- Performance: The US presidential election in November acted as a key catalyst for a crypto market rally, with Bitcoin reaching near 100k USD and altcoins, particularly XRP and Cardano, outperforming due to reduced regulatory uncertainty and increasing adoption narratives. Strong on-chain fundamentals, including supply constraints and institutional demand, suggest the rally could extend into 2025, while the altcoin market experienced its highest outperformance since mid-2022, driven by diverse investment themes.

- Macro: The US Dollar has become the most dominant macro factor for bitcoin recently and so the recent Dollar appreciation has turned into a headwind for bitcoin and cryptoassets, especially since it implies a contraction in global money supply. Newly asserted US dominance with the new administration as well as increasing Euro sovereign risks could exacerbate Dollar strength over the coming months. However, increasing Dollar strength should lead to further rate cut odds for the Fed as a strong Dollar jeopardizes the current economic recovery in the US.

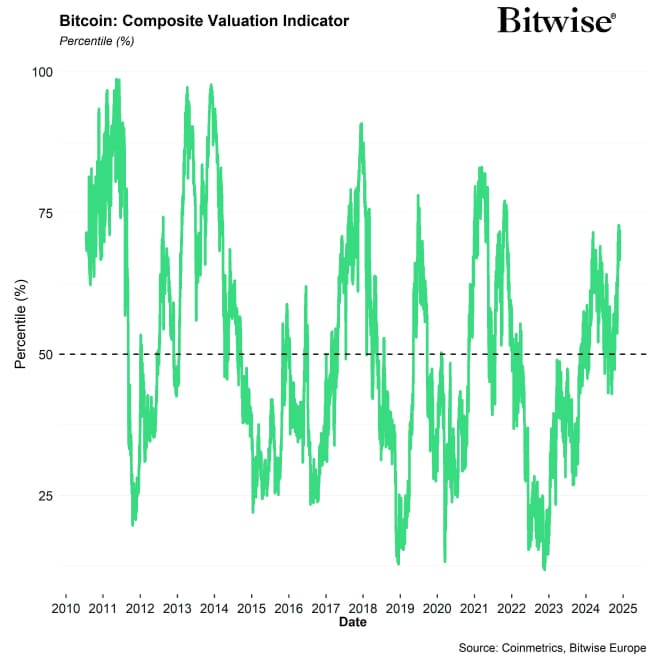

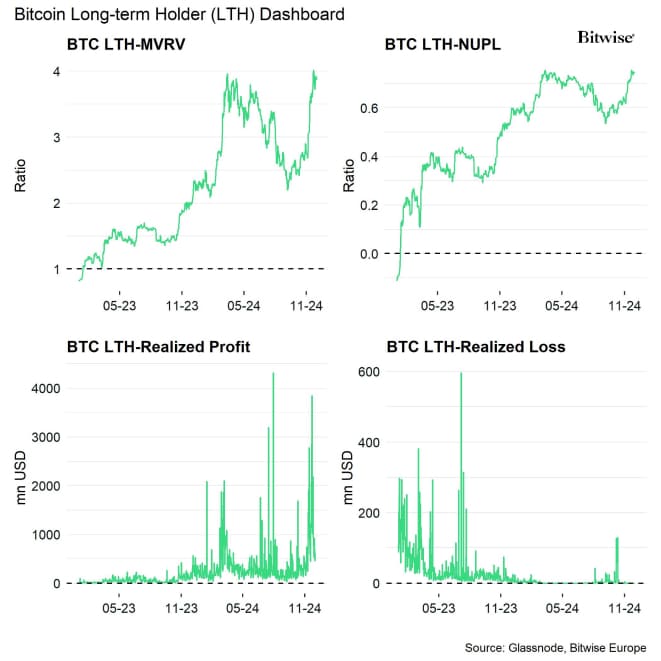

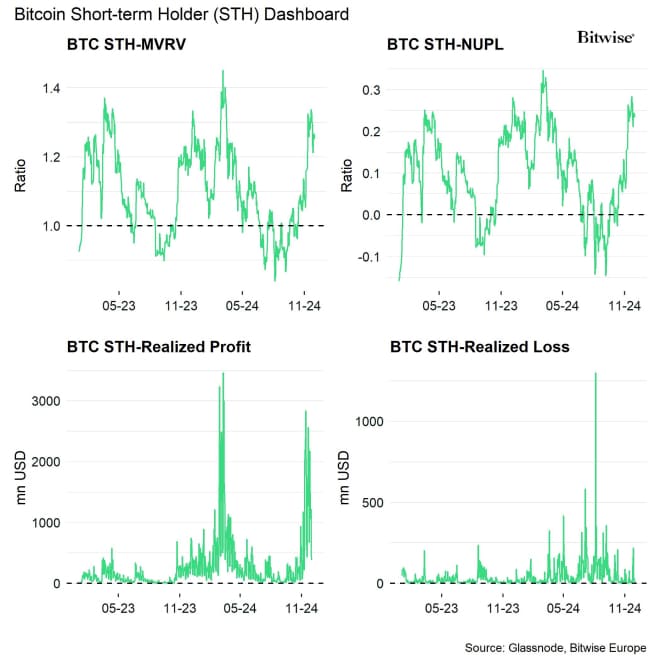

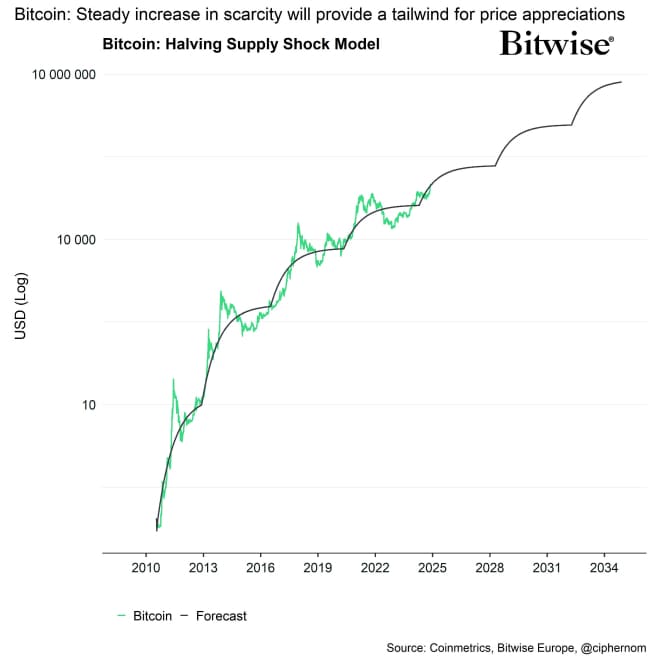

- On-Chain: Cycle top probabilities have increased somewhat as sentiment appears to be stretched, and long-term holders have increasingly taken profits. Nonetheless, the Bitcoin supply shock continues to intensify as evidenced by the continuing decline in exchange balances and liquid supply. We expect this to be a major tailwind in 2025, at least until the second half of next year. Moreover, valuations that are only moderately expensive still leave more room for further price appreciations over the coming months.

Chart of the Month

Performance

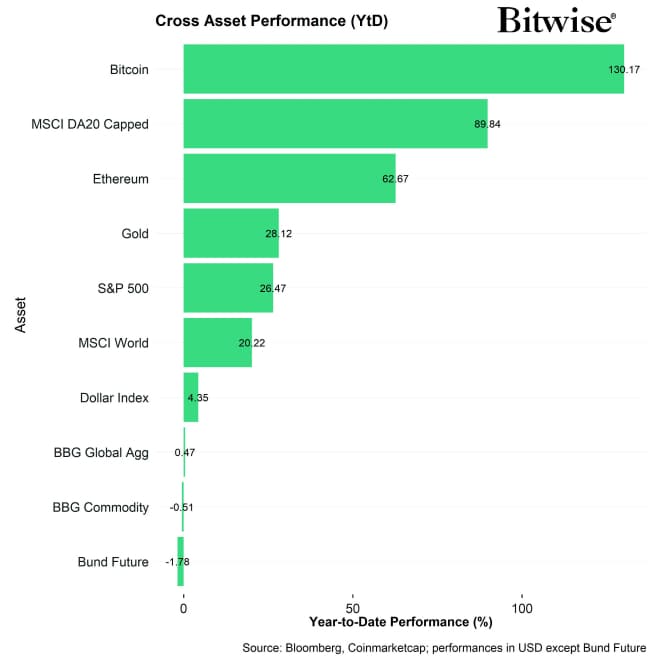

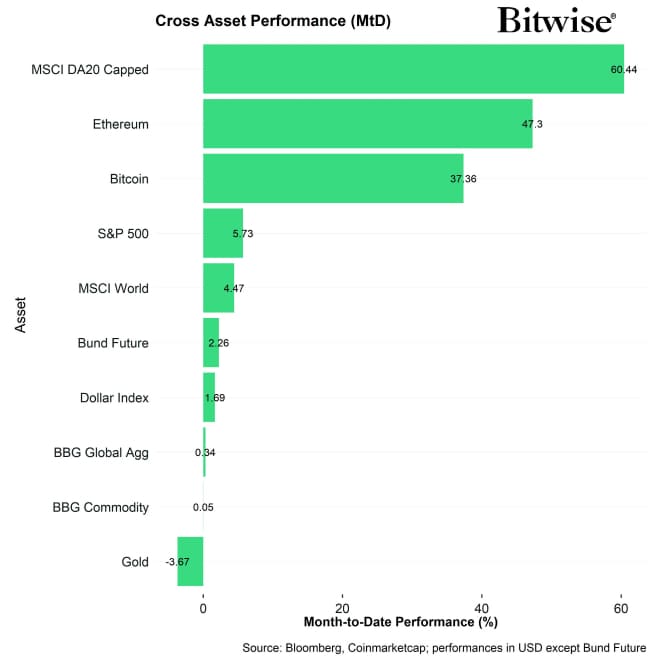

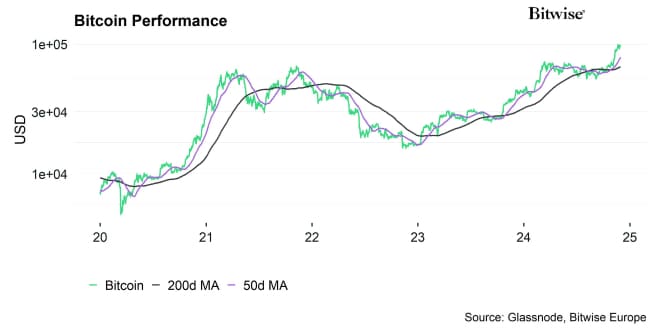

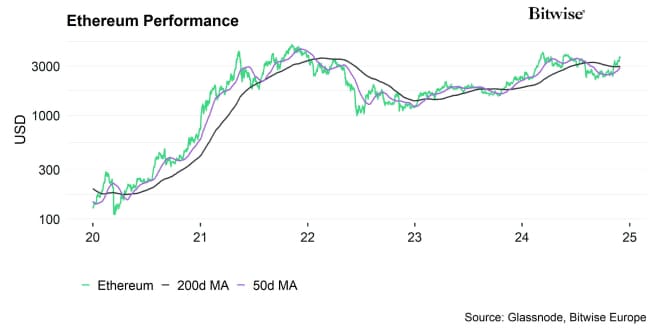

The performance in November was significantly influenced by the US presidential election at the beginning of the month. The election event itself served as a very significant catalyst for a renewed rally in cryptoassets and altcoins in particular. Bitcoin was able to break out of the price range it established since March 2024 and reached new all-time highs and almost the 100k USD mark.

Although we think that the prerequisites for a renewed bull run had already been in place before the election event, we also think that the Trump administration will certainly accelerate the mainstream adoption of cryptoassets in the United States and globally.

The new administration will most likely provide higher regulatory clarity for cryptoassets and will also foster domestic developments of the industry via mining and the potential adoption of Bitcoin as a sovereign reserve asset. You can read more about the implications of the US election outcome for cryptoassets here.

These themes will most likely continue to drive the investment narratives in 2025 as well.

