- Market sentiment has stabilized as outflows from Grayscale’s Bitcoin Trust (GBTC) have slowed down

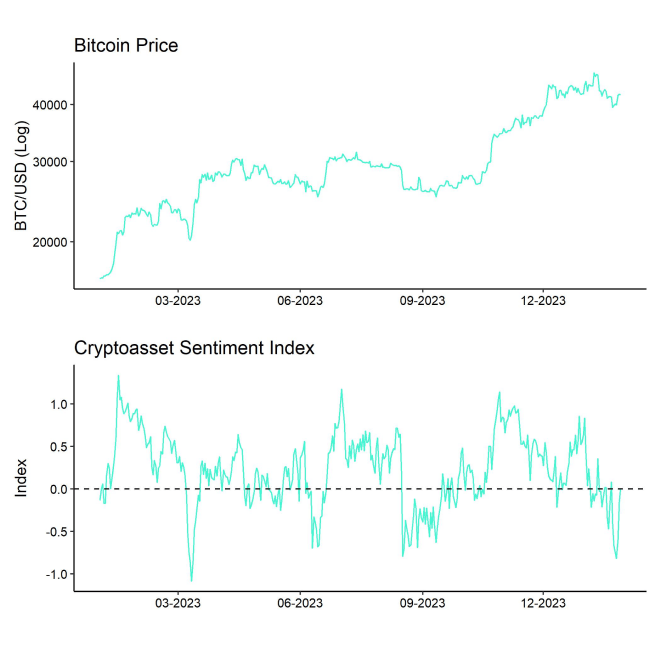

- Our in-house “Cryptoasset Sentiment Index” declined to levels that signal a short-term tactical bottom last week

- We expect the influence of macro factors on Bitcoin & Cryptoassets to reassert itself over the coming weeks

Chart of the Week

Performance

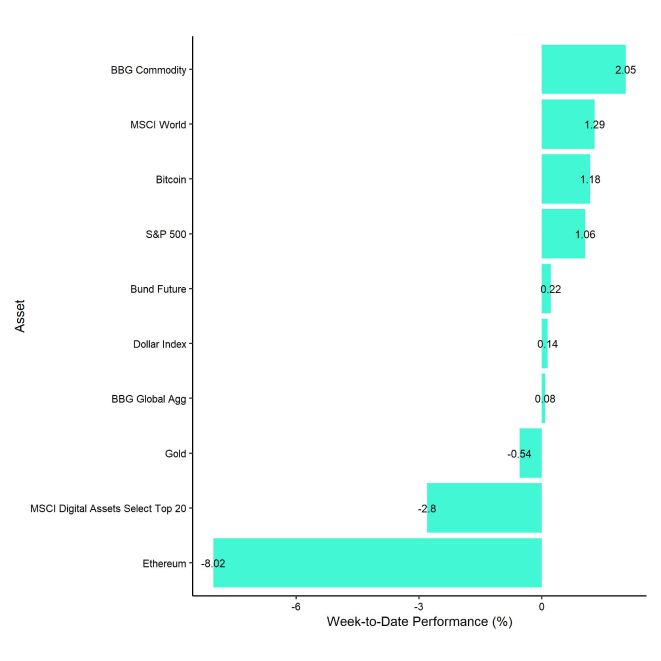

Last week, cryptoassets mostly recovered from the sell-off in the prior week. One of the main reasons for this recovery was that outflows from the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – have slowed down recently which has lifted market sentiment a bit.

