Co-CEO of ETC Group

From a raw price perspective, Bitcoin ended the quarter almost exactly where it started. But in terms of adoption, Bitcoin is light years ahead of where it was at the start of 2022. We have new populations along with governments and major multinationals realising, testing and supporting the Bitcoin investment thesis.

Q1 2022 was the quarter when Bitcoin’s multiple uses became clear: cryptocurrency alternative hard asset and global, neutral reserve.

How this report works

To get a sense of what happened to Bitcoin across Q1 2022 it is important to look at the macroeconomic and geopolitical picture, along with three major drivers.

Bitcoin Macro

How and where Bitcoin sits in the pantheon of investable assets, and how global regulation and policy affect its use.

Institutional Bitcoin

Adoption as a corporate and municipal treasury, as store of value or means of exchange, along with the trading use of Bitcoin as an investable asset both in terms of derivatives markets, and institutional investments.

Bitcoin Fundamentals

The fundamentals of the network, as derived from on-chain analysis. We give a characterisation of how Bitcoin is being used and whether the signals from holders are telling the strategic investor should be bullish or bearish.

Introduction

From a raw price perspective, Bitcoin began and ended the quarter almost exactly where it started, hovering around the $47k mark. But to suggest that Q1 2022 was full of sound and fury but signifying nothing for the world’s first cryptocurrency would be well off the mark. There were some seismic changes across the three months from 1 January to 31 March 2022, with major macroeconomic and geopolitical factors at play.

If most analysts had been told that Bitcoin’s price would hold up so well in the face of the largest conflict on European soil since 1945, skyrocketing oil prices and a collapsing bond market, it is likely few would have believed it.

Certainly not, given a recent media narrative that Bitcoin is a risk-on asset and that it is highly correlated with traditionally more risky plays in the tech-focused NASDAQ 100.

In fact, Bitcoin outperformed tech stocks across Q1 ending some 10% higher than the index by 31 March 2022.

Last year we heard repeatedly that Bitcoin outperformed every asset over every timeline. It should come as little surprise that over a shorter time period, coming off record high prices, that all time highs did not persist. Now, instead, we see headlines like that from CNBC on 28 February: “Bitcoin’s status as ‘digital gold’ is falling apart.”

They write: “Bitcoin is often referred to as digital gold by its backers. The term refers to the idea that bitcoin can provide a store of value similar to gold — one that is uncorrelated with other financial markets like stocks.”

This is true, in part. But it is absolutely not the whole story, and it is duplicitous to suggest that Bitcoin is only a store of value as ‘digital gold’.

As we demonstrate in this report, the smallest holders of Bitcoin are its fastest-growth group, and

To quote Thomas Sowell, perhaps the finest economist never to win a Nobel Prize:

Economics is the study of the use of scarce assets which have alternative uses.

Bitcoin’s ‘alternative uses’ do not extend to industrial machinery, as do gold, silver or copper, but instead to its internal characteristics.

This is what many struggle to grasp about Bitcoin. Its alternative uses are

- As a currency

- As a reserve asset

If a Bitcoin is being used as a currency, it cannot also at the same time be used as digital gold, in the same way as gold hammered into thin sheets and used as a conductor in manufacturing for solid state electronic devices cannot at the time be used as bullion in a vault.

Bitcoin is highly divisible, unlike gold. It is also easy and cheap to store and send across borders, and proof of ownership to a third party is simple rather than obscure.

In truth, the character of Bitcoin is becoming more complex over time, and its multiple uses are coming to the fore: as cross-border currency, as pristine collateral, as corporate treasury, and as global, neutral reserve asset. Bitcoin is the world’s first truly scarce, desirable asset, whose supply schedule is known in advance.

So while in the past year we have seen Bitcoin’s price swing back and forth between around $30k and $60k, this is mostly just short-term noise. What really counts for Bitcoin is the network, its adoption, and the changing character of how it is being used.

Bitcoin Macro

Ukraine proves Bitcoin thesis

With Europe facing unprecedented turmoil, cryptoassets were at the heart of some incredible and groundbreaking uses of technology.

It may take some time for the wider world to adequately process the idea that a sovereign nation turned to the global cryptoasset community for critical crowdfunding using this technology, thereby validating part of the total investment thesis: that it is a novel way to move and store value cross-border and peer-to-peer, in a frictionless way that avoids censorship and resists seizure.

On 26 February the Ukrainian government posted on Twitter three wallet addresses: one for Bitcoin (BTC), one for Ethereum (ETH), and one for Tether (USDT), and within 24 hours raised millions of dollars.

By 8 March the fundraising total reached $60.5m, with 120,000 people donating cryptoassets of one kind or another. This displays precisely how it is not simply money, but any kind of tokenisable asset that can be moved cross-border on public blockchains. And because the Bitcoin and Ethereum networks maintain an open and transparent record of transactions, anyone can follow the donations in real-time.

By the end of Q1 2022, donations had surpassed $100m, according to data provided by AML compliance provider Slowmist.

This state of affairs did throw up accusations that Russia’s sanctioned wealthy could utilise crypto in the same way: to evade sanctions. ETC Group have written a lengthy rebuttal on this point. In summary, public blockchain ledgers like Bitcoin remain highly inefficient ways to launder large amounts of money simply because anyone can view a record of all transactions at any time.

Coupled with the skill of forensic blockchain analysts like Chainalysis and Elliptic, who are employed by the US government, the amount of money Russia would have to attempt to conceal are orders of magnitude larger than what is possible.

As Politico reported on 25 February, the US Treasury Department knows there is no realistic risk of Russia using crypto to evade sanctions at any meaningful scale.

Treasury officials say they aren’t overly worried about crypto undermining the efforts to choke off the Kremlin’s access to capital. Laundering large amounts of money through a dizzying array of digital wallets and exchanges is expensive, time consuming and would likely be visible in the broader crypto market, given the massive investment portfolios of individuals and institutions named in the sanctions,

the reporters write.

Additionally, if Moscow seeks an alternative to interbank settlements service SWIFT, after its major lenders were kicked from the programme, it will not use Bitcoin. Instead of a public, open network it cannot control, the Russian government is much more likely to use CIPS, the onshore yuan clearing and settlement system offered by China. To this point, both Sberbank and Alfa Bank announced plans to issue Mir cards with China’s UnionPay, after Mastercard and Visa stopped operating in the country.

Oligarchs cannot cover their tracks with crypto, making it useless for evading sanctions. By contrast, sanctions may have frozen part of Russia’s foreign exchange assets, but its gold reserves could remain a lifeline. Gold comprises a quarter of Russia’s reserves and being able to monetise it would evidently undercut the effect of external sanctions.

Sanctions froze around $300m of Russia’s $640m stockpile of forex reserves held overseas, Reuters reported in March.

It is much more likely that Russia will sell its gold reserves on international markets, swapping that for high-value currency to defend against the crashing rouble. US senators urgently sought to close that loophole.

As Axiom revealed in their 22 March scoop, US lawmakers took their concerns to the highest office, that of Treasury Secretary Janet Yellen, to discuss how to freeze the roughly $132 billion in Russian gold assets. The Kremlin began stockpiling gold in 2014, when the US applied fresh waves of sanctions on the country for its annexation of Crimea. That is part of the dedollarisation project that Russia has been engaging in for the past seven years, and something which we have seen play out in real time over past months.

The de-dollarisation project ongoing in Russia appears to be a deliberate, long-term policy move. While in 2013, 80% of Russian exports were denominated in USD, by 2022 that figure had fallen to just over 50%. In Xi Jinping’s Beijing, Moscow found a willing partner for this de-dollarisation. The move became a specific priority for Russia following its annexation of Crimea in 2014 and the subsequent imposition of Western sanctions, which limited the ability of state firms and banks to raise financing in Western markets, and the scale of the project has only increased in recent years.

And while China has eschewed Bitcoin from a fundamental policy perspective and notably dismantled its world-leading position as the global leader in Bitcoin mining, its partner to the east is going in the opposite direction.

At the same time, Bitcoin’s utility versus gold became evident. Gold is costly to transport, difficult to move across borders, and also hard to trace. The opposite is true for Bitcoin, in which it is relatively simple to complete physical delivery of a transparently-owned and digitally-recorded asset.

Unlike its forex reserves, however, Russian gold was held in Moscow, making foriegn sanctions much more difficult to enact.

G7 leaders announced on 24 March they would apply secondary sanctions to American entities knowingly transacting with or transporting gold from Russia’s central bank holdings. Sanctions would be applied if American businesses sell gold either physically or electronically in Russia.

In a statement, the White House said:

G7 leaders and the EU will continue to work jointly to blunt Russia’s ability to deploy its international reserves to prop up Russia’s economy and fund Putin’s war, including by making it clear that any transaction involving gold related to the Central Bank of the Russian Federation is covered by existing sanctions.

The rate and impact of sanctions on Russia has shocked even seasoned market participants. It is the first time in living memory that an entire country has been — to use the parlance of our social media times — cancelled. The first of several dozen multinationals exited the Russian market in the days after the 24 February invasion and scores more followed over the ensuing weeks.

One research team at the University of Yale has produced a list of well over 500 corporate entities from banks to sports associations, detailing which are withdrawing from the country entirely, which are suspending operations, and which are remaining in the state.

Russia’s largest lender Sberbank announced on 17 March 2022 it had received a licence from the Bank of Russia to issue digital assets “which will enable them to attract market investments”, as well as buying and selling cryptocurrencies “which will position them to invest their currently idle funds to generate income”.

Biden Executive Order sees US extend ‘global leadership’ in crypto

Macro market watchers reacted with glee to US President Joe Biden’s Executive Order on digital assets on 9 March, as he indicated a favourable regulatory environment for cryptocurrencies going forward.

Text from the order, which sets a 180-day deadline on departments reporting on the risks and opportunities from cryptocurrencies, calls for a comprehensive and co-ordinated approach to digital asset policy.

[It’s] unequivocally bullish for the crypto ecosystem over all timeframes,

Travis Kling, CEO at Ikigai Asset Management told CNBC.

It’s easy to lose sight of how much ground this ecosystem has covered in the last two years in terms of legitimacy and stance from the US government, but this [Executive Order] makes it clear the US government is not banning crypto, it is embracing it.

13% of Americans held or traded crypto in the last year, according to University of Chicago research.

That compares to 24% of Americans who held or traded equities.

Biden’s Executive Order directs the Justice Department, the Treasury Department and other important agencies to study the legal and economic ramifications of cryptocurrencies, along with the possibility of creating a US central bank digital currency. Last year the White House said it was considering implementing wide-ranging oversight of crypto markets, including closer supervision of decentralised finance (DeFi) and stablecoins.

Markets turned buoyant in the wake of a statement that appears to have been prematurely published on the US Treasury website. Treasury Secretary Janet Yellen said the pending executive order from the President calls for a co-ordinated and comprehensive approach to digital asset policy [that] will support responsible innovation. Industry news website Coindesk published an archived copy of the post. The friendlier-than-expected language alleviated fears of a sudden tightening of US rules around cryptoassets.

At a state level, the US has been rushing to attract crypto businesses with swathes of favourable legislation. In early February a bipartisan group of US House lawmakers reintroduced the Virtual Currency Tax Fairness Act as an amendment to the IRS tax authority’s revised tax code, exempting consumers from having to report crypto transactions of less than $200.

On 21 February 2022 California State Senator Sydney Kamlager put forward Senate Bill 1275 to recognise Bitcoin as a payment method for state taxes in California, while her colleagues in the House are seeking to table a bill to make Bitcoin legal tender. Three days earlier, Colorado Governor Jared Polis announced on stage at an Ethereum conference that the state would accept taxes and fees in cryptocurrency by the summer of 2022.

Both Georgia and Illinois also put forward legislation in February to exempt industrial-scale Bitcoin miners operating in data centres of at least 75,000sq ft from paying state taxes, aiming to join Texas and Kentucky, who already offer similar incentives. Each of these four states has received scores of crypto companies rushing to leave China since that country’s ban on crypto mining in May 2021. At the time, China accounted for more than 60% of the world’s digital asset mining hashrate. Today it is effectively zero, with the US by far the largest beneficiary.

As we note in our Q1 Blockchain Infrastructure report, the US is the world leader in Bitcoin mining. Its largest mining pool, Foundry USA, has accelerated its dominance from 7.9% of hashrate to 19.5% of hashrate in the period from October 2021 to April 2022. And the entry of Intel (NASDAQ:INTC) into manufacturing more energy-efficiency Bitcoin mining machines tells a tale all of its own: of a more permissive US landscape for Bitcoin on both a corporate and institutional level.

Global crypto legislation moves ahead

Crypto markets are extremely sensitive to regulatory news from global superpowers: predictable given the wide differences in regulation between nations.

On 20 January the central bank, Russia’s de facto financial regulator, called for a full ban on mining, trading and cryptocurrency usage.

But according to national news agency Tass, on 26 January President Putin pushed back on the bank’s comments, saying that Russia has competitive advantages in cryptocurrency mining, ordering the bank and the government to come to some kind of consensus on the matter before reporting on the results. According to the Cambridge Centre for Alternative Finance, Russia controls around 11% of the world’s Bitcoin mining, third in the world behind the United States and Kazakhstan.

Putin concluded that the regulator is

not trying to block technical progress and takes required measures to implement state-of-the-art technologies in this area.

In response the Russian Finance Ministry put forward a legal cryptocurrency framework, noting that it supports regulation, citing potential tax revenues from the several million crypto wallets containing ~2 trillion rubles ($25.6bn) opened by Russian citizens, the potential for increased fraud and inability of law enforcement to track crimes posed by a total ban.

In Q1 Dubai also adopted its first law legalising digital assets and set up a financial watchdog to oversee the industry. Announcing the news on 9 March 2022 ruler Sheikh Mohammed bin Rashid said he wanted to position the emirate as a world leader in cryptocurrency and blockchain.

India, South Korea see huge potential tax revenue from legalised crypto

And after years of back and forth between its Reserve Bank and Supreme Court, India too is edging towards legalising crypto.

In the country’s annual budget speech on 1 February, Finance Minister Nirmala Sitharaman proposed a 30% tax on income from the transfer of digital assets, while announcing that the country would launch a digital rupee CBDC by 2023.

Leading Indian crypto businesses focused on the macro implications.

India is finally on the path to legitimising the crypto sector in India, said Nishal Shetty, the CEO of WazirX, one of the country’s largest cryptoexchanges.

A digital rupee would also

pave the way for crypto adoption,

he added, saying that

clarity on crypto taxation will add much needed recognition for the crypto ecosystem.

Sidharth Sogani, CEO of research house Crebaco added:

You can’t tax something which is illegal. Hence this is a very positive move by the government. If there are tax clarities in this space, more money is likely to come in.

South Korea’s crypto market is huge by any metric. According to the country’s financial regulator, while stocks have traditionally been the country’s favourite investment vehicle, crypto is catching up fast. The total value of South Korea’s cryptoasset market has reached 55.2 trillion won, the Financial Services Commission says, with average daily trading of 11.3 trillion won.

More than 15 million people in the country (which has a total population of 51 million people), have accounts with cryptocurrency brokers. And so the election of President Yoon Suk-yeol in March 2022 marks a turning point. As part of a broad range of crypto-specific policy positions, the President-elect said he would legalise ICOs in the country, boost South Korea’s burgeoning industry and promised not to impose taxes on digital asset trading gains of up to 50 million won ($40,000), treating them in the same manner as gains from equities.

UK to regulate crypto, legalise stablecoins

Not content to allow the Americans to become global leaders in cryptoassets without a fight, the UK government announced on 4 April 2022 it will regulate the sector to allow consumers to use stablecoins and cryptoassets safely and legally.

It’s my ambition to make the UK a global hub for cryptoasset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country,

said Chancellor Rishi Sunak in a statement.

Stablecoins like USDC and BGBP are the lifeblood of the cryptoasset industry, providing on-ramps for consumers from fiat (state-backed) currencies like the US dollar and the British pound sterling into cryptoassets such as Bitcoin and Ethereum. They are pegged 1:1 to a reference asset such that they maintain stable value relative to traditional currencies, or to commodities like gold or silver, thereby bypassing the day-to-day volatility evident in large sections of the industry.

The stablecoin market cap is increasing by around $100m daily, and most recently hit a total of $180bn, according to The Block Crypto data.

In a keynote speech to UK Fintech Week, financial services minister John Glen said the UK’s tax code would not need major surgery to make it work for crypto.

If crypto technologies are going to be a big part of the future, then we in the UK want to be in, and in o the ground floor. We see enormous potential in crypto and we want to give ourselves every chance to take maximum advantage.

