ETC Group Crypto Minutes Week #29

China's obliteration of its Bitcoin industry will cause the largest wealth transfer in crypto history, while central bank 'addiction' to money printing could overwhelm the global economy.

China's obliteration of its Bitcoin industry will cause the largest wealth transfer in crypto history, while central bank 'addiction' to money printing could overwhelm the global economy.

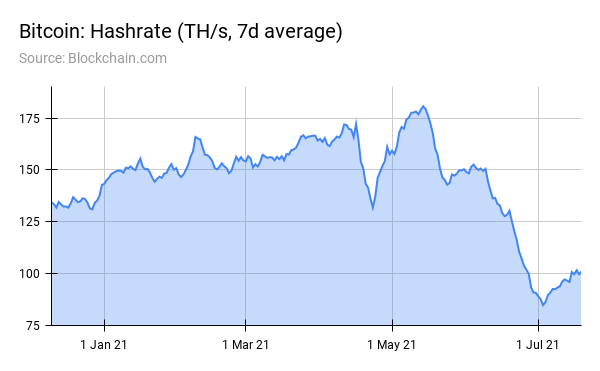

The Bitcoin hashrate is a key security metric. In essence, this is the speed at which mining computers run algorithms to compete for new bitcoin. The number of hashes performed by mining machines is a direct way of knowing how much energy is being expended in keeping the golden copy of the Bitcoin transaction ledger safe and up to date. And so the more hashpower leveraged across the network, the greater its security and the greater resistance it has to being attacked.

On May 13 2021 the Bitcoin hashrate peaked at an all time high of 180.66 Th/s. Within 7 weeks, by 3 July, it had plummeted more than half to 84.79 Th/s. This was a level first surpassed in September 2019 and not seen in the 18 months since.

China's crackdown is the key.

As noted by one well-placed analyst, China's recent obliteration of its own vast bitcoin mining industry was not a mere war of words, it was harsher and more deliberate than any state-run campaign in history.

There were a lot of talks in 2018-2019 but there wasn't anything seriously enforced. But this time it seems like there's no way to go back. Banks are cutting funding channels for OTC desks. The other side is the energy angle...that's why we see Shenzhen shutting down power supplies to bitcoin mining farms. Wolfie Zhao, Asia Editor, The Block

In the weeks since, hashrate has recovered by 20% to reclaim 100 Th/s. Miners have been fleeing to more friendly jurisdictions in the US and Europe, with those regions snapping up larger proportions of the new bitcoin created by successfully mining blocks of transactions.

A higher hashrate is an indication of a healthier network, and a determiner of positive sentiment, in that miners are investing in more powerful equipment. Both of these factors can be a frontrun indicator of higher future Bitcoin values.

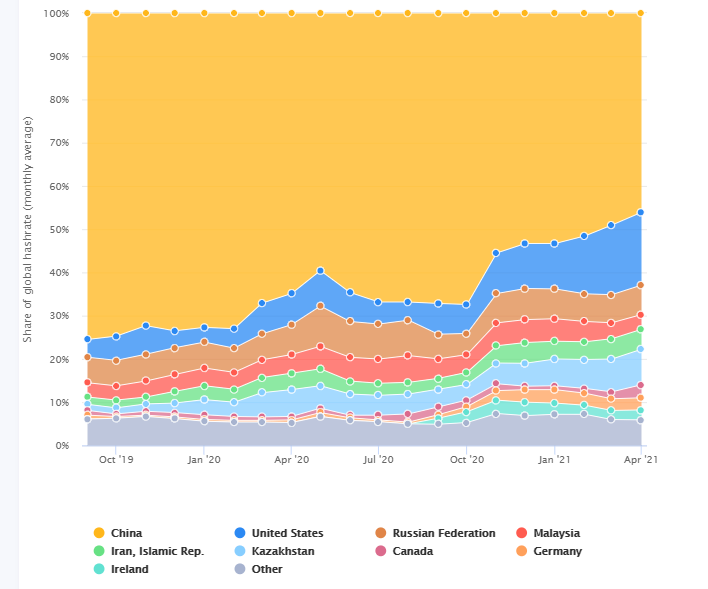

Figures from the Cambridge Bitcoin Electricity Consumption Index, from April 2020, show that China controlled 65% of the Bitcoin hashrate. The second-largest region was the US with 7.24%.

The balance of these figures has shifted immeasurably in the 12 months since. More recent figures updated by researchers show that Chinese hashrate share had dropped to 46% by April 2021, with the US the largest gainer at 16.85%. In third place was Kazakhstan with over 8% of the Bitcoin hashrate. At the time Canada controlled 3%, while Ireland had 2.27%.

On 16 July China published the whitepaper for its central bank digital currency, the e-CNY. It cited speculation as the main driver for the crackdown on Bitcoin trading, banking and mining across the state.

This opens up an unprecedented opportunity for miners to profit, most notably in the US, Kazakhstan and Western Europe.

Our interpretation is that the insistence of the Chinese state in abandoning Bitcoin will predicate the largest wealth transfer in crypto history.

The UK's upper chamber, the House of Lords, has warned in a harsh report that the Bank of England is 'addicted' to printing money through quantitative easing.

Throughout the pandemic, this once-emergency measure employed only in dire circumstances has become accepted standard practice. As a result, the price of equities, real estate and other traditional assets have become grossly inflated.

Peers said the bank must be more transparent about how it was going to tail off its ?895bn money-printing and bond buying programme without impacting inflation and damaging the economy.

Most major central banks, including the US, UK, Eurozone, Sweden, Switzerland and Japan all have ongoing QE programmes. The Federal Reserve launched unlimited asset purchases - dubbed 'QE infinity' - in March 2020. Since then, central bankers have often purchased more bonds in weeks than during entire QE programmes lasting years.

In the report the former committee chairman Michael Forsyth warned that central banks faced losing public confidence if it became clear that they were using QE to shore up economies with no end date in sight, and printing money to finance day-to-day government spending.

[The Bank] could lose credibility destroying its ability to control inflation and maintain financial stability. QE appears to be the answer to all the country's economic problems. The Bank must be more transparent, justify the use of QE and show it's working. The Bank needs to explain how it will curb inflation if it is more than just short term. It also needs to do more to mitigate widening wealth inequalities that have resulted from rising asset prices caused by QE. Michae Forsyth,chair, UK Economic Affairs Committee

In June the Federal Reserve's balance sheet hit an unprecedented $8 trillion

This milestone should be a reminder that...the Fed may soon start reducing, or "tapering," the $120 billion a month it has been pumping into the financial system since the start of the pandemic. Robert Burgess,Bloomberg Opinion

On the opposite side of the fence, Bitcoin fundamentals remain programmatically sound: a deflationary asset with a fixed supply that will continue to reduce its issuance every four years until 2140.

Rafael Schultze-Kraft, a lead analyst for Glassnode, reminds us of this fact.

Bitcoin simply continues to work as intended, securely producing block after block, like clockwork, following a deterministic supply schedule.

While you're concerned with FUD, #Bitcoin simply continues to work as intended, securely producing block after block, like clockwork, following a deterministic supply schedule, controlled by no one, unstoppable since more than a decade.

— Rafael Schultze-Kraft (@n3ocortex) May 23, 2021

Never lose sight of this amid the noise. pic.twitter.com/0FoOpL4mJE

BTC/USD

Bitcoin market-watchers saw a steady decline this week, starting at $32,970.38 and slipping to less than $30,000 by 20 July. That, however, marked a clear inflection point as traders rallied to buy the dip, climbing 5.7% to end the week at $30,962.41. $28,775 remains the yearly low, reached on 22 June 2021 in the wake of China's crackdown on mining, and near-term support appears to be strong on higher volumes around the $30,000-mark.

ETH/USD

Ethereum volatility shrunk this week as bears fought with bulls for control, tipping Ether to a weekly high of $2,032.62 before weakening 15.5% to a low of $1,718.11. From this point the native currency of the programmable money blockchain climbed almost 10% to finish the week at $1,883.69. In the near term all eyes are on whether the psychologically-important $2,000 level will turn into support or resistance.

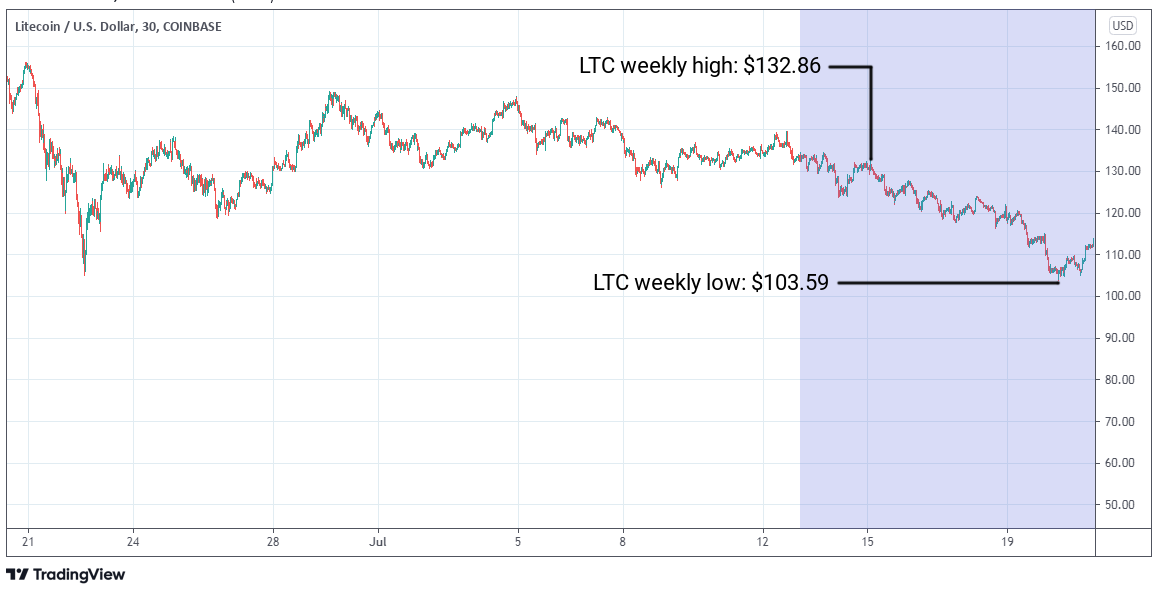

LTC/USD

Litecoin markets approached the $100 lows seen at the end of June, as sentiment indicators shifted bearish, at least in the short-term. The payments protocol found little support across the week, sliding gently from a $132.38 start to finish the week 13.9% lower at $113.90. One bullish point would be that traders expressed no appetite for LTC to dip below $103, rebounding 10.0% to finish this week's session.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.