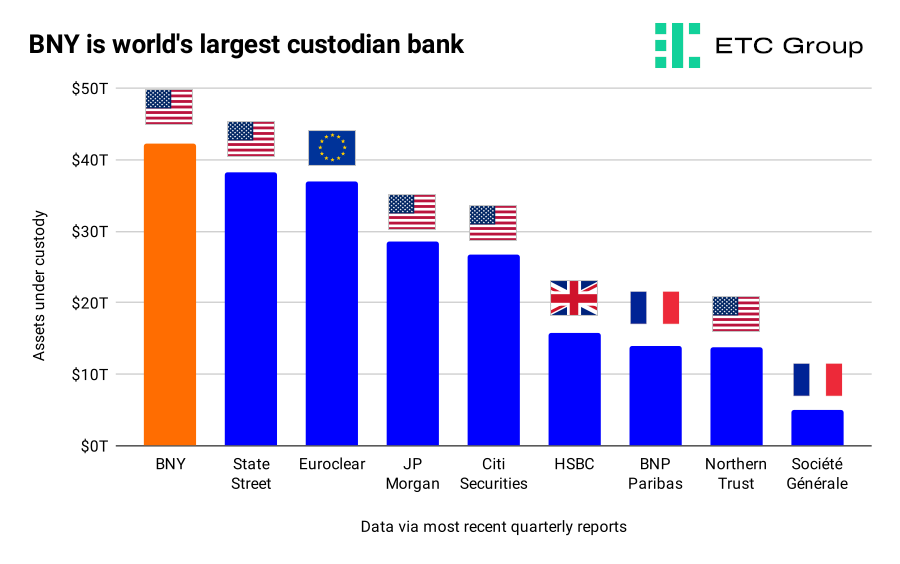

When it comes to institutional players, there simply isn’t anyone bigger or more prominent on the world stage than the Bank of New York Mellon. BNY has $42.2 trillion in assets under custody and $1.8 trillion in assets under management.

Not to be outdone, number three on this chart, the Euro securities settlement house Euroclear, said back in March that it had joined a group of banks building a tokenised asset payment system, to record company shares on public blockchains and speed up settlement of transactions worldwide.

But why is BNY’s move such a huge deal, and why are people so excited?

Firstly, from a commercial point of view this move will unlock a massive amount of buy-side participation in crypto markets.

There are pools of capital out there in TradFi land that are simply not comfortable holding their assets with existing crypto-native custodians, but they will be with BNY, because they will have existing relationships with BNY Mellon on the custody side.

If a sovereign wealth fund is looking to deploy large amounts of capital into Bitcoin or Ethereum, it becomes a very difficult conversation to get top leadership on board by suggesting custody with a crypto-native startup. That same conversation is a lot easier to explain if they simply say they chose BNY Mellon. It’s the same with Fidelity, which has offered Bitcoin trading to hedge funds and institutional clients since 2018.

The other point is that in terms of market structure, the BNY Mellon team has an implicit understanding of how things need to look and must work in traditional venues with large hedge funds and buy-side participants.

Another significant detail is that top leadership at BNY Mellon bought into this vision, and were able to explain to different parties exactly how important Bitcoin and Ethereum were to their strategic vision and spent the time and capital necessary to integrate with all the blue-chip service providers in crypto compliance, trade execution and market data.

Banking regulators as a whole are not particularly friendly to digital assets today. In fact, many are overtly hostile — the Basel Committee, for example.

In the US, it’s an open secret that the federal regulatory body the FDIC has been discouraging banks from interacting with crypto — both in formal guidance and informally, touting the ‘systemic risk’ angle.

But now, much more capital is going to be able to flow into Bitcoin and Ethereum as part of this BNY deal.

Google, Mastercard, financial giants jump in amid Crypto Winter

Bear markets are the best time to build products, without euphoric price speculation adding undue and unwanted pressure.

So, it has been particularly interesting to watch global financial giants doubling down on their crypto exposure amid Crypto Winter, with Bitcoin prices 72% down from their all time high, stabilising in the $18k to $20k range for the past four months.