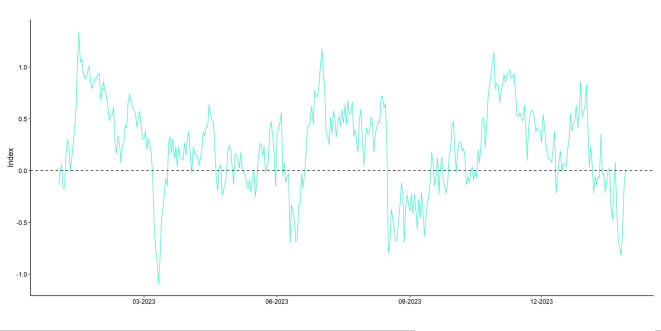

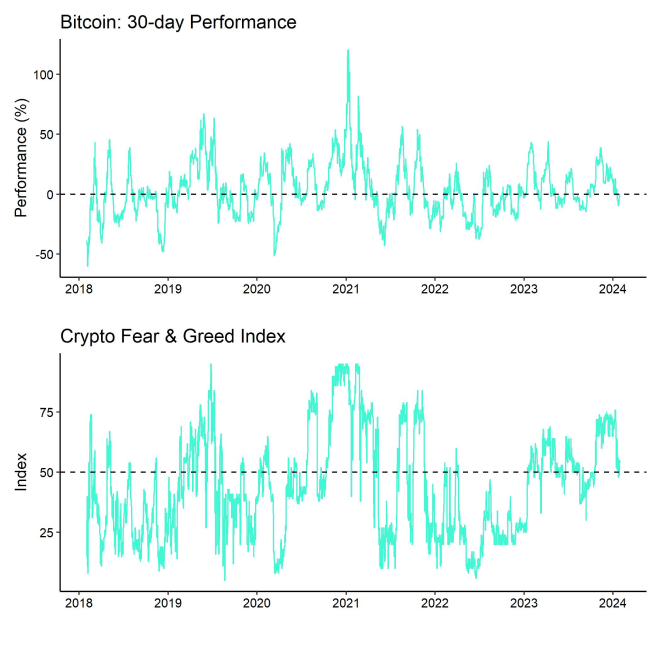

Market sentiment was relatively bearish at the beginning of last week, with our in-house “Cryptoasset Sentiment Index” hitting the lowest level since March 2023 amid heightened fund outflows and increasing bitcoin exchange inflows.

The index has decreased to such low levels that at least a short-term tactical bottom appears to be quite likely.

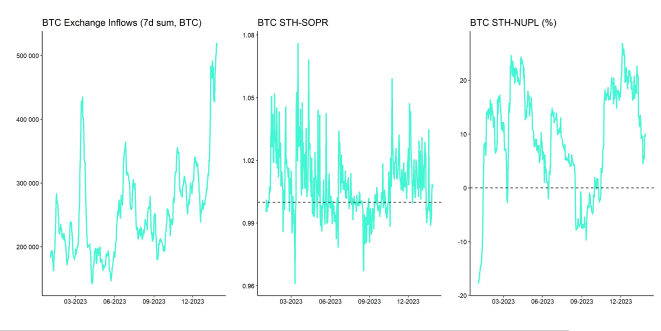

Over the course of last week, we saw a significant reversal in sentiment from low levels amid reversals in spot bitcoin exchange inflows and bitcoin put-call volume ratios that had put pressure on the market.

Ethereum also came under pressure after a portion of the chain's major operators were rendered inoperable on Sunday due to a problem in Ethereum's Nethermind client software, which is used by blockchain validators to communicate with the network.

The incident has raised concerns about the centralization and high reliance on single dominant client softwares like Geth – a risk referred to as “supermajority client risk” – which has dampened market sentiment towards Ethereum last week.

Overall, although ETF fund flows in the US still appear to be relatively influential, the market clearly lacks some new catalysts in the short term. It is quite likely that the influence of macro factors such as global growth expectations or monetary policy could reassert itself over the coming months, at least until the Bitcoin Halving in April 2024.

In this context, the FOMC will convene to decide on US monetary policy on the 30 th and 31 st of January this week. The FOMC is expected to hold interest rates unchanged this week and only to cut rates later in March based on expectations priced into Fed Funds Futures.

However, interest rate cuts have recently been priced out which was also seen as a potential bearish macro catalyst for the latest sell-off in cryptoassets.

In this context, we are currently measuring a dominant influence of global growth expectations and general level of risk appetite on Bitcoin and only to a lesser extent an influence by other macro factors such as monetary policy or the US Dollar.

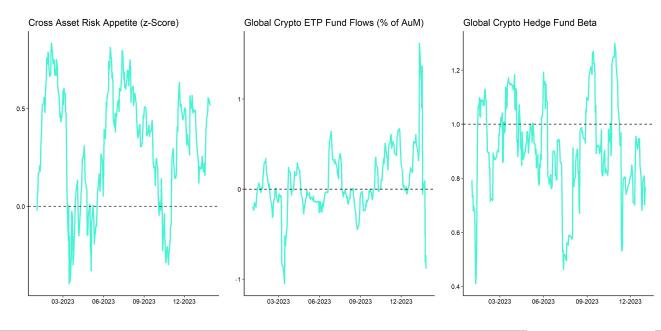

Our own measure of Cross Asset Risk Appetite (CARA) has also recovered last week which has likely supported the recovery in for Bitcoin and other cryptoassets as well.

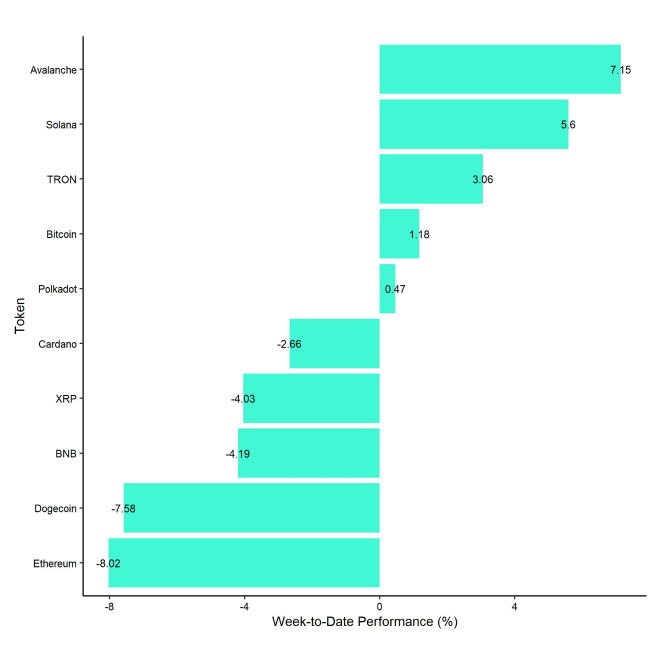

In general, among the top 10 crypto assets, Avalanche, Solana, and TRON were the relative outperformers.

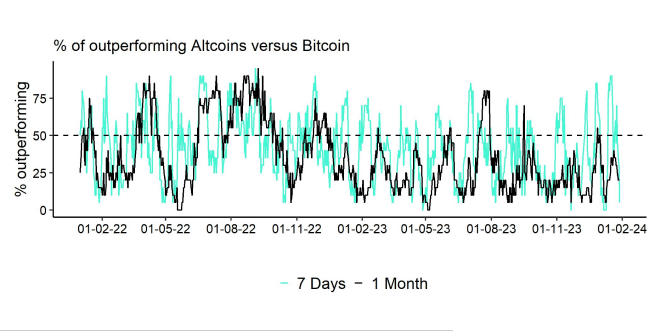

Altcoin outperformance vis-à-vis Bitcoin was relatively weak compared to the week prior, with only 5% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

Sentiment

Market sentiment was relatively bearish at the beginning of last week, with our in-house “Cryptoasset Sentiment Index” hitting the lowest level since March 2023.

The index has decreased to such low levels that at least a short-term tactical bottom appears to be quite likely.

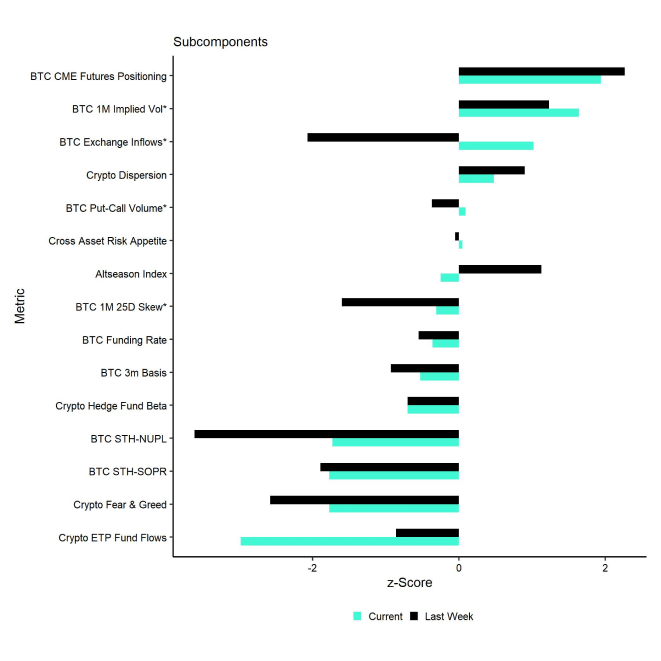

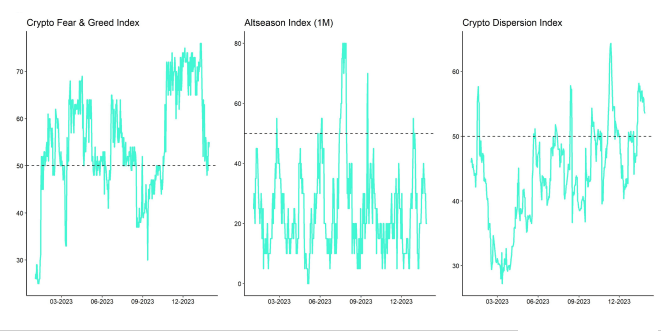

At the moment, only 6 out of 15 indicators are above their short-term trend.

Compared to last week, we saw major reversals to the upside in BTC exchange inflows and BTC put-call volume ratios.

The Crypto Fear & Greed Index has swung back to "Greed" territory as of this morning.

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) has recently increased. Overall, this is signalling a return in risk appetite in traditional financial markets.

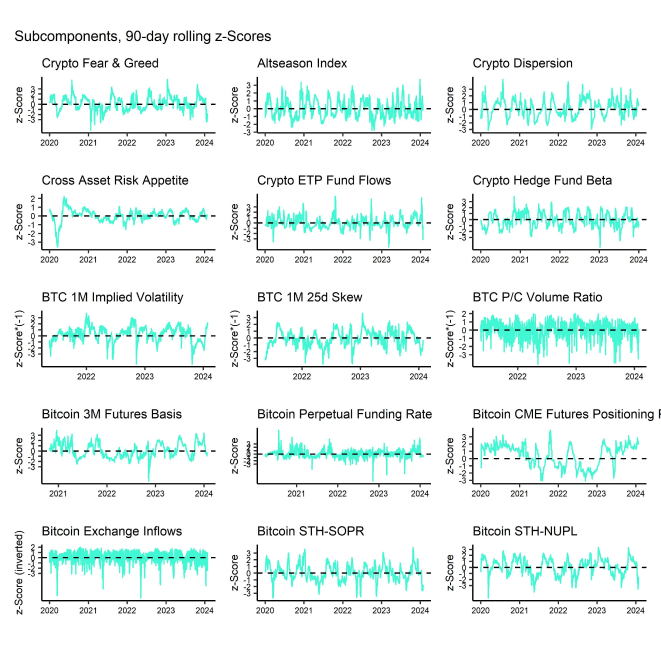

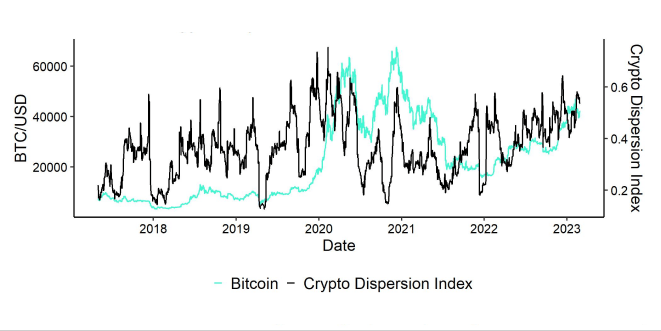

Performance dispersion among cryptoassets has recently remained elevated.

In general, high-performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased, which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, altcoin outperformance vis-à-vis Bitcoin has declined considerably amid an underperformance of Ethereum vis-à-vis Bitcoin. Only 5% of our tracked altcoins have outperformed Bitcoin on a weekly basis.

In general, low altcoin outperformance tends to be a sign of low risk appetite within cryptoasset markets.

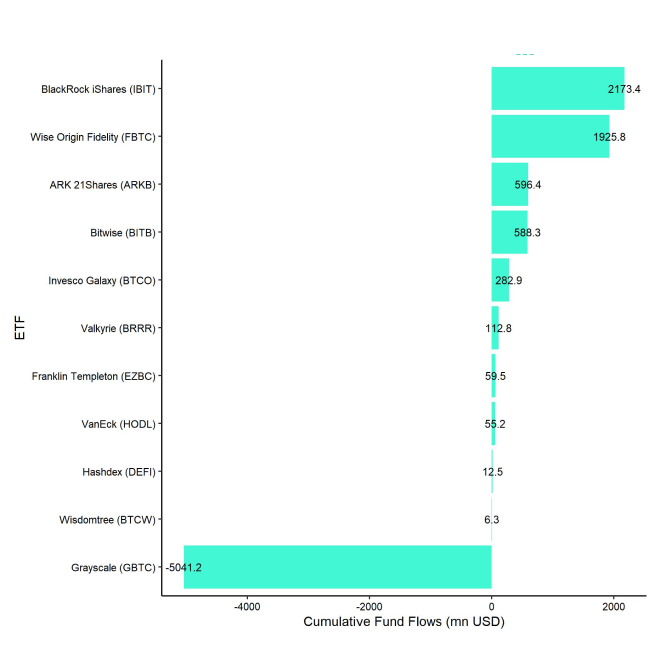

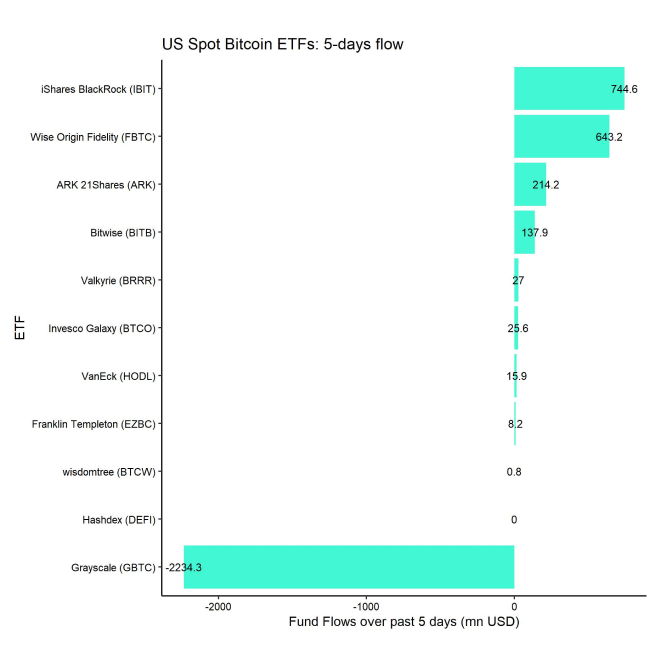

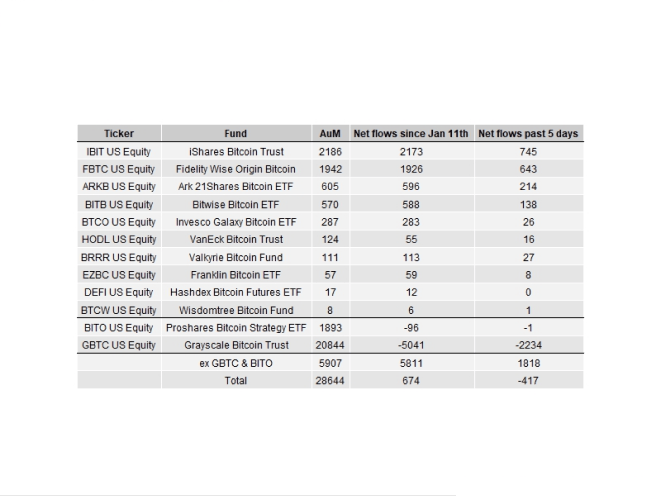

Fund Flows

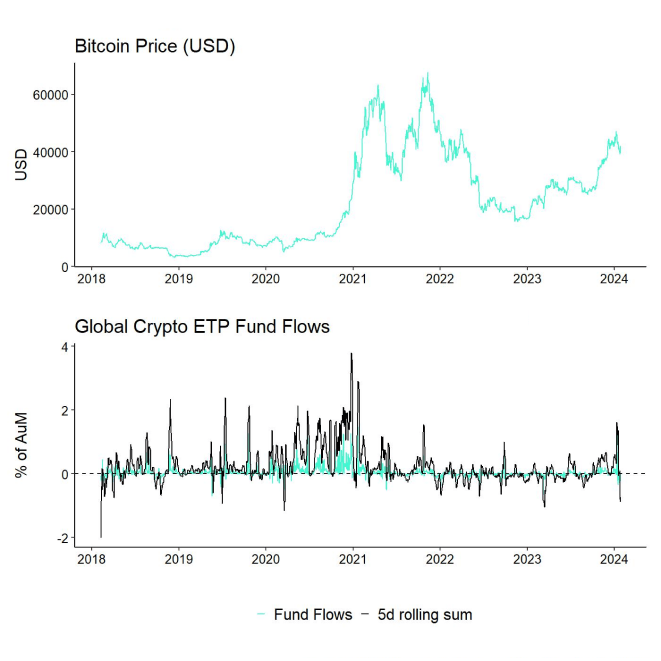

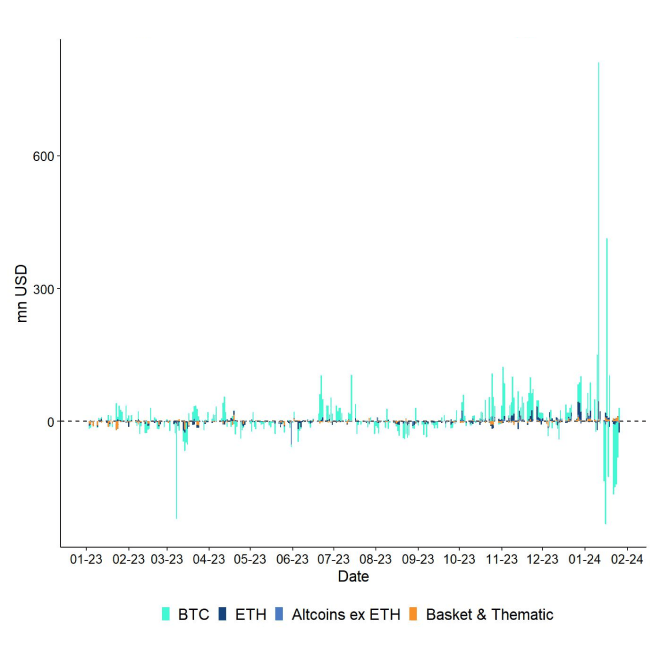

In aggregate, we saw weekly net fund outflows from all types of cryptoassets in the amount of -500.1 mn USD (week ending Friday) based on Bloomberg data.

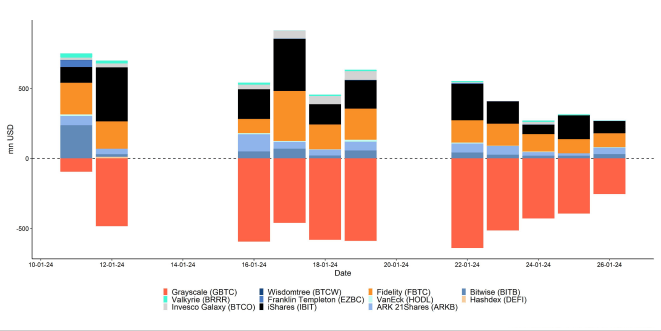

Global Bitcoin ETPs saw significant outflows of -491.5 mn USD of which -417.0 mn were related to US spot Bitcoin ETFs. This was mostly related to continuing outflows from the Grayscale Bitcoin Trust (GBTC) which amounted to -2,234.3 mn USD last week alone. This was partially counteracted by net inflows other US spot Bitcoin ETFs that were able to attract 1,818.0 mn USD in net inflows.

On a positive note, the outflows from GBTC have slowed down over the past 5 trading days which has also improved market sentiment as well.

Note that some fund flows data for US major issuers are still lacking in the abovementioned numbers due to T+2 settlement.

Apart from Bitcoin, we saw comparatively small flows into other cryptoassets last week.

Ethereum ETPs also saw net outflows in the amount of -37.3 mn USD while other altcoin ETPs ex Ethereum managed to attract +1.1 mn USD.

Thematic & basket crypto ETPs also managed to attract net inflows of +27.6 mn USD, based on our calculations.

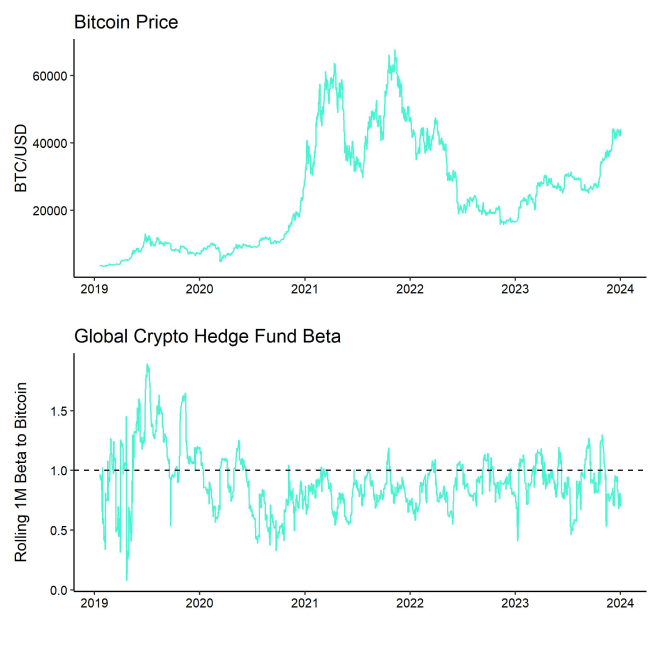

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading still remains low at below 0.8, implying that global crypto hedge funds still remain under-exposed to Bitcoin market risks. It appears as if crypto hedge funds are still waiting on the sidelines for new catalysts.

On-Chain Data

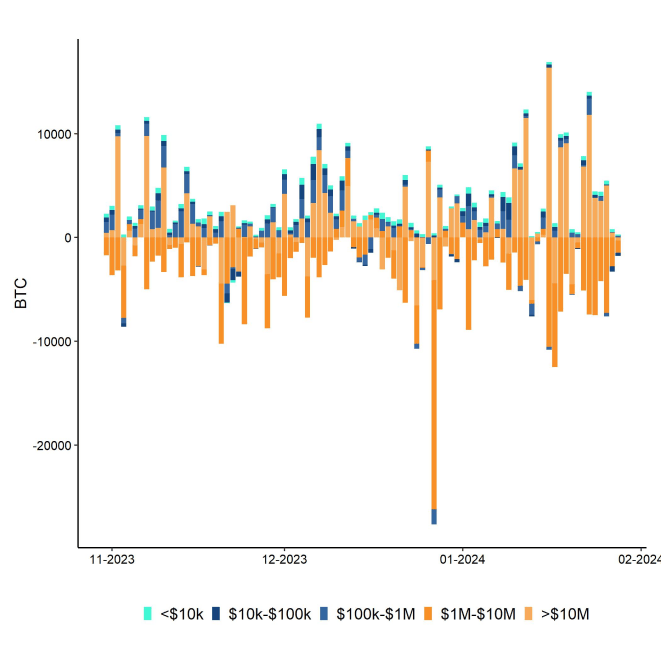

Last week, in- and outflows related to spot Bitcoin ETFs continued to exert a significant influence on Bitcoin on-chain data as well.

High outflows from the Grayscale Bitcoin Trust (GBTC) led to increased exchange inflows into crypto exchanges, in particular Coinbase.

More particularly, last Monday GBTC transfers to Coinbase accounted from approximately 76% of overall whale exchange deposits to Coinbase on that day. That percentage has declined gradually throughout the past week and was at around 30% last Friday.

We have analysed the effect of the GBTC selling on the price of Bitcoin in more detail here.

However, although GBTC percentage in whale exchange inflows has somewhat declined, whale exchange inflows still remain relatively high from a structural point of view. This could put a lid on any significant price advances in the short term. Besides, the average coin dormancy also remains relatively high which tends to be a bearish signal.

Dormancy, defined as the ratio of coin days destroyed to total transfer volume, is the average number of days destroyed per coin traded. The higher the coin days destroyed, the longer a coin has been dormant. It usually signals whether older coins are on the move.

On a positive note, Bitcoin miners have ceased to sell their BTC reserves – a process which had started around November 2023 already. Aggregate BTC miner balances have moved sideways over the past week. It is also positive to observe that the number of BTC whale has increased significantly over the past week. Whales are defined as unique entities holding at least 1k BTC. This increase implies that, on aggregate, whales might be accumulating coins again.

In fact, we are observing an increase in BTC holdings in wallets that hold between 1k BTC and 100k BTC.

Futures, Options & Perpetuals

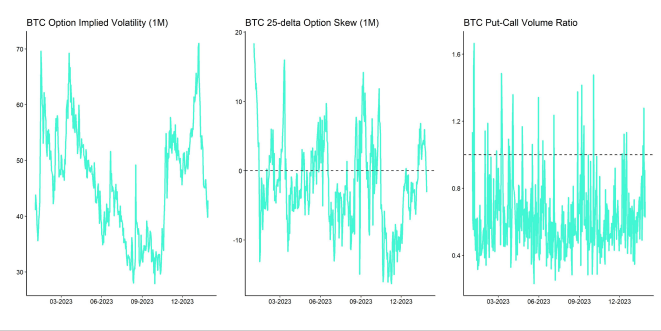

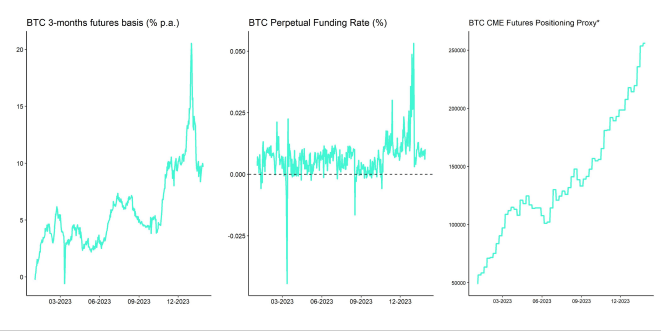

BTC futures open interest declined somewhat last week while perpetual open interest was mostly unchanged. There were no significant futures long or short liquidations last week.

The 3-months annualized BTC futures basis has stabilized at around 9.7% p.a. and perpetual funding rates have been positive throughout the week.

There were more significant developments in the BTC option space, which saw a massive expiry last week on Friday that led to a decrease of around -86k BTC in option open interest. Put-call open interest ratio remains relatively low implying that most traders have relatively low put exposure.

That being said, last Thursday saw a significant spike in put buying as put-call volume ratios spiked to the highest level since October 2023. The BTC 25-delta 1-month option skew had also increased before that amid the sell-off but has recently declined from high levels.

There is generally a declining trend in implied volatilities since early January 2024 that continued last week as well. BTC option traders have generally been pricing out the uncertainty around the ETF approvals.

Bottom Line

- Market sentiment has stabilized as outflows from Grayscale’s Bitcoin Trust (GBTC) have slowed down

- Our in-house “Cryptoasset Sentiment Index” declined to levels that signal a short-term tactical bottom last week

- We expect the influence of macro factors on Bitcoin & Cryptoassets to reassert itself over the coming weeks

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.