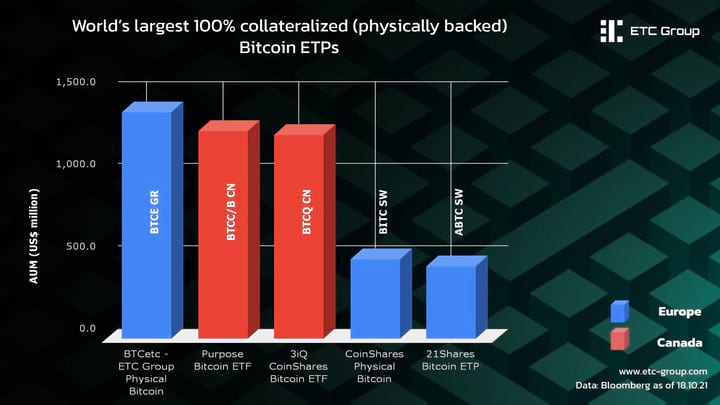

Europe overtakes Canada to hold the world’s largest and most traded physical single asset cryptocurrency ETP

ETC Group’s Bitcoin ETC surpasses US$1.3 Billion AUM as the total European market for comparable crypto exchange traded products exceeds $4 billion[1]

London, UK. October 18, 2021 - ETC Group ( etc-group.com ), Europe’s leading specialist provider of institutional-grade digital asset-backed securities, announces that its total Assets Under Management (AUM) has reached US$1.5 billion[2], with its Bitcoin exchange traded product (BTCE) now the world’s largest physically backed single cryptocurrency ETP with over US$1.3 billion AUM[3].

This leadership position in the rapidly growing digital asset security market comes only 16 months after the launch of ETC Group’s first product, BTCE - ETC Group Physical Bitcoin (BTCE), on Deutsche Börse’s Xetra exchange. Research released this month by CryptoCompare also shows that BTCE is the most traded listed crypto ETP with average daily trading volumes of US$26.3 million, more than seven times its nearest competitor[4].

ETC Group has pioneered the digital asset management industry by providing institutional quality, 100% physically backed, high liquidity digital asset backed securities. With a Germany domiciled issuer, its Bitcoin product BTCE was the first crypto product to be centrally cleared when it listed on XETRA[5]. ETC Group was also the first company to make its leading Bitcoin ETC carbon neutral, and the first issuer to list a Crypto ETP on a UK stock exchange. Recently, BTCE became the underlying product of Europe’s first Futures contracts announced by Eurex, Europe’s largest derivatives exchange.

ETC Group’s leadership position is testament to the focus we have on delivering the highest quality crypto exchange traded products, and ensuring that we partner with the industry’s leading market makers, custodians, and exchanges to provide both retail and institutional investors highly liquid, transparent, regulated and secure exposure to the world’s leading cryptocurrencies. We’re delighted to be leading the charge for Europe, whose regulatory regime, multiple exchanges across different countries, and investor awareness has put it at the forefront of exchange traded cryptocurrency investment. Bradley Duke, CEO of ETC Group

ETC Group now lists Bitcoin, Ethereum, Litecoin and Bitcoin Cash ETCs across multiple exchanges in Europe, and is planning to expand its suite of products to meet investor demand for digital asset-backed investments on Europe’s financial markets.

Cryptocurrencies are highly volatile, and your capital is at risk. Disclaimer: https://bit.ly/etcdisc

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer