ETC Group Crypto Minutes Week #29

China's obliteration of its Bitcoin industry will cause the largest wealth transfer in crypto history, while central bank 'addiction' to money printing could overwhelm the global economy.

China's obliteration of its Bitcoin industry will cause the largest wealth transfer in crypto history, while central bank 'addiction' to money printing could overwhelm the global economy.

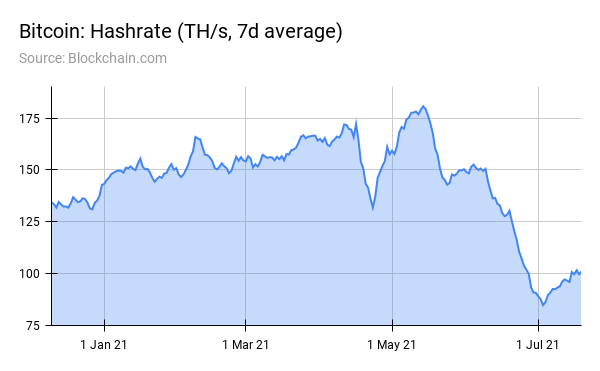

The Bitcoin hashrate is a key security metric. In essence, this is the speed at which mining computers run algorithms to compete for new bitcoin. The number of hashes performed by mining machines is a direct way of knowing how much energy is being expended in keeping the golden copy of the Bitcoin transaction ledger safe and up to date. And so the more hashpower leveraged across the network, the greater its security and the greater resistance it has to being attacked.

On May 13 2021 the Bitcoin hashrate peaked at an all time high of 180.66 Th/s. Within 7 weeks, by 3 July, it had plummeted more than half to 84.79 Th/s. This was a level first surpassed in September 2019 and not seen in the 18 months since.

China's crackdown is the key.

As noted by one well-placed analyst, China's recent obliteration of its own vast bitcoin mining industry was not a mere war of words, it was harsher and more deliberate than any state-run campaign in history.

There were a lot of talks in 2018-2019 but there wasn't anything seriously enforced. But this time it seems like there's no way to go back. Banks are cutting funding channels for OTC desks. The other side is the energy angle...that's why we see Shenzhen shutting down power supplies to bitcoin mining farms. Wolfie Zhao, Asia Editor, The Block

In the weeks since, hashrate has recovered by 20% to reclaim 100 Th/s. Miners have been fleeing to more friendly jurisdictions in the US and Europe, with those regions snapping up larger proportions of the new bitcoin created by successfully mining blocks of transactions.

A higher hashrate is an indication of a healthier network, and a determiner of positive sentiment, in that miners are investing in more powerful equipment. Both of these factors can be a frontrun indicator of higher future Bitcoin values.

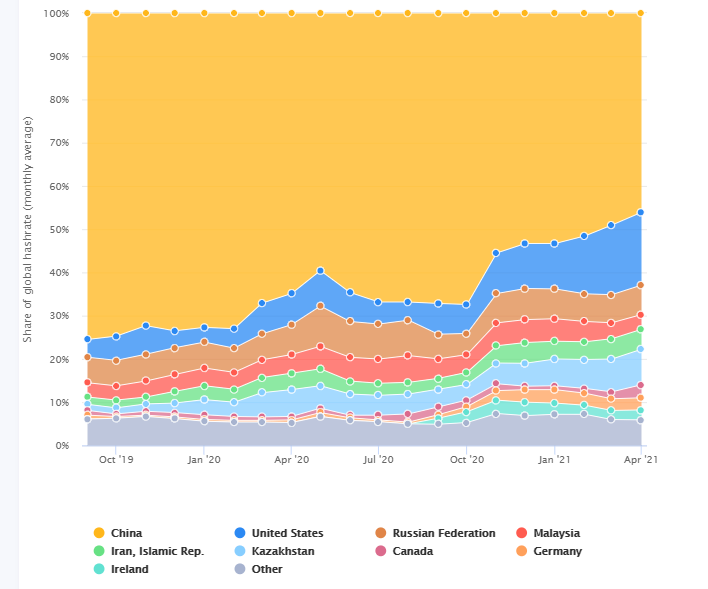

Figures from the Cambridge Bitcoin Electricity Consumption Index, from April 2020, show that China controlled 65% of the Bitcoin hashrate. The second-largest region was the US with 7.24%.

The balance of these figures has shifted immeasurably in the 12 months since. More recent figures updated by researchers show that Chinese hashrate share had dropped to 46% by April 2021, with the US the largest gainer at 16.85%. In third place was Kazakhstan with over 8% of the Bitcoin hashrate. At the time Canada controlled 3%, while Ireland had 2.27%.

On 16 July China published the whitepaper for its central bank digital currency, the e-CNY. It cited speculation as the main driver for the crackdown on Bitcoin trading, banking and mining across the state.

This opens up an unprecedented opportunity for miners to profit, most notably in the US, Kazakhstan and Western Europe.

Our interpretation is that the insistence of the Chinese state in abandoning Bitcoin will predicate the largest wealth transfer in crypto history.

The UK's upper chamber, the House of Lords, has warned in a harsh report that the Bank of England is 'addicted' to printing money through quantitative easing.

Throughout the pandemic, this once-emergency measure employed only in dire circumstances has become accepted standard practice. As a result, the price of equities, real estate and other traditional assets have become grossly inflated.

Peers said the bank must be more transparent about how it was going to tail off its ?895bn money-printing and bond buying programme without impacting inflation and damaging the economy.

Most major central banks, including the US, UK, Eurozone, Sweden, Switzerland and Japan all have ongoing QE programmes. The Federal Reserve launched unlimited asset purchases - dubbed 'QE infinity' - in March 2020. Since then, central bankers have often purchased more bonds in weeks than during entire QE programmes lasting years.

In the report the former committee chairman Michael Forsyth warned that central banks faced losing public confidence if it became clear that they were using QE to shore up economies with no end date in sight, and printing money to finance day-to-day government spending.

[The Bank] could lose credibility destroying its ability to control inflation and maintain financial stability. QE appears to be the answer to all the country's economic problems. The Bank must be more transparent, justify the use of QE and show it's working. The Bank needs to explain how it will curb inflation if it is more than just short term. It also needs to do more to mitigate widening wealth inequalities that have resulted from rising asset prices caused by QE. Michae Forsyth,chair, UK Economic Affairs Committee

In June the Federal Reserve's balance sheet hit an unprecedented $8 trillion

This milestone should be a reminder that...the Fed may soon start reducing, or "tapering," the $120 billion a month it has been pumping into the financial system since the start of the pandemic. Robert Burgess,Bloomberg Opinion

On the opposite side of the fence, Bitcoin fundamentals remain programmatically sound: a deflationary asset with a fixed supply that will continue to reduce its issuance every four years until 2140.

Rafael Schultze-Kraft, a lead analyst for Glassnode, reminds us of this fact.

Bitcoin simply continues to work as intended, securely producing block after block, like clockwork, following a deterministic supply schedule.

While you're concerned with FUD, #Bitcoin simply continues to work as intended, securely producing block after block, like clockwork, following a deterministic supply schedule, controlled by no one, unstoppable since more than a decade.

— Rafael Schultze-Kraft (@n3ocortex) May 23, 2021

Never lose sight of this amid the noise. pic.twitter.com/0FoOpL4mJE

BTC/USD

Bitcoin market-watchers saw a steady decline this week, starting at $32,970.38 and slipping to less than $30,000 by 20 July. That, however, marked a clear inflection point as traders rallied to buy the dip, climbing 5.7% to end the week at $30,962.41. $28,775 remains the yearly low, reached on 22 June 2021 in the wake of China's crackdown on mining, and near-term support appears to be strong on higher volumes around the $30,000-mark.

ETH/USD

Ethereum volatility shrunk this week as bears fought with bulls for control, tipping Ether to a weekly high of $2,032.62 before weakening 15.5% to a low of $1,718.11. From this point the native currency of the programmable money blockchain climbed almost 10% to finish the week at $1,883.69. In the near term all eyes are on whether the psychologically-important $2,000 level will turn into support or resistance.

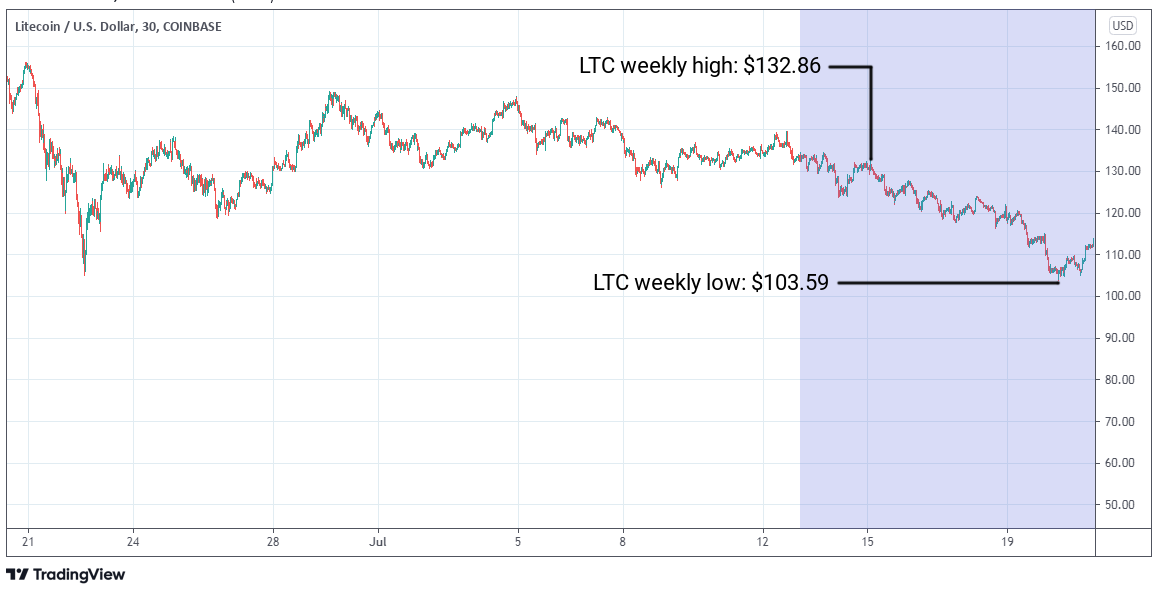

LTC/USD

Litecoin markets approached the $100 lows seen at the end of June, as sentiment indicators shifted bearish, at least in the short-term. The payments protocol found little support across the week, sliding gently from a $132.38 start to finish the week 13.9% lower at $113.90. One bullish point would be that traders expressed no appetite for LTC to dip below $103, rebounding 10.0% to finish this week's session.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

ETC Group développe des instruments financiers innovants adossés à des actifs numériques, notamment l'ETC Group Physical Bitcoin (BTCE) et l'ETC Group Physical Ethereum (ZETH), qui sont cotés sur des échanges européens, comme le XETRA, Euronext, SIX, AQUIS UK et Wiener Börse.

ETC Group a lancé le premier produit négocié en bourse (exchange traded product- ETP) Bitcoin à compensation centralisée au monde en juin 2020 sur la Deutsche Börse XETRA, la plus grande plateforme de cotation d'ETF d'Europe.

ETC Group travaille en permanence à l'élargissement de sa gamme d'ETPs garantis par des crypto-monnaies, de qualité institutionnelle, offrant aux investisseurs la possibilité de s'exposer au Bitcoin, à l'Ethereum, au Cardano, au Solana et à d'autres actifs numériques populaires sur les principales bourses européennes.