- Cryptoasset performances were relatively mixed as there was a wider performance divergence among individual cryptoassets

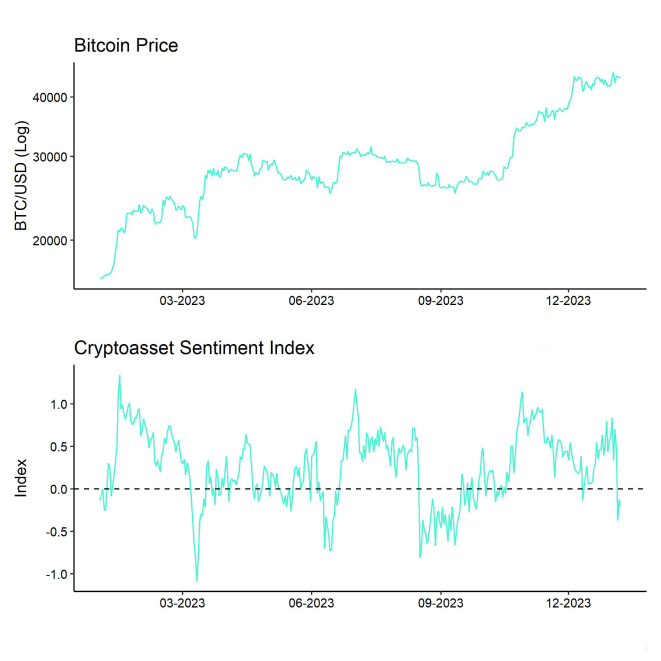

- Our in-house “Cryptoasset Sentiment Index” has declined and is signalling a slightly bearish sentiment

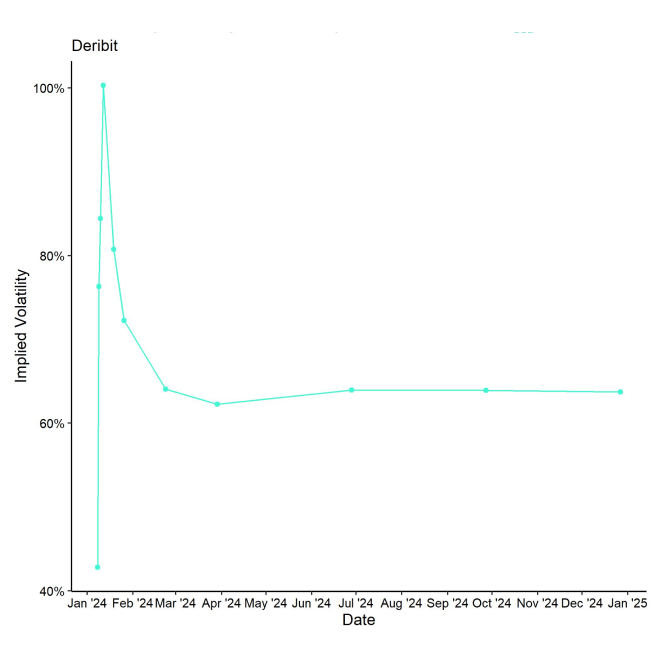

- Bitcoin option traders brace for higher uncertainty before the ETF approvals with a clear increase in implied volatilities for options expiring this week (Chart-of-the-Week).

