1. Summary

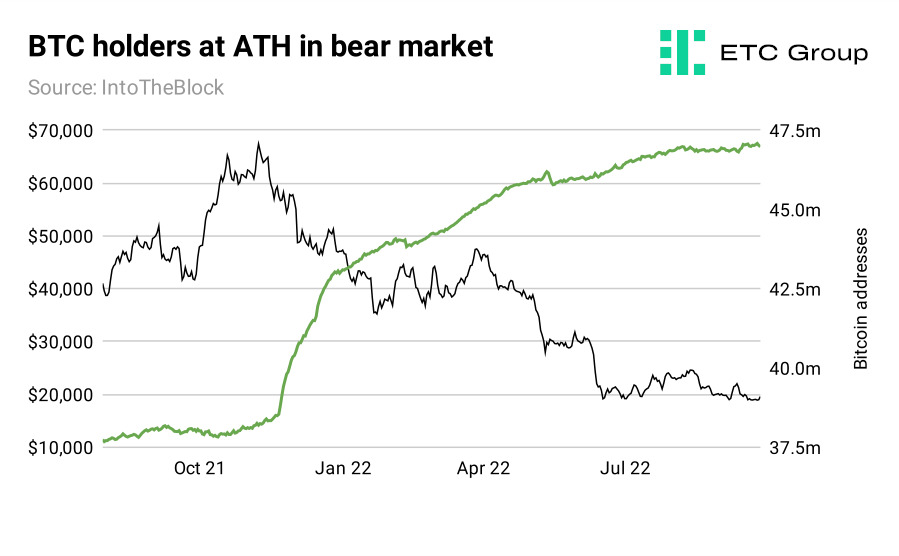

- BTC holders rise to 47 million all time high despite bear market

- Merge is just the start for Ethereum's global computer

- Crypto could be decoupling from equity markets

- No Fed Pivot but Bank of England forced to step in with £65bn QE

- Currency crises, macro worries set stage for Bitcoin as ultimate supply-capped asset

- Bond markets pricing in deflation/credit default risk over inflation

2. Overview

With investor sentiment largely leaning bearish in September 2022, the bright spots for the month were largely confined to success stories from smart contract blockchains. Notably, these were Solana; Avalanche; and of course Ethereum, whose Merge to Proof of Stake (PoS) went off without a hitch on 15 September. Despite fears of a high technical implementation risk, the long-awaited and long-overdue overhaul of the second-largest blockchain went incredibly smoothly. A Proof of Work (PoW) fork of Ethereum also launched, with ZETH Ethereum ETP holders receiving a 1:1 allocation of the new ZETW Ethereum ETP into their accounts for free.

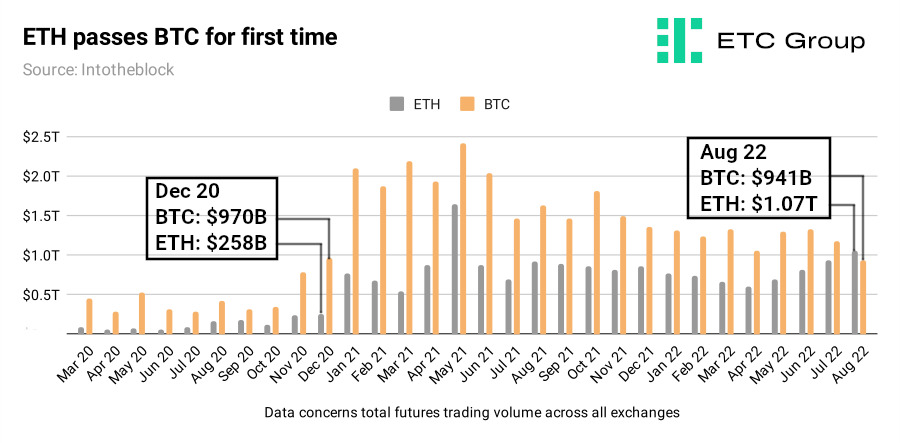

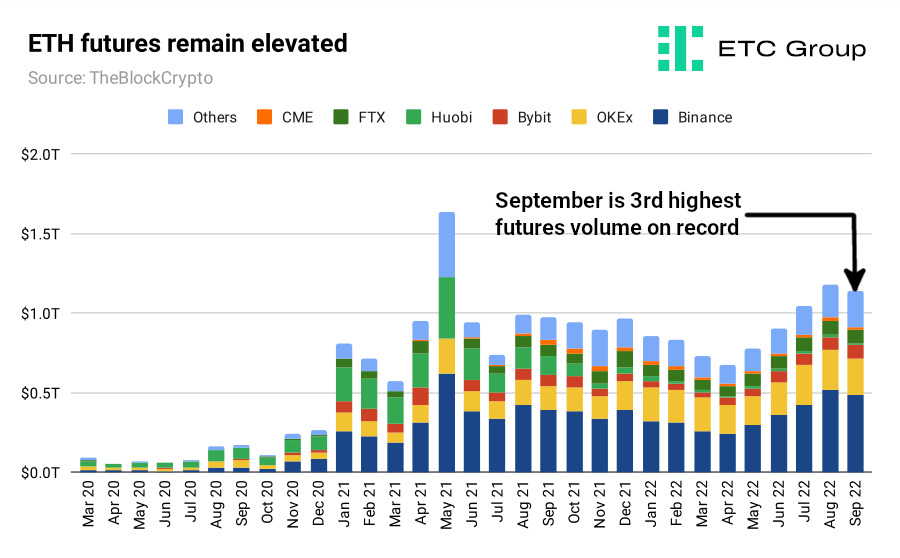

In the run up to the Merge, ETH futures volume outpaced BTC for the first time in history.

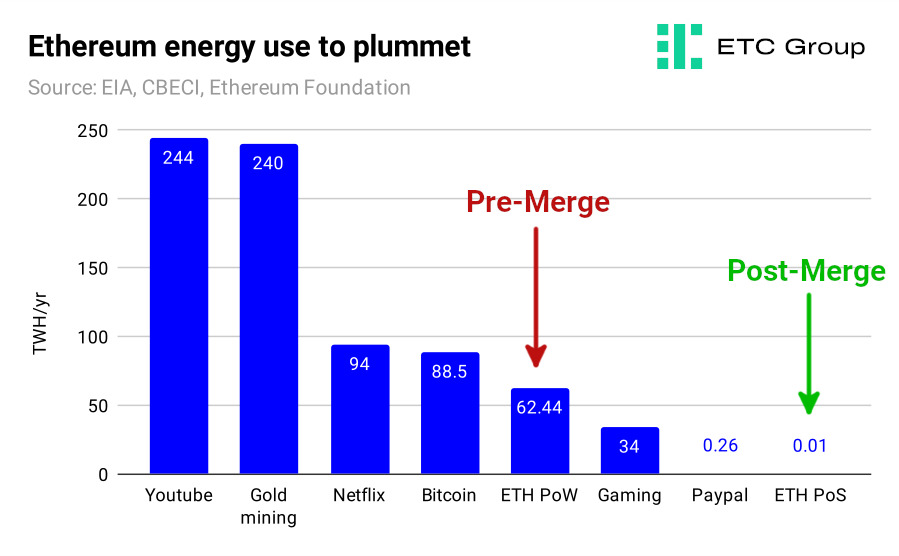

The main point to note here is that while the Ethereum Merge does not directly address the longstanding issues that have affected the blockchain: high transaction fees, blockspace congestion, or slow transaction speeds, its successful implementation does several important things. First, it ushers in a new environmentally friendly era for Ethereum, with the blockchain now using 99.95% less energy. Vitalik Buterin tweeted one fairly incredible statistic: with the end of mining on Ethereum, the world's energy usage declined by 0.2%.

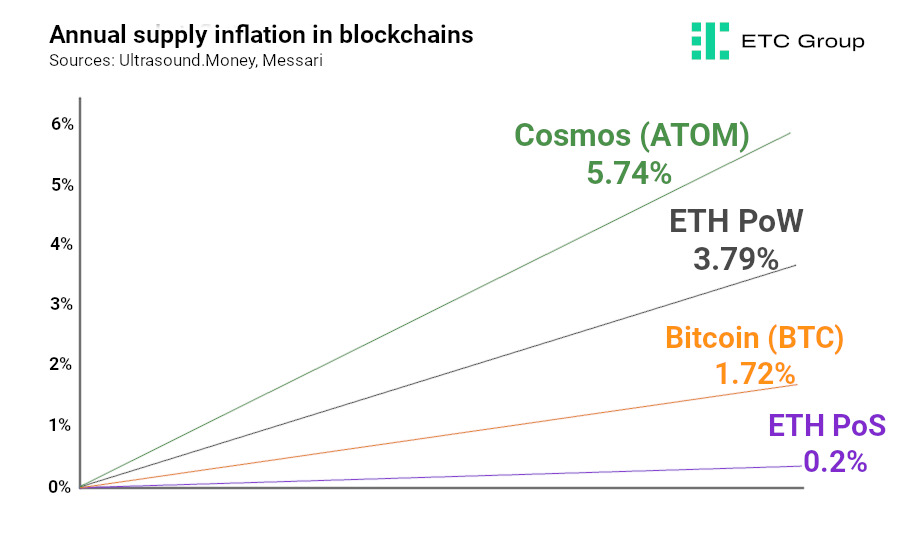

Second, it makes ETH a yield-bearing instrument akin to a dividend stock. Third, it points to a future where ETH is deflationary, in a world where rampant money printing is the ethos of central banks worldwide.

For more on Ethereum's deflationary structure post-Merge, read this.

Finally, this massive upgrade success makes it orders of magnitude more likely that Ethereum developers will be able to enact the next series of improvements to take Ethereum from being 55% complete to 100% complete over the next decade.

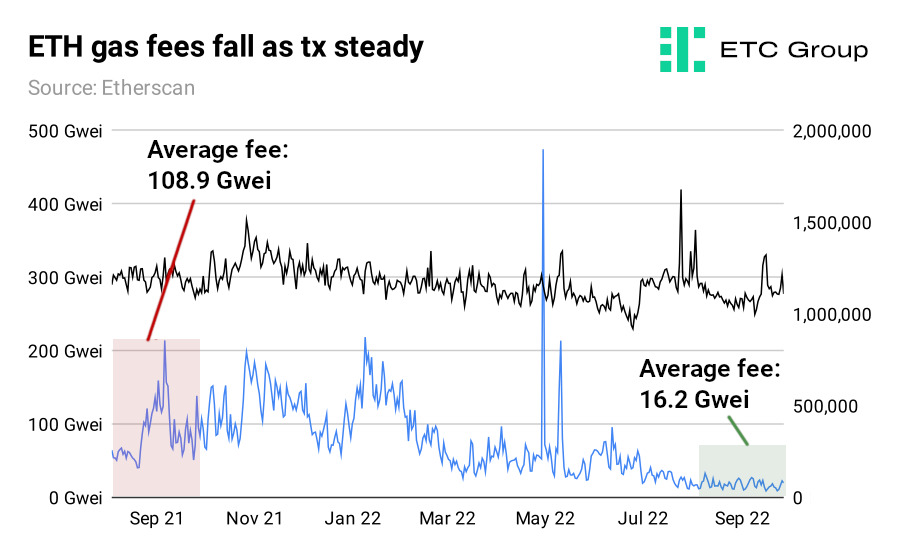

It is worth noting that despite The Merge was not specifically designed to impact high transaction fees, operations on the Ethereum blockchain are now markedly cheaper than they were a year ago.

When markets shift out of bear market mode, as they eventually will - and demand for blockspace recovers, with trading volumes on NFT markets and transfers between ETH wallets improving - we expect the number of daily transactions to increase also.

The next set of continued improvements to the Ethereum blockchain post-Merge will be the Shanghai hard fork, which is expected at least six months from the end of September (around the end of Q1 2023) and according to Ethereum's Github planning page, is in its very early stages. Among the biggest changes is allowing staked ETH to become unstaked from the chain. While some market commentators have peddled fears of mass ETH withdrawals, the chain has queuing protections in place to stop this from happening. One other innovation under Ethereum Improvement Proposal 4844 (EIP-4884) will introduce separate fee markets for transactions utilising add-ons like Polygon, which is expected to drastically cut the cost of routing transactions through Layer 2 tech on Ethereum.

The forced selling that characterised Bitcoin markets in June and July is over, and while we are not yet seeing large buyers moving up the bid with BTC prices in the $18k to $20k range, we are also not seeing any more large sellers entering, hence the high levels of accumulation, steady if unspectacular price moves and a general digital asset investor philosophy of holding out for better times ahead.

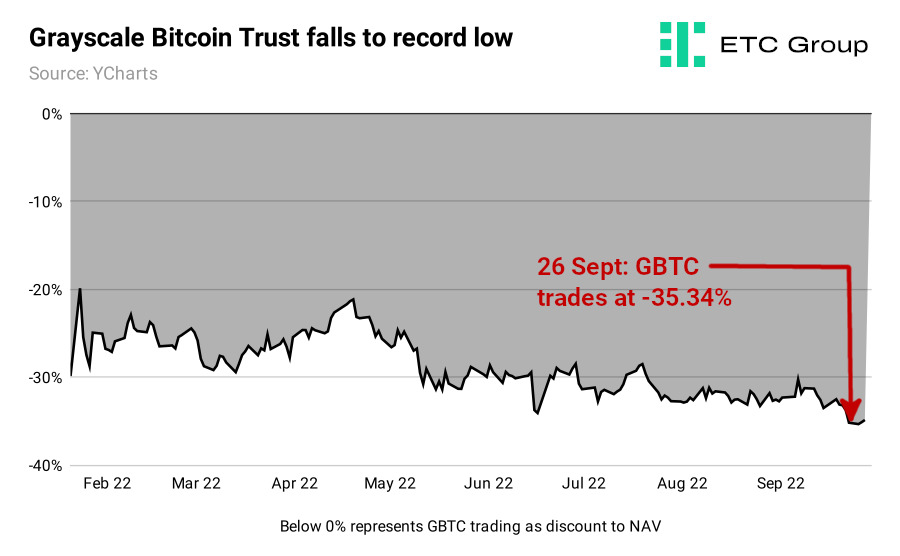

A reminder this month that not all institutional Bitcoin vehicles are equal came via the Grayscale Bitcoin Trust. This is the largest such vehicle for US investors to gain exposure to the price of Bitcoin but is by late September was trading at a record 35% below its Net Asset Value.

As crypto critic Amy Castor wrote in April:

Grayscale wants to convert its GBTC into a bitcoin ETF after flooding the market with shares. GBTC is trading 25% below its Net Asset Value, and investors are rightfully pissed off.

If such annoyance was evident at minus 25%, one can only imagine the conversations asset managers are having with GBTC now trading a further 10% below NAV. In the year to 26 September Grayscale's GBTC declined from a 21.2% discount to a 35.34% discount.

Over the last nine years Grayscale has been selling GBTC as the premier way to gain access to bitcoin exposure without having to buy or custody Bitcoin itself. That is quite evidently no longer the case with the rise of Bitcoin ETPs. GBTC has been trading at a discount to NAV since early March 2021.

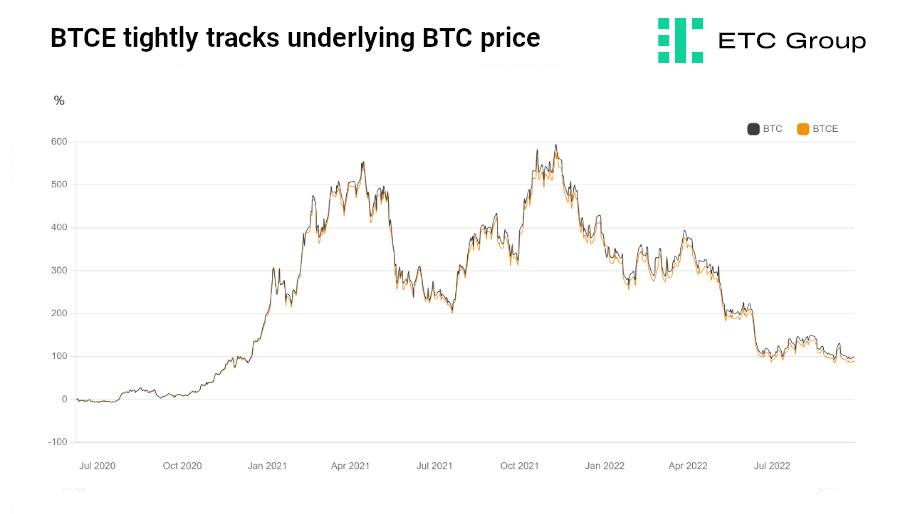

The purpose of an ETP is to track the value of its underlying asset. When it was set up, Grayscale issued a fixed number of shares in its closed-ended fund. Unlike Grayscale's model, shares in ETPs can be created and redeemed to meet demand, meaning the number of ETP units is variable and priced in accordance with underlying assets, in this case BTC.

When investors take a stake in crypto ETPs, they receive a portion of underlying shares, instead of the actual crypto coins or tokens themselves. In other words, they are trading the value of the shares and don't have to take ownership of the underlying asset.

As a closed-ended fund, GBTC does not have the same create-redeem function as Bitcoin ETPs listed on regulated exchanges in Europe, which allow them to tightly track the actual price of BTC.

3. Macro Signals

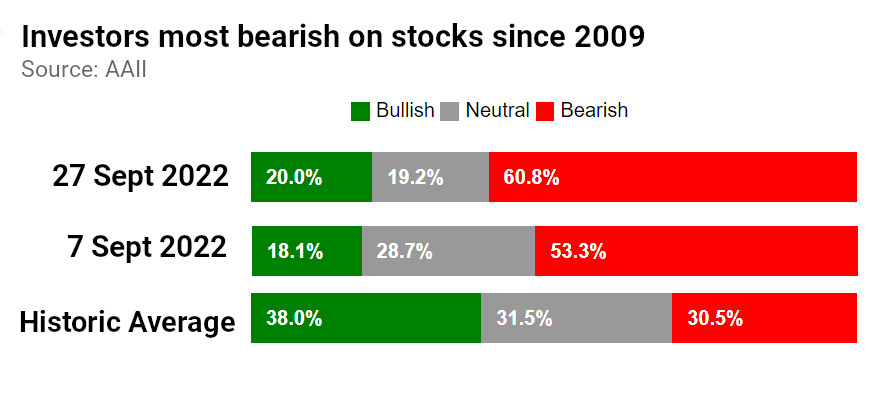

Bullish rebounds in equities and digital assets were hampered by more cautious market sentiment which increased dramatically as the month wore on. Central banks continue to raise rates aggressively to combat inflation, which remains at persistent, multi-decade highs across the West. Consumer price inflation data from the US for August, released on 13 September, came in hotter than expected at 8.3%, sending markets as much as 10% lower over the following 24 hours. Later in the month, there were worrying signs from US bond markets which witnessed their largest sell-off since 1949. Bond funds saw outflows of $6.9bn in the week to 21 September, with equity funds recording outflows of $7.8bn and investors shifting $30.3bn into cash, according to Bank of America research citing EFPR data. A BoA research note released on 23 September, suggested traditional investor sentiment was at its lowest since the 2008 Great Financial Crisis.

In line with expectations, the Federal Reserve raised rates by 75 basis points, but also signalled that they would hold interest rates at higher levels for longer. In general, rate hikes make it more expensive for individuals and corporations to borrow, making it more likely that investors will switch riskier assets out of their portfolios. Central banks in the UK, Switzerland, Canada, the EU and Sweden also raised rates in September - some by record amounts - again giving traders the signal to discount risk assets. The EU and Switzerland notably both exited the experimental era of negative interest rates this month, for the first time since 2007.

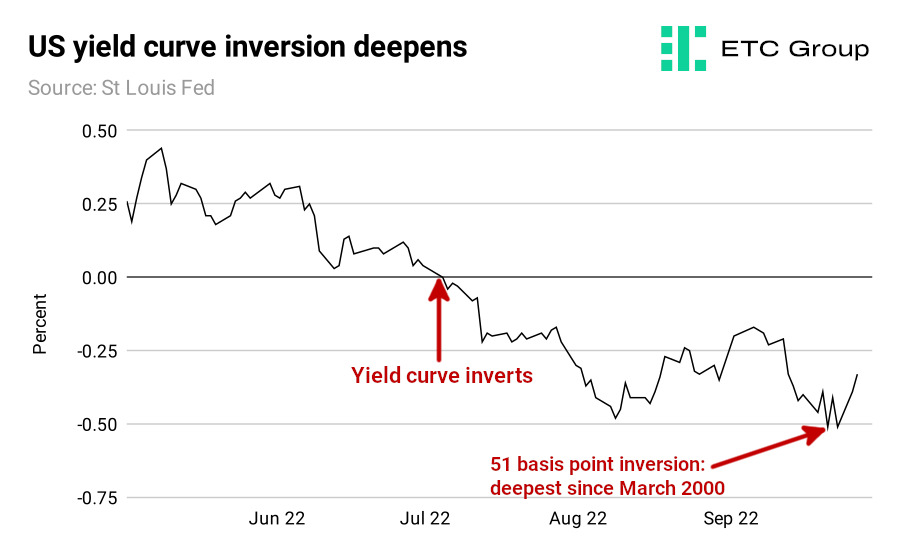

One additional warning sign for the state of the global economy came from an unexpected location: German bunds (government bonds). As the economic powerhouse of Europe, Germany's bond market is normally extremely stable - even boring. But on 15 September the 10-year and 30-year bund curve inverted for the first time since July 2008. This suggests that markets are pricing in the risk of more deflationary, not inflationary risks at the long end of the yield curve. Yield curves invert when shorter-dated bonds pay more than longer-dated bonds. This indicates widespread investor fears that faster central bank rate hikes will deepen upcoming economic slowdowns.

One highly-watched portion of the US yield curve: the 2-year to 10-year, has been inverted for more than 80 days, and on 23 September hit a low of 51bps, surpassing the worst levels seen at the height of the 2008 crisis.

Inversions are now evident in several other points on the US Treasury yield curve: the 5-year to 10-year, 2-year to 20-year, and the 10-year to 30-year. According to CME's Fedwatch, the chances for the next rate hike at the 2 November FOMC meeting have shifted in favour of a 50bps over a 75bps increase.

Economists are starting to suspect that all is not well in multiple parts of the world economy, with the risks tilting away from inflation and towards defaults as government and corporate borrowing becomes more expensive due to interest rate rises.

Some more concerning news for the health of the UK economy broke as the month closed.

UK pension funds were hit with a margin calls to the tune of £100m from lending banks as UK bonds and sterling crashed. The Bank of England was forced to step in and calm markets with a £65bn bond-buying commitment when a critical part of the UK economy essentially stopped working. Pension funds tend to buy UK gilts as they are considered relatively safe investments, but these funds also borrow money from banks to do so. Some also buy derivatives of UK gilts from lending banks.

The move by the Bank of England to step in and restart bond buying - effectively restarting QE - has led some commentators to suggest the Fed will end its quantitative tightening (being called the ‘Fed Reverse Pivot') but this seems unlikely. The US central bank has made it clear it will keep raising rates to get inflation under control. Until those figures come down to its 2% target, no matter the amount of economic damage wrought.

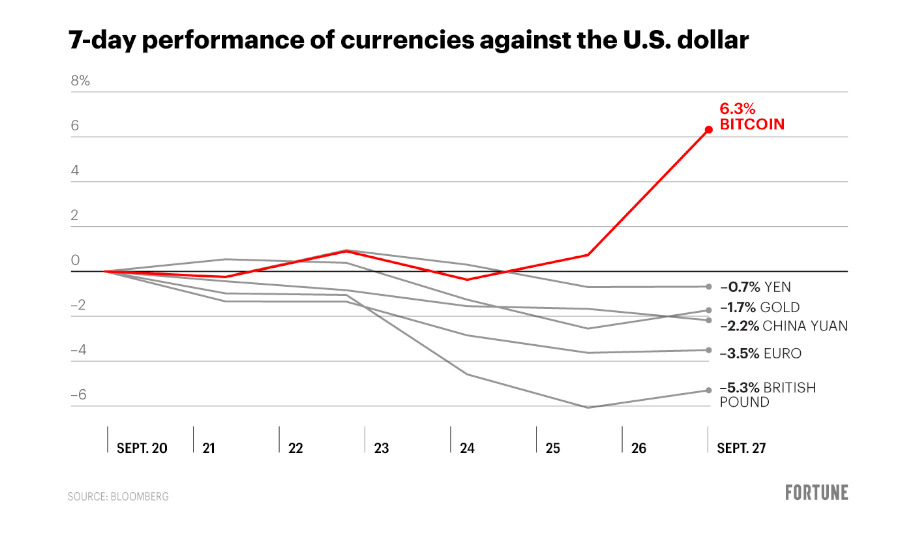

Signs that the supply-limited Bitcoin could be the salve against mass currency duation are starting to reappear. As Fortune reported, BTC outperformed every major currency (and gold) in the week to 27 September.

Even the New York Times has had to (begrudgingly) accept that Bitcoin's correlation with equity markets wasn't always the case, and may not continue indefinitely. “When central banks raised interest rates, Bitcoin largely traded like risky assets such as tech stocks. But that hasn't necessarily been the case over the past month. Bitcoin has traded in the green so far in September while the tech-heavy Nasdaq is down nearly 10% over that period,” senior editor Bernhard Warner wrote on 27 September.

Signs of decoupling?

The S&P 500 has now extended its losing streak to three consecutive quarters. The US benchmark index shed 5.3% over Q3 2022, the Dow tumbled 6.7% and the Nasdaq was down by 4.1%, leaving all three indices more than 21% down for the years. Expectations that stock prices would fall over the next six months climbed to the highest level since March 2009, according to the American Association of Individual Investors.

By the same token, Bitcoin and Ethereum have stayed remarkably steady since their mid-June lows. Bitcoin remained almost exactly where it was, while Ethereum climbed 29% from its low of $993 to end Q3 at $1290.

There were major currency crises unfolding as the end of September 2022 approached. Central banks have been forced to sell dollars to prop up their own declining currencies in the face of dollar strength at 20-year highs, Reuters reported.

In the last two weeks of the month the Indian rupee hit a record low of 81.62 against the US dollar. The British pound sterling set a new low watermark on 26 September and the internationally traded Chinese yuan set a new record low of 7.18 against USD since records began in 2011. All of this really means that there is nowhere left to hide for fiat currencies. Amid this state of affairs, the stage is set for Bitcoin to retake its narrative as the ultimate, supply-capped hard asset.

4. Regulatory Signals

First US reports on Digital Assets - when regulation?

In September the first tranche of reports following President Biden's Executive Order on Digital Assets started to hit the mat. While claiming to provide an overarching regulatory framework for crypto and digital assets, those who actually read the reports struggled to find such clarity.

Regulating stablecoins would appear to be the low-hanging fruit that regulators will tackle first: just as in the EU's Markets in Crypto Assets legislation, this regulatory session will consider agency recommendations “to create a federal framework to regulate nonbank payment providers”.

President Biden's bombshell Executive Order on “Ensuring Responsible Development of Digital Assets” on 9 March 2022 threw the entire weight of the US government machine behind advancing the global regulatory crypto landscape. As ETC Group noted at the time, the decision to create long-sought after national frameworks for digital assets was unequivocally bullish on all timelines.

Several reports, including from the Department of Justice, failed to advance the conversation, offering only ' international law co-operation' as their main conclusion. Others focused more on outdated or debunked risks than opportunities. One report in particular from the Office of Science and Technology Policy (OSTP) caught the eye as it addressed energy use in digital assets.

The OSTP paper agreed that Bitcoin mining creates only 0.2% to 0.3% of global CO2 emissions, and only 0.4% to 0.8% of United States CO2 emissions , a giant leap forward for making evidence-based policy decisions when considering the industry. It also accepted that mobile Bitcoin mining rigs could be used to improve decarbonisation through mitigating flared methane gas.

Both Houses of Congress now have bills put forward supporting the CFTC as the primary regulator of Bitcoin and crypto markets, Coindesk reports. The major advantage is that if both the House and the Senate pass identical bills, it vastly streamlines the legislative process and increases the speed at which these bills could reach the President's desk for his signature.

UK advances FSMB for crypto regulation

The Financial Services and Markets Bill passed the Second Reading in the UK House of Commons on 7 September and will progress next to the Committee Stage.

The bill will address the policy black hole engulfing the cryptoasset sector by mandating that the government tailor regulations for service providers like stablecoin issuers, exchanges, and custodians. It's expected this will be done by extending the authority of the 2009 Banking Act to digital assets for the first time in the UK.

The UK Parliament also saw its first ever debate on cryptoasset regulation on 7 September.

Korea escalates Terra LUNA

It has been difficult to underestimate the reputational damage done to the crypto industry by the collapse of Terra LUNA. On 25 September Interpol issued a ‘Red Notice' locate-and-arrest request to law enforcement agencies worldwide for the algorithmic stablecoin's figurehead Do Kwon. The collapse of the heavily-hyped project took down several interconnected parties, including the high-profile $10bn hedge fund Three Arrows Capital, prime broker Voyager Digital and the lender Celsius, whose CEO Alex Mashinsky resigned in the middle of bankruptcy proceedings. Issuers such as Van Eck and Valour, that made the decision to launch crypto ETPs based on the asset, were forced to suspend those investment vehicles.

SEC vs XRP nears an end?

The two-year battle between Ripple Labs, issuer of XRP, and the SEC took another turn in September. When news broke that the US regulator may be seeking an end to the case, the price of Ripple's token XRP skyrocketed. The point in question that is expected to be answered by the court ruling, is whether XRP should be considered a security. The result is expected to have wide-reaching impacts on digital assets at large. Both Ripple and the SEC requested summary judgement on 13 September saying that the judge overseeing the case had enough information to rule one way or the other without going to trial. If Ripple were to win, crypto companies would have precedent to argue that their own assets should not be considered securities in the United States.

