Introduction - What is Polkadot?

Polkadot is a second-generation smart contract blockchain designed to solve many of the scaling challenges that have impeded Ethereum since its introduction in 2015.

But the main reason so many people are so excited about Polkadot against the alternatives is that it operates in an entirely different manner to the individual rival blockchains on the market today.

It uses technology called sharding to link together multiple blockchains in a single network. These links allow those chains to process transactions in parallel, as well as exchanging data between them, while each trades on the security guarantee of using the underlying Polkadot network.

In the Polkadot whitepaper[1], Dr Wood proposes theproject as “a scalable heterogenous multichain”, which he argues overcomes many of theshortcomings of discrete blockchains.

Unlike previous blockchain implementations which have focused on providing a single chain of varying degrees of generality over potential applications, Polkadot itself is designed to provide no inherent application functionality at all. Rather, Polkadot provides the bedrock…upon which a large number of validatable, globally-coherent dynamic data structures may be hosted side-by-side.

In theory, Polkadot allows any type of data — not just tokens or coins — to be sent between any type of blockchain, ushering in the age of cross-compatibility and interoperability in a fragmented space.

While Ethereum 2.0 will also bring in sharding to help it scale the number of transactions currently flowing through it, Polkadot employs the technology in a slightly different way.

Shards on the Polkadot network are referred to as ‘parachains’. These parachains can execute parallel transactions for improved speed, without each chain necessarily connecting to every other chain.

The theory — now being put into action — is that spreading transactions across these sharded blockchains means that the ecosystem should be able to scale faster and more cost-effectively than its blockchain competitors.

Polkadot vs Ethereum

It is impossible not to compare Polkadot to Ethereum: Polkadot explicitly make the comparison with Ethereum 2.0[2] and this should come as no surprise to avid market watchers.

In the early days of cryptocurrency, Ethereum attracted the best minds in distributed computing and cryptography. Its original six-man founding team have created some of the most influential and highly capitalised blockchain projects to date.

Alongside Vitalik Buterin, the de-facto figurehead for the ~$470bn market cap blockchain[3], this group includes:

●Charles Hoskinson,the founder of Cardano, currently the world’s sixth-largest crypto project witha market valuation of $43bn[4];

● Consensys founder Joseph Lubin, whose enterprise blockchain software business created the Metamask wallet and is valued at $3.2bn[5]; and

● Polkadot founder, the English computer scientist Dr Gavin Wood.

One of Dr Wood’s most lauded creations[6] is Solidity, the programming language used for writing smart contracts on Ethereum, Tron and Avalanche.

It is this technical prowess — and the status with which he is revered in the crypto community — that has given Polkadot a huge headstart. In the 18 months since its genesis block was launched, Polkadot has already amassed a market cap of $27bn[7]. Despite this relatively short incubation period, there is clear appetite for a ‘blockchain of blockchains’, and Polkadot seems to fit the bill.

The Polkadot ecosystem is, by any metric, awash with crypto cash. Wood tweeted[8] on 17 October that the blockchain’s treasury stood at over $500m “ready to spend on your ideas for building, improving,educating and indeed anything else that the Polkadot governance believesvaluable”.

The project is overseen and developed by the Swiss non-profit Web3 Foundation[9], which like many other blockchain foundations provides grants[10] to development teams helping to build out its ecosystem of decentralised apps, blockchain explorers, wallets, NFT marketplaces and other tools.

The Polkadot Ecosystem

The RelayChain is the underlying protocol that provides security for multiple sharded blockchains running in parallel. Transactions from the parachains are confirmed on the Relay Chain using a system of validators.

Parachains are individually-designed blockchains that can be built to run according to their own specific rules and regulations. Each has smart contract functionality and can mint their own tokens, rather than relying on the underlying blockchain’s native currency as a means of exchange. They can be public and open for anyone to access (like Tezos, Bitcoin or Ethereum), or private, where a single organisation has control, for example Hyperledger Fabric or R3’s Corda. As such, each can perform a variety of functions, and can be designed for high transaction throughput use cases like DeFi, NFTs or gaming, or more industrial verticals like central bank digital currencies, supply chains or healthcare. Polkadot allows parachains to communicate with one another if they wish, allowing cross-chain data and token exchanges.