Chart of the Week

Performance

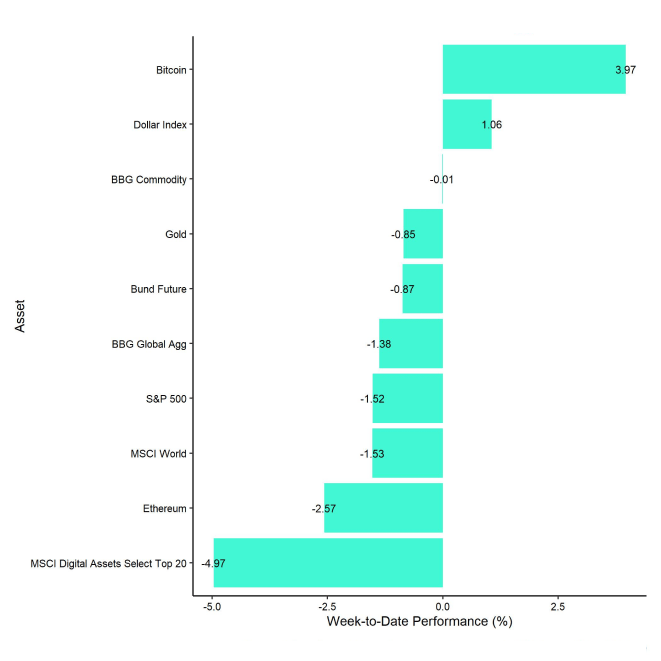

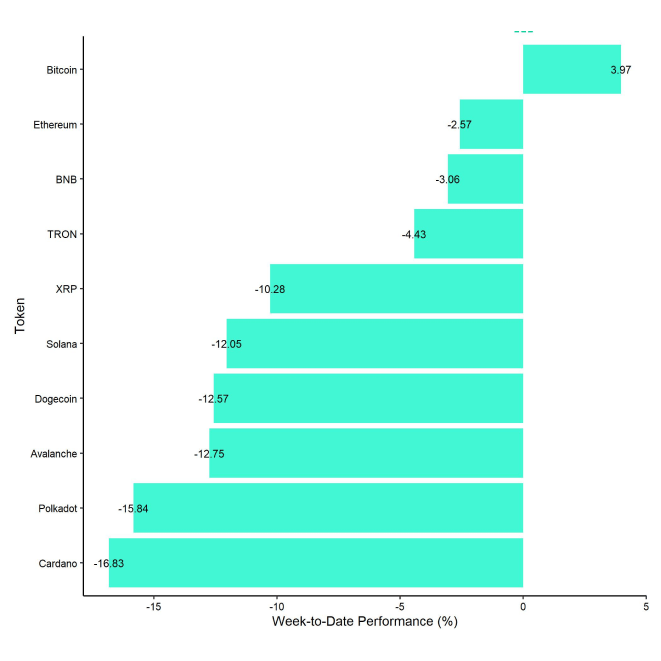

Last week, cryptoasset performances were relatively mixed, as there was a wider performance divergence among individual cryptoassets. Bitcoin continued to be supported by the positive prospects for a spot Bitcoin ETF in the US while other cryptoassets underperformed after a flash crash last week.

Bitcoin sold off more than -10% last week after a speculative research note suggested that the SEC might reject the ETFs in January. We have covered the reasons for this sell-off in greater detail here.

The most recent information, however, does not suggest a significant shift in the likelihood that the spot Bitcoin ETFs will be approved in the US.

To the contrary, Bloomberg ETF analysts still expect an approval and even a trading launch this week.

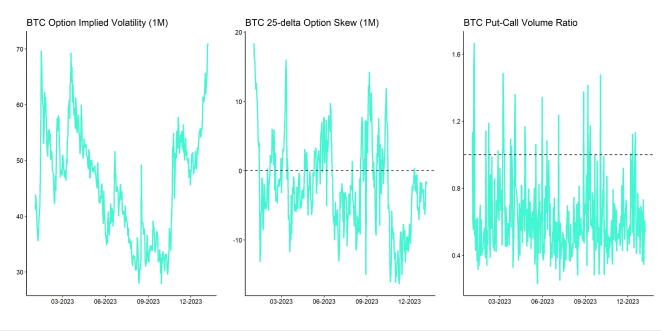

Meanwhile, the BTC options market is also expecting heightened uncertainty this week, as options that expire this Friday are trading well above options with later expiries (Chart-of-the-Week). The implied volatility of 1-week at-the-money BTC options has reached the highest level since November 2022 when FTX collapsed.

At the time of writing, at-the-money options with expiry on Friday are trading at 99% implied volatility. There is a clear skew towards puts for Friday's options, so BTC option traders have bid up downside protections.

Despite the heightened uncertainty, the most likely scenario remains an approval of the spot Bitcoin ETFs in the US this week.

In general, among the top 10 crypto assets, Bitcoin, Ethereum, and BNB were the relative outperformers.

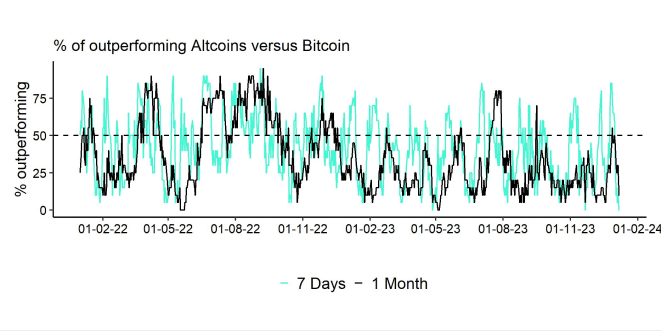

Altcoin outperformance vis-à-vis Bitcoin was very weak compared to the week prior, with none of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

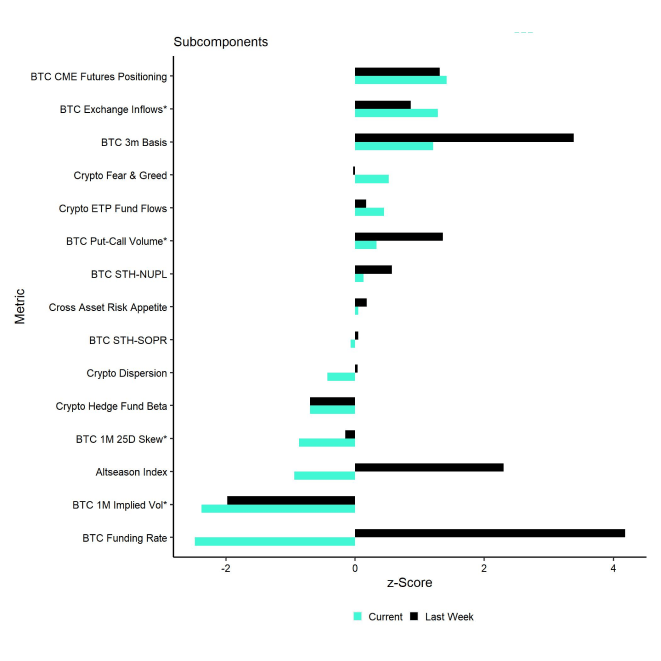

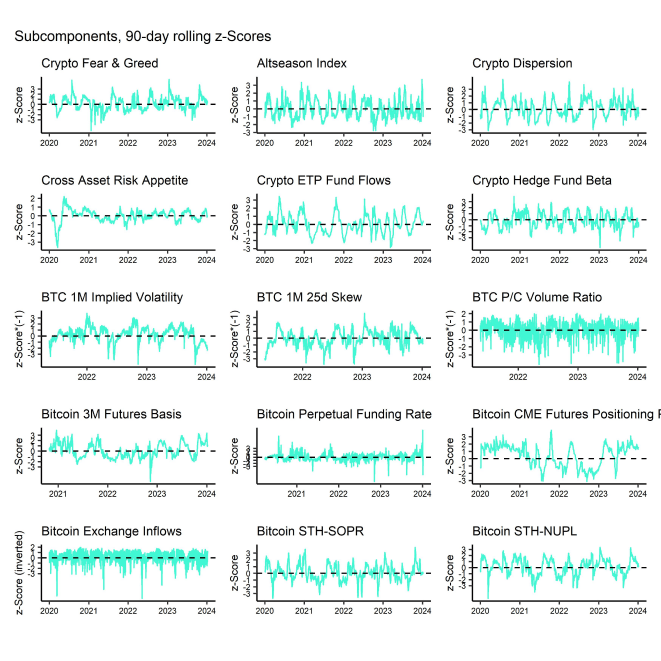

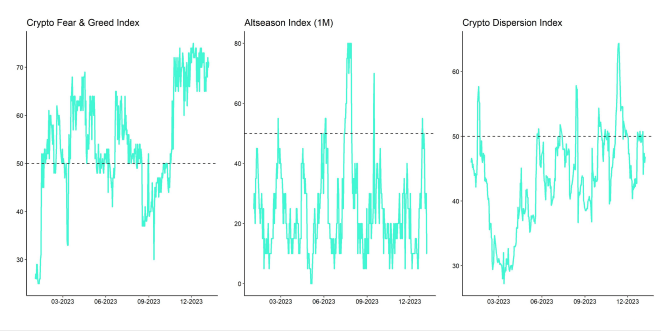

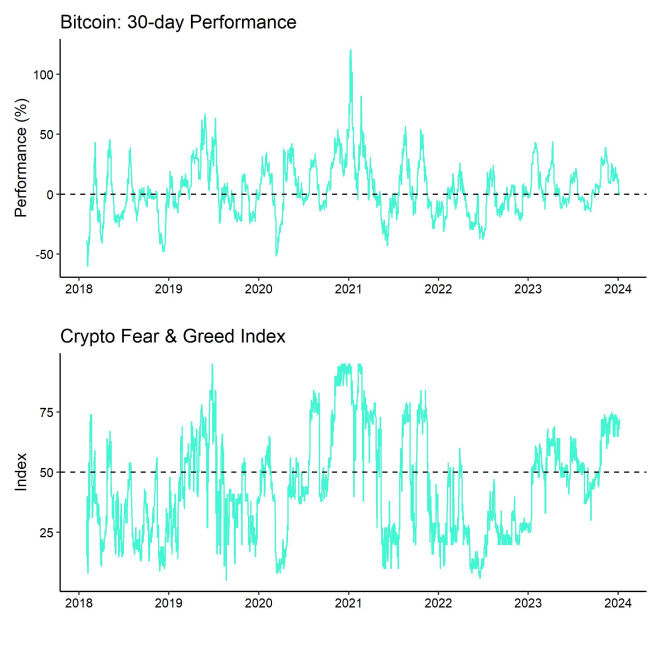

Our in-house Cryptoasset Sentiment Index has recently declined and currently signals a slightly bearish sentiment. At the moment , 8 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals to the downside in BTC funding rates and BTC implied volatilities. Note that an increase in implied volatility leads to adecrease in Cryptoasset Sentiment within our index.

The Crypto Fear & Greed Index still remains in "Greed" territory as of this morning.

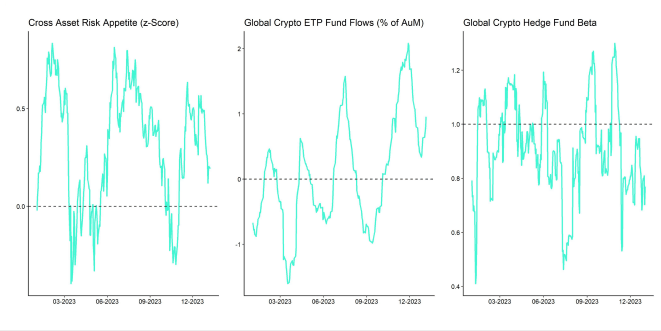

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) has recently stabilized at lower levels after having decreased significantly heading into year-end. Overall this is still signalling a decline in risk appetite in traditional financial markets. That being said, the indicator remains slightly in positive territory overall.

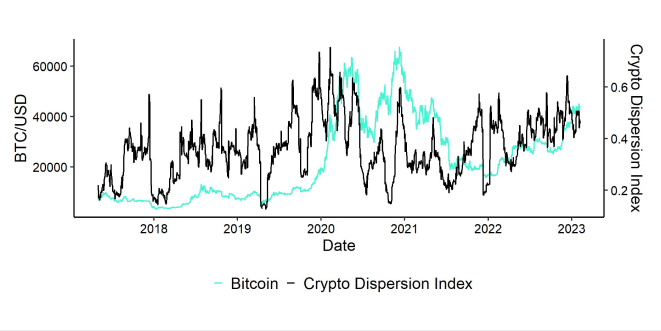

Performance dispersion among cryptoassets has mostly moved sideways last week but still continues to be relatively high . In general, high-performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased, which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, altcoin outperformance has declined considerably compared to the week prior, with none of our tracked altcoins outperforming Bitcoin on a weekly basis. In general, low altcoin outperformance tends to be a sign of low risk appetite within cryptoasset markets.

