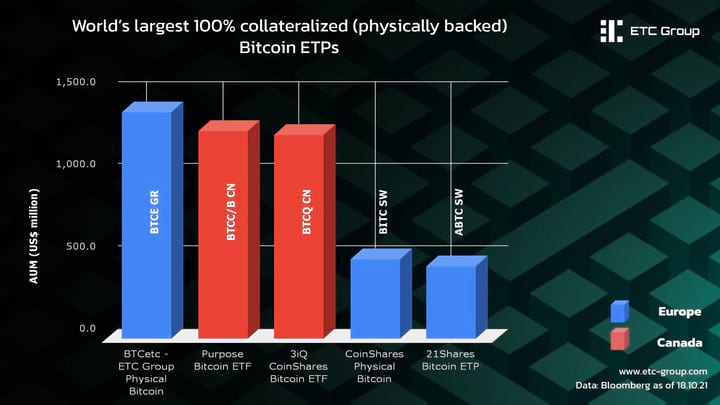

Europe overtakes Canada to hold the world’s largest and most traded physical single asset cryptocurrency ETP

ETC Group’s Bitcoin ETC surpasses US$1.3 Billion AUM as the total European market for comparable crypto exchange traded products exceeds $4 billion[1]

London, UK. October 18, 2021 - ETC Group ( etc-group.com ), Europe’s leading specialist provider of institutional-grade digital asset-backed securities, announces that its total Assets Under Management (AUM) has reached US$1.5 billion[2], with its Bitcoin exchange traded product (BTCE) now the world’s largest physically backed single cryptocurrency ETP with over US$1.3 billion AUM[3].

This leadership position in the rapidly growing digital asset security market comes only 16 months after the launch of ETC Group’s first product, BTCE - ETC Group Physical Bitcoin (BTCE), on Deutsche Börse’s Xetra exchange. Research released this month by CryptoCompare also shows that BTCE is the most traded listed crypto ETP with average daily trading volumes of US$26.3 million, more than seven times its nearest competitor[4].

ETC Group has pioneered the digital asset management industry by providing institutional quality, 100% physically backed, high liquidity digital asset backed securities. With a Germany domiciled issuer, its Bitcoin product BTCE was the first crypto product to be centrally cleared when it listed on XETRA[5]. ETC Group was also the first company to make its leading Bitcoin ETC carbon neutral, and the first issuer to list a Crypto ETP on a UK stock exchange. Recently, BTCE became the underlying product of Europe’s first Futures contracts announced by Eurex, Europe’s largest derivatives exchange.

ETC Group’s leadership position is testament to the focus we have on delivering the highest quality crypto exchange traded products, and ensuring that we partner with the industry’s leading market makers, custodians, and exchanges to provide both retail and institutional investors highly liquid, transparent, regulated and secure exposure to the world’s leading cryptocurrencies. We’re delighted to be leading the charge for Europe, whose regulatory regime, multiple exchanges across different countries, and investor awareness has put it at the forefront of exchange traded cryptocurrency investment. Bradley Duke, CEO of ETC Group

ETC Group now lists Bitcoin, Ethereum, Litecoin and Bitcoin Cash ETCs across multiple exchanges in Europe, and is planning to expand its suite of products to meet investor demand for digital asset-backed investments on Europe’s financial markets.

Cryptocurrencies are highly volatile, and your capital is at risk. Disclaimer: https://bit.ly/etcdisc

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.