- Bitcoin stabilizes above 60k USD amid a rebound in risk appetite; Ethereum outperforms

- Our in-house “Cryptoasset Sentiment Indicator” continues to recover from year-to-date lows

- Bitcoin on-chain data indicate that accumulation activity has recently increased strongly which is likely going to support prices above 60k USD for the time being

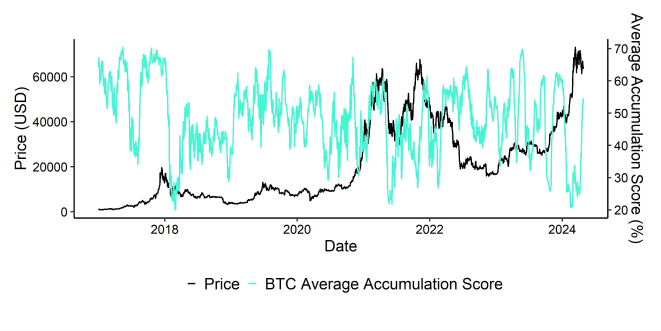

Chart of the Week

Performance

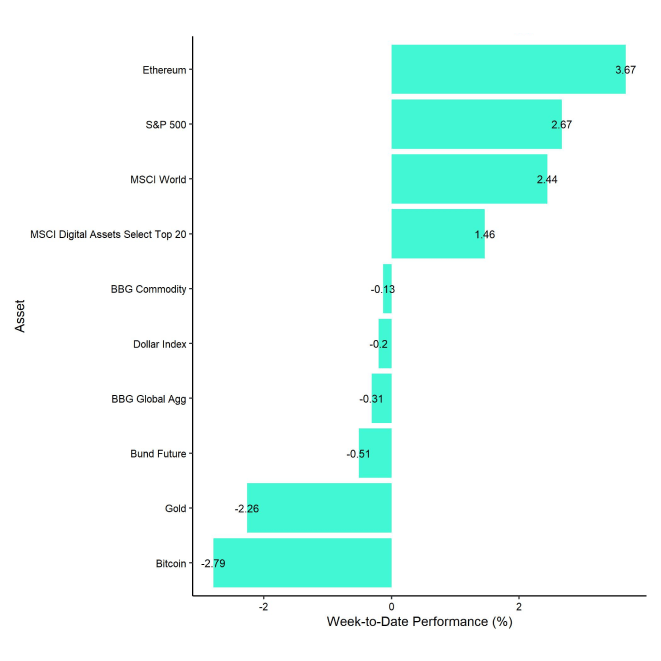

Last week, cryptoasset performances were relatively mixed as Bitcoin stabilized above 60k USD and Ethereum outperformed.

We also saw a sharp reversal in crypto sentiment from year-to-date lows. The improvement in overall sentiment was mostly related to a sharp reversal in traditional financial market's risk appetite that buoyed risky assets like US equities.

Some macro risks like the recent depreciation in the Japanese Yen still seem to be an isolated event so far but could affect other assets' performances more broadly if the depreciation started to accelerate.

In general, we think that the depreciation in the Yen is more indicative of broader USD appreciation pressure and, hence, tightening US financial conditions. This tends to be net bearish for Bitcoin and cryptoassets from a macro perspective in the short term.

There was also a small outcry on social media about a potential haircut to the collateral value of US ETFs that have Bitcoin as underlying as the DTCC had issued an important notice on Friday. Market participants feared that this might decrease the demand for US spot Bitcoin ETFs going forward. However, it is important to note that the ability to use crypto ETFs for lending and collateral with brokerage is likely unaffected by this and remains dependent on the broker's risk tolerance.

However, the overall news flow still remains relatively bearish with the recent takedown of wallet service provider Samourai wallet in the US due to concerns over illicit transactions. This is contributing to increased regulatory uncertainty in the US.

This week, we expect overall cryptoasset volatility to pick up again amid the Hong Kong spot Bitcoin and Ethereum ETF trading launches tomorrow and the FOMC's monetary policy decision on Wednesday.

3 companies have lined up to issue both a Bitcoin and Ethereum spot ETF in Hong Kong tomorrow – China AMC, Harvest, and Bosera. This will add to the existing Bitcoin Futures ETFs already issued in Hong Kong by Samsung and CSOP.

