- Introducing the new “Crypto Market Compass” – your weekly guide to successfully navigate Bitcoin & Cryptoasset Markets

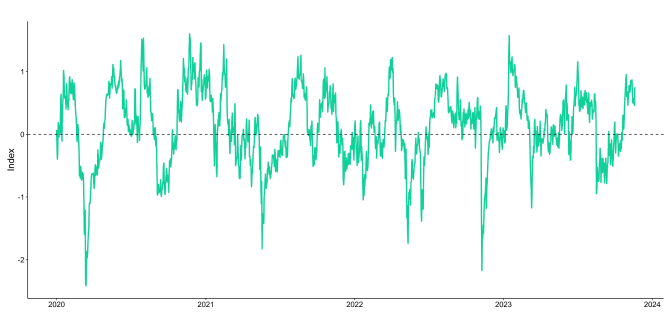

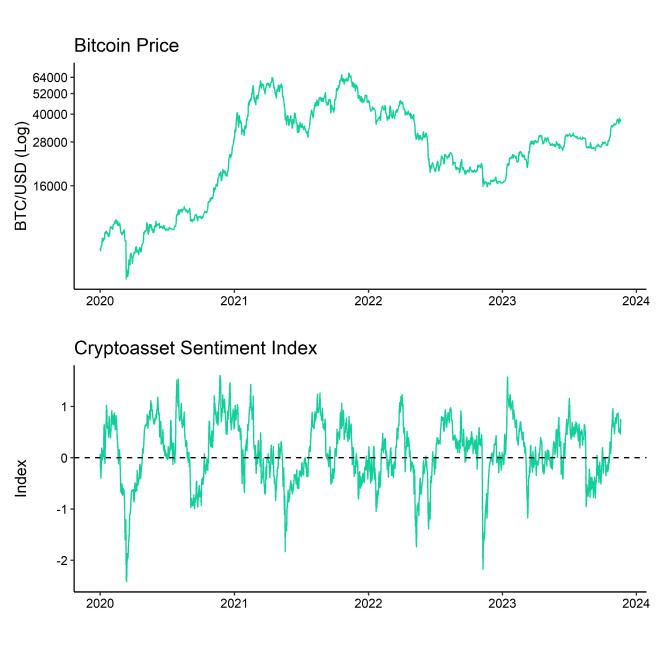

- Featuring the new “Cryptoasset Sentiment Index” – a composite index combining cryptoasset sentiment, flows, on-chain, and derivatives metrics

- Cryptoasset Sentiment remains elevated following the election of Javier Milei as next Argentine president (Chart of the Week)

Chart of the Week

Performance

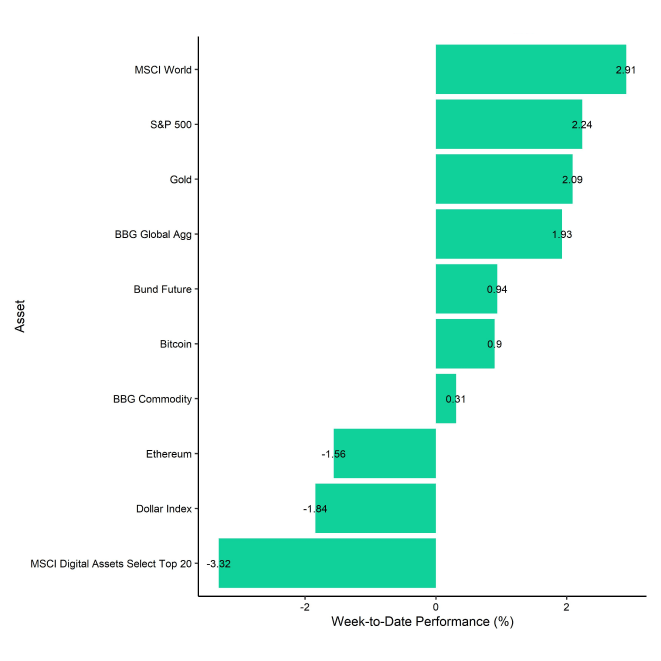

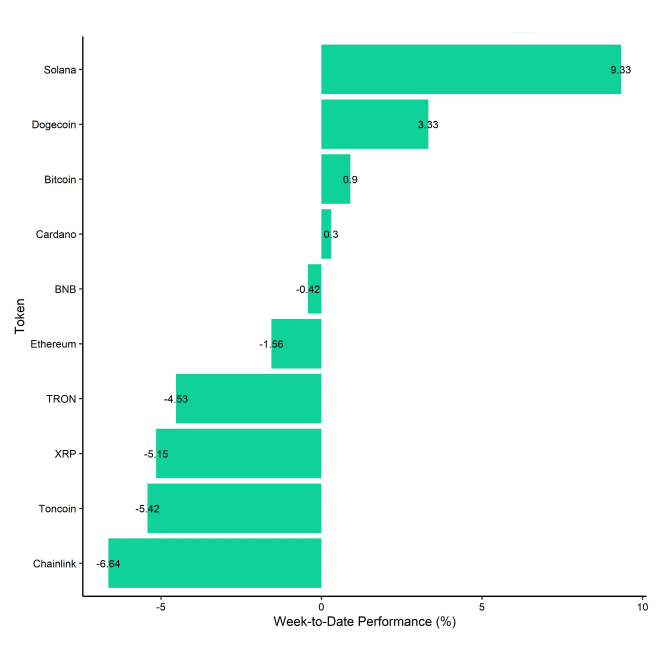

Last week, cryptoassets mostly went sideways as the market was looking for new catalysts. Despite a relatively strong outperformance by high beta cryptoassets such as Solana, overall altcoin outperformance remained somewhat muted compared to the prior week.

Meanwhile, traditional assets such as global equities managed to gain significantly over the last week on the back of a continuing improvement in cross asset risk appetite which was due to a further repricing of the US Dollar (weaker) and monetary policy expectations (easier).

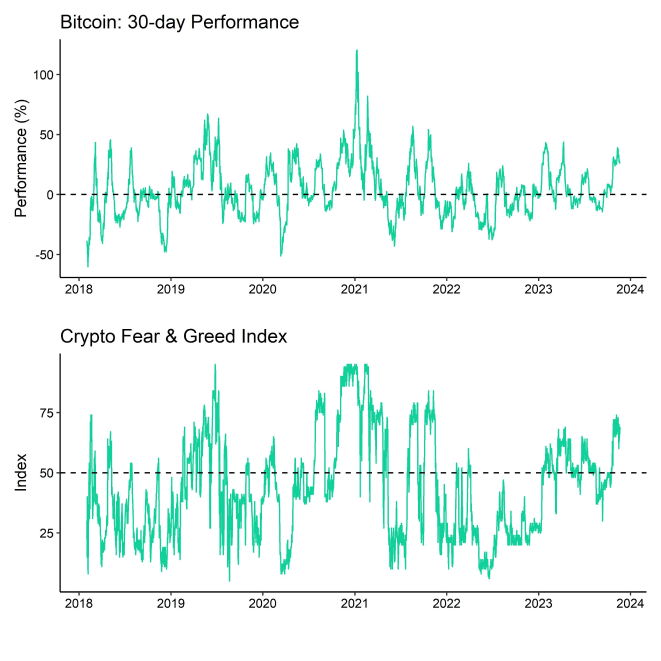

Overnight, the news broke that the libertarian and pro-Bitcoin candidate Javier Milei was elected as the new president of Argentina which buoyed cryptoasset market sentiment somewhat. In that context, overall cryptoasset sentiment remains somewhat elevated which implies that, barring any short-term approval of a spot Bitcoin ETF in the US, a short-term pull-back appears to be quite likely (Chart of the Week).

Among the top 10 crypto assets, Solana, Dogecoin, and Bitcoin were the relative outperformers.

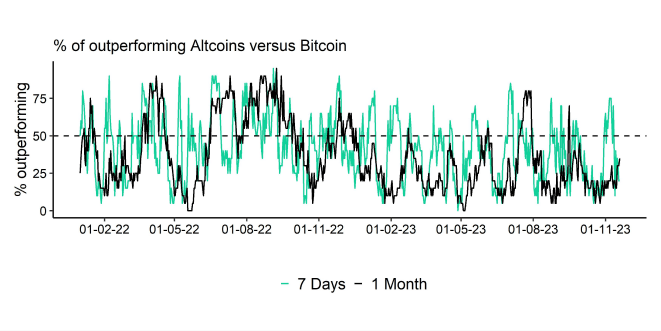

However, overall altcoin outperformance vis-à-vis Bitcoin has continued to be fairly muted. Only 20% of our tracked altcoins managed to outperform Bitcoin on a weekly basis.

Sentiment

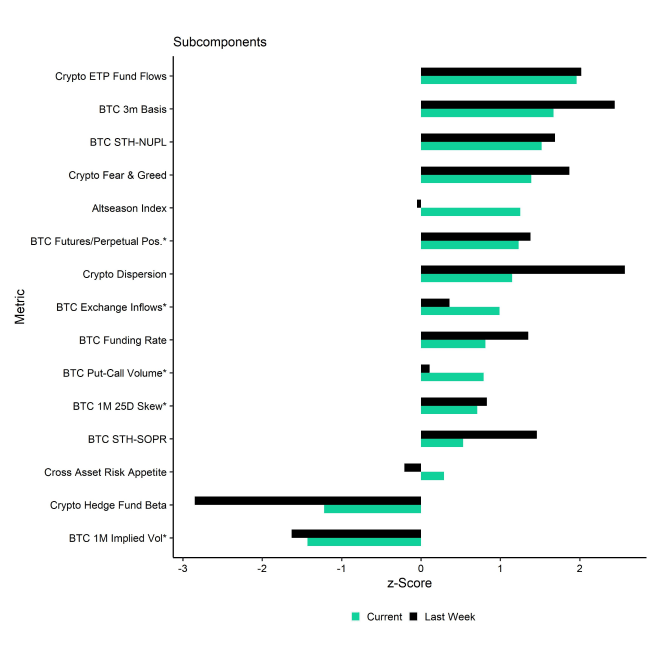

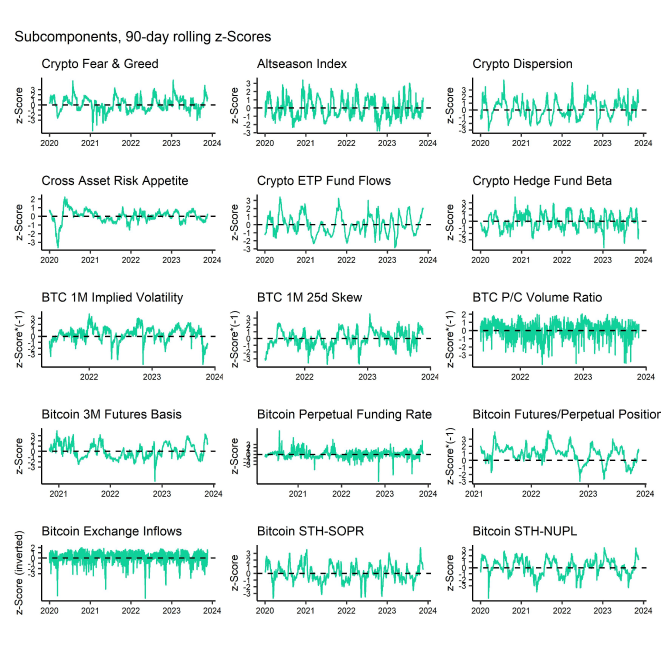

Our in-house Cryptoasset Sentiment Index has increased following the Argentine election outcome and is now firmly in bullish territory. At the moment, 13 out of 15 indicators are above their short-term trend.

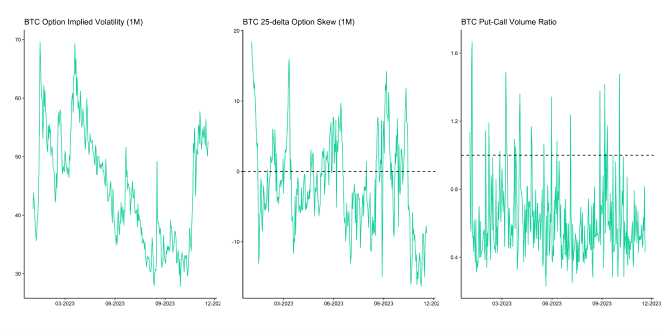

Compared to last week, we saw major reversals to the upside in the Altseason index and BTC Put-Call Volume Ratio.

