Institutions, pension funds drive Bitcoin adoption

Recent Bitcoin price weakness and continued volatility across the asset class belie a wave of institutional adoption that accelerated throughout 2021, ETC Group research shows.

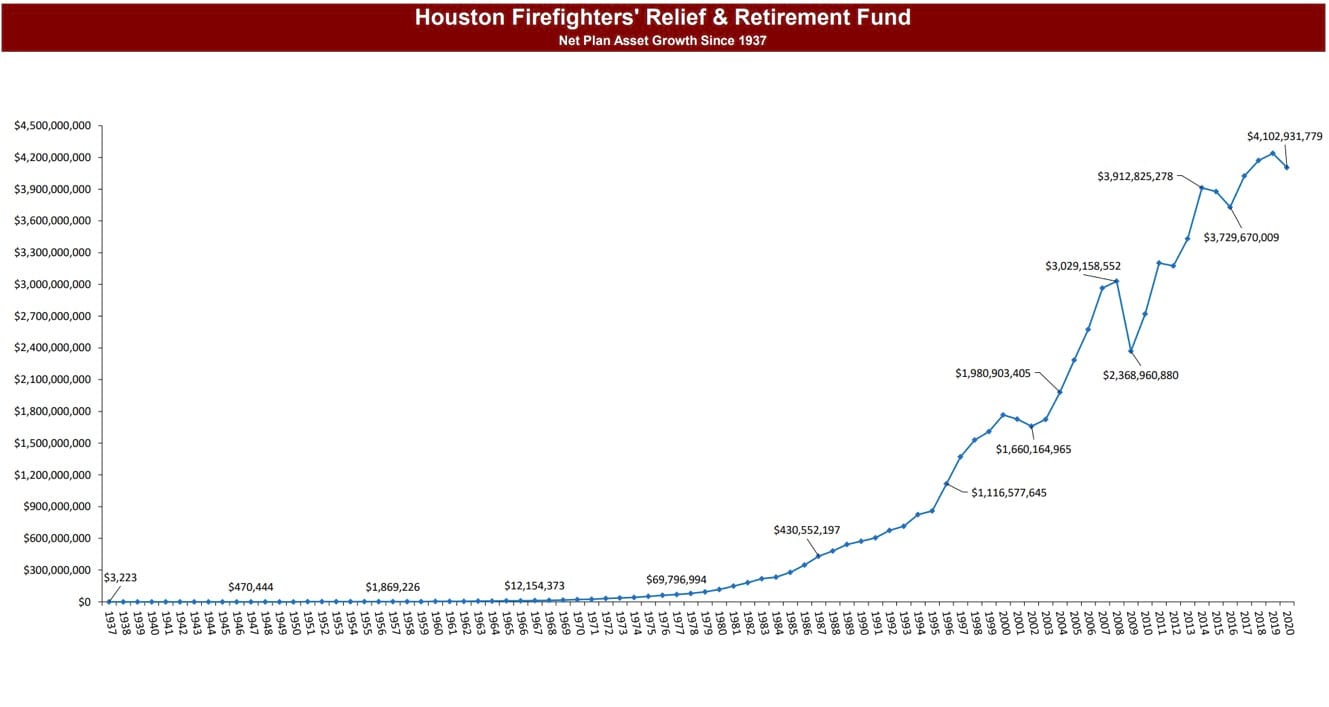

Perhaps the most striking example of institutional adoption came from what is understood to be the first public US pension fund detailing a direct investment in Bitcoin, 12 years after Bitcoin's creation and six years after the asset became widely available to the general public through regulated exchanges [1] .

The Houston Firefighters Relief and Retirement Fund (HFRRF) was established by US state statute in 1937 and its stated mandate -- accessed 27 Jan 2022'>[2] is to

[practice] the traditional philosophy of asset allocation by maintaining percentage ranges of the assets in domestic stocks, international stocks, bonds, cash, private equity, alternative investments and real estate. Using an asset allocation forces the Fund to be a disciplined investor.

The pension fund, which looks after the retirement wealth of 6,600 firefighters and their families, officially crossed the Rubicon on 21 October 2021, purchasing $25m in Bitcoin and Ether -- accessed 27 Jan 2022'>[3] .

The investment

[practice] the traditional philosophy of asset allocation by maintaining percentage ranges of the assets in domestic stocks, international stocks, bonds, cash, private equity, alternative investments and real estate. Using an asset allocation forces the Fund to be a disciplined investor Bsaid chief investment officer Ajit Singh

$25m appears prudent position sizing. With $4.1bn in assets under management, that makes the purchase 0.625% of the HFRRF total AUM.

As ever, the question of whether to allocate institutional capital to Bitcoin is down to the particular preference of an investment committee. But the asset is becoming ever more closely integrated with world financial systems and has demonstrated the potential for outsize returns over time.

While $4bn is a large amount of capital to deploy, it is relatively small in terms of global wealth management.

Consider then CDPQ, the Caisse de depot et placement du Quebec known (in English language media) as the Caisse. This is the second-largest public pension plan in Canada, with AUM of 100 times that of HFRRF, a whopping $389bn. According to SWFInstitute.org, CDPQ is the 12 th -largest public pension fund in the world [4] .

It, too, made its first ever publicly-announced investment into cryptoassets in October 2021. By investing in the not-yet-public Celsius lending network [5] , CDPQ has made a structural long-term bet on the future of cryptoassets. And at $400m the investment is a sizeable one, giving the DeFi specialist a pre-market valuation of $3bn.

Canadian pension funds are known globally as among the most innovative and aggressive when it comes to investments in newer industries and alternative asset classes.

Ray Dalio, a billionaire crypto early adopter, told CNBC recently [6] that a 1% to 2% allocation to the asset class is ‘reasonable', and the message appears to be spreading. The Bridgewater Associates founder is famous for his global macro style and his firm - with $150bn AUM - manages assets for the most conservative of conservative investors: central banks, foreign governments and pension funds alike.

Ever greater numbers of institutional investors are looking at the cryptocurrency to see if it could help them protect their wealth as inflation hits four-decade highs in the US. These investors now range beyond the swift-moving high-net-worth individuals, hedge funds, family offices and private banks. Serious due diligence conversations are instead underway in the more risk-averse sections of the market: at conservative pension funds, and in wealthy university endowment programmes.

These types of investors are used to having a wide mix of investable assets on their balance sheet: most notably store of value assets like bonds and gold.

But in the most highly-charged, highest-inflation environment in living memory, gold actually lost 4% of its value in 2021, while bond investors face the prospect of a decade of negative real rates.

It is worth quoting Andressen Horowitz here. In the reasoning for putting together cryptocurrency infrastructure investment funds worth $3bn+ they say 4 :

Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform

In the 2020s, that new model of computing (and new classes of applications) are blockchains and their decentralised apps.

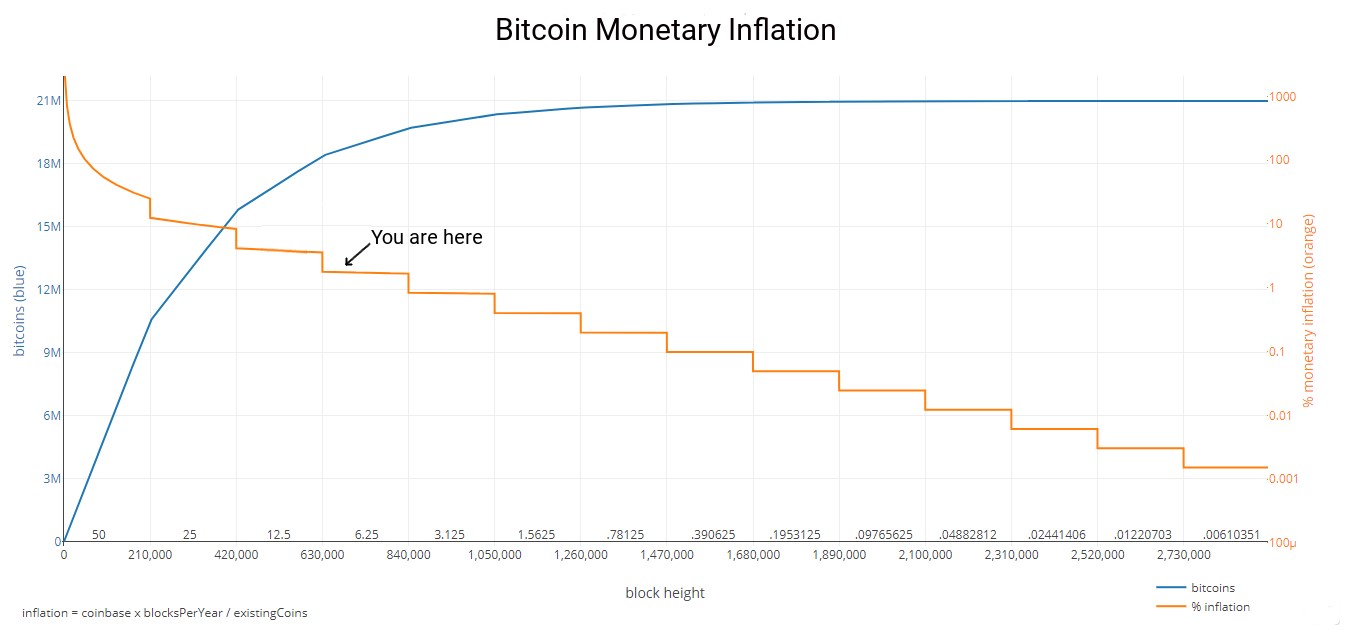

Bitcoin has achieved its status not by printing more BTC units. The opposite, in fact. Bitcoin offers scarcity by design, with its code creating relatively fewer BTC every year over time, until new issuance ceases entirely around 2140. Compare this to the waves of excess cash created by central banks globally, and see for reference this chart of Bitcoin monetary inflation [7] , in which the number of new coins issued decreases in pre-defined steps every four years, when the number of new bitcoins created per block of successfully verified transactions is cut in half (known as the Bitcoin ‘halving').

Great mining migration continues to enrich US

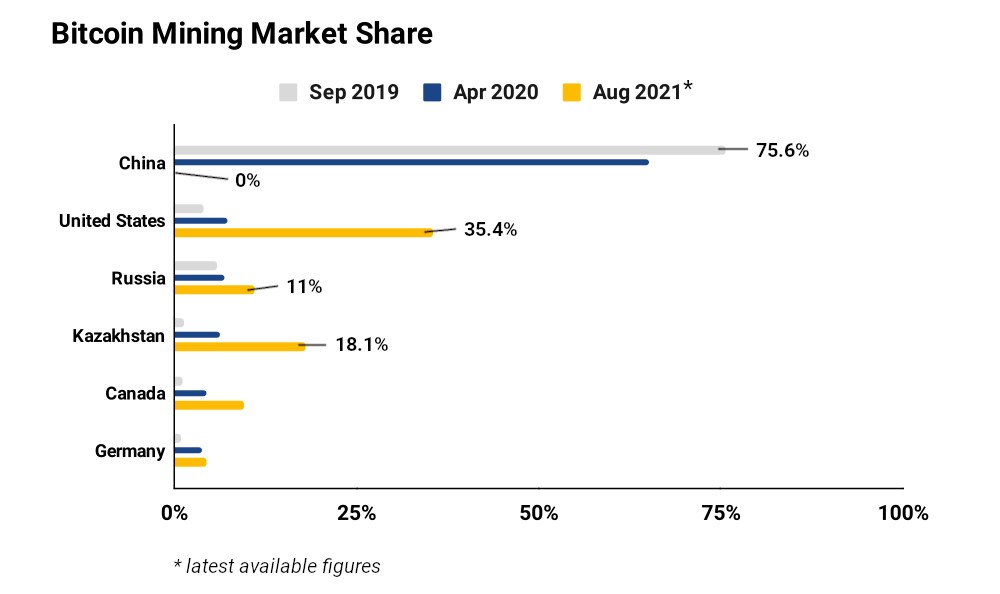

The Bitcoin mining market experienced an incredible restructuring in 2021. An estimated 53% [8] of the industry was banned from the once-monopoly dominant China in May 2021 and publicly-traded and private miners forced to relocate almost overnight. We saw the incredible story of Chinese logistics firm Fenghua International airlifting 3.3 tons of Antminer S19 mining machines to Maryland from Guangzhou [9] . This shift has empowered US-based Bitcoin miners to capture an ever greater share of the Bitcoin hashrate: a measure of all the computing power dedicated to solving complex equations on the network in a bid to that verify blocks of transactions and be rewarded in new bitcoins. For each block, or set of transactions they mine, they receive 6.25 newly-created Bitcoins. With each coin now worth in excess of $30,000, the potential revenues on offer are extreme.

The pre-eminent researchers in the space are the Cambridge Centre for Alternative Finance (CCAF) who track the global distribution of the Bitcoin hashrate. Their latest available figures recorded to the end of August 2021 show that once-dominant China now has effectively zero hashrate while the biggest winners are the United States, Kazakhstan and Russia.

Michael Rauchs, digital assets lead at the CCAF, noted the scale of the global shift in a 13 October post [10] .

He said:

The immediate effect of the government-mandated ban on crypto mining in China was a 38% drop in global network hashrate in June 2021 – which corresponds roughly to China's share of hashrate before the clampdown, suggesting that Chinese miners ceased operations simultaneously. New data reported by partnering mining pools BTC.com, Poolin, ViaBTC and Foundry confirms this observation: declared mining operations in mainland China have effectively dropped to zero, from a high of [75.6]% of the world's total Bitcoin mining in September 2019 when this data was first recorded.

As predicted by ETC Group in our Q3 2021 report [11] , Foundry USA has been the biggest winner from China's wide-scale dismantling of its Bitcoin mining industry. Because it is so difficult for individual and even corporate miners to win block rewards, virtually all miners connect to so-called mining ‘pools', which aggregate their resources and distribute rewards in a pro-rata fashion.

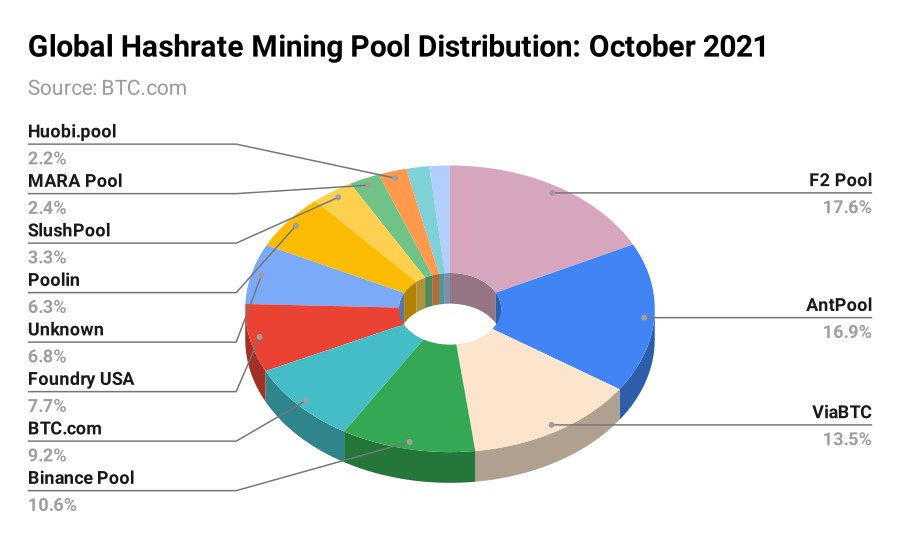

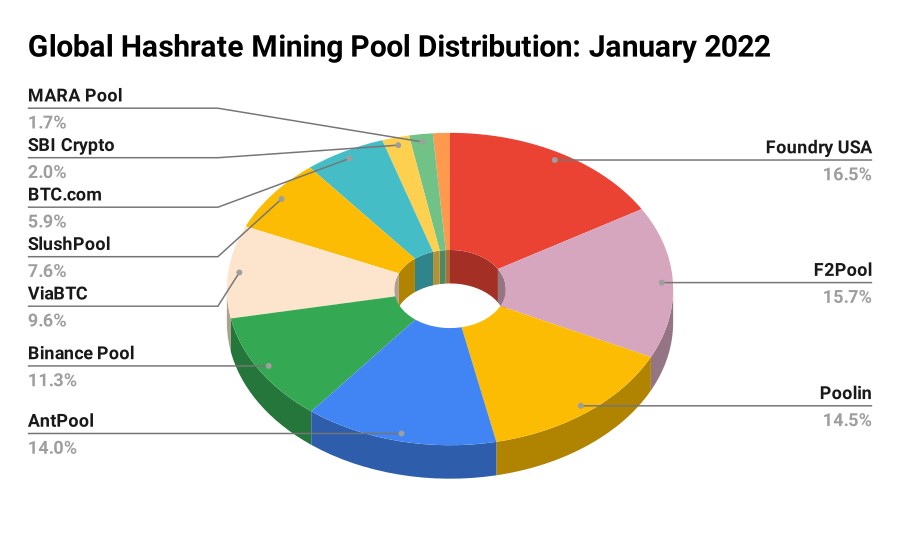

Consider the chart of the distribution of resources across global mining pools.

October 2021

January 2022

Foundry USA has grown its share from 7.7% to 16.5% over the period surveyed.

MARA Pool, too, remains a statistically-significant portion of the world's top mining pools. This US-based pool focuses on carbon-neutral mining, which will likely be a significantly larger focus of mining pools going forward, as regulators grapple with how to define regulations across Bitcoin's growing infrastructure. Foundry USA says its energy mix is leaning heavily towards renewables, with 71% non-fossil fuel based [12] .

The world's richest asset managers continue to invest heavily in Bitcoin mining, too. Earlier this year, $9trn asset manager BlackRock joined Fidelity and Vanguard by taking significant stakes worth a total of $382m [13] in Marathon Digital (NASDAQ:MARA) and Riot Blockchain (NASDAQ:RIOT), two of the largest publicly-traded mining companies.

According to public filings with the SEC, BlackRock invested $206.7m to buy 6.71% of Marathon Digital Holdings and $176.1m to purchase 6.61% of Riot Blockchain stock.

The investments were spread across several of BlackRock's mutual funds and ETFs, including its iShares Russell 2000 ETF. This means that millions globally now have exposure to Bitcoin - as these companies hold the cryptoasset on their balance sheets - and have indirect interest in the infrastructure that secures the Bitcoin network.

One other potential point of interest is in the use of the Bitcoin network as a way to utilise ‘stranded' natural gas in order to reduce greenhouse gas emissions while at the same time creating a new source of revenue for oil and gas producers.

Miners like Riot Blockchain are continuing to buy up land in Texas [14] , one of the only states with a deregulated power grid [15] . That means they can not only take advantage of low prices per kilowatt, but can make money selling energy back to the grid at times of high load.

Locally, legislators are rushing to push through crypto-friendly laws. In September 2021, Texas became the third state - after Wyoming and Rhode Island - to recognise cryptocurrency under commercial law [16] . That's big business. Lest we forget the amount of money flowing through the Lone Star State: if it were a country, Texas would boast the world's 10th-largest GDP, as it produces more than Brazil, Russia and South Korea.

While there are ongoing concerns about the energy-intensiveness of Bitcoin mining, the state of play is not so clear cut as media headlines might suggest. China's crypto mining boom was largely coal-based [18] and the government there is desperate to cut its fossil fuel emissions to less than 20% of the total energy mix by 2060 [19] .

The wholesale shift to more regulated markets like the US and Canada also means that greater numbers of Bitcoin miners are using renewable energy, with some estimates putting the figure as high as 76% [20] .

Other solutions to allow miners to meet and exceed ESG targets are starting to appear.

Speaking at the Texas Blockchain Summit [21] on 8 October 2021, Senator Ted Cruz noted [22] the huge opportunity Bitcoin mining companies had from using flared natural gas going to waste in oil fields across the state.

He said:

I think there are massive opportunities. Fifty percent of the natural gas in this country that is flared, is being flared in the Permian [Basin] in West Texas right now. I think that is an enormous opportunity for Bitcoin because right now, that is energy that is just being wasted

Senator Cruz is a member of the US Congressional Joint Economic Committee, which has a mandate to report on the economic condition of the country and make suggestions for improvements to the economy.

Other states are racing to catch up. In North Dakota, legislators passed a law this year making oil producers eligible for tax credits [23] if they employ on-site flare mitigation.

Investment banks remain bullish on Bitcoin long-term

While 2022 is likely to be a turbulent year for the crypto market at large, institutional investment banks like Goldman Sachs and JP Morgan remain generally positive on the future direction of travel for Bitcoin.

Two client notes released in the post-quarter period show the depth of interest in Bitcoin as a store of value.

Digital asset market infrastructure is increasingly shifting institutional, as the world's largest interbroker-dealer TP ICAP moves into trading crypto [24] . It comes as little surprise that as their first trade they utilised the world's most liquid Bitcoin ETP, ETC Group's BTCE, which is physically-backed 1:1 with the underlying, centrally-cleared and trades on regulated exchanges.

TP ICAP facilitates transactions between investment banks, hedge funds and other large financial institutions. Which is why the financial world sits up and takes notice of whatever it does. It has been trading in Europe for clients including Goldman Sachs, Jane Street and Flow Traders, digital asset leads Simon Forster and Duncan Trenholme told Coindesk [25] .

Trading an equity-linked product on an exchange is probably the easiest way for clients to get comfortable with digital assets, Forster said, adding that the firm had been active in trading ETPs such as ETC Group's physical bitcoin product, BTCE - Will Canny , Coindesk, 10 January 2022

One of the bigger shocks for hedging traders is that last year, amid US inflation spiking to a 39-year high (and UK inflation at a 10 year high, and EU inflation the highest since the euro was introduced), gold prices slid 4% across the year [26] to close out at $1,829. Traditionally gold is seen as a place to protect investor cash from inflation. It failed fairly spectacularly on that count in 2021. We know that investors have been parking their cash in Bitcoin and crypto in ever greater numbers: as the market cap of all cryptoassets rose from $700bn in January 2021 to over $3 trillion by November 2021 [27] .

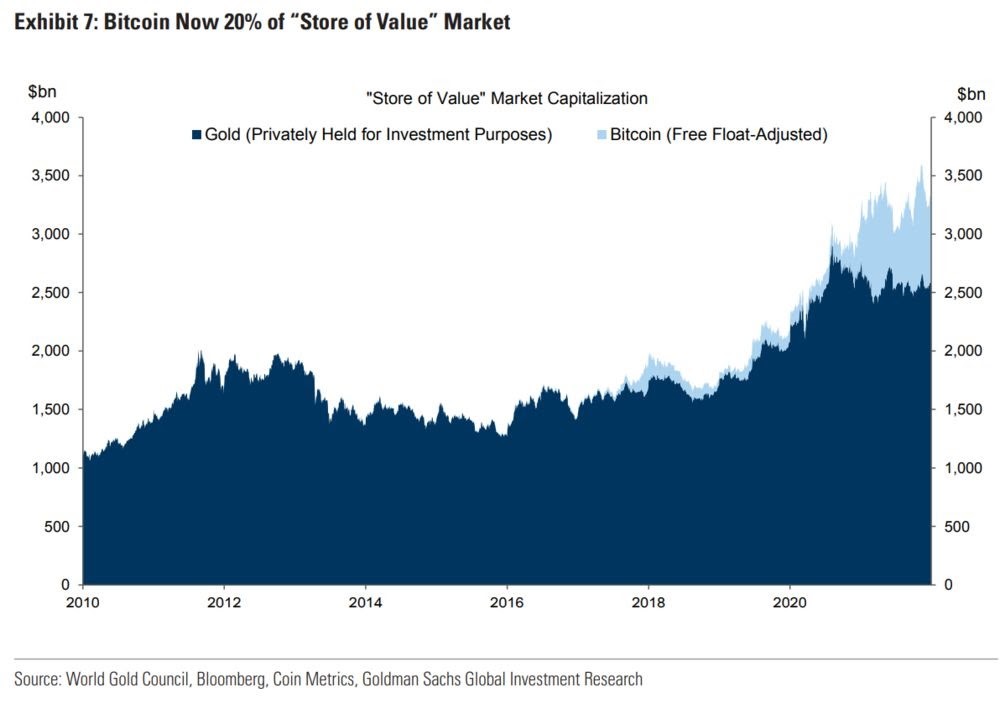

Zach Pandl, co-head of FX and emerging markets strategy at Goldman Sachs Group, released a research note [28] on 4 January 2022 predicting Bitcoin's potential move to $100,000 as it continues to take ‘store of value' market share from gold.

The value of gold available for investment is around $2.6trn, while Pandl estimates Bitcoin's float-adjusted market cap is just under $700bn. That accounts for 20% share of the store of value market, which Goldman says comprises Bitcoin and gold.

If Bitcoin were to increase its market share from 20% to 50% over the next five years, that would put prices just above $100,000 per BTC, representing a 17% or 18% compound annualized return.

Kenneth Worthington, equity research analyst at JP Morgan, followed a client note on 7 January 2022, noting that institutional and mainstream crypto adoption would continue to grow in 2022 [29] , and adding that Bitcoin is particularly well designed as a modern store of value , and the strong design has contributed to increased confidence in the value of Bitcoin.

Long-term conviction holders DCA in

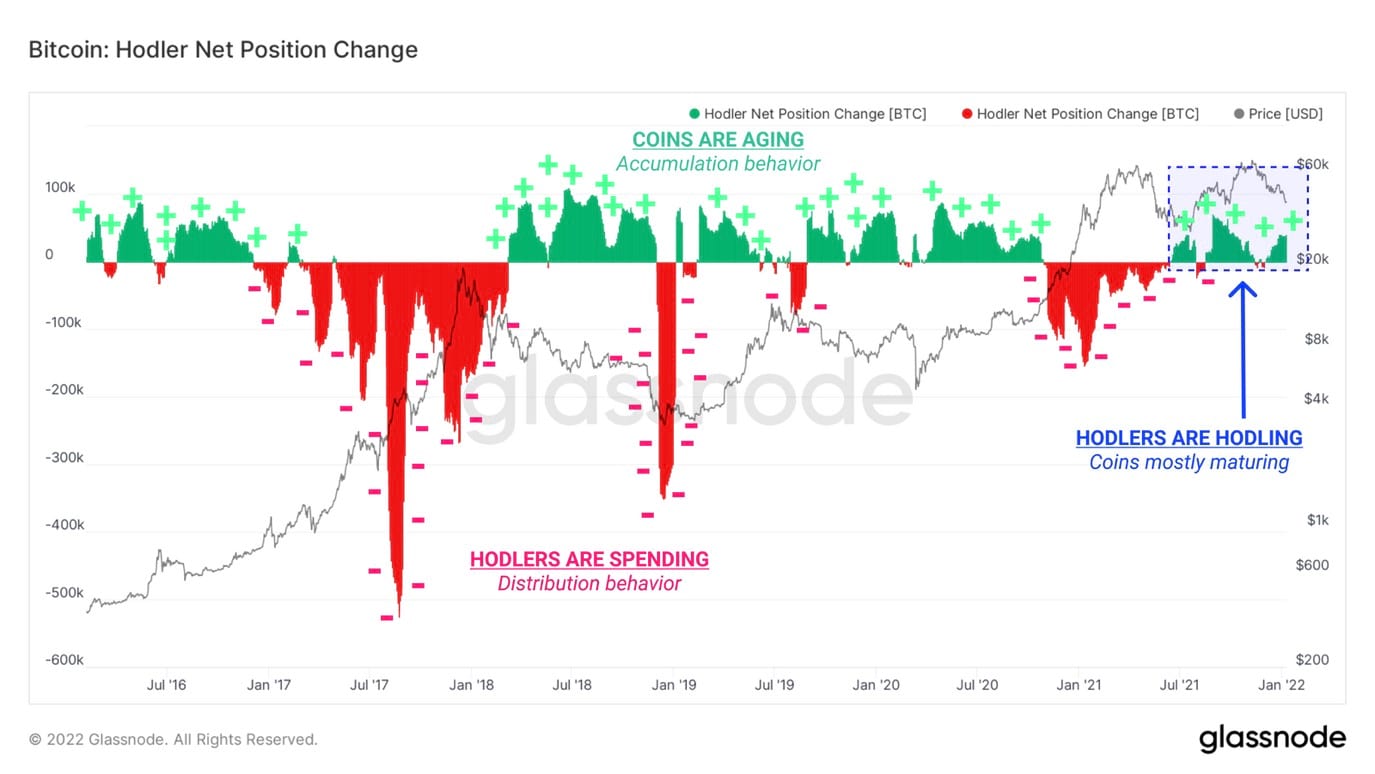

Long-term, high-conviction Bitcoin holders have been undeterred by choppy markets, with recent on-chain analysis showing it is highly levered weak hands who have sold out at a loss.

Glassnode's ‘Hodler Net Position Change' graph demonstrates that long-term holders are continuing to accumulate at periods of Bitcoin price weakness, and suggesting that high-conviction term holders have been dollar-cost averaging (DCA) into Bitcoin, including the high-net-worth marginal buyers from the previous two years.

Positive (green) values mean coins are ageing at a higher rate than spending. Typically bearish conditions with long-term accumulation by high conviction buyers.

Negative (red) values show higher rates of spending, particularly from older coins, outpacing accumulation. This is frequently observed at the height of bull markets and at moments of total capitulation when older hands are more likely to relinquish holdings.

For institutional investors still on the sidelines - having watched Bitcoin retrace more than 40% from its $69,000 all time high - now may be a more attractive long hold entry point.

On 30 December 2021 Michael Saylor's business software firm Microstrategy (NASDAQ:MSTR) added 1,914 BTC [30] to the firm's holdings at an average $49,229 for a $94.2m outlay. That makes the enterprise analytics company a $3.75bn HODLer with a $30,159 average. It does rather beg the question: In 10 years, will anyone remember that this was a business intelligence software company, or more likely that it was the canary in the coalmine for multinationals replacing cash with Bitcoin as a treasury asset?

MicroStrategy has purchased an additional 1,914 bitcoins for ~$94.2 million in cash at an average price of ~$49,229 per #bitcoin. As of 12/29/21 we #hodl ~124,391 bitcoins acquired for ~$3.75 billion at an average price of ~$30,159 per bitcoin. $MSTRhttps://t.co/tNxDwaT8VD

— Michael Saylor⚡️ (@saylor) December 30, 2021

Canadian crypto miner Bitfarms announced [31] on 10 January 2022 it had purchased 1,000 BTC for $43m at an average price of $43,200, just weeks after securing a $100m credit facility [32] from Galaxy Digital, the merchant bank that investors can find as a major constituent of ETC Group's Digital Asset and Blockchain Equity UCITS ETF.

Billionaire value investor Bill Miller also recently came out to say that he holds 50% of his net worth in Bitcoin and related assets. Miller - lauded among private investors in the same hushed tones as Warren Buffett and Peter Lynch - bought his first Bitcoin at $200 and said he added heavily at the $30,000 region in the summer of 2021.

That, co-incidentally, was after China first turned off the power to bitcoin miners, then banned crypto transactions altogether and the Bitcoin price fell from a then-high of $64,000 to bottom out at around $29,700.

The billionaire said in a December 2021 interview [34] with Wealthtrack: Bitcoin has gone up, on average, 170% every year for the past 11 years , adding that he has long-term conviction enough to ride out the kind of volatility we are seeing now. Across that period Bitcoin's price has three times plummeted more than 80%. Mark Yusko, chief investment officer and founder of Morgan Creek Asset Management recently noted an interesting parallel [35] : that Miller, is one of the only investors on record to have bought Amazon shares at their IPO and held until today, despite that share's relative volatility.

Amazon has been a public company for 24 years. It's...compounded over 100% for 24 years. How many bought Amazon on day one and held it [until] today? I know of five. Jeff, his mom, his dad, his ex-wife, and Bill Miller. There are millions of people who have bought Amazon at different times. But why did no-one buy and hold it that whole period? Volatility. It's had a double-digit drawdown every single year, including this year. Average? 31% peak to trough. 5 times more than 50%. Twice, more than 90%. People can't handle that kind of volatility and so they shy away from it when they should be running towards it

Leverage remains an issue to be solved by regulators

There is still too much leverage in crypto as a whole, and too many daytraders employing inadequate risk management in what is, let's not forget, an 80-vol asset. (Some commentators peg Bitcoin as a 100-vol asset [36] ). This is evidenced by the wide-scale long/short position liquidation when Bitcoin prices move to the downside and losses are magnified. We hope this can be solved by legislation from financial regulators.

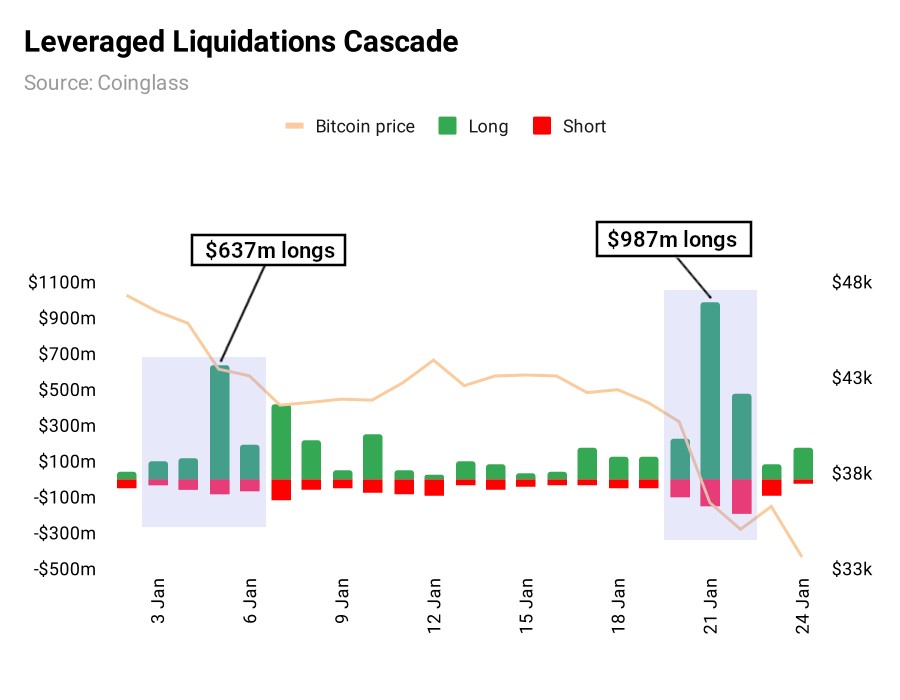

There is now proveably more capital involved in daytrading cryptomarkets than there was in 2020. On 5 January where the Bitcoin price dipped from $45.8k to $43.4k there were $637.68m of long/short trading positions liquidated across the top 10 cryptoassets. Leveraged liquidations then hit nearly $1bn overnight on 21 January as Bitcoin blew through support and fell from $40.6k to $36.4k.

Tobias Adrian, director of the IMF's Monetary and Capital Markets Department, told Yahoo Finance in a recent interview [37] :

There's very little data at the moment, data disclosures are not standardized. Investors often don't know how much risk they're taking… There's little regulation around margin setting

Largely retail-focused cryptoexchanges like Binance, derivatives leader FTX and Huobi each offer extreme leverage of up 50x to new users, and while the 125x leverage [38] of years past is not as prevelant as it once was, these kinds of debt-based trading strategies still magnify losses in the spot market far more than is appropriate.

European regulators have committed to introducing a bloc-wide, cross-border regulatory framework to support digital assets by 2024 at the latest [39] . Stronger regulations almost always mean better protection for investors.

Over in the US, things are moving ever faster, and with good reason. The Biden administration is reportedly moving to release an executive order by February 2022 at the latest [40] to outline a comprehensive government strategy on cryptoassets and to ask federal agencies to prepare reports looking at the risks and opportunities sector wide.

Where Bitcoin fits into the macro story

In a 7 October 2021 client note JP Morgan analysts reported that institutional investors were increasingly moving their wealth out of gold and into Bitcoin [41] .

The investment bank noted three key drivers behind the shift. Firstly, assurances by US policymakers that there were no plans to follow China to ban cryptoassets, secondly, the rise of Bitcoin's Layer 2 Lightning Network helped by El Salvador's bitcoin adoption, and thirdly, the re-emergence of inflation concerns among investors has renewed interest in the usage of bitcoin as an inflation hedge.

For financial markets, the massive global liquidity injections to support economies in the face of the pandemic have been one of the major underlying drivers of returns. But if ‘QE infinity' was indeed the reason for the relentless rise in Bitcoin, as well as stock markets, why, then, were returns from the asset so much higher in 2021 than an index tracking the S&P 500? Buying Bitcoin on January 1 and holding until mid-December 2021 would have returned 63%, three times that of the American index.

The first steps taken to normalise monetary policy as the Covid-19 emergency fades are having seismic effects on markets and investors worldwide.

The Bank of England began buying government bonds in March 2009 and after more than a decade of quantitative easing, now has almost £900bn of government bonds on its balance sheet.

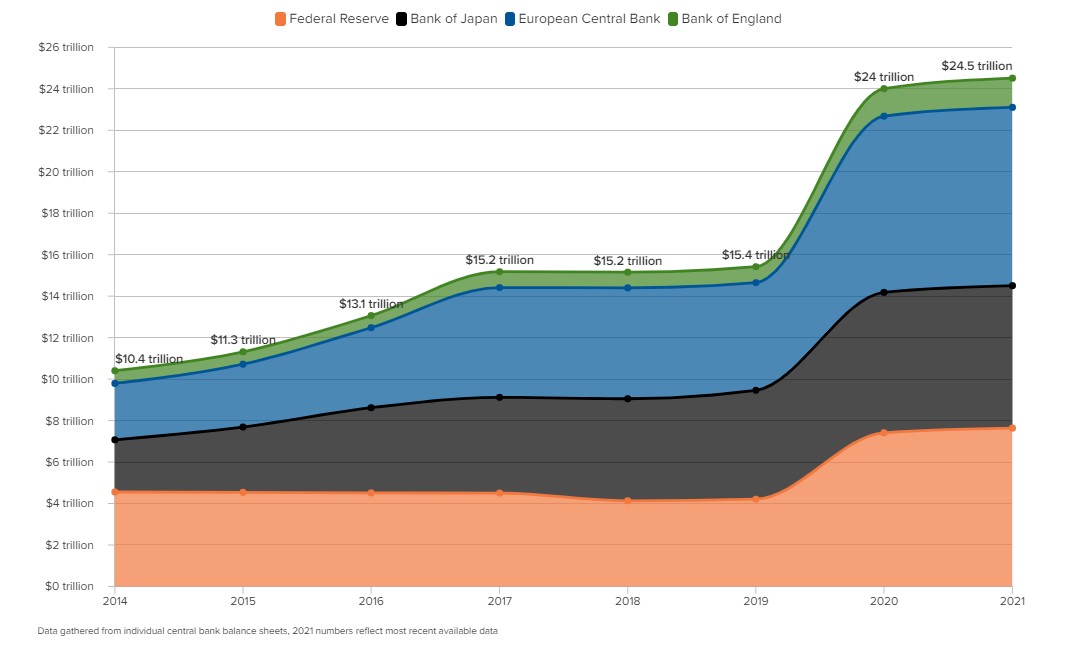

According to research group The Atlantic Council [42] , central banks globally have pumped more than $25 trillion into the global economy, with $9 trillion since the advent of Covid-19 alone.

To address the economic shock triggered by COVID-19, the world's four major central banks have expanded their QE programs by a total of $9.1 trillion to support their economies and the functioning of global financial markets. The four banks' new asset purchases have increased the size of their cumulative balance sheet by roughly 60 percent since the beginning of 2020. The Atlantic Council , 2021 research

Unwinding such purchases will have far-reaching effects. Pre-Covid, the big four central banks: the Federal Reserve, the Bank of Japan, the European Central Bank and the Bank of England were each beginning to pull back on their bond-buying programmes.

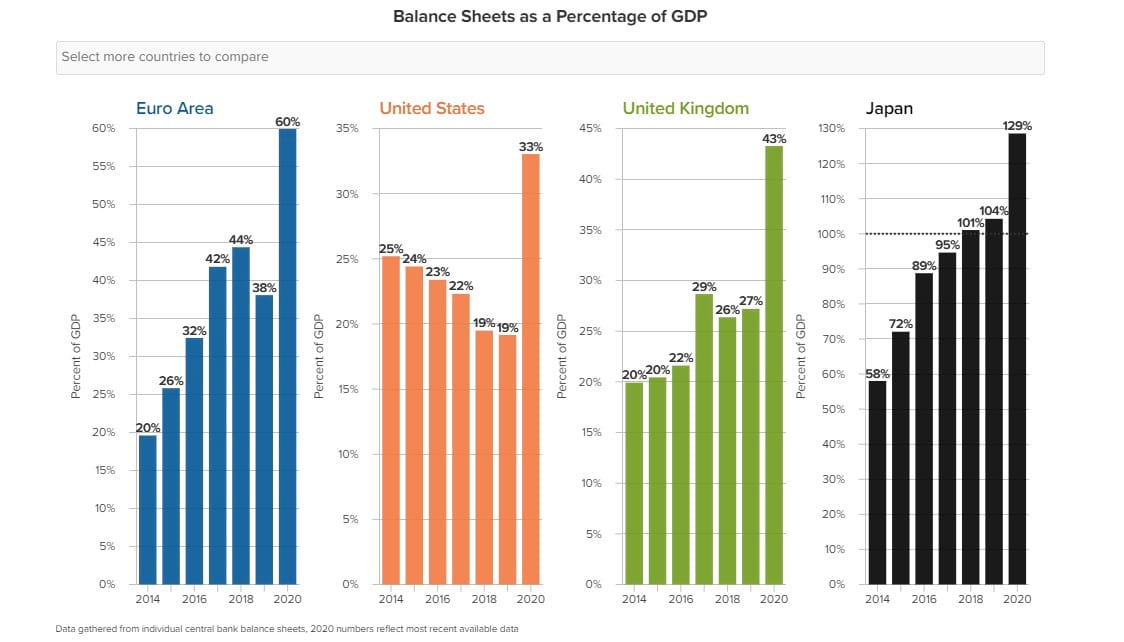

But the unprecedented economic shock of lockdowns and the pandemic mean that debt as a percentage of GDP has rocketed across these regions. Japanese debt has now reached 129% of GDP, and it remains to be seen how long markets will allow formerly cautious central banks to get away with paying lip-service to historic monetary standards.

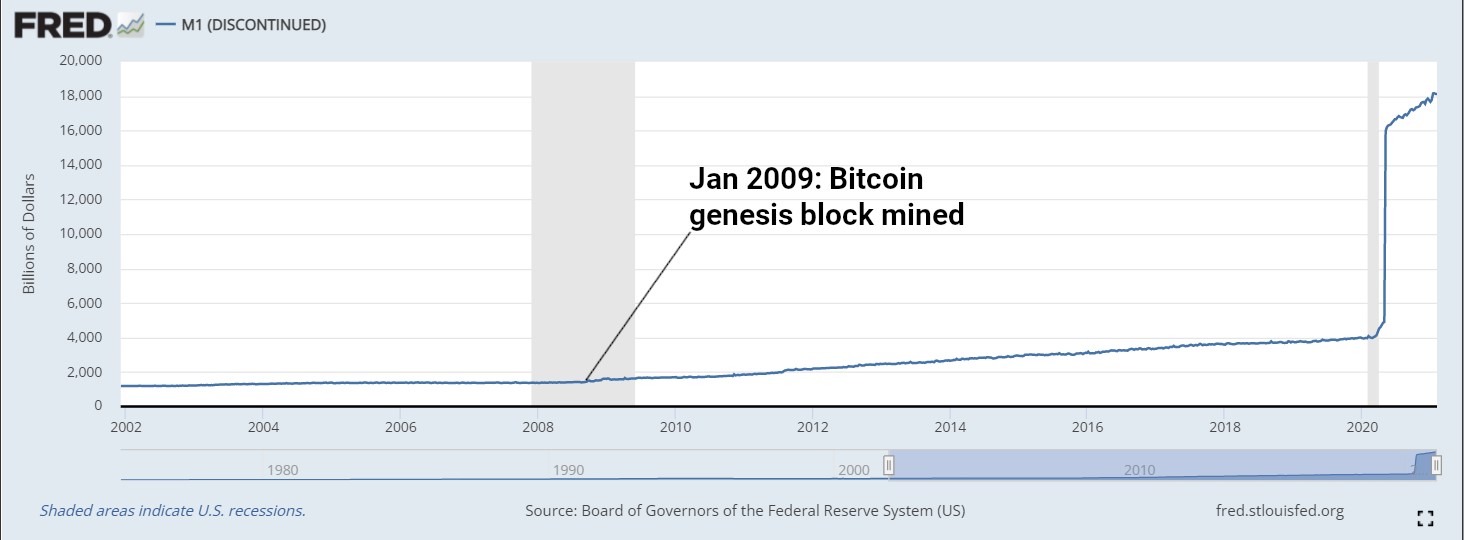

Two relevant statistics we keep returning to are these: 22% of all the US dollars in existence today were created in 2020 [43] . Approximately 75% of all the US dollars now in circulation were created after Bitcoin was invented. See for reference the steep rise in M1 money supply as recorded by the St Louis Fed below.

With ever more money chasing the same number of assets, it is no surprise that equity markets rocketed to record highs. And yet across Q4 and 2021 as a whole Bitcoin continued to outperform.

Gold is traditionally the go-to store of value in times of economic troubles, but in the most inflationary period in recent history, it has failed not only to attract new investors but even to maintain its store of value.

The precious metal lost around 4% of its value across 2021, and in an end-of-2021 round up Reuters reported lacklustre demand [44] from investors for its safe haven properties.

This disconnect is driving the growing interest in bitcoin.

Emerging Markets also the engine of Bitcoin adoption

While recent Bitcoin prices have fallen from their all-time-highs and its moves with respect to equities have led some to question its correlation with stock markets, the fact is that countries with rampant inflation and local currency duation are seeing exponentially larger numbers of Bitcoin holders and increased cryptocurrency adoption in general.

Take for example, Ukraine.

Figures accessed via government data provider Opendatabot [45] show that civil servants in the country have formally declared owning a total of 46,351 BTC (worth $1.83bn 12 at time of writing). Bitcoin holders range from government-employed workers in the smallest district and regional assemblies to those working for the Ministry of Defence.

The annual inflation rate in Ukraine as of the end of Q4 2021 [46] was 10.0%.

In the trans-European/western Asian country of Turkey, where inflation rates have skyrocketed to 36% as of the end of Q4 2021 [47] , the highest since September 2002, Bitcoin adoption and usage has been increasing rapidly.

In fact, Bitcoin trades topped 1 million per day in the face of local currency duation, according to Reuters [48] .

Converting lira into US dollars or gold is common for Turks, who have seen the currency lose 90% of its value since 2008. But with Ankara looking to make those practices harder…crypto trading has gained in popularity. Worries about Turkey's economic policy have seen the lira slump nearly 40% since September, driving Turks to look for places to park their savings to avoid the effects of soaring inflation Marc Jones and Tom Wilson , Reuters, 12 Dec 2021

Since 2019 both Bitcoin and stablecoin Tether are the most popular assets to trade against the Turkish lira, data shared with Reuters shows.

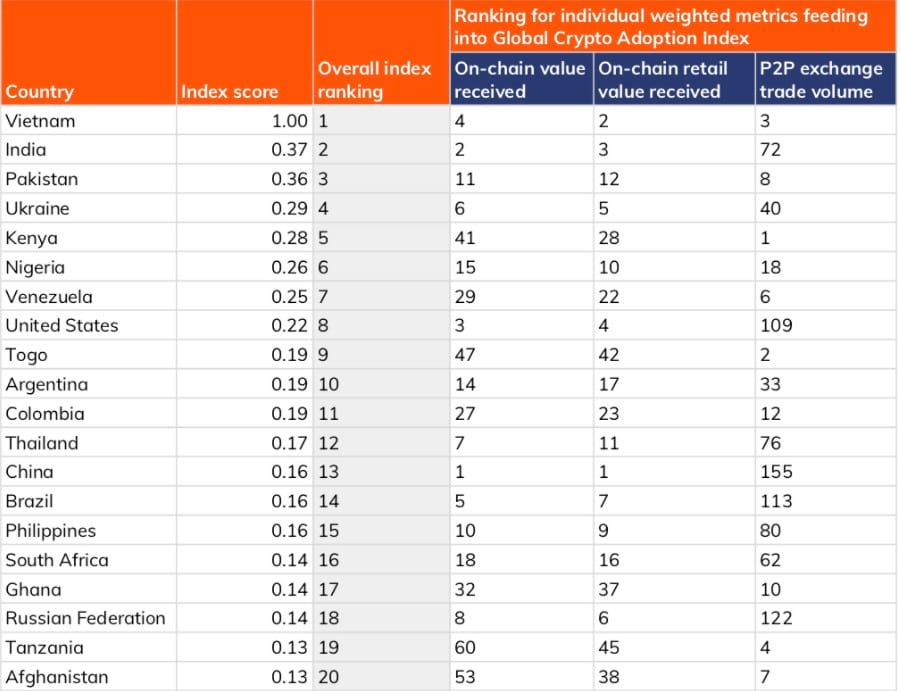

This analysis is borne out by broader research published in Q4 by Chainalysis [49] , which shows global crypto adoption now 881% higher than it was one year ago.

In emerging markets, many turn to cryptocurrency to preserve their savings in the face of currency duation, send and receive remittances and carry out business transactions, while adoption in North America, Western Europe and Eastern Asia over the last year has been powered largely by institutional investment Chainalysis Global Crypto Adoption Index , 14 Oct 2021

These results show that the top 20 countries seeing the fastest crypto adoption are emerging markets like India and Brazil. Emerging markets are typified by rapid economic growth and a growing share of global GDP.

Even in more relatively static economies, like Bulgaria, which has seen its own inflation jump to a 13-year high [50] of 7.8% as of the end of Q4 2021, public figures own significant amounts of Bitcoin.

According to local data, the Bulgarian government tops the list of authorities that hold the cryptocurrency, with 213,519 BTC recorded on file [51] . That far outstrips the headline-producing El Salvador, whose holdings according to public record stands at 9,500 BTC [52] .

Finland and Georgia round out the top five Bitcoin-owning governments.

As of the end of Q4 2021, 7.2% of the entire bitcoin supply -- 1.5m BTC, $55bn-worth at time of writing -- was held by ETFs, ETPs like ETC Group's BTCE, sovereign wealth funds, and on the balance sheets of public and private companies [53] .

The South American angle

Brazil's recent fascination with Bitcoin is worth repeating here.

As the second-largest city in Brazil, and the third-largest in South America, Rio de Janeiro has quite considerable purchasing power and political influence in the region. With a GDP of $169.1bn [54] it is also the fourth-richest city in Latin America, behind Mexico City, Sao Paolo and Buenos Aires. So it was no surprise to see headlines globally when mayor Eduardo Paes announced during Rio Innovation Week on 14 January 2021 that the city's municipal treasury would move 1% of its assets into Bitcoin and other cryptoassets [55] .

According to the country's central bank, the total amount of cryptoassets held by Brazilians totalled $50bn in 2021, compared to $16bn held in US stocks and shares [56] .

Paes' move is part of a wider scheme to locate Rio de Janiero as Brazil's ‘crypto capital', attracting wealthy businesses to its shores. Recent reports quoting insiders suggest that Brazil's only national stock exchange B3 is planning to enter crypto markets in 2022, potentially launching a crypto ETF [57] .

And as recently as October 2021, the Brazilian Congress was considering legislation to regulate cryptoexchanges, enacting industry-standard KYC procedures and strengthening local powers to prosecute crypto-related crimes [58] .

At the same time, Brazil - like most economic powerhouses worldwide - is struggling to keep inflation in check. Recent data via the government statistics authority IBRE pegs 2021 annual inflation at 10.06% [59] , more than double its 2020 figure of 4.5% and the highest the country has seen in six years.

Bitcoin's investment status as an inflation hedge has come under question as, since the back end of 2021 and turn of 2022, it has appeared to move more in tune with equities and behave more like a risk-on asset. But there is no doubt that inflation-hit countries see the thesis playing out long-term.

It's still early

Let us not forget what Bitcoin offers in a world addicted to quantitative easing. Not our assessment, but that of the United Kingdom's House of Lords, which made the extraordinary accusation in a recent challenge to the Bank of England's relentless money-printing.

In a scathing report, Lord Forsyth of Drumlean, chair of the country's Economic Affairs Committee, argued [60] :

The Bank of England has become addicted to quantitative easing. It appears to be its answer to all the country's economic problems and by the end of 2021, the Bank will own an eye-watering £857bn ($1.2trn) of government bonds.

According to data provider Glassnode, by mid-Q4, the number of non-zero Bitcoin balances reached a record high of 38.73 million [61] . And yet, despite the stunning performance of the technology to date, it is still early days for Bitcoin investors. A little over 220 million people own cryptocurrencies in one form or another [62] , around 2.75% of the world's population.

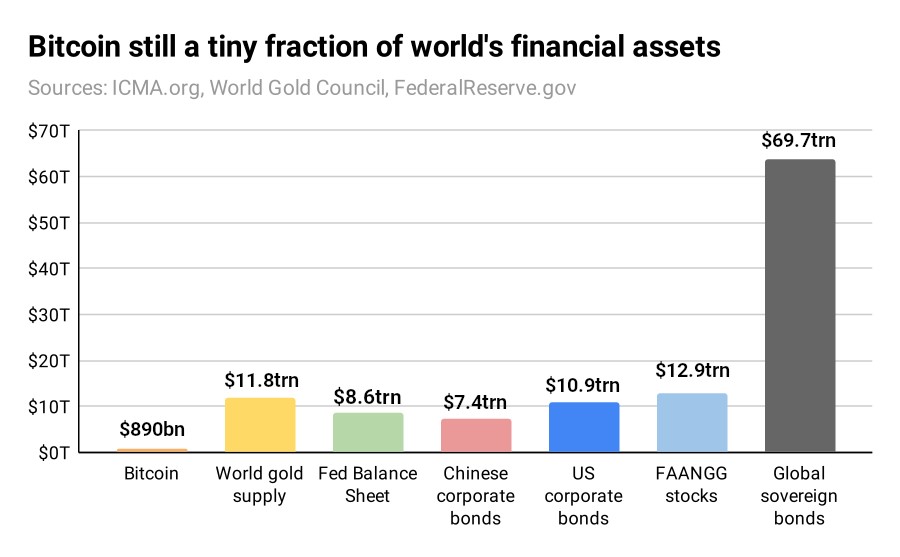

More pertinently, the total Bitcoin market cap of as of the end of Q4 2021 [63] - $890bn - was just a tiny fraction of other financial assets.

There are approximately 201,296 tonnes of above-ground gold, according to the World Gold Council, making the world's supply of precious metal worth approximately $11.8trn at current market rates. At the top of the pile is debt: the total global sovereign bond market represents $63.4trn in market value.

Outlook

It is worth a reminder, given how quickly crypto markets move - and how price euphoria can switch to abject depression - that the total market cap of all cryptoassets only crossed $1 trillion for the first time on 29 January 2021, and made the same move above $2 trillion three months later. We are still feeling the after-effects of such a swift rise to prominence today.

The data shows that Bitcoin is a more popular store of value than ever before.

It is increasingly integrated with the wider world financial system and adoption is in its relatively early stages. But the network's efficiency is growing, quarter on quarter. While its legal tender status in El Salvador is likely to remain an outlier, institutional investors are increasingly of the opinion that the asset class cannot be ignored as a 50-year or 100-year financial technology bet.

So, whether it comes in the form of increased adoption in emerging markets, or simple hedging to protect savings in a world of rampant inflation, Bitcoin remains an intriguing, deflationary-by-design portfolio diversifier.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

About Bitwise

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.