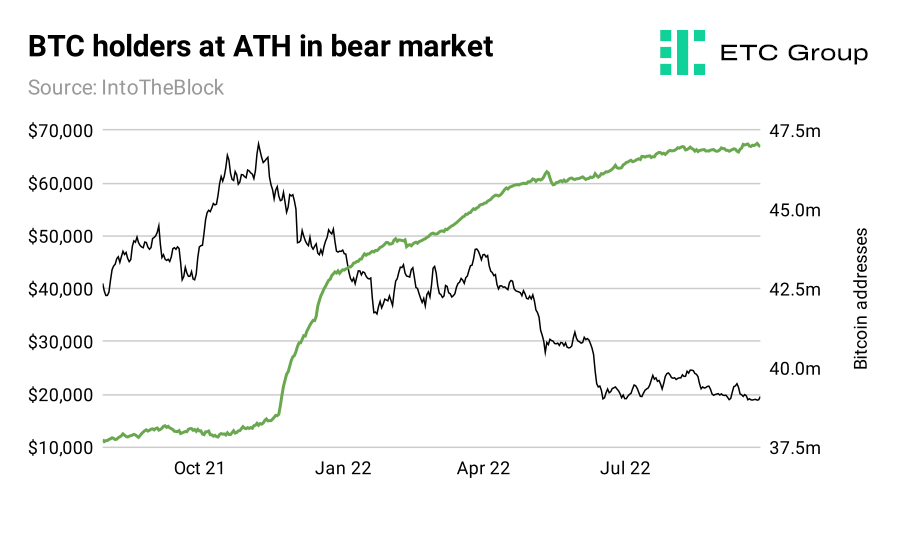

As reported in ETC Group’s first Digital Assets Monthly Review in early October, the number of Bitcoin holders continues to breach all time highs, with the number of addresses holding the asset now at 47 million. That’s 9 million more than 12 months ago.

That has left traditional financial giants playing catchup to some extent, with many more flooding into digital asset markets to build out their exposure.

ETC Group, for example, offers 14 single-asset crypto ETPs where investors can simply and easily access Bitcoin, Ethereum, Solana, Tezos, Avalanche, and many more, without having to worry about custody.

Morgan Stanley research reveals that a growing number of funds are now betting on the long-term appeal of Bitcoin and Ethereum, despite the depths of the bear market.

Over 90 crypto ETPs and trust products have launched since November 2021, showing that asset managers are entirely unperturbed by prices sliding from their all time highs over the last 11 months.

Those 90 funds represent more than half the 180 active crypto ETPs now available to investors.

It’s become increasingly clear that no-one is giving up on crypto. And while there has been a full detox of speculative excess, we are seeing long-term Bitcoin holders refusing to sell out, even with weak macro in play.

Google, of course, inked a deal on 11 October with Coinbase to allow web3 customers to pay for Google Cloud services in crypto. Coinbase’s stock jumped on the news, and with good reason. Its ecommerce platform allows users to pay in Bitcoin, Ethereum, the asset-backed stablecoins USDC and USDT, along with 6 other digital currencies.

In the last few days, Mastercard has also announced it will let financial institutions offer crypto trading to their clients. The payments giant will act as a bridge between banks and the Paxos trading platform.

Mastercard said it would handle regulatory compliance and security — two key reasons that banks cite for avoiding the asset class.

Since 2020 Paxos, a New York-based brokerage, has powered PayPal’s service enabling US users to buy, hold and sell crypto directly from the PayPal digital wallet.

This is another vote of confidence in the long-term future of markets. And it’s happening not amid the speculative excess of a bull market, but in the depths of a bruising Crypto Winter.

Holding Bitcoin and crypto suddenly much easier for US companies

One other US regulatory move that may have flown more under the radar — but is just as important — is the news that the Financial Accounting Standards Board (FASB) has agreed to make fair value the primary accounting method for measuring cryptoassets. So, what does that mean, and why is it important?

Well, it just became a lot more simple for US public companies to hold Bitcoin and other cryptoassets on their balance sheets.

If you’re a business like Tesla and you buy Bitcoin at $50,000, currently it must appear on your balance sheet as an intangible asset.