Fund Flows

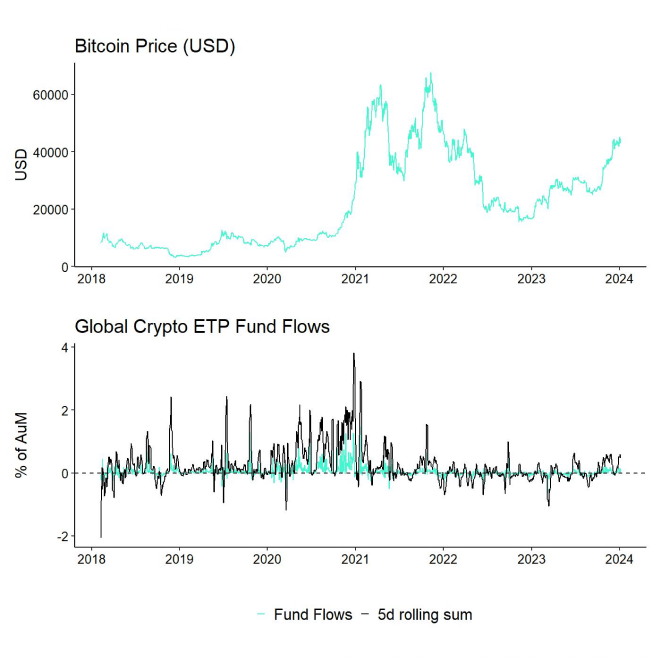

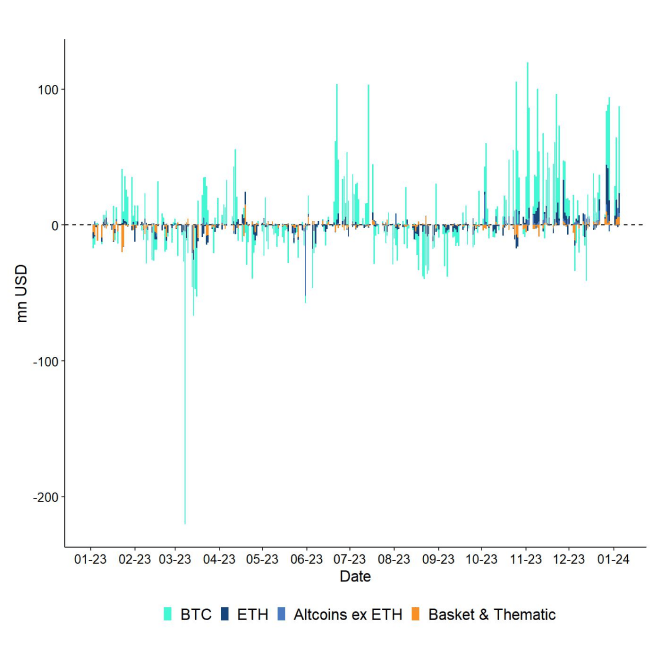

During the first 4 trading days of the year 2024 (02/01 - 05/01), we saw another week of significant net inflows into cryptoasset ETPs, despite the interim sell-off.

In aggregate, we saw net fund inflows in the amount of +190.5 mn USD (week ending Friday).

Bitcoin ETPs managed to attract the bulk of these inflows (+131.9 mn USD) while Ethereum ETPs also attracted a significant amount of funds (+33.9 mn USD).

Altcoin ex ETH ETPs and thematic & basket crypto ETPs also managed to attract net inflows of +9.0 mn USD and +15.7 mn USD, respectively, based on our calculations.

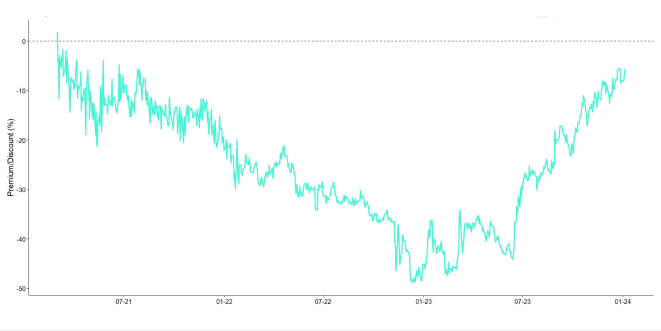

Meanwhile, the NAV discount of the biggest Bitcoin fund in the world - Grayscale Bitcoin Trust (GBTC) – narrowed again last week to around -5.6%. In other words, investors are assigning a probability of around 94.4% that the Trust will ultimately be converted into a Spot Bitcoin ETF which is up from the week prior.

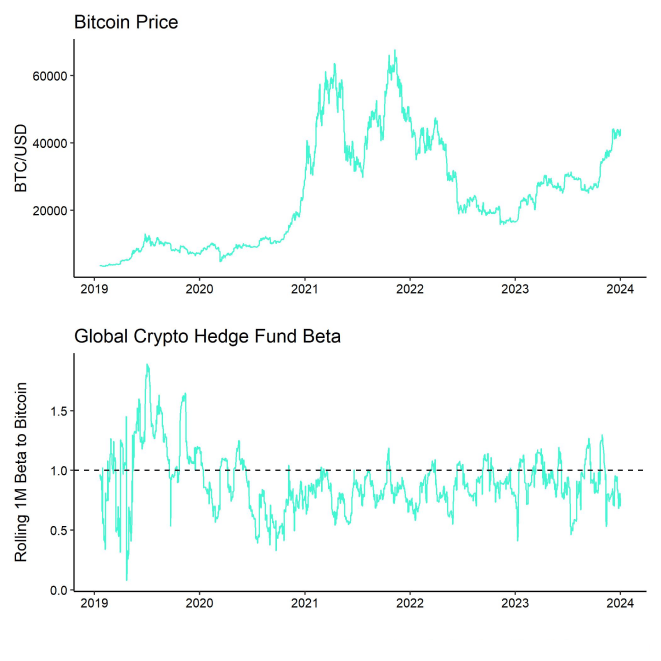

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remains low at approximately 0.8, implying that global crypto hedge funds still remain under-exposed to Bitcoin market risks. It appears as if crypto hedge funds are still waiting on the sidelines for new catalysts.

On-Chain Data

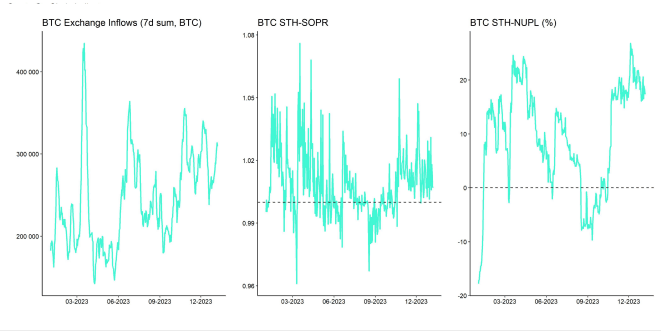

Overall, core on-chain data for Bitcoin remains relatively weak at the moment with active and new addresses still hovering near the lowest levels since May 2023.

The congestion in the Bitcoin mempool has started to ease more recently, with the total number of yet to be confirmed transactions declining to the lowest level since November 2023. Mean transaction fees have also been declining more recently and daily miner revenues have clearly normalized itself over the past.

Nonetheless, BTC miners continue to distribute their reserves and aggregate miner balances have declined to the lowest level since December 2022, according to data provided by Glassnode. The trend of those aggregate miner balances is clearly to the downside. Miners have increasingly sending BTC to exchanges as miner exchange transfers have recently spiked to the highest level since August 2023.

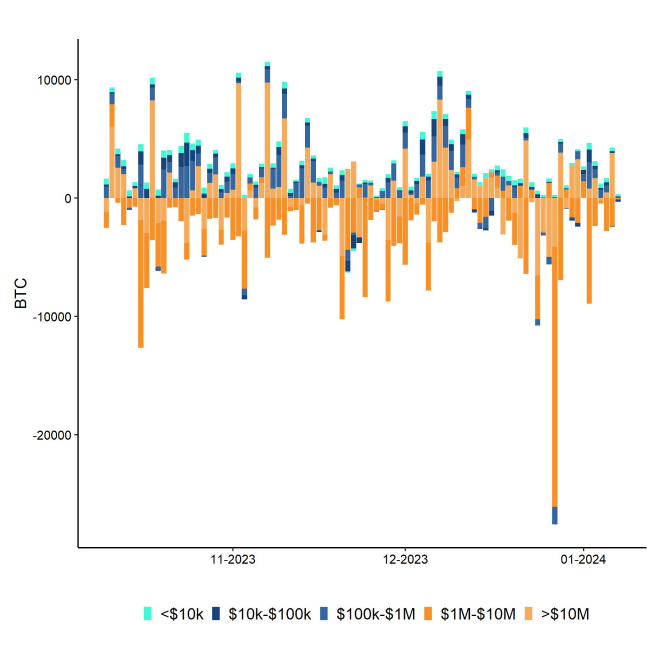

Nonetheless, overall exchange balances for Bitcoin continue to hover near 5-year lows. In fact, net exchange outflows have continued to be high with around -26.5k BTC in net outflows over the past 30 days according to the latest data provided by Glassnode.

The sell-off on Wednesday last week has not materially changed that which might explain why the sell-off has been relatively short-lived. There was generally no material spike in realized losses either despite the sell-off.

That being said, short-term Bitcoin holders, i.e. those with a holding period of 155 days or less, showed a ‘mini-capitulation' on Wednesday last week when the short-term holder spent output profit ratio (STH-SOPR) shortly declined to the lowest reading since October 2023.

However, it can generally be said that the short-term sell-off last week was mostly driven by activity on derivatives exchanges and not spot exchanges which we will cover in the next paragraph.

Futures, Options & Perpetuals

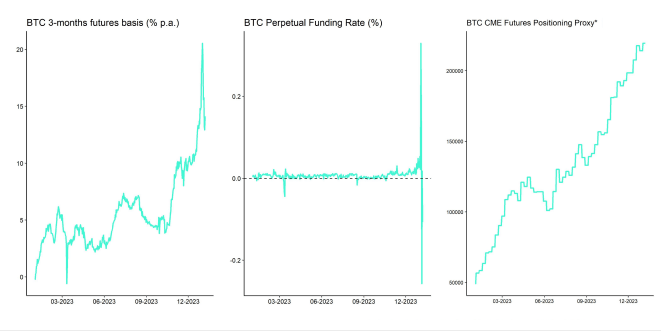

In the run-up to the price correction last week, we saw a sharp rise in both BTC futures basis rates and perpetual funding rates across various exchanges. For instance, the BTC 3-months annualized futures basis temporarily reached a rate of above 22% p.a. intra-day on Wednesday before reversing sharply. At the time of writing, the 3-months annualized basis rate is currently at around 14% p.a.

BTC funding rates also spiked to the highest levels last seen during the last bull market in 2021 before reversing sharply lower and eventually going negative after the sell-off. Current funding rates have visibly normalized as well and are trading mostly in positive territory at the time of writing.

The sharp spike in both basis rates and funding rates could have incentivized more derivatives traders to engage in the basis or perpetual swap trade, which is a likely cause for the interim sell-off last week.

In fact, we saw an increase in CME futures open interest to new all-time highs in BTC terms after the sell-off while open interest particularly on Binance declined due to an increase in long futures liquidations. This implies that futures traders on CME have increasingly put on short futures trades heading into the sell-off. CME's open interest dominance in Bitcoin futures has meanwhile reached around 32% with the second futures exchange Binance only accounting for 25% of open interest.

According to the latest data by Bloomberg, net non-commercial positioning in Bitcoin futures remains net negative with around -2221 contracts which amount to 11105 BTC in net short positioning by CME non-commercials.

Looking ahead, the likely approval of the spot Bitcoin ETFs is still the most important event in the short-term. In this context, BTC options also brace for heightened uncertainty this week with Friday's options trading at almost 100% implied volatility (Chart-of-the-Week).

The BTC options implied volatility term structure is clearly hump-shaped with later expiries showing a lower implied volatility. Implied volatilities have clearly picked in recent days with the implied volatility for 1-week options reaching the highest level since November 2022, when FTX collapsed.

That being said, any unwind in downside protections could continue to support Bitcoin after the ETF approval. In fact, most of the short-term BTC option open interest appears to be put option as there is a clear skew towards puts for Friday's options, so BTC option traders have bid up downside protections. More specifically, the 1-week 25-delta skew is currently at ~1.9% in favour of puts.

All in all, given this level of uncertainty, a rather cautious stance appears to be reasonable in the short-term.

Bottom Line

- Cryptoasset performances were relatively mixed as there was a wider performance divergence among individual cryptoassets

- Our in-house “Cryptoasset Sentiment Index” has declined and is signalling a slightly bearish sentiment

- Bitcoin option traders brace for higher uncertainty before the ETF approvals with a clear increase in implied volatilities for options expiring this week (Chart-of-the-Week).

Appendix

Copyright © 2024 ETC Group. Alle Rechte vorbehalten