ETC Group Crypto Minutes Week #27

Bitcoin markets reach a whale-sized turning point, EY adds Layer 2 tech for ETH and institutional DeFi begins

Bitcoin markets reach a whale-sized turning point, EY adds Layer 2 tech for ETH and institutional DeFi begins

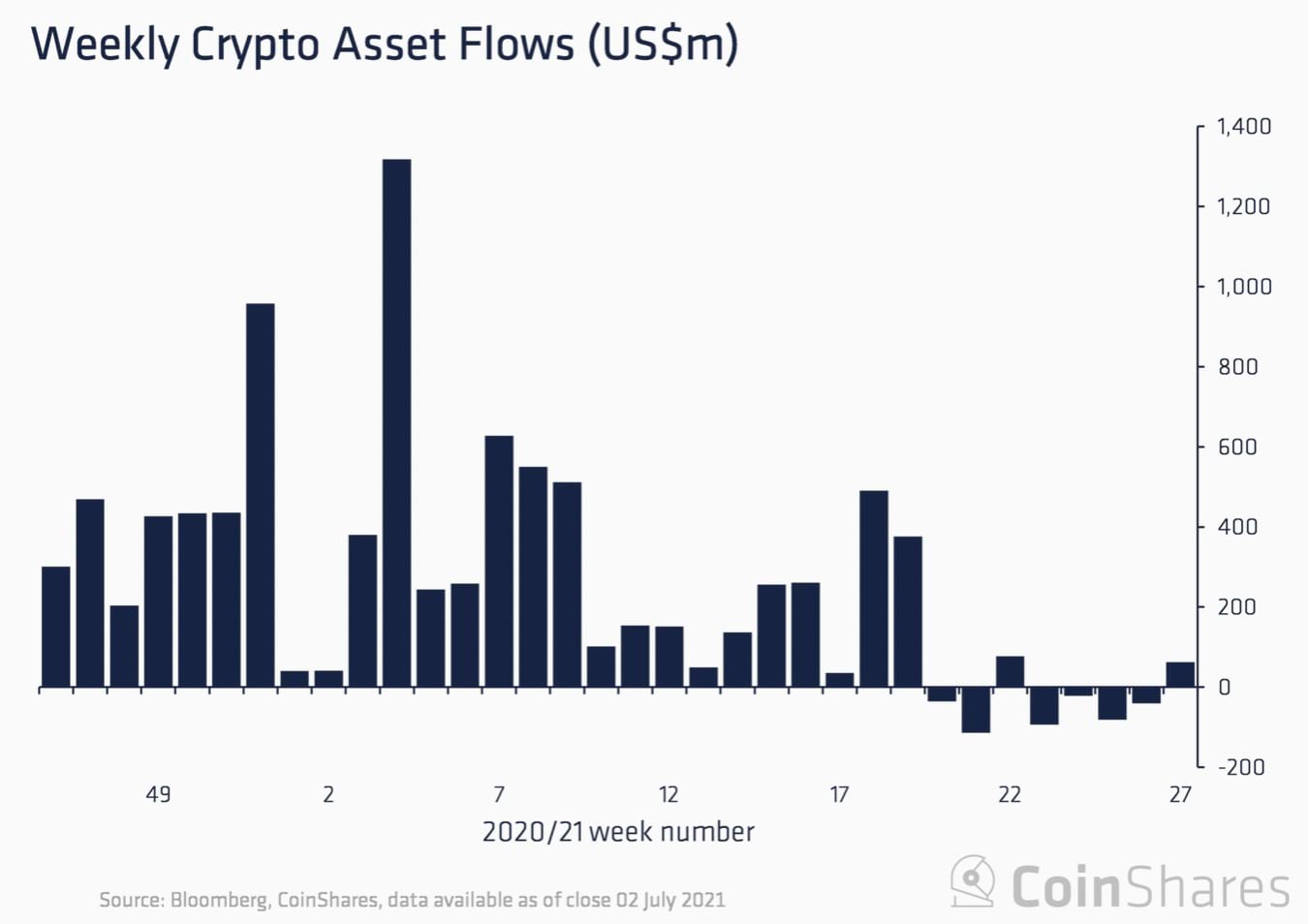

Investors are again pouring money into cryptoassets for the first time in nine weeks, suggesting a positive upturn in market sentiment.

Regulated investment products in cryptoasset ETPs and ETFs saw net inflows of $63m in the past week after more than a month of net outflows, according to CoinShares data.

Over a third of these net inflows came into ETC Group products, which include the 100% collateralized and redeemable Physical Bitcoin (BTCE), Physical ETH (ZETH) and Physical Litecoin (ELTC). On 2 July BTCE became the first Bitcoin ETP to offset its carbon footprint, compensating for the CO2 equivalent emissions associated with Bitcoin mining and transactions

For the first time in five weeks digital asset investment products saw inflows totalling $63m last week. And for the first time in nine weeks, inflows were seen across all individual digital asset implying a turnaround in sentiment amongst investors. CoinShares, Digital Asset Inflows Report, 5 July 2021

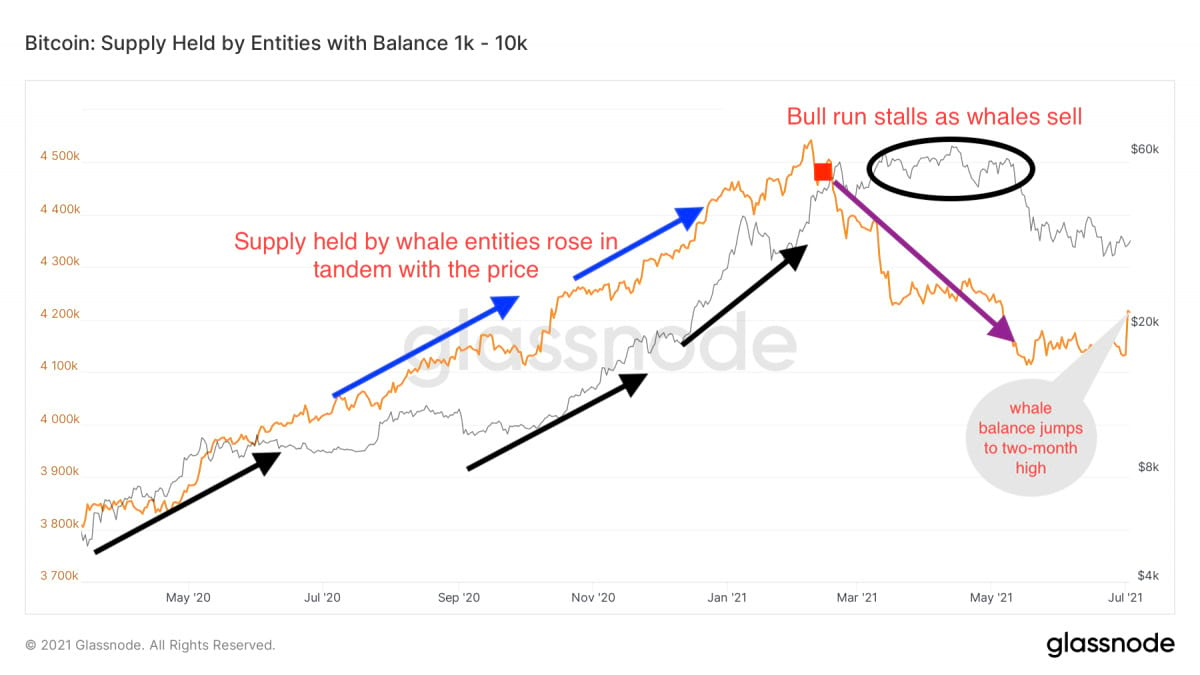

Additionally, data pulled from public blockchains shows that Bitcoin 'whales', the wealthiest investors in the space, are aggressively adding Bitcoin to their portfolios.

The number of coins held by the richest participants — those with between 1,000 BTC and 10,000 BTC ($34.2m to $342m) — spiked to a two-month high, according to data analytics provider Glassnode.

Wealthy investors played a key role in moving bitcoin prices from $10,000 to over $60,000 in the five months to May 2021.

Renewed accumulation by the market's wealthiest participants is seen as a bullish sign for markets going forward, and the number of these large entities jumped to a three-week high of 1,922, Coindesk reported.

On 1 July global accounting giant EY released a public zero-knowledge (zk) layer 2 Ethereum scaling solution to tackle the blockchain's cost base for transactions. .

The EY code, called Nightfall 3 - which is freely available on Github - aggregates or 'rolls up' transactions into groups, removing the need for them to be processed on the underlying Ethereum Layer 1 blockchain.

Along with sharding (splitting computing load across sidechains), zk-rollups are one of the most promising technological updates coming in the ETH2 roadmap.

This update is denoted 'optimistic' because it assumes that transactions are valid unless specifically proven otherwise. This lightens processing requirements, and with it gas costs, by removing the need for validation from all nodes and participants.

We Based on EY experience, zk-Optimistic rollups are currently among the most effective in balancing security incentives and mathematical efficiency for running private transactions on the public Ethereum network. Paul Brody, EY Global Blockchain Lead, 1 July 2021

EY first began releasing zero-knowledge protocols for Ethereum into the public domain in October 2019. The continued deployment of EY's substantial development resources into increasing the efficiency of Ethereum transactions is indicative of wider structural interest in DeFi.

In early March 2021, for example, Ethereum won a huge seal of approval from Amazon Web Services when the internet utility giant announced the general availability of Ethereum on Amazon Mananged Blockchain.

Unlike the Bitcoin network, which in the main can only process one asset (BTC), on Ethereum many thousands of assets can be wrapped into ERC-20 tokens and moved around on-chain. That includes Wrapped Bitcoin (WBTC), a representation of Bitcoin on Ethereum.

We The popular narrative is that Bitcoin is [still a] good store of value if you're worried about inflation, or if you're in an emerging market it will hedge against currency collapse, but if you want to do anything that's very familiar to people on Wall Street like trade derivatives or create things that resemble equity or debt then they are all super hyped about building on Ethereum, that's where the zeitgeist is right now. Joe Weisenthal, Bloomberg Odd Lots podcast, 1 July 2021

Banks, audit and account networks and professionals spanning the whole gamut of traditional financial services are becoming increasingly interested in the promise of DeFi.

And this week we saw what is understood to be the first regulated DeFi exchange for institutions.

After a long gestation period, Germany's Swarm Markets became the first decentralised exchange to launch under the supervision of BaFin, the German market regulator. It goes live with $15 million in pledged liquidity.

People are looking for ways to make their collateral work for them but need to operate in a trusted and secure environment that suits their compliance needs. We see regulation as necessary for the evolution of DeFi as opposed to it being a limiting factor. Instead of reinventing the wheel, we've applied existing German regulation to DeFi markets. This regulatory layer will give enough assurances and protections to allow capital and assets into the ecosystem that have been sitting on the sidelines for far too long. Philipp Pieper, co-founder, Swarm Markets, 1 July 2021

Despite declining from a mid-May peak, there still remains over $50bn of cryptoasset value locked in DeFi smart contracts, according to industry aggregator DeFiPulse.

And Germany has long been at a pioneer for institutional crypto adoption and regulation, with scores of banks scrambling to apply for licenses to custody cryptoassets since the floodgates opened on 1 January 2020.

An amendment to the fourth EU Money Laundering Directive meant that financial institutions could handle and store cryptocurrencies by arranging a license with the securities regulator BaFin.

When the Bundesrat Federal Council passed the new law on 29 November 2019, the upper house of the country's Parliament released a new source of custom for the country's 1,900 financial institutions. Interestingly enough, Germany has more banks per capita than any other European country - more than Switzerland certainly, which is considered the banking capital of the bloc. Serving its 83 million population are around 200 private banks, 400 savings banks and 1,100 credit unions.

Global ETP providers like ETC Group, VanEck and WisdomTree have consistently chosen Germany's B?rse Xetra as their preferred listing venue for regulated, central counterparty cleared cryptoasset products, since ETC Group pioneered the way onto Deutsche B?rse XETRA, Europe's largest ETF trading venue, with the listing of the world's first centrally cleared Bitcoin ETP in June 2020. One year later, in June 2021 the German arm of Coinbase (NASDAQ:COIN) became the first non-bank institution authorised to provide cryptoasset custody in Germany.

BTC/USD

Bitcoin buying continued in force this week, supporting a near 7.5% upturn in the flagship cryptocurrency's fortunes, beginning at $34,117.45 and peaking to resistance just above $36,600. Near-term upside towards $40,000 remains limited by this ceiling, although bitcoin prices have defended higher lows since the mid-June dip to $29,000.

ETH/USD

Ether posted wide gains against the US dollar this week, supported by a move back into a relative position of strength above $2,000, after a several weeks of posting lower lows and dipping towards the $1,700 mark. Beginning at $2,118.30, ETH added 12.8% across the seven days to claim $2,389.56 before sliding back 4.5% to end the week at $2,280.95. The midway point to $3,000 appears the most likely near-term resistance/support point. The native currency of the programmable money blockchain first reached this milestone on 15 April 2021 on its bull run to over $4,300 and has not been that high since falling through this level on 16 June 2021.

LTC/USD

Price volatility decreased significantly in Litecoin markets as the payments protocol held its position to end the week net flat. From $135.79, LTC posted single digit gains to reach $149.00, before sliding back to neutral at $135.60. It did, however, continue its recent trend of hitting higher lows from the recent capitulation to under $105 on 22 June 2021.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.