Ethereum Shanghai hard fork in spotlight 200 days beyond The Merge

It's an interesting coincidence that at precisely the same time that macro investors are hoping China's reopening will drive another stock market rally, so crypto investors are expecting Ethereum's Shanghai upgrade to provide a bedrock of support to a price rally that has lasted three months or more.

At the time of writing it is exactly 200 days since The Merge: the Ethereum network overhaul that in September 2022 faultlessly transitioned the second-most valuable blockchain away from mining and Proof of Work (PoW) and into the newer Proof of Stake model.

In doing so, Ethereum's cadre of developers and supporters ushered in a new era, dispensing with the energy-intensive mining model that backs Bitcoin, Litecoin and other PoW chains, and accepting some tradeoffs in concentration of staking power in order to scale the blockchain to crypto's first billion users.

While it was an extraordinarily technically complex process to push through (and was seven years in the making) The Merge left many additional potential upgrades by the roadside. One of the most important - staking withdrawals - will be enacted when Ethereum's Shanghai hard fork completes on 12 April.

Staking withdrawals will allow capital that has been locked up in the Ethereum staking contract since December 2020 to be withdrawn, should users so choose.

90 million Ethereum addresses?

Readers and regular users will know by now that over the years since its 2015 launch, Ethereum became a victim of its own success, with regular network congestion and unpalatably high fees. Still, for a time it was the only smart contract game in town and as such hoovered up all of the capital, most of the userbase and the vast majority of demand for blockspace from apps running on its network. Those network effects are exceedingly difficult for new entrants to build.

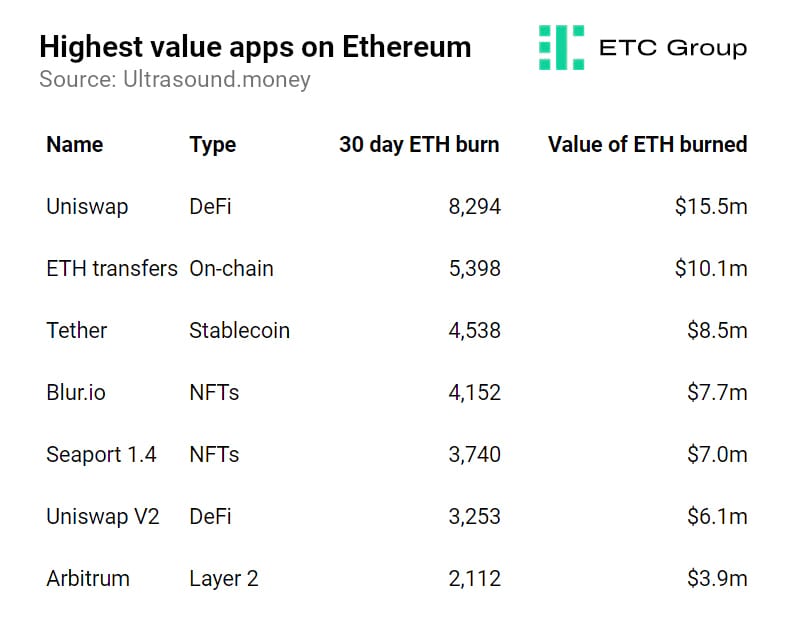

Included in the list of top dapps on Ethereum are the NFT market Opensea (with its recent protocol upgrade to Seaport 1.4), decentralised exchange Uniswap and the Layer 2 solution Arbitrum. Every time an operation is performed on the Ethereum blockchain, such as an NFT sale or moving ETH from a wallet to an exchange, a portion of the fees charged is removed from the total supply.

The table below shows the highest value apps on Ethereum, ranked by their 30-day ETH burn. The data is correct to 4 April 2023.

The success of a blockchain that has grown to a value of $210bn may not be quite as surprising when we note the facts: that Ethereum is effectively an operating system that is shared among hundreds of thousands of computers, that can compute (almost) any task, which is not owned or managed by any one company, that can't be taken down or censored by a group of powerful stakeholders for their own gain, that hosts more than half of the $50bn DeFi market for financial apps and platforms. We could go on.

Ethereum also boasts 25% of all 23,000 crypto developers working on its development, according to VC stalwart Electric Capital's latest annual report.

Tracking the number of developers working on a particular blockchain is a useful leading indicator of value creation, EC's lead author Maria Shen writes, because

developers build killer applications that deliver value to end users, which attracts more customers, which then draws [in] more developers.

Additionally, a 2 April all time high of 90 million Ethereum addresses may not precisely represent one person per address, (nor 90 million daily active users) but we can still extrapolate that Ethereum is growing its influence.

What Dragonfly Capital's Haseeb Qureshi told Laura Shin on the Unchained podcast in 2020 stands true now:

Ethereum is a call option on it winning [becoming] the smart contract platform for the world, and smart contracts being a thing.

Forgive the brief tangent, but it's worth invoking Sutton's Law here.

This is an axiom used in both medicine and computer programming and runs along the same lines as Occam's Razor. It states that when performing a diagnosis, making a prediction, or debugging code, one should first consider the obvious. It is rather delightfully named after famed US bank robber William Sutton, who when asked why he chose his particular line of work, said:

Because that's where the money is.

Similarly, in smart contracts, in developer engagement, in innovation and utility, Ethereum is where the money is. “Ethereum has really shored up its roadmap; there's a lot more clarity now on how to get [to 100% completion], Qureshi added, noting:

Every day that passes that Ethereum doesn't get dethroned it's more likely that Ethereum wins.

Ethereum's closest rival by market cap, Cardano, introduced its own version of smart contracts in September 2021 with the ability to build dapps, while Polkadot (and its testnet Kusama) together represent the second-largest number of blockchain developers working on a single chain.

But the scale of the difference between Ethereum and its rivals is worth reiterating.

Ethereum's 5,750-strong developer community is 2.8 times larger than its nearest competitor (Polkadot: 2,083), and across the rocky bear market of 2022 this cohort grew by 5% despite token prices crashing by 70% or more. Normally crypto developers join the ecosystem as token prices increase.

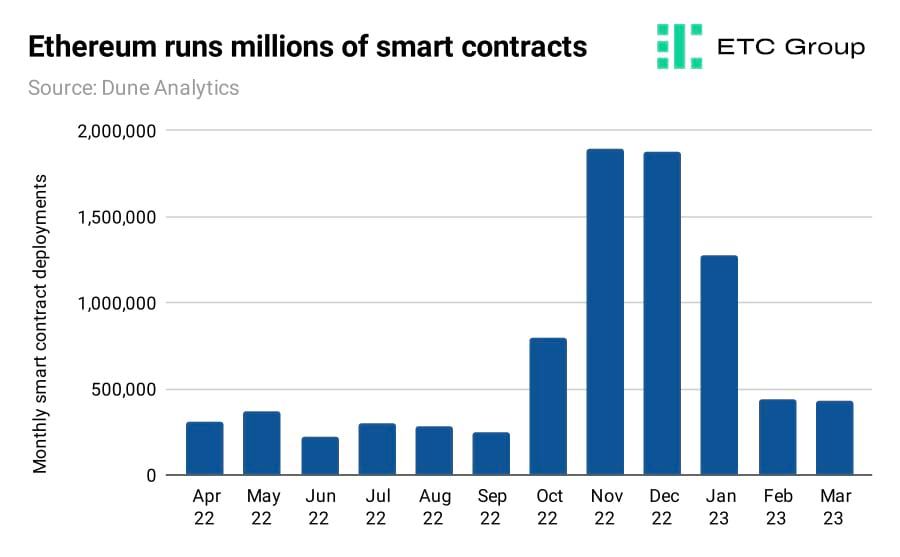

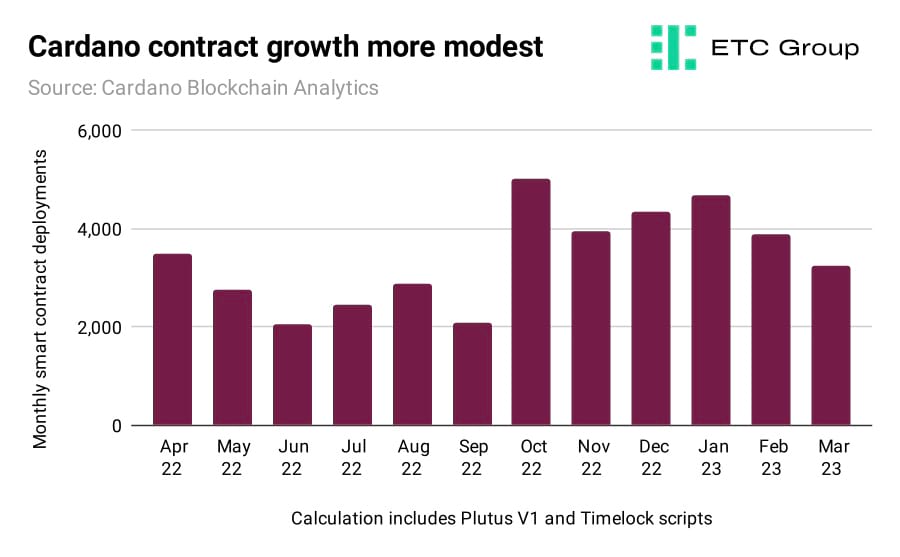

We may also compare the number of smart contracts running on Ethereum to those on Cardano. The scale of the difference is so vast that it is impossible to accurately represent the comparison in a single chart.

Over the course of its history Ethereum has successfully processed more than 40 million smart contracts.Over 400,000 new contracts are deployed on Ethereum on a monthly basis.

Over the same period, the average for Cardano is fewer than 3,000 while total smart contract deployment is a little over 90,000.

Warren Buffett or Peter Lynch would talk about an economic ‘moat' around a company that investors should see - its market dominance or userbase and revenue growth - before committing capital to buy shares.

By the same token, crypto investors need to see adoption, usage, new forms of utility and mainstream interest that breaks out beyond hardcore early adopters.

Ethereum Layer 2s drastically cut fees, scale ETH

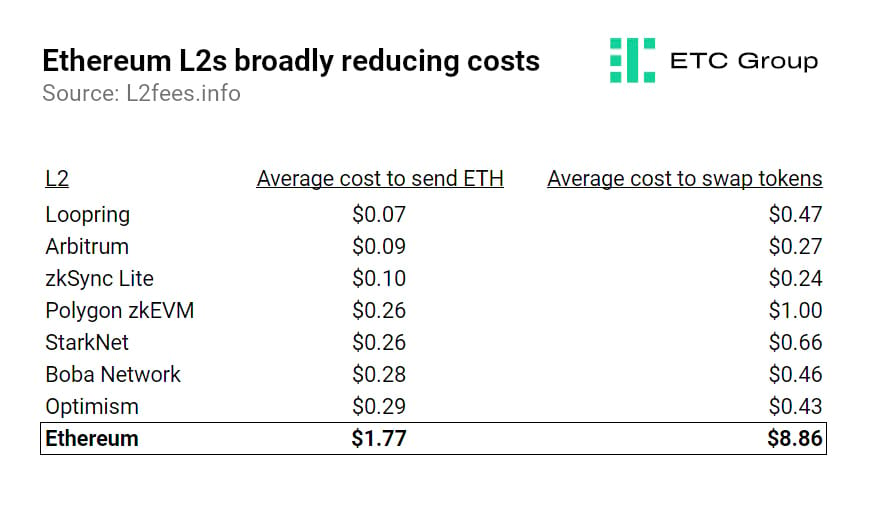

Vitalik Buterin said in May 2022 that to be “truly acceptable” and to scale successfully, Layer 2 add-ons for Ethereum would need to reduce simple transaction costs below $0.05.

Broadly, Layer 2 solutions collect up batches of transactions and process them off-chain to save on time and computing power.

The simplest operations - sending ETH from one place to another - cost the least computing power and are therefore the cheapest. More complex operations are more expensive.

Options like Loopring, Polygon, zkSync and Arbitrum have widely aided this cause, given that the main chain still sees relatively high transaction fees approaching $10 in some cases.

Despite its popularity, and its moat, the high latency and low throughput available means that Ethereum still struggles with transaction speeds. If DeFi does continue its growth to be the dominant application of the 2020s, then dapps' long-threatened shift away from Ethereum may just become reality.

Cosmos appears to be the new blockchain home of choice for dapps frustrated by slow transaction speeds on Ethereum. While its token ATOM is only the 22nd largest on the market, investors have long considered its host chain to have potential as an Ethereum competitor alongside Avalanche (AVAX) and Solana (SOL).

dYdX, one of the largest decentralised exchanges, recently formalised its planned swap from Ethereum to Cosmos with the move expected to go through in September 2023. dYdX currently has $341 million in TVL. Representatives specifically cited Ethereum's low transactions per second as the main driver behind the move. Ethereum TPS can speed up or slow down depending on how many users are trying to user the network, but generally falls between 10 and 45 transactions per second.

This is the second major project in recent months to announce its migration from Ethereum to Cosmos. SushiSwap is making a similar move after it acquired the Cosmos-based trading platform Vortex Protocol in February.

Still, DeFi in particular benefits from very large network effects, while makes expanding a rival system tricky, especially when the incumbent controls 58.5% of market share.

EOS, EVM, Binance fee cut demonstrate Ethereum's moat

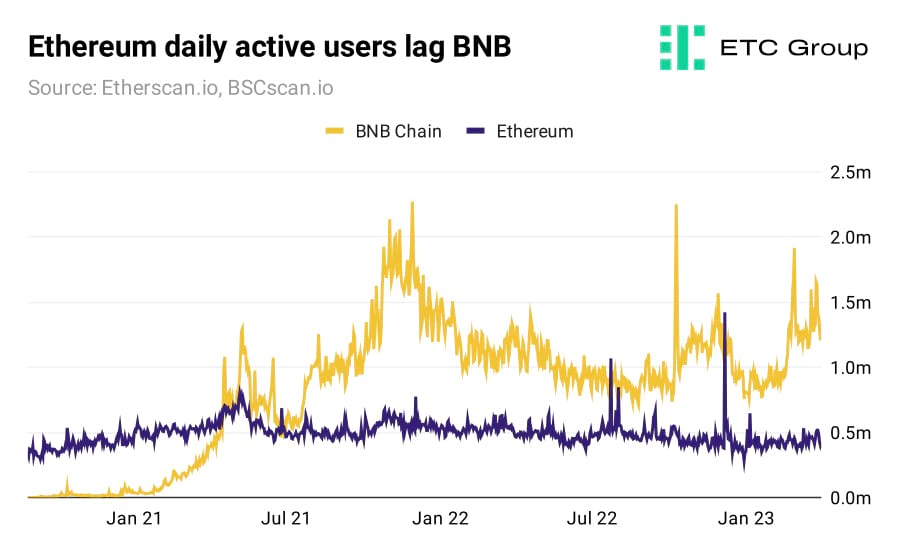

With around 500,000 daily active users, Ethereum's recent address growth has not been as strong as its nearest competitors.

However, rival blockchains still struggle to match Ethereum's potent mix of strong network effects, broad decentralisation and bombproof security. Solana for example, long a favourite of traders everywhere, has faced significant scaling challenges of its own, and repeat network outages have blackened its copy book with users who prioritise stability, security and uptime.

And despite fast user growth, in order to compete with Ethereum, BNB Chain is now corralling its users to suggest broad changes to how the blockchain functions.

BNB Chain's operator Binance is currently in the crosshairs of the CFTC regulator in the United States and while a single lawsuit cannot fully halt technological development, it does bring fresh uncertainty to the future of applications developed under the Binance banner.

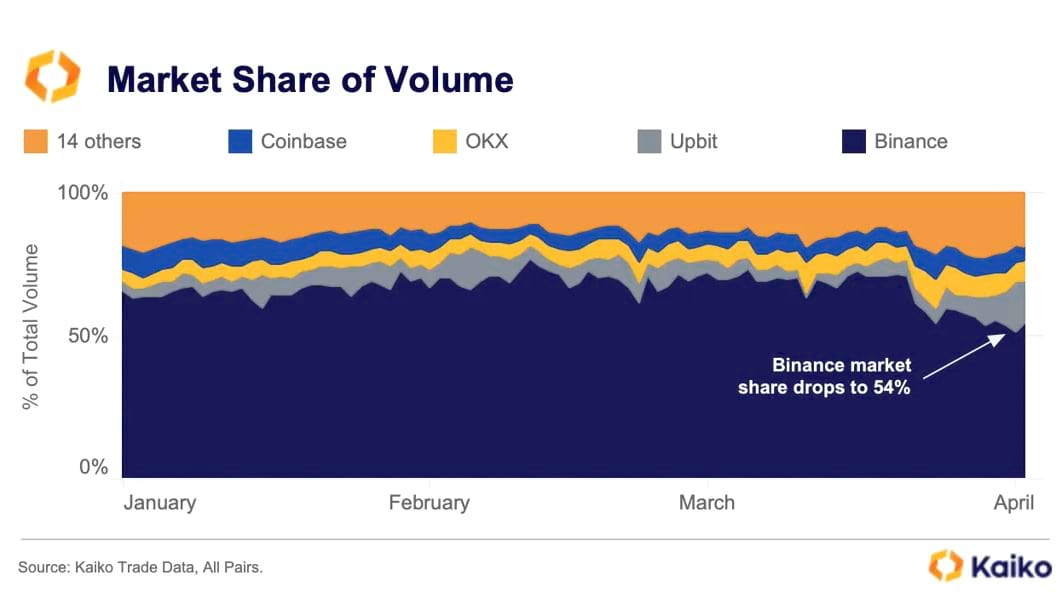

The exchange itself is also seeing struggles, witnessing a 16% drop in market share when it ended zero-fee trading, according to Kaiko data.

Any blockchain lacking Ethereum Virtual Machine compatibility, lacking collateral that is as highly regarded as ETH and lacking interoperability will struggle to dent that first-mover advantage.

EVM compatibility also allows users to use popular Ethereum-based wallets such as Metamask with alternate blockchains, something Zilqilla recounted in announcing its own EVM capability switch, set for 23 April 2023.

It could easily be argued that EOS - of the 2019 $4.4bn ICO fame - which announced that by 14 April it will have breathed new life into its DeFi ecosystem by introducing EVM compatibility, could still fail on the other points.

The EOS token is not as high quality collateral as ETH; it does not have the same trading volume or liquidity and hence is more volatile.

The Ethereum Virtual Machine is designed to be platform-agnostic, in that it can run on any blockchain that supports EVM standards.

Despite its unique user growth BNB Chain lacks differentiation from Fantom, Algorand or other smart contract chains, making it difficult to retain dapps, which hop between EVM-compatible chains depending on user growth and the level of investment offered.

“In order to make BSC more attractive for new projects and retain existing projects there should be added value,” writes one developer, “by implementing…new types of smart contracts not available on EVM-compatible networks. This can create a barrier to migration for projects that rely on these new features or functionalities.”

One such alteration would optimise its version of the EVM for high-performance computing.

Other suggestions include introducing native oracle pricing and increasing runtime limits, which would allow more complex code instructions to run on the blockchain.

Finally, a 28 March proposal specifically cites the growth of Ethereum's Layer 2 solutions in suggesting cuts to BNB Chain's fixed fee structure.

“Over the last 6 months, the key measurements of the network have plateaued, creating a situation where the network is underutilized, with utilization varying between 15-20%.

“BSC transaction costs are currently set at a relatively high fixed rate of 5 gwei, writes developer Arno B, “which may not be as appealing to users as the more affordable fees provided by L2 solutions outside of the BSC ecosystem. This will ensure the existing and future BNB Chain L2 solutions remain competitive and keep attractive users in the ecosystem.”

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer