Introduction

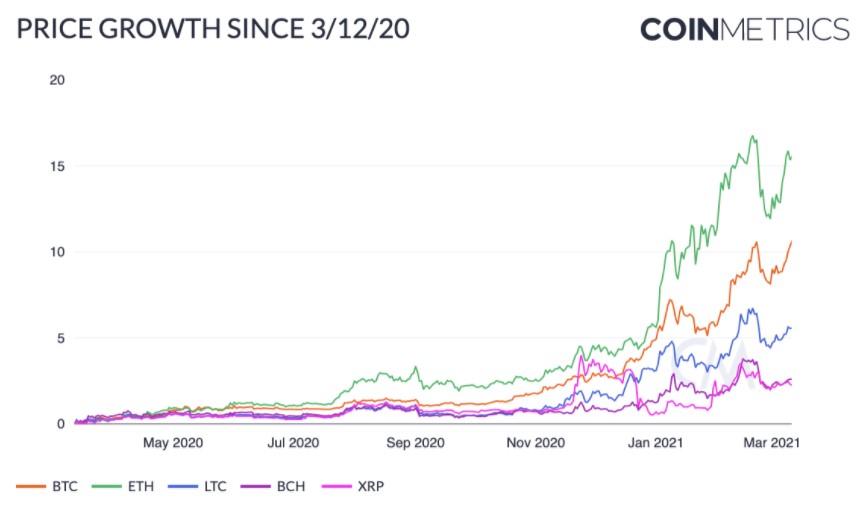

One of the more intriguing things about the long-term bullish growth of the cryptoasset market is the rise of highly liquid large-cap altcoins. Altcoin is portmanteau of ‘alternative’ and ‘coin’ and refers to every other cryptoasset than Bitcoin.

The most enduring of these is Litecoin (LTC). Once released, it quickly rose to prominence and has remained popular ever since. As of 19 April 2021, Litecoin has amassed a market cap of $17.26bn, compared to Bitcoin’s $1.03trn.

Litecoin is now one of the most recognised, trusted, and most utilised blockchain-based payment networks in the world. It is one of only two blockchains, the other being Bitcoin, that can boast 100% network uptime since its creation and lasting for a decade or more.This kind of longevity has been crucial to its incorporation onto all of the largest cryptoexchanges including Binance, Coinbase and Huobi Global, as well as mainstream recognition from major global payment processor Paypal.

When Paypal announced in October 2020 that it would cross the Rubicon to start supporting cryptoassets, only four of the most recognised projects were chosen: Bitcoin, Litecoin, Ethereum and Bitcoin Cash. At Paypal’s recent Investor Day 2021 the payment company’s chief strategy and growth officer Jonathan Auerbach noted there were plans to expand support for these cryptoassets in the UK, “within months”, while Techcrunch reported that mobile payment app Venmo would receive the same functionality by mid-2021.

Litecoin was created in 2011 by the MIT-educated software engineer Charlie Lee, who helped develop some of the early iterations of Chrome OS and Youtube at Google, before going on to become the Director of Engineering at Coinbase, leaving in 2017 to develop Litecoin full-time.

As the name suggests, Lee’s intention for Litecoin was to be a ‘light’ version of Bitcoin: an altcoin more suited to payments than the original cryptocurrency, with faster transaction times and lower fees.

Litecoin Core, the code that underpins the blockchain, is written in the highly-popular and common programming language C++, while Python is used for some ancillary tools. That means its code is simple for external developers to use and understand.

With its faster block times and higher transaction throughput, Litecoin was conceived as a more practical and scalable medium of exchange. So while Bitcoin’s use case has evolved into more of a store of value than a currency, Litecoin remains a popular payment alternative to fiat cash like US dollars or pounds sterling.

The interesting point to note about Litecoin is its incredible durability. Cryptoasset data provider Coinmarketcap.com first started tracking valuation metrics in early 2013, and across that eight-year period only two coins have never fallen out of the top 10 projects by market cap: Bitcoin and Litecoin.

While many pretenders and challengers have risen in prestige and then fallen into obscurity, these two remain the bedrock of the entire cryptoasset market.

Institutional interest growth

Institutional investors are also starting to accumulate Litecoin in increased amounts. Litecoin is now the $39bn cryptoasset manager Grayscale’s third-largest holding behind Bitcoin and Ethereum and as of mid April 2021 it has around 1.5 million LTC under management in its Litecoin Trust. This is a significant expansion since the beginning of 2021. Data from market intelligence provider Bybt.com also shows that Grayscale bought 80% of all the Litecoin mined in February 2021

And so it is a little unusual to discover that comparatively little academic attention has been focused on Litecoin to date. Analysts tend to spend a large proportion of their focus on Bitcoin and Ethereum or the 'hot' coins of one particular month. The current situation does purport to offer an entry point for the long-term investor to amplify their crypto portfolio gains at a relatively low risk, given the project’s longevity, wide-scale usage and trading liquidity.

This relative underappreciation on an analytical level is clear: certainly few investment banks have proposed long-term price predictions for Litecoin in the way JP Morgan or Citibank have for Bitcoin. This is starting to change, with more analysts devoting time to Litecoin price predictions

And among the more recent investigations of institutional altcoin accumulation comes from Messari, whose screeners display the portfolios of crypto hedge funds and venture capitalists like Andreessen Horowitz (a16z), Coinbase Ventures, Pantera Capital and Winkelvoss Capital, for example.

Similarities and Differences

Bitcoin is an open-source software and as such, any developer can copy its codebase to create their own version. Thousands of Bitcoin-alike projects have been spawned from this single technological marvel. But only one has remained in the most traded, most used and most desirable category since data records began: Litecoin. Within two years of the Bitcoin whitepaper debuting to a small audience of cryptography enthusiasts on a little-known mailing list, Charlie Lee launched this new blockchain.

Lee made some striking changes to Bitcoin’s functionality but the two blockchains share many features.

Similarities

Scarce: 80% of the all the litecoins that will ever exist have already been mined into existence. There is a hard cap of 84 million LTC. As of 15 April 2021, 66.7 million LTC have been created. Like Bitcoin, Litecoin undergoes a halving of its block rewards every four years to maintain a deflationary structure, and therefore retains a similar long-term value proposition.

Secured by Proof of Work: Both the Bitcoin and Litecoin blockchains are secured by a Proof of Work consensus mechanism. This means that miners compete to solve challenging mathematical puzzles in order to win the right to confirm blocks of transactions, and win compensation in the form of block rewards. Block rewards for Litecoin mining are paid in LTC, whereas rewards for Bitcoin mining are paid in BTC.

Highly divisible: Both Bitcoin and Litecoin are divisible into near-infinitesimal amounts. In fact, both are divisible to 8 decimal places, and the current minimum amount able to be transferred are 0.00000001 BTC and 0.00000001 LTC.

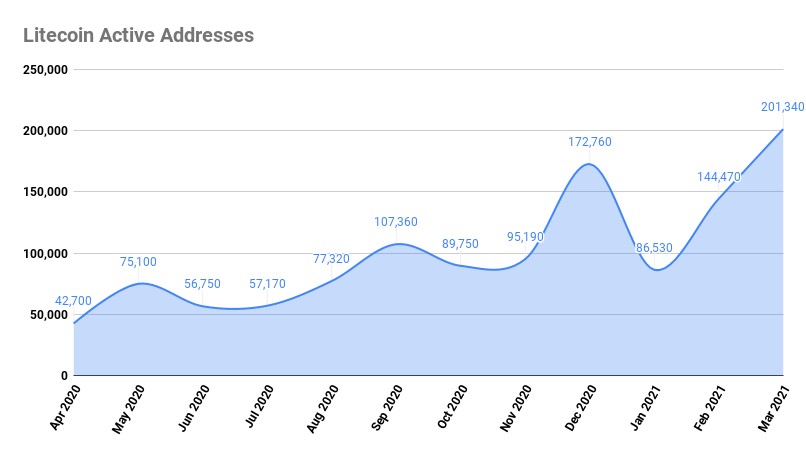

Strong network effects: Aside from the original cryptocurrency, Litecoin is one of the oldest and most secure coins on the market as well as one of the most used digital currency payment platforms. One widely-cited 2017 research paper found that blockchains like Bitcoin appear to conform to Metcalfe’s Law, which states that the value of a network is proportional to the number of connected users in the network. While originally used to describe the increased value of connections in telecommunications, tech applications like Facebook and Tencent have been shown to act in this way, and cryptocurrencies have too.

The implication here is that the more widely utilised a blockchain network like Litecoin becomes, the more its value grows over time.

Supporting this conclusion is the fact that the number of unique Litecoin addresses has grown strongly over the past 12 months. According to data from BitInfoCharts, in March 2020 the number of unique Litecoin addresses holding the cryptoasset was just under 43,000. A year later, that number was over 200,000. By 29 March 2021 the number of active addresses hit 286,000, a three-year high.

Data from blockchain analytics provider Glassnode also shows how the number of new Litecoin addresses being created daily is rising sharply, approximately trebling over the past 12 months. That suggests a growing adoption rate for LTC 10 years on from its invention.

In addition, a 2020 Cornell research paper investigating the Martingale probability theory of price bubbles points to the same interpretation, noting that in the time frame studied, five of eight cryptocurrencies covered (Bitcoin, Bitcoin Cash, EOS, Monero and Zcash) exhibited price bubbles while Litecoin did not. “Value bubbles show up where repeated extremely high value increases are not accompanied by any commensurate increase in the number of participating users, or any other development that could give rise to the higher value,” the researchers wrote.

And while network effects can unwind over time, projects that can consistently develop their functionality and compatibility can maintain this momentum.

Litecoin’s similarity to Bitcoin — a complement, not a competitor — goes further, too: many users point to Litecoin as a useful and viable test network for Bitcoin. Chief among these examples is Litecoin’s adoption of SegWit (Segregated Witness).

In May 2017 Litecoin amended its code to support SegWit, an improvement which reduces the size needed within blocks to store transactions. SegWit rearranges the data contained in each block — like a disk defragmenter for a hard drive — to free up space and allow the inclusion of additional data.

Because of Litecoin’s close connection to Bitcoin, it was deduced that Bitcoin could follow the code change with few complications, and developers completed the switch in August 2017.

This upgrade separated out signature data from transaction data, increased Bitcoin’s block size limit from 1MB to 2MB and helped to mitigate issues that periodically throttle transactions speeds across the Bitcoin network. In this way Litecoin has long served as a blueprint for Bitcoin’s future codebase updates.

Differences

4x faster: New blocks of transactions on the Litecoin network are generated on average every 2.5 minutes, compared to Bitcoin’s 10 minute average. As a consequence, Litecoin’s transaction throughput is also approximately four times faster than Bitcoin.

As Lee explains: “Just a few years after Satoshi Nakamoto’s whitepaper ushered in a new financial and technological paradigm with Bitcon, I quickly realised that one of its major drawbacks was speed. A new block is added to the Bitcoin blockchain approximately every ten minutes and, thinking of a future where this incredible new technology would be widely adopted, I realised that transaction throughput would become a serious scalability problem.”

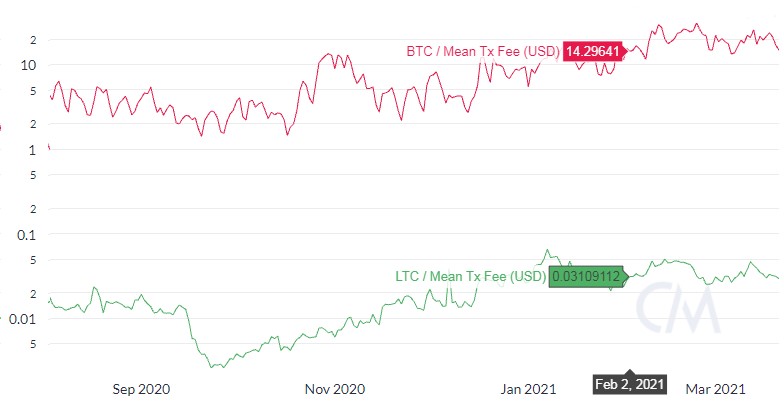

Dramatically lower fees per transaction: Throughout its history Litecoin has maintained reasonable fees at a consistently low level. Unlike Ethereum, whose fees to process transactions rise and fall depending on how many people are utilising the network at any one time, Litecoin fees have remained remarkably stable over time.

Litecoin’s fee structure is one of the most attractive elements of its use. It costs around 1/1000 of an LTC to process a transaction and crucially, fees do not rise at larger transaction amounts. This stability and usability has allowed Litecoin to maintain a very strong userbase.

And while both Bitcoin and Litecoin mean fees per transaction can spike during periods of volatility, the baseline for Litecoin is several orders of magnitude lower. Taking a snapshot of the market in February 2021, for example, we can see that the mean transaction (tx) fees in USD for Bitcoin was $14.30, while for Litecoin it was $0.03 (NB, chart is shown on a logarithmic scale).

Scrypt not SHA-256: While Litecoin’s codebase is a copy of Bitcoin, and both networks are secured by Proof of Work, one very important technical difference remains. Litecoin uses a unique cryptographic hashing algorithm called Scrypt, which is specifically designed to make it prohibitively costly to perform large-scale hardware attacks on a network. As well as offering a very strong cryptographic basis for the Litecoin blockchain this produced two interesting effects.

Firstly, in the early years of Litecoin it made mining this cryptoasset far more accessible to individuals, who were able to mine and mint new Litecoin with the processing power available from most home computer CPUs.

Secondly, it meant that Litecoin was not competing with Bitcoin for miners, as users could mine both Bitcoin and Litecoin at the same time. Attempting to mine two cryptographically identical cryptocurrencies in parallel requires twice the connections and twice the distribution channels, adding to cost-intensiveness.

As the Litecoin Foundation explains:

It was considered of extreme importance to utilize a different mining algorithm to not compete with Bitcoin miners. Thanks to this decision, Litecoin dominates Scrypt mining, making it more secure and less prone to being successfully attacked. This decision has helped Litecoin maintain its reputation as a secure coin and has contributed to it withstanding the test of time, unlike other more easily attackable coins that have met unfortunate fates.

How could Litecoin change in the future?

Like many of the most popular blockchains today, Litecoin is not simply static but a constantly-evolving project: it has had to be, in order to maintain its security and stability as user numbers have exploded.

And while Bitcoin’s use case has changed from its original design as a peer-to-peer cash alternative, and more towards a gold-like store of value, Litecoin has remained a popular way to spend and send digital currency.

It is, of course, extremely common in the fast-changing world of blockchain and cryptocurrencies to find supporters of new projects claiming that this project or that project is technically superior to the incumbents. Certainly, there are multiple blockchains which boast lower theoretical fees and transaction speeds far in excess of Bitcoin or even Litecoin. This does not mean, however, that investors nor users will immediately flock to trade, hold or use these cryptoassets.

What is patently clear is that wide-scale usage, visibility and utility trumps theoretical or technical prowess. If this were not the case, then every computer user in the world would have a copy of Linux rather than Microsoft Windows as their operating system. Current usage is a far more valuable metric for investors to watch than exact transaction throughput.

Still, Litecoin’s developers have remained committed to expanding Litecoin’s functionality.

August 2020 saw the first LTC-native VISA debit card launched in the US, plans to expand next to 31 European countries. It includes commonly regulated features like the requirement to pass anti-money laundering credential checks, called Know Your Customer or KYC, and integrates with all of the largest mobile payment networks such as Google Pay, Samsung Pay and Apple Pay.

More recently, 15 March 2021 saw the announcement from lead Litecoin developer David Burkett that the planned Mimblewimble Extension Block (MWEB) upgrade was ‘code-complete’ and hence ready for review and testing before implementation. That process is now underway. A testnet for developers to use for debugging and quality assurance has been live since October 2020.

MWEB is designed as a sophisticated upgrade to enhance Litecoin’s privacy and fungibility, two features of sound money systems which advocates argue are somewhat lacking in both Bitcoin and Litecoin today.

Effectively MWEB allows Litecoin to ape the anonymity functions of cash. Today anyone can look up and analyse cryptocurrency transactions through public blockchain explorers. As the Litecoin Foundation explains:

If a company wanted to pay employees in cryptocurrency, it would be essential for those transaction amounts to be private. If not, Employee A would be able to analyse how much Employee B was receiving.

This appears to be an esoteric argument, until we realise the strength of executive interest in these kinds of functions. For example, Peter Wall, the CEO of $1.2bn market cap Argo Blockchain (LSE:ARB) recently announced he would start receiving his salary in BTC rather than pound sterling. The City of Miami is also considering similar proposals on whether public sector workers could have part of their salary paid in cryptocurrency, and in another signal of mainstream adoption the owner of the NBA’s Sacremento Kings revealed on 6 April 2021 he would offer the option of cryptocurrency salary payments to all players.

More companies are using Litecoin than ever before. They include Vaultoro, a real-time trading platform that allows users to switch between LTC and physical gold and which operates a “glass books” protocol that allows anyone to audit its reserves. But perhaps the most significant addition in recent months is the integration of Litecoin with Unstoppable Domains, a Silicon Valley company backed by VCs like Draper Associates. The blockchain domain-builder converts crypto wallet addresses from traditional alphanumeric strings into human readable addresses for sending and receiving coins. “[Sending coins] can be an intimidating experience for a newcomer,” writes the Litecoin Foundation in its Q1 2021 report.

Unstoppable Domains has collaborated with the Foundation’s official wallet, the Litewallet, to integrate this capability and create a more seamless and user-friendly experience.

Conclusion

The growth of the large-cap altcoin market remains one of the areas where relatively new entrants to cryptocurrency may still be able to generate outsize returns as part of a diversified portfolio.

Litecoin’s strength lies in its robust longevity and its consistent development and evolution. Having a creator like Charlie Lee who is also a highly-visible spokesperson and prominent advocate — unlike the still-anonymous Satoshi Nakamoto — is a driver of additional support and one point where most cryptoasset projects fall down.

Newer development in its codebase, including the integration of the Lightning Network, the MWEB upgrade, and spending and usage developments like the Litecoin card and various other integrations could provide a basis for further long-term support.

Though across the past decade it has been theoretically superceded by projects claiming faster processing times or transaction speeds, Litecoin still remains one of the most-traded and most recognised cryptoassets in the world. And as institutional support grows, and the wider altcoin market cap continues to see long-term bullish support, Litecoin’s network effects could expand even further.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

Über ETC Group

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.