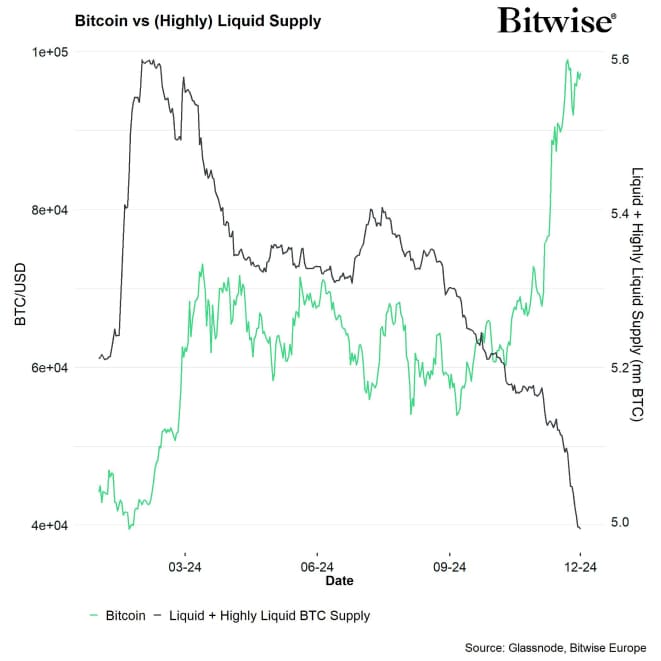

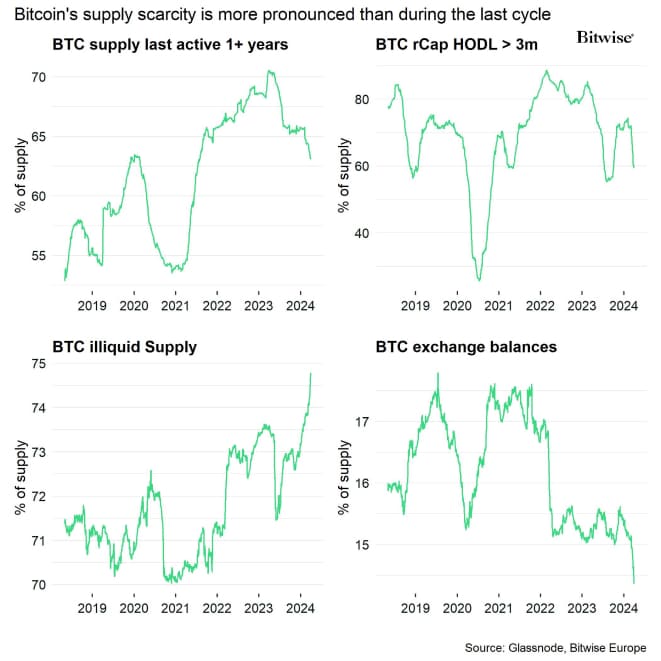

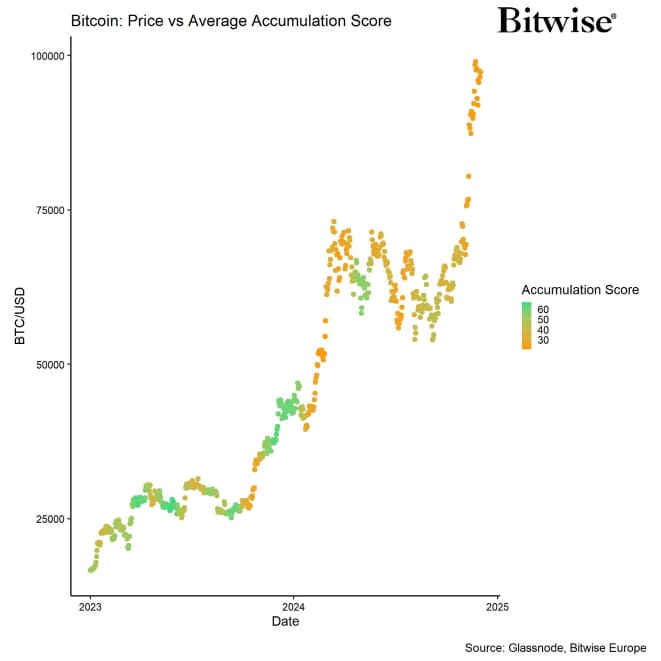

In this context, the Bitcoin supply shock that emanated from the Halving continues to intensify despite the fact that the approach to 100k USD incentivized many investors to take profits as outlined in our last week's Crypto Market Compass.

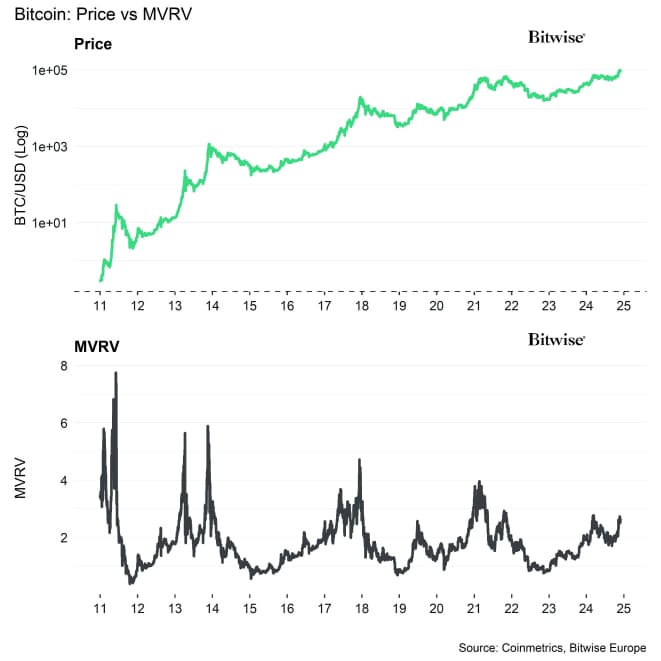

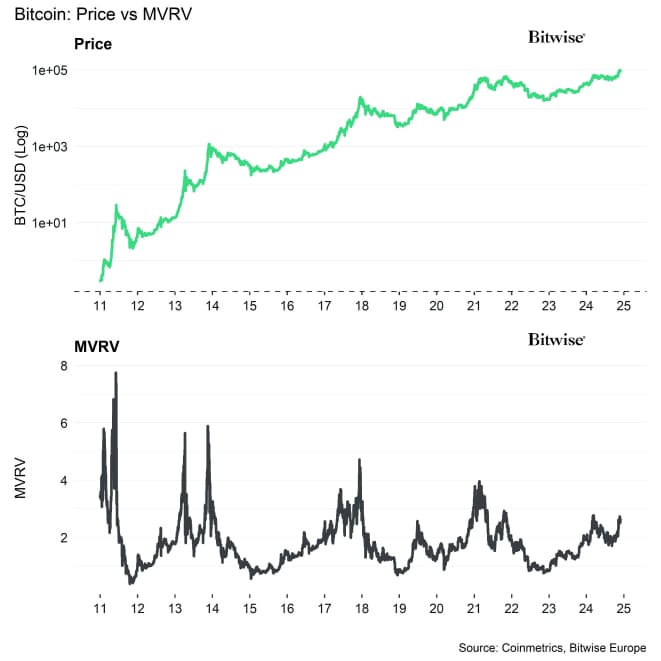

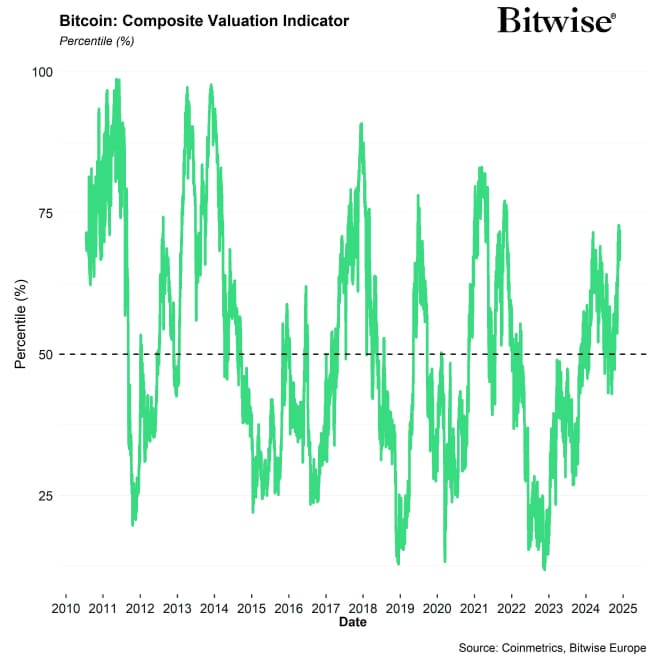

