ETC Group Crypto Minutes Week #17

Ethereum clearly decoupled from Bitcoin this week, setting another record high against the US dollar at $2,645.97 even while its closest rival stuttered.

Ethereum clearly decoupled from Bitcoin this week, setting another record high against the US dollar at $2,645.97 even while its closest rival stuttered.

It is really rather fascinating watching the way that money flows between the major assets in the crypto space, as new projects jostle for position and legacy tokens fall off the grid. And we can tease out some significant insights if we can screen out the noise and look at the hard data.

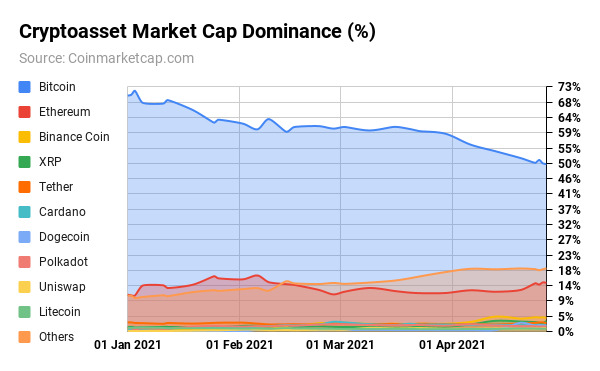

Since the start of 2021, Bitcoin's dominance of the total market cap of all projects in the crypto space has fallen from 70.6% to a hair under 50%.

But this is not simply that Bitcoin's grip on the market has weakened, and that its powerbase is much diminished. We know that as a false assertion, because this week Bitcoin recaptured its $1 trillion+ valuation while its market cap dominance continued to fall. What this implies is that the whole market is ballooning and that large-cap altcoins like Ethereum and Litecoin are among those benefiting the most.

We must remind ourselves that the total market cap of all cryptoassets passed $1 trillion for the first time on 29 January 2021, rising above $2 trillion on 10 April 2021. So we are still in the early stages of markets feeling out this momentum.

Ethereum clearly decoupled from Bitcoin this week, setting another record high against the US dollar at $2,645.97 even while its closest rival stuttered. But one element that continues to surprise is a persistent understanding gap in traditional circles about the blockchain's broad utility.

Nowhere was that clearer than in a 22 April market note sent out by UK broker Hargreaves Lansdown that alleged: "Ethereum in particular has made great strides ahead in recent days... Investors should be extremely cautious about getting caught up in this stampede because Ethereum is still very much a bet. Its price is being driven primarily by future price speculation rather than an underlying use-case." (our emphasis)

As we laid out in our deep dive on how to value Ethereum, the smart contract blockchain is the foundation layer for almost the entirety of the booming DeFi and NFT markets, and its applications are myriad.

While the future direction of cryptoasset prices in the near-term are far from certain, the idea that Ethereum has no underlying use-case is just plain wrong, Bradley Duke, CEO of ETC Group.

I am surprised to still be hearing this fallacy. The fact is that ETH is fast becoming the base currency of digital asset markets. And it is the blockchain's wide utility that is driving its prominence and relevance.

Macro analysts would tend to agree. Raoul Pal of Real Vision picked up this thread on Twitter this week.

When you price anything up in DeFi, NFT, community tokens or even metaverse worlds, everything is basically priced in ETH, including designers' time [while] BTC is the pristine collateral and base layer. Raoul Pal, 22 April 2021

A healthy bull market correction is never a bad thing given the sharp value accretion of recent weeks. Corrections in bull markets tend to be opportunities rather than threats, after all. Bitcoin dipped from a weekly high of $56,987 to $47,019 before rebounding back to $55,172. But rather than the boom and crash of past years, with fearful money pulling out of cryptoassets in the face of such price action, we are seeing instead a steady dispersal of buying power further down the asset chain. In plain English, investors are keeping their money in cryptoassets but looking more closely at large, medium and small-cap altcoins to hedge against short-term weakness in the number one cryptocurrency.

And so, the cryptoasset space is starting to resemble traditional equity portfolio management in a way that it really has not before. It is heartening to see that this dislocation is fading away, replaced with more easily-recognisable mechanics.

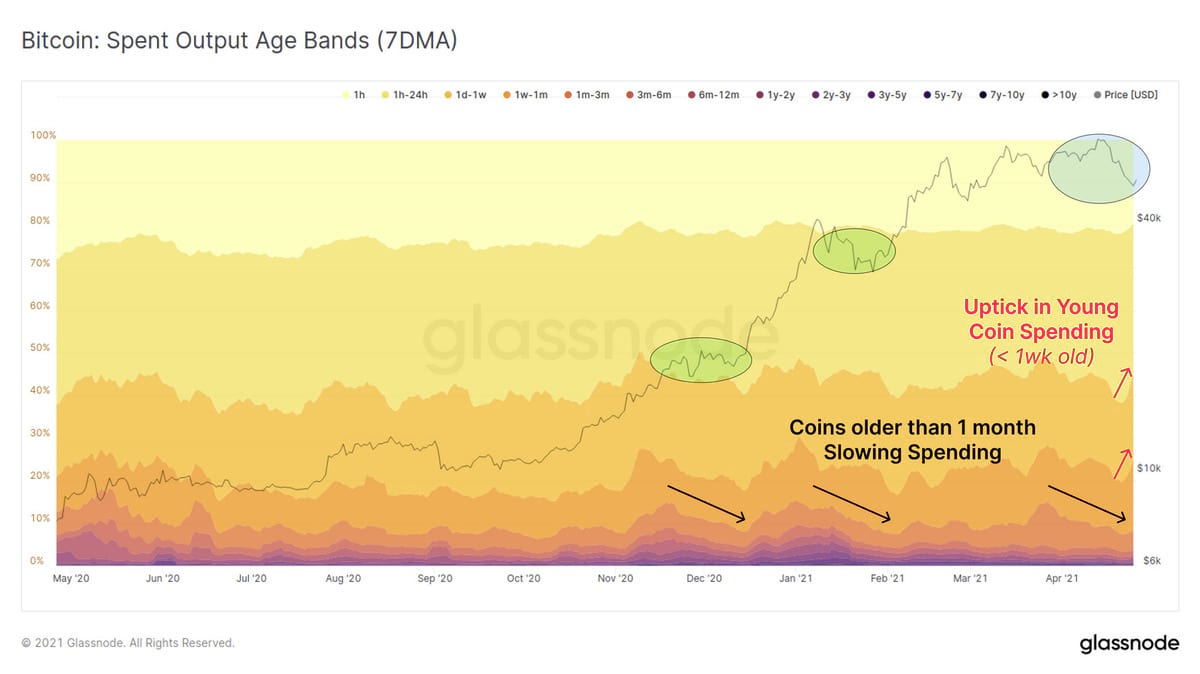

One other interesting insight: on-chain data via Glassnode suggests that while transaction volume across the Bitcoin blockchain peaked to new all-time highs this week, the average age of coins being spent has dropped to levels not seen since the Bitcoin price was below $20,000.

With only relatively newly-acquired bitcoins being spent, Glassnode says:

"Overall this suggests that the correction has largely affected relatively newer entrants to the market," adding that the longer-term Bitcoin buyers are clinging on to their holdings.

It can be seen that coins older than one month represent a very small and declining proportion of the total transaction flow. Conversely, the number of young coins (< 1 week old) being spent have seen an uptick...suggesting newer market entrants were shaken out during this correction. Notably, coins older than 6 months [coloured purple] have not seen a meaningful increase in spending since the correction back in February. Previous instances of similar spending behavious was observed during the December 2020 consolidation, just before breaking to new all-time-highs, and during the first bull market correction in January. Glassnode, Spent Output Age Bands analysis

Citing an anonymous source, Nishant Kumar reported:

On the regulatory side of things, there were a clutch of intriguing moves made this week, first when rumours broke that the Biden administration was working on a cryptocurrency regulatory framework. Fox Business anchor Charlie Gasparino outlined in his exclusive:

The Biden administration is in what's been described to me from people close to them as the early stages of developing a regulatory approach to the crypto market. It's being debated inside the Biden administration. From what I understand, SEC Chair Gensler is waiting for some direction from Treasury [officials] for the overall policy before he develops a more specific regulatory approach to crypto.

But a US ban on payments using Bitcoin like we've seen in Turkey this month is not on the cards, Gasparino said.

Crypto is here to stay. Based on the people I'm talking to I don't think they're going to outlaw it. Too many American investors are in this space. There will probably be more regulation.

High net-worth operators in the US are parsing the text of every Biden public statement to glean each scrap of vital information right now. Tax is known to be on Biden's mind and his team are already moving to sell the idea of increasing to raise the corporate tax rate to 28% from 21%, and to raise the top rate on capital gains to 43.3%, effectively doubling the tax rate wealthy Americans pay on investment returns when they sell stocks and other assets.

This has already hit stringent opposition from the likes of the Wall Street Journal and consumer lobby groups like the Tax Foundation.

Piecemeal nation-state regulation has created many imbalances across the globe in how cryptoassets are treated.

But greater regulatory oversight tends to inflame, rather than dampen enthusiasm in crypto markets and this is certainly one area that newer entrants tend to misread. This was last proven in June 2020 when the US first allowed chartered banks to custody cryptoassets, and then in January 2021 to stake those assets by participating as nodes in blockchain networks, leading to major institutional purchases totalling tens of billions of dollars which treat Bitcoin and cryptoassets either as an inflation hedge or as a new form of corporate treasury reserve.

And while one of the first US corporates to cross the Rubicon, Tesla, sold around $150m of its BTC this week, writing on Twitter, Elon Musk moved to dispel any notion of Bitcoin short- termism.

I have not sold any of my Bitcoin. Tesla sold 10% of its holdings essentially to prove [the] liquidity of Bitcoin as an alternative to holding cash on [its] balance sheet.

It appears likely that taxes on cryptocurrency day-traders will be on regulators' radas in the coming months. Indonesia's commodity futures market watchdog is considering applying a per-transaction tax on exchanges, the Phnom Penh Post reported this week, while South Korea's finance minister told Reuters that a tax on trading profits "is inevitable" in 2022.

Seoul is likely to impose a 20% capital gains tax levy on annual profits of more than 2.5 million won ($2.253) from trading crypto, it said. This demonstrates yet another benefit for ETP crypto holders in Europe.

Bitcoin had a notably tough week, retracing away from the mid-$60,000s we saw earlier in April to settle around the mid-$50,000 mark. Markets hate uncertainty more than anything, and the as the macro news of potential regulatory changes filtered through, Bitcoin shed 16.1% of its value before regaining almost everything it had lost, to end the week at $55,172. It's worth recalling the journey that BTC has been on thus far: in the last three months a simple market tracker would have returned 76.6% to investors, and more than 425% across the last year.

Ethereum, as noted above, started to decouple from Bitcoin this past week, stretching to a fresh all-time high of $2,645.97, some 29.02% higher than seven days previously. That soaring momentum fell off a little towards the end of the week, dropping around 3.5% to finish at $2,551.85.

Litecoin continues to claim tenth spot in the list of the world's most-valued cryptoassets, but had something of a bumpy ride in tandem with Bitcoin this week. It showed a wide variance of 39% between its high and low prices, indicating some level of trader and investor price discovery in these historically elevated ranges. But LTC remains quite some way off its $420.25 all time high set back in December 2017. From a low of $207.21, Litecoin climbed back to reach $253.86 at the week's end.

BTC/USD

ETH/USD

LTC/USD

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

ETC Group has been created to provide investors with the tools to access the investment opportunities of the digital assets' and blockchain ecosystem. The company develops innovative digital asset-backed securities including ETC Group Physical Bitcoin (BTCE) and ETC Group Physical Ethereum (ZETH) which are listed on European exchanges including XETRA, Euronext, SIX, AQUIS UK and Wiener Börse.

With a track record of over three years, ETC Group is made up of an exceptional team of financial services professionals and entrepreneurs with experience spanning both digital assets and regulated markets. With product quality and safety at the core of our product creation approach, the company aims to continuously launch best-in-class institutional-grade exchange traded products.

As a company, ETC Group has previously launched BTCE - the world’s first centrally cleared Bitcoin exchange traded product on Deutsche Börse XETRA, the largest ETF trading venue in Europe, and also listed DA20, the world’s first crypto ETP tracking an MSCI index signalling a move towards investment management products. DA20 provides broad market exposure to investors by tracking an index of 20 cryptocurrencies which cover 85% of the total crypto market capitalisation.