ETC Group Crypto Market Compass

Week 13, 2024

Editorial Note: We won’t publish the Crypto Market Compass (CMC) next week because of the Easter holiday season. The next CMC will be published on the 22/04/2024.

Editorial Note: We won’t publish the Crypto Market Compass (CMC) next week because of the Easter holiday season. The next CMC will be published on the 22/04/2024.

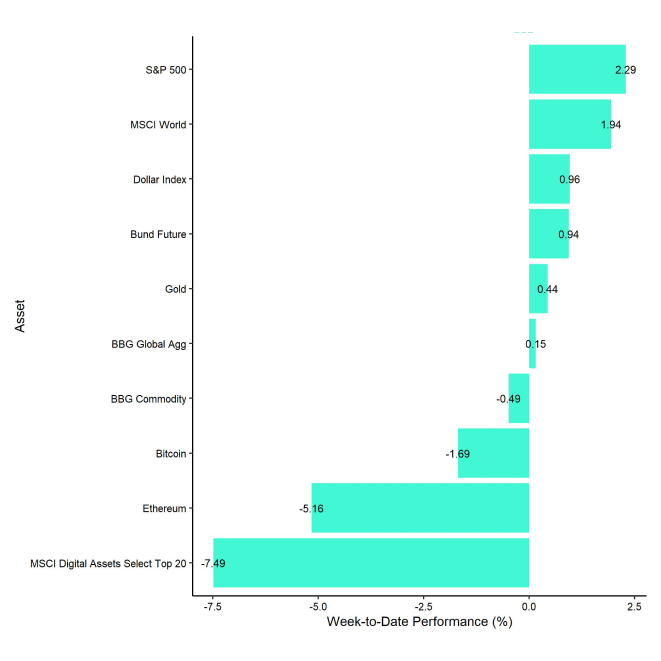

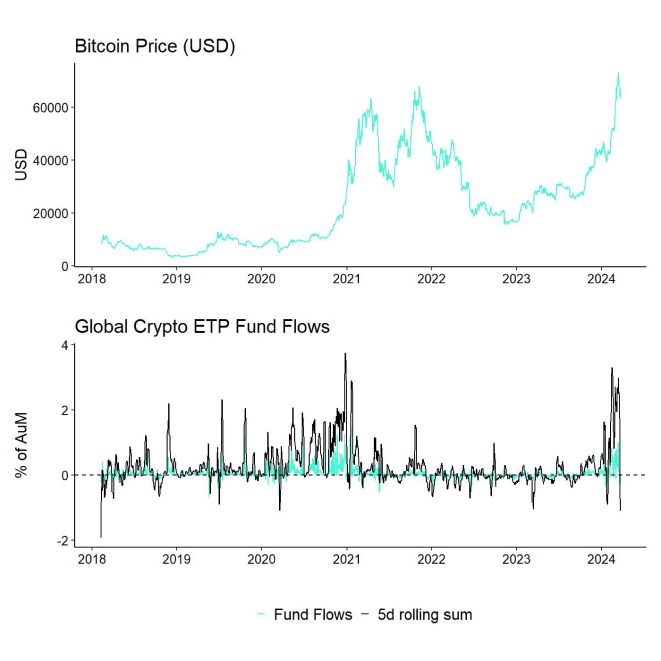

Last week, cryptoassets underperformed on account of increased net outflows from global Bitcoin ETPs. Last week, saw the highest weekly net outflows ever recorded and the steepest net outflows from US spot Bitcoin ETFs since trading launch.

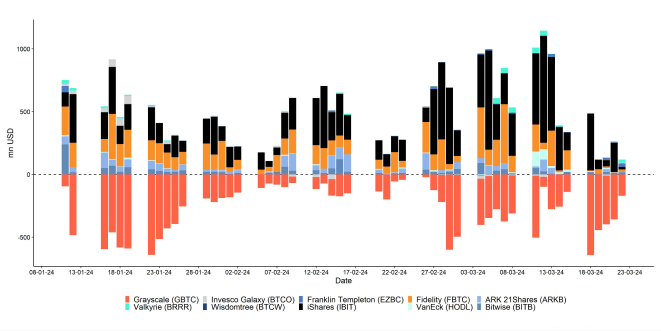

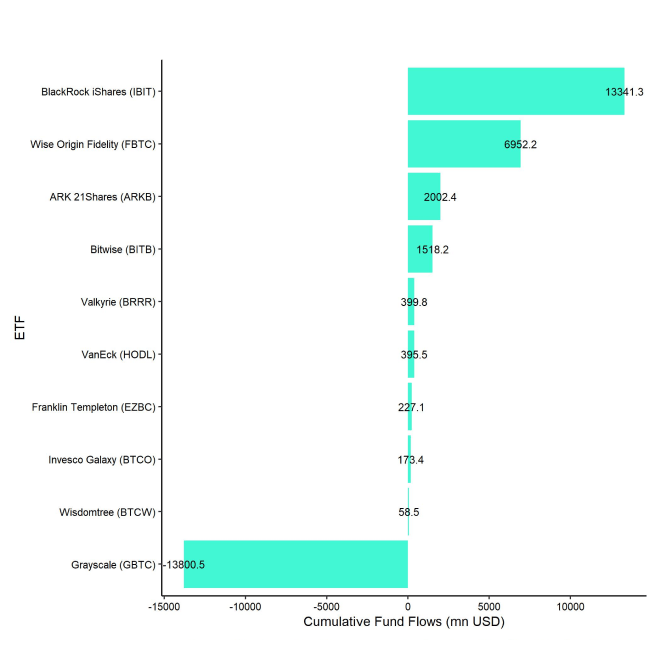

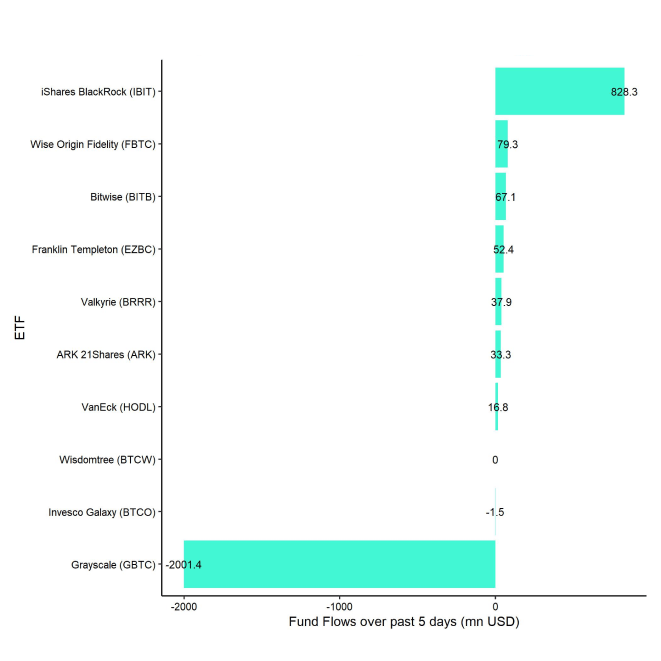

However, most of these net outflows were concentrated in the Grayscale Bitcoin Trust (GBTC) in the US which saw more than -2 bn USD in net outflows last week while other US spot Bitcoin ETFs saw continued net inflows. Accelerating outflows from GBTC could be related to ongoing FTX or Genesis bankruptcy sales that are likely going to last only temporary.

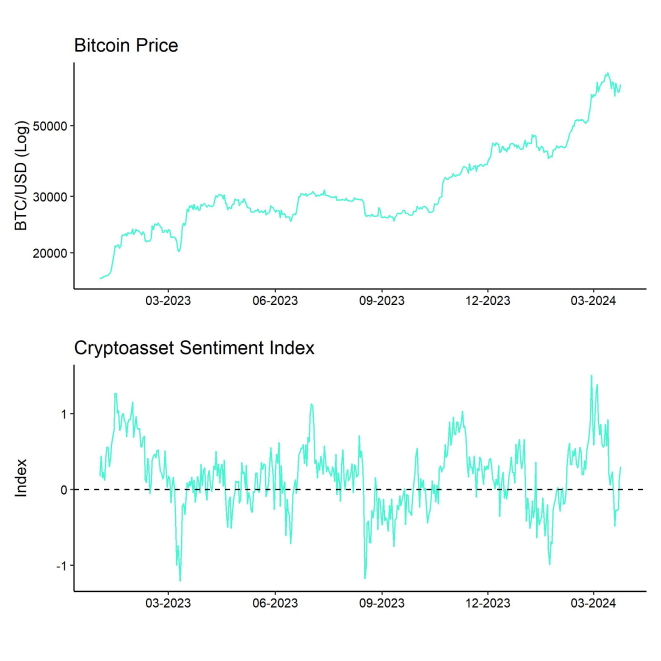

Accelerating outflows from GBTC have clearly darkened market sentiment which had fallen to the lowest levels since January 2024 when outflows from GBTC had also worsened market sentiment.

Another factor that has contributed to a worsening sentiment in crypto markets were reports that the SEC is waging a campaign to classify Ethereum as a security.

This comes at a time when the final deadline for the approval of a spot Ethereum ETF by one of the issuers is approaching fast (23 rd of May). The odds for an earlier approval by the end of May 2024 have plummeted to around 22% following these reports according to the betting website Polymarket.

The recent assessment of Ethereum by the SEC seems to be inconsistent with earlier regulatory action. The mere fact that the SEC had allowed Ethereum futures to trade on regulated exchanges was explicitly an acknowledgement that ETH is a non-security.

However, the fact that even the approval of the Bitcoin spot ETFs was a close call within the SEC (3 yea vs 2 nay) still induces a lot of uncertainty regarding the approval of the Ethereum spot ETF.

On a positive note, BlackRock has recently launched a digital asset fund (called “BUIDL”) based on the Ethereum blockchain that intends to invest into tokenized assets. This seems to be a major endorsement amid the ongoing investigations by the SEC.

Besides, the Fed decided to keep interest rates unchanged at its latest FOMC meeting which was generally interpreted as dovish forward guidance as the Fed still telegraphed around 3 rate cuts à 25 bps this year.

Meanwhile, some major central banks such as the SNB in Switzerland and the Banco de México in Mexico have already delivered their first rate cut in what appears to be an early start to a global rate cutting cycle which would be a significant tailwind for cryptoassets going forward.

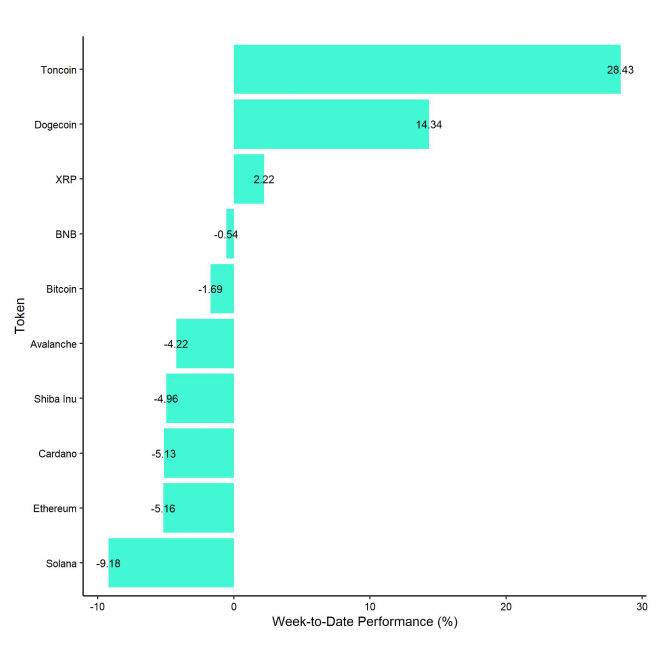

In general, among the top 10 crypto assets, Toncoin, Dogecoin, and XRP were the relative outperformers.

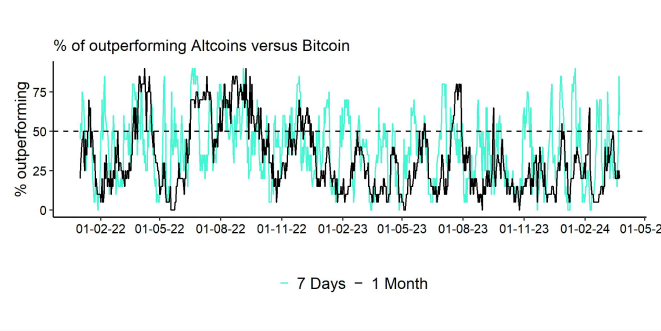

Overall altcoin outperformance vis-à-vis Bitcoin also picked up compared to the week prior, with around 60% of our tracked altcoins managing to outperform Bitcoin on a weekly basis.

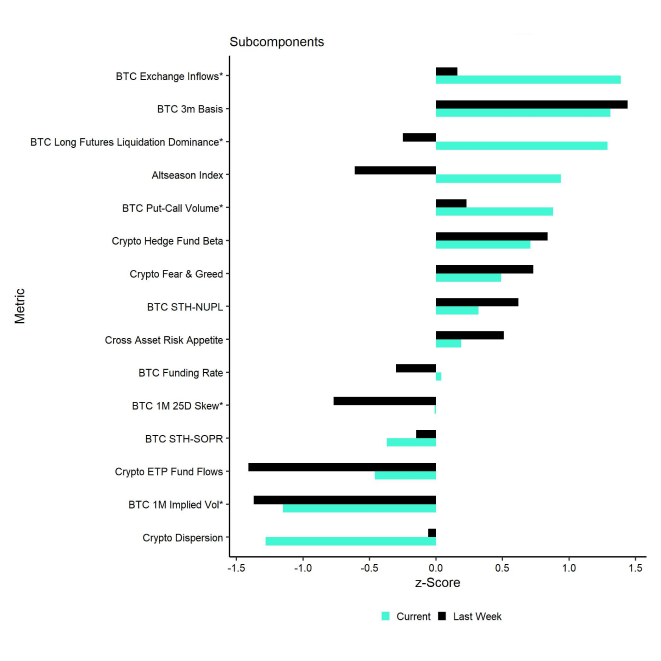

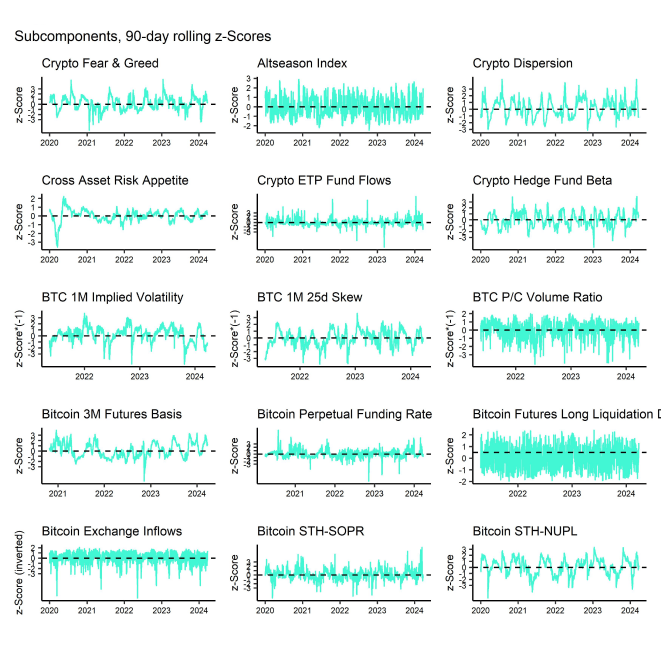

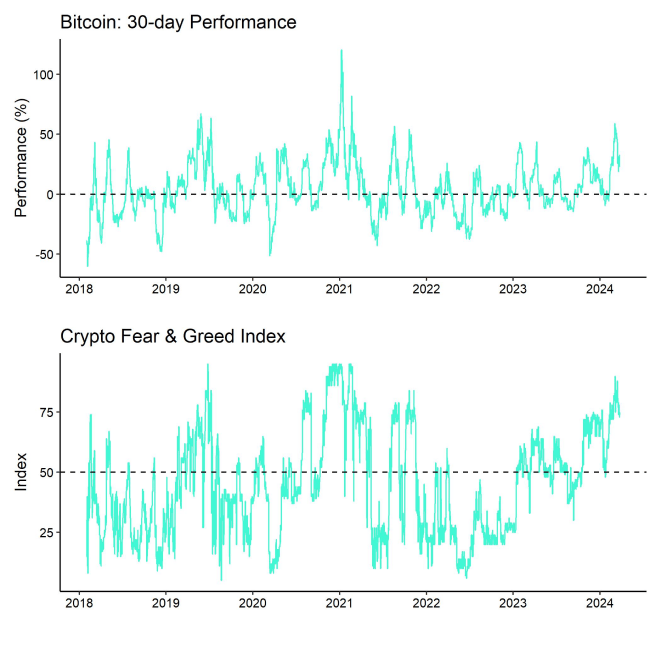

Our in-house “Cryptoasset Sentiment Index” had declined significantly before reversing some of the declines more recently. The index is currently signalling neutral sentiment again.

At the moment, 10 out of 15 indicators are above their short-term trend.

There were significant reversals to the upside in BTC long futures liquidation dominance and the Altseason Index.

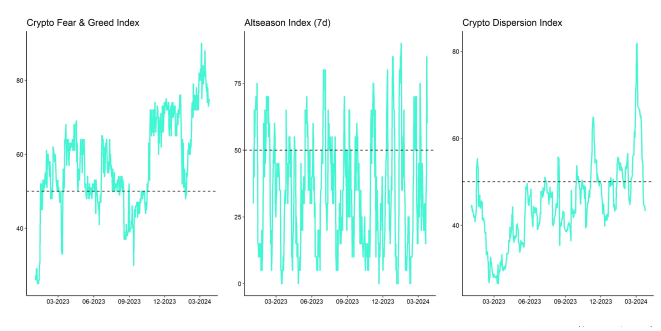

The Crypto Fear & Greed Index remains in "Greed" territory as of this morning.

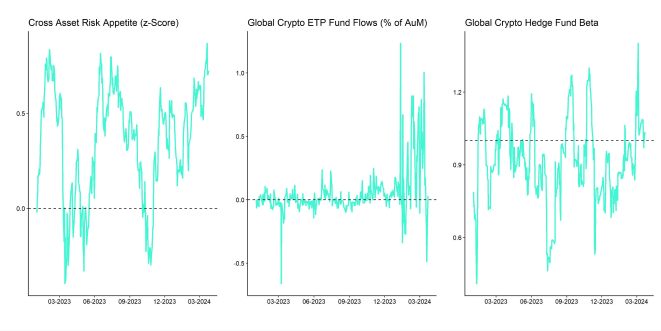

Besides, our own measure of Cross Asset Risk Appetite (CARA) has decreased throughout the week which signals diminishing bullish sentiment in traditional financial markets.

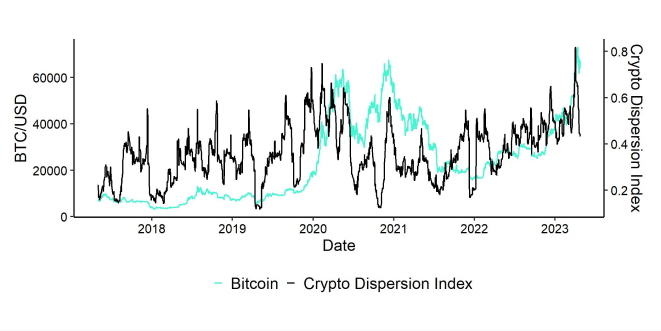

Performance dispersion among cryptoassets has continued to decline further amid the recent correction. However, overall performance dispersion still remains slightly elevated.

In general, high performance dispersion among cryptoassets implies that correlations among cryptoassets are low, which means that cryptoassets are trading more on coin-specific factors and that cryptoassets are increasingly decoupling from the performance of Bitcoin.

At the same time, altcoin outperformance vis-à-vis Bitcoin has recently picked up compared to the week prior, with around 60% of our tracked altcoins that have outperformed Bitcoin on a weekly basis. At the same time, there was a significant underperformance of Ethereum vis-à-vis Bitcoin last week.

In general, increasing altcoin outperformance tends to be a sign of increasing risk appetite within cryptoasset markets.

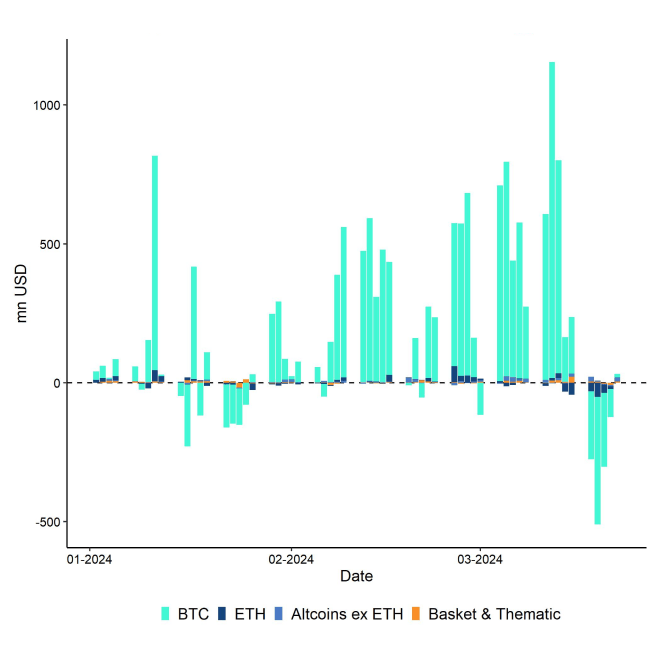

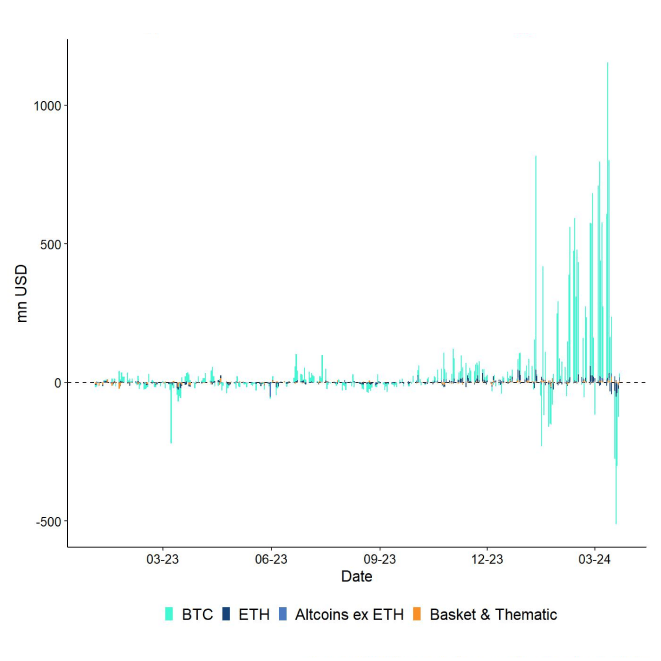

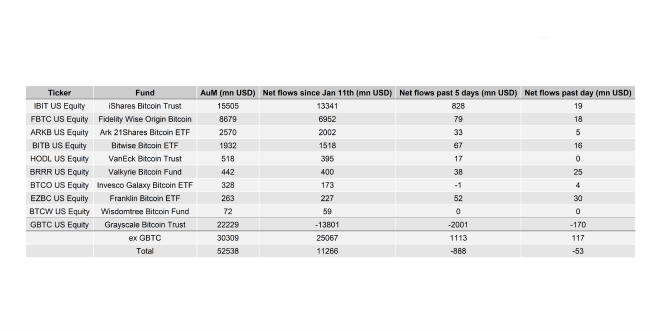

Last week, we saw the highest weekly net outflows ever recorded across all types of products of around -1,153.3 mn USD (week ending Friday) based on Bloomberg data.

Global Bitcoin ETPs dominated with net outflows of -1,058.3 mn USD of which -887.7 mn (net) were related to US spot Bitcoin ETFs alone. In contrast, the ETC Group Physical Bitcoin ETP (BTCE) saw net inflows equivalent to +6.6 mn USD last week.

The Grayscale Bitcoin Trust (GBTC) experienced record net outflows of approximately -2,001.4 mn USD last week. However, other US spot Bitcoin ETFs even managed to attract +1,113 mn USD (ex GBTC).

Global Ethereum ETPs also saw significant net outflows last week of around -123.6 mn USD, which represents an acceleration of outflows compared to the week prior. Meanwhile, the ETC Group Physical Ethereum ETP (ZETH) had -3.9 mn USD in net outflows, while the ETC Group Ethereum Staking ETP (ET32) also experienced some net outflows (-3.3 mn USD) last week.

Besides, Altcoin ETPs ex Ethereum again managed to attract net inflows of around +29.9 mn USD last week.

In contrast, Thematic & basket crypto ETPs experienced minor net outflows of -1.3 mn USD, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) defied negative market trends with minor net inflows of around +0.4 mn USD last week.

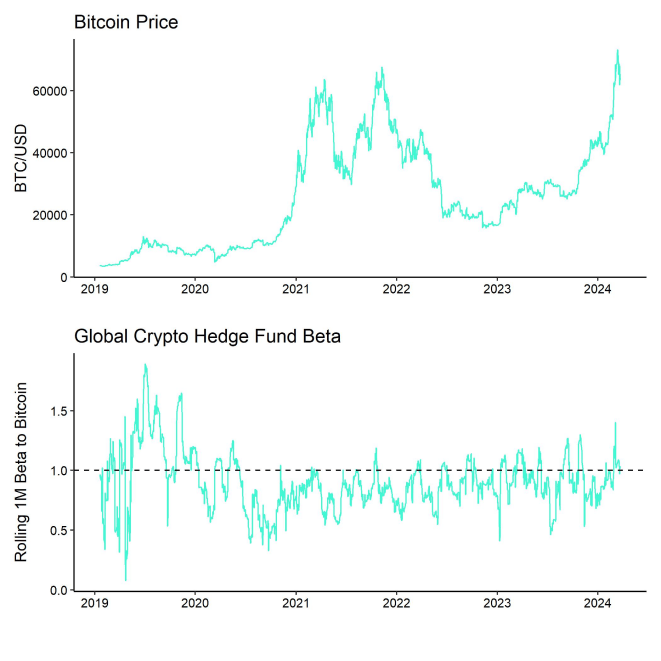

Besides, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remained at around 1.03 which implies that global crypto hedge funds have currently a neutral market exposure and are neither overweight nor underweight relative to the market.

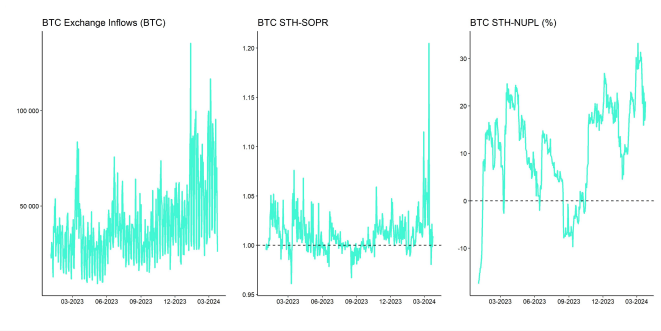

Despite the recent consolidation below 70k USD in Bitcoin, coins continue to be taken off exchanges on a net basis as BTC exchange balances have recently reached a new multiyear low.

In contrast, Ethereum has seen a steady increase in exchange balances since the beginning of March which has exerted more downside pressure more recently.

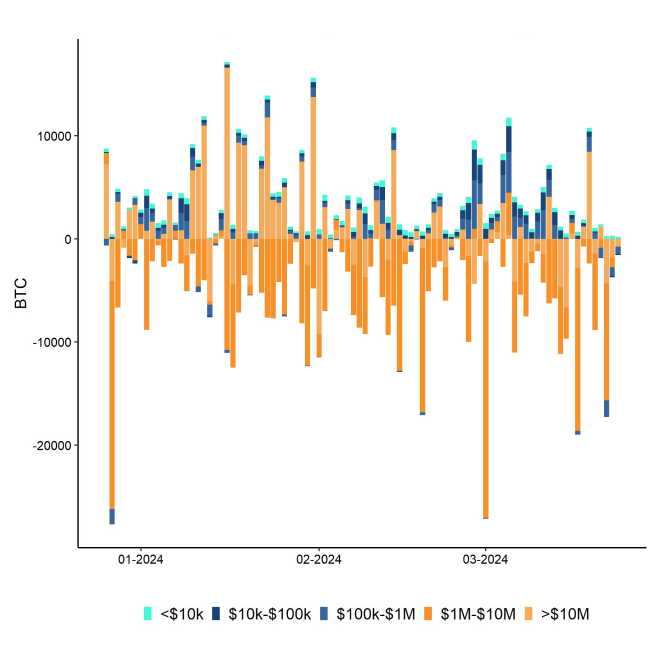

We have recently observed some bearish BTC net transfers to exchanges from very large holders (> 10 mn USD wallet size) but mid-sized ($100k-$1M) to large holders ($1M-$10M) have continued to take coins off exchanges over the past week.

However, whale transfers to exchanges have recently turned slightly positive implying net sales by whales (entities that control at least 1,000 BTC) over the past week.

The cumulative volume delta (CVD), which measures the net difference between buying and selling trade volumes, was negative with around -910 mn USD in net selling volumes over the past week. Negative US spot Bitcoin ETF fund flows were certainly a major driver of this selling volume.

Ongoing consolidation appears to be relatively likely in the short term despite the upcoming Bitcoin Halving in April. The reason is that the positive effects from the Halving only become visible around 100 days after the Halving according to our latest analyses.

If the market was trading lower, we should find support in Bitcoin near 55.4k USD as the short-term holder's cost basis is around that price level. Short-term holders tended to capitulate whenever the price dipped below their cost basis which should provide a solid basis for a continuation of the bull market.

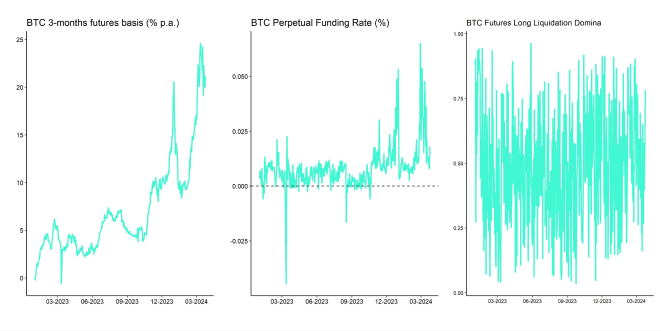

Bitcoin futures traders reduced somewhat reduced their exposure during last week while perpetual open interest was mostly flat in BTC-terms. Futures open interest on the CME also decreased last week.

Futures long liquidations spiked last week on Tuesday above 100 mn USD according to data provided by Glassnode as Bitcoin dipped below 60k USD for a short period of time. Liquidations have levelled off significantly since then.

The Bitcoin futures basis also continued to decline from the recent highs observed at the beginning of March and was at around 21.2% p.a., at the time of writing this report.

The perpetual funding rate also mostly decreased last week and has only yesterday spiked as perpetual futures traders seem to have increased their exposure somewhat over the weekend.

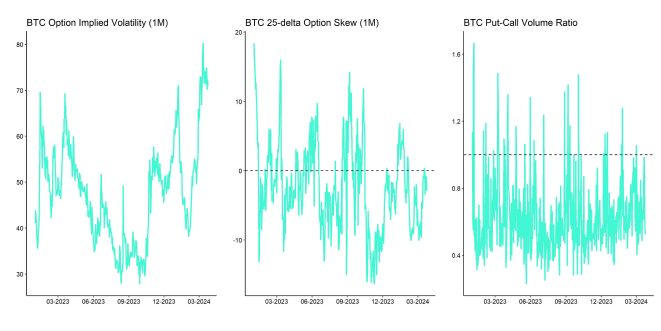

In contrast, Bitcoin options' open interest increased slightly last week. The Put-call open interest continued to decline compared to last week and is now at around 0.56 as option traders seem to unwind some of their downside hedges.

Put-call volume ratios spiked only briefly last week on Thursday in a sign of increased short-term risk aversion. For every BTC call traded, there were around 0.98 in puts traded on Thursday last week.

The 25-delta BTC 1-month option skew remained elevated but generally trended down as delta-equivalent calls were trading at a higher implied volatility than puts.

However, BTC option implied volatilities continued to come off the highs recorded at the beginning of March. Implied volatilities of 1-month ATM Bitcoin options are currently at around 70.9% p.a.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.