That means that if the price of Bitcoin falls, accountants must mark down its value. If the price of Bitcoin rises again? It can’t be marked back up. That leaves many businesses with an official hole in their accounts — a difficult state of affairs to justify.

These kinds of accounting rules seriously discourage any company from putting Bitcoin or any other kind of crypto on a balance sheet, because they force businesses to take a writedown in the asset’s value, and do not allow them to write it back up.

In a Youtube video covering the 12 October decision meeting, FASB board member Christine Botosan said: “Given how these assets generate huge cash flows, I strongly feel that fair value is in fact, the right measurement basis, and it better captures the economics of this type of asset.”

The FASB had a totally incorrect view that Bitcoin was difficult to ‘mark to market’, a term which means adjusting the value of an asset that fluctuates over time.

Most firms tend to use the CME Bitcoin Reference Rate and CME Ether Reference Rate which take an aggregated snapshot of the price of BTC and ETH on major spot exchanges including Coinbase, Gemini, Bitstamp and Kraken. Both are published at 4pm London time every day. More recent developments mean market data firms like Coinmetrics can offer a 24/7 reference rate.

It’s notable that it was the Canadian arm — and not the US branch — of KPMG that came out and put Bitcoin and Ethereum on its balance sheet.

But we foresee many more American companies entranced by the possibilities of Bitcoin and crypto now encouraged to buy and hold digital assets of all kinds.

Markets

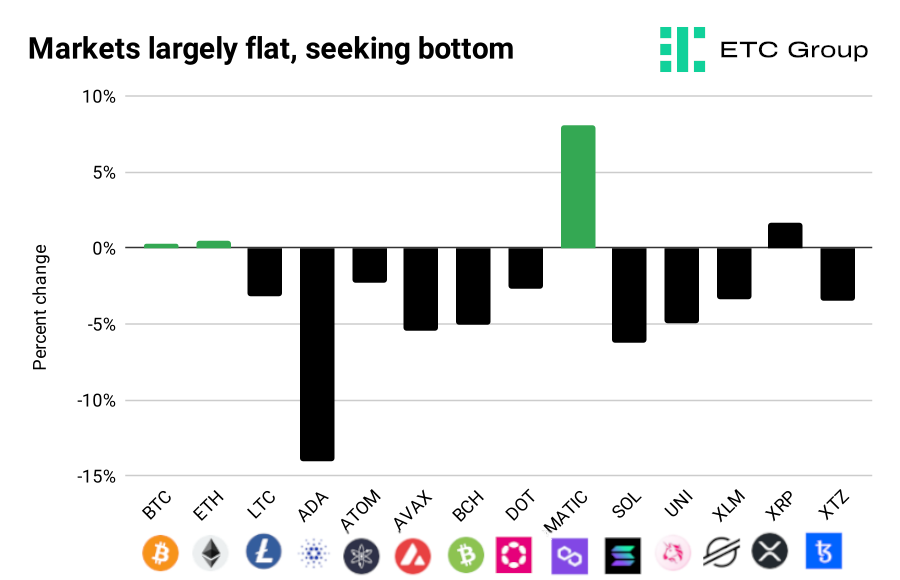

Digital asset markets have been largely flat, albeit with hints of positivity here and there. The two largest cryptos by market cap, Bitcoin and Ethereum, both ended the period in the green but climbed by less than a single percentage point over the past two weeks.

Little drama would indicate that traders are still unsure which way markets will shift in the coming weeks, and we are entering the ‘crab’ phase of the cycle, where volatility falls as markets seek the next major bullish or bearish narrative.

Ethereum Layer 2 blockchain Polygon (MATIC) was the biggest winner across the fortnight with a gain of more than 8%.

Cardano took the largest hit to its market cap, sliding 14% from $0.428 to $0.368 as traders digested the early impact of the Vasil hard fork and its impact on blockchain transaction fees.

We know that risk assets tend to bottom first in bear markets. With central banks continuing their pledge to crash markets with historic interest rate rises, and equities experiencing more volatility than crypto, we truly have entered the Twilight Zone as we barrel into Q4.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer