ETC Group Crypto Minutes Week #37

Whales in a decade-long diversification plan snap up $2.3bn BTC in the latest market correction, institutions have overtaken retail in Ethereum-based DeFi, and Ukraine legalises Bitcoin.

Whales in a decade-long diversification plan snap up $2.3bn BTC in the latest market correction, institutions have overtaken retail in Ethereum-based DeFi, and Ukraine legalises Bitcoin.

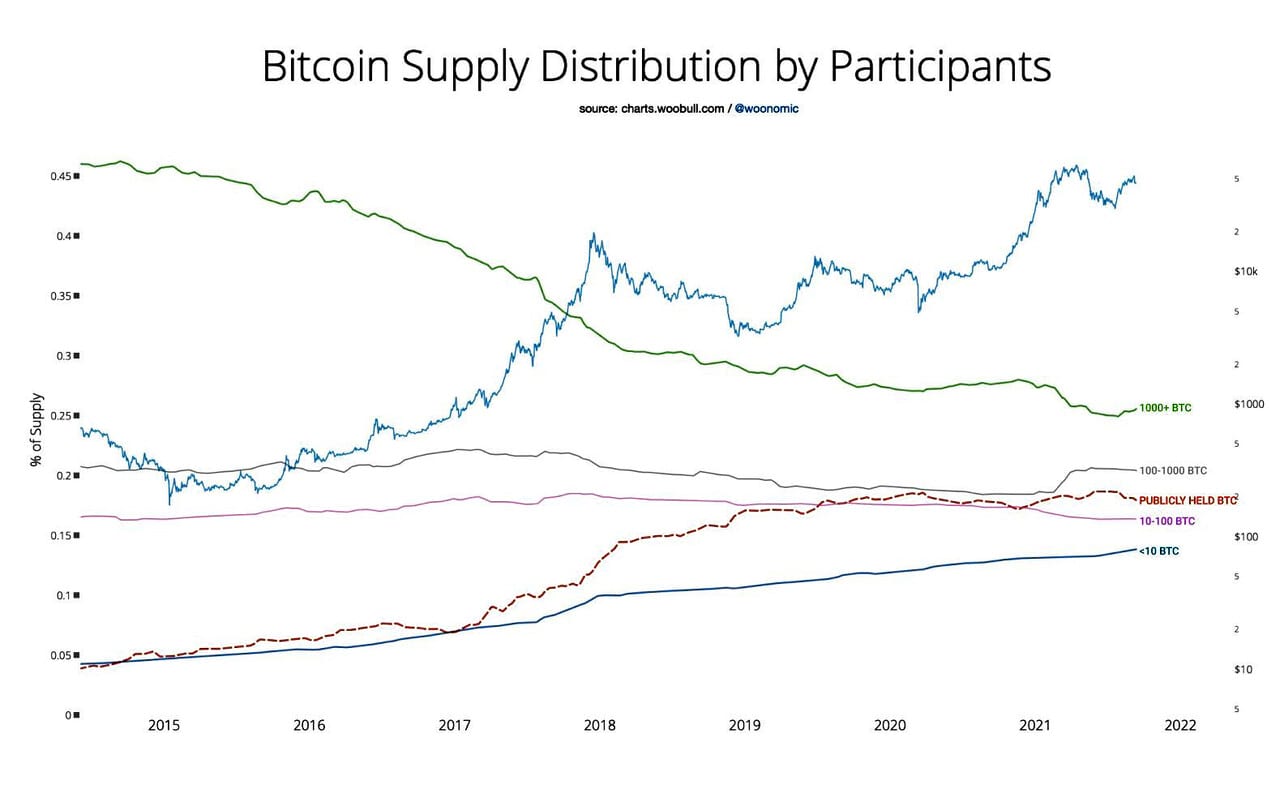

While markets could not sustain the recent upward climb beyond $50,000 per BTC, on-chain metrics this week show that Bitcoin whales — the richest owners who control at least 10,000 BTC (~$459m) — have been accumulating heavily.

On-chain analyst Woonomic shows that addresses that own between 10,000 and 100,000 BTC have bought roughly 50,000 BTC ($2.3bn) in the past week.

Supply distribution of Bitcoin update: Whales added recently. 10-1000 BTC holders mainly flat. Reserves held publicly reducing (mainly exchanges and ETFs reducing while corporates adding…Whales think coins are cheap right now. Whales are opportunists. They’re in a decade-long diversification plan selling into every bull market having made their money. But they do take the opportunity to buy when they see a strong rally ahead, like right now. @woonomic, 12 September 2021

The inventory of BTC held on speculative exchanges is falling as long-term buyers and corporates step in, Woonomic added.

Large holders tend to accumulate Bitcoin in anticipation of higher prices. This is a cycle that has played out countless times since Bitcoin was first widely tradeable in the early 2010s.

Among them, now, are El Salvadorian President Nayib Bukele. He tweeted on 7 September that — in the parlance of the crypto market — the country’s treasury department was “buying the dip”, adding 150 BTC at the then-market price of $42,900.

Buying the dip 😉

— Nayib Bukele 🇸🇻 (@nayibbukele) September 7, 2021

150 new coins added.#BitcoinDay #BTC🇸🇻

Michael Saylor’s Microstrategy (NASDAQ:MSTR), the pioneer in corporate Bitcoin treasury buying, is another. On 13 September, the CEO announced his company had picked up another 5,050 BTC at an average of $48,099. That takes the business intelligence software giant’s total holdings to 114,042 bitcoins, acquired for $3.1bn at an average price of $27,713.

MicroStrategy has purchased an additional 5,050 bitcoins for ~$242.9 million in cash at an average price of ~$48,099 per #bitcoin. As of 9/12/21 we #hodl ~114,042 bitcoins acquired for ~$3.16 billion at an average price of ~$27,713 per bitcoin. $MSTRhttps://t.co/2ESbTy6ad7

— Michael Saylor⚡️ (@michael_saylor) September 13, 2021

These reported buys are a small fraction of the total whale accumulation over the past seven days, leaving some 44,800 BTC ($2.08bn) unaccounted for. Such massive alterations in supply distribution suggest we may see new or existing institutions announce large Bitcoin purchases over the coming weeks and months.

Brevan Howard could be one of them. It’s speculation at this time, but in favour of the assessment is the fact that the $13bn hedge fund has appointed CMT Digital CEO Colleen Sullivan to run a new crypto division, BH Digital.

As reported in Reuters and the Financial Times, Brevan Howard is pushing to “significantly expand” its crypto ventures; the latest sign that institutional interest in the asset class is gaining momentum.

Brevan Howard’s belief in the huge diversity of opportunities within the digital asset space and the significance of this to long-term macro investors is the reason we are delighted to welcome Colleen to the firm. Colleen’s exceptional track record in making highly successful crypto venture investments will be of tremendous benefit to Brevan Howard clients and underscores the firm’s commitment to rapidly expanding its platform and offerings in cryptocurrencies and digital assets. Aron Landy, CEO, Brevan Howard

The storied macro fund announced in June 2021 via this SEC filing the landmark news that it was starting to take long and short positions in crypto trades.

Decentralised finance — the first major Ethereum application to break into the mainstream — has somewhat fallen off the media radar, replaced in the headlines by soaring NFT markets.

However, 2020’s breakthrough sector continues to grow unabated and on 7 September hit an all time high at $98.6bn.

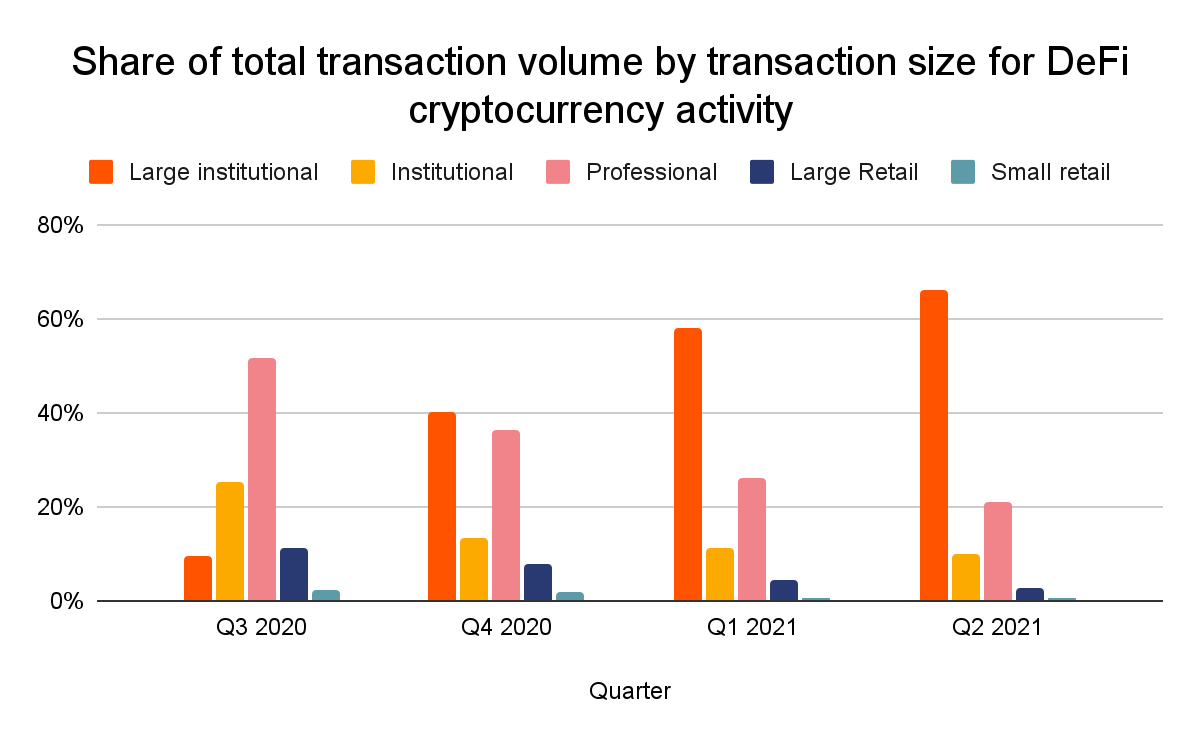

And institutions now dominate, according to a new report by Chainalysis. This suggests a more stable and considered future for decentralised lending and borrowing, insurance markets, asset swaps, staking and all the other innovations that DeFi technology affords.

The data shows that large transactions make up a much bigger share of DeFi activity, suggesting that DeFi is disproportionately popular for bigger investors compared to cryptocurrency as a whole. Large institutional transactions, meaning those above $10 million in USD, accounted for over 60% of DeFi transactions in Q2 2021, compared to under 50% for all cryptocurrency transactions. Chainalysis, Global DeFi Adoption Index 2021

In the ETC Group Valuing Ethereum research paper, published in April 2021, we noted that 79 out of the 80 most popular DeFi protocols were based on the Ethereum blockchain.

Since that report, the raw numbers have increased further: 120 out of the 125 largest DeFi venues now work on Ethereum. Bitcoin hosts one out of top 125, ETH Layer 2 scaling solution Polygon is used in two, and three protocols are multichain rather than using Ethereum only.

This kind of monopoly has only grown through utility: there are scores of smart contract-enabled blockchains for market participants to pick from. And yet the near-total majority chooses Ethereum.

Certainly, the health of the network is better than ever. Ethereum hashrate has been in recovery since June 2021 and surpassed its previous all-time-high of 715.4 TH/s on Sunday 12 September, Coindesk reported. Hashrate is a measurement of the amount of computing power being used to secure the network from outside attack. As ETC Group has suggested, these figures indicate that the worst effects of China’s crackdown have now passed, with large-scale cryptomining businesses shifting out of Asia and into the US and Eastern Europe.

On Wednesday 8 September Ukraine passed a draft law legalising and regulating cryptocurrency and other digital assets, making it the fifth-such economy to do so in recent weeks.

The law, “On Virtual Assets”, effectively provides protections for consumers and businesses transacting in cryptocurrencies, and offers a legal definition for digital assets as “intangible assets expressed in a form of electronic data”. It also spells out legal protections for cryptoasset owners and exchange operators, protecting them from fraud.

The law clearly defines private keys and digital asset wallets, core terminology never before laid out in Ukrainian legislation, but does not make cryptocurrencies legal tender alongside the national currency, as has happened in El Salvador.

Cryptocurrency use in the country has long existed in a legal grey area: with individual trading, custody and crypto business banking neither specifically outlawed nor particularly encouraged. Cryptocurrencies are hugely popular in the Ukraine, however, according to the Kyiv Post, which first reported the news.

The daily turnover of virtual assets in the country accounts for $37,000, according to Mykhailo Federov, Ukraine’s Minister of Digital Transformation. If cryptocurrency becomes legal and therefore safer, more Ukrainians will invest in it, Federov said. ‘Only a few countries in the world have legalized cryptoassets — Germany, Luxembourg, Singapore. Ukraine will be one of them,’ he added. Daryna Antoniuk, Kyiv Post, 8 September 2021

Before the law, citizens were free to buy and sell cryptocurrencies, but exchanges and entrepreneurs often found it difficult to secure and maintain banking services. Authorities often took a combative stance towards crypto companies, regarding them as scams and confiscating equipment without due cause.

267 lawmakers in the Ukrainian Parliament voted for the bill on Wednesday 8 September, making the decision near-unanimous.

It was first submitted to the Verkhovna Rada in November 2020, making the 11-month turnaround rather speedy by comparison to other national political chambers — India, for example.

The law on virtual assets allows crypto businesses to work officially in Ukraine and pay taxes here. To register a crypto business, a company needs to prove that it is transparent and has an excellent reputation. The permission to start a business costs over $3,100. To prevent profit laundering and financial terrorism, crypto businesses have to declare their activity to the state. Daryna Antoniuk, Kyiv Post, 8 September 2021

Ukraine plans to open the cryptocurrency market for business and investors by 2022, a press spokesperson told the newspaper, after Parliament has amended the necessary tax codes.

Now the bill heads to the desk of President Volodymyr Zelenskyy for his signature and to be formally enshrined in law.

Countries that have spent years trying to parse the outcomes of cryptocurrency and cryptoasset legislation are now starting to write and approve legislation in black and white. Few economies choose to be the first over the parapet. But now the floodgates have opened. And the consequences will ripple through the world for decades.

BTC/USD

All the talk this week was of BTC’s near $10,000 slide from $52,902.16 to $42,786.71. That’s unsurprising given Bitcoin’s pretty stellar trajectory in recent weeks. But since the lows of 7 September’s corrective slump, Bitcoin recovered 9.7% to reach the high-$46,000 region. In the main, Bitcoin markets have slipped into rangebound territory between $43,000 and $47,000, with neither bullish nor bearish traders controlling the market.

ETH/USD

Ethereum’s precipitous 23.4% drop shook markets this week, as the internal currency of the platform touched the edge of $3,000 before recovering to the mid-$3,400 range. That 13.2% bounceback will be a salve to short-term traders keen to push ETH into uncharted territory above $4,000, but it appears that Ether will remain planted in this middle ground for now.

LTC/USD

LTC followed the wider market across the seven-day trading session, plummeting as low as $160.70 from $209 on Tuesday 7 September. That dip was shortlived, however, and by the end of the week the payments protocol had turned around the loss to end some 16.8% higher at $187.78. The source of Litecoin’s near-30% midweek spike to $237.50 (and quick reversal to the mean) was much reported on and we need not rake over the coals of it here. Still, despite the error, bearish price action has not taken hold and LTC remains at historically elevated levels, four times higher than the $45 seen in September 2020.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

ETC Group has been created to provide investors with the tools to access the investment opportunities of the digital assets' and blockchain ecosystem. The company develops innovative digital asset-backed securities including ETC Group Physical Bitcoin (BTCE) and ETC Group Physical Ethereum (ZETH) which are listed on European exchanges including XETRA, Euronext, SIX, AQUIS UK and Wiener Börse.

With a track record of over three years, ETC Group is made up of an exceptional team of financial services professionals and entrepreneurs with experience spanning both digital assets and regulated markets. With product quality and safety at the core of our product creation approach, the company aims to continuously launch best-in-class institutional-grade exchange traded products.

As a company, ETC Group has previously launched BTCE - the world’s first centrally cleared Bitcoin exchange traded product on Deutsche Börse XETRA, the largest ETF trading venue in Europe, and also listed DA20, the world’s first crypto ETP tracking an MSCI index signalling a move towards investment management products. DA20 provides broad market exposure to investors by tracking an index of 20 cryptocurrencies which cover 85% of the total crypto market capitalisation.