ETC Group Crypto Minutes Week #26

Contrarian signals flash buy-in point for Bitcoin, the top US regulator says Bitcoin is a commodity, not a security, while markets face a tough recovery as lenders and exchanges limit withdrawals.

Contrarian signals flash buy-in point for Bitcoin, the top US regulator says Bitcoin is a commodity, not a security, while markets face a tough recovery as lenders and exchanges limit withdrawals.

Investors are often told that dollar-cost averaging in bear markets will make them the best profits of their lifetime. Following that advice is more difficult than understanding the principle, however. When market prices for top cryptoassets are 70% off their all time highs, as they are today, fear overtakes courage of conviction and investors tend to pull cash out of the market instead of placing bets on the next set of winners - at relative bargain prices. Such is the nature of crowds.

But at least one traditional finance expert has recognised the potential for creating generational wealth from investing in crypto. Sir Jon Cunliffe, the Deputy Governor for Financial Stability at the Bank of England said as much in a 22 June 2022 speech to Zurich's Point Zero Forum.

The analogy for me is the dot-com boom, when $5 trillion was wiped off values. A lot of companies went, but the technology didn't go away. Those that survived - the Amazons and the eBays - turned out to be the dominant players.

Cunliffe has not always been a Bitcoin or Ethereum fanatic. But he does realise the importance of backing the next generation of technology that will power the future.

So, while amid the crash, there has been the expected ‘I told you so' from some quarters, others are starting to realise the possible future that could be created by the leading cryptoassets.

As a16z wrote in their May 2022 State of Crypto report:

Consider that any prospective founders who swore off tech and the internet in the aftermath of the early 2000s dotcom crash missed the best opportunities of the decade: cloud computing, social networks, online video streaming, smartphones etc.

The American born British fund manager Sir John Templeton was named the greatest stock picker of the 20th century by Money magazine way back in 1999. One of his more famous quotes is:

The time of maximum pessimism is the time to buy and the time of maximum optimism is the time to sell.

On the eve of World War II in 1939, investors were fleeing stock markets. That is when Sir John decided to buy shares in 100 companies, many of which were facing bankruptcy. If ever there was a time of sellers being forced to sell and buyers scooping up bargains, this was it. His portfolio returned 400% over the next four years.

Templeton was following Benjamin Graham's advice. Graham is the originator of value investing and served as Warren Buffett's mentor and chief inspiration.

Templeton added:

If you want to have a better performance than the crowd, you must do things differently from the crowd.

Likewise, investors in cryptoassets must arm themselves with information. A staggering amount of wealth has been destroyed in the last month, but many more fortunes will be created from the wreckage.

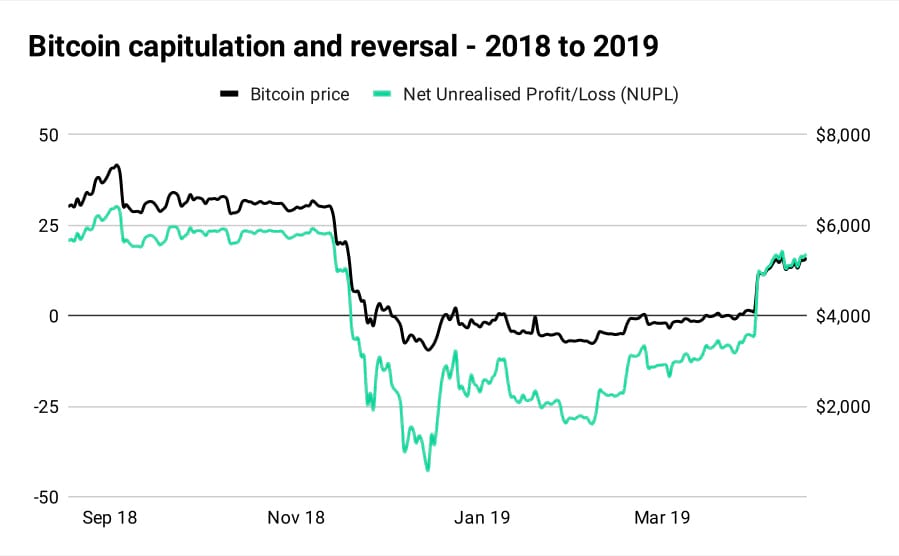

Consider this. Today, Bitcoin is objectively cheap from a historical perspective. It currently sits below its 200-week moving average. This has only happened four previous times since 2015. Seven years ago, Bitcoin dipped under $200. In 2019, Bitcoin fell below $3,300 and in 2020 Bitcoin plummeted to less than $4,860. These price points marked significant market bottoms.

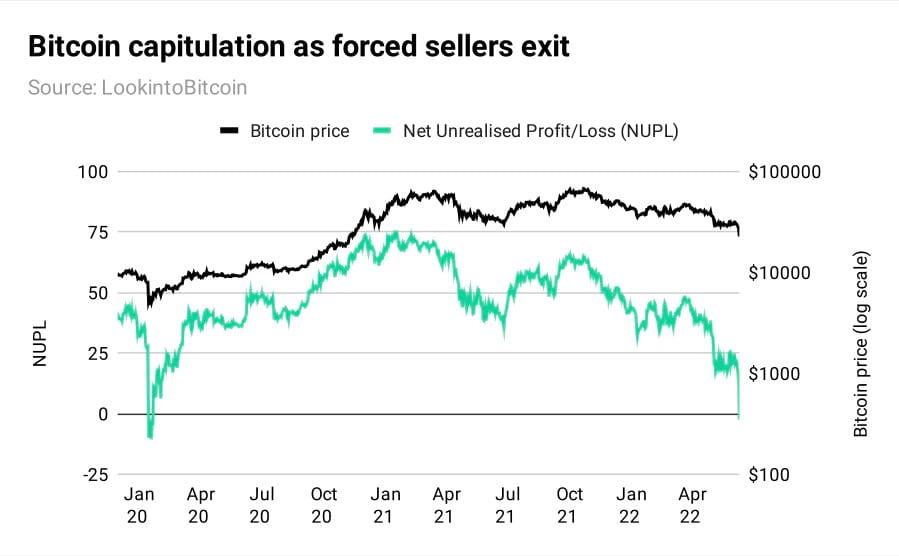

Net Unrealised Profit/Loss (NUPL) is an on-chain measurement of the average price users paid for their Bitcoin. As we noted in our last Crypto Minutes, markets are currently in the capitulation zone - at an NUPL of less than zero. This is a painful point for many where fear overtakes courage, but it is also where conviction investors tend to start building long-term positions.

If only those investors who sold out in fear in 2018 had realised that Bitcoin would defy its critics and live to fight another day. In 2018 when the price of a single Bitcoin dipped to less than $2,000 it seemed to the more anxious investors that the crypto experiment was over. Not so. And Bitcoin remains the greatest invention of computer science since the internet.

When we as investors are informed that our best performance is likely to come not in euphoric bull markets but in fearful bear markets, the reaction is normally one of distrust.

Taking such an approach requires courage, and the knowledge that moves may not play out immediately.

But it has been proven time and again that looking for buying opportunities when others are being forced to sell at a discount can produce any investor's best gains. Sir John Templeton knew this.

As a professor teaching blockchain at MIT, Gary Gensler showed a great appreciation for crypto and Bitcoin. His series of video lectures is still available for free at MIT OpenCourseware. Now as head of the US Securities and Exchange Commission, Gensler has a different mandate from educating the nation's top mathematics and science students on the vast possibilities of technologically groundbreaking and cryptographically-secure currencies.

Speaking to CNBC on 27 June 2022, the man charged with leading regulation in North America stuck his head above the parapet to define Bitcoin as a commodity. This is a debate that has consumed the financial industry for years, and the results of which will have wide-ranging effects on how the financial system treats the world's first cryptocurrency.

Markets are still waiting for the results of President Joe Biden's March 2022 Executive Order which effectively legitimised crypto at a federal level in the United States.

A reckless lack of risk management from some portions of the market, namely crypto lenders and hedge funds alike, has hurt investor sentiment across the board. This is well known. But if Bitcoin wins the mark of approval by being brought under the regulatory wing of the Commodity Futures Trading Commission, investors will be better protected and crypto's future more likely secured.

In a high-profile US Congressional hearing on cryptoassets on 24 June, the CFTC market oversight division director Vincent McGonagle appeared alongside the brilliant Georgetown law professor Chris Brummer and Cardano founder Charles Hoskinson to debate the merits of crypto regulation with a panel of politicians. Some of the members of Congress were well-educated and others were, frankly, not.

Determining the point at which securities are fully decentralized and no longer subject to SEC oversight remains a “tangled web”, McGonagle said.

What category - security, commodity, utility - a particular cryptoasset falls into seems to depend on the day of the week or what the weather is like outside. This part of the financial sector is extremely fast-moving, fluid, and often beset by conflicting judgements. Other than Bitcoin, the only other crypto to receive an official judgement from the CFTC is Ethereum. In 2019, CFTC chief Heath Tabert said Ethereum was a commodity. But in noting to CNBC recently that ‘only' Bitcoin was a commodity, Gensler implies that Ethereum is a security.

Regulators have been handed the unenviable task of trying to write the rules for how cryptoassets should be treated in their country. But progress is very slowly being made.

History will record that this Crypto Winter was initiated by a series of back-to-back shocks: the $40bn implosion of Terra LUNA, lender Celsius and its freeze on withdrawals, then the collapse of prominent $10bn hedge fund Three Arrows Capital (3AC).

Forced selling is everywhere.

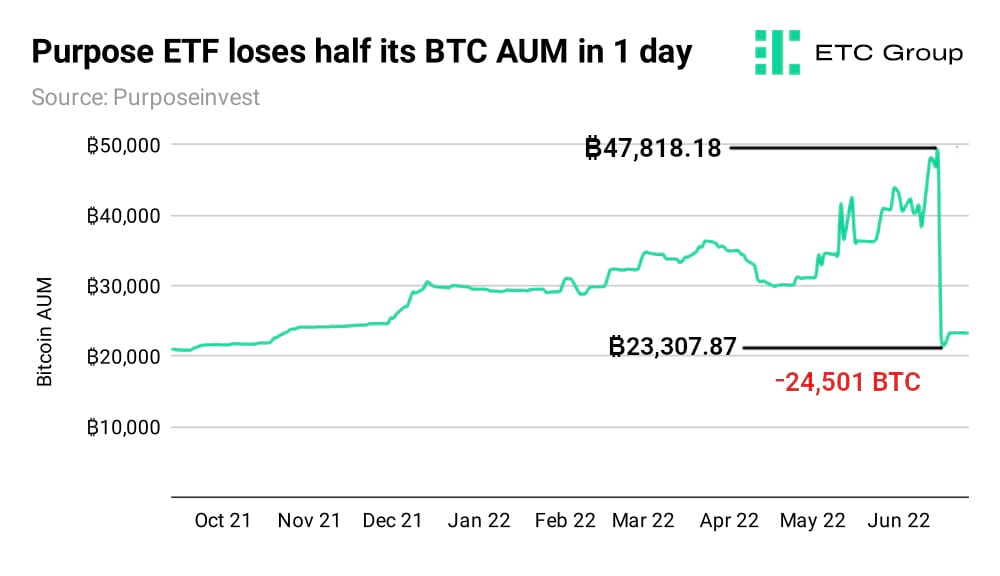

In a single day from 16 June to 17 June 2022, Canada's Purpose Bitcoin ETF lost half its Bitcoin under management: a drop of 24,501 BTC, equal to $515.8m in outflows. That suggests there was capitulation or forced liquidation from an indebted seller.

There are many people in crypto who take on incredibly risky amounts of leverage in order to amplify their gains. But when the market turns against them, they see the other side of this strategy. Leverage also greatly amplifies losses.

Rumours had been swirling that 3AC was insolvent, and on Monday 27 June we saw the extraordinary news that Canadian crypto broker Voyager Digital had issued a default notice to 3AC, noting that it had failed to repay a $350m loan denominated in USDC, along with 15,250 BTC, worth around $323m.