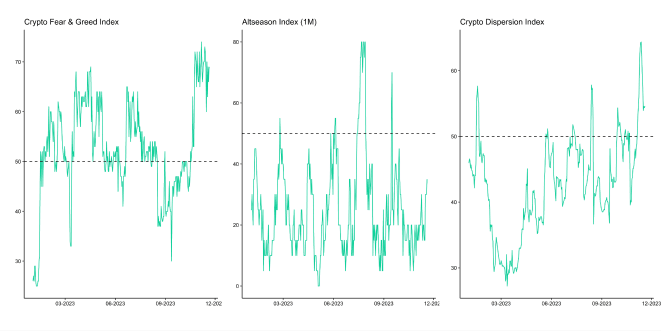

The Crypto Fear & Greed Index also remains in "Greed" territory as of this morning.

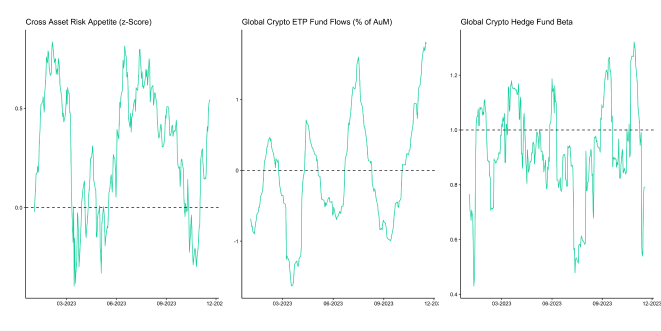

Meanwhile, our own measure of Cross Asset Risk Appetite (CARA) increased significantly last week on the back of a further repricing of the US Dollar (weaker) and monetary policy expectations (easier). This may explain the ongoing significant inflows into cryptoasset ETPs as well (see further below).

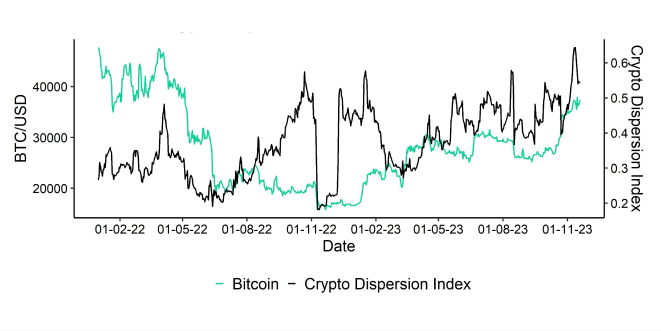

Performance dispersion among cryptoassets has declined slightly compared to last week but continues to be relatively high. In general, high performance dispersion among cryptoassets implies that correlations among cryptoassets have decreased which means that cryptoassets are trading more on coin-specific factors and that diversification among cryptoassets is high.

At the same time, as mentioned above, altcoin outperformance has continued to be low with only 20% of altcoins outperforming Bitcoin on a weekly basis. In general, low altcoin outperformance is a sign of low risk appetite within cryptoasset markets.

Flows

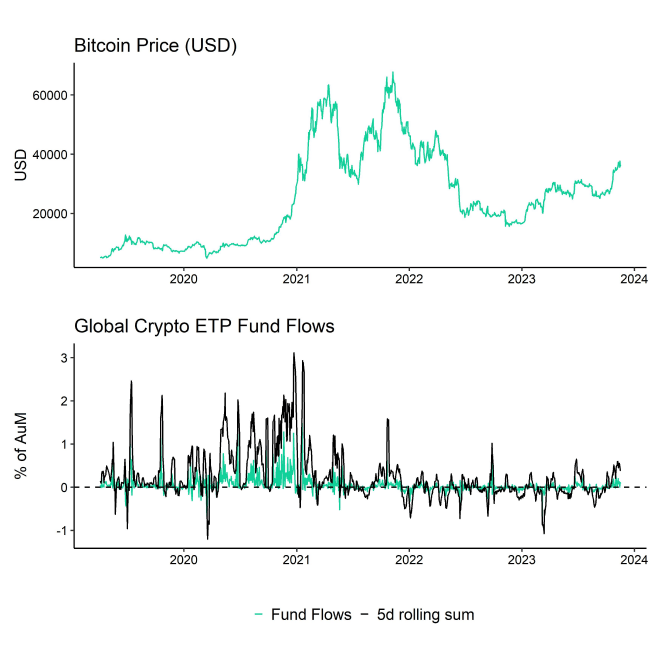

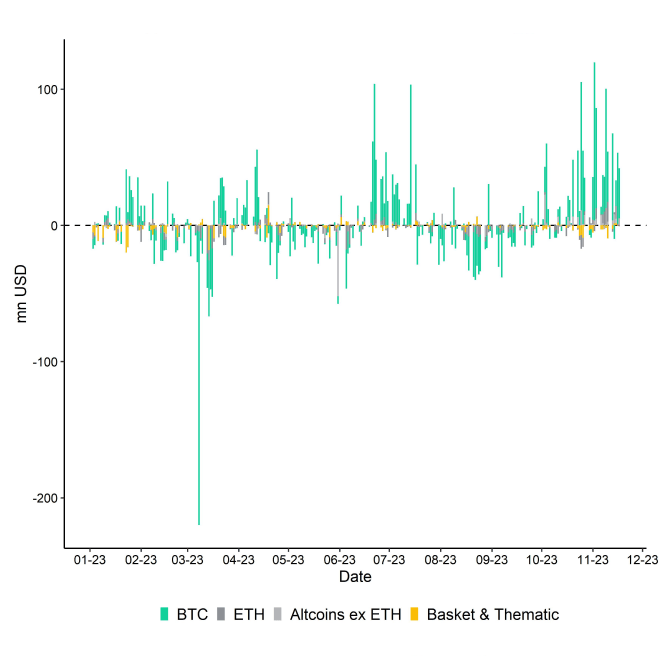

Last week, we saw yet another week of significant net fund inflows into global cryptoasset ETPs.

In aggregate, we saw net fund inflows in the amount of +189.8 mn USD (week ending Friday).

The very large majority of these inflows focused on Bitcoin ETPs (+161.8 mn USD) and Altcoin ex ETH ETPs (+18.8 mn USD). Ethereum ETPs attracted +9.0 mn USD in net fund inflows last week on the back of the news that BlackRock has officially filed for an Ethereum ETF in the US as well.

Meanwhile, thematic & basket crypto ETPs only experienced minor net fund inflows (+0.3 mn USD) last week.

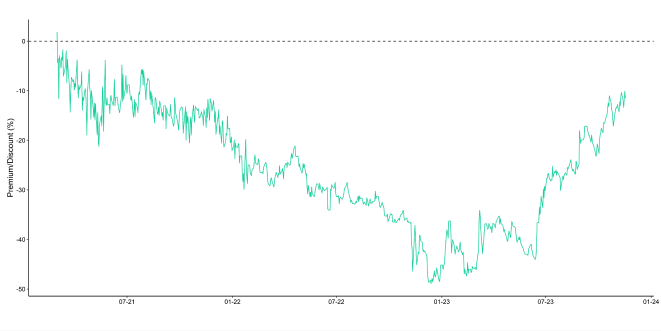

The NAV discount of the biggest Bitcoin fund in the world - Grayscale Bitcoin Trust (GBTC) – remains relatively narrow at the moment with around -10%. In other words, investors are assigning a probability of around 90% that the Trust will ultimately be converted into a Spot Bitcoin ETF.

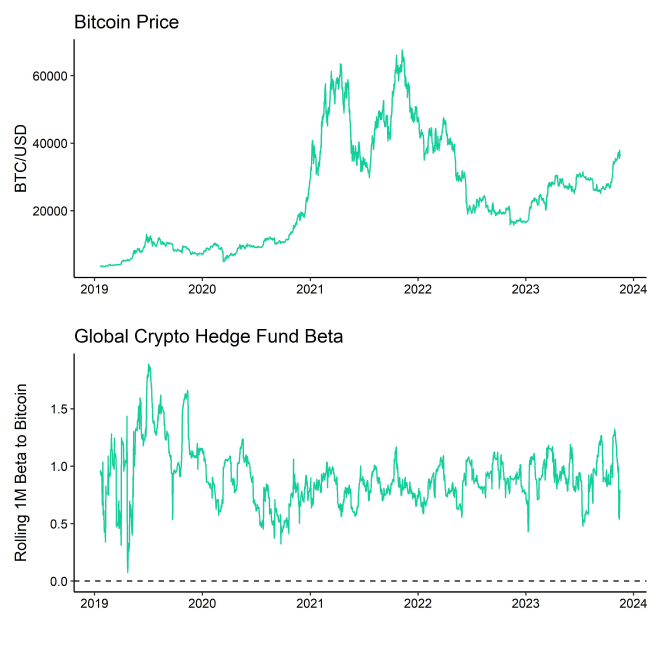

Moreover, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remains relatively low with around 0.8, implying that global crypto hedge funds are under-exposed to the market.

On-Chain

Overall, on-chain activity in Bitcoin remains relatively high at the moment.

For instance, although active addresses and new addresses on the Bitcoin blockchain have decreased slightly compared to last week, the Bitcoin mempool remains near capacity. The mempool is the queue of unconfirmed Bitcoin transactions.

In aggregate, we saw net fund inflows in the amount of +189.8 mn USD (week ending Friday).

The very large majority of these inflows focused on Bitcoin ETPs (+161.8 mn USD) and Altcoin ex ETH ETPs (+18.8 mn USD). Ethereum ETPs attracted +9.0 mn USD in net fund inflows last week on the back of the news that BlackRock has officially filed for an Ethereum ETF in the US as well.

Meanwhile, thematic & basket crypto ETPs only experienced minor net fund inflows (+0.3 mn USD) last week.

The NAV discount of the biggest Bitcoin fund in the world - Grayscale Bitcoin Trust (GBTC) – remains relatively narrow at the moment with around -10%. In other words, investors are assigning a probability of around 90% that the Trust will ultimately be converted into a Spot Bitcoin ETF.

Moreover, the beta of global crypto hedge funds to Bitcoin over the last 20 trading remains relatively low with around 0.8, implying that global crypto hedge funds are under-exposed to the market.

Overall, on-chain activity in Bitcoin remains relatively high at the moment.

For instance, although active addresses and new addresses on the Bitcoin blockchain have decreased slightly compared to last week, the Bitcoin mempool remains near capacity. The mempool is the queue of unconfirmed Bitcoin transactions.

A high amount of transactions in the mempool usually indicates high demand for Bitcoin transactions and block space in general. The mean amount of transactions per block is also hovering near all-time highs above 4000 transactions per block at the moment.

This also shows up in the relatively elevated level of transaction fees as both median and mean relative fee in the Bitcoin mempool have increased to the highest level since May 2023 when the BRC-20 frenzy clogged the network.

In that context, the daily level of inscriptions has recently increased to a new all-time high as well most of which are text-based/BRC-20 inscriptions. The transaction count share of inscriptions has regularly clocked above 60% recently, implying that 3 out of 5 Bitcoin transactions contained an inscription on average.

Meanwhile, Bitcoin’s hash has also reached a new all-time high last week with 551 EH/s recorded just yesterday. So, Bitcoin miners continue to increase their hash rate ahead of the upcoming Bitcoin Halving which is anticipated next year in April.

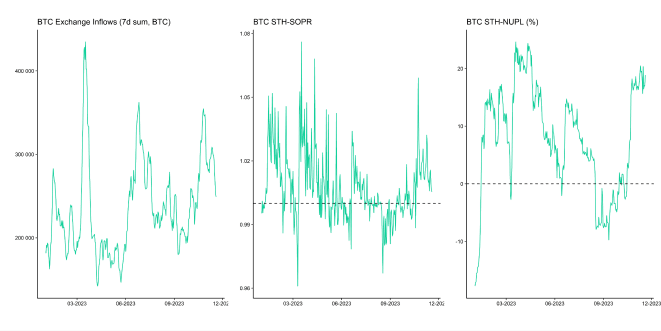

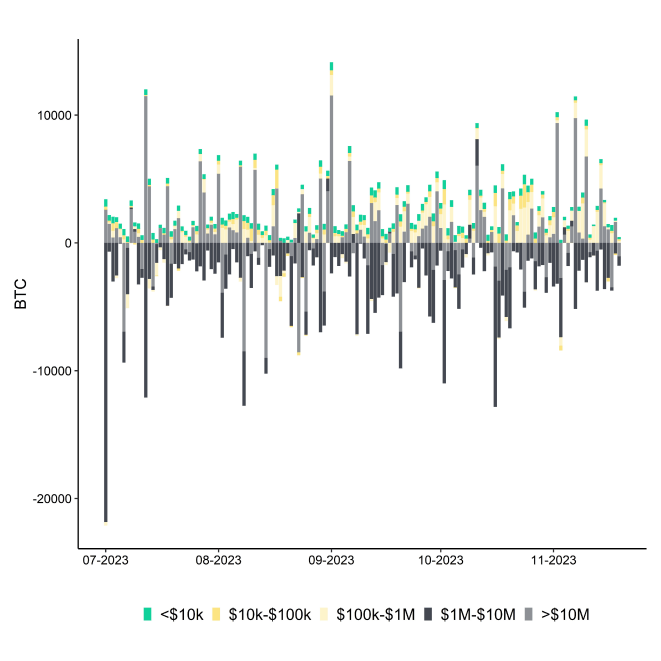

Exchange activity is still biased towards inflows. However, net exchange inflows of BTC have recently subsided as well. Over the last 7 days, most wallet cohorts experienced net inflows with the exception of wallets with a size of 1 mn – 10 mn USD which saw net outflows to the tune of 11.8k BTC from exchanges. In contrast, net exchange volumes for Ethereum remained very biased towards outflows. ETH exchange balances have recently reached a fresh 7-year low implying increasing supply illiquidity of Ethereum which tends be bullish.

On a very positive note, accumulation activity across various BTC wallet cohorts remains near the strongest observed year-to-date.

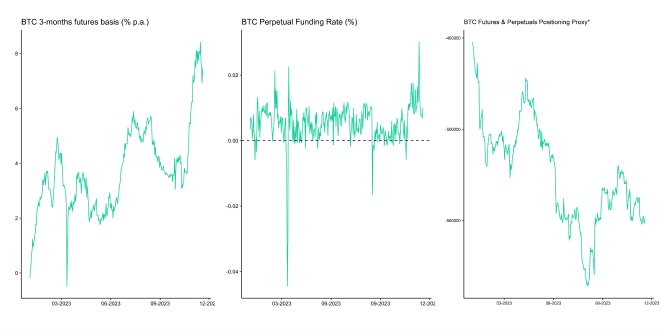

Derivatives

Open interest in both BTC futures and perpetuals decreased last week. CME remains the biggest futures market in terms of open interest ahead of Binance this week. The 3-months annualized rolling basis in BTC futures has decreased somewhat compared to last week but remains near year-to-date highs of around 7.5% p.a. BTC perpetual funding rates have mostly remained positive throughout the week across various exchanges.

On the other hand, BTC options open interest mostly went sideways in BTC-terms but still hovers near all-time highs. There was no significant change in relative put-call open interest for BTC options and only a minor spike in relative put-call trading volumes in favour of puts last week.

biased towards call options judging by the elevated 25-delta skew which currently shows an implied volatility premium of around 8.7% for delta-equivalent BTC call options with 1-month expiry.Bottom Line

- We are introducing the new “Crypto Market Compass” – your weekly guide to successfully navigate Bitcoin & Cryptoasset Markets.

- It features the new “Cryptoasset Sentiment Index” – a composite index combining cryptoasset sentiment, flow, on-chain, and derivatives metrics.

- Cryptoasset sentiment remains elevated following the election of Javier Milei as next Argentine president (Chart of the Week).

Appendix

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.