ETF, ETC or ETN

An overview of the exchange traded products landscape in Europe

An overview of the exchange traded products landscape in Europe

With the recent approval of a Bitcoin ETF in the United States, interest in Exchange Traded Products has boomed. The emergence of these financial products offering exposure to digital assets heralds a new era for investors both institutional and retail. The total market cap of all cryptocurrencies, tokens and digital assets hovers around $2.6 trillion at time of writing, according to Coinmarketcap, so naturally investors are seeking ways to gain safe and comprehensible exposure to this growing sector, which do not involve the sometimes tricky process of buying and holding cryptocurrencies on exchanges like Coinbase or Kraken. But there still remains significant confusion about the way these financial products are structured. So what’s the difference between an ETP, an ETF, an ETC and an ETN?

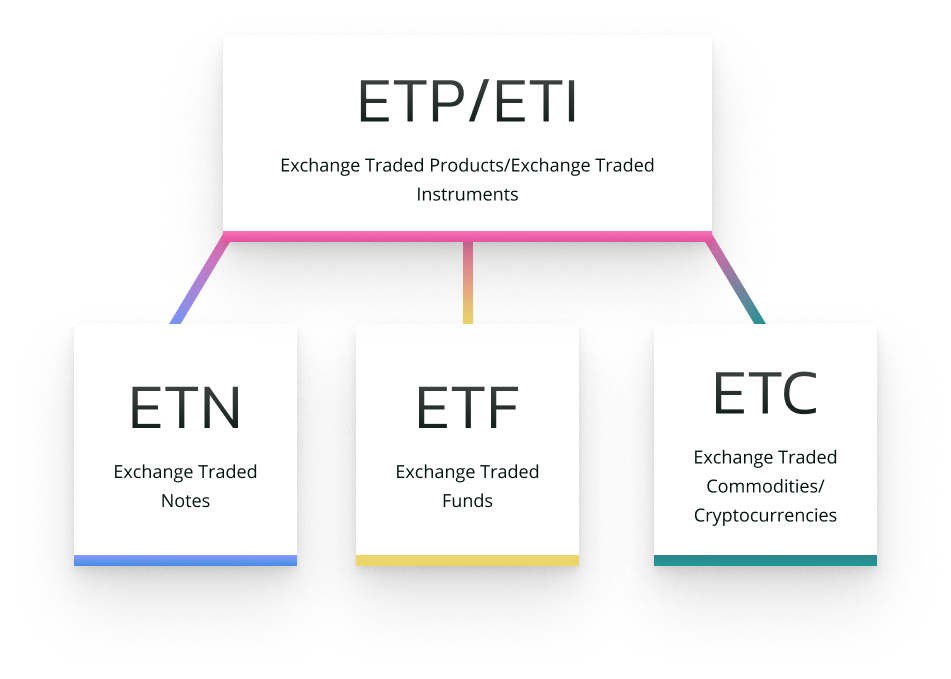

In short, ETFs, ETNs and ETCs are a family of financial products, all of which fall under the classification of ETPs or ETIs. ETPs are another name for ETIs, but the latter is rarely used these days.

ETFs, ETNs and ETCs all work in approximately the same manner. Each can be traded on regulated stock exchanges — which are overseen by regulators, with the normal investor protections that this kind of oversight provides — and exist to provide investors with 1-to-1 exposure to an underlying asset or index.

The key benefit to investors of holding an ETF, ETN or ETC is to gain broad exposure to a particular index or market sector without having to buy and hold hundreds of stocks and shares, or to be able to track the price of a single popular asset like gold, Bitcoin or Ethereum, without having the concern of arranging the custody of those assets themselves.

The key features that ETNs, ETFs and ETCs all share is that:

ETNs, ETFs and ETCs can be listed anywhere from Germany’s Deutsche Börse Xetra to the New York Stock Exchange.

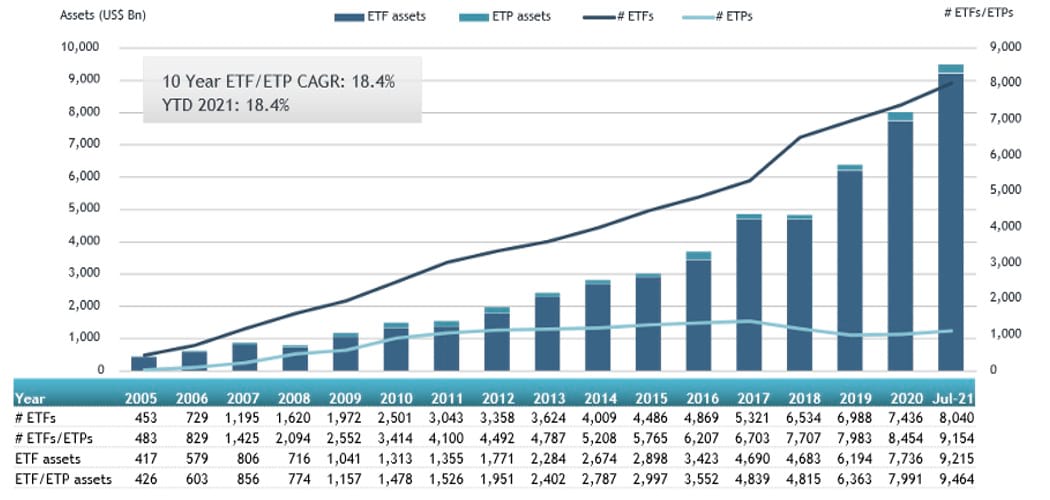

There is a seemingly insatiable appetite for these kinds of financial instruments and the amount invested in ETPs globally keeps breaking records, month by month.

Assets under management in all ETPs globally reached $7 trillion by September 2020, $8.56 trillion by the end of Q1 2021, and $9.46 trillion by the end of July 2021, which are the latest available figures from industry data provider ETFGI. Investors poured net inflows of $739.5bn into these products in the year to July 2021, almost double the $373bn recorded at the same point in 2020.

Global ETP and ETF assets as of July 2021

More than 9,000 ETPs were listed globally as of July 2021, up from just 483 in 2005. So they are very popular, to say the least.

Complicating the picture is one significant issue: naming conventions. The terms ETPs and ETFs are often used interchangeably, even in the mainstream financial press. ETFs make up more than 90% of ETP usage, so this state of affairs is not particularly surprising. But that does make it more difficult that it needs to be to tease out the relevant differences between these financial products.

ETFs or Exchange Traded Funds are a very popular form of investment which usually offers exposure to a single asset or a basket of assets (listed company stocks and shares, bonds, or cryptocurrency). They can be held in trading accounts or tax-advantaged accounts like ISAs and SIPPs in the UK, or IRAs in the United States. Fund providers buy the underlying assets and then sell shares in that fund to investors. Shareholders own a slice of the ETF, but don’t own the underlying stocks or bonds themselves.

ETCs (Exchange Traded Commodities/Currencies or Exchange Traded Cryptocurrencies) are a type of financial instrument representing a commodity, such as oil, lumber, coffee, precious metals like gold and silver, or cryptocurrencies like Bitcoin or Ethereum.

Like ETFs, ETCs passively track the price performance of the underlying assets they refer to.

ETCs are debt instruments, but unlike ETNs, they represent a direct investment by the issuer in the commodity itself (or derivatives, like futures contracts in the commodity). So: ETCs have to buy and hold physical gold, oil, lumber or Bitcoin. In this way they are considered much safer than ETNs. As with ETFs, issuers sell shares in the ETC to investors, and shareholders own a piece of the ETC, but not the underlying commodities themselves.

ETC Group coined the term ‘Exchange Traded Cryptocurrencies’, because like traditional gold or oil ETCs they are 100% collateralised: that is, they hold 100% of the assets that they represent on the market. For example, the BTCE – ETC Group Physical Bitcoin (BTCE) has over $1.4bn of assets under management at time of writing. This means that ETC Group custodies over 24,000 bitcoin held in cold storage safe-keeping with a specialised and regulated digital assets custodian on behalf of investors as of 25 November 2021.”