To date the UK government has been relatively cautious around cryptoassets in general, with the Bank of England and the market regulator, the Financial Conduct Authority, regularly warning consumers that trading cryptoassets could mean they will lose all of their money. And while since 2016 the UK has run a fintech sandbox programme, which contains multiple crypto custody and trading businesses, it has never before put forward a framework for legalising the whole sector.

Part of the Chancellor’s plan includes:

- Ordering the Royal Mint, which supplies all of the nation’s coinage, to create an NFT

- Using blockchain to issue sovereign debt or UK Gilts, the equivalent of US Treasury bonds

- Extending the Investment Manager’s Exception (IME) to cryptoassets

This latter point is particularly impactful.

The IME effectively aims to cut the UK tax take on investment transactions and thereby attract foreign investment funds to London.

The capital city has long been a centre of the fund management industry globally and UK tax treatments are designed to attract foreign investment funds to use UK fund managers: regulated funds are not considered to be UK tax resident even if their central management “abides” in the UK.

But The City has been badly hurt by Brexit, with the finance sector losing most of its access to the European Union, its largest export partner, Square Mile policy chief Catherine McGuinness told Reuters earlier this year.

Glen added that Britain would look at removing the disincentives for fund managers to include cryptoassets in their portfolios, painting a highly bullish picture for UK crypto in general.

Make no mistake: Rishi Sunak’s long-term plan is to attract the world’s largest cryptoasset investment funds to the UK (and hence, pull them away from Dublin, the EU, Singapore, Hong Kong and New York) by offering significant tax incentives.

A potential US recession on the way

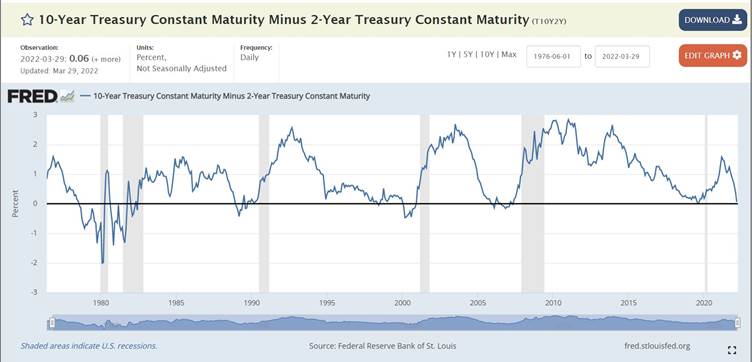

There was some potentially bearish news from a closely-watched portion of the US bond market at the quarter’s end. On 29 March 2022 the 10-year to 2-year US Treasury yield curve inverted for the first time since September 2019. It must be noted that this is not the full yield curve. Just one section of it. But an important one all the same. It is striking that this state of affairs had not reared its head even throughout the economic crisis posed by Covid-19 lockdowns when world supply chains ground to a halt.

In periods of economic calm, bondholders should be compensated more for holding 10-year US government debt than they are for holding 2-year US government debt. That’s because tying up their capital for longer exposes holders to more risk. An inverted yield curve suggests that short-term interest rates are now being priced at a higher value than long-term interest rates. The net result is likely that liquidity will be pulled out of credit markets.

An inverted yield curve pulls liquidity from the market as creditors start to borrow short and lend long, instead of the other way around. Yield curve inversion has also preceded every US recession since the 1970s, as evidenced by the below chart from the St Louis Federal Reserve. Note that every time the blue line (the relationship between the yield on a 10-year US Treasury vs the yield on a 2-year US Treasury) touches zero or dips below it, economic trouble tends to follow. The shaded areas indicate US recessions.

The bond market in general has been extremely unsettled by concerns of rising inflation.

Even the IMF admitted in its January 2022 World Economic Outlook what many believed to be the case. Elevated inflation is expected to persist for longer than envisioned…with ongoing supply chain disruptions and high energy prices continuing in 2022.

That means risks are tilted to the downside as advanced economies lift rates, the IMF said. Additionally, risks to financial stability and emerging market and developing economies’ capital flows, currencies and fiscal positions — especially with debt levels having increased significantly in the past two years — may emerge.

Central banks have found themselves in an increasingly difficult position ever since putting in place effectively infinite quantitative easing. Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, spoke the words that will define this era when he said in March 2020:

There is an infinite amount of cash in the Federal Reserve.

If market watchers see the Fed’s March 2022 move to increase interest rates upwards for the first time since September 2018, and further up to seven more times in 2022, as just another rate hiking cycle, they would be missing a larger point. This quantitative tightening is happening across an investment landscape that none of us have lived through before. The world is in its first pandemic recovery in 100 years. We may also be approaching the age of the first bursting of a global sovereign debt bubble in equally as long.

Global debt rose by 28% to 256 percent of GDP in 2020, according to the latest update of the IMF’s Global Debt Database. Government borrowing accounted for more than half of the increase, with global public debt ratio soaring to a record 99% of GDP.

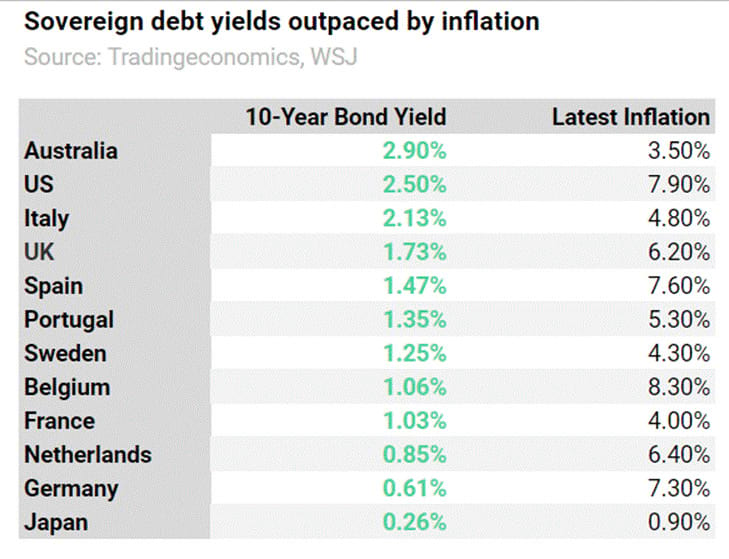

The question being: who wants to hold government debt in an age when governments are on the brink of default? And certainly when yields on long-term government debt are being massively outpaced by inflation.

Even in the best-case scenario at the lowest-loss end of the scale, in Australia, where yields are over 2.9%, holders are still losing out as headline inflation for 2021 reached 3.5%, its highest point since June of 2011. As Ronald Mizen writes for the Australian Financial Review:

A surprise jump in both headline and underlying inflation has economists convinced that the Reserve Bank of Australia will be forced to lift interest rates well ahead of its official outlook and as early as May [2022].

ETC Group is hardly the first to make this assertion, but the point is still valid.

It is entirely possible that negative real rates will be necessary on a sustained basis to make fiscal positions across Western governments sustainable.

Central banks are in a bind, and one largely of their own making. Allowing markets to crash would expose the fragility of debt-burdened economies. They cannot raise rates too high, because everyone is so indebted, making it more costly to pay off (or more likely to roll over) those debts. And their position is warranted, of course. Those debt increases preserved jobs and avoided bankruptcies, and taking no action would have ushered in economic devastation.

At a record $226 trillion, global debt is now at an eyewatering three times the $84 trillion of global GDP.

As Michael Howell, managing director of Crossborder Capital, argued in the Financial Times late last year, we now have institutionalised instability and volatility inherent in global financial markets.

Taking an average debt maturity of five years implies a $60tn annual refinancing problem that requires balance sheet capacity, or, in other words, liquidity. This means the modern financial cycle gyrates with the tempo of debt maturities. More liquidity requires more debt as collateral, and more debt needs more liquidity for refinancing. Policymakers seem stuck in this cycle.

They keep policy interest rates low and, thereby, encourage still more borrowing, but, often in the same breath, they threaten to withdraw liquidity through so-called quantitative tightening or tapering measures… Less liquidity makes it difficult to roll over existing debts.

The colourfully-named ‘Fed Put’ was heavily in evidence in 2008, 2010 and 2015 when successive chairs of the US central bank stepped in to quell crashing stock markets with massive asset purchases. But the world is facing a liquidity crisis.

And renewed QE now seems the only option on the table in the event of the next inevitable market sell-off.

US investors are already pessimistic. The results from the latest AAII Sentiment Survey show the percentage of individual investors describing their six-month outlooks for stocks as ‘bearish’ reaching its highest level in nearly nine years.

