Introduction

The Metaverse has been hard for investors to avoid in the last 12 months. It has been variously described as everything from the evolution of virtual reality (VR) to the next iteration of the internet.

That is one way to think about it, that of a coming technological overhaul which will move users from read-only static webpages (Web1) to interactive read + write and social networks (Web2) to read + write + own (Web3).

The Metaverse is one specific evolution of Web3. When 'complete', it will involve a series of decentralised interconnected and increasingly realistic 3D virtual worlds, each with their own functional online economy.

A January 2022 report by Gartner suggests that by 2026, 25% of people globally will spend at least one hour per day in the Metaverse for work, shopping, education, social media and entertainment.

The term 'Metaverse' was coined 30 years ago by Neal Stephenson in his 1992 novel Snow Crash. The author foretold a future where users connected to a VR space using the internet and interacted with objects and other human beings through augmented reality (AR). Players were represented by avatars, with computer programs ('software agents') acting on their behalf.

It was prophetic, but like most predictions, only partially correct. We can consider the software agents of this fiction like the blockchain-based smart contracts of today: automated pieces of code that carry out specific pre-defined actions in law, finance or to ascribe rights to digital property (NFTs).

VR and AR are not new technologies but their usage is growing and their influence is starting to bleed into everyday life. Facebook's October 2021 name-change to Meta, and its $10bn commitment to developing the Metaverse, was just the crest of a wave. In February 2022 Nigel Bolton, co-head of equities at $10 trillion asset manager Blackrock, predicted "game changer" products including AR glasses and 5G technology would fuel huge Metaverse growth in 2022, not only for tech firms but also consumer, advertising and leisure stocks.

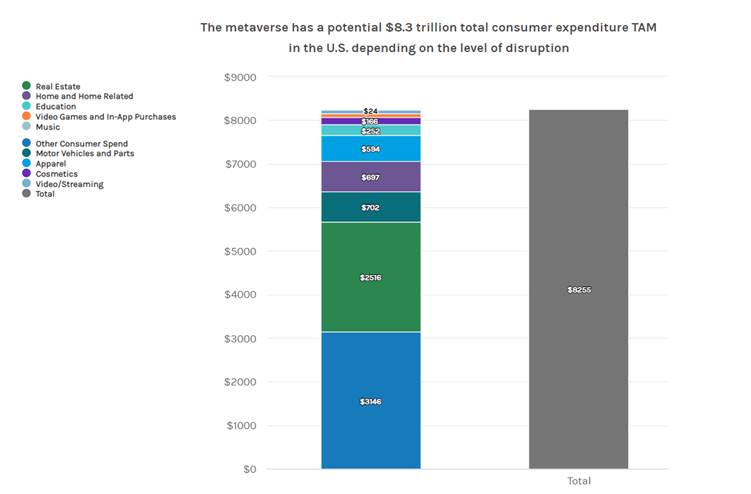

The world's most recognised investment banks have already scoped out the total addressable market. Morgan Stanley sees Metaverse-related businesses combined creating an $8.3 trillion opportunity in the United States alone. Goldman Sachs sees an ultimate valuation of more than $12 trillion globally.

The pace of change may be even more rapid than that. Given that digital asset markets have grown from a $10 billion industry to one worth $2 trillion in less than 6 years, such predictions should not be quickly dismissed.

Key features

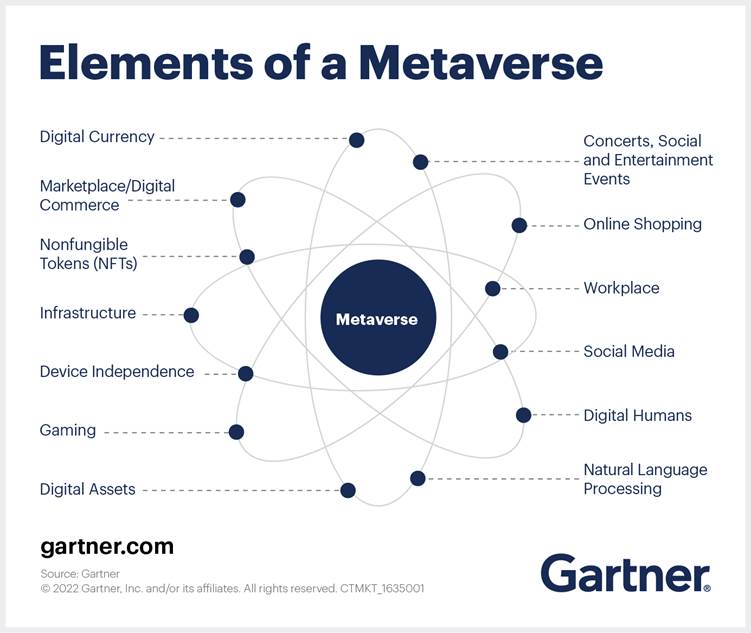

The key verticals involved in the Metaverse include cutting-edge technologies in online gaming, virtual reality, 3D graphics engines, high-speed wireless communications, video streaming and more, but ultimately Metaverse development is likely to affect almost every industry in the future and stretch far beyond its first major application in gaming.

Morgan Stanley senior internet analyst Brian Nowak writes:

While the market is still debating how long the metaverse will take to develop and what it will feature, we think the metaverse is most likely going to be a next-generation social media, streaming, gaming and shopping platform. In some ways we already live in a metaverse, as shown by the 11 billion days per year spent by daily active users in the US consuming digital media...that time could move to the metaverse.

Other predictions from Morgan Stanley are that the Metaverse market could extend as far as enterprise applications for real estate, automotive and education sectors, alongside consumer verticals in video streaming, music and gaming.

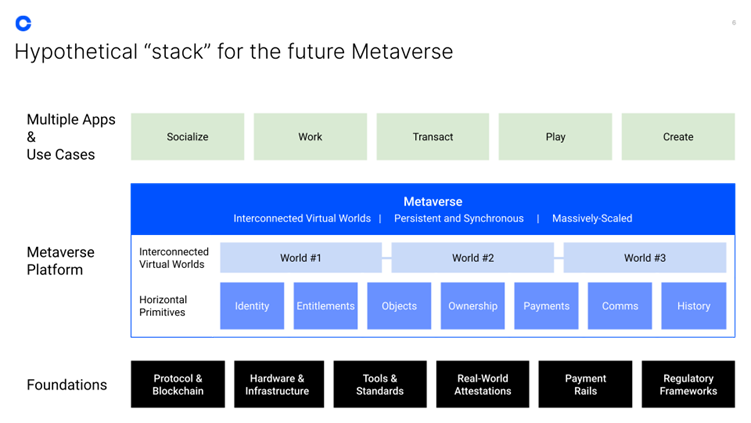

As digital asset exchange Coinbase (NASDAQ:COIN) noted in its own investigation: the hypothetical tech stack of the Metaverse will include persistent, synchronous and mass-scale virtual worlds upon which user will have the ability to socialise, work, transact and create.

VR/AR/MR

One of the cornerstones of the Metaverse is VR (virtual reality) and its associated technologies AR (augmented reality) and MR (mixed reality). The terminology has not yet been rigorously defined, but the key concepts are that VR immerses people in 3D virtual environments, while AR/XR/MR takes computer-generated images and overlays them on our view of the world.

Nintendo (TYO:7974) produced the first globally successful mass-market mobile gaming application of AR/XR with 2016's Pokemon Go. Using GPS-enabled mobile phones, players located, captured, and battled with virtual creatures. So immersive was the experience that huge crowds of players formed in the locations where these digital monsters appeared, for example in Taipei where thousands of gamers descended on a particular street where a 'rare' Pokemon was located. This cultural phenomenon peaked at 233 million players in 2016 and while users now sit around 150 million, the game still generated its highest ever revenue of $1.2bn in 2020.

Microsoft (NASDAQ:MSFT) moved into enterprise MR with its Hololens project in 2015. More recently its January 2022 all-cash $68.7bn deal to buy gaming company Activision Blizzard was to "accelerate the growth in Microsoft's gaming business and [to] provide building blocks for the metaverse."

Apple (NASDAQ:AAPL) is reportedly seeking to launch an enterprise-focused mixed-reality headset as soon as the end of Q2 2022, featuring dual 8K displays and more than a dozen motion-tracking sensors.

Meta Platforms (NASDAQ:FB) is undoubtedly the market leader in retail VR. By April 2021, its Oculus Quest 2 VR headset passed the milestone of selling more total units than all other Oculus headsets combined. Speaking to Bloomberg, the VP of Reality Labs Andrew Bosworth said the sales were

a tremendous indicator that we are now at that point where we have broken through from the early adopter crowd to an increasingly mainstream crowd.

As the New York Times reported in January 2022:

Of the more than 3,000 open jobs listed on Meta's website, more than 24% are for roles in augmented or virtual reality. One job listed for a 'gameplay engineering manager' for Horizon, the company's free virtual reality game, said the candidate's responsibilities would include imagining new ways to experience concerts and conventions.

With the mapping ability of Google Earth extending from the deserts of the Kalahari to the mountains of Bali, VR users today can visit almost every location on the planet in 3D from the comfort of their sofa. Both this, and the freedom of movement constraints imposed by the Covid pandemic have opened the door to a very large potential market opportunity.

Why sell just 3,000 physical seats to a live concert or sporting event when the same 3D audio and visual experience can be ported to VR and sold to 300,000? Or 3 million?

On the enterprise side of the AR market, leaders are likely to include companies such as PTC Inc (NASDAQ:PTC), which focuses on industrial workforces collaborating remotely.

Roblox, Snap, Meta to lead

Meta, along with Roblox (NYSE:RBLX) and Snap (NYSE:SNAP) will be the early winners of the retail Metaverse economy, according to Goldman Sachs.

Snap is at the forefront (and an emerging industry leader) with respect to the rise of augmented reality, as management has prioritized investments in the development and adoption of AR technologies/use cases, their late-2021 report reads.

Snap has 200,000 Lens creators and developers with use cases spanning taking spatial measurements, new forms of storytelling for entertainment and shopping (for example trying on shoes in AR and purchasing directly).

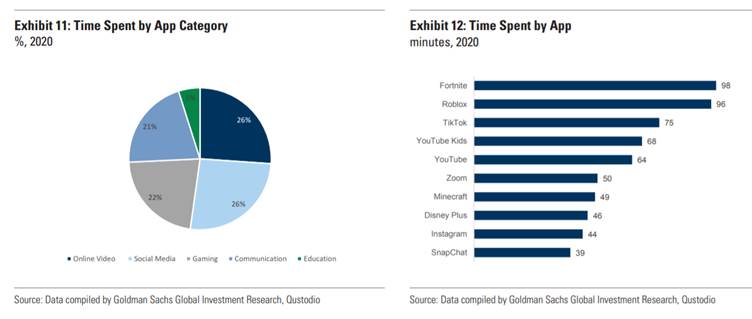

Epic Games' Fortnite and Roblox lead social gaming metrics, with users spending on average more than an hour and a half on each multiplayer open-world game in 2020, "signalling the value the younger generation place on social elements and virtual worlds within gaming".

As one of the world's most popular gaming platforms, Roblox also benefits from its large creator economy with over 50 million daily active users and 200 million monthly active users, Goldman notes. Roblox monetises its user base through the sale of its virtual currency, Robux, which can be used to enhance game experiences, customise a players avatar, or acquire development resources. The platform includes content developed by individuals alongside film and TV studios like Warner Bros and Netflix, game studios and external music artists.

NFTs: Cross-platform digital scarcity

Non-fungible tokens (NFTs) are undoubtedly one of the first mainstream mass-market applications of blockchain technology, and the picture has shifted from profile pictures of apes and cats into digital artwork and beyond. ETC Group research shows NFT sales growth jumped 15,000% between 2020 and 2021.

So while traditionally-minded businesses from Samsung (KRX:005930) to PWC's Hong Kong arm are each buying up NFT land and opening stores in metaverse-focused blockchain projects, it is no wonder that Gucci, Burberry (LSE:BRBY), Gap (NYSE:GPS), Nike (NYSE:NKE) — with its December 2021 buyout of NFT fashion and collectibles startup RTFKT — and any major multinational fashion brand investors care to name have spotted an opportunity in creating and selling exclusive digital goods.

This growing trend proves that digital scarcity programmatically controlled by code, as with Bitcoin and NFTs, are just as desirable as physical scarcity, whether by price or by the availability of raw materials. To dismiss the opportunity out of hand is to dismiss a fundamental part of human nature: people want to own things that others can't.

Some exclusive digital products have even sold for higher prices than their physical counterparts. In June 2021 a Gucci 'Queen Bee Dionysus' bag listed on the Roblox marketplace reached $4,115, 21% more than the cost of a physical bag at $3,400.

Regulation

Potential regulation of the metaverse is at an early stage but could encompass everything from personal digital identity to payments and video streaming to property rights.

Meta has already rowed back its attempts to control the digital currency of the metaverse after hitting regulatory barriers. Its 2019-introduced Libra project, later renamed to Diem, was shelved in February 2022 and its assets sold to Silvergate Bank.

And as Osborne Clarke partner Felix Hilgert cites:

Where a metaverse includes live content and streaming...providers may fall within the purview of media regulation with which game companies and social networks have not traditionally been concerned.

Core regulation in this field includes the EU Audiovisual Media Services Directive (AVMSD), and online streams may require licences depending on which country's participants view them.

On 8 February 2022 the European Union head of antitrust, Margrethe Vestager, said that officials in the EU should learn more about the metaverse before seeking to impose regulations. As quoted by Reuters, the European Commissioner for Competition explained that the metaverse was here already, adding:

Of course we start analysing what will be the role for a regulator, what is the role for our legislature. That move has in turn triggered concerns about possible dominance [of Meta Platforms]. Everything we do must be fact-based...we need to understand it before we can decide what actions would be appropriate.

Outlook

It may seem today that the dominance of the internet was a foregone conclusion. After all, everything from our phones to our watches and even new washing machines are smart, WiFi-enabled, and interconnected. But at least five years after the TCP/IP protocol that allowed computers on the same network to share data was created, it remained a niche invention popular only with researchers and academics.

By the same token, what consists of investing in the 'metaverse' may change quite radically over the next decade. Cutting-edge and misunderstood technologies may become mainstream, billion-dollar industries, just as with cryptographically-secure blockchain-powered NFTs.

And while fictional visions of the Metaverse may take decades to become reality, the elements that power such a future are already here: where working, shopping and social media shifts from behind a phone or laptop screen into a VR/MR space, where users actually own their customisable digital identity through NFTs, can port them from one currently siloed part of the net to another, and pay for goods using digital assets.

The conclusion? The smart money believes that a multi-trillion dollar investment opportunity is ahead.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

About ETC Group

ETC Group has been created to provide investors with the tools to access the investment opportunities of the digital assets' and blockchain ecosystem. The company develops innovative digital asset-backed securities including ETC Group Physical Bitcoin (BTCE) and ETC Group Physical Ethereum (ZETH) which are listed on European exchanges including XETRA, Euronext, SIX, AQUIS UK and Wiener Börse.

With a track record of over three years, ETC Group is made up of an exceptional team of financial services professionals and entrepreneurs with experience spanning both digital assets and regulated markets. With product quality and safety at the core of our product creation approach, the company aims to continuously launch best-in-class institutional-grade exchange traded products.

As a company, ETC Group has previously launched BTCE - the world’s first centrally cleared Bitcoin exchange traded product on Deutsche Börse XETRA, the largest ETF trading venue in Europe, and also listed DA20, the world’s first crypto ETP tracking an MSCI index signalling a move towards investment management products. DA20 provides broad market exposure to investors by tracking an index of 20 cryptocurrencies which cover 85% of the total crypto market capitalisation.