Retail megatrend: Ethereum NFT sales rocket by 15,000%

Analysis of network data by ETC Group shows that NFT sales on Ethereum have skyrocketed by 15,000% year on year.

Non-fungible digital tokens were undoubtedly the story of 2021, producing tens of billions of dollars in sales and becoming the first true retail megatrend in crypto.

These blockchain-based digital items are individual and unique by design, as opposed to cryptocurrencies whose units are interchangeable. Most NFT projects are built on the Ethereum blockchain in the form of ERC-721 or ERC-1155 tokens.

They can store data including images, GIFs, videos or even music. Their high level of programmability also means that artists and creators can set conditions: for example offering buyers downloads of other material as a reward, or giving themselves sell-on fees when NFTs are resold, for example.

ETC Group predicted in Q3 2021[1] that NFTs would be the ‘Trojan horse’ to bring crypto to its first billion users, and we are more confident than ever, given the data.

Our analysis shows that sales across Ethereum-based NFT platforms grew from $31.9m in Q4 2020 to $4.85bn in Q4 2021[2].

The Wall Street Journal reported an exclusive on 6 January 2022 that Gamestop (NASDAQ:GME) was entering cryptocurrency and NFT markets[3] in a bid to switch from meme stock short-squeeze candidate to truly profitable enterprise, and hiring more than 20 people to run this new division.

And $440bn market cap Samsung (KRX:005930) has made its ownentry into the space, announcing on 3 January 2022 three TV models for 2022 including extensive support for NFTs[4], with a screen-based explorer, galleries and marketplace aggregator, while the shoe has dropped for one other venerable institution: the Associated Press.

The AP is the gold standard globally in photojournalism". It said[5] on 10 January 2022 it would use blockchain-as-a-service provider Xooa to build a Polygon-based NFT marketplace to sell its journalists’ work. There is more on Polygon as Ethereum’s Layer 2 solution below. So whether it is celebrated music stars like Eminem spending 123.4ETH ($462,000 at time of writing) on a Bored Ape Yacht Club NFT[6], multinational fashion brands like Nike[7] buying NFT collections, Microsoft’s VC fund leading funding rounds in NFT studios[8] or even Gucci, Burberry and Diesel[9] treating NFTs as the gateway drug to collect large new audiences, non-fungible token adoption is now global, and it is here to stay.

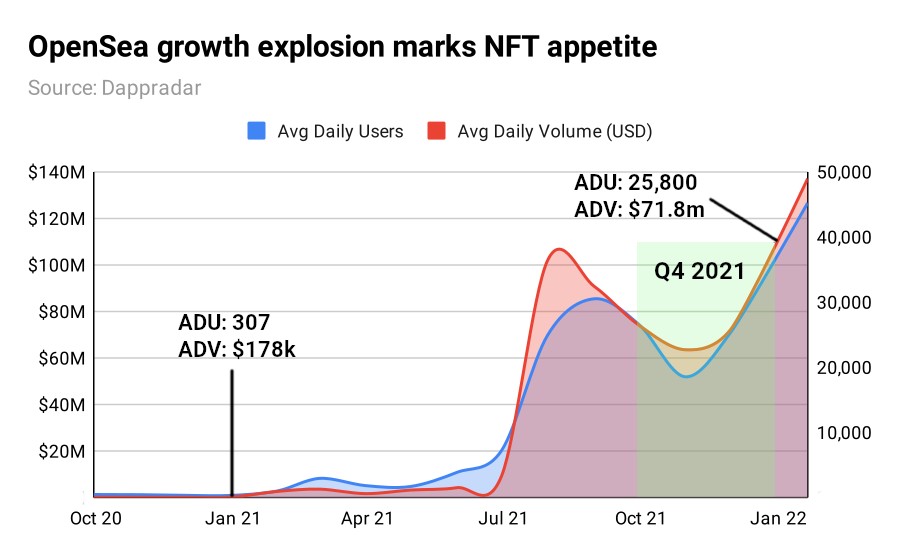

OpenSea unlocks door to NFTs

The rise of OpenSea is emblematic of the growth of NFT markets at large. It is the biggest NFT marketplace boasting the highest-value individual trades, the largest pool of buyers and sellers, and the biggest public profile.

Recent estimates put its dominance of the NFT market at 97%, with $14bn of trading volume in 2021. The second-largest platform", Rarible, processed $260m of NFT trades across the year[10].

Across 2021 it saw trading volumes rise 646x[11], with the bulk of that shift happening in the latter part of the year.

Post-Q4 it raised $300m" for a $13.3bn premarket valuation[12], and insiders believe it could be the first NFT-only market to join cryptoexchange Coinbase (NASDAQ: COIN) and Bitcoin miners such as Riot Blockchain (NASDAQ:RIOT) to list on a recognised and regulated stock exchange.

At time of publication, OpenSea supports only three blockchains: Ethereum, Polygon, which is Ethereum’s Layer 2 solution (more on that below), and South Korea’s Klaytn.

Data available through DappRadar[13] shows that as recently as the turn of 2021, OpenSea was only serving 300 users per day, between them" trading less than $200,000 of digital assets.

By the end of Q4 2021, those numbers had exploded to an average 25,800 users buying and selling over $70m".

In 2022 so far, surging demand on OpenSea continues, with $137m" traded per day, and 45,000 users buying and selling NFTs on the platform daily.

Ethereum DeFi jumps 764% to over $150bn TVL

Decentralised finance (DeFi) too remained in an incredible growth spurt in Q4 2021 with Ethereum seeing a more than 750% rise in the amount of dollar value locked in lending, borrowing and yield-producing platforms for investors.

What was a highly niche crypto subsector worth just a couple of billion dollars in January last year has now ballooned to become a $200bn+ industry.

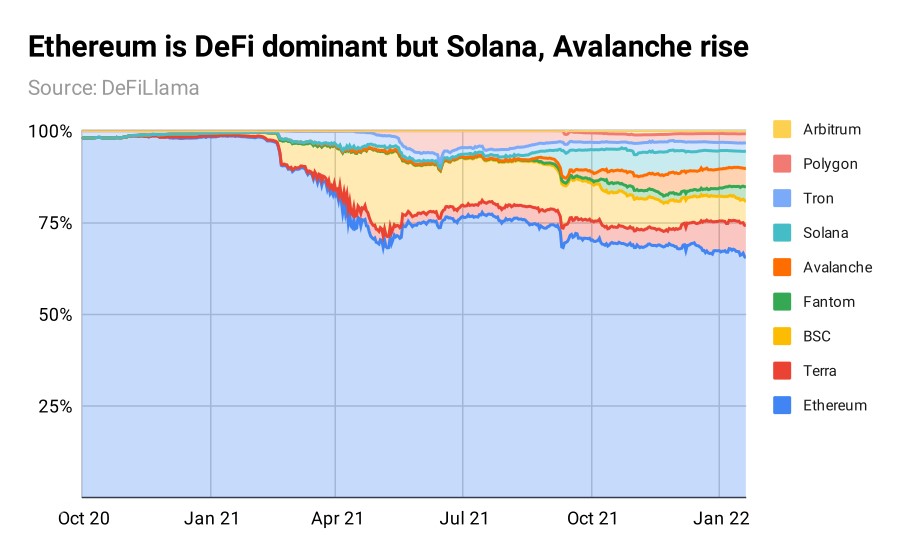

Our research shows that DeFi is starting to turn from Ethereum-only to multi-chain. Ethereum had a near-monopoly of 96% of the DeFi market at the turn of 2021[14]. By the beginning of Q4 that dominance had fallen to 70%, and by the end of December 2021 Ethereum contributed 62% of the total DeFi market.

However, while Solana (SOL), Terra (LUNA) and Avalanche (AVAX) all grew their respective TVL in Q4 2021, they remain a fraction of that posed by Ethereum.

Still, raw percentage figures often don’t tell the whole story.

If cryptocurrency is entering its teenage years, then DeFi is still in the crib.

This is still unexplored territory for ~98% of traditional investors. DeFi remains an arcane technology to explain, and even the terminology of liquidity pools, yield farming and staking remain somewhat impenetrable to those not well-versed in crypto.

It is worth re-stating that fewer than 3% of the world’s population owns any crypto at all[15], let alone interact with relatively new crypto-based advances like decentralised finance. And the total value locked in DeFi today as ~$230bn is only 10% of the total crypto market cap of ~$2 trillion.

Our point being: there is not a finite pool of users nor a limited pile of capital for which protocols can compete. Instead: as DeFi broadens its reach and investors seek above-market rates of yield with global inflation crushing savings, Ethereum continues to lead the way.

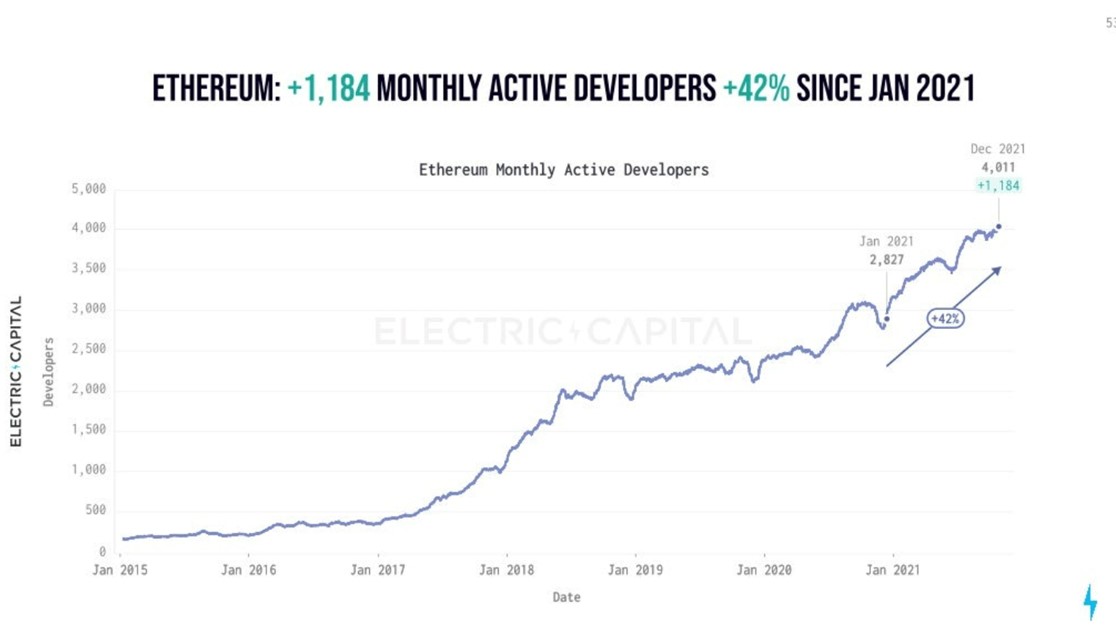

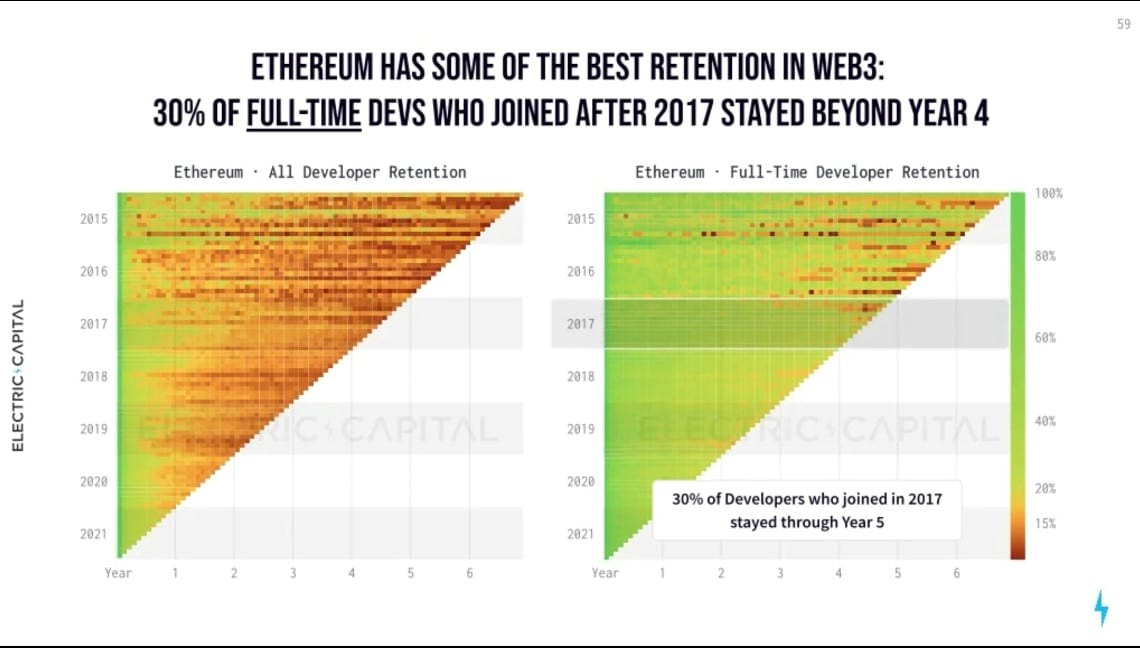

Ethereum attracting highest number of Web3 developers

In terms of development activity Ethereum continues to lead the way.

According to Electric Capital, which tracks the number of blockchain developers entering the space and working on decentralised apps and projects, including DeFi, Ethereum is the largest blockchain by far, 2.8 times larger than the nearest competitor Polkadot.

It has added 1,184 monthly active developers across the year to grow to more than 4,000, up 42% since January 2021. More than 20% of all new Web3 developers join the Ethereum ecosystem: testament to its extensive suite of documentation, its security and the network effects it has managed to grow since it arrived in crypto markets in 2015.

Ethereum also has some of the best retention rates: 30% of full-time developers who joined after 2017 stay for four years or more.

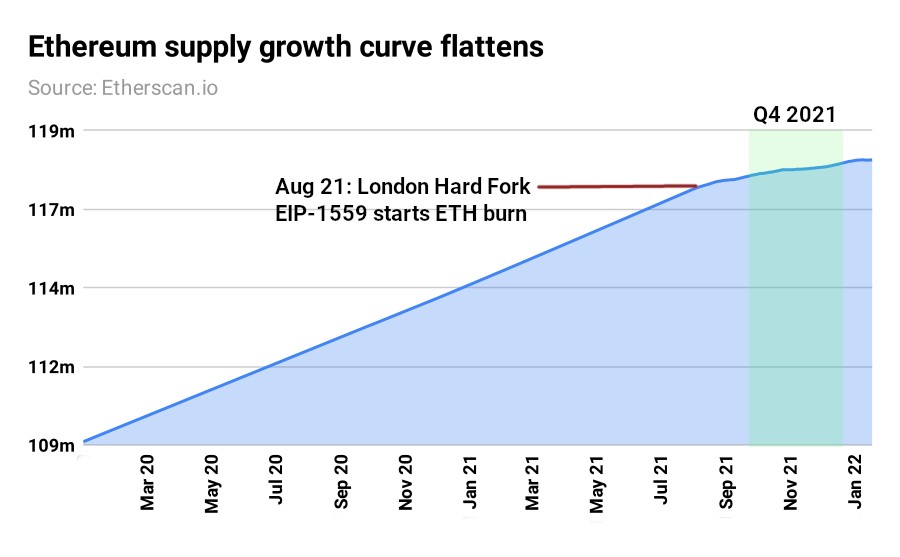

$5bn in ETH deleted: deflationary tokenomics

Perhaps the most significant change made to Ethereum’s code in recent history is something called EIP-1559. This splits transaction fees into two parts: a priority fee and a base fee. The first part is paid to miners, while the second is destroyed, reducing the overall supply of ETH on the market.

Since EIP-1559 was introduced in August 2021, $5bn in Ethereum has been permanently deleted from supply[16].

With this in mind, it pays to look at how Ethereum’s supply growth curve began to flatten mid-Q3 2021 and levelled out significantly in Q4 2021.

Before this point, institutions and retail investors forecasting a strong future for Ethereum largely did so in the belief that it was a technology bet, as Ethereum underpinned such a large proportion of burgeoning DeFi and NFT markets.

That dominance is still in evidence. But investors have a significant second point of value to contend with: ETH itself has a deflationary mechanism" installed, and by the time of the Merge, will be in a deflationary state.

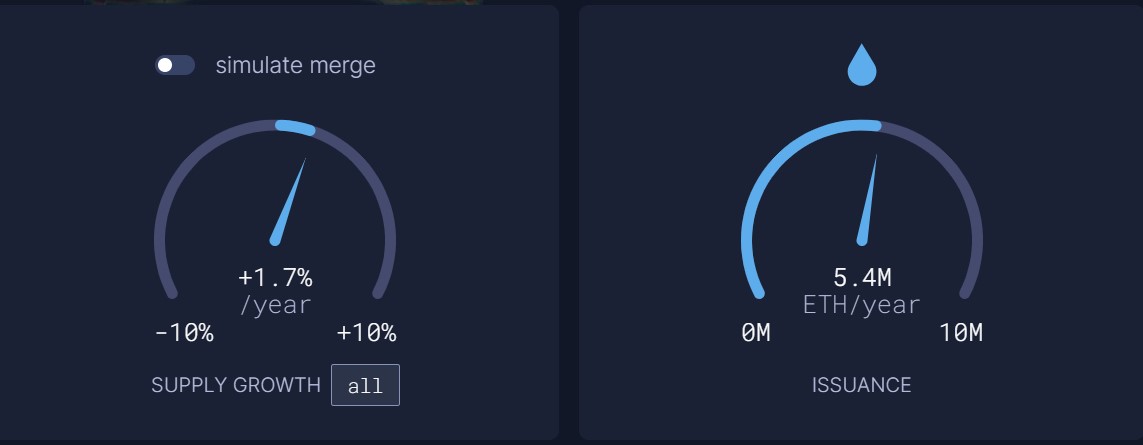

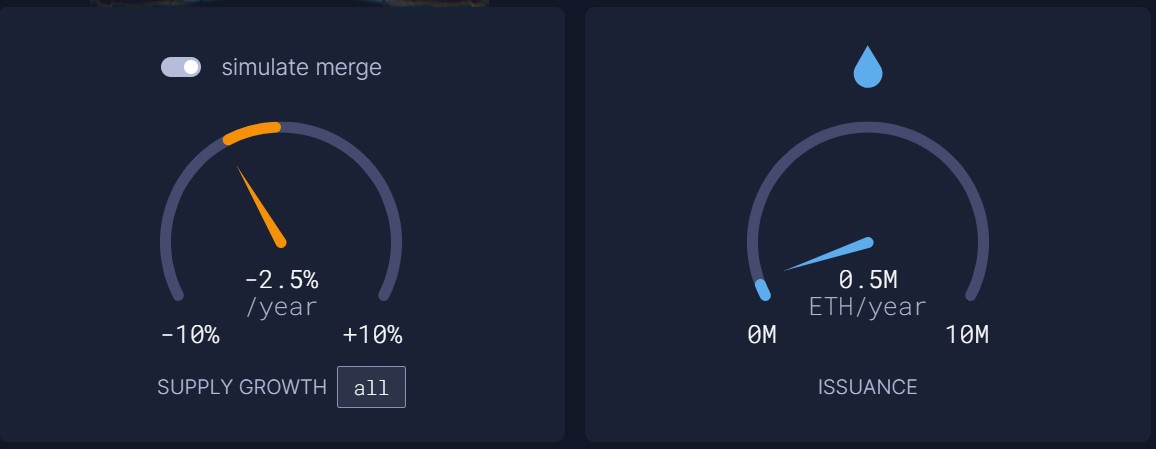

Today, Ethereum supply inflation is pegged at just 1.7% per year, with a projection of negative 2.4% when Ethereum’s Proof of Work mechanism is disabled in Q2 this year and the network moves entirely to Proof of Stake.

Today: Pre-Merge

June 2022: Post-Merge>

Every time any operation is performed, from a CryptoPunk being sold on OpenSea, to trader depositing liquidity in Uniswap, or a gamer breeding a new character on Axie Infinity, ETH is removed from the total supply. That’s because these myriad applications all run on the Ethereum blockchain.

Now current and future ETH owners can have confidence both that the network will remain secure under Proof of Stake and that their holdings will experience minimal dilution.

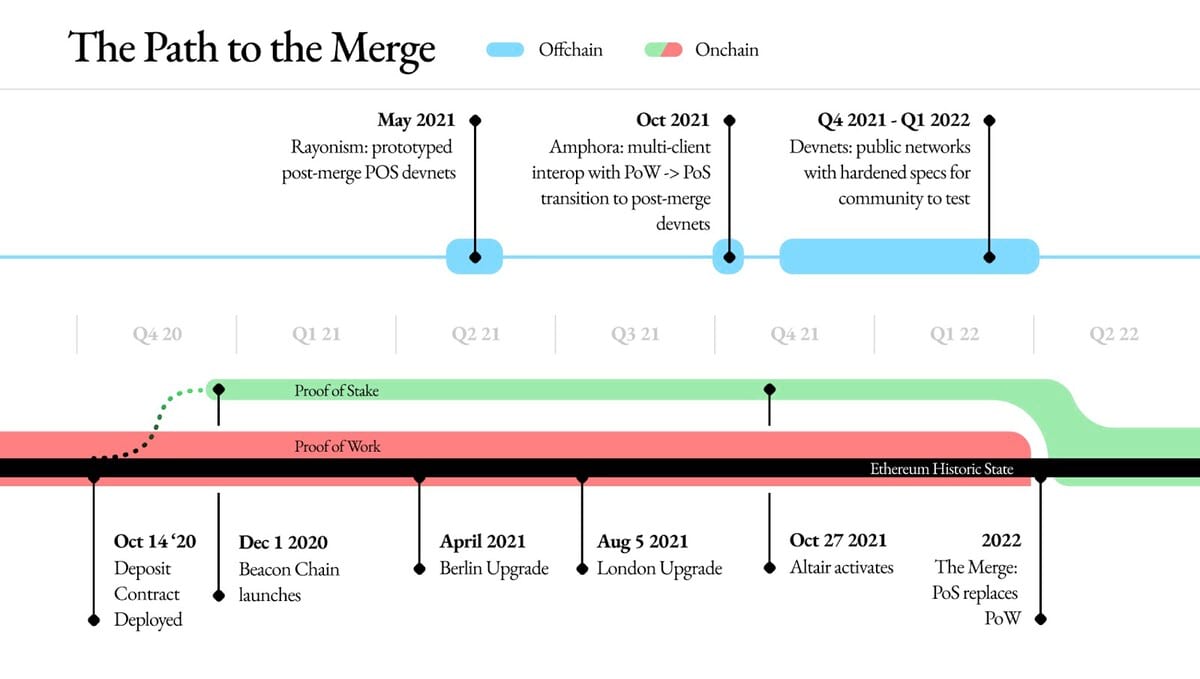

ETH2 switch date clarity

At the end of Q4 2021 8.83 million ETH was staked in the ETH2 deposit contract, ETC Group analysis shows: a 307% jump from Q4 2020.

This demonstrates the robust community support continues for Ethereum’s upcoming switch away from Proof of Work mining to a Proof of Stake consensus mechanism. The ETH2 smart contract is where users send their ETH to stake them on the new network.

Recent updates from the Ethereum Foundation[17] put the date of the Merge, where Proof of Stake replaces Proof of Work, back from Q1 to Q2 2022, suggesting that the technology switch could be here as soon as the end of June 2022. This shift will eliminate the need for energy-intensive mining to secure the blockchain and cut Ethereum’s energy usage by around 99.95%[18], according to official estimates.

More clarity around this date has aided institutional investment in Ethereum.

Mid-Q4 we heard again from JP Morgan[19] that Ethereum could even be a better bet than Bitcoin in the long run, given that the blockchain is less susceptible to changes in central bank interest rates because it is not store-of-value focused.

With Ethereum deriving its value from its applications, ranging from DeFi to gaming to NFTs and stablecoins, it appears less susceptible than bitcoin to higher [bond] yields, analysts wrote

While we see no cryptocurrency coming anywhere close to Bitcoin’s market cap or penetration over the next two years, the investment bank does have something right.

Ethereum investment vehicles listed on regulated stock exchanges, like ETC Group’s Ethereum ETC (ZETH) remain the first entry point for investors seeking to capture a slice of growing markets.

New investors consistently seek the line of least resistance — often asking for ways to capture the whole market — but despite corporate interest clearly growing, the NFT space remains incredibly fragmented aside from Ethereum, as newer protocols vie for prominence.

That still makes the second-largest cryptoasset one of the best ways for investors to gain exposure to NFTs and DeFi.

ETH fees rise 17x but Layer 2 solutions could hold the key

As demand for Ethereum has grown, more people have begun bidding for the right to have their transactions processed on the blockchain. As a result, the cost to do so has risen 1,820% year on year, according to figures analysed by ETC Group.

Simple transactions can cost hundreds of dollars depending on how many people are using Ethereum at any one time. Clearly, for small-value buys and sells (and hence faster retail adoption) this makes Ethereum Layer 1 sub-optimal and at times borderline unusable. As more users and more TVL flows into the space, this perhaps explains one of the reasons for the rapid growth of Layer 1 alternatives and newer blockchains over the incumbent: such as Solana, Avalanche and Polkadot.

Thankfully, a new type of solution has emerged. Layer 2s are second blockchains built on top of Ethereum, and through which transactions can be routed. The most popular to date are Polygon, Optimism and Arbitrum. These blockchains employ tech called ‘rollups’ to drastically lower fees and improve the time it takes for the Ethereum network to confirm that transactions have succeeded.

Polygon uses zk-rollups — a technology based on zero-knowledge proofs, a type of complex mathematics that allows data to be stored off-chain, only revealing the most important data relevant to a smart contract. This saves huge amounts of processing power and capacity, cutting transaction fees.

Users can add Optimism, Arbitrum or Polygon to popular wallets like MetaMask, and then connect as normal to their preferred NFT or DeFi marketplaces.

Working in the background, these technologies pull transactions away from Ethereum’s base payer and batch them in much larger sets, relieving congestion and allowing for lower fees and near-instant confirmation times.

And while traders and users are routing their purchase of a Bored Ape or Cryptopunk through these networks instead of Ethereum’s base layer, they don’t need to know the ins and outs of the mathematical proofs behind the technology: they only see the benefits.

This type of much-simplified UI and UX improvement should bring waves of new users to Ethereum in 2022.

Polygon leads Layer 2 pack

Of the three, only Polygon has its own token, MATIC: Optimism and Arbitrum are priced in ETH. And Polygon has emerged as the leader in Ethereum Layer 2s, mainly for its ease of use.

Optimism and Arbitrum are still in the beta phase of development, and the tech requires that users have to wait 7 days before they can withdraw assets back to Ethereum’s main chain.

As of the start of Q4, Polygon unique addresses crossed 100 million, and the number of decentralised apps developing using the Layer 2 blockchain reached 3,000, from just 30 one year ago.

And on 22 December 2021 we also saw the world’s largest decentralised exchange, Uniswap, connect to Polygon[20]. Now with the world’s largest NFT market and the world’s largest DeFi market in its grasp, Polygon is improving Ethereum’s scalability like no other tech to date.

Outlook

There are a number of factors which point to Ethereum’s potential growth in 2022.

The blockchain has its flaws, but it remains the backbone for the first truly retail-centric application of cryptoassets: NFTs.

NFTs will continue to outperform" in the Ethereum universe. While DeFi and automated market makers like Uniswap are undoubtedly revolutionary for the way financial technology works, they are a tough concept to grasp even for some inside the industry. It’s much simpler to for the general public to understand a unique piece of artwork, or a collectible, as evidenced by the scale of such a 15,000% rise.

In 2022 we expect this trend to continue as more corporates and multinationals see the benefits in extending their earning power to a passionate crypto community: and also as more join up to win new fans in this growing market.

Secondly, the programmable money blockchain remained the institutional investment of choice in Q4 2021. More certainty about the date for the Merge and switch to Proof of Stake, along with ever-greater amounts of ETH being staked in the ETH2 deposit contract point to this same conclusion.

It continues to dominate DeFi markets despite the likes of Terra, Solana and Avalanche each extending their own userbase. This is due to ongoing network effects, the perception of its strong decentralisation and security, and in Q4, the rise of Layer 2 solutions providing fee-free ways for users to interact with explosive-growth applications.

Ethereum has always been a victim of its own extraordinary success. And while its DeFi and NFT rivals continue to grow in popularity, the data shows that they are not doing so at Ethereum’s expense — with 750%+ growth in TVL on the network.

Ethereum, more than any blockchain, still continues to promise the most as a computing backbone and host venue for thousands of other decentralised applications.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

Über ETC Group

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.