Bloomberg Intelligence analysts expect the Hong Kong spot Bitcoin ETFs to collect around 1bn USD in their 1st year of trading which would be relatively small compared to the overall size of the global Bitcoin ETP market (~66.2 bn USD based on our calculations).

So, the Hong Kong ETF launches are unlikely to have a very significant impact. That being said, the threshold for fund flows into Hong Kong spot ETFs to surprise to the upside is relatively low.

Concerning the FOMC meeting on Wednesday, futures rates traders expect the Fed to keep interest rates unchanged at the next meeting. However, guidance on the future outlook for interest rates will be watched more closely.

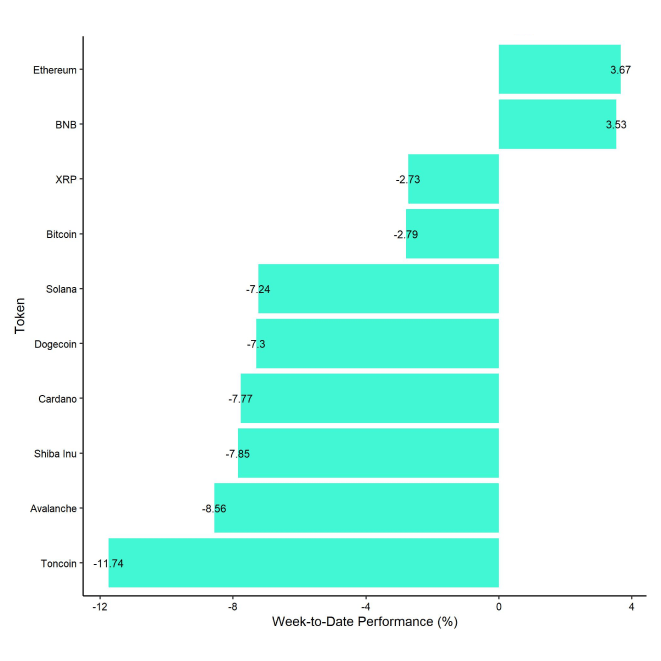

In general, among the top 10 crypto assets, Ethereum, BNB, and XRP were the relative outperformers.

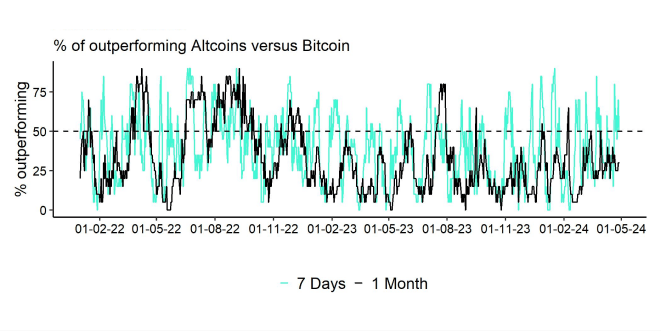

Overall altcoin outperformance vis-à-vis Bitcoin also remained relatively high, with around 50% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

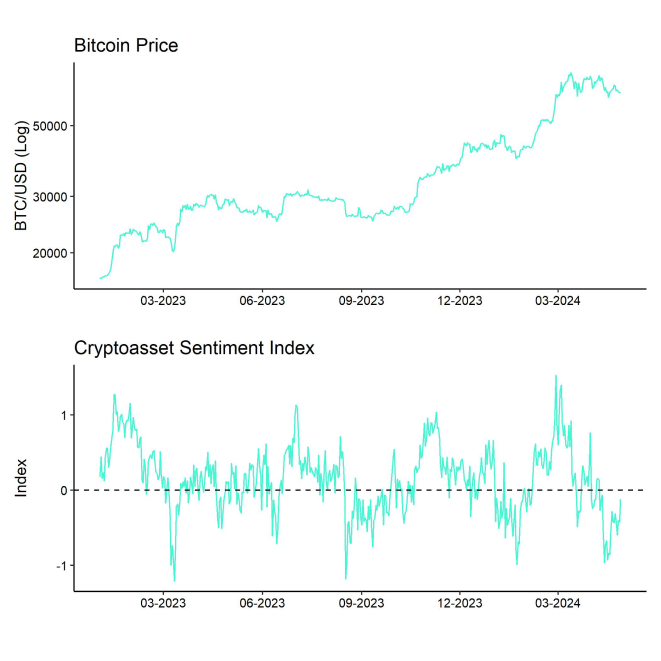

Sentiment

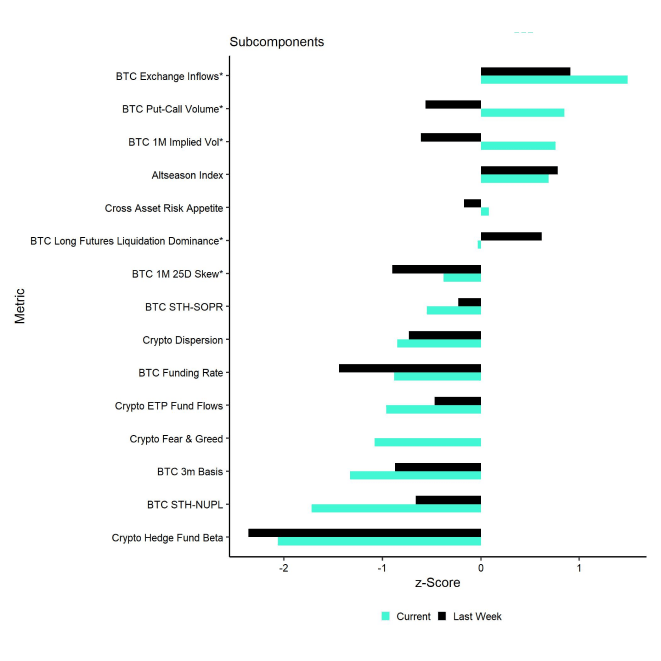

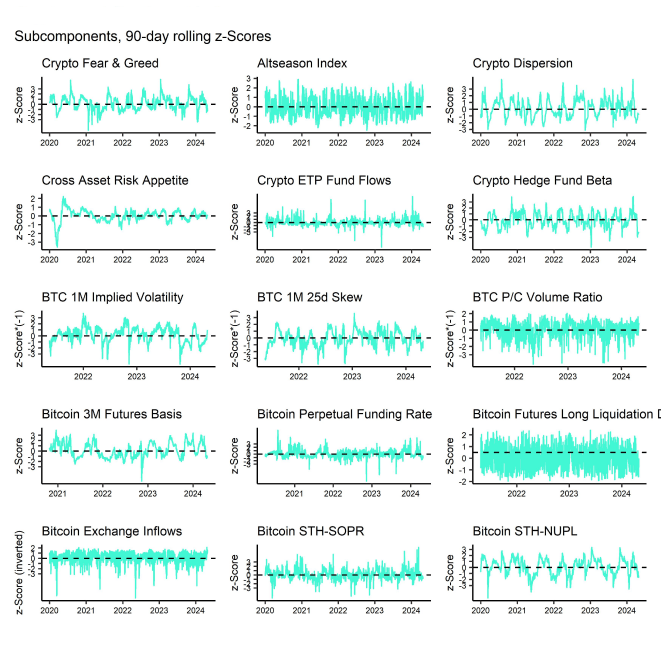

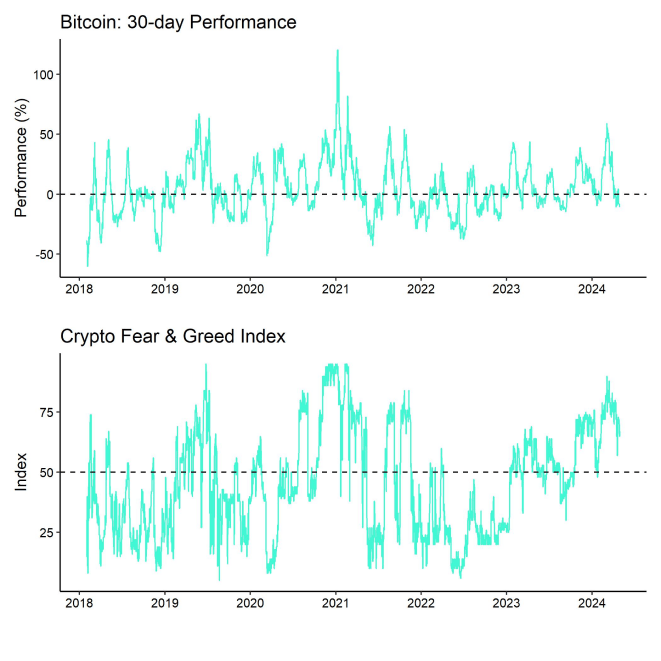

Our in-house “Cryptoasset Sentiment Index” has continued to recover from year-to-date lows that were induced by the rise in geopolitical tensions and tightening financial conditions. The index is currently still signalling slightly bearish sentiment.

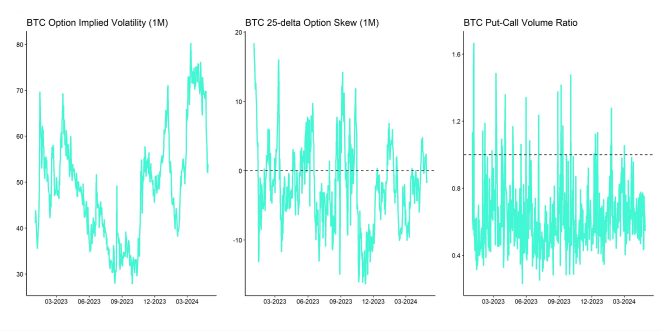

At the moment, only 5 out of 15 indicators are above their short-term trend.

Last week, there were significant reversals to the upside in BTC put-call volume ratios and BTC option implied volatilities, which both declined last week.

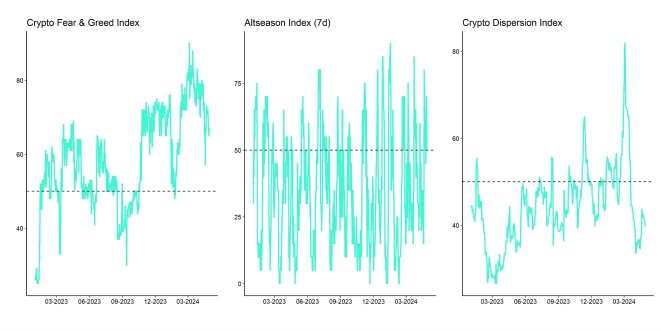

The Crypto Fear & Greed Index remains in "Greed" territory as of this morning.

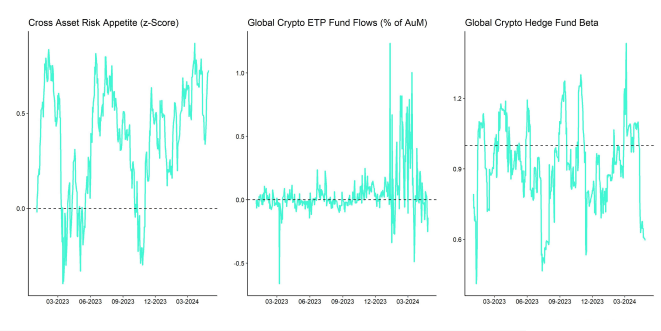

Besides, our own measure of Cross Asset Risk Appetite (CARA) has also recovered sharply throughout the week which signals a sharp recovery in risk appetite in traditional financial markets.

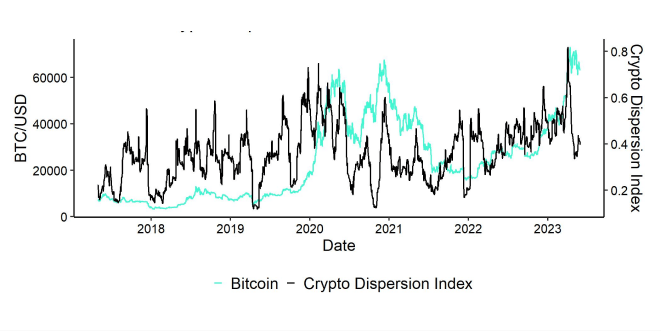

Performance dispersion among cryptoassets has continued to decline amid the recent correction. Overall performance dispersion is currently moderate.

Altcoin outperformance vis-à-vis Bitcoin has recently remained relatively high, with around 50% of our tracked altcoins that have outperformed Bitcoin on a weekly basis. At the same time, there was a significant outperformance of Ethereum vis-à-vis Bitcoin last week.

In general, increasing altcoin outperformance tends to be a sign of increasing risk appetite within cryptoasset markets.

Fund Flows

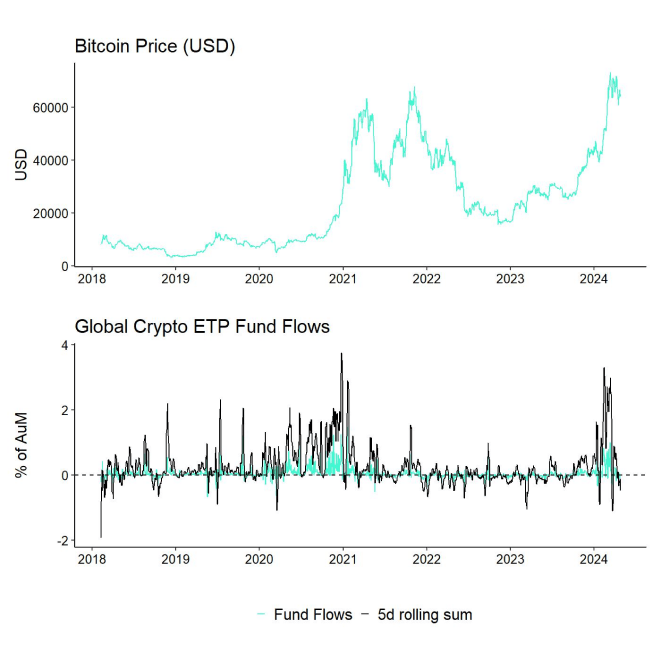

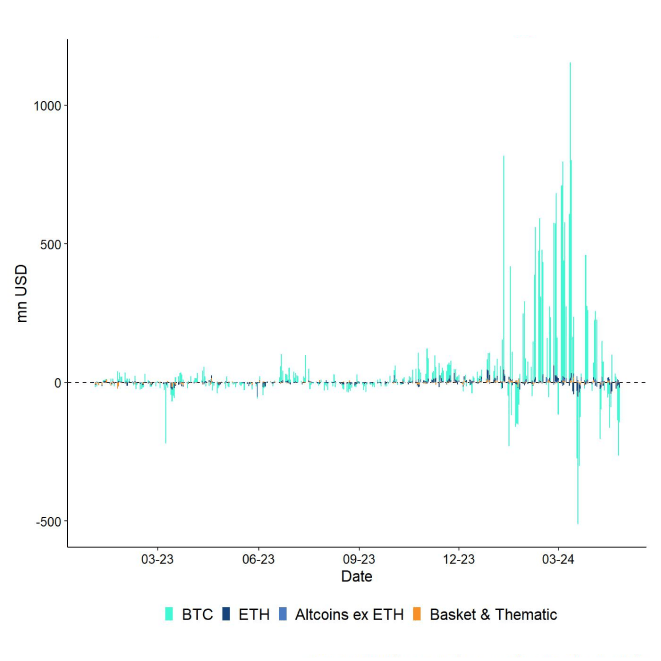

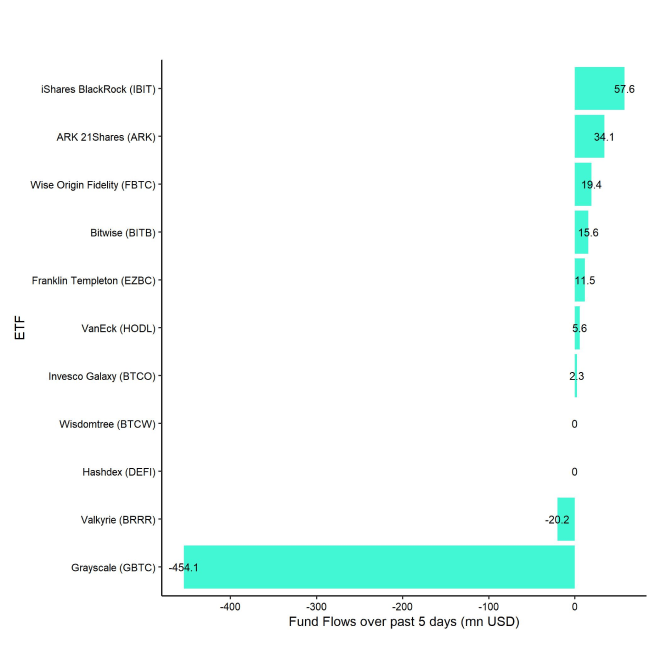

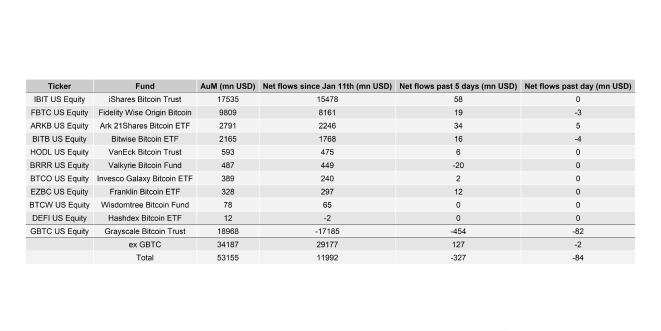

Last week, we saw continued net outflows from global crypto ETPs with around -496.8 mn USD (week ending Friday) based on Bloomberg data.

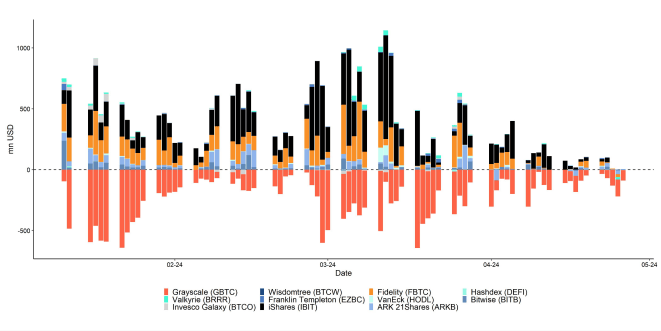

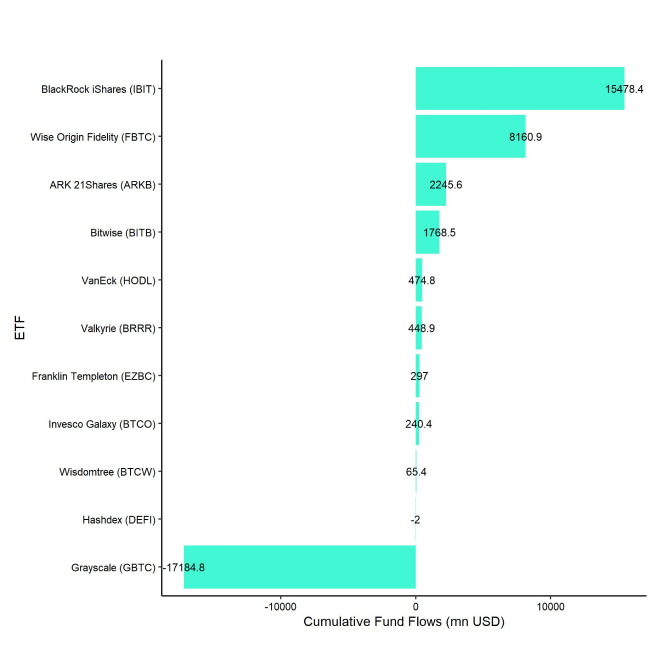

Global Bitcoin ETPs dominated with net outflows of -462.0 mn USD of which -328.1 mn (net) were related to US spot Bitcoin ETFs alone. The ETC Group Physical Bitcoin ETP (BTCE) also saw net outflows equivalent to -13.3 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) continued to experience increasing net outflows of approximately -454.1 mn USD last week.

Global Ethereum ETPs also saw significant net outflows last week as well of around -63.8 mn USD. Meanwhile, the ETC Group Physical Ethereum ETP (ZETH) defied negative market trends with a small net inflows (+0.24 mn USD). The ETC Group Ethereum Staking ETP (ET32) had neither share creations nor redemptions (+/- 0 mn USD) last week.

Besides, Altcoin ETPs ex Ethereum again managed to attract increasing net inflows of around +27.6 mn USD amid the ongoing rotation into altcoins. This represents an acceleration in net inflows relative to the week prior.

Besides, Thematic & basket crypto ETPs also experienced minor net inflows of +1.5 mn USD, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) did experience neither in- nor outflows last week (+/- 0 mn USD).

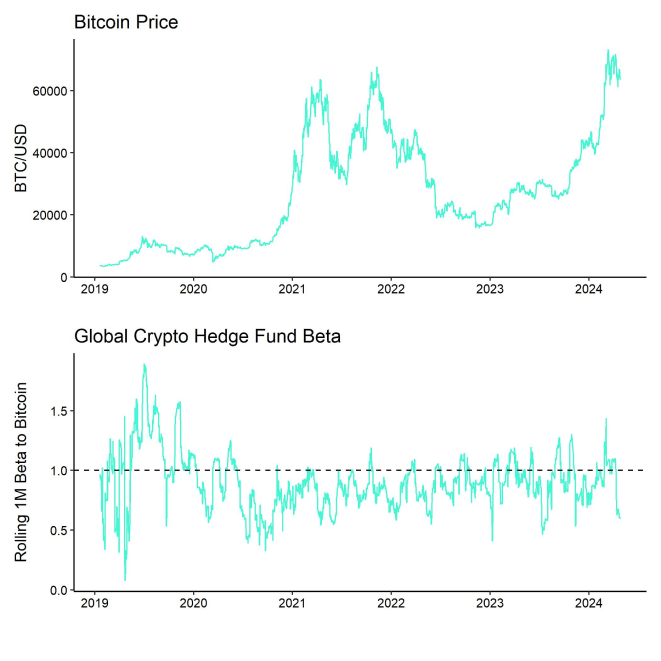

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading continued to decrease to around 0.59 to the lowest level year-to-date. This implies that global crypto hedge funds have significantly reduced their market exposure and are significantly underweight relative to the market.

On-Chain Data

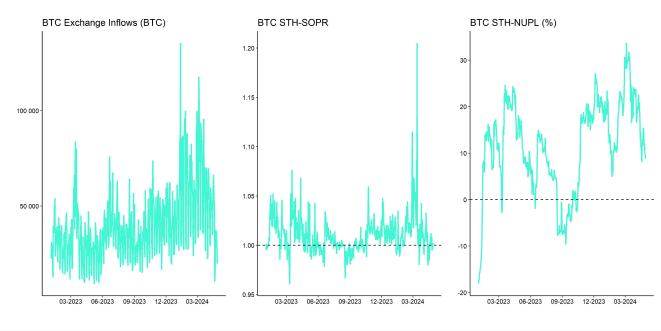

Recent on-chain data for Bitcoin can generally be described as “stabilizing”.

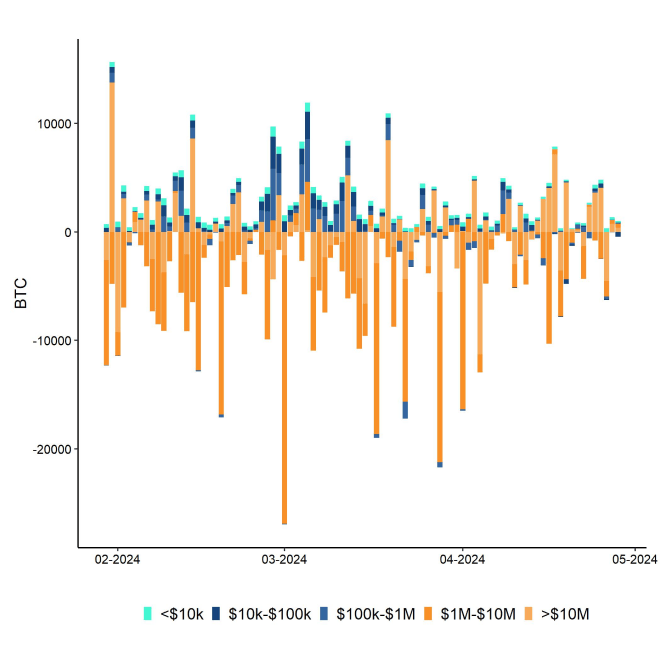

A bright spot seems to be the recent pick-up in accumulation activity across certain wallet cohorts in Bitcoin. On-chain data for Bitcoin indicate that accumulation activity has recently increased strongly which is likely going to support prices above 60k USD for the time being (Chart-of-the-Week ).

This seems to be mostly related to increasing accumulation activity in smaller wallet cohorts though.

The average accumulation score aggregates individual accumulation scores across different wallet cohorts and shows the average balance growth across these different wallet cohorts.

A weak link within the Bitcoin on-chain landscape was the strong decline in active addresses that had been induced by the sharp increase in transaction fees around the Halving. Although active addresses have recovered a bit, they still remain near year-to-date lows.

On a positive note, Bitcoin's hash rate so far remains unaffected by the recent halving of miner's block subsidy from 6.25 BTC to 3.125 BTC per block. BTC miner wallet balances have also moved sideways which indicates that miners have not started selling into their reserves which would have been a sign of a potential short-term “miner capitulation”.

That being said, net buying volumes of bitcoins on spot exchanges remain negative amid the ongoing net outflows from US spot Bitcoin ETFs, in particular GBTC.

Overall net exchange flows remained fairly balanced over the past week with only miniscule net BTC transfers to exchanges dominated by some whales net exchange transfers which is why BTC exchange balances moved sideways last week. Ethereum exchange balances went slightly down last week.

In general, profit-taking by both short- and long-term holders of Bitcoin remains relatively low which has decreased selling pressure on prices.

Overall, Bitcoin's on-chain data remain dominated by developments in spot Bitcoin ETFs which currently do not provide a significant tailwind. A broadening accumulation activity across more and bigger wallet cohorts would certainly be a positive sign.

Futures, Options & Perpetuals

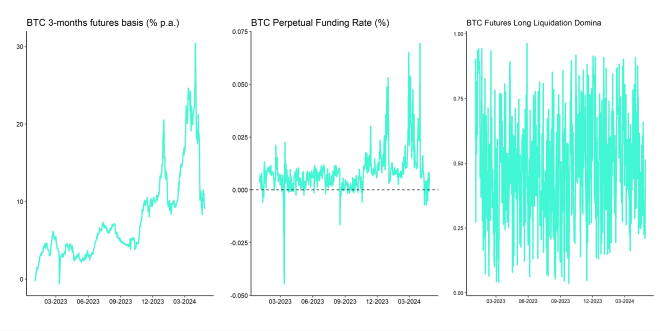

Last week, futures open interest went mostly sideways in BTC-terms and perpetual BTC futures only experienced a slight increase in open interest.

The Bitcoin futures basis also continued to move sideways last week. At the time of writing, the 3-months annualized Bitcoin futures basis rate is at around 9.1% p.a. which still marks a significant decline from the highs observed at the end of March (~30.4% p.a.).

The weighted Bitcoin perpetual funding rate across various exchanges was also relatively low and even went negative on Thursday last week.

Bitcoin options' open interest decreased significantly last week amid the April option expiries. This also led to a significant decline in put-call open interest ratio which implies that many put options have not been renewed. The market remains skewed towards higher price expectations via calls.

Consistent with this observation, the 25-delta BTC 1-month option skew also declined last week as BTC options traders paid higher volatility premia for calls than for delta-equivalent puts. That being said, skews still remain relatively high despite the recent stabilization in prices.

Meanwhile, BTC option implied volatilities have declined significantly amid the recent stabilization in prices. Implied volatilities of 1-month ATM Bitcoin options are currently at around 54% p.a.

Bottom Line

- Bitcoin stabilizes above 60k USD amid a rebound in risk appetite; Ethereum outperforms

- Our in-house “Cryptoasset Sentiment Indicator” continues to recover from year-to-date lows

- Bitcoin on-chain data indicate that accumulation activity has recently increased strongly which is likely going to support prices above 60k USD for the time being

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  De

De