Parathreads are one step down in functionality from parachains: these are effectively ‘pay as you go’ blockchains that still trade on the security of the Relay Chain but don’t need to have a constant connection with it.

The difference between parachains and parathreads is largely economic; the latter avoids the auction method of selection (see below) and instead comes with a fixed fee for registration which Polkadot says[11] will “realistically be muchlowerthan the cost of acquiring a parachain slot”. Parathreads are not currently live on the network. The only estimate from Polkadot is that it expects them to launch “some months” after parachains, and that this extra functionality will need to be enabled through an on-chain governance vote.

Bridges allow chains running on Polkadot to be interoperable with external public blockchains like Bitcoin and Ethereum.

Polkadot currently supports 100 parachains and early roadmaps suggest that it could accommodate many thousands of parathreads in future[12]. While block times on parathreads will likely be slower, both can still connect individually to the Relay Chain, giving developers of these linked projects the flexibility to determine their own rules on how they operate.

The network’s native token is DOT. It is used as a stake in parachain auctions as well as for making governance decisions on upgrades to the network.

According to Gavin Wood[13], internal benchmarking in August 2020 proved Polkadot capable of processing 1,000 transactions per second, with the lofty projection of as many as 1 million transactions per second once parachains are enacted.

Auctioning off

To become one of these highly-coveted parachains, blockchain projects must undergo an auction process[14] to win the right to take up space and the presumably cost-intensive nature of relying on the Polkadot’s Relay Chain security. The project with the highest crowdloaned amount wins.

This crowdloan system, where parties lock up a minimum of 5 DOT for two years while a project runs as a parachain, does two interesting things. Firstly, it proves out the economic value of a project before release, drawing in much more capital to a project before it goes live than might be realised otherwise. This is evident in the cap table of investors for some of the winners, which includes crypto VC royalty like Sequoia Capital, Coinbase Ventures, Pantera and Polychain Capital. Secondly, it gives developers the chance to showcase their product long before launch, building out a large community of stakeholders beyond the initial team.

DeFi and stablecoin platform Acala was the first winner of a parachain auction, with $1.3bn in DOT raised from over 81,000 wallets[15].

On 25 November, the Ethereum-compatible smart contract project Moonbeam won[16] the second Polkadot auction, with more than $1.4bn in DOT pledged. On 3 December, Japan’s dapp-focused Astar Network took the top spot[17] with 10.3m DOTpledged by 27,100 investors. ParallelFinance took the fourth parachain auction slot with 10.75m DOT pledged[18]. At time of writing, Clover Finance and EFinity are leading the race for the fifth and final auction slot in this batch, with around 7.4 million DOT pledged to each project apiece[19].

Polkadot leases out its parachain slots for 96 weeks (two years) at a time, with an option to renew. The first batch of auction-winning projects, Acala, Moonbeam, Astar Network, Parallel Finance and the final winner will operate on the network until October 2023[20], with their launch date scheduled for 18 December 2021.

Nominated Proof of Stake

Polkadot uses a Nominated Proof of Stake (NPos) consensus mechanism. The blockchain was initially launched using an entirely centralised Proof of Authority setup, where six validators run by the Web3 Foundation maintained the chain to ensure its smooth running, and acted to attract a diverse subset of new validators. Polkadot switched over to NPos as part of its latest update. This system allows DOT holders to stake their token and help to secure the network, either by running nodes as a validator and confirming transactions, as well as adding blocks to the Relay Chain. Alternatively, for those holding fewer DOT, there is the possibility to allocate their tokens to nominate up to 16 elected validators. Staking rewards for this option are currently in the region of 6.5% APY[21].

The minimum number of DOT to be allowed to stake is not fixed, as it is with Ethereum (stakers must have 32 ETH to make a deposit into the ETH2 smart contract[22]). Instead the figure is flexible, and since inception has varied from 40 DOT as high as 350 DOT. As of 24 November 2021[23], the minimum is 120 DOT (~$3,175), although Polkadot says this is subject to change.

Both validators and nominators are rewarded with DOT for helping to process transactions and secure the network. The way the Polkadot network encourages good behaviour is to punish both validators and nominators if a validator attacks the network, attempts to run modified software or goes offline along with at least 10% of other validators (which could be construed as a malicious attack)[24]. This is called ‘slashing’, and means a percentage of staked tokens are taken from validators — and the nominators that elected them — and returned to the Polkadot treasury. It’s a sensible slice of game theory which means that nominators will likely seek out validators with the best reputation before staking tokens to nominate them.

Governance

Polkadot’s governance model is on-chain and enacted autonomously, allowing the blockchain to evolve without the need for contentious and lengthy battles between opposing sides. As such, it is possible to upgrade the blockchain more seamlessly that would otherwise be possible.

Changes to the system are proposed and voted upon on-chain.

By contrast, Ethereum governance occurs off-chain[25] through numerous discussion channels. The Ethereum Foundation itself admits that:

Since so many people depend on Ethereum'sstability,there is a very high coordination threshold for core changes, including socialand technical processes, to ensure any changes to Ethereum are secure andwidely supported by the community.

The downside of such a method (compared to on-chain governance) is that it can take much longer to agree on protocol upgrades. With the speed of change in blockchain development lightning fast, delays of weeks or months can be critical.

DOT holders can submit proposals and/or vote on existing upgrades, or nominate themselves to an on-chain Council, which represents more passive DOT holders in much the same way as current political structures in democratic countries.

Valuation

Social signals can give us a decent rough estimate of the retail popularity of any given blockchain. For example, the size of the discussion group dedicated to a particular crypto on Reddit. At 69,000 members[26], r/Polkadot is not in the same league as longer-standing protocols like Bitcoin Cash’s (604,000 members in the subreddit), but is comparable with the likes of Solana and Chainlink.

In terms of institutional investment products, those dedicated to Polkadot remain limited as of midway-through Q4 2021, but more are starting to appear.

Osprey Funds was first to market with a Polkadot Trust in April 2021[27], albeit with a rather bold 2.5% management fee. Valour then followed 21Shares to market with a Polkadot ETP in spring of 2021[28]. And while the world’s largest digital asset manager, Grayscale, filed with the SEC to open a Polkadot Trust[29] in January 2021, at time of writing the product had not yet made it to market.

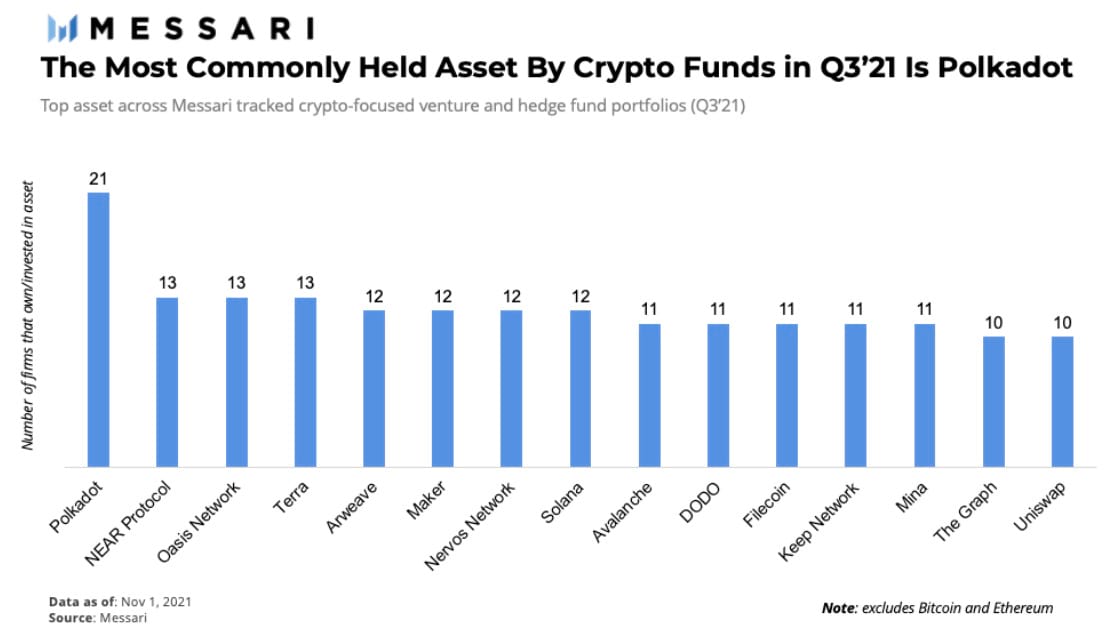

Capital-rich investors a little further ahead on the maturity curve are piling into DOT, however.

Messari’s Q3 2021 analysis of crypto hedge funds[30] found Polkadot the lead investment by quite some considerable margin.

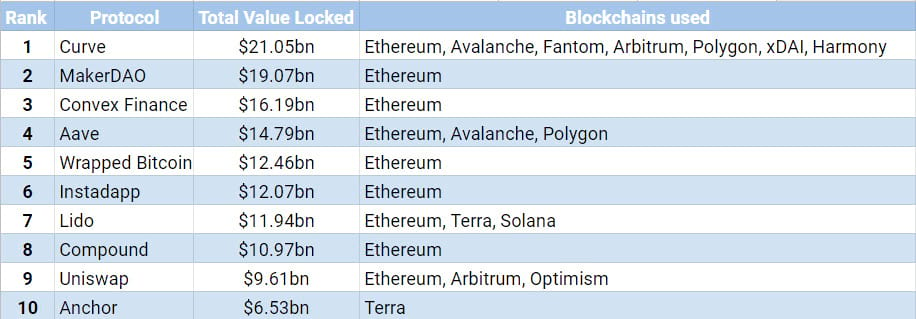

As we head into 2022, it has become evident that the market is evolving from one where both value and development is highly concentrated among a small number of players, into a multi-chain world. While Ethereum was once the single blockchain that underpinned decentralised finance markets, competitors are rising quickly to snap at its heels.

And while Ethereum still retains near-total dominance of the NFT market as the basis for 49 of the top 50 markets by daily trading volume[31], long-standing issues around its scalability, very high transaction fees and slow confirmations has led to alternatives grabbing market share. While some of these are Layer 2 additions to Ethereum itself, like Arbitrum and Polygon, other chains are creeping into the mix.

For example, the top 10 DeFi protocols by Total Value Locked now looks very different to just six months ago.

All of this has happened remarkably quickly, as it tends to do in the fast-paced blockchain space. Polkadot pitches itself as a solution to this fragmentation: with the overarching aim from the Web3 Foundation of creating a decentralised web as the next stage of evolution of the internet itself.

In the interim, the addition of crowdloan-funded projects into an auction setup is innovative, and has attracted the attention of not just crypto VC funders, but large communities of users too.

While some have suggested Polkadot enacts zero transaction fees, this is a little bit of a misnomer: there are transaction fees but they remain reasonably low. One estimate puts a simple balance transfer at around 0.015 DOT or $0.40.

Transactions that take place on parachains don’t incur Relay Chain fees in DOT (because each project may have its own token, or be tokenless). Projects may set their own transaction fees — as parachain auction winner Acala has done[33].

What is true is that unlike Ethereum, where gas prices need to be competitive to compensate miners for including transactions in a block, Polkadot already gives newly minted DOT to its validators and nominators, and these actors aren’t strictly competing against one another on price. Transactions fees can be calculated with reasonable certainty in advance, which is a major boon for businesses trying to profit from large and growing DeFi markets.

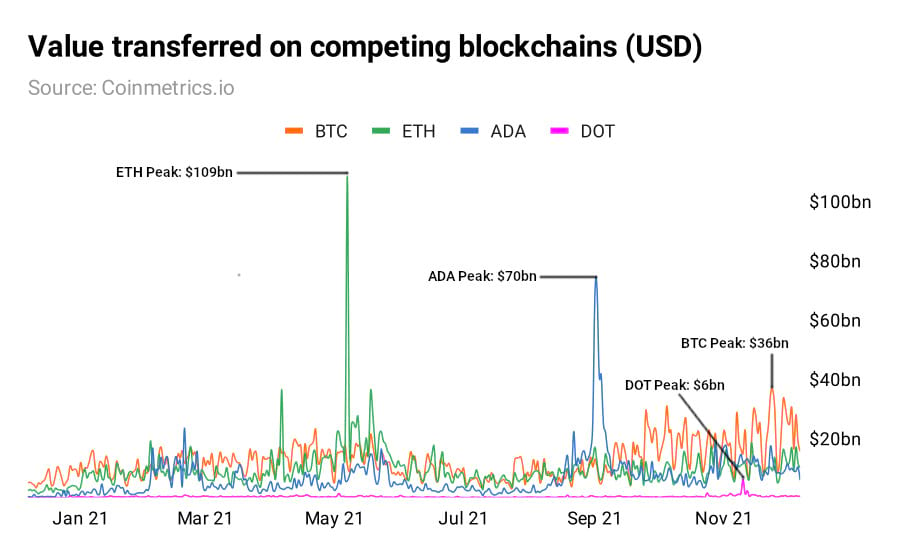

In terms of valuation, it is still relatively early in the story of Polkadot. As the chart below displays, the multichain bridge has a long way to go to catch up with the kinds of dollar values being transacted through rival networks. The original cryptocurrency, Bitcoin, leads in terms of total transaction value, but the growth momentum has shifted to the kinds of smart contract blockchains that can more easily allow decentralised apps to be built and run on top of them, such as Ethereum (ETH) and Cardano (ADA).

Since the 26 May 2020 network launch, active accounts have been growing steadily, but we have not yet seen the kind of parabolic movement one might hope for from a network that is up and running at scale.

Venture capital and hedge funds are investing heavily in both Polkadot itself, and as has been made obvious by the likes of parachain auction winners Moonbeam and Acala, projects that will compete directly with Ethereum-based DeFi and decentralised apps.

Conclusion

Polkadot is not the first Proof of Stake blockchain. In the last four years, Proof of Stake chains have taken over the charts and their representation in the top 20 coins by market cap has tripled[34]. What Polkadot does promise is a way to usher in the age of cross-compatibility: and that is a sell that VCs, hedge funds and the wider crypto community are getting behind in their droves.

Given the rapid growth of DeFi and NFT protocols in the last two years, investors are already living in a multichain world, whether they realise it or not. Ethereum is not the monolith that it once was, and the rise of clear competitors like Solana, Avalanche and now Polkadot is testament to this point.

When the Polkadot genesis block was launched on 26 May 2020, it did so to considerable fanfare, led by a charismatic Ethereum co-founder using all the tools at his disposal to make decentralised apps blockchain-agnostic.

DeFi is a massive growth market and is likely to continue the trend into 2022. Polkadot has moved out of the theoretical phase and into reality, and we have seen precisely how successful it has been in the early crowdloan phase, with individual parachain auction projects raising billions of dollars-worth of DOT for this prestigious position.

A lot of Polkadot’s popularity is based on promise. And while even six months ago, there were few live projects to point to, that state is changing.

There are only a handful of people in the world that can build a successful blockchain network based on cutting-edge cryptography and make it a success. Polkadot hinges on Gavin Wood and the kinds of teams Polkadot is able to attract to its stable.

The community reaction to crowdfunding auctions has been impressive to date, with hundreds of thousands of individuals and businesses lending their support

At the same time, the number of blockchain projects identifying themselves as a technological improvement on Ethereum has grown sharply. That’s mainly due to the strength of the incumbent smart contract blockchain, its dominance over DeFi and NFT markets, and the growth of its market cap above $400bn, while at the same time users and developers identify and encounter clear UI, UX and cost issues that have been ongoing since at least 2018.

There are clear long-standing problems with Ethereum. Severe network congestion, unworkably high transaction fees, and off-chain governance, which slows development to a crawl. Hence the rise of the ‘Ethereum-killer’ blockchain. A bet on Polkadot is a bet on a multichain smart contract future, which has become not just a compelling argument, but the dominant narrative facing crypto as a whole.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

Über ETC Group

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.