- There is a strong case to be made for Ethereum as a substitute for a high-growth tech investment.

- The outperformance of an optimized equity portfolio that includes Ethereum vis-à-vis a NASDAQ 100 benchmark amounted to around 10%-points per year since 2021 without significantly compromising on overall volatility or max drawdown of the pure equity portfolio

- We think that the market has yet to fully discount the performance potential of Ethereum (ETH) especially with regards to the potential price impact via the Ethereum ETF trading launch in the US

Becoming the next "Morningstar"

Equity fund managers are always on the lookout for new investment ideas that may help them to “beat the market”, i.e. outperform their respective equity index/benchmark.

In particular, US equity benchmarks are considered to be one of the best performing and most competitive equity benchmarks worldwide. In recent years, popular strategies have evolved around overweighting high growth quality stocks such as the “FAANGs” or the “Magnificent 7” in order to outperform major US indices like the S&P 500 or the NASDAQ 100.

This report presents a novel approach to structurally outperform a high-growth US equity benchmark like the NASDAQ 100 without compromising too much on risk by adding exposure to one of the fastest growing major cryptoassets – Ethereum.

What is Ethereum?

Ethereum represents a significant evolutionary step in the internet's development, transitioning from Web1 and Web2 to Web3 or the “Internet of Value.”

Since its inception in 2015, Ethereum has developed a diverse ecosystem of decentralized applications (dApps), notably in Decentralized Finance (DeFi).

In general, Ethereum is expected to dis-intermediate and disrupt the following industries:

- Banking & Payments

- Social Media / Marketing / Gaming

- Infrastructure (tokenisation)

- AI

Ethereum is similar to an app store or tech platform like Android or iOS where decentralized applications can be built on and assets can be transferred as easy as sending an Email.

Ethereum can be considered a new type of asset that covers multiple business reservoirs, extracting value from each via transaction fees/”taxes” from those who build on Ethereum and leverage the security and the tech platform.

Unique to Ethereum is the ability for investors to own a part of its value layer by investing into the Ethereum token (ETH), akin to owning shares in the foundational internet protocol TCP/IP.

Moreover, Ethereum investors can earn a yield like equity dividends by validating transactions – so-called “staking rewards”. In addition, the Ethereum protocol takes a certain amount of tokens out of circulation through its “burn” mechanism which is comparable to a stock buyback in equities.

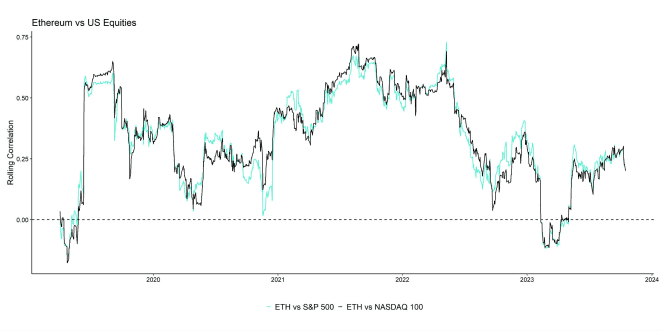

It is no surprise that Ethereum (ETH) tends to be somewhat correlated with the performance of major equity indices such as the S&P 500 or the NASDAQ 100 but also offers diversification relative to pure equity allocations. For instance, the full sample correlation of Ethereum (ETH) to the S&P 500 is only around 0.31.

We therefore think that there is a strong case to be made for Ethereum as a substitute for a high-growth tech investment.

Read more in our special report on the investment case for Ethereum.

The numbers

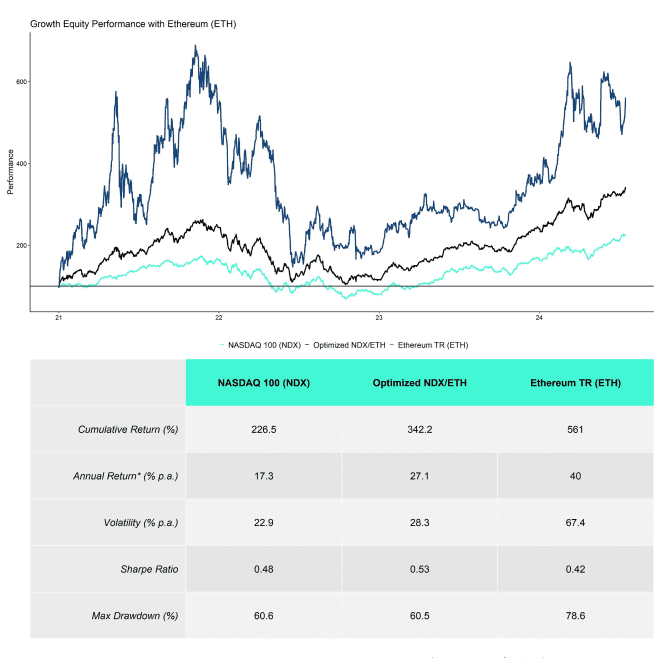

The following chart and table present the performance of a plain-vanilla NASDAQ 100 (NDX) investment, an optimized portfolio consisting of NASDAQ 100 (NDX) and Ethereum (ETH) as well as a pure Ethereum (ETH) investment:

ETH performance includes staking returns; Past performance not indicative of future returns.

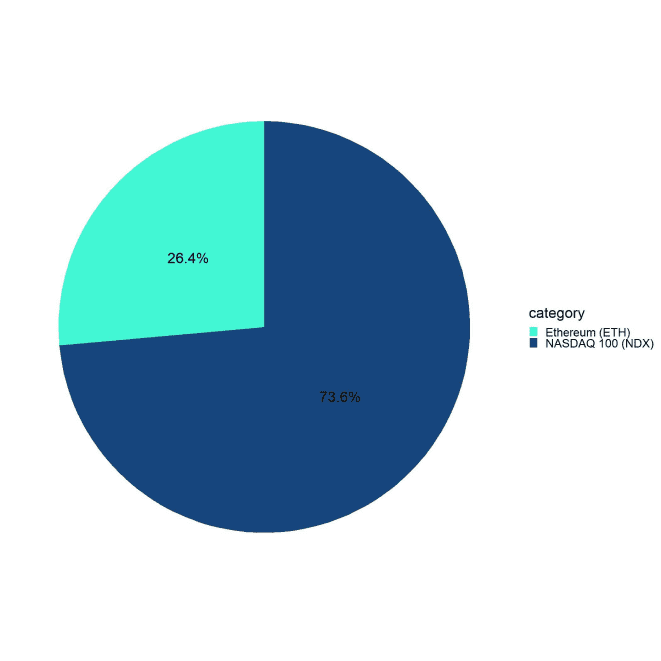

As one can see, an equity manager would have outperformed a pure NASDAQ 100 benchmark significantly by allocating approximately a quarter of this equity portfolio to Ethereum (ETH).

Optimized weights based on maximized Sharpe Ratio; Sample: Jan 2021 - Today

The outperformance vis-à-vis a NASDAQ 100 benchmark amounted to around 10%-points per year since 2021 without significantly compromising on overall volatility or max drawdown of the pure equity portfolio.

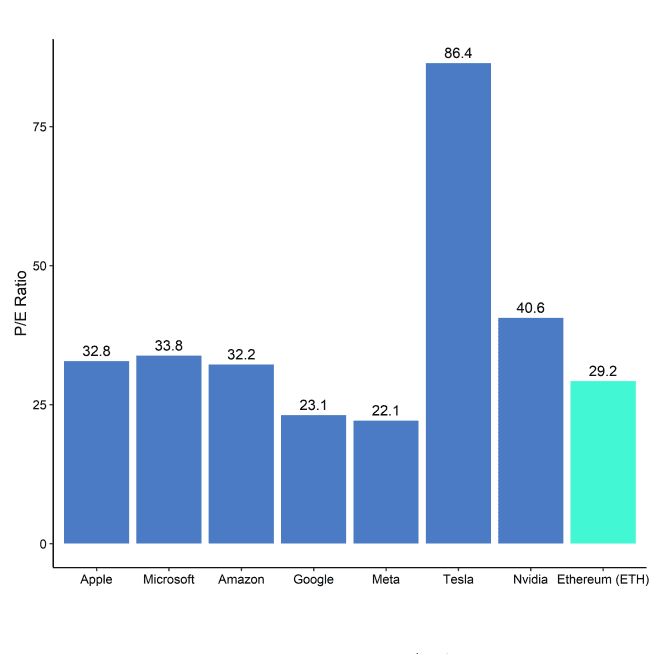

What is more is that Ethereum's “Price-to-Earnings” ratio implied by staking rewards (“dividends”) and burn rate (“buybacks”) is comparatively attractive relative to the Magnificent 7 stocks, despite very high expected returns for Ethereum over the coming 10 years:

12-months forward P/E for Equities; Data available as of close 2024-07-15

We don't think that the market has yet fully discounted the performance potential of Ethereum (ETH) especially with regards to the potential price impact via the Ethereum ETF trading launch in the US as analysed here.

Bottom Line

- There is a strong case to be made for Ethereum as a substitute for a high-growth tech investment.

- The outperformance of an optimized equity portfolio that includes Ethereum vis-à-vis a NASDAQ 100 benchmark amounted to around 10%-points per year since 2021 without significantly compromising on overall volatility or max drawdown of the pure equity portfolio

- We think that the market has yet to fully discount the performance potential of Ethereum (ETH) especially with regards to the potential price impact via the Ethereum ETF trading launch in the US

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De