Coinbase backing US Tornado Cash lawsuit

The leading retail-focused digital asset exchange Coinbase said it would bankroll a lawsuit against the US Treasury Department against the decision to impose sanctions on privacy-enhancing blockchain payments platform Tornado Cash. Coinbase argues that the sanctions exceed the Treasury's authority and that sanctioning open-source code - instead of individuals - will have a chilling effect on US blockchain innovation.

5. On Chain Signals

Bitcoin

Liquidity demand: Exchange flows

Bitcoin exchange inflows remained elevated compared to previous months, signalling traders were moving more coins into selling positions. Bearish Bitcoin

Futures activity

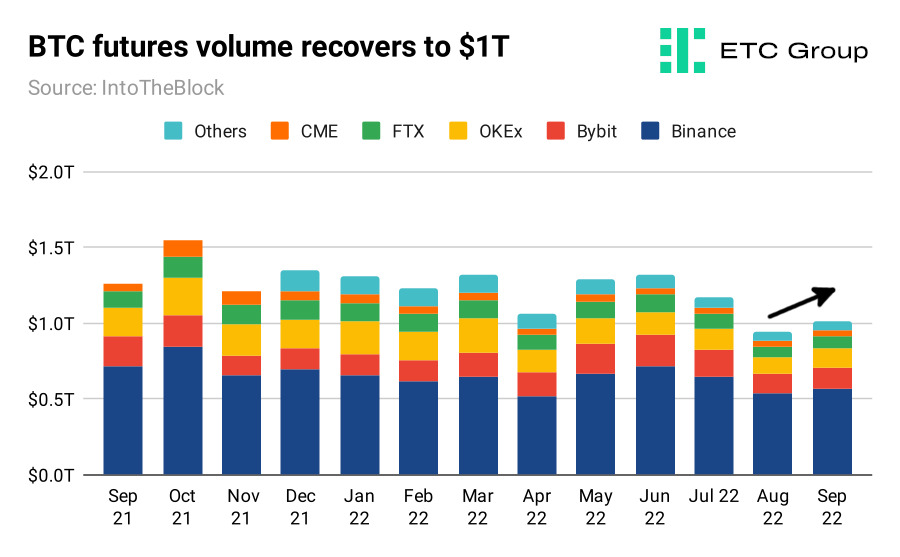

Bitcoin futures trading volume picked up to exceed $1T from August's two-year low, but more data is needed to confirm the trend. Neutral Bitcoin

HODLer behaviour

The number of Bitcoin holders has been growing in the bear market. Over 47 million addresses are currently holding BTC, 9 million more than a year ago. Bullish Bitcoin

Institutional demand

Institutional demand for BTC as measured by global crypto ETP inflows fell in September. Bearish Bitcoin

P&L of investors

Bitcoin Net Unrealised Profit and Loss is near its lowest ever point, suggesting material upside for new or existing investors adding at these levels. Bullish Bitcoin

Ethereum

Liquidity demand: Exchange flows

A clear trend shows Ethereum exchange inflows outpacing outflows to mid-September ahead of the Merge, with traders moving coins into selling positions. In the latter half of the month post-Merge, outflows took over, suggesting more buying pressure. Neutral Ethereum

Futures activity

Ethereum futures trading volume took a slight dip from August ($1.05T) to September ($1.01T) but this month is still the third highest on record. Bullish Ethereum

HODLer behaviour

Enabling staking with Proof of Stake Ethereum saw the number of addresses holding ETH for 1+ year rise in Septmber to its highest ever point at 52 million. Bullish Ethereum

Institutional demand

Institutional demand for ETH as measured by crypto ETPs fell in September. Bearish Ethereum

6. Altcoin Brief

Investors are still betting big on smart contract blockchains, many of which are demonstrating strong support from institutions and retail communities even with token prices well below their November 2021 peak.

Cosmos debuts new whitepaper revamping ATOM tokenomics - Cosmos.Network (26 September)

The Internet of blockchains has suffered from something of an identity crisis of late, but has put that to bed with a new whitepaper which includes all of the recent upgrades to the Cosmos Hub, including Interchain Security and liquid staking. Attempting to reconfigure the value proposition of ATOM: under the new system, ATOM tokens become the preferred collateral across the Cosmos Network, instead of simply allowing blockchains to create their own preferred collateral.

Solana folds Helium into blockchain - ETC Group (22 September)

The Helium community has voted to shut the decentralised wireless network's own Layer 1 blockchain and shift its operations wholesale to Solana. Helium Improvement Proposal 70 enacted the move, and proved less controversial than first expected. This network-wide governance vote passed with a wide majority of 81%.

Avalanche hosts first tokenised fund for $491bn asset manager KKR - Wall Street Journal (13 September 2022)

Avalanche has received its biggest institutional seal of approval to date and shone a spotlight on one key innovation of smart contract blockchains. The $491bn asset manager KKR, one of the world's largest equity funds, has opened access to private investors to its $6bn private equity healthcare fund by tokenising those assets on Avalanche's blockchain. The tokenised position is the first to be offered by a major equity fund in the United States, according to executives cited by the Wall Street Journal.

Cardano Vasil hard fork debuts a week after The Merge

Less than a week after the Ethereum Merge, the biggest software upgrade in crypto history, Cardano enacted its own long-awaited improvement in the form of the Vasil hard fork. The augmentation of Cardano's blockchain promises a swathe of new features, a year after Cardano introduced smart contracts with the Alonso hard fork in September 2021. These include lowering transaction fees, introducing better decentralised app scalability and faster transaction processing.

7. Into the Metaverse

It is impossible to read a news website for any length of time today without stumbling across another investment bank prediction of the vast pools of value creation engendered by the metaverse. It began with Morgan Stanley's $8.3 trillion global valuation and continued into Citibank's more aggressive $13 trillion by 2030 projection.

Take for example JP Morgan's September 2022 prediction that China's metaverse-related economy could triple the country's $44bn online gaming industry to $131bn. Digging into the detail of the bank's policy paper, its analysts estimate a $4 trillion total addressable market for the metaverse in China from “converting offline consumption across physical goods and services”.

In other Metaverse-related news, the Hong Kong blockchain gaming studio Animoca Brands picked up another $110m from institutional investors including Singapore's Temasek and Chinese private equity firm Boyu Capital. On the other side of the pond, Disney is ramping up its own efforts, seeking to hire a general counsel specialising in blockchain, metaverse, NFTs and DeFi, in what appears to be a more aggressive push into Web3 tech.

8. Outlook

- The Ethereum Merge story was major worldwide headline news, demonstrating just how far digital assets have come and how ingrained their successes and failures are for global markets today. Upside pressure on Ethereum valuations due to the Merge - as expected - did not materialise, largely because the effects of the blockchain's switch to Proof of Stake had been priced in by traders. But this technical accomplishment sets the stage for the greater likelihood of successful network upgrades in future.

- ETC Group expects crypto markets to trade largely sideways over the next month, barring any unknown unknowns. Macro conditions produced the worst first half year for equities in 52 years, and recent signals are not showing any let up for the second half of the year.

- The ongoing macro picture appears to be unfavourable for digital assets as a whole for the rest of 2022, given that central banks are raising rates across the board and that higher rates are now expected to persist well into 2023. However, the narrative of Bitcoin as the ultimate supply-limited asset is started to regain pace.

- The number of addresses holding Bitcoin has reached an all time high at more than 47 million.

- Both Bitcoin and Ethereum have widely outperformed all three major US stock indices over the last quarter, with the top two cryptoassets showing potential early signs of decoupling from equity markets.

- Regulatory papers coming out of the US have been surprisingly positive: not least one paper by the US Office of Science and Technology which acknowledges Bitcoin mining contributes less than 1% of US CO2 emissions. November midterms in the US may yet surprise markets with a swathe of crypto and blockchain-friendly candidates up for election.

- History is repeating itself in Bitcoin with large levels of bear market accumulation; long-term holders are increasing their Bitcoin exposure even as prices waver. This type of pattern continues to validate Bitcoin's store of value thesis.

- Bitcoin remains well undervalued from a technical perspective, with valuation metrics like NUPL notably flashing BTC in a position where long-term average-in buys have been historically profitable. HODLer behaviour across BTC and ETH remains at all time highs, despite the bear market prices, suggesting that investors are generally willing to buy low and hold out for better times ahead.

Our latest research

- Why Structure Really Matters in Crypto ETPs

- The State of Ethereum: The Merge

- Is Ethereum deflationary post-Merge?

ETC Group Research In The Press

ETC Group's research team is regularly quoted in high profile digital asset and traditional media venues. Below is a selection of the highlights and features this month.

Digital Assets & Crypto Review H1 2022 (1 September 2022) - HanETF

Head of Research Tom Rodgers writes two articles on how the bear market is impacting Bitcoin miners and the collapse of Terra Luna for this prestigious institutionally-focused half-yearly report.

Ethereum futures hit $1 trillion, overtake Bitcoin for the first time (9 September 2022) - CryptoNews

CryptoNews mentions Tom Rodgers' research showing that Ethereum futures volume overtook Bitcoin for the first time ever in the run up to the Merge.

Will Bitcoin take the No.1 spot in this metric after Ethereum Merge? (12 September 2022) - AMB Crypto

AMB Crypto references Tom Rodgers' research showing that Ethereum futures volume overtook Bitcoin for the first time ever in the run up to the Merge.

Demystifying NFTs (14 September 2022) - Prolific North

Head of Research Tom Rodgers produces a deep dive for Prolific North on the Ethereum blockchain, the basics of NFTs, their growing popularity, and their myriad use cases for brands.

Bitcoin Halving 2024 (22 September 2022) - ETF Stream: Crypto Unlocked

Head of Research Tom Rodgers writes a feature for in an institutionally-focused report by ETF Stream on the state of digital assets from an Exchange Traded Fund perspective, zeroing in on the upcoming Bitcoin Halving in 2024.

NFTs and the North (22 September 2022) - Prolific North

Head of Research Tom Rodgers is quoted in an article about top-tier football clubs like Manchester City utilising NFTs to create more fan engagement.

Connect with and Follow us

Linkedin: ETC Group

Linkedin: Tom Rodgers, Head of Research

Linkedin: Hanut Singh, Research Analyst

Twitter: ETC Group

Twitter: ETC Group Research

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.