"Crucially, the company’s products also allow investors to physically redeem the Bitcoin, Ethereum etc that they have invested in. If they no longer want to track the price of these cryptocurrencies, alternatively to selling on the stock exchange, they can redeem their shares and have the cryptocurrencies themselves instead. The physical redemption product feature makes the products fully fungible, which is the reason they track the underlying assets so closely. If this were not the case, market makers would see arbitrage opportunities and price differences away immediately. Finally, investors can always be confident to have direct access to the underlying asset if they wish to."

" ETC Group has also specifically structured its products — like BTCE or the ZETH – ETC Group Physical Ethereum (ZETH) — to closely match the features of the physical gold ETCs found on the exchanges whether they are listed, for example Germany’s Deutsche Börse Xetra.

While the classification of cryptocurrencies has yet to be explicitly determined by market regulators, the SEC, which oversees securities regulation and investor protection in the United States ruled as long ago as 2018 that Bitcoin and Ethereum were not securities. Bitcoin futures products in the US are also regulated by the commodities watchdog, the CFTC.

ETNs (Exchange Traded Notes) are more controversial than the other ETPs listed here. That’s because they are senior unsecured debt instruments. Senior debt is technically considered to be more secure than other types of debt, because it is borrowed money that an issuer must pay off first if it goes out of business.

But while an ETC holds a number of physically redeemable commodities (gold, Bitcoin) and an ETF holds a number of securities (stocks, bonds), ETNs in their most common form don’t hold anything. They basically exist as credit notes issued mostly by banks, for example Barclays, Credit Suisse, Deutsche Bank or Morgan Stanley.

In exchange for loaning the bank your money, the bank promises to track the performance of an index, less a management fee. If a bank is unable to fulfill that promise, investors find themselves with little ability to get their money back.

While bank default is extremely unlikely, investors still recall the 2007-2008 financial crisis and the collapse of Lehman Brothers. Among the financial instruments left in limbo by the bankruptcy were three ETNs with around $13m of assets under management: the Opta Lehman Brothers Commodity Index ETN (LCBI); the Opta LBCI Pure Beta Total Return Index ETN (RAW) and the Opta S&P Private Equity Index Net Return ETN (PPE).

They were the first ETNs ever to close, and it took four years for bankruptcy proceedings to begin for Lehman Brothers to start paying out claims to ETN investors. Those payouts began in 2012 and were still ongoing more than six years later.

ETNs can be leveraged or unleveraged. Leveraged ETNs are more volatile (subject to price swings) than unleveraged ETNs.

ETNs are by far the least popular of the family of Exchange Traded Products. Critics point to the fact that they come with substantial credit risk: that is, the risk that the issuer (the bank) will default, leaving investors unable to redeem the cost of their investment.

North American asset managers have been sitting on the sidelines, frustrated, for years, while cryptocurrency prices have soared. The clamour from clients to offer them exposure to the market in a low-fee, secure way has become ever more deafening as markets have more than tripled from $760bn at the turn of 2021 to $2.5 trillion today.

The SEC has been rejecting plans for US-listed Bitcoin ETFs for years. A laundry list of asset management giants have tried and failed over the years.

The Winklevoss twins, through their Gemini exchange, were the first to attempt it in 2013, with the US securities regulator finally turning them down after four long years. Van Eck/SolidX was next to try, filing in 2016 and battling for three years before withdrawing their proposal in 2019.

ProShares, Direxion, GraniteShares, Wiltshire Phoenix and Bitwise all tried their hand, but the SEC stalled for time. All the while, European cryptocurrency ETCs traded on regulated exchanges like Germany’s Deutsche Börse XETRA and Switzerland’s SIX, were stealing a march on the US.

The SEC often cited a lack of market maturity, and fears over a lack of investor protection, as the reasons for batting away scores of US spot Bitcoin ETF applications. More recently, the SEC chairman Gary Gensler said he is more comfortable with the types of protections embodied in the Investment Company Act of 1940, which governs futures ETFs, compared to the Securities Act of 1933, which oversees physical ETFs.

His remarks in front of the Future of Asset Management North America Conference on 29 September 2021 reiterated an earlier statement made to the 3 August Aspen Security Forum:

Earlier this year, a number of open-end mutual funds launched that invested in Chicago Mercantile Exchange (CME)-traded bitcoin futures. Subsequently, we’ve started to see filings under the Investment Company Act with regard to exchange-traded funds (ETFs) seeking to invest in CME-traded bitcoin futures. When combined with the other federal securities laws, the ’40 Act provides significant investor protections for mutual funds and ETFs. I look forward to staff’s review of such filings.

It is not entirely clear why Gensler is more comfortable with this relatively unconventional type of asset structure for Bitcoin ETFs in the US, but not funds structured under the more widely used 1933 Act. Investors have certainly not been as anxious to invest in futures-linked Bitcoin investment products as they have with the more easily-understood vanilla ETFs and European ETCs in Europe that track Bitcoin’s spot price.

Financial products like ETPs can differ widely depending on the jurisdiction in which they are issued: for example in Europe versus the US. There may be variations in investor protection rights depending on the market regulator, for example those overseen by the European Securities Market Authority as opposed to the SEC.

These differing legal structures make the whole scenario difficult to grasp even for experts. For example, what are called gold ETFs in the US are normally trusts, while gold ETFs in Europe are usually debt instruments.

European ETPs (which include ETC Group Cryptocurrency ETCs), even though they offer exposure to financial assets very similar or identical to what a US ETF may offer, are not registered under the US Securities Act of 1933. As such they can’t be offered to US investors.

This is true in the opposite direction: such regulatory restrictions make it difficult for US investors to purchase European-regulated products.

Dfferent products might also have very different tax implications. Products that fall under the ETP classification are usually designed to be tax efficient for a particular jurisdiction. For example, ETC Group expects that after a new circular by the German Finance Ministry of Germany is published, it will be confirmed that German investors holding ETC Group products will not be liable to any capital gains tax.

To summarize, ETPs, ETNs, ETCs and ETFs may seem interchangeable on the surface but they often differ wildly in their structure, and can come with nasty surprises for the unwary. It is not a lot of fun to sift through tens of pages of the regulatorily-required Prospectuses or Key Information Documents but it is vital for investors to know what they are getting into. The best suggestion is to consult professional investment and tax advisors if you are considering investing in any of the above.

| ETP type | ETF | ETC | ETN (other than ETC) |

|---|---|---|---|

| Name | Exchange Traded Fund | Exchange Traded Commodity/ Cryptocurrency | Exchange Traded Note |

| Main objective |

Provide access to, among others:

|

Provide access to, among others:

|

Provide access to an asset or benchmark using an uncollateralised debt security |

| Structure/ Type of Issuance | Shares in a fund | Debt security | Debt security |

| Issuance | UCITS framework in the European Union which provides a number oNf,f important safeguards for investors | Not governed by UCITS diversification requirements and can therefore provide exposure to single underlying commodities and currencies as well as diversified baskets | Generally issued by banks and usually entirely reliant on the creditworthiness of the issuing entity |

| Issuer default risk | Limited [2] | No [3] | Yes |

| UCITS compliant | Yes | No | No |

| UCITS eligibility | Yes | Yes | Yes |

| Maturity | Open-ended | Open-ended | Mostly close-ended |

Comparison of a popular physically-backed commodity ETC to a physically-backed cryptocurrency ETC on the example of XETRA-Gold® (Ticker: 4GLD) and BTCE – ETC Group Physical Bitcoin (Ticker: BTCE)

| ETC Name | XETRA-Gold® [4] | BTCE – ETC Group Physical Bitcoin (BTCE)[5] |

|---|---|---|

| Primary listing | Regulated market of the Frankfurt Stock Exchange | Regulated market of the Frankfurt Stock Exchange |

| Trading Platform | Xetra® | Xetra® |

| ISIN | DE000A0S9GB0 | DE000A27Z304 |

| Term | Unlimited (open-ended) | Unlimited (open-ended) |

| 100%% physically backed | Yes, with Gold | Yes, with Bitcoin |

| Custody | The underlying gold is held in custody in the vaults of Clearstream Banking AG, a wholly-owned subsidiary of Deutsche Börse AG | The underlying Bitcoin is held in cold-storage (offline) custody using physical bank-grade vaults at BitGo Trust Company (regulated) |

| Physical delivery | Yes, investors can exercise their right to delivery of the securitised amount of gold against the issuer at any time (Minimum delivery: 1 gram of gold) | Yes, investors can exercise their right to delivery of the underlying Bitcoin against the issuer at any time (Minimum delivery: 1 unit of BTCE) |

| Assets secured by independent trustee for benefit of investors | No, this product does not provide investors with any rights to the deposited gold or gold delivery claims, which are held solely by the issuer | Yes, this product grants investors the right to the deposited Bitcoin or to the security rights held by the Collateral Trustee through the custody account and through the Issuer’s securities account |

| Primary listing | Regulated market of the Frankfurt Stock Exchange | Regulated market of the Frankfurt Stock Exchange |

Products traded on ETN segments do not necessarily feature the characteristics of ETNs, which in their most common form are known as being uncollateralised exchange traded notes. Stock exchanges have their own internal procedures and capabilities as to the segment on which securities are admitted to listing and trading. As for XETRA, cryptocurrency exchange traded products are listed on the exchange’s ETN trading segment, since XETRA rightly does not classify the products as commodity related securities. Since December 2009, XETRA has been offering ETNs (Exchange Traded Notes). ETNs on XETRA are on-exchange bonds, just like ETCs. However, they track the development of non-commodity indices. ETNs and ETCs alike are traded on Xetra from 9.00 a.m. to 5.30 p.m. The same order types may be used, and at least one designated sponsor is responsible for providing liquidity. [6]

BTCE – ETC Group Physical Bitcoin is listed on several exchanges across Europe:

| Exchange | Classification/Segment | Ticker symbol | Listing date | Trading currencies |

|---|---|---|---|---|

| Deutsche Börse XETRA | (collateralised) ETN | BTCE | 18.06.2020 | EUR, USD |

| SIX Swiss Exchange | ETP | BTCE | 13.01.2021 | USD, CHF, GBP |

| Euronext Paris | ETP, sub type: ETC | BTCE | 01.06.2021 | EUR |

| Euronext Amsterdam | ETP, sub type: ETC | BTCE | 01.06.2021 | USD |

| Vienna Stock Exchange | Zerobond [7] | BTCE | 18.08.2021 | EUR |

| Aquis Exchange | ETP | BTCE | 07.06.2021 | EUR, USD, GBP |

Disclosure | Copyright © 2022 ETC Group. All rights reserved

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

Bitwise is one of the world’s leading crypto specialist asset managers. Thousands of financial advisors, family offices, and institutional investors across the globe have partnered with us to understand and access the opportunities in crypto. Since 2017, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETPs, separately managed accounts, private funds, and hedge fund strategies—spanning both the U.S. and Europe.

In Europe, for the past four years Bitwise (previously ETC Group) has developed an extensive and innovative suite of crypto ETPs, including Europe’s largest and most liquid bitcoin ETP.

This family of crypto ETPs is domiciled in Germany and approved by BaFin. We exclusively partner with reputable entities from the traditional financial industry, ensuring that 100% of the assets are securely stored offline (cold storage) through regulated custodians.

Our European products comprise a collection of carefully designed financial instruments that seamlessly integrate into any professional portfolio, providing comprehensive exposure to crypto as an asset class. Access is straightforward via major European stock exchanges, with primary listings on Xetra, the most liquid exchange for ETF trading in Europe.

Retail investors benefit from easy access through numerous DIY/online brokers, coupled with our robust and secure physical ETP structure, which includes a redemption feature.