- Last week, cryptoassets outperformed traditional assets due to a reacceleration in US spot Bitcoin ETF inflows

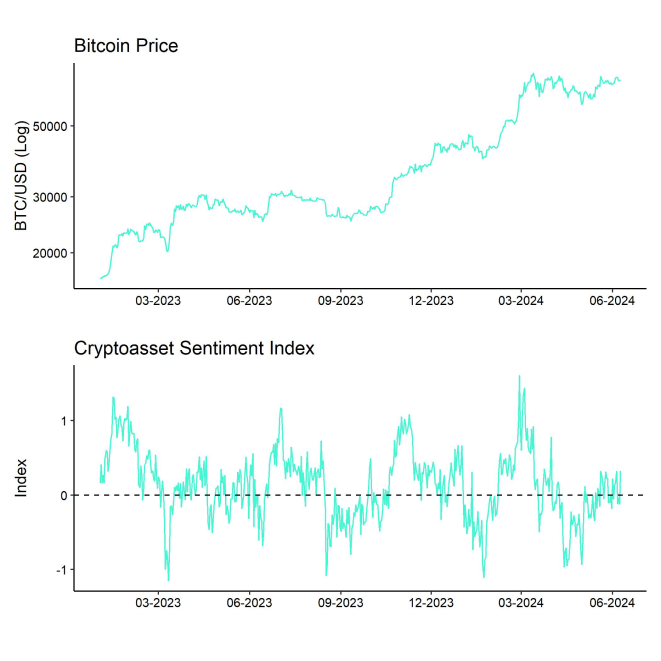

- Our in-house “Cryptoasset Sentiment Indicator” continues to fluctuate around neutral levels of sentiment

- US spot Bitcoin ETFs saw their highest weekly net inflow since mid-March and have seen 20 consecutive trading days of positive net inflows so far

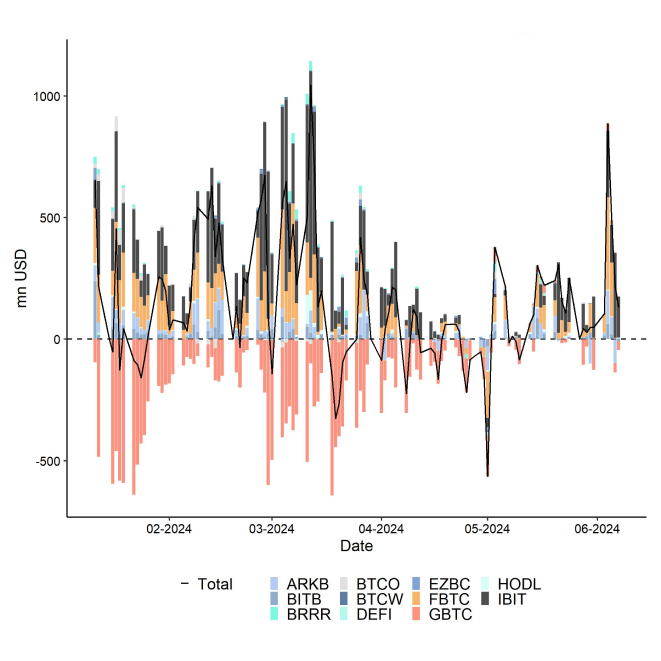

Chart of the Week

Performance

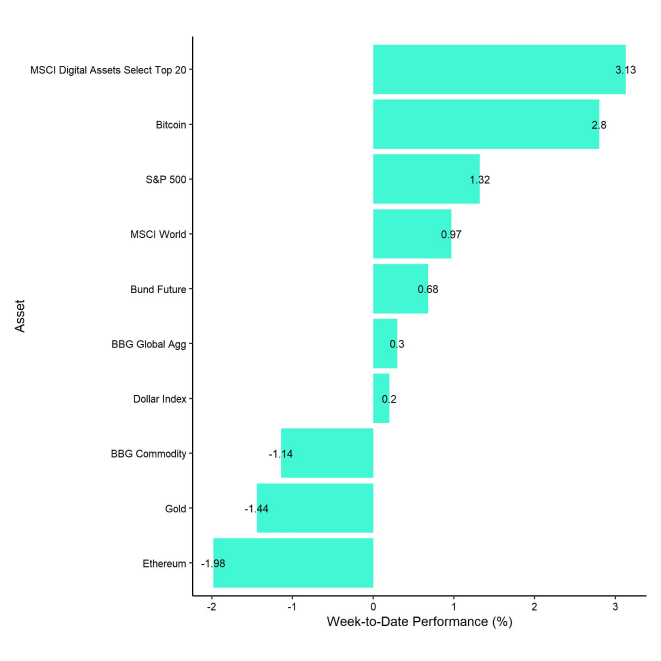

Last week, cryptoassets outperformed traditional assets once again supported by a renewed acceleration in global crypto ETP net inflows and US spot Bitcoin ETF net inflows in particular.

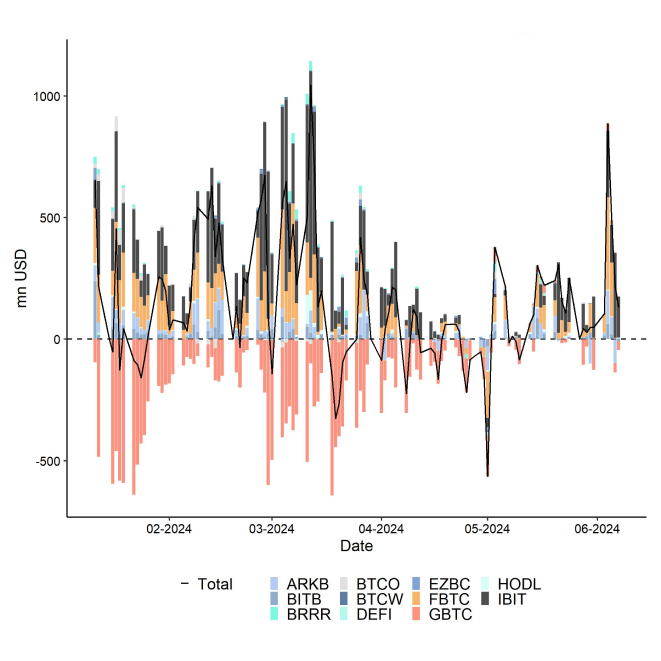

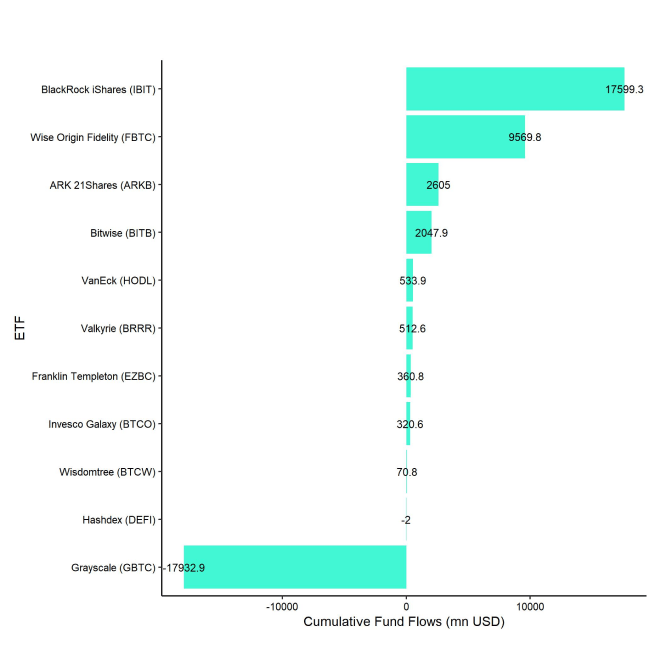

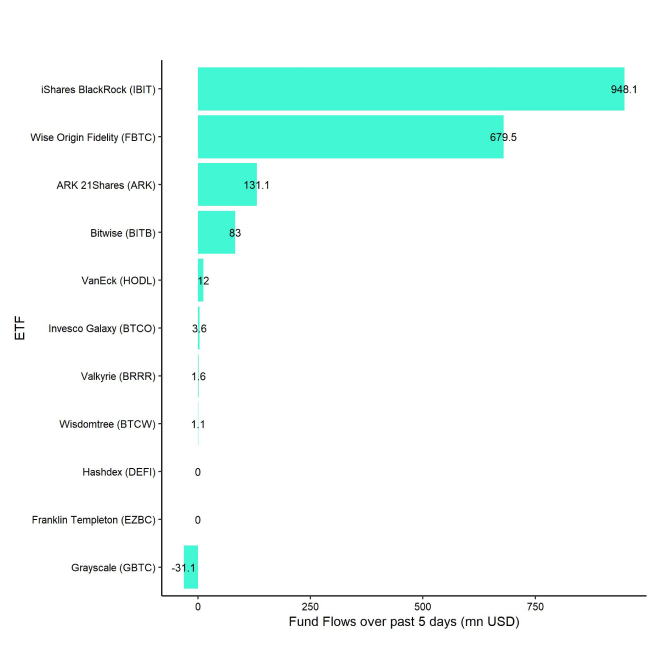

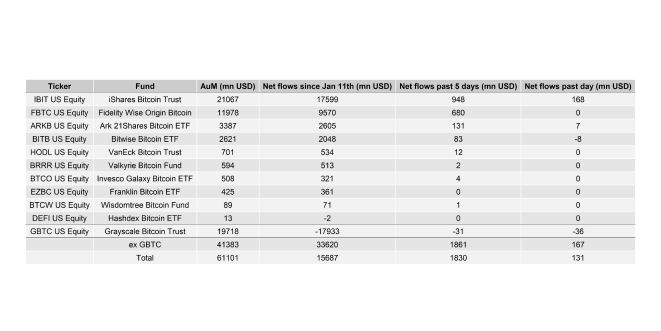

More specifically, US spot Bitcoin ETFs saw their highest weekly net inflow since mid-March (Chart-of-the-Week). Weekly crypto ETP net inflows across all types of cryptoassets surpassed 2 bn USD last week, of which net inflows into US spot Bitcoin ETFs accounted for ~80.5% alone. US spot Bitcoin ETFs have seen 20 consecutive trading days of positive net inflows so far.

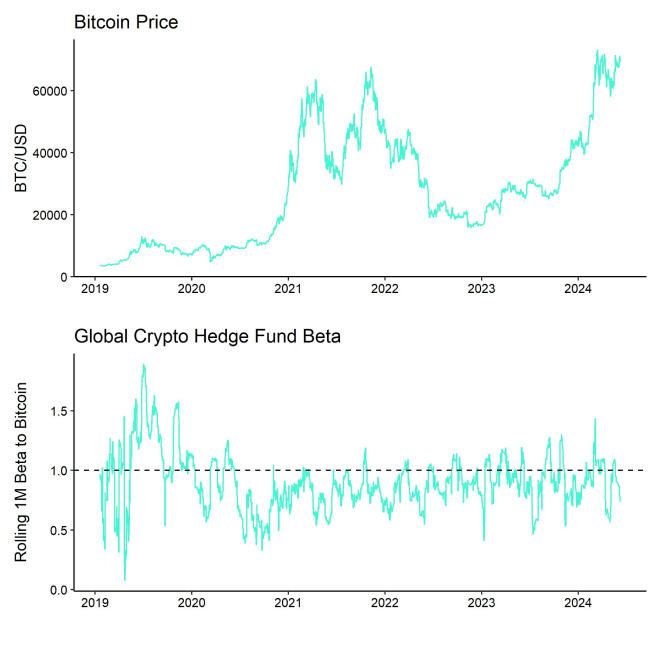

It seems as if risk appetite is returning to the crypto markets, especially after the ECB and Bank of Canada both announced to cut their key interest rates last week. These developments mark a significant shift in major central banks' monetary policy as these are the first interest rate cuts since 2019 (ECB) and 2020 (Bank of Canada), respectively.

The macro liquidity tide is obviously turning already, which we have also analysed in our latest monthly report here.

However, the net implications for Bitcoin and cryptoassets of this reversal in global monetary policy are still somewhat mixed as these changes also signal that economic data are worsening significantly and global growth still seems to be the most dominant macro factor for Bitcoin at the moment based on our analyses.

In this context, the latest non-farm payrolls print that came in way above expectations seems to be inconsistent with other US employment data that continue to signal worsening labour market conditions.

That being said, over the medium- to long-term, monetary policy easing will provide a significant tailwind for Bitcoin and cryptoassets, especially in light of the latest Bitcoin Halving that will probably affect performances positively from summer onwards.

Increasing spot supply scarcity is generally visible for both Bitcoin and Ethereum as on-exchange balances continue to hit multi-year lows.

So, while the growth of fiat liquidity supply is likely to accelerate over the next 12 months, the illiquidity of supply of major cryptoassets such as Bitcoin and Ethereum will also worsen.

This combination of fiat demand expansion and cryptoasseet supply tightening is bound to be very positive for cryptoassets going forward.

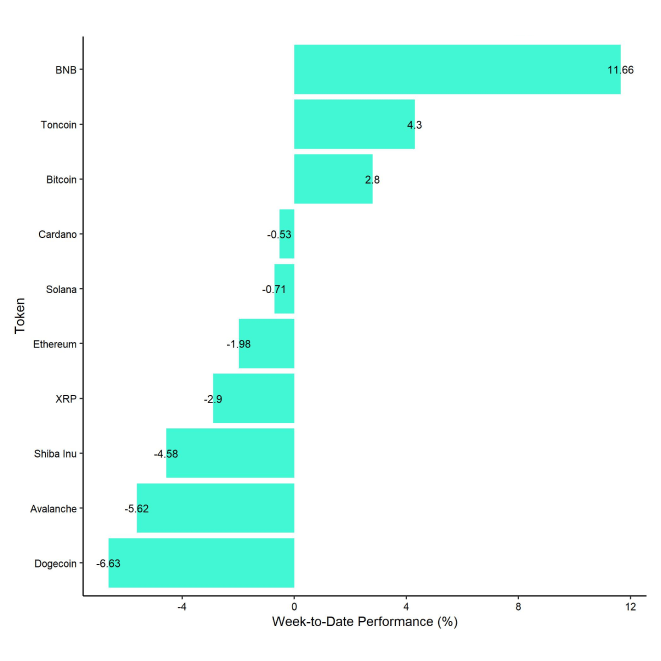

In general, among the top 10 crypto assets, BNB, Toncoin, and Bitcoin were the relative outperformers.

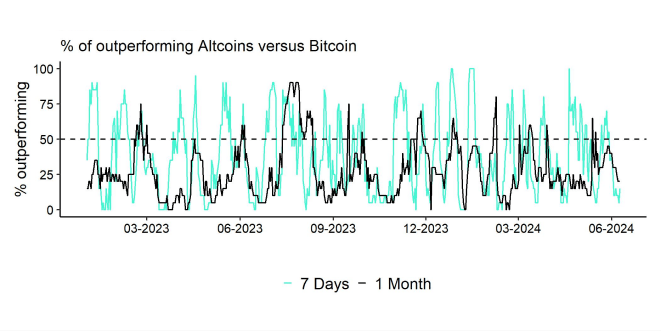

Overall, altcoin outperformance vis-à-vis Bitcoin has declined significantly compared to the prior week, with only around 15% of our tracked altcoins managing to outperform Bitcoin on a weekly basis. This is consistent with the fact that Bitcoin outperformed Ethereum by almost 500 bps last week, which is generally a sentiment gauge for the overall altcoin market.

Sentiment

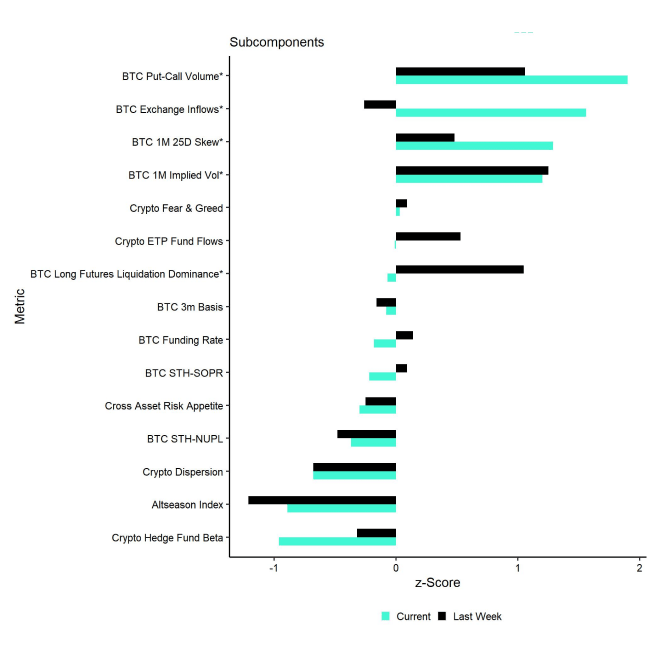

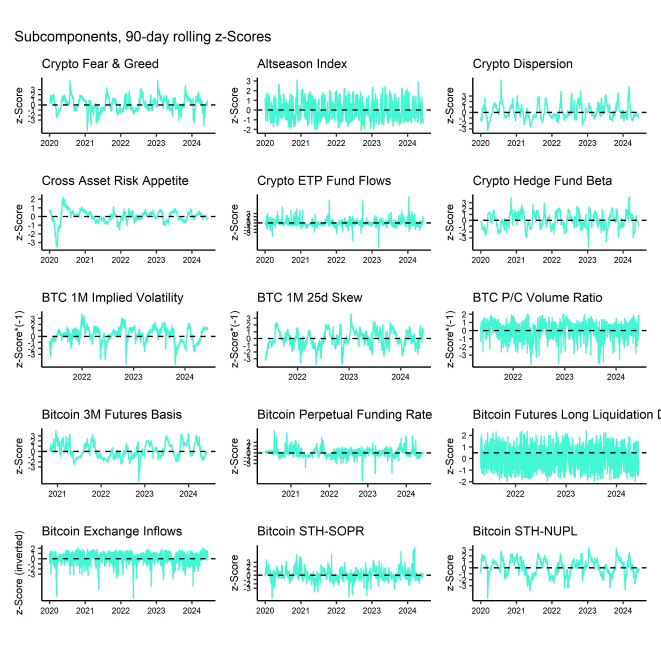

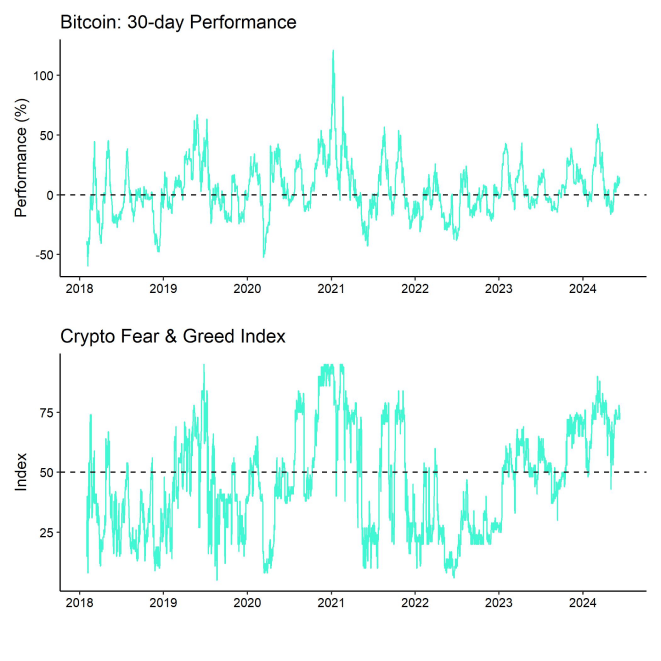

Our in-house “Cryptoasset Sentiment Index” continues to fluctuate around neutral levels of sentiment.

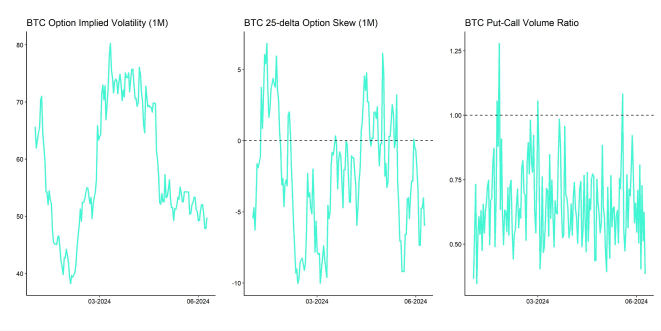

At the moment, 5 out of 15 indicators are above their short-term trend.

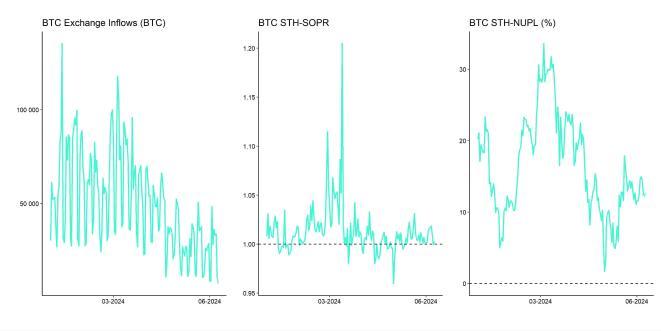

Last week, there were significant reversals to the upside in BTC exchange inflows and BTC options put-call volume ratios.

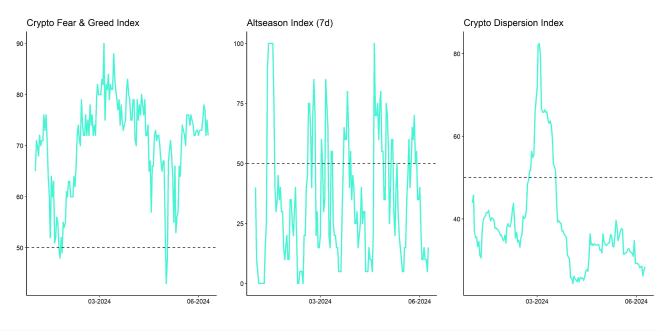

The Crypto Fear & Greed Index signals "Greed" as of this morning.

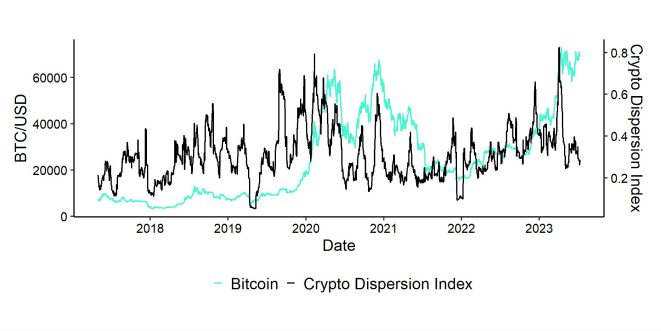

Performance dispersion among cryptoassets still remains very low. Most altcoins are still trading in line with Bitcoin.

Altcoin outperformance vis-à-vis Bitcoin has declined significantly compared to the week prior, with only around 15% of our tracked altcoins outperforming Bitcoin on a weekly basis, which is consistent with the fact that Bitcoin outperformed Ethereum last week.

In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance could signal low appetite for risk at the moment.

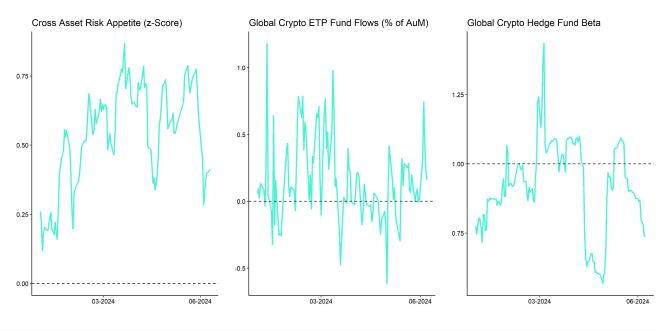

Meanwhile, sentiment in traditional financial markets rebounded to the upside from its recent lows, judging by our own measure of Cross Asset Risk Appetite (CARA).