Bearish sentiment, expectations that stock prices will fall over the next six months, jumped 10.5 percentage points to 53.7%. Optimism is below its historical average of 38.0% for the 14th consecutive week. It remains at an unusually low level. Pessimism was last higher on April 11, 2013,

the AAII said.

Or as one CNBC news anchor put it in the fallout from the 2008-2009 financial crisis:

You print a couple of trillion dollars, and people start to get nervous. Out of this we have something called a Bitcoin….

So what’s the end point?

Bitcoin eats the fixed income market

As Luke Gromen said last year:

The really interesting thing is not Bitcoin eating gold, it’s Bitcoin eating the fixed income market.

Bloomberg noted in a March 2022 article that there are now fewer US investors willing to stump up for bonds in general.

Sustained high inflation — far beyond the “transitory” expectations of the Fed, which became a bad joke over the period — could be another nail in the coffin for the traditional 60/40 or 60% stocks, 40% bonds portfolio. Anyone holding 40% of their net worth in bonds, with fewer than 2% yields on offer and inflation in the 7-8% region is losing money every day.

One argument for the classic 60/40 portfolio popularised by Vanguard founder Jack Bogle is that equities are intended to drive outperforming returns, while bonds are chosen to reduce volatility and smooth out downside risk. But we are entering an age of higher volatility across the board, in equities, commodities, bonds and alternative asset classes alike.

40% in bonds in any portfolio used to be a great strategy simply because the world has witnessed a 35-year bull market in bonds. Rising interest rates are going to be bad for any bond portfolio, and high inflation is another headwind. Western governments have found themselves in an extremely tricky and delicate situation. They themselves can’t afford higher interest rates because they have too much debt, and won’t be able to afford to refinance that debt at higher rates. Bonds are already going unwanted and unsold as it is. So who will end up buying sovereign debt? The answer must be central banks.

Debt doesn’t have great asymmetry in terms of risk to reward.

For those who still want to hold bonds to protect against downside volatility, a more sensible portfolio allocation could be 55% stocks, 35% bonds, and 5% crypto, for example. Ray Dalio suggested in January 2022 that just 2% held of one’s net worth held in cryptoassets like Bitcoin would be a “reasonable” allocation.

One key point to make is that, as T Rowe Price reported on 25 March, its traders are continuing to see elevated volatility in the investment-grade corporate bond market, amid hawkish comments from [US Federal Reserve chairman Jerome Powell] and technical conditions hampered by thin liquidity.

If credit markets continue to sell off, market liquidity will continue to fall as volatility spikes.

And if sovereign nations try to get out of this in the same way they always have, by spinning up the printing presses yet again, then it is increasingly likely that investors, and even the intractable laggards and elderly conservatives who hold sometimes up to 70% of their wealth bonds — will start to shift away from fixed income.

As we suggest in our Blockchain Infrastructure Q1 report, crypto has moved beyond the early adopter phase and into the early majority.

El Salvador Bitcoin bond delayed

As the only country where Bitcoin is legal tender, El Salvador remains a statistical outlier in terms of the nation-state use of cryptoassets and some news during Q1 complicated the picture further. President Nayib Bukele put forward proposals in November 2021 to build a ‘Bitcoin City’ funded by the sale of a $1bn Bitcoin bond. Half the funds would be used to accumulate BTC for the government treasury, with the rest allocated to build out El Salvador’s Bitcoin mining infrastructure, which Bukele wants to power with geothermal energy from the country’s volcanoes. The bond offers an annual coupon for investors of 6.5% and will be issued by state-owned energy company La Geo. Crucially, the Bitcoin bond will come with a sovereign repayment guarantee.

But as Reuters reported, on 22 March El Salvador decided to postpone the issuance of the bond to wait for more favourable market conditions. Speaking on local TV show Frente a Frente, Finance Minister Alejandro Zelaya said the issuance could be delayed until September 2022. Impacting the decision was the outbreak of war in Ukraine and the associated impact on the price of Bitcoin, Zelaya added.

It may still be too early for banks to accept bonds denominated in Bitcoin, even if they use the underlying blockchain technology to automate and improve their own services.

Banks have already tokenised bond assets on the blockchain, most notably the European Investment bank in April 2021, which issued a $100m bond using the Ethereum blockchain.

In Q1 we heard that Euroclear had invested in Fnality, a consortium of global banks aiming to provide near real-time 24/7 settlement in digitised assets, allowing banks to slash their intraday funding requirements and unlocking the potential of tokenised financial markets.

Full year 2021 results reported in January 2022 demonstrate the numbers involved. Euroclear Group settled the equivalent of $992 trillion in securities transactions across 2021 — more than 10 times the entire GDP of every country in the world — and held $37.8 trillion in assets for its clients as of the end of last year.

Fnality’s founding shareholders are: Banco Santander, BNY Mellon, Barclays, CIBC, Commerzbank, Credit Suisse, ING, KBC Group, Lloyds Banking Group, Mizuho Bank, MUFG Bank, Nasdaq, State Street Corporation, Sumitomo Mitsui Banking Corporation, and UBS.

Institutional Bitcoin

Traditional technical indicators usually reserved for equities markets showed Bitcoin in oversold territory at the start of the quarter.

One traditional momentum metric that remains exceedingly popular is Relative Strength Index or RSI. This shows whether markets are overbought — that euphoria is at its peak — or on the opposite side, they are oversold. By the second week of January, crypto markets were flashing heavily oversold indicators, suggesting that selling exuberance was overdone.

Anything at 70 or above (the green line) on the RSI indicator is considered overbought and a ‘sell’ indicator. Anything 30 or below (the red line) is considered oversold and hence a ‘buy’ indicator.

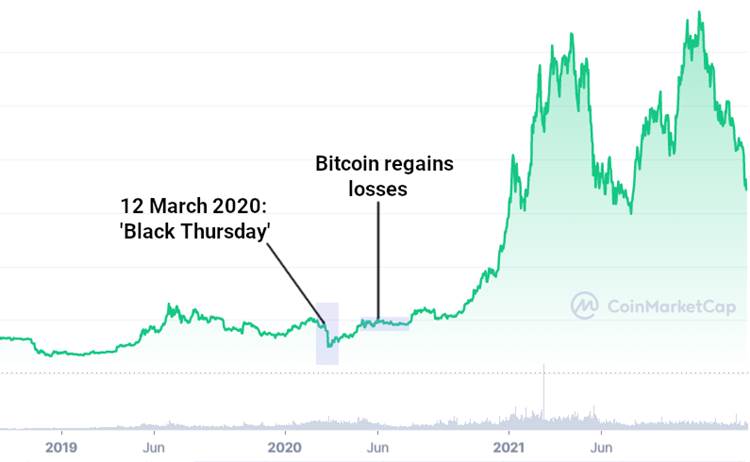

By these readings Bitcoin was sitting at historically oversold levels with RSI at its lowest point since the days around ‘Black Thursday’ in March 2020. Younger readers may not recall, but on the second Thursday in March 2020, Bitcoin holders experienced some tense moments when the price of the world’s first cryptocurrency crashed 40%, dropping from $8k to $4.7k overnight.

At the time leveraged long/short liquidations hit $880m. Critics emerged from all sides to declare the crypto experiment over. But six weeks later, Bitcoin had regained all of its losses, and in the year that followed ran up gains of over 1,000% more. With 20/20 hindsight, it was a great time to buy. As always. those that could withstand volatility came out on top.

And there is now markedly more capital involved in day-trading cryptomarkets than there was in 2020.

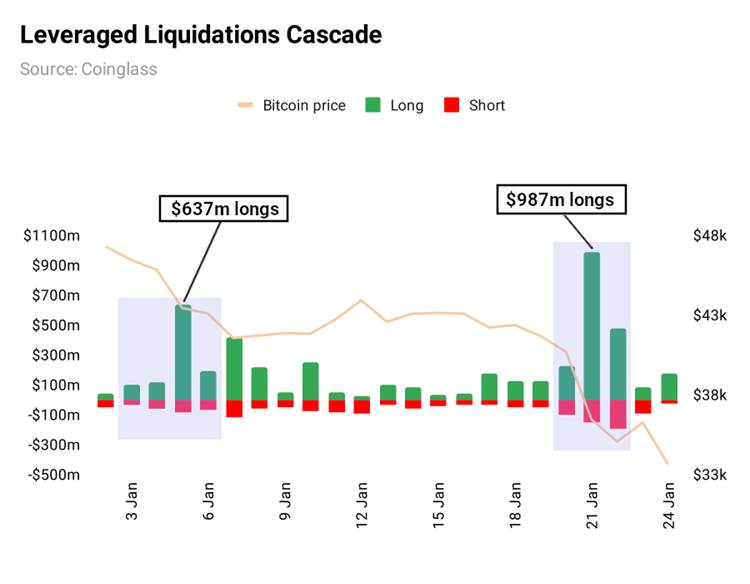

It is certainly worth focusing on specific periods of BTC price weakness to see how derivatives markets impact day to day trading. On 5 January where the Bitcoin price dropped more than 5% overnight, from $45.8k to $43.4k, there were $637.68m of long/short trading positions liquidated across the top 10 cryptoassets. Leveraged liquidations then hit nearly $1bn overnight on 21 January as Bitcoin blew through support and fell from $40.6k to $36.4k.

Note: above chart shows liquidations across all top 10 non-stablecoin cryptoassets: BTC, ETH, SOL, DOT, XRP, ADA, LUNA.

A 20.5% drawdown in the value of any asset is scary for investors, and the fall from $45.8k to $36.4k over the course of the two weeks certainly introduced an element of fear.

On 26 January, Bloomberg went all in and called a ‘prolonged’ bear market. Prices had been cut in half from $69k all time highs.

However, just two weeks later, and its own research arm Bloomberg Intelligence (BI) says Bitcoin

may be uniquely suited to enduring price appreciation.

Canada’s spot Bitcoin ETF saw the third largest inflows in its history on 1 February, attracting over 1,050BTC, according to Glassnode.

Looking at long/short liquidations more broadly across Q1 2022, we can see that volatility has decreased significantly throughout February and March.

In general the longer red candles show that it is short positions in Bitcoin (traders betting that the price will go down) that are being liquidated, as opposed to longer green candles, which indicate that long positions in Bitcoin (traders betting that the price will go up) that are seeing their positions closed.

In totum, Bitcoin investors who are buying for the long haul are starting to realise that they need to have (or develop) tolerance for the kind of short-term pain that is driven by leveraged derivatives trading that is out of their control, and screening out the day-to-day noise as far as they possibly can.

In a February 2022 round up, Mike McGlone, BI’s Senior Commodity Strategist, writes:

Some purging of the speculative excesses of 2021 may mark much of 2022, but Bitcoin is poised to come out ahead. Early adoption days and limited supply of the nascent technology/asset are prime advantages for price appreciation of the benchmark crypto, which is well on its way to becoming global digital collateral.

Institutional inflows to Bitcoin in Q1

This idea of Bitcoin as global digital collateral also played out in the institutional investment market in Q1 2022. January began with marked outflows from digital asset investment products across the board. The first week of the year saw the largest net outflows on record for BTC, not a particular surprise given that markets were coming off record price highs of $69,000 reached in November 2021.

And we know 2021 was a huge year for institutional digital asset investment in general. Bitcoin in particular saw a 16% rise in total inflows for the year, from $5.4bn to $6.3bn, and yet its growth in percentage terms was one of the lowest among all digital assets. This speaks to a generalised discovery by institutional investors of the breadth of digital asset markets, and the technology improvements possible therein.

We began the first week of 2022 with Bitcoin net outflows at $107m, perhaps a response to market uncertainty over the scale and speed of rate hikes throughout 2022. The Federal Reserve holds eight meetings throughout the year under the auspices of the Federal Open Markets Committee (FOMC) and it is here where traders get an inkling of the US central bank’s intentions and how it intends to deal with what in 2022 will very likely be rising inflation.

Negative sentiment persisted in the first half of the month, with a further $54.7m net flowing out of Bitcoin ETPs and ETFs, but the situation would not last. By late January we saw the first green shoots of recovery in institutional Bitcoin investing. What followed was a generalised sentiment shift to the positive over the course of the next six weeks.

A cautious inflow of $13.8m in the week of 24 January broke a five-week run of outflows that had started in late 2021, with investors taking advantage of a dip in the Bitcoin price as low as $33,800. That level proved to be the nadir of Bitcoin markets in 2022 to date.

The upwards trickle steadily became a flood. Even with the threat of European conflict on the horizon, inflows continued to be positive throughout early and mid-February 2022. And even with some nervousness around the length and scale of the conflict, with two weeks of net BTC outflows from ETPs and ETFs in the middle two weeks of March, by the end of the period sentiment had shifted back to the positive again.

One point to make is this: if Bitcoin was fundamentally a risk-on play, then surely the time when investors would capitulate and sell out at any price would be the breakout of war, supplanted by a rush into legacy hard assets like gold or even real estate. That didn’t happen. The period from the breakout of war in Ukraine showed buyers and investors rushing towards Bitcoin, not away from it.

There is still much debate raging about Bitcoin’s status as either a) a risk-on asset or b) a lightly inflation hedge. Bitcoin rarely conforms to type, sometimes behaving like a tech stock and sometimes like a commodity, at other times trading like a currency.

What has become increasingly clear as the months wore on is that there are two quite distinct marginal buyers of Bitcoin. The first are the satoshi stackers: those who believe in the Bitcoin thesis as a unit of account, and will continue to HODL long term, no matter what is happening in wider markets. And then there are the speculators, who will sell up at the first sign of trouble.

South American municipal Bitcoin adoption

South America as a whole is embracing cryptoassets like never before. In the last few months Mexico’s national stock exchange said it was considering listing Bitcoin futures, Paraguay’s Senate approved legislation to take advantage of the country’s energy surplus and to regulate crypto mining and trading, Argentina has said it will levy a 0.6% tax on cryptoexchange operations and Hong Kong’s institutionally-focused exchange OSL announced in October it was expanding into Latin America.

Rio de Janeiro is the second-largest city in Brazil, and the third-largest in South America. As such it has quite considerable purchasing power and political influence in the region. With a GDP of $169.1bn it is also the fourth-richest city in Latin America, behind Mexico City, Sao Paolo and Buenos Aires.

So it was no surprise to see headlines globally when mayor Eduardo Paes announced on 14 January that the city’s municipal treasury would move 1% of its assets into Bitcoin and other cryptoassets.

According to the country’s central bank, the total amount of cryptoassets held by Brazilians reached $50bn in 2021, compared to $16bn held in US stocks and shares.

As Bloomberg writes, Paes’ move is part of a wider scheme to locate Rio de Janeiro as Brazil’s ‘crypto capital’, attracting wealthy businesses to its shores. Recent reports quoting insiders suggest that Brazil’s only national stock exchange B3 is planning to enter crypto markets in 2022, potentially launching a crypto ETF.

Further to the adoption story in South America, in a 25 March post on the city’s municipal website, Chicão Bulhões, the Secretary of Economic Development, noted that Rio de Janeiro would start to accept Bitcoin for real estate tax payments by 2023.

More of Paes’ initiatives under ‘Cripto Rio’ include tax breaks for bitcoin-based businesses operating in the city, and a promise that any regulation will not impede the growth of the industry. As recently as October 2021, the Brazilian Congress was considering legislation to regulate cryptoexchanges, enacting industry-standard KYC procedures and strengthening local powers to prosecute crypto-related crimes.

At the same time, Brazil — like most economic powerhouses worldwide — is struggling to keep inflation in check. Recent data via the government statistics authority IBRE pegs 2021 annual inflation at 10.06%, more than double its 2020 figure of 4.5% and the highest the country has seen in six years.

Bitcoin’s investment status as an inflation hedge has come under question as, since the back end of 2021 and turn of 2022, it has appeared to move more in tune with equities and behave more like a risk-on asset. But there is no doubt that inflation-hit countries see the thesis playing out long-term.

US corporates could convert $4trn cash into BTC

Another part of the investment thesis sees Bitcoin as a new venue for corporate treasury and global reserve asset. We know the Canadian arm of KPMG was a major domino to fall, adding Bitcoin to its treasury in place of cash in February 2022.

In 2010, noted developer Hal Finney made a post on the infamous BitcoinTalk forum that predicted the another current use case for Bitcoin. Finney argued that Bitcoin’s ultimate fate was likely to become high-powered money that serves as a reserve currency for banks that issue their own digital cash. A little more than a decade on, and that prediction appears to be coming true.

US corporates are holding record amounts of cash. $2.5 trillionas of the end of 2020, and over $4 trillionas of March 2022.

And corporate treasurers have much to challenge them going forward, with digital asset alternatives to money market funds now top of their agenda.

There are discussions happening in boardrooms and on corporate treasury Zoom calls all over the world around potentially allocating excess cash to BTC. Treasurers must optimise liquidity (making sure cash is always available for a company to use) while also managing yield and risk. Low-yield money market funds used to be the low-effort venue for excess balance sheet cash, but those days are coming to a close, as while considered ‘safe', overnight funds no longer generate enough interest to beat inflation.

While an additional 50 basis points may be available for longer-term dated funds, treasurers may have to tie up cash for an unpalatable number of months, and risk losing out to inflation anyway.

So with corporate cash effectively seeing negative interest rate and its value being eaten away by inflation daily, treasurers allocating between 1% and 5% to BTC is no longer out of the question. Changing treasury policy to accommodate BTC investments is not a barrier to entry .Microstrategy altered its treasury policy to read: “Bitcoin [will be] serving as the primary treasury reserve asset on an ongoing basis…”

There are several options for those companies that don't want to fork out for custody or manage their own private keys: many invest in funds or regulated Exchange-Traded Products that hold physical BTC, and hence isolate the business and the risk one step away from holding the underlying cryptocurrency itself.

Monitoring and reporting on Bitcoin has improved vastly over the past two years. And while enterprise resource planning systems and legacy treasury management systems often lack the APIs and data architecture capable of tracking and reporting on Bitcoin in real time, the OECD has initiated a public consultationrunning from 22 March until 29 April 2022 consulting on this particular aspect.

Major corporations increased their holdings of Bitcoin by 123% in 2021 and the figures are expected to grow ever stronger in 2022. Across Q1 2022 markets witnessed a growing interest in the asset class by corporations and their willingness to hold BTC on their balance sheet.

Data compiled by researcher Kevin Rooke called ‘Who Owns All the Bitcoin?’, along with figures from BitcoinTreasuries.net and independent research compiled by ETC Group demonstrate that as of the end of Q1 2022 the largest 11 corporate holders of Bitcoin held over 1 million BTC, or 7.1% of the entire BTC supply.

While ETC Group’s Bitcoin holdings are not available to be traded, other funds do often lend out their Bitcoin, meaning that it is not a simple calculation of removing the ~7% figure from the total Bitcoin supply and calling that amount unavailable to trade. Still, these figures demonstrate the depth of corporate and institutional appetite for Bitcoin is increasing quarter over quarter.

What may come as some surprise to anyone perusing the below chart of the largest Bitcoin holders is that the Tezos Foundation, backer and developer of the Tezos (XTZ) smart contract blockchain, is one of them. Co-founders Kathleen and Arthur Breitman were early investors in Bitcoin and the Tezos Foundation reports its holdings on a biannual basis.

Reduced free float and Bitcoin collateral

Another factor of increased Bitcoin corporate holdings is to reduce the free float of Bitcoin. While there are 19,000,000 BTC in circulating supply, and while Bitcoin’s market cap was $871.5bn as of the end of Q1 2022, the free float, or the amount available to be traded was $666.84bn or 76.51% of the total, according to Coinmetrics.

That means the supply of Bitcoin to trade remains relatively scarce.

Bitcoin’s float-adjusted market cap is likely to fall over time as more corporates start to use it as a reserve asset.

In terms of public companies, early adopter Microstrategy has long led the pack. CEO Michael Saylor made his all-in on Bitcoin decision years ago and the company’s repeat purchases — most recently $25m for 660BTC on 1 February — hardly make headlines any more.

And while despite Elon Musk’s much-publicised backtrack on accepting Bitcoin in payment for its vehicles, the company has not divested any appreciable portion of its holdings. According to a February 2022 SEC filing, Tesla has since sold less than 10% ($128m) of the $1.5 billion Bitcoin it bought in Q1 2021 and its holdings have since swelled in value.

The fair market value of our bitcoin holdings as of December 31, 2021 was $1.99 billion, the company reported in those February 2022 regulatory documents to the US market regulator.

What is more salient, though, is Saylor’s assertion that Bitcoin is a structural 100-year investment. He told Yahoo Finance Live on 4 February:

People buy bitcoin because they want to buy an asset, they understand that [it] might have value in 100 years. The truth is there is no security trading on the Nasdaq or the New York Stock Exchange right now that you can understand 100 years from now.

His company now owns 124,391BTC and remains the world’s leading publicly-traded company in terms of Bitcoin corporate treasury.

Microstrategy went one step further in Q1 2022, doubling down on its long Bitcoin bet and adding institutional leverage to its stable by borrowing $205m, using its already-held Bitcoin as collateral to buy more BTC through its June 2021-formed subsidiary MacroStrategy LLC.

Through its LEN programme, Silvergate Bank provided the liquidity for the purchase.

Using the capital from the loan, we've effectively turned our bitcoin into productive collateral, which allows us to further execute against our business strategy, said Saylor.

Since December 2021 Coinbase has offered its retail users the ability to take out loans of up to $1m using held Bitcoin as collateral. We are now starting to see repeats of the same upswell being made in the corporate and institutional market.

No asset class can match Bitcoin as collateral. There is limited counterparty risk. It is available to trade everywhere in the world 24 hours a day, seven days a week and 365 days a year. There are no warehousing costs, and being digital it does not degrade over time. In fact it costs almost nothing to store and hold, aside from the electricity that powers the computers where Bitcoin’s full nodes account for a complete history of transactions. It can be transferred from one side of the globe to the other at near-zero cost and at the speed of the internet.

Futures commission merchants are increasingly looking at ways to accept Bitcoin as collateral, and the Walt Lukken, President of the FIA, the leading trade body for futures and derivatives, noted in a 15 March speech that derivatives markets must embrace digital assets.

The conclusion must be that Bitcoin is becoming pristine collateral and has the potential to become a global neutral reserve asset.

Bitcoin as cryptocurrency’s reserve asset?

We certainly saw more evidence in Q1 2022 that BTC was becoming the reserve asset of choice for the cryptocurrency industry.

Do Kwon, co-founder and CEO of the non-profit Terraform Labs, that provides support to the Terra (LUNA) smart contract blockchain, said he planned to back the UST algorithmic stablecoin with $10bn of Bitcoin monetary reserves, thereby making Bitcoin the reserve asset for his company’s private US dollar-pegged stablecoin.

Doing so would make LFG the third largest corporate holder of Bitcoin globally.

Kwon laid out this strategy on 23 March, noting that a consortium of VC funds called the Luna Foundation Guard (LFG), which includes Jump Capital and Three Arrows Capital, had raised $2.2bn for the first portion of the Bitcoin buy.

These Terra backers now explicitly state they are establishing a UST reserve protocol to ensure the stablecoin maintains its 1:1 peg to the dollar. In an event where the market price of UST materially deviates from the USD peg, holders of UST will be able to close the arbitrage and bring the market price of UST back to the peg by swapping UST for major, non-correlated assets like BTC that capitalise the reserve.

It’s not [$10bn] today, Kwon clarified in a tweet. As UST money supply grows a portion of the seigniorage will go to build BTC reserves bridged to the Terra chain, We have [$3bn] funds ready to seed this reserve, but technical infrastructure is still not ready yet.

The LFG bitcoin wallet address holds 40,000 BTC worth some $1.6bn at time of writing, with 2,830 BTC sent to the address on 28 March alone.

Big Four to provide structural backbone

The 7 February announcement that the Canadian arm of accounting giant KPMG had added Bitcoin and Ethereum to its corporate treasury marked the first of the Big Four to cross the Rubicon.

Cryptoassets are a maturing asset class,

noted Benjie Thomas, the Canadian Managing Partner for KPMG Advisory.

Investors such as hedge funds and family offices to large insurers and pension funds are increasingly gaining exposure…this investment reflects our belief that institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.

KPMG said it established a governance committee for oversight and to approve the treasury allocation, as well as assessing the tax and accounting implications of the transaction.

KPMG Cryptoassets and Blockchain Services co-leader Kareen Sadek added:

We’ve invested in a strong cryptoassets practice and we will continue to enhance and build on our capabilities across DeFi, NFTs and the Metaverse, to name a few. We expect to see a lot of growth in these areas in the years to come.

Canadian businesses have long been at the forefront of recognising the long-term structural importance of Bitcoin and crypto. In October 2021, the world’s 12th-largest pension fund CDPQ made a $400m investment in DeFi lender Celsius Network.

These companies are not buying Bitcoin to trade it, they are buying it as a 30, 40, or 50 year structural investment. While it takes a long time for a company like KPMG or MassMutual Life Insurance (which bought $100m of BTC in December 2020) to commit, they tend to commit for a very long time.

These firms take a very long time to make their decisions, much slower than Bitcoin advocates might like. But an initial allocation to BTC in these instances has been validated by the market, so more dominos will likely fall.

Aside from its widely-cited reports on the state of crypto funding, PwC also entered the metaverse in Q1, spending a reported $10,000 on a slice of digital land registered as a non-fungible token (NFT) in Ethereum-based virtual game Sandbox. Hosted on this digital land will be, of course, a virtual PwC metaverse consultancy.

We heard in Q1 2022 that Deloitte too had made another big push into crypto beyond simple consulting, by partnering with El Corte Ingles, the third-largest retailer and distribution company in Spain. Together the two companies announced plans to create a cryptocurrency exchange to service the 11 million customers the retailer has connected to its in-house credit card. The exchange, called Bitcor, will offer a range of cryptos to buy, including Bitcoin and Ethereum.

Bitcoin Fundamentals

Bitcoin on-chain analytics provide us with a way of analysing holder behaviour, which is key to show how Bitcoin is being used, and to making projections for how Bitcoin might change in the future. Traditional financial metrics don’t apply. As an analogue: in the 1990s, Wall Street analysts struggled to value internet stocks using their traditional methods, like price to earnings ratios. This set of companies was managing to reach its market at near-zero cost, simply by having access to the internet.

One of the more valuable on-chain metrics used to classify market players into meaningful groups is that of Long Term Holders and liquid supply.

Bitcoin’s UTXO-based system allows for analysis of on-chain data based on the “age” of Bitcoin in the network. This categorises bitcoins depending on the last time they were moved between wallets or between users.

Glassnode analysts classify Long Term Holders as those holding Bitcoin for over 155 days (~5 months). There is a full explanation of this here, but suffice it to say, the longer a coin does not move from a wallet address, the less likely it is to move (called ‘coin dormancy’) and it is statistically unlikely for a coin to ever move if it stays unused for 155 days or more.

Bitcoin is seeing an ever greater proportion of coins moving from liquid to illiquid. Liquid is denoted by those coins held by traders, while illiquid Bitcoin is those held by Long Term Holders.

Perceived asset scarcity is a key aspect of this behaviour. Prominent studies in the field of psychology have repeatedly demonstrated that humans find scare assets more attractive

Robert B. Cialdini, Influence: The Psychology of Persuasion (Harper Business, new and expanded edition, May 2021), likely a deeply-embedded principle originating with early humans and their ability to find supplies of food, with those most successful most likely to survive harsh conditions.

Pre-Bitcoin, the world had never seen an asset with a truly fixed supply — and crucially, one whose supply is known in advance, that also has the features of being seizure-resistant, censorship-resistant, portable, easy to move cross border, highly desirable and highly divisible.

Every commodity analyst knows the concept of limited supply. The world’s oil supplies, for example. Oil, gold, lumber or any other commodity, however limited, does not have a fixed supply that is known in advance, unlike Bitcoin.

As Thomas Sowell argues in Basic Economics:

Certain sands containing oil in Venezuela and Canada had such low yields that they were not even counted in the world’s oil reserves until oil prices hit new highs in the early twenty-first century…In short, there is no fixed supply of oil — or of most other things. In some finite sense the earth has a finite amount of each resource but, even when that amount may be enough to last for centuries or millennia, at any given time the amount that is economically feasible to extract and process varies directly with the price for which it can be sold.

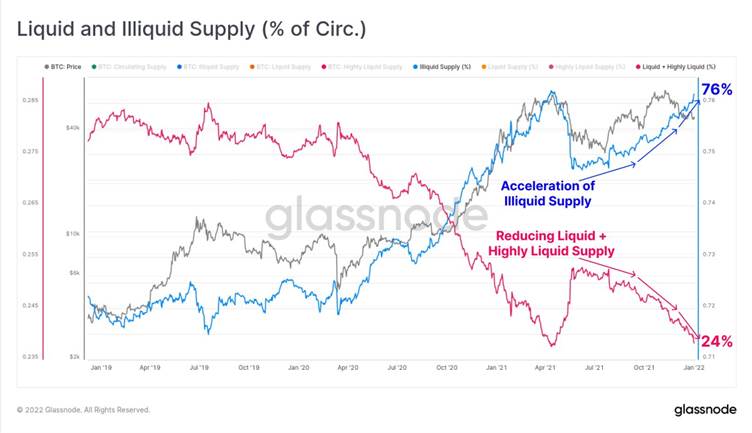

The above chart shows how since January 2021 Liquid and Highly Liquid supply has fallen to 24% of total Bitcoin, while illiquid Supply has accelerated to 76% of total Bitcoin.

Bitcoin last active 1+ year ago near all time highs

A general lack of market activity in the New Year contributed to softened trading volumes and prices heading sideways, with the first few weeks of January pure consolidation.

But coin dormancy and illiquid supply continues to grow to impressive levels. The proportion of long-term holders who have never sold any Bitcoin at all, ever, since buying their first BTC, is nearing record highs.

As Glassnode analysts reported on 28 March, the proportion of Bitcoin supply aged 12 months or older is also rapidly approaching all time highs.

Coins accumulated in Q1 of the 2021 bull market remain unspent in investor wallets. This generally signifies that Bitcoin investors maintain a strong conviction in the asset, despite the many macro and geopolitical headwinds,

the analysts write.

Owners of these coins have held through at least two drawdowns of 50% or more, as well as two all time highs. This suggests there is a cadre of Bitcoin investors who will not sell at any price. Coin age is one of Glassnode’s fundamental tools for categorising crypto holders into groups: in that, statistically speaking,

Investors who hold Bitcoin for any length of time are more likely to experience the ups and downs of this volatile asset class,and iit is also true that the longer Bitcoin is held, the more likelihood that these holders will be hardened into higher-conviction personnel.

As we approach the end of Q1 2022, we can see an extraordinary increase in the proportion of coins [aged 12 months or older], a figure which has risen by 9.4% over the past eight months.

With 62.9% of Bitcoin supply now having not moved in over a year, we are just a few basis points away from the record levels seen in late 2021. By contrast, look at the chart above to see that in the depths of the Bitcoin bear market in 2018, only 40.7% of the Bitcoin supply was last active more than one year ago, suggesting that traders and investors were either using their BTC to pay for goods and services, or moving it around from their own wallets to exchanges to trade and sell it.

Reaching back to Thomas Sowell again it is important to understand how prices rise and fall in a free market. Prices rise because the amount demanded exceeds the amount supplied at existing prices. Prices fall because the amount supplied exceeds the amount demanded at existing prices.

Plainly, the amount of Bitcoin supply available at existing prices is not enough to keep up with demand. And with an ever-greater number of HODLers, it appears clear accumulation is ramping up and free float supply is continuing to decrease.

On-chain analysis of the fundamental metrics in Bitcoin’s network signalled generally bullish throughout Q1 2022. Coupled with greater institutional investment in the early and latter part of the quarter, this looks positive for the strategic Bitcoin investor going forward..

Accumulation addresses grow by 1,800BTC/day

The data show that Bitcoin holders are hoarding more Bitcoin, for longer. These accumulation addresses are starting to provide a price floor per BTC, as fewer coins are available on the market to trade.

Accumulation addresses are defined as those which have more than one incoming Bitcoin deposit, have never spent any Bitcoin and were also active in the last seven years. This accounts for wallets and coins that have been lost, or where users have forgotten their passwords.

This metric excludes [cryptocurrency] exchanges and [Bitcoin] miners, but will include large entities like custodians, LFG and [MicroStrategy subsidiary] MacroStrategy, Glassnode write.

There are now over 500,000 Bitcoin accumulation addresses holding a total of 2.6 million BTC (around 14% of total supply).

The total balance held in accumulation addresses climbed by 217,000BTC over the four months from early December 2021 to early April 2022. This represents a growth rate of 1,800 BTC per day and is significant because it is twice the daily issuance of new Bitcoin to miners, which could account for existing market participants holding more Bitcoin. This also breaks away from a generally sideways balance trend established throughout most of 2021, Glassnode analysts say.

Bitcoin HODLing climbs to all time high

Additionally, by looking at the ‘age’ of coins in the network that have not moved in a year or more, we can see that accumulation (HODL %) hit a new all time high in 2022.

The number of HODLing addresses tends to fall when prices reach a cycle high and people cash their Bitcoin in for fiat profit. Once coins are moved they are no longer counted in the HODL % bracket..

In Q1, HODLing behaviour equalled the previous record of 63% ATH last seen in Q3 2020 and by the end of Q1 2022 crossed a new 64% all time high.

The magic of Bitcoin is that two things can be true at the same time. That a) the number of people accumulating and HODLing Bitcoin is at all time highs, and b) the Bitcoin network is more efficient and cheaper to use as a cross-border payments network than ever before.

Again: referencing Thomas Sowell, economics is the study of scarce assets which have alternative uses. Bitcoin’s dual alternative uses — as means of payment or as a neutral reserve asset — are being brought into ever sharper focus.

Exchange reserves drop to all time lows

HODLing behaviour is complemented by another useful metric: exchange reserves. When more users are moving BTC away from crypto exchanges like Coinbase and Binance (where the majority of BTC is sold), this indicates relatively lower selling pressure. The opposite, when users are moving more BTC onto exchanges (and so the amount of BTC those exchanges hold in reserve rises), this indicates relatively higher selling pressure.

As this chart from Cryptoquant shows, exchange reserves hit new lows in Q1 2022.

Small BTC holders growing fastest

Addresses are not the same as users in Bitcoin, because any user can create multiple addresses. They are, however, a reasonable proxy measurement to demonstrate the adoption of any cryptoasset.

The number of small Bitcoin holders grew substantially during the quarter. Having passed 20 million for the first time in November 2021, the number of addresses holding between 0 and 0.001BTC ($~45) rose from 20.68m to 21.45m.

The number of addresses containing between 0.001BTC ($~45) and 0.01BTC ($~450) also crossed 10 million for the first time in Q1 2022, on 27 February.

While buyers in the upper echelons of capital allocation are likely to have outsize influence on market price, the data show that the addresses holding the smallest amount of Bitcoin are rising the fastest.

This suggests a groundswell of new and existing users coming on to the Bitcoin network for the first time.

BTC Layer 2: Lightning Network growth continues

The rapid growth of the Layer 2 technology Lightning Network — a way of netting payments off the blockchain — is key to Bitcoin’s use as ‘peer to peer electronic cash’ as described in the title of its whitepaper.

Across Q1 2022 the capacity of Lightning Network channels grew by 9.12% to more than 3,600BTC (~$148m).

The Lightning Network is powered by smart contracts and employs micropayment channels to carry out transactions near-instantaneously. It is generally seen as one of the key methods of scaling Bitcoin as a currency. And because it moves transaction processing away from the main Bitcoin blockchain, the Lightning Network makes it much more feasible to carry out day-to-day payments and microtransactions using Bitcoin.

Theoretically, Lightning Network can process millions of transactions per second, if the number of channels continues to grow. Transactions are also settled off-chain, making Bitcoin micropayments practical.

Transaction speeds are typically measured in milliseconds. The Lightning Network relies on smart contracts rather than having to wait for confirmation on-chain. On-chain confirmation can take up to 60 minutes with standard Bitcoin transactions — as blocks of transactions are processed once every 10 minutes and it takes around six confirmations for blocks to be considered immutable.

The growth in the number of new channels appears to be slowing, however. As of 31 December 2021 there were 80,369 Lightning Network channels available. By 1 April 2022 that figure had only increased to 82,401, a 2.52% rise. This compared unfavourably to channel growth between September 2021 and December 2021, when the number of Lightning Network channels rose from 64,625 to 80,369, or a 24.36% jump.

More Lightning Network infrastructure will be required to continue the growth of the network.

Cost to use BTC now lowest since 2020

Another question we must ask is this: Is Bitcoin becoming more or less expensive for the average end user to utilise?

Figures analysed by ETC Group show the median transaction fee for Bitcoin dropped 28.5% from $0.70 to $0.50 per transaction, compared to Q4 2021. Transaction fees for sending and receiving value using the Bitcoin network have dropped to their lowest level since 2020, ETC Group research shows. And over the course of the last 12 months, the average cost per transaction has plummeted by 93.6%, from $7.97 to $0.50.

Fundamentals + Economic Perfect Storm to take Bitcoin to All Time Highs

The reason why Bitcoin is prized so highly as an asset and as a means of exchange is that it provides the perfect ideological counterpoint to debased government money today. It also consists of many of the properties of sound money.

It is very early to be making predictions about how Bitcoin will perform in a highly inflationary environment. The world has not witnessed such a state of affairs in decades. But if anything was likely to push more investors, users and holders towards alternative, provably scarce assets, it would be a cost of living crisis in the West, soaring gas and oil prices, and stubbornly high inflation, making cash held in savings accounts ever more toxic by the day. Throw in the potential for a US recession, as predicted by the yield curve inversion mentioned earlier, and the picture could not be better set up for a strong 2022 for Bitcoin.

Hard assets with growing adoption metrics are never so valuable as in times of trouble. Liquid hard assets especially so. While real estate or gold may be hard assets, they are difficult to transport, costly to store or maintain, and generally indivisible. Tokenisation and representation of these assets on public blockchains would solve those particular issues, but that is a discussion outside the scope of this report.

Fresh evidence of Bitcoin utility comes firstly from the fact that smallest BTC holders are growing the fastest, secondly that Lightning Network capacity keeps making all time highs, coupled with the fact that on-chain data shows more users are HODLing more Bitcoin for longer.

By every metric we have looked at, Bitcoin has now reached critical mass.

Plenty of novel technologies are never adopted to this level.

We have consistently said that to see Bitcoin breaking out of its long-term range between $28,000 and $69,000, we would need to see more country-level adoption from larger GDP nations, firmer regulation from major nations, and more corporations staking their reputation and their future on crypto by adding Bitcoin to their corporate treasury.

We are starting to see the latter two of those three metrics breached. Timelines are difficult (and usually proved wrong), so we will not attempt to give a date for Bitcoin reaching new all time highs. But it does appear inevitable given the points noted above.

With greater adoption, Long Term Holders holding more, and for longer, along with an inflationary macro environment that highly favours alternative assets over fixed income, we can certainly see the bullish case for Bitcoin.

Outlook

With Bitcoin reaching an all-time high of $69,000 in November 2021, much of the early part of 2022 was marked by profit taking and purging of the speculative excesses that dominated the previous quarter. Despite the long-held and stubborn arguments against its adoption, Bitcoin continues to demonstrate not just strength among existing holders but at every turn, demonstrate a new way for individuals, corporates and governments to send and receive money and express long-term value.

We do see Bitcoin rangebound in the $28,000 to $69,000 region for the rest of 2022, barring any Black Swan events such as more countries adopting Bitcoin as legal tender.

Our outlook on a longer timeframe is entirely unchanged. Aside a central bank moves that put interest rates at multiples higher than what is expected, we see the long-term price appreciation in Bitcoin continuing apace. Over the next five to 10 years, history will likely record that Bitcoin’s investment thesis has gained much and lost nothing from recent macroeconomic events.

Early adopters are maturing into early majority, as evidenced by OTC crypto trades from Goldman Sachs, and the use of Bitcoin as a cross-border asset to aid Ukraine. Against the backdrop of soaring inflation in nearly every country, volatile bond markets, and central banks hiking rates, a limited supply schedule is a key advantage for continued price appreciation in the original cryptocurrency, and Bitcoin remains on track to becoming a global reserve asset.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

About ETC Group

ETC Group has been created to provide investors with the tools to access the investment opportunities of the digital assets' and blockchain ecosystem. The company develops innovative digital asset-backed securities including ETC Group Physical Bitcoin (BTCE) and ETC Group Physical Ethereum (ZETH) which are listed on European exchanges including XETRA, Euronext, SIX, AQUIS UK and Wiener Börse.

With a track record of over three years, ETC Group is made up of an exceptional team of financial services professionals and entrepreneurs with experience spanning both digital assets and regulated markets. With product quality and safety at the core of our product creation approach, the company aims to continuously launch best-in-class institutional-grade exchange traded products.

As a company, ETC Group has previously launched BTCE - the world’s first centrally cleared Bitcoin exchange traded product on Deutsche Börse XETRA, the largest ETF trading venue in Europe, and also listed DA20, the world’s first crypto ETP tracking an MSCI index signalling a move towards investment management products. DA20 provides broad market exposure to investors by tracking an index of 20 cryptocurrencies which cover 85% of the total crypto market capitalisation.