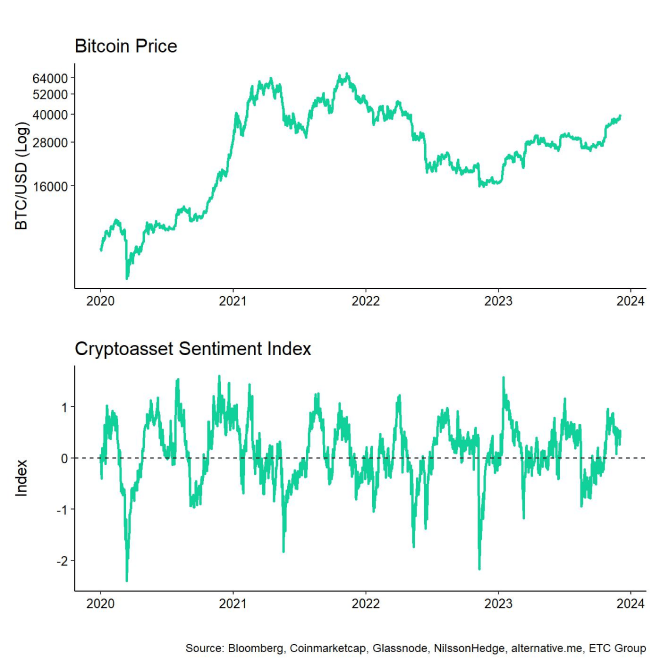

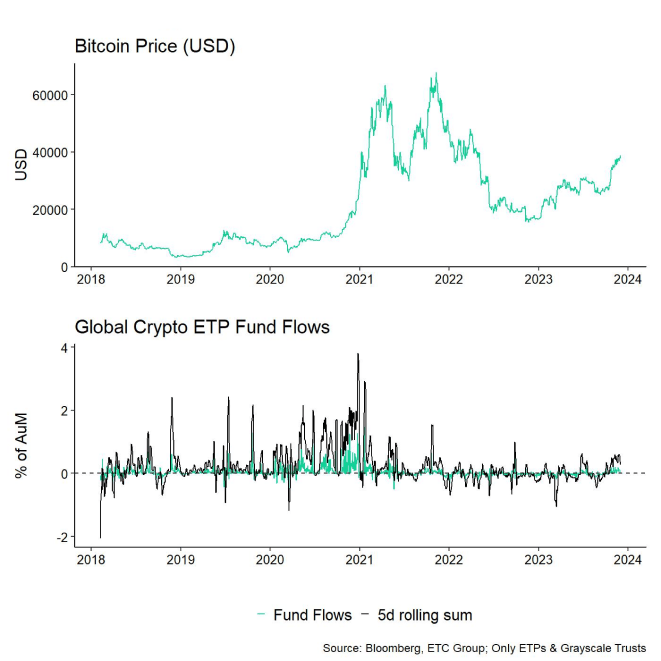

- Bitcoin crosses 40k USD for the first time since April 2022 amid a very significant repricing in US monetary policy and futures short liquidations

- Our in-house “Cryptoasset Sentiment Index” declined somewhat compared to last week

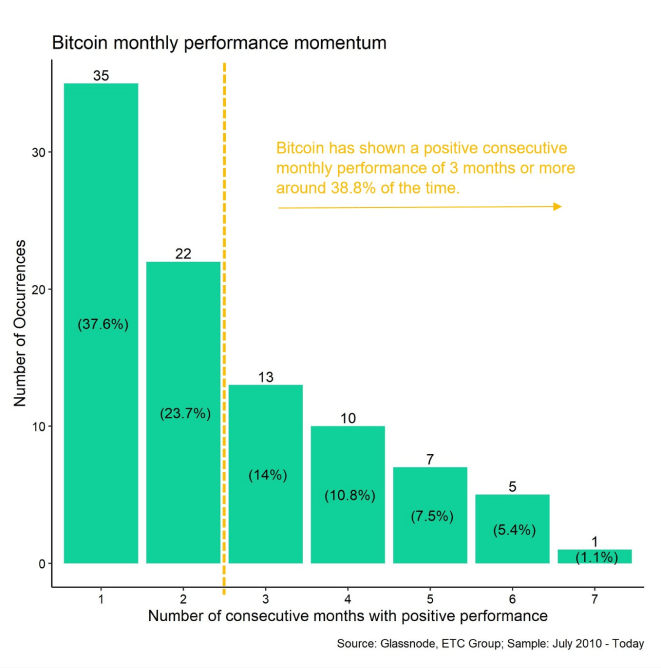

- Bitcoin is clearly gaining momentum with 3 consecutive positive months in a row so far

Chart of the Week

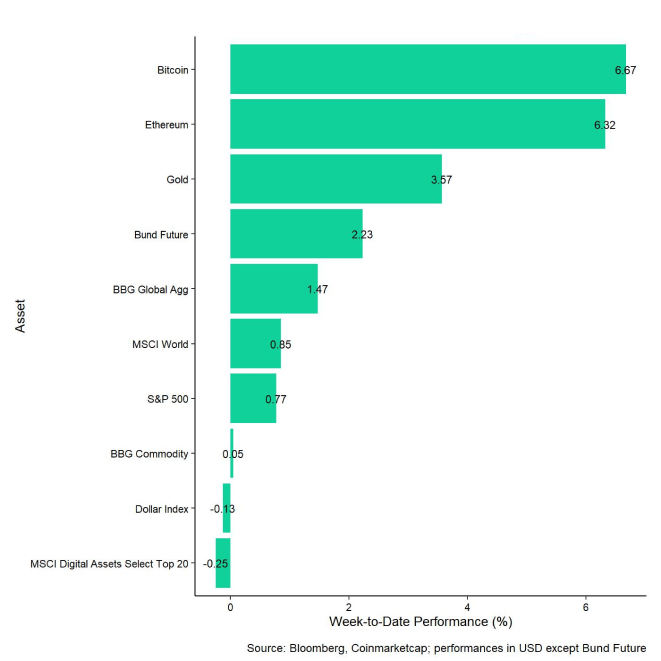

Performance

Last week, cryptoassets managed to outperform traditional assets like equities on the back of a significant repricing in US monetary policy expectations. Rate futures markets expect that the peak in this Fed interest rate hiking cycle is behind us and already price in 5 cuts of 25 bps until December 2024. This is a significant shift compared to the beginning of November, when traders only priced in 3 cuts in 2024.

Moreover, we saw significant futures short liquidations over the weekend that propelled Bitcoin above 40k USD for the first time since April 2022. More specifically, more than 66 mn USD in BTC short futures value has been liquidated over the weekend so far according to data provided by Glassnode.

This tends to have a positive impact on price, as short-positioned traders need to cover their positions by buying back the underlying – a process known as “short covering”.

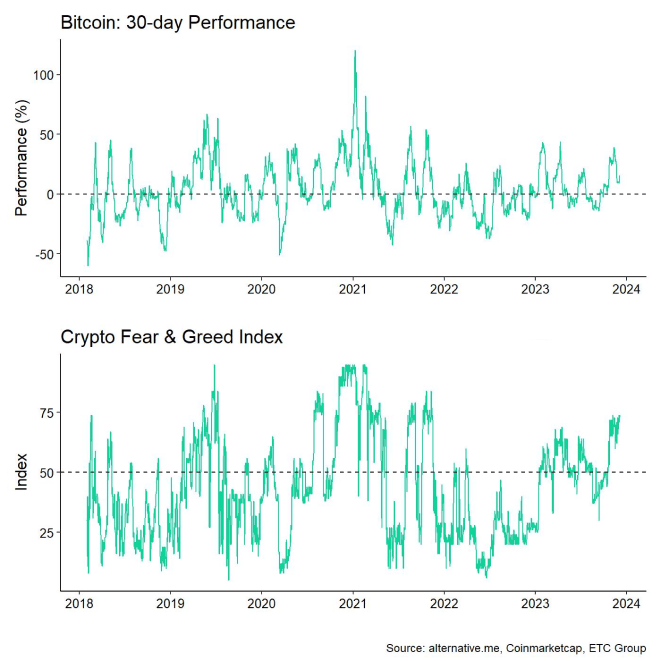

Bitcoin is clearly gaining momentum, having already increased 3 consecutive months in a row. Historically speaking, Bitcoin has shown a positive consecutive monthly performance of 3 months or more around 38.8% of the time (Chart-of-the-Week).

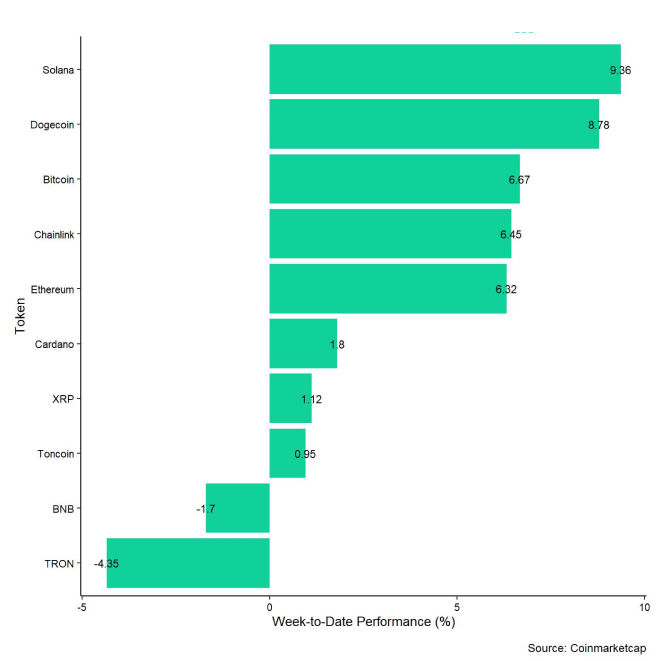

Among the top 10 crypto assets, Solana, Dogecoin, and Bitcoin were the relative outperformers.

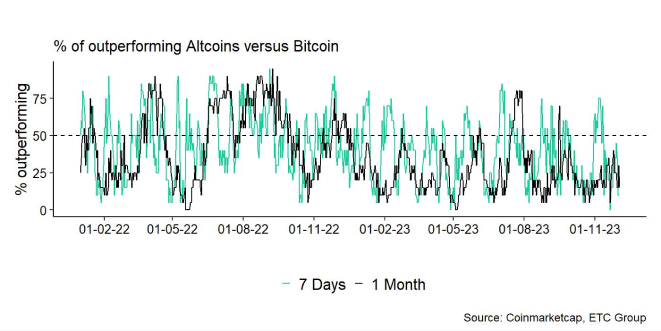

However, altcoin outperformance vis-à-vis Bitcoin was generally low over the week as only 10% of our tracked altcoins managed to outperform Bitcoin on a weekly basis.

Sentiment

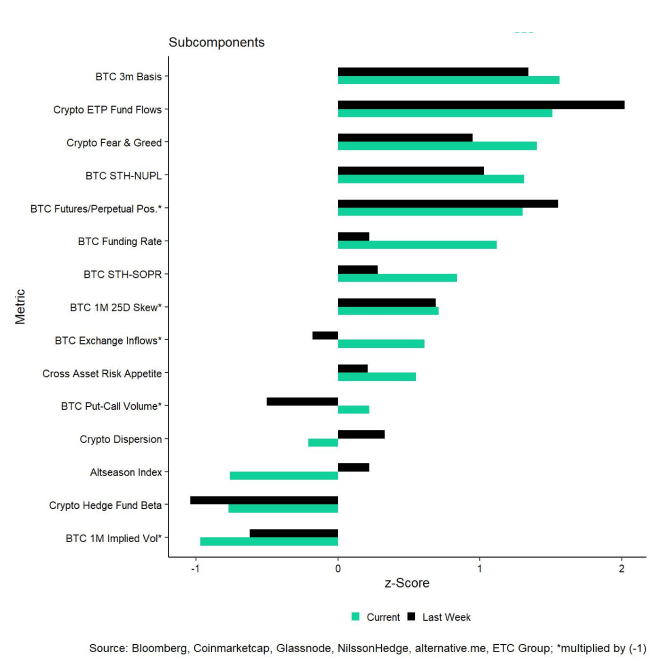

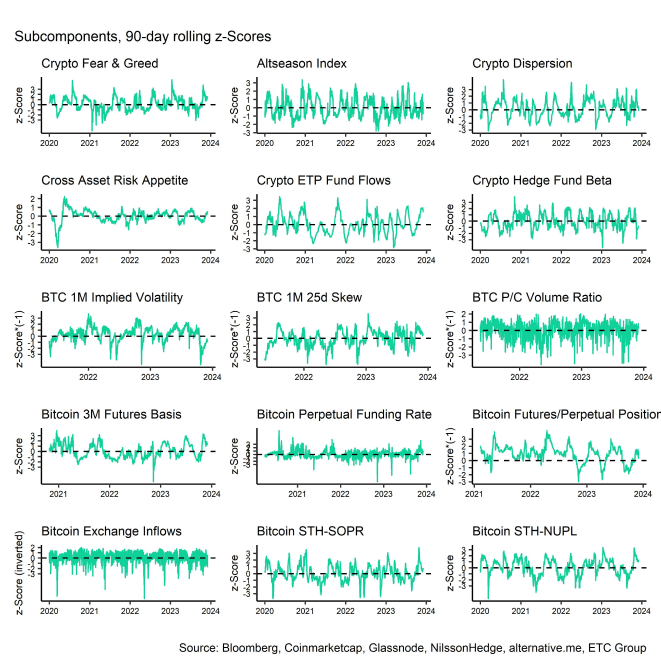

Our in-house Cryptoasset Sentiment Index has declined somewhat compared to last week but is still in positive territory. At the moment, 11 out of 15 indicators are above their short-term trend.

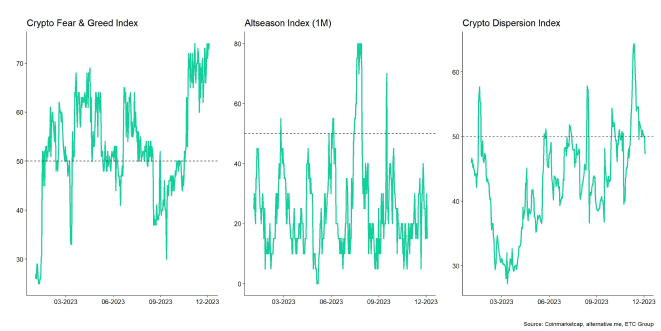

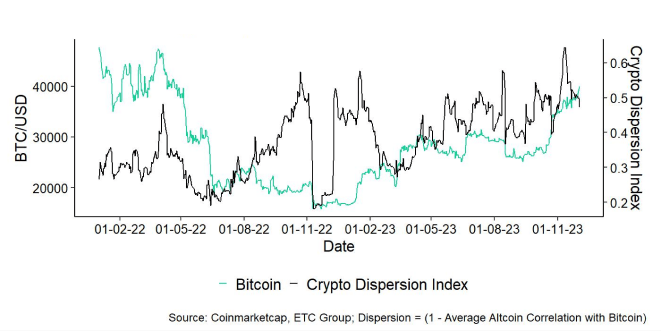

Compared to last week, we saw major reversals to the downside in the Altseason index and Crypto Dispersion Index.

The Crypto Fear & Greed Index also remains in "Greed" territory as of this morning.

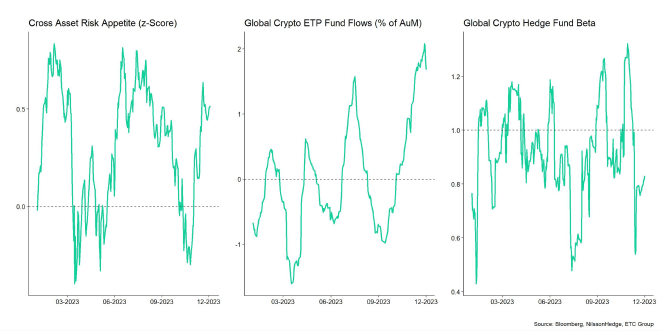

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) has also increased significantly, implying a positive sentiment in traditional financial markets.

However, performance dispersion among cryptoassets has declined somewhat compared to last week but continues to be relatively high. In general, high-performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased, which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, altcoin outperformance has continued to be low with only 10% of altcoins outperforming Bitcoin on a weekly basis. In general, low altcoin outperformance tends to be a sign of low-risk appetite within cryptoasset markets.

Flows

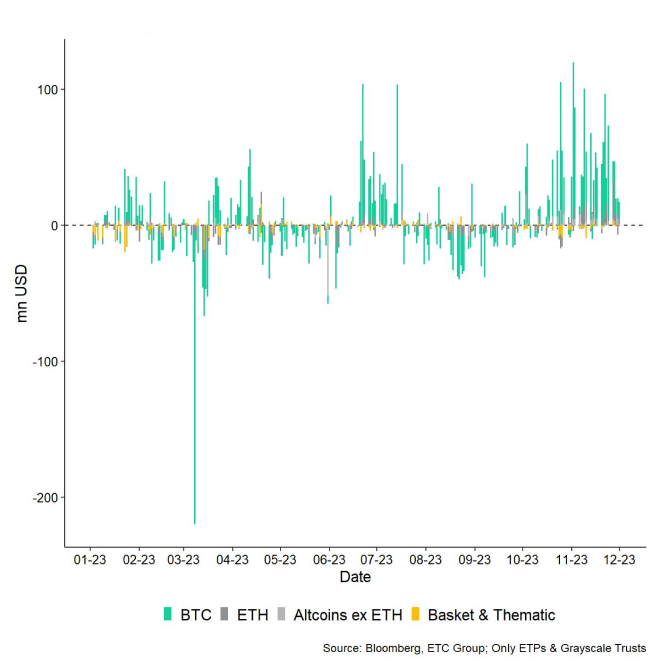

Last week, we saw yet another week of significant net fund inflows into global cryptoasset ETPs.

In aggregate, we saw net fund inflows in the amount of +141.9 mn USD (week ending Friday).

Most of these inflows focused on Bitcoin ETPs (+90.0 mn USD) although Ethereum ETPs also managed to attract a larger amount of these flows (+39.3 mn USD). Altcoin ex ETH ETPs attracted +9.1 mn USD while thematic & basket crypto ETPs attracted +3.6 mn USD in net fund inflows last week.

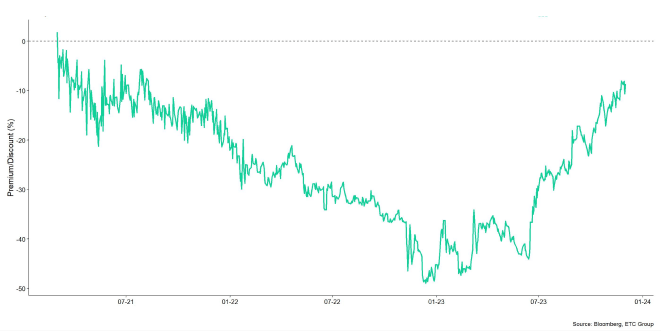

The NAV discount of the biggest Bitcoin fund in the world - Grayscale Bitcoin Trust (GBTC) – was mostly unchanged last week at around -8%. In other words, investors are assigning a probability of around 92% that the Trust will ultimately be converted into a Spot Bitcoin ETF.

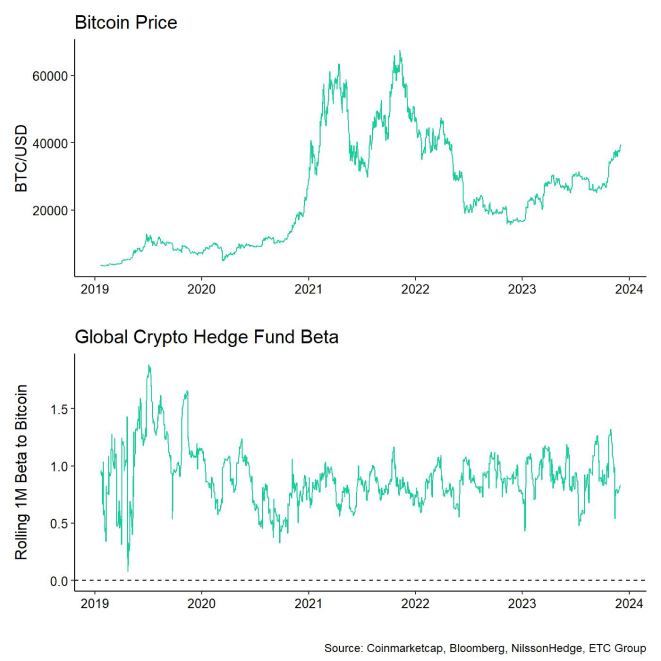

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remains low with slightly more than 0.8, implying that global crypto hedge funds remain under-exposed to Bitcoin market risks.

On-Chain

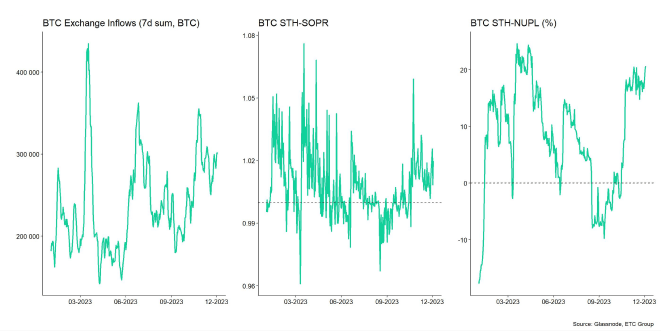

Overall, on-chain activity in Bitcoin has declined somewhat last week but remains comparatively high.

Both the number of active addresses, new addresses, and number of transactions have declined compared to last week. However, mean transactions fees on the Bitcoin blockchain remain at elevated levels as the congestion of the mempool has declined only slightly. The mean number of transactions per block is currently still above 4000 transactions per block.

Meanwhile, the mean hash rate has reached a new all-time high last week with ~571 EH/s recorded on Friday. It seems as if Bitcoin miners are trying to increase their revenue share as much as possible in anticipation of the halving of the block subsidy scheduled for April 2024.

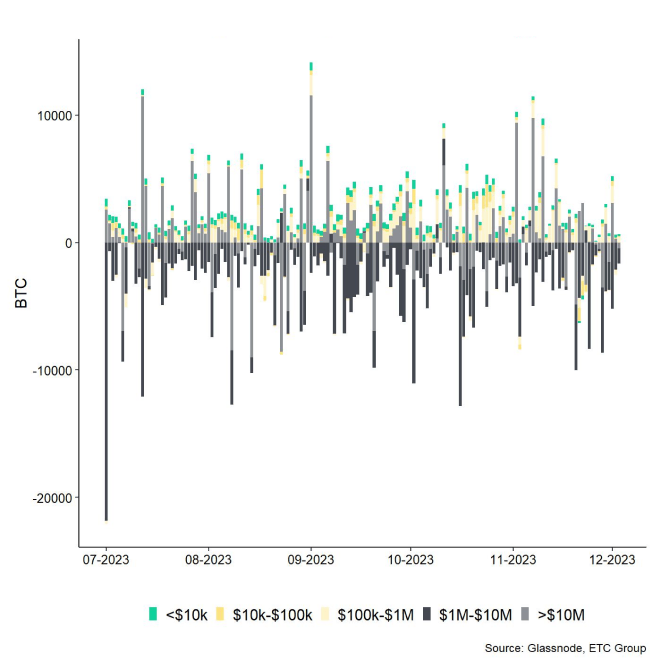

Moreover, exchange activity has been positive for Bitcoin last week as aggregate BTC exchange balances declined to a fresh 5-year low according to data provided by Glassnode. Aggregate Ethereum exchange balances also continued to drift lower last week, hovering near 7-year lows.

Around -13k BTC have flown out of exchanges over the past week, most of which flew out of Binance.

A very significant on-chain development for Ethereum was also the fact that the Total-Value-Locked (TVL) of Ethereum Layer 2s reached a new all-time high of 15.2 bn USD last week, according to data provided by L2BEAT. Meanwhile, the percentage of Ethereum users using Layer 2s also hit a new all-time high as well based on data provided by Dune.

Derivatives

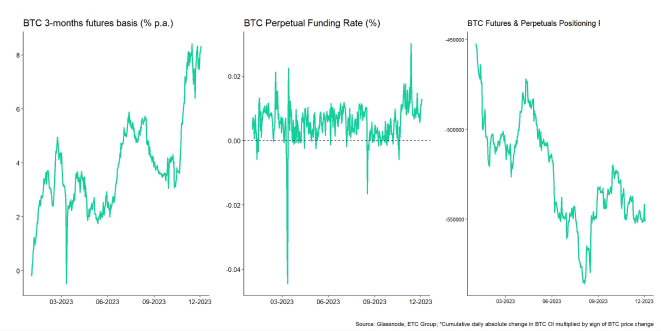

Aggregate open interest in BTC futures was relatively stable last week although there were some significant divergences across exchanges. For instance, CME BTC futures' open interest reached a new all-time high last week with over 125k BTC in open interest. CME is still the biggest BTC futures exchange. There was also a significant increase in BitMEX BTC futures open interest last week of around 5k BTC in additional open interest that implies an increase in institutional buying interest.

There was also a considerable number of futures short liquidations over the weekend that propelled Bitcoin above 40k USD. More specifically, more than 66 mn USD in BTC short futures value has been liquidated over the weekend so far according to data provided by Glassnode. Many of these liquidations appeared to have happened on Binance and Bitfinex.

The 3-months annualized rolling basis in BTC futures has increased again compared to last week and remains near year-to-date highs of around 8.3% p.a.

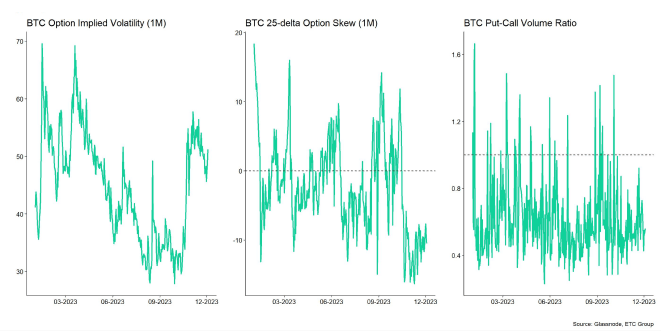

BTC perpetual funding rates remained positive throughout the week across various exchanges.

Besides, BTC option open interest remained relatively flat throughout the week as did relative put-call open interest. However, BTC 1-month 25-delta option skews gradually increased over the past week, implying a relative increase in put demand by BTC option traders. Overall, BTC 1-month implied volatilities have decreased over the past week and have only recently ticked up again.

Bottom Line

- Bitcoin crosses 40k USD for the first time since April 2022 amid a significant repricing in US monetary policy and futures short liquidations

- Our in-house “Cryptoasset Sentiment Index” declined somewhat compared to last week

- Bitcoin is clearly gaining momentum with 3 consecutive positive months in a row so far

Appendix

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer