Bitcoin Ordinals lead network to new record

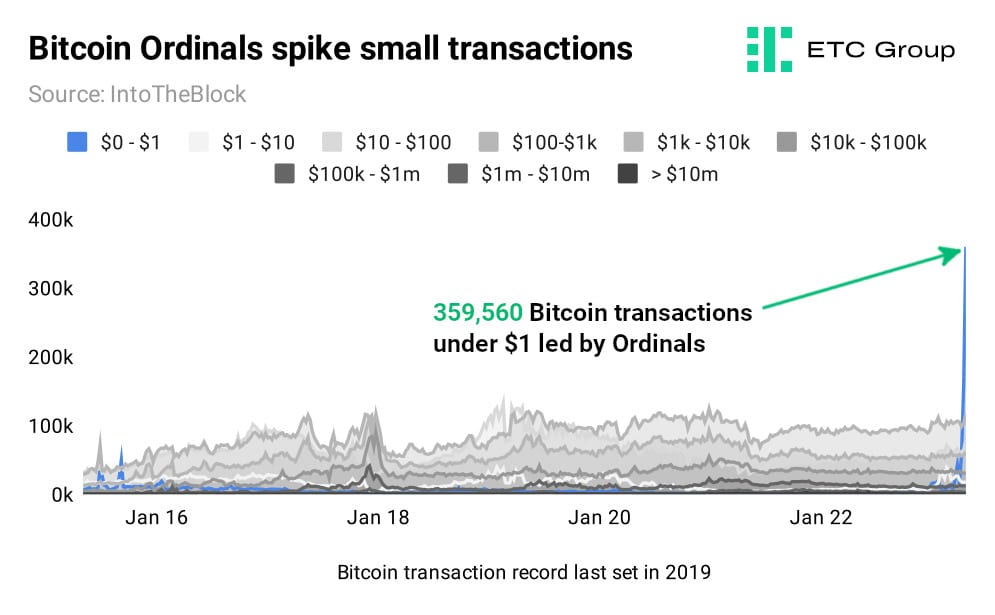

The use of Bitcoin's newest native asset - NFT-like Ordinals - has spiked small transactions on the network to a new all time high. Bitcoin's record was last set in June 2019, when 372,130 transactions were completed in a single day. At the time, the Bitcoin price was $11,670.

But the rapid rise of Ordinals means that the daily count of Bitcoin transactions hit a record of more than 568,000 on Sunday 30 April. Analysis of these transactions show that more than 300,000 came from Bitcoin Ordinals.

Ordinals were created in late 2022 by researcher Casey Rodarmor. They allow users to inscribe individual satoshis - the smallest unit of a Bitcoin - with additional data, such as text, images, audio or video files, thereby creating unique and non-fungible assets that can themselves be traded.

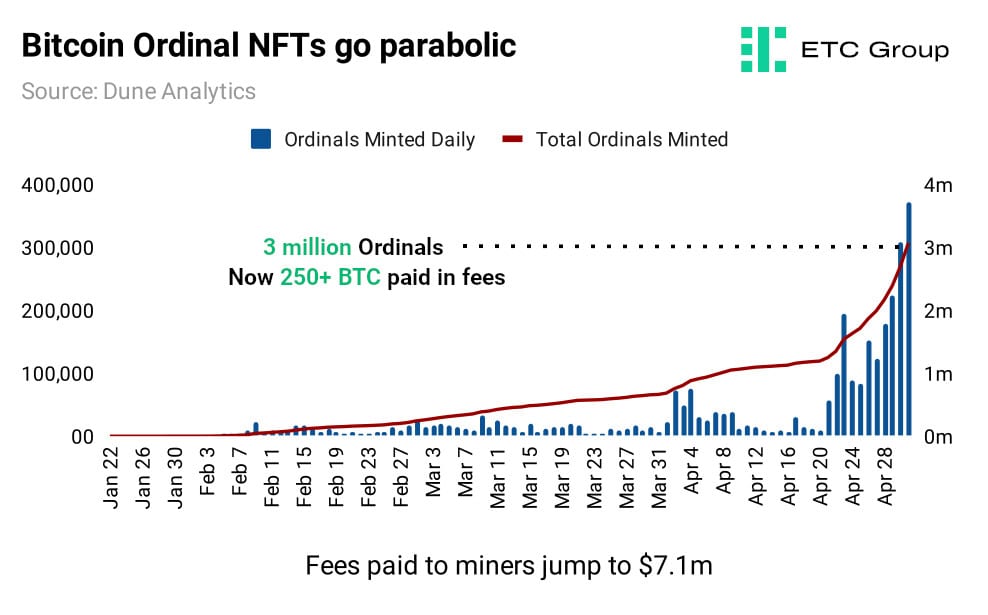

Despite a slow initial discovery process, it appears these new assets are reaching critical mass as more than 3 million Ordinals have been inscribed to date.

Since the start of the year, more than 250 BTC (~$7.1m) has been paid to miners for

processing transactions related to Ordinals.

One of the more intriguing aspects of this new asset type for Bitcoin has been the rise of small transactions under $1.

At the point in time that the last daily transaction record was set, some four years ago, the vast majority of transactions were concentrated in the $1,000 to $10,000 range, implying that the main use case for Bitcoin was as an asset for trading.

Compare that with today, where 359,560 of the total transactions processed were less than $1. This suggests a broad increase in retail and small users utilising the network for its new technological applications.

Ethereum staking stabilises and tokenised assets soar

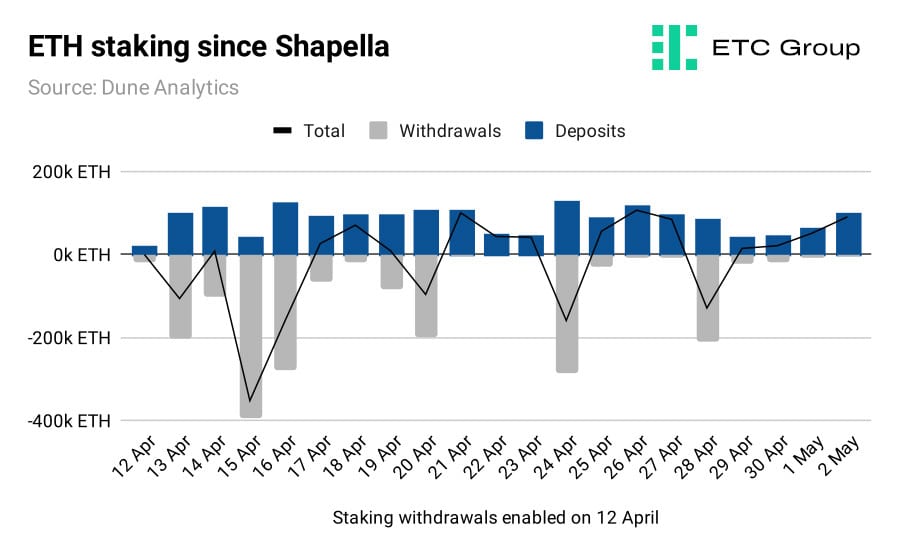

The completion of Ethereum's network switch to Proof of Stake was finalised with the Shapella hard fork on 12 April.

This concludes a years-long move to end Proof of Work mining on the second-largest blockchain by market cap, and enables a mass derisking for investors by allowing them to withdraw accrued staking rewards.

Since December 2020 Ethereum has allowed investors to lock up ETH to support the blockchain's security model, amassing yield in the form of more ETH as a result. Annual yields have typically ranged from 4% to 8% depending on the staking venue.

Critics had suggested that Ethereum could see a mass price depreciation in the weeks after Shapella with validators pulling their accumulated rewards out of the network and depositing them on the market, with that mass supply overwhelming demand.

But those fears have proved unfounded. In fact, since Shapella more staking deposits have flooded into Ethereum rather than out of it.

This brings us to three fairly obvious conclusions. First, the more risk-averse institutional investors who were perhaps sitting on the sidelines waiting for Shapella to complete have witnessed a broad derisking from a technically complex upgrade, and broad stability in the weeks since from the programmable money blockchain.

Second, larger validators now have much improved capital efficiency.

Third, this shows that the ETH carry trade works, in that traders can complete the final leg of the trade: they can borrow, buy ETH, stake it and obtain the yield, but critically, can unstake as well.

This fact - just as it did post-Merge in September 222 - has imbued markets with increased confidence in the Ethereum ecosystem while also unlocking new pools of capital to take part in ETH staking

Experiments in tokenisation using Ethereum and its scaling solution Polygon have continued apace.

On 20 April, Societe Generale Forge (SocGen) became the first global systemically important bank to launch a stablecoin on the Ethereum blockchain. SocGen released the EURCV stablecoin noting that it would be backed by less high-quality collateral than supports the likes of Circle's USDC, which uses US Treasuries and Treasury repo.

As LedgerInsights reported:

Collateral backing EURCV will be cash at a bank with at least the credit rating of SocGen, and short term securities with an unsecured credit rating.

On 26 April, the money manager Franklin Templeton, which has $1.5 trillion AUM, launched its first onchain money market fund on the Polygon blockchain.

Polygon is a scaling upgrade for Ethereum which bundles together transactions and processes them in batches without relying on the processing power of the Ethereum base chain. This means that transactions can be confirmed much more quickly and much more cheaply than using Ethereum alone.

As Duncan Trenholme, co-head of digital assets at TP ICAP noted last year at the launch of its wholesale crypto spot market:

We believe blockchain will lead to the tokenisation of traditional asset classes. This will result in a more efficient, automated and risk-mitigated trading and settlement process for financial markets.

$1 trillion US bank deposit flight continues

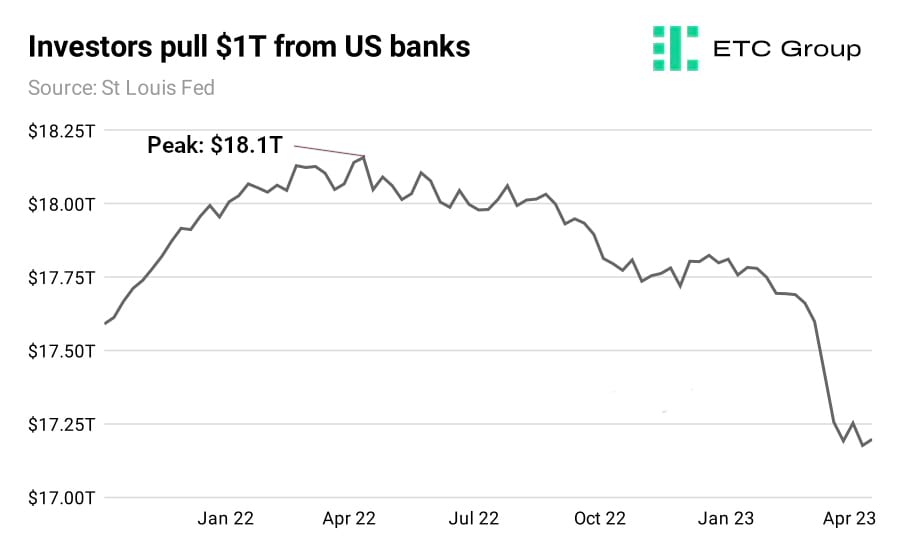

Amid the macroeconomic uncertainty engulfing the globe, and jitters over the health of the US banking system after three of the four largest bank collapses in American history, investors continue to seek refuge in alternative assets.

Deposits climbed at a record pace in 2020 and 2021 amid the uncertainty of the pandemic. But more than $1 trillion has now exited commercial banks since the peak in April 2022.

The biggest gainers from this nervousness have been safe-haven assets like Bitcoin, gold and money market funds. The addition of has only added to capital flight - while the US has raised its debt cap and avoided default 78 times since 1960,

Amid all of this lies a new scrap in Congress over the US debt ceiling, which has only added to capital flight. This fiscal phenomenon has seen Congress has raised the debt ceiling 78 times since 1960, and 17 times since Bitcoin was created in 2008. The possibility of the US defaulting on its debts is never a real possibility, given the outsize effect it would have on global markets. But its effects in the midst of the worst banking crisis since 2008 are clearly tangible.

Sharp falls in the share prices of US regional banks and medium-size lenders had markets on edge as April closed out, with President Joe Biden stepping in to insist the banking system was safe and sound, despite the collapse of Silicon Valley Bank, and the following takeover of First Republic Bank by JP Morgan.

The Federal Reserve was again on the verge of raising US interest rates in an attempt to tamp down inflation to its 2% target. On Wednesday 3 May, the rate setters were expected to increase their benchmark rate by 25 basis points to between 5% and 5.25%, the highest since 2007.

Markets have now priced in the potential for a peak US interest rate of between 5.5% and 5.75% coming in June 2023, with officials expected to pause or start cutting rates after that month's FOMC meeting.

Declining interest rates would prove another tailwind for cashflow-generating assets like equities and Ethereum, for example. When interest rates start to fall, the Net Present Value (NPV) of future cashflows rises - as the two metrics are inversely correlated.

And as the Bank of America suggested in a recent report, Ethereum creates cashflows through transaction fees, NFT sales and DeFi lending and borrowing, so one would expect that in an environment of falling bank benchmarks that the NPV of Ethereum would start to rise (along with investment bank price predictions).

Markets

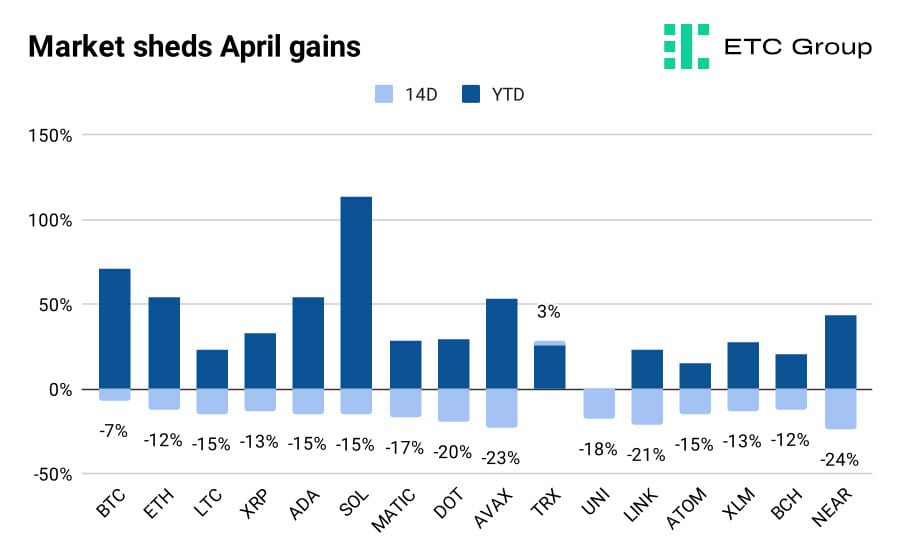

Markets have chopped sideways in recent weeks after Bitcoin brushed past $30k and Ethereum climbed above $2k, with both two blue-chip cryptos retracing slightly from those psychologically-important trading levels. After a 65%+ run up in BTC, and a 50%+ elevation from Ethereum in the year to date, there has been some profit taking as expected.

The biggest winner of the last two weeks has been Tron, the Ethereum clone whose users mainly reside in the Asia Pacific region. It saw a slight 3% uptick over the fortnight.

Elsewhere in the top 20 digital assets by market cap, Layer 1 competitors to Ethereum including Near and Avalanche each registered declines of more than 20%, suggesting that Shapella has reinforced the recent investor flight to quality.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer