- Performance: January saw Bitcoin emerge as a key outperformer amid Trump’s inauguration and a shifting U.S. regulatory landscape favouring digital assets, including discussions around a Strategic Bitcoin Reserve. While macroeconomic uncertainty, rising tariffs, and equity market volatility pressured risk assets, Bitcoin’s strong on-chain fundamentals and historically low sentiment suggest an increasingly favourable risk-reward setup.

- Macro: Bitcoin and cryptoassets remain vulnerable to macroeconomic risks, as correlations with US equities stay elevated amid tightening financial conditions and shifting global growth expectations. While bearish sentiment in crypto markets suggests some downside may already be priced in, ongoing monetary policy uncertainty and potential inflation shocks pose continued risks in the near term.

- On-Chain: Despite macroeconomic headwinds, strong on-chain dynamics continue to support Bitcoin, with a deepening supply shortage driven by U.S. spot Bitcoin ETF inflows, corporate treasury adoption, and increasing miner holdings. The ongoing accumulation and post-Halving supply shock are likely to provide a sustained tailwind for Bitcoin, helping to mitigate downside risks in the near term.

Chart of the Month

Performance

The performance in January was mostly dominated by Trump's inauguration as the 47 th president of the United States and a more favourable regulatory environment for cryptoassets in the US.

In fact, immediately after the inauguration, Trump signed the executive order called “Strengthening American Leadership in Digital Financial Technology”.

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance. This group will design a federal regulatory framework for digital assets, including stablecoins, and explore the possibility of creating a national digital asset reserve.

Chaired by the White House AI & Crypto Czar, David Sacks, the group includes key officials such as the Treasury Secretary and the SEC Chairman. The AI & Crypto Czar will work alongside leading experts in digital assets and markets to incorporate external insights into the group's initiatives.

Federal departments and agencies are directed to review existing regulations and policies related to digital assets, identifying those that should be revised or repealed, and submit their recommendations to the Working Group.

Additionally, the order prohibits agencies from taking any steps toward the development, issuance, or promotion of central bank digital currencies (CBDCs). It also overturns the previous administration's Digital Assets Executive Order and the Treasury's framework for international digital asset engagement, which were seen as obstacles to innovation and U.S. global competitiveness in digital finance.

The move to establish a national digital asset stockpile is viewed as a step toward potentially creating a Strategic Bitcoin Reserve.

Nonetheless, all these positive industry-specific developments have been overshadowed by increasing macro woes more recently.

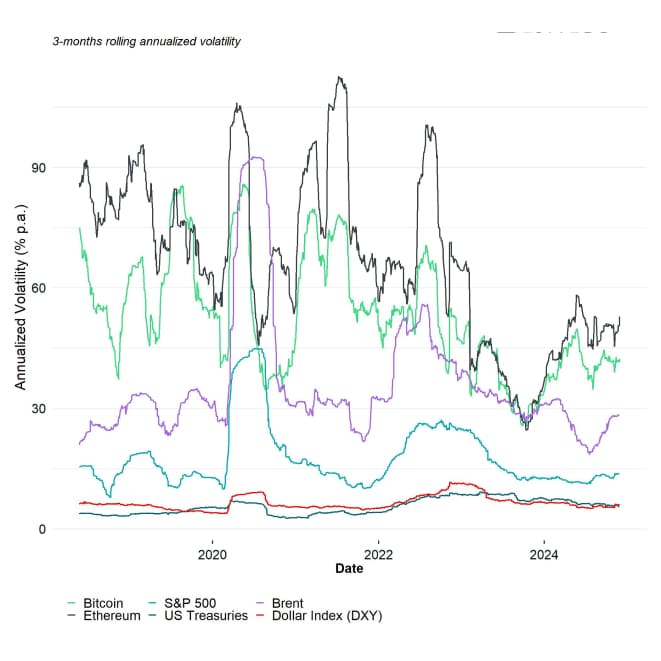

On the one hand, the recent Deepseek AI controversy has introduced short-term volatility in U.S. equities and also impacted cryptoassets. Indices such as the S&P 500 have become increasingly concentrated in a few large-cap stocks, like Nvidia, which have driven market performance in recent months. Some of the Mag7 stocks appear susceptible to declines due to their relatively high valuations.

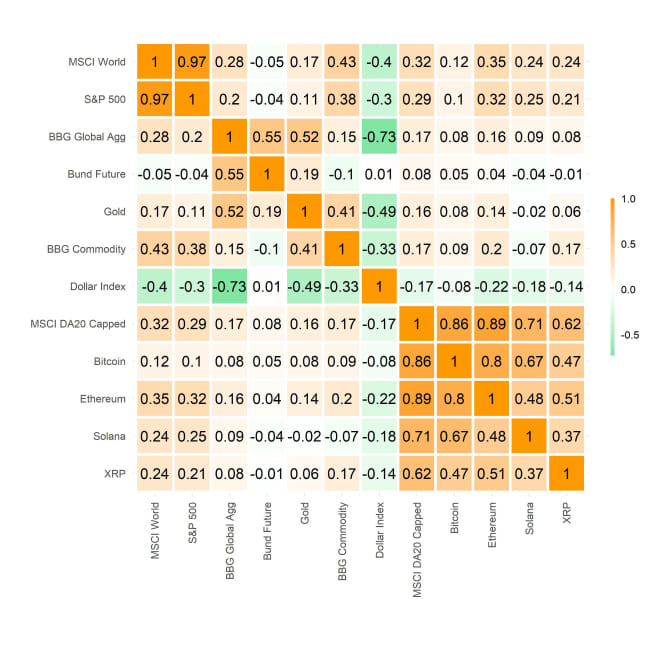

A key concern is the strong correlation between major cryptoassets like Bitcoin and Ethereum and U.S. equities, which has remained above 0.5 over the past three months. This means that any downturn in traditional stock markets could also ripple through the crypto market.

Moreover, the sudden increase in import tariff rates on Chinese, Canadian, and Mexican imports into the US has increased geopolitical and economic uncertainty due to continued Dollar strength which has weighed on Bitcoin and cyptoassets as well.

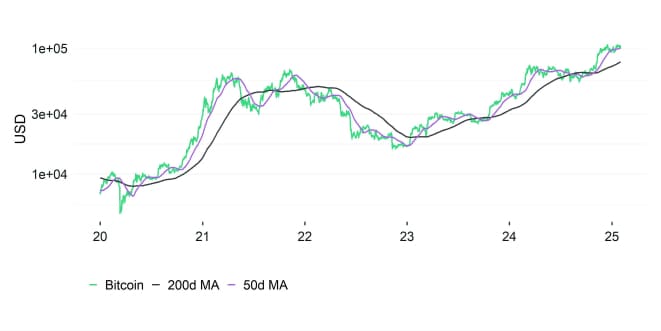

Although there are clear negative performance effects exerted by the increased economic uncertainty, we think that, due to the ongoing support by on-chain fundamentals and the fact that Cryptoasset Sentiment is already relatively bearish, the latest tariff-related market ructions could create some very attractive opportunities to increase exposure in Bitcoin and cryptoassets as highlighted here.

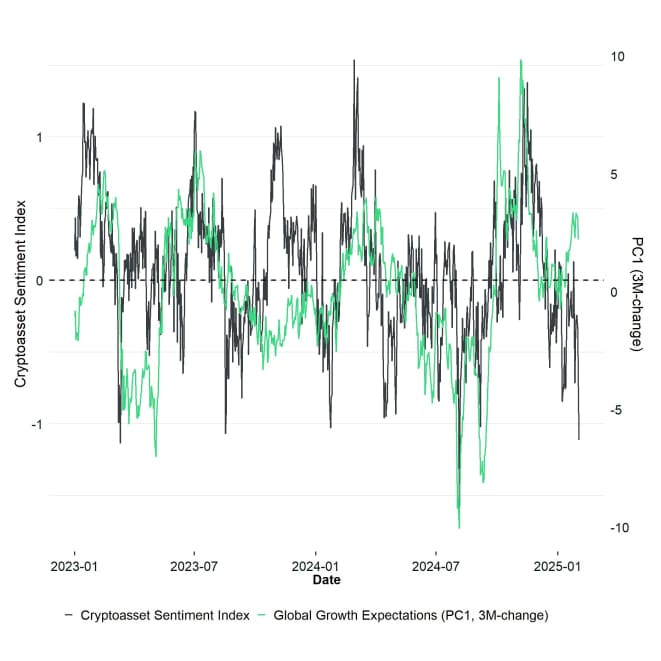

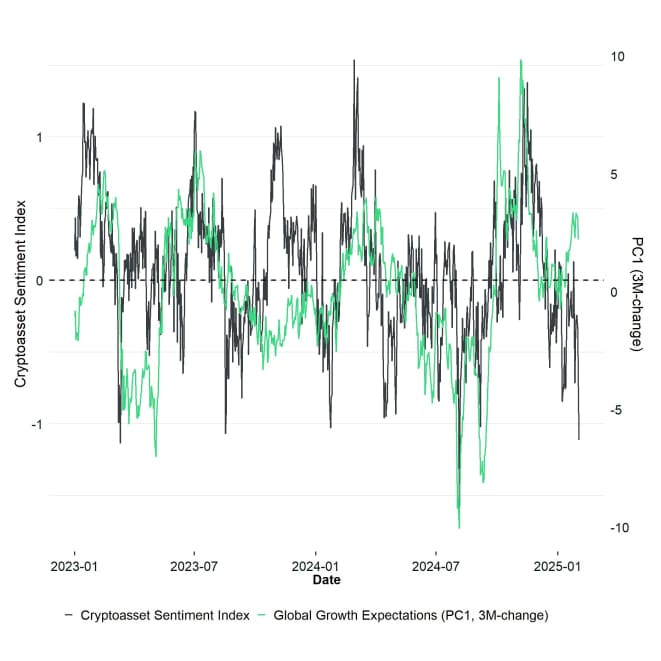

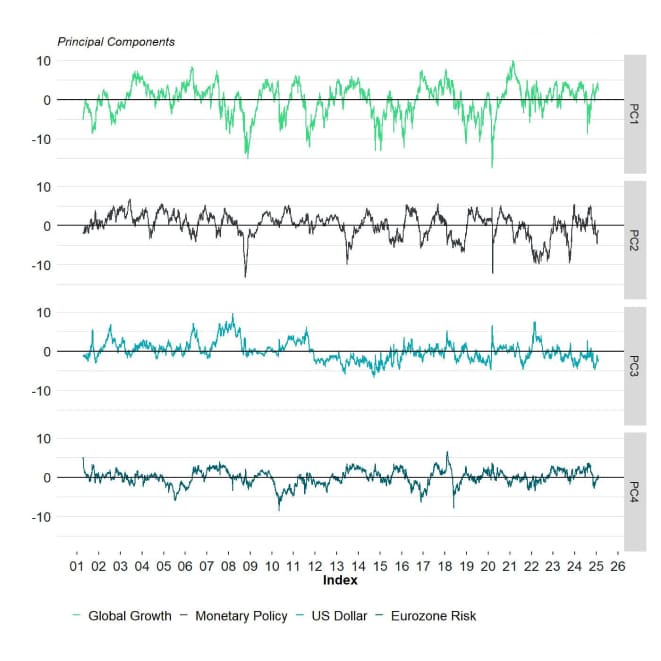

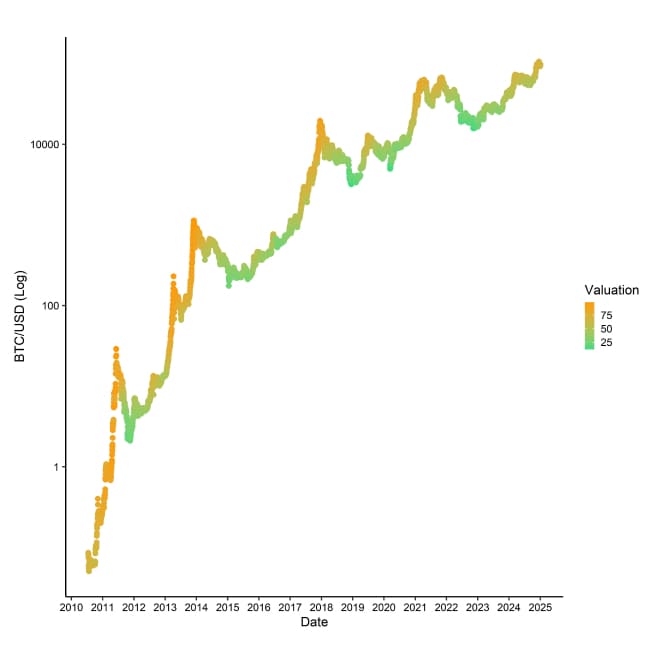

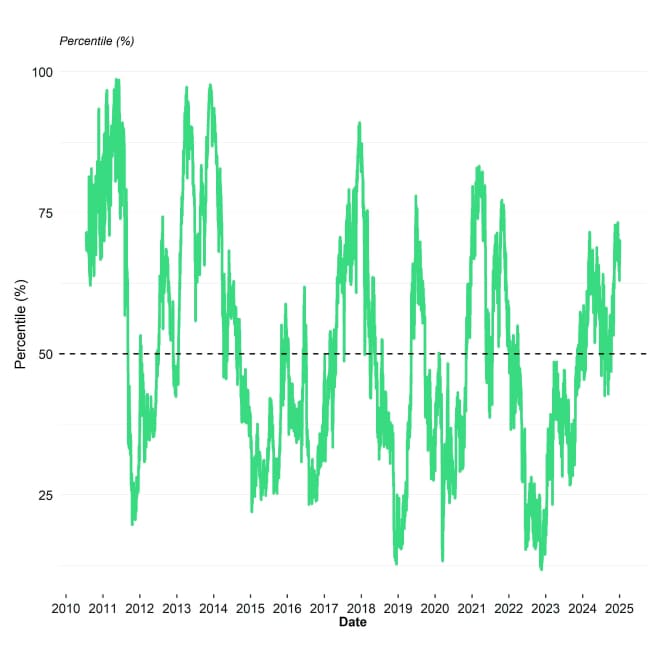

It looks as if crypto markets are already discounting a significant amount of global growth worries as highlighted by our Chart-of-the-Month.

In fact, our Cryptoasset Sentiment Index has already fallen to the lowest level since August 2024 signalling an increasing asymmetry in the risk-reward ratio for Bitcoin.

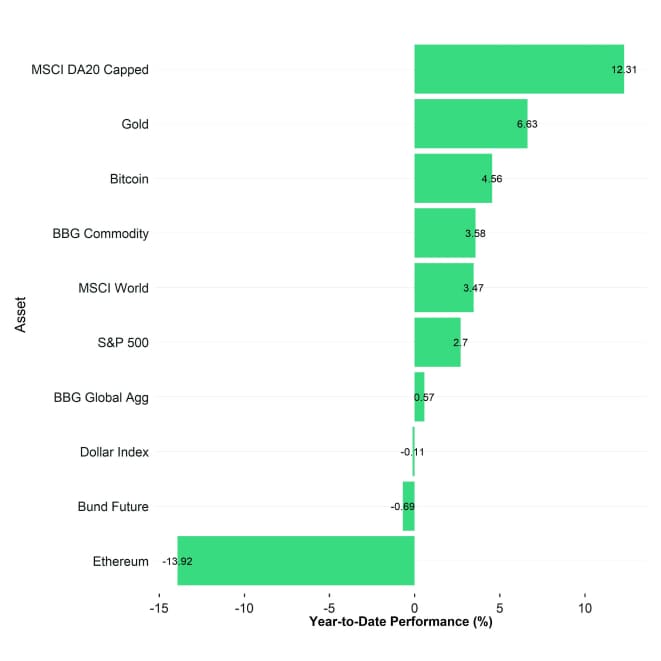

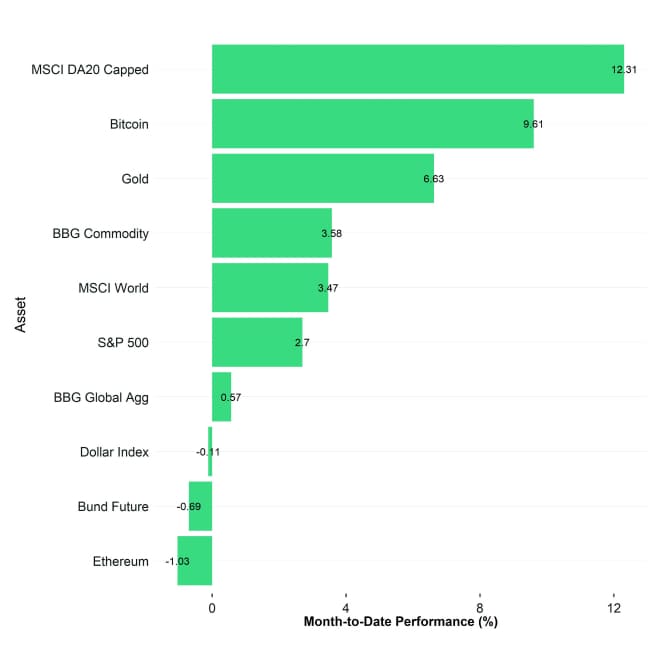

A closer look at our product performances also reveals Bitcoin continued to be one of the major outperformers although major cryptoassets like Solana and XRP also managed to generate high returns in January.

Please note that we have recently completed the full transitioning from ETC Group product names to Bitwise following the recent acquisition.

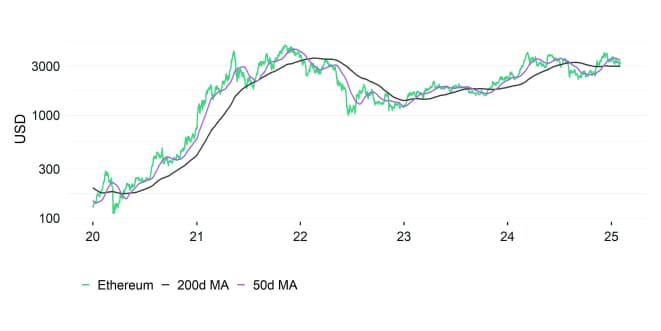

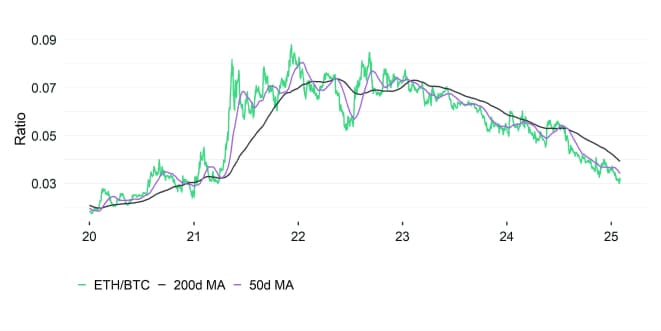

A point that is worth highlighting in January is that Ethereum continued to underperform Bitcoin significantly which is most-likely due to an increasing focus on Bitcoin in the discussion around the Strategic Reserve in the US but also due to an increasing tension within the Ethereum community and the vision propagated by its founder Vitalik Buterin.

We will publish a separate more detailed analysis on the relative performance of ETH vis-à-vis BTC this week.

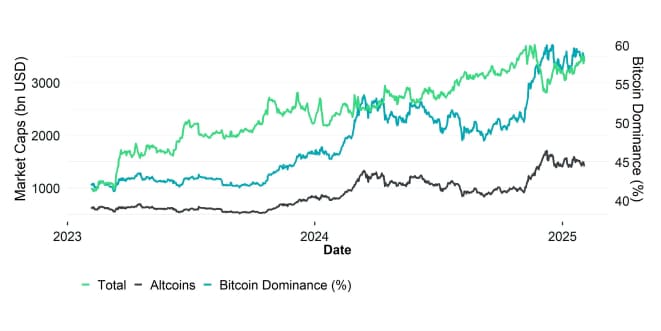

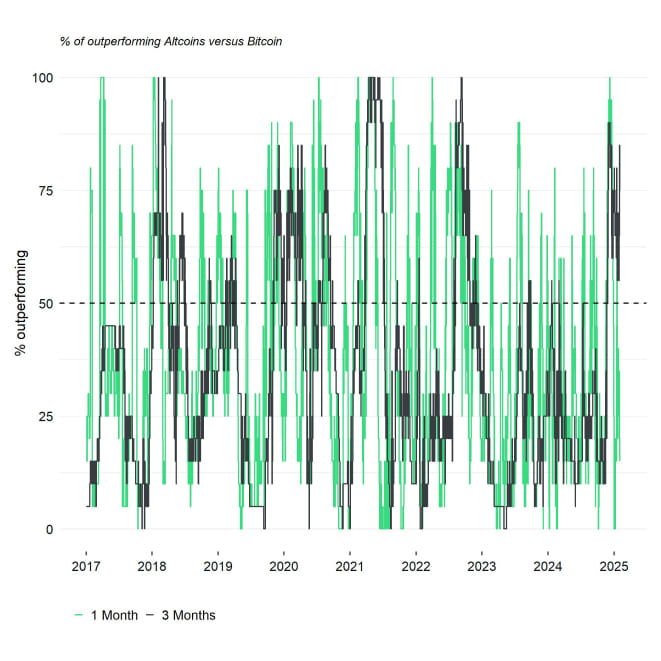

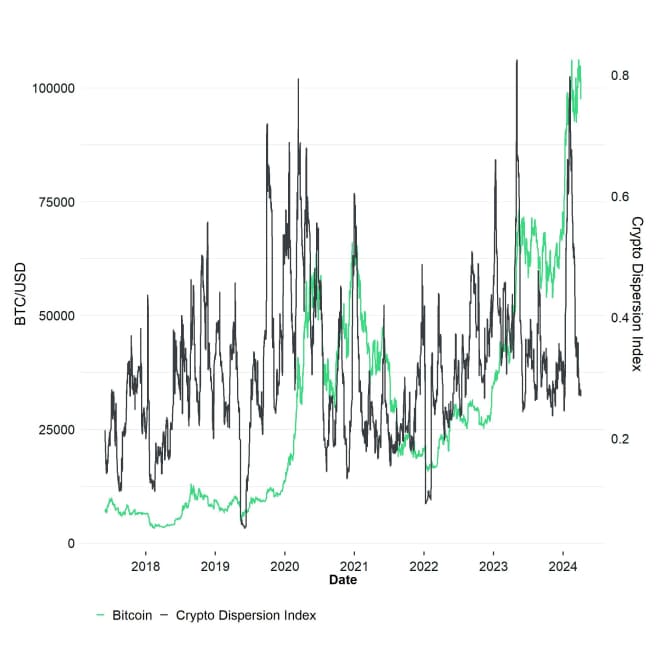

Our Altseason Index implies that altcoin outperformance has been relatively weak and our Crypto Dispersion Index also implies that correlation between altcoins and Bitcoin have increased significantly as the market is increasingly being dominated by macro-related drivers.

Bottom Line: January saw Bitcoin emerge as a key outperformer amid Trump's inauguration and a shifting U.S. regulatory landscape favouring digital assets, including discussions around a Strategic Bitcoin Reserve. While macroeconomic uncertainty, rising tariffs, and equity market volatility pressured risk assets, Bitcoin's strong on-chain fundamentals and historically low sentiment suggest an increasingly favourable risk-reward setup.

Macro Environment

Although on-chain drivers remain supportive, the macro environment continues to be more challenging for Bitcoin and cryptoassets. A key focus in January was the Deepseek saga that put US semiconductor stocks like Nvidia and major software companies like Microsoft under immense pressure.

The catalyst was the release of the Chinese Deepseek AI software that showed better performance results than OpenAI's ChatGPT and with significantly lower costs. Traditional financial markets started questioning the efficiency of major AI projects such as Stargate with estimated investments of up to 500 bn USD after it was revealed that Deepseek was able to develop its latest AI model with only 6 mn USD in a “side project”.

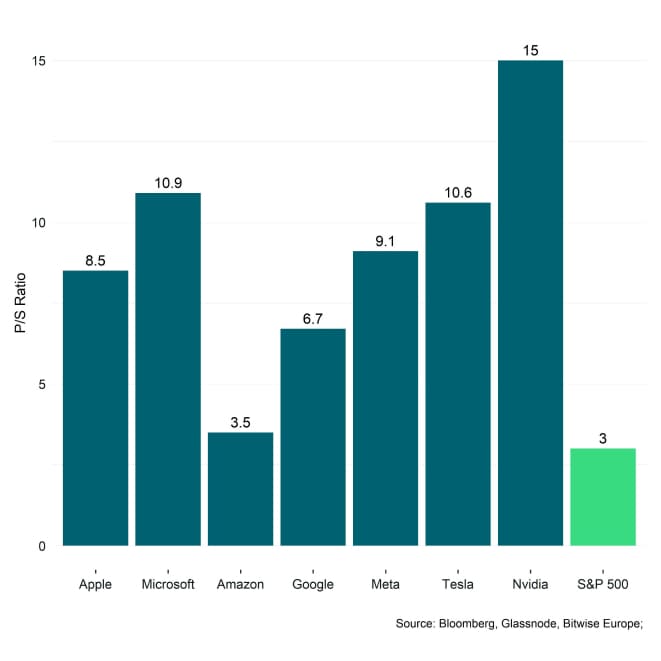

High valuations of major companies like Nvidia make US equities are more vulnerable to unforeseen shocks and tighter monetary policy. In particular, Nvidia still sports a price-to-sales ratio of 15 after the latest correction compared to an average price-to-sales ratio of 3 for the S&P 500.

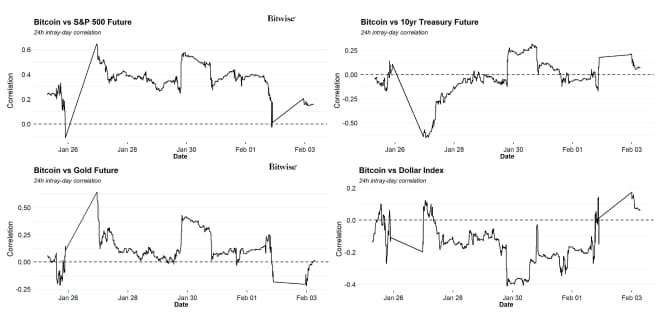

The issue for Bitcoin and other cryptoassets: Correlations between major cryptoassets and US equities remain relatively high which is what we have also identified in last month's report already.

Intra-day correlations between Bitcoin and S&P 500 futures also remained somewhat elevated after the latest correction.

From a pure macro perspective, this implies that cryptoassets still remain somewhat at risk if US equities continue to reprice to the downside in the short term.

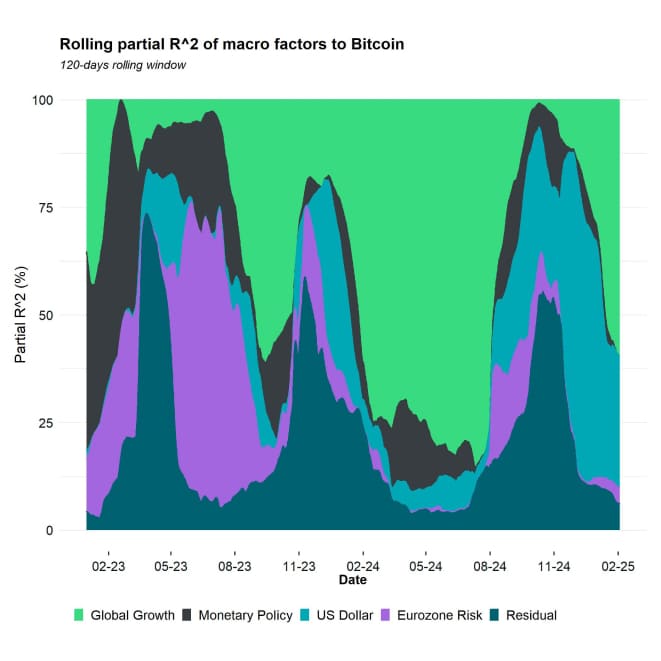

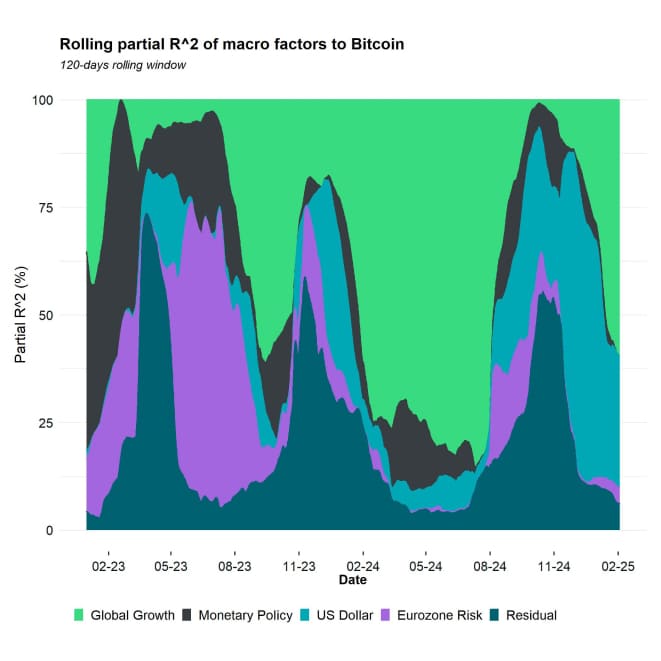

From a quantitative perspective, Bitcoin's performance appears to be increasingly dominated by changes in global growth expectations.

More specifically, more than half of Bitcoin's performance was explained by changes in global growth expectations over the past 6 months.

In general, changes in global growth expectations tend to be associated with the general degree of cross asset risk appetite which is why Bitcoin appears to be a “risk-on/risk-off trade” at the moment judging by this analysis.

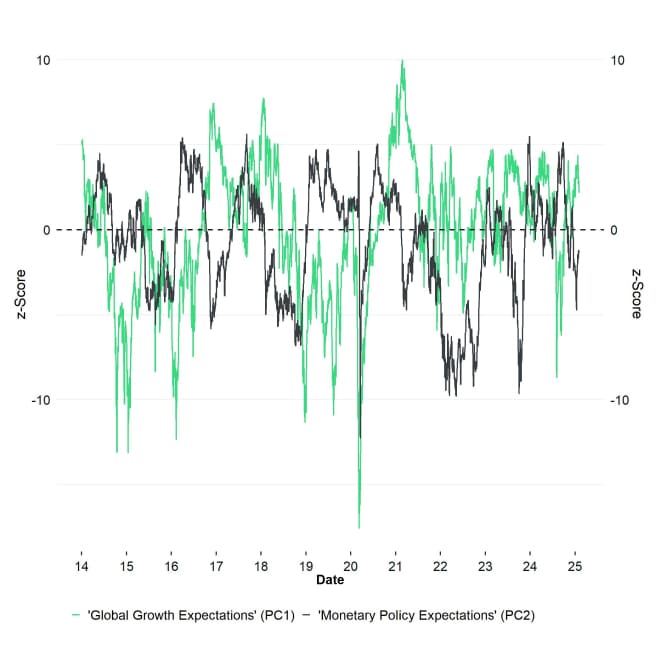

Monetary policy expectations and US financial conditions generally tend to lead market-based changes in global growth expectations and the latest deterioration in monetary policy expectations still represents a risk for still benign global growth expectations.

In this context, the Fed has left its key target rate unchanged during its latest FOMC Meeting on the 29 th of January. This represents the first pause after 3 consecutive rate cuts that the Fed performed since it commenced its rate cutting cycle in September 2024.

Although the move was largely anticipated by financial markets it increases the uncertainty of further rate cuts and possibly opens the door for rate hikes if inflation rates start to reaccelerate over the coming months.

In fact, inflation risks could be exacerbated by further tariff announcements from the Trump administration over the coming months. In a recent statement on the social media platform Truth Social, Trump has threatened to impose 100% import tariffs on BRICS nations that plan to undermine the US Dollar. The Trump administration has just recently imposed higher import tariffs of 25% on both Canadian and Mexican imports into the US in order to pressure these nations to curb illegal immigration into the US. Further tariffs on Chinese and EU imports are also expected.

This is bound to increase domestic import price inflation in the US significantly, since both Canada and Mexico already account for around 27% of trade with the US. This implies that import prices in the US will probably increase by 6.75%-points in February alone due to these tariffs.

This has significant macro implications:

A re-acceleration of US inflation decreases the odds of further rate cuts by the Fed, as policymakers may be forced to maintain or even tighten monetary policy to curb rising prices. This, in turn, jeopardizes financial markets and the US housing sector, as prolonged higher interest rates increase borrowing costs, tighten financial conditions, and dampen economic activity.

Meanwhile, ECB has cut its key interest rate for the fourth time at its latest policy meeting since it commenced its rate cutting cycle in June 2024.

The divergence in monetary policies between the ECB and the Fed is also fuelling continued EUR weakness / Dollar strength which also tends to be a headwind for Bitcoin and cryptoassets. The reason is that Dollar appreciations tend to be contractionary for global money supply as demonstrated in our report in December 2024.

In addition, the recent rise in tariff-related geopolitical and economic uncertainty is also fuelling additional Dollar strength. On that note, global money supply continues to contract due to the strength of the US Dollar which tends to be net headwind for Bitcoin.

In general, Bitcoin tends to thrive in a macro environment where monetary policy and financial conditions are loose, the Dollar weakens, and global money supply growth accelerates.

Therefore, the ongoing tightening in monetary policy and financial conditions continues to be a macro risk for Bitcoin in the near term, especially if they affect global growth expectations negatively.

It is no surprise that changes in global growth expectations and Cryptoasset Sentiment are relatively correlated.

This is also implying that a potential repricing in global growth expectations to the downside could also affect Cryptoasset Sentiment negatively.

On the bright side, sentiment in crypto markets is already relatively bearish with crypto hedge funds and global crypto ETP flows already exhibiting a significant amount of de-risking.

Moreover, further downside in US equities due to tariff-related economic and geopolitical uncertainty could further fuel expectations for looser monetary policy down the road. In fact, we have already seen a significant decline in long-term Treasury yields due to these latest stock market ructions.

Bottom Line: Bitcoin and cryptoassets remain vulnerable to macroeconomic risks, as correlations with US equities stay elevated amid tightening financial conditions and shifting global growth expectations. While bearish sentiment in crypto markets suggests some downside may already be priced in, ongoing monetary policy uncertainty and potential inflation shocks pose continued risks in the near term.

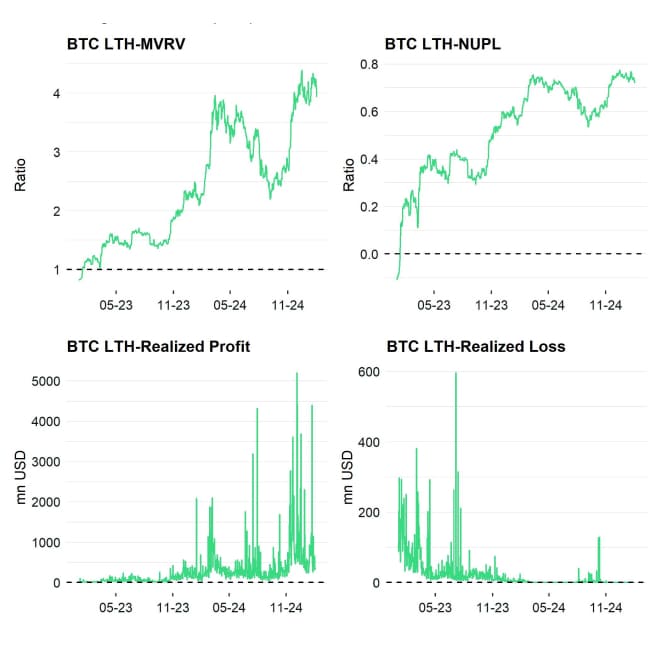

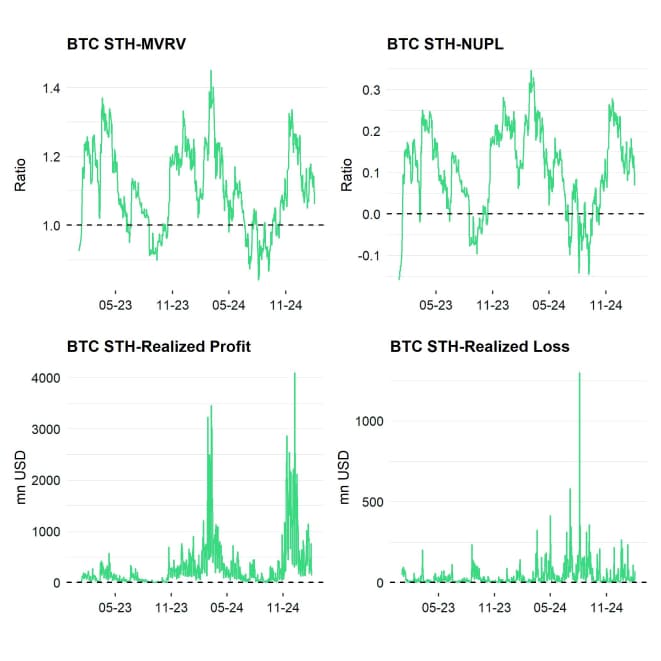

On-Chain Developments

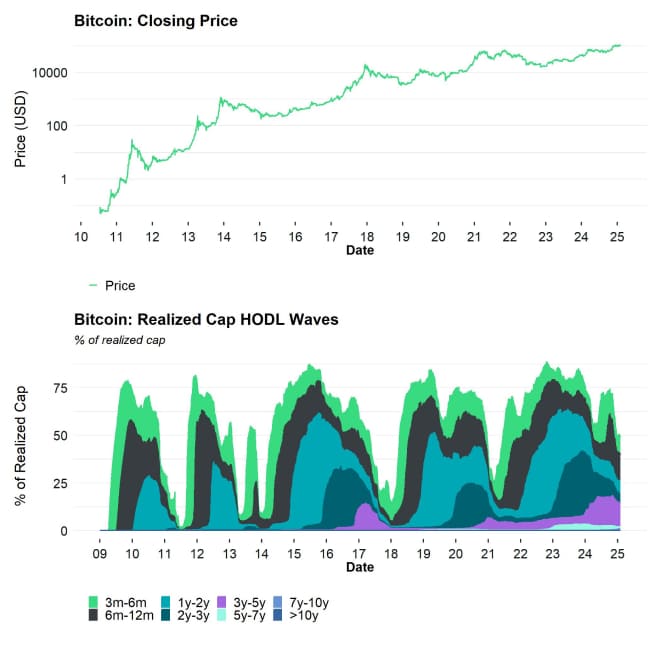

Although macroeconomic factors have recently become a net obstacle, on-chain dynamics have remained a strong driving force for Bitcoin.

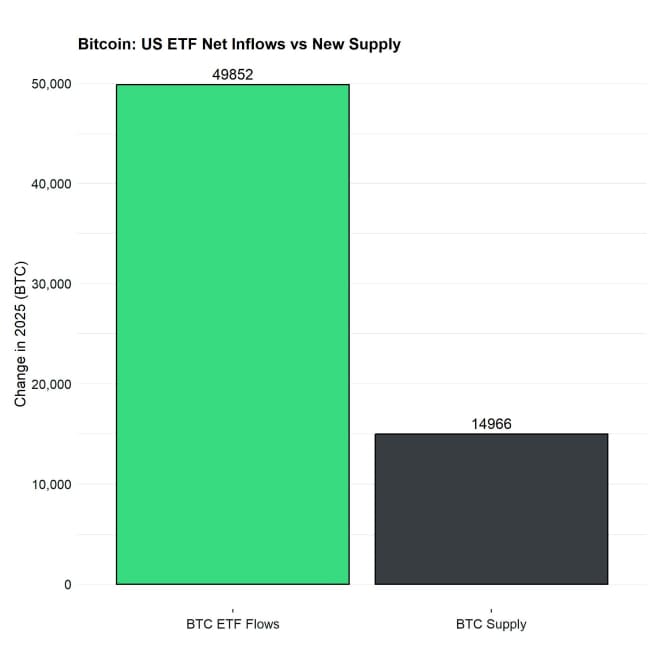

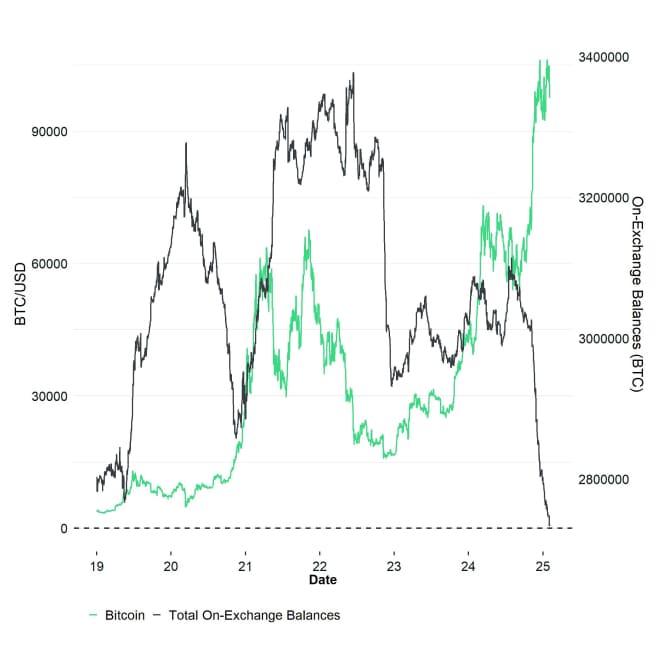

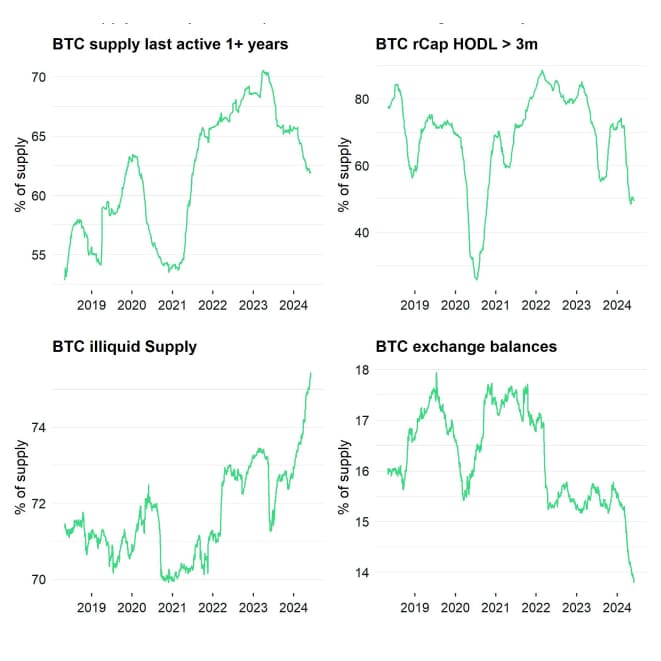

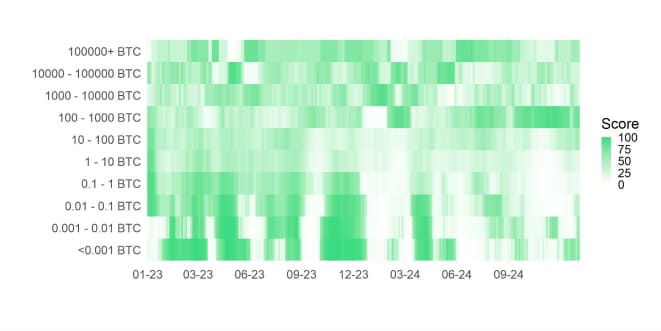

The supply shortage of BTC has deepened in January, as indicated by the ongoing decline in exchange balances and the reduction in liquid supply. This trend has been primarily fuelled by persistent demand from U.S. spot Bitcoin ETFs, as well as an increasing pace of Bitcoin adoption by corporate treasuries.

Just to put the acquisitions of these entities into perspective: US spot Bitcoin ETF inflows and corporate bitcoin purchases have outpaced the growth of new bitcoin supply by a factor of 3.2 times and 2.2 times, respectively.

It is worth highlighting that these buyers are generally price-agnostic especially if the underlying motive is to establish a strategic buy-and-hold allocation or to establish a Bitcoin standard within the corporate treasury framework.

Thus, it is not surprising that exchange balances have continued to decline at a rapid pace, despite the recent market volatility. More specifically, at the time of writing this report, bitcoin on-exchange balances have already declined by -48k BTC in 2025 already, implying a continued demand overhang / supply deficit for bitcoins.

This development is exacerbated by the fact that Bitcoin miners have so far increased their aggregate BTC holdings in 2025, implying that they have started to withhold some of the newly-mined supply from the market.

Some market analysts have highlighted that the recent decline in exchange balances was mostly due to continued exchange withdrawals by ETFs to Coinbase institutional custody wallets. We think this is rather a positive sign, implying that US spot Bitcoin ETFs have created a pervasive demand overhang / supply deficit.

Since most of these net inflows generally constitute buy-and-hold flows, we also expect these exchange withdrawals to be relatively sticky.

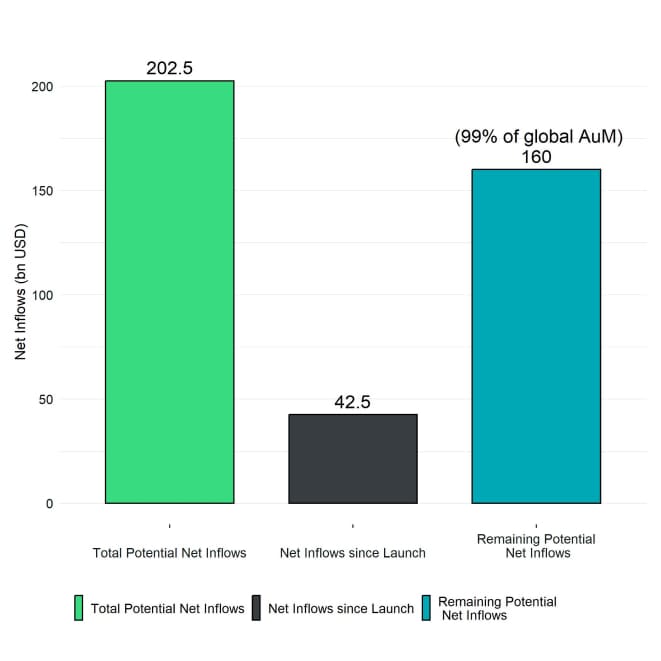

What is more is that net inflows into US spot Bitcoin ETFs are bound to stay relatively high as highlighted in our 2025 outlook report where we officially predicted net inflows into spot Bitcoin ETFs in 2025 to surpass 2024 levels.

Moreover, a recent survey by EY has indicated that 68% of asset managers are either holding Bitcoin ETPs already or want to add exposure to their portfolio in 2025. This implies that the potential for additional flows into US spot Bitcoin ETFs is far from being exhausted.

So, based on this rationale, it is quite likely that the current bitcoin supply deficit on exchanges will persist for the foreseeable future.

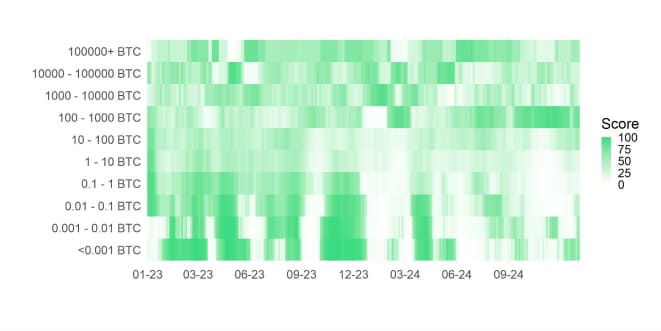

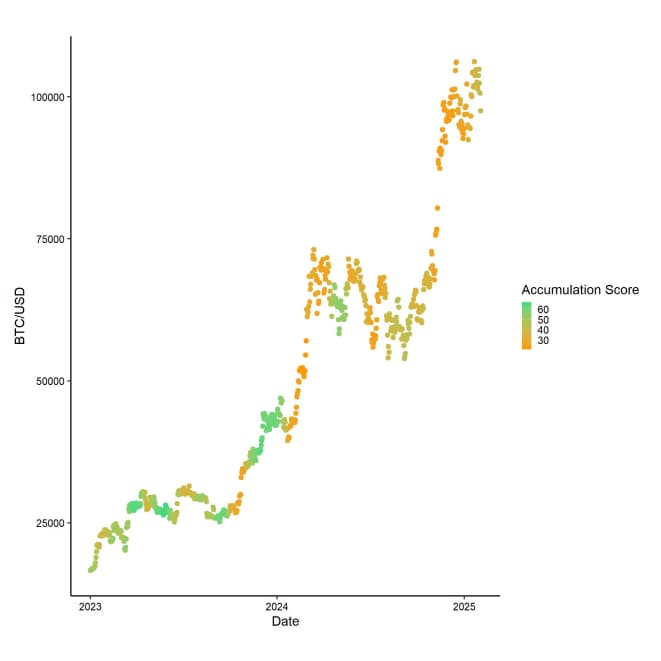

What is more is that accumulation activity has recently started to re-accelerate again in January, implying increasing buying interest at around 100k USD already. Accumulation activity has generally been contrarian – increasing when prices decreased, decreasing when prices increased.

This should provide a floor to further downside risks amid the latest macro developments as well.

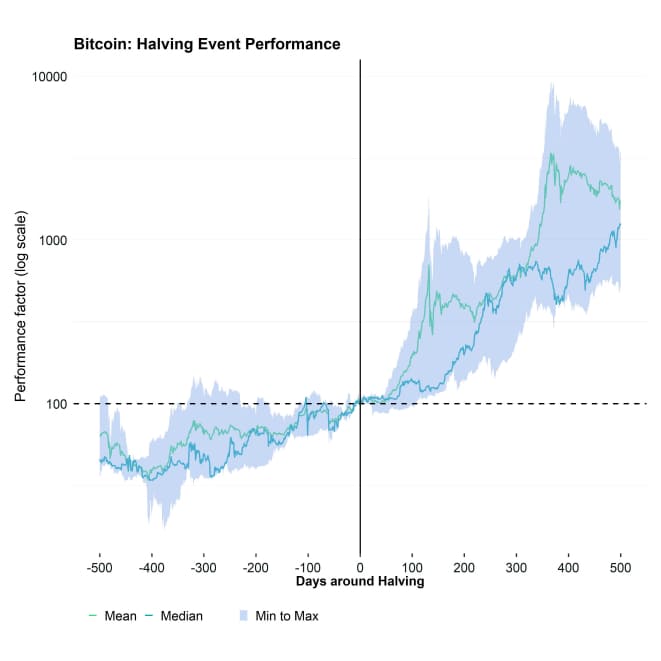

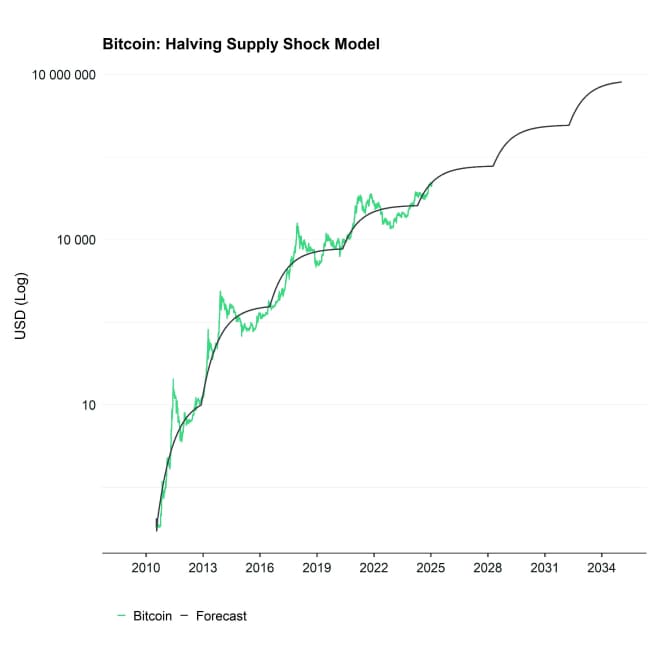

In general, we reiterate our expectation that the supply shock that originally emanated from the Halving in April 2024 should continue to provide an increasing tailwind, at least until mid-2025. This supply shock is currently exacerbated by the strong demand coming from spot Bitcoin ETFs as well as corporate treasuries.

Bottom Line: Despite macroeconomic headwinds, strong on-chain dynamics continue to support Bitcoin, with a deepening supply shortage driven by U.S. spot Bitcoin ETF inflows, corporate treasury adoption, and increasing miner holdings. The ongoing accumulation and post-Halving supply shock are likely to provide a sustained tailwind for Bitcoin, helping to mitigate downside risks in the near term.

Bottom Line

- Performance: January saw Bitcoin emerge as a key outperformer amid Trump’s inauguration and a shifting U.S. regulatory landscape favouring digital assets, including discussions around a Strategic Bitcoin Reserve. While macroeconomic uncertainty, rising tariffs, and equity market volatility pressured risk assets, Bitcoin’s strong on-chain fundamentals and historically low sentiment suggest an increasingly favourable risk-reward setup.

- Macro: Bitcoin and cryptoassets remain vulnerable to macroeconomic risks, as correlations with US equities stay elevated amid tightening financial conditions and shifting global growth expectations. While bearish sentiment in crypto markets suggests some downside may already be priced in, ongoing monetary policy uncertainty and potential inflation shocks pose continued risks in the near term.

- On-Chain: Despite macroeconomic headwinds, strong on-chain dynamics continue to support Bitcoin, with a deepening supply shortage driven by U.S. spot Bitcoin ETF inflows, corporate treasury adoption, and increasing miner holdings. The ongoing accumulation and post-Halving supply shock are likely to provide a sustained tailwind for Bitcoin, helping to mitigate downside risks in the near term.

Appendix

Cryptoasset Market Overview

Cryptoassets & Macroeconomy

Cryptoassets & Multiasset Portfolios

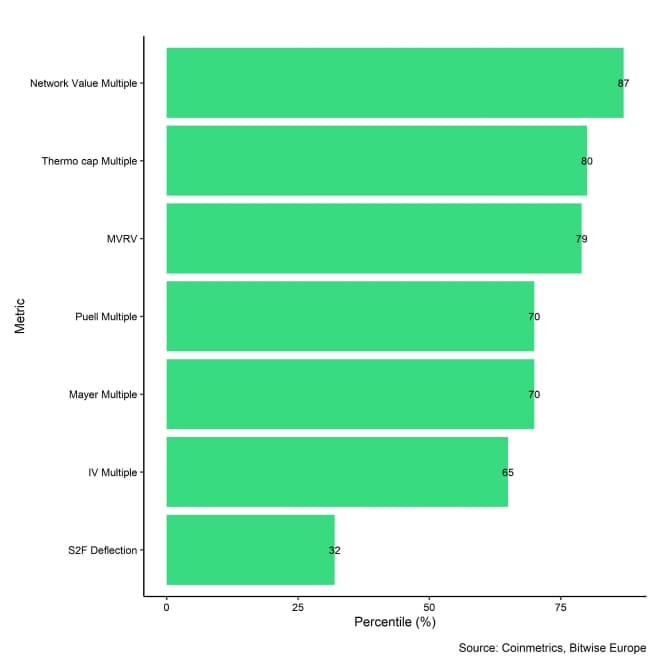

Cryptoasset Valuations

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De