There is no doubt that Bitcoin has permanently altered the investment landscape.

Bitcoin has achieved annualised returns of 78.1% over the last 7 years at the cost of similar annualised volatility. When played cautiously, Bitcoin can represent one of the best risk-reward plays for investors seeking uncorrelated alternative assets in their portfolio.

ETC Group research shows that even a small Bitcoin allocation of 3% in a traditional 60/40 portfolio can increase the internal rate of return over five years by up to 73%[1].

But not all products to access Bitcoin are equal.

Bitcoin ETPs - often imitated, never duplicated

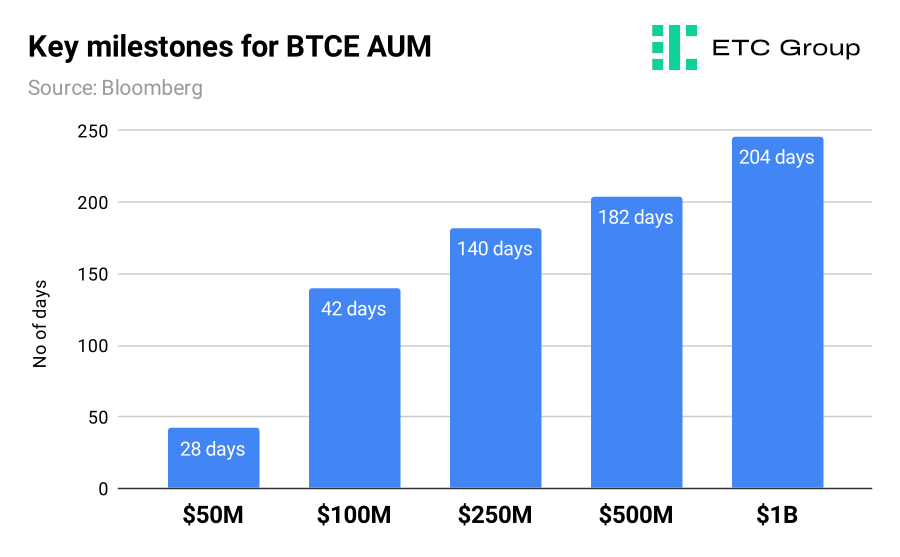

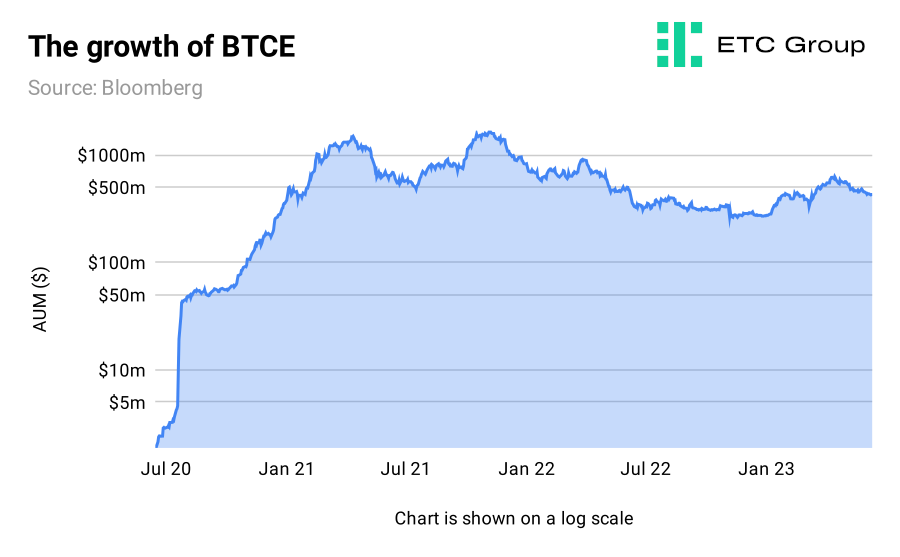

In the three years since ETC Group launched the ETC Group Physical Bitcoin (BTCE), the amount of Bitcoin held by funds and exchange traded products (ETPs) has increased by 300,000 BTC.

The total AUM held by funds and ETPs has more than tripled from $6.2bn to $20.7bn while more than 100 crypto ETPs have come to market since the launch of BTCE.

ETPs: The most secure route to Bitcoin exposure

As the 2023 Trackinsight Global ETF Survey notes: “A comparative analysis of all implementation solutions available to investors to gain exposure to the spot price of cryptocurrencies shows that ETPs present the most secure and economical route…The growing appetite for ETPs over the last three years is a clear sign that there is an inherent need to protect the end investors and their assets.”

BTCE was created to put a regulatory wrapper around Bitcoin so that investors could get exposure to the cryptocurrency in the most recognisable and regulated manner.

Most liquid Bitcoin ETP

Data from Deutsche Börse XETRA, the primary listing venue and one of several European stock exchanges on which BTCE trades, shows that the physically-backed Bitcoin ETP has been the most traded exchange traded product from January 2023 to May 2023.

In March 2023, the order book turnover for BTCE on Xetra was €164.74m, three times more than its nearest competitor, and almost €60m higher than the largest fixed income product.

The five largest trading days on Xetra for BTCE since inception range from €121.4m to €174.4m.

Counted in US dollars, the total trading volume for BTCE on Deutsche Börse XETRA since launch is more than $13.8 billion.

The closest thing to a risk-free trade in Bitcoin — trading the basis with futures — is a popular arbitrage strategy which sees traders buy spot Bitcoin (or a highly liquid associated product like BTCE), while simultaneously selling long-dated Bitcoin futures, collecting ‘risk-free’ premium.

Because of its deep liquidity profile, BTCE seems to have become the instrument of choice for hedge funds and other institutions making this type of trade.

Sweat-free Bitcoin ETP

ETPs that allow the lending of their underlying assets are in an objectively higher counterparty risk position than those that do not.

This was most notably researched in Crypto ETPs: Why Structure Matters, which explained how investors could be exposed to undue risk when crypto funds and ETPs lend out underlying assets.

BTCE’s structure and prospectus do not allow lending of its underlying assets, and investors have a legal claim to the Bitcoin backing it, should the issuer ever go out of business.

BTCE also benefits from a “bankruptcy remote” product structure, which segregates the underlying assets in the ETP. This means that even if the issuer becomes insolvent, the assets in the ETP are unaffected, giving investors the peace of mind they need to invest or trade with confidence.

An independent trustee holds a security interest in the underlying assets on investors’ behalf, which means that BTCE investors face no issuer default risk.

In the three years since BTCE launched in June 2020, the exchange rate of a single Bitcoin has almost tripled from $9,000 to $26,000.

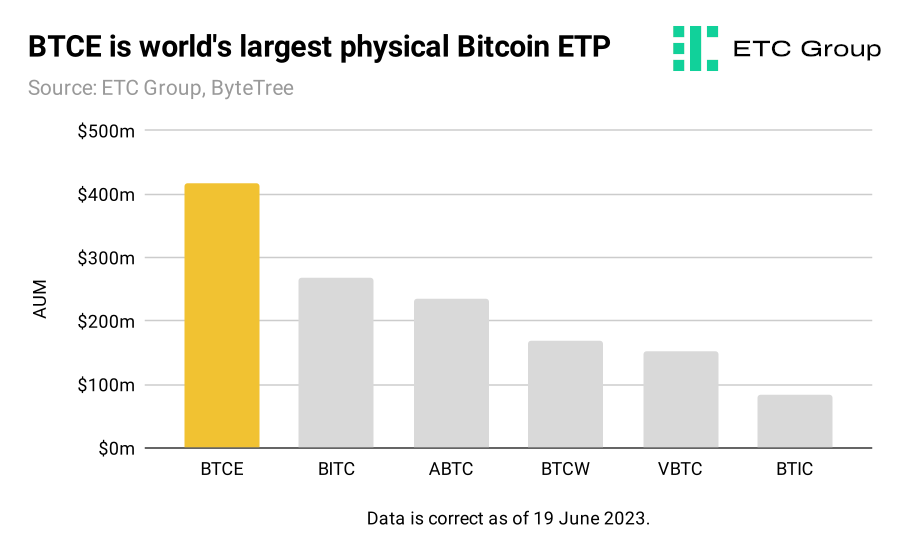

The assets under management of Europe’s first centrally cleared Bitcoin product have similarly grown from zero to $429 million and in terms of underlying assets from 0 to 16,247 BTC kept in cold storage custody (as of June 19th 2023).

And while the next three years are bound to produce much volatility in crypto markets, BTCE will continue to be the backbone of this market, running like clockwork in the background.

Notes

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.