ETC Group Crypto Minutes Week #22

While the ability for cryptoassets to provide a good hedge against inflation is again in the spotlight this week, more billionaires and one-time sceptics are weighing significant Bitcoin investments.

While the ability for cryptoassets to provide a good hedge against inflation is again in the spotlight this week, more billionaires and one-time sceptics are weighing significant Bitcoin investments.

The ability for cryptoassets to provide a good hedge against inflation is again in the spotlight this week, as consumer and commercial price rises start to accelerate across the board. It’s perhaps the reason why more billionaires and one-time sceptics are weighing significant Bitcoin investments. Carl Icahn is the latest, telling Bloomberg he is considering a $1bn to $1.5bn purchase through Icahn Enterprises.

We’re pumping a lot of money into this economy and obviously you’re going to get inflation from that. Equities are being traded at ridiculous prices. And you can’t have these values without excess inflation. Cryptoassets are here to stay in one form or another [so] I’m looking at the whole business, and how I might get involved in it. Carl Icahn, owner, Icahn Enterprises

UK factory output figures have hit a record pace, The Guardian reported on 1 June. A surge of new orders helped Britain’s manufacturing sector to post the highest monthly figures since records began in 1992. IHS Markit, which compiles the figures, said that UK PMIs hit an unprecendented 65.6 in May 2021, compared to 60.9 in April. Any reading over 50 indicates sector-level growth.

UK manufacturing growth boomed in May, as the PMI rose to a record high amid the strongest intake of new orders in nearly three decades. However, producers also saw supply-chain disruption, leading to soaring output costs. IHS Markit, PMI reporting

Across the Atlantic, CNN reported that US gas prices hit their highest prices in seven years on 30 May, aided by soaring WTI and Brent crude prices, with both benchmarks approaching the $70 per barrel mark.

Reuters also recorded on 1 June 2021 how Eurozone inflation jumped past the European Central Bank’s target in May, with manufacturing too facing record input costs in the face of output records tumbling.

The real result of such numbers on bond yields was almost immediate, with German 10-year yields hitting fresh all time lows, dropping to minus 2.67%. The German Federal Statistics Office noted that inflation in the Euro powerhouse climbed from 2% in April 2021 to 2.5% in May 2021.

Real yields are now NEGATIVE for 61 consecutive months, another fresh historic record! Holger Zschaepitz, markets reporter, Die Welt

At the same time, the balance sheets of the ECB, the US Federal Reserve and the Bank of Japan each hit all time highs as central banks continue their unprecedented quantitative easing experiment, seemingly indefinitely. The ECB’s balance sheet extended to €7,657.6bn as Christine Lagarde continues to print Euros at an accelerated rate: the bank’s total balance sheet is now equal to 77% of the Eurozone’s entire GDP.

Ethereum is already the global settlement layer for trillions of dollars-worth of digital assets. The extraordinary growth and utility of this blockchain does not comes without problems: slow transaction times and high fees are persistent issues. But each in turn could be solved by the rapidly-approaching ETH2 upgrade.

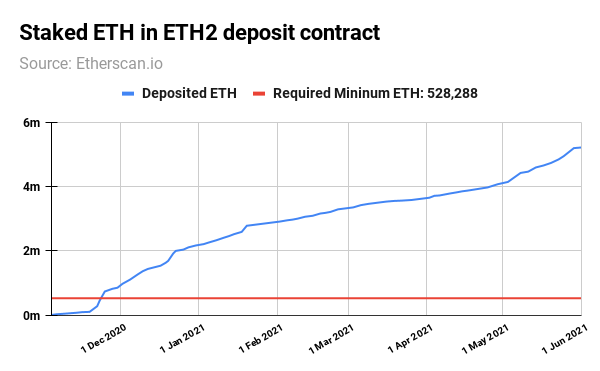

We heard this week that the ETH2 staking contract has now surpassed 5 million ETH, worth a total of $13.5bn at time of writing, where 1 ETH = ~$2,600.

The contract holding all of this ETH is viewable via the Etherscan.io block explorer. This size of the staking contract is a proxy for the strength of community support for Ethereum’s long-term development, with a suite of upgrades expected between now and 2023.

The main difference between ETH and ETH2 is its consensus mechanism: Ethereum is moving away from Proof of Work to Proof of Stake. This technical shift alters Ethereum’s reliance on miners to process blocks of transactions. In its place, any party that owns 32ETH (~$84,329) and is willing to stake that ETH into the ETH2 contract will be allowed to process transactions instead. As per a recent blog post from the Ethereum Foundation developer Carl Beekhuizen, after the merge to ETH2, the Ethereum blockchain will use around 99.95% less energy.

The Genesis launch of ETH2, called the Beacon chain, required an absolute minimum of 16,384 validators to deposit and maintain funds equivalent to 524,288 ETH into the ETH2 contract. Because this minimum balance was maintained until the launch date, the Beacon chain (the core upgrade turning ETH from Proof of Work to Proof of Stake) went live on 1 December 2020.

That was the first move in a multi-year upgrade that could see Ethereum blockchain process 100,000 transactions per second. Between now and 2023, developers are expecting to introduce features like sharding, transaction rollups and parallel chains to speed up processing.

As of 1 June 2021, the ETH2 contract is over-subscribed by 994%, showing the level of support for the Ethereum blockchain’s switch to the newer, greener PoS consensus mechanism. Data from analytics provider Beaconcha.in shows that 153,161 validators are now active on the network.

A recent hackathon, or developer conference, has also accelerated Ethereum’s upcoming ETH2 merger.

All teams now have a deep familiarity with the structure of the merge, and a clear visual on how their software will evolve in this coming year. Client teams are now focused on this summer’s two forks, London and Altair, which researchers are back to merge spec refinements and testing. After the summer upgrades, teams will shift their focus to the merge, and begin tackling the production engineering with an eye toward public testnets. Danny Ryan, lead ETH2 co-ordinator, Ethereum Foundation

ETH2 won’t change anything about the way Ethereum is used, only its efficiency. Malicious actors seeking to carry out illicit actions are heavily disincentivised from doing so. The minimum 32ETH required to become a validator has to be locked up for the duration of transaction processing and ETH2 punishes poor behaviour (like going offline, failing to validate certain transactions, or attempting to manipulate Ethereum’s record) forcing bad actors to lose their staked ETH.

It’s no secret that Binance has long wanted a piece of Ethereum’s success with DeFi, knowing that Vitalik Buterin’s 2015-launched foundational financial base layer has a vice-like grip on the market. Ethereum’s pre-emininence in DeFi comes really from its technological advances, wide adoption and the perception and reality of its internal security. By contrast, Binance’s failure to secure its protocols correctly has led to its DeFi platforms losing staggering amounts of money in recent weeks.

One of the main uses for smart contracts is to create programmable transactions. For example, with automated market makers like Uniswap, all of whose markets are Ethereum-based. Each Uniswap liquidity pool, whether that’s DAI to ETH or USDC to ETH, is simply a smart contract running on Ethereum.

Users can write particular functions into the smart contract: programming logic that governs how that transaction plays out.

When poor security meets inadequate governance, that’s when smart contract-based DeFi loans, borrowing or swaps start to see significant and costly problems.

At present, there’s no question that Binance can offer lower transaction fees for services on its Binance Smart Chain platform than Ethereum. But this has come at a security cost. Between March and early June 2021, $125m of Binance’s BUSD stablecoin has been stolen from leaky DeFi protocols.

And the thefts are accelerating. Just the latest of Binance’s failings was exposed on 29 May, when the automated market maker Belt Finance was exploited for $6.2m in BUSD. In a post-mortem report, the Belt Finance team admitted that attackers managed to exploit the bug eight times before the hack was discovered. 24 hours earlier, Binance-based BurgerSwap saw $7.2m stolen. And on 20 May a staggering $45m was stolen from the Binance Smart Chain-based PancakeBunny DeFi service.

Further attacks against two Binance DeFi protocols, Bogged Finance and BunnySwap earlier in May, saw another $6m in BUSD stolen. In March, decentralised storage provider Turtledex exit-scammed users for $2.5m That thefts came hot on the heels of two of the largest hacks in recent memory, again both against Binance-based DeFi services. On 2 May Spartan Finance was hacked for over $30m while Uranium Finance, a Uniswap clone, lost $50m in a late April hack.

Binance CEO CZ Zhao recently defended the number of DeFi protocols using code copy-pasted from Ethereum on Binance Smart Chain. Insitutional interest in DeFi loans and borrowing is rising rapidly, but with security issues like these, it can’t be long until there is a mass exodus away from the rival blockchain.

BTC/USD

After all the excitement and cascade effects of heavily-leveraged liquidations in last week’s crash, markets have stabilised in a fairly tight range. Starting the week at almost exactly $40,000, Bitcoin dipped to just over 16% to a weekly low of $33,420.18, before paring back those losses to climb 8.1% to $36,148.48. The $40,000 region was surpassed twice earlier in the week, but it is that round number that now appears to be providing some near-term resistance.

ETH/USD

After briefly careening down into the $1,700 range, Ethereum has reverted to recent type, bouncing back above the $2,000 level it first captured in February 2021. There began a relatively quiet and stable week for the Ethereum blockchain’s native currency, as ETH posted a high of $2,905.96, just 5.4% above where it began. By the end of the week ETH had bounced off a low of $2,187.27, adding another 16.2% to finish proceedings at $2,541.25.

LTC/USD

Litecoin has rebounded strongly from recent lows, aided by the launch of Venmo’s much-awaiting cryptocurrency offering, another milestone in adoption for one of the oldest and most-secure crypto payments platforms on the market. Like Bitcoin and Ethereum, Litecoin too traded in quite a tight range this week, beginning at a hair under $200 and finishing the week just below $180. A daily low of $156.53 was quickly rejected as traders brought LTC back up into the mid $170s, and the payments coin finished the week some 14.4% above its weekly low.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.