ETC Group Crypto Minutes Week #18

More institutions are jumping on the Bitcoin bandwagon but the cryptoasset appears to be taking a breather from its stunning rise in the year to date.

More institutions are jumping on the Bitcoin bandwagon but the cryptoasset appears to be taking a breather from its stunning rise in the year to date.

As inflation hedges go, crypto is outperforming every other asset by a country mile. Almost every stocks and shares investing newsletter is now begrudgingly including crypto as an option to consider. It appears the tide of institutional adoption has finally broken the dam to some degree, and for investing professionals not to include cryptoassets now seems rather out of touch.

Perhaps the world’s most famous investor, Warren Buffett, was back in the headlines this week, as he spoke (remotely, of course) at the annual Berkshire Hathaway shareholders meeting.

Buffett’s focus was runaway inflation, with the Berkshire chairman and CEO telling investors:

We are seeing very substantial inflation. It’s very interesting. We are raising prices. People are raising prices to us and it’s being accepted.

In the UK, the Office for National Statistics says that in March 2021, inflation hit 0.7% which is hardly something to worry about, in normal times. Anyone who has lived through the past year, though, can attest to how abnormal it has been.

The Bank of England’s Monetary Policy Committee puts 2022 and 2023 Q1 inflation forecasts at a much higher 2.1%, a figure that breaches its own targets. Across the pond in the US, the Federal Reserve’s Thomas Barkin admitted to CNBC that inflation would rise this year but insisted it would stabilise and fall in 2022.

Allianz economic advisor Mohamed El-Erian commented that the Fed has “backed itself into a corner on inflation” by insisting that current inflation pressures are only transitory.

Inflation has begun to accelerate recently due to multiple factors, including increasing demand and struggles with some areas of the supply chain. The core personal consumption expenditures price index rose 1.8% in March 2021 [and] the headline number increased 2.3%, the quickest pace for that measure since 2018. Yun Li, Markets and Investing reporter, CNBC

Hundreds of thousands — if not millions — of investors hang on Mr Buffett’s every word, and luckily for them, he is an extraordinarily prolific writer and speaker.

But for such a keen interviewee on every other topic, the 90-year-old has been curiously reticent on cryptoassets, save for his infamous “rat-poison squared” comment on Bitcoin back in 2018. He was again tight lipped in the Los Angeles meeting, letting slip only that:

I’m alright on that one. It’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any bitcoin. Warren Buffett

Buffett has long advocated never investing in anything he doesn’t personally understand. And missing out on bitcoin’s tremendous rise is no particular problem, holding as he does one of the world’s largest fortunes.

While Warren Buffett is far from the wealthiest person in history (that accolade, depending on which history you read, goes to either William the Conquerer or Musa the First of Mali) he is counted among this generation’s richest. According to the Bloomberg Billionaires Index, the Berkshire chairman, dubbed the “oracle of Omaha” by his legions of fans, is the sixth wealthiest person alive with a fortune in excess of $100bn.

For the rest of us mere mortals, the dual picture of rising inflation and changing supply-demand ratios across the board pose more challenging situations ahead.

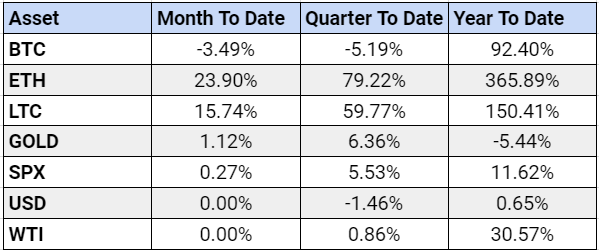

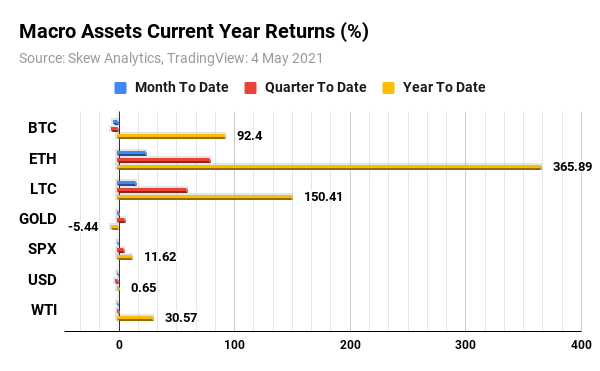

A few stats that investors might like to peruse are the performance of Bitcoin, Ethereum and Litecoin against other common inflation hedges which also boast extremely high liquidity, like the S&P 500, WTI Crude Oil futures and spot gold.

As we suggested in Week 17’s Crypto Minutes, currently there is value cycling away from BTC and into the large cap altcoins ETH and LTC.

Using data from the recently Coinbase-acquired Skew Analytics, we can see that BTC has returned -5.25% in Q2 so far (red line), while Ethereum has produced a 71.83% return, and Litecoin 59.77%.

The year to date metrics tell another side of the story

Ethereum’s recent record-busting rise has seen its returns reach above 365% since since the turn of 2021. While Litecoin may garner far fewer headlines than its cryptoasset rivals, it too has vastly outperformed these other common inflation hedges. As Mark Hulbert writes for Marketwatch this week, the US stock market’s cyclically-adjusted price to earnings ratio is the highest in the world, and this offers investors very little cover, while last year’s best performers have struggled. After a brilliant first half of 2020 in which gold breached $2,000/oz and briefly recorded an eight-year high, the precious metal fell sharply. It is now down 5.44% in the year to date.

With the wide institutional adoption of cryptoassets, not least from news that JP Morgan is launching a managed Bitcoin fund, there are likely many hidden billionaires who have profited from this bull market. But it was Ethereum’s figurehead, the mathematician Vitalik Buterin, who won the choice accolade this week, crossing a billion-dollar net worth from his ETH holdings.

Ethereum has clearly decoupled from Bitcoin, and this week pressed home that advantage, climbing to a fresh record high of $3,476.18, just weeks after crossing the $2,000 barrier for the first time.

Buterin has been transparent from the beginning about how much Ethereum he holds. And using the Etherscan blockchain explorer we can see that his public wallet address hosts 335,521 ETH, worth today in excess of $1.1bn.

The 27-year-old was born in Kolomna, a small town 70 miles outside Moscow, but grew up in Canada as the son of a prominent computer scientist. History records that just a year after learning about Bitcoin from his father, the younger Buterin proposed Ethereum in a white paper. Buterin went on to launch the revolutionary smart contract blockchain network in 2015.

There were six co-founders of Ethereum, the majority of whom have moved on to positions of power elsewhere in the crypto spectrum. They include Dr Gavin Wood, the creator of the Solidity programming language, which underpins the vast majority of smart contracts. He is now the head of Polkadot, a top-ten cryptoasset with a valuation in excess of $34.8bn. Also in this illustrious list are Charles Hankinson, creator of the $42.8bn-rated Cardano blockchain, and Joseph Lubin, who went on to start the Ethereum product development house Consensys.

Lubin, incidentally, also made the news this week, as part of the European Investment Bank’s first ever blockchain-based bond.

The EIB is the European Union’s lending arm. On 27 April it launched an unsecured 2-year bond on the Ethereum mainnet. It is worth €100 million ($121 million) and will mature on 28 April 2023, with its sale jointly managed by Goldman Sachs, Banco Santander and Société Générale.

The EIB noted in a statement that the benefits of digitalising the bond include reduced costs, improved transparency and faster settlement.

The EIB is clearly well-placed to lead the way now in the issuance of digital bonds on blockchain. These digital bonds will play a role in giving the Bank a quicker and more streamlined access to alternative sources of finance to boost projects across the globe. Mourinho Félix, EIB Vice President

Importantly, the payment by the underwriters were represented on the Ethereum mainnet in the form of Central Bank Digital Currency (CBDC).

A series of pilots into using Ethereum to issue CBDCs has so far included the Hong Kong Monetary Authority, the Bank of Thailand, SocGen’s Forge and the Reserve Bank of Australia.

Lubin’s Consensys was chosen by French bank Societe Generale and its digital asset subsidiary Forge to define and develop the smart contract deployed by the Banque de France on Ethereum’s network.

Fortune reported earlier this month how Lubin’s Consensys had received its first major external funding, as Mastercard, UBS and JP Morgan poured $65m into the startup. Before this point Lubin had largely funded Consensys from his own ETH fortune.

We heard in December last year that Amazon Managed Blockchain had moved to support Ethereum, and news that the European Investment Bank has chosen Ethereum for its first ever blockchain-based bond is yet another trigger for the institutional use of this cryptoasset.”

“Currently there are a number of factors increasing demand for ETH and reducing its available supply. On the investment side, that is the continued rise of staked ETH in DeFi and NFTs. On the technical side the introduction of EIP 1559 in the London hard fork, scheduled for July 2021, is slated to introduce a deflationary mechanism in the ETH currency, which could heighten this restriction at a time of extreme demand. Bradley Duke, CEO of ETC Group

Bitcoin moved largely sideways this week as its large-cap altcoin rivals benefited strongly. More institutions are jumping on the Bitcoin bandwagon but the cryptoasset appears to be taking a breather from its stunning rise in the year to date. The world’s largest cryptoasset dipped to a low of $52,312.09, gaining steadily over the weekend to add 12.69%, but hitting rejection at a note off $59,000, before settling at the mid $55,000-mark.

Ethereum, as noted above, has broken all price records this week and looked to be going parabolic as April moved into May. In a stretch of very few intraday losses, ETH gained a total of 42.13% across the week and is now looking for a support base with previous resistance in the $2,500-$2,600 region overwhelmed. Despite an 8.48% dip overnight from 3 to 4 May into the early $3,000s, ETH regained it all and is now swimming in uncharted waters above $3,500 per coin.

Litecoin too has made strong moves north this week, itself decoupling away from an historically tight track on the price of Bitcoin. LTC gained 33.07% across the week, and any further increase from here would retest April’s highs in the mid-$330 region.

BTC/USD

ETH/USD

LTC/USD

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

Bitwise ist einer der global führenden Krypto-Vermögensverwalter. Tausende von Finanzberatern, Family Offices und institutionellen Anlegern auf der ganzen Welt haben sich mit uns zusammengetan, um die Chancen von Kryptowährungen zu erfassen und zu nutzen. Seit 2017 hat Bitwise eine beeindruckende Erfolgsbilanz vorzuweisen bei der Verwaltung einer breiten Palette von Index- und aktiven Lösungen für ETPs, separat verwalteten Konten, Privatfonds und Hedge-Fonds-Strategien - sowohl in den USA als auch in Europa.

In Europa hat Bitwise (vormals ETC Group) in den letzten vier Jahren eine der umfangreichsten und innovativsten Produktfamilien von Krypto-ETPs entwickelt, darunter Europas größtes und liquides Bitcoin-ETP. Diese Produktfamilie von Krypto-ETPs ist in Deutschland domiziliert und von der BaFin zugelassen. Wir arbeiten ausschließlich mit renommierten Unternehmen aus der traditionellen Finanzbranche zusammen und stellen sicher, dass 100 % der Vermögenswerte sicher offline (Cold Storage) bei regulierten Verwahrern gelagert werden.

Unsere europäischen Produkte umfassen eine Palette von sorgfältig strukturierten Finanzinstrumenten, die sich nahtlos in jedes professionelle Portfolio einfügen und ein ganzheitliches Exposure zur Anlageklasse Krypto bieten. Der Zugang erfolgt unkompliziert über die wichtigsten europäischen Börsen, wobei die Hauptnotierung auf Xetra erfolgt, der liquidesten Börse für den ETF-Handel in Europa. Privatanleger profitieren von einem einfachen Zugang über zahlreiche DIY-Broker in Verbindung mit unserer robusten und sicheren physischen ETP-Struktur, die auch eine Auszahlfunktion beinhaltet.