Fund Flows

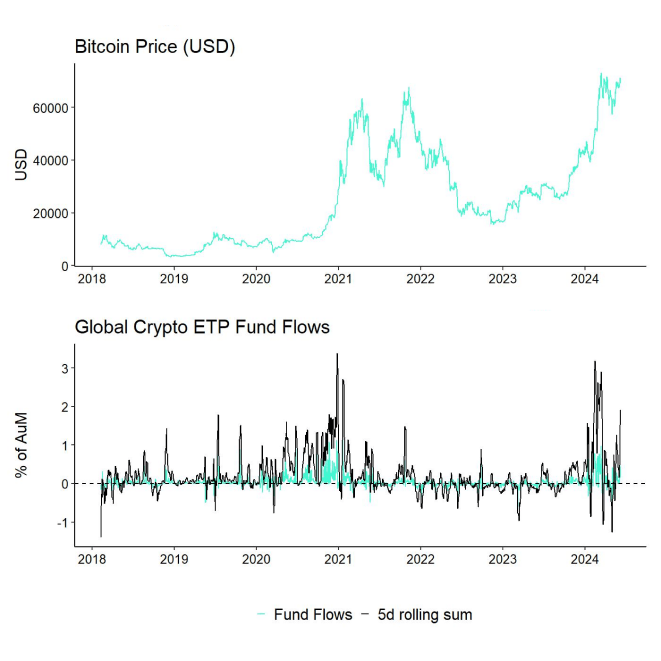

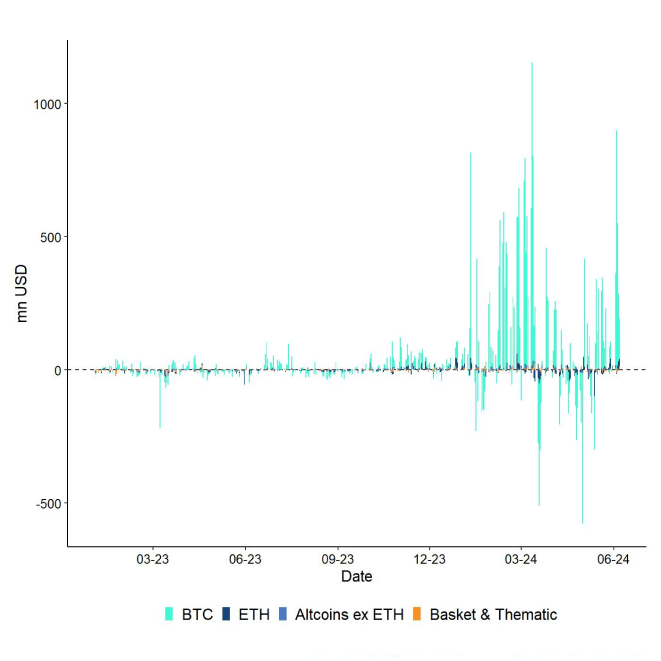

Last week, we saw very positive net inflows into global crypto ETPs of around +2,270.4 mn USD which was the highest amount of weekly net inflows since mid-March.

Global Bitcoin ETPs saw net inflows of +2,189.0 mn USD last week, of which +1,828.9 mn USD (net) were related to US spot Bitcoin ETFs alone. US spot Bitcoin ETFs have seen 20 consecutive trading days of positive net inflows so far.

Flows into Hong Kong spot Bitcoin ETFs were also decent, with net inflows of around +260.6 mn USD, according to data provided by Bloomberg.

The ETC Group Physical Bitcoin ETP (BTCE) saw minor net outflows equivalent to -5.3 mn USD while the ETC Group Core Bitcoin ETP (BTC1) saw no net flows (+/- 0 mn USD) last week.

The Grayscale Bitcoin Trust (GBTC) continued to see minor net outflows with approximately -31.1 mn USD last week, while other major US spot Bitcoin ETFs continued to attract more capital.

Global Ethereum ETPs saw accelerating net inflows last week, with net inflows of around +80.0 mn USD.

Furthermore, the ETC Group Physical Ethereum ETP (ZETH) saw another week of net inflows of +1.5 mn USD last week. The ETC Group Ethereum Staking ETP (ET32) saw neither in- nor outflows last week (+/- 0 mn USD).

Besides, Altcoin ETPs ex Ethereum also experienced some minor net inflows of around +17.8 mn USD last week.

Besides, Thematic & basket crypto ETPs continue to see minor net outflows of -7.5 mn USD, based on our calculations. The ETC Group MSCI Digital Assets Select 20 ETP (DA20) saw neither in- nor outflows last week (+/- 0 mn USD).

Meanwhile, global crypto hedge funds continue to decrease their market exposure to Bitcoin. The beta of global crypto hedge funds' performance has declined to 0.73 over the past 20 trading days.

On-Chain Data

Looking at core on-chain data for Bitcoin, we can make the following observations.

Active addresses still hover near year-to-lows as transaction fees remain relatively high. There was also a spike in mean transaction fees last week on Friday to the highest level since the Halving event on the 20 th of April. The mean transaction fee reached 83.7 USD that day.

One of the reasons is that the overall number of transactions and also the transaction rate (transactions/second) have gradually increased over the past weeks which has resulted in an increase in the mempool of unconfirmed transactions.

This does not seem to be inscription-related, as this share has remained below 10% of overall transaction count.

The Bitcoin hash rate also continued to be relatively high and we even saw a slight increase in network hash rate compared to the prior week. In this context, there are still no signs of “miner capitulation” in light of the recent reduction of mining revenues due to the Halving. For instance, aggregate BTC miner balances have moved sideways and we haven't seen significant miner transfers to exchanges either.

Looking at exchange activity, one can observe say that exchange balances continue to decline to fresh multi-year lows. For instance, aggregate BTC exchange balances have touched the lowest level since March 2018 and aggregate ETH exchange balances touched the lowest level since July 2016 last week.

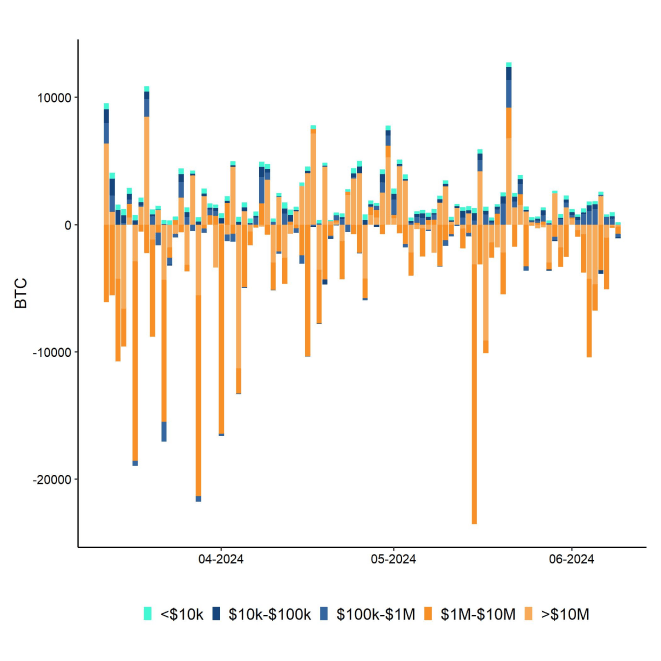

Bitcoin exchanges saw around -21.7k BTC in net withdrawals over the past 7 days and whales have continued to send bitcoins of exchange as well. Whales are defined as network entities that control at least 1,000 BTC.

However, net buying minus selling volumes on exchanges have been negative over the past week, despite significant net inflows into spot US Bitcoin ETFs. This implies that there is significant selling pressure on spot exchanges that is countering current buying demand.

This is probably one of the main reasons why bitcoin has not reclaimed new all-time highs despite reaccelerating US spot Bitcoin ETF inflows.

Futures, Options & Perpetuals

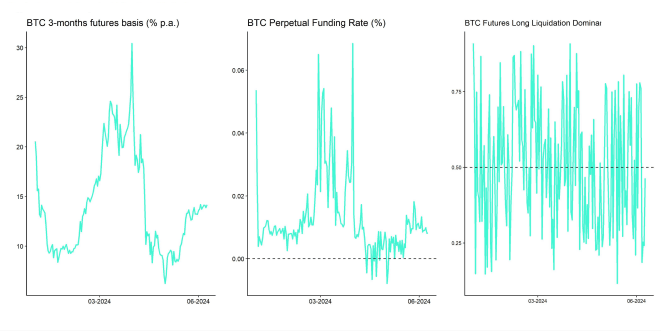

Last week, BTC futures open interest increased significantly and reached the highest level since January 2023 in BTC-terms. Perpetual open interest also reached the highest level since December 2023 in BTC-terms. The significant increase futures open interest was only partially attributed to an increase in CME futures open interest that accounted for less than half of this increase. However, the CME data point to a significant increase in net short open interest by non-commercials.

This is probably due to the fact that the Bitcoin futures basis continued to creep upwards and has reached a 2-months high of around 14.2% p.a. This has probably attracted more basis trades, which has resulted in the abovementioned increase in short open interest. The basis trade consists of a delta-neutral long and short position in Bitcoin.

Meanwhile, perpetual funding rates continued to be relatively elevated, signalling decent demand for long perpetual contracts.

Bitcoin options' open interest also increased significantly last week. The decline in relative put-call open interest ratio implies that this increase was mostly driven by an increase in call open interest on a net basis. A call option gives the holder the right to buy the underlying at a specific price in the future. Relative put-call volume ratios declined throughout the week.

The decline in the 25-delta BTC 1-month option skew also corroborates the view that there was increased demand for calls relative to puts.

BTC option implied volatilities also continued to decrease last week. Implied volatilities of 1-month ATM Bitcoin options are currently at around 49.8% p.a.

Bottom Line

- Last week, cryptoassets outperformed traditional assets due to a reacceleration in US spot Bitcoin ETF inflows

- Our in-house “Cryptoasset Sentiment Indicator” continues to fluctuate around neutral levels of sentiment

- US spot Bitcoin ETFs saw their highest weekly net inflow since mid-March and have seen 20 consecutive trading days of positive net inflows so far

Appendix

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De