These deals tend to be worked out behind the scenes. So for Voyager Digital to issue a $670m+ public default note means the situation must be at critical levels. As per a company statement, as of 27 June 2022 Voyager held $137m in cash.

The scale of 3AC's total liabilities are not yet known but reporting by TheBlockCrypto suggests it could be in the region of $1.5bn to $2.5bn.

3AC was, as of January 2022, the largest single investor in Grayscale's GBTC Bitcoin Trust with a reported 38.9 million shares. Its demise will likely have a long-term negative effect on Grayscale's flagship product, and indeed GBTC has been trading at a whopping 30%+ discount to its Net Asset Value in recent months. Investors who were sold on the idea that this was the best way to gain exposure to the price of Bitcoin are rightly unhappy, with the price of Bitcoin 30% higher than their own GBTC shareholdings.

On 21 June, two of India's largest cryptocurrency exchanges, CoinDCX and CoinSwitch Kuber, both stopped customers from withdrawing funds, sparking fears of an escalating liquidity crisis.

Other lenders and brokers caught up in the crossfire, including Hong Kong's Babel Finance and Voyager Digital have set daily withdrawal limits in a bid to manage their own liquidity crises. Voyager customers are limited to withdrawals of $10,000 per day and 20 transactions within 24 hours. The TSX-listed company has seen its share prices crater by over 90% this year with investors fearing it could face insolvency.

One potential saviour has appeared.

Sam Bankman-Fried, one of the youngest crypto billionaires and founder of derivatives exchange FTX has found a new calling with Crypto Winter setting in: keeping struggling cryptoasset lenders and companies afloat.

On 21 June 2022 FTX extended a $250 million line of credit to crypto lending platform BlockFi in an attempt to prop up its balance sheet. The loan will reportedly see FTX eventually partner with BlockFi to roll out interest-bearing products. But one stakeholder has suggested that the term sheet between the two parties could give FTX the option to acquire BlockFi “ at no cost ”.

According to leaked income statements, BlockFi has been weathering hundreds of millions of dollars of losses for the last two years.

The situation the crypto lender now finds itself has been exacerbated by dour market conditions and poor risk management strategies. It joins a growing list of crypto lending companies like Celsius, Babel Finance, and Maple Finance that have been bogged down by liquidity crises.

Alameda Research, a cryptoasset trading firm also established by Bankman-Fried, has committed $200 million alongside 15,000 BTC to Voyager Digital.

Bankman-Fried's actions in trying to mitigate a series of merciless liquidations in the cryptoasset sector are somewhat reminiscent of the US Federal Reserve stepping in to bail out banks during the 2008-2009 financial crisis. America's de facto central bank handed out $700 billion to the traditional financial sector in order to prevent it from collapsing.

Likewise, Bankman-Fried has come out and asserted that it is his personal duty to “protect the digital asset ecosystem and its customers”. Although, this does not mean that contagion in the cryptoasset sector will not have detrimental trickle-down effects on his own portfolio, the companies he has created, and other industry leaders.

In January, FTX raised $400 million a Series C round that chalked up its valuation to $32 billion. The exchange is also one of a few industry participants still actively recruiting new talent with a number of its competitors like Coinbase being forced to slash costs by introducing layoffs.

FTX has defied market conditions and been on a global spending spree of late. The exchange recently acquired the cryptoasset trading firm Bitvo in Canada and incorporated the fintech company Liquid Group in the beginning of June which allows it to expand its footprint in East Asia. The integration of Liquid Group, and its subsidiaries, will allow FTX to offer spot and derivatives products in Japan as it will gain access to the firm's Type 1 Financial Instruments Business License. Until now, Japan's rigorous regulatory landscape has deterred crypto platforms from being able to widen operations in the country.

Central banks in the UK and US have been enacting their annual stress tests in June.

The Bank of England said on 10 June 2022 it was satisfied that Britain's leading banks could be shut down without risking the stability of the financial system, even as it found major shortcomings at three top lenders. The US Federal Reserve also published the results of its own stress tests on 27 June 2022, noting that all 33 banks passed its examination.

As a response to the 2008 Global Financial Crisis, the 2009 Basel III accord introduced regulation that requires commercial banks to maintain minimum capital ratios. Banks must maintain at least 6% Tier 1 capital. Tier 1 capital is a core measure of a bank's financial strength.

When (not if) crypto markets are armed with adequate regulation, we could easily see crypto-focused or crypto-native lenders have to undergo similar types of stress tests to ensure they are not making risky bets and have enough capital to survive periods of liquidity issues.

26 June: Harmony (ONE) suffers $100m hack as multi-sig cross-chain bridge exploited

24 June: Axie Infinity Ronin bridge to reopen after $625m theft

23 June: Solana developers unveil Web3 mobile phone

22 June: Binance.US scraps Bitcoin trading fees

20 June: Solana Solend whale account takeover sparks DAO DeFi debate

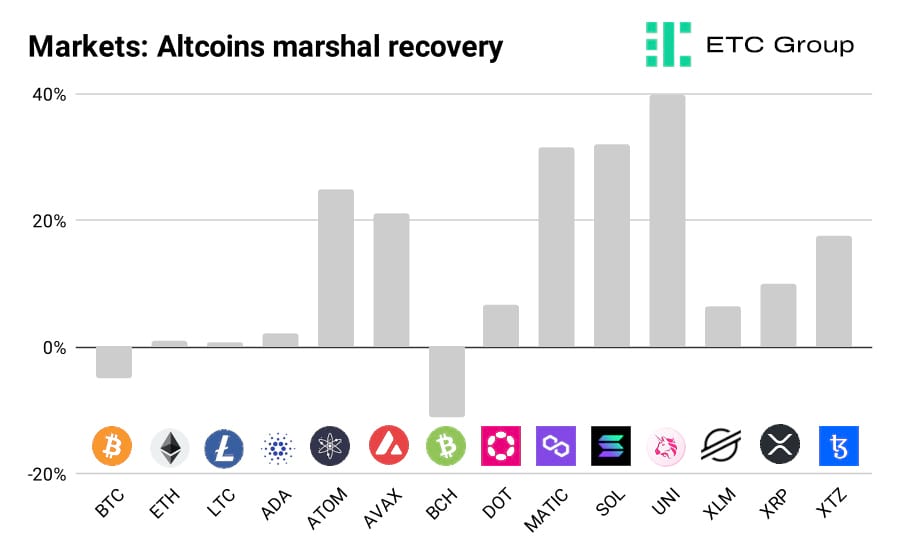

In the fortnight to 28 June, crypto markets saw a slight recovery, with Bitcoin back above $20k and Ethereum holding above $1.2k.

The pain for overleveraged market participants is likely not over yet and prices could dip further as risk-happy gamblers are forced to sell holdings at a discount to cover their margin calls.

More broadly, investor appetite for perceived riskier assets has dropped dramatically. The president of the World Bank, David Malpass, said in a 26 June speech that the world faces feeble growth, that 40-year high inflation rates could last a further two years and many countries will “find it very hard” to avoid recession.

Bitcoin has stabilised after its precipitous crash but remains in a tight range between $21,000-$23,000 and still 69% away from the all-time high it printed in November 2021.

Similarly, Ethereum rebounded from a low beneath $1,000, climbing back to $1,200 albeit with little further upward price action. Altcoins like Uniswap (UNI), Solana (SOL), and Polygon (MATIC) have shown the greatest signs of recovery and largely erased the losses they shouldered earlier in June. Each of these digital assets has appreciated by over 30%.

The value of Uniswap in particular has recovered by 40%: the Ethereum-based decentralised exchange token has seen an impressive revival given increased trading activity on the platform and its acquisition of the Genie NFT marketplace.

Smart contract platforms Cosmos (ATOM) and Avalanche (AVAX) followed the same lead with price rises of 25% and 21% respectively since 14 June.

Bitcoin Cash (BCH) has been among the weakest performers in the cryptoasset sector over the last fortnight as investors continue to unwind their positions. Its price is currently touching $110 – a level last seen in January 2019.

All this said: historically, investors have made the largest gains from scooping up cheap assets at times of market distress when others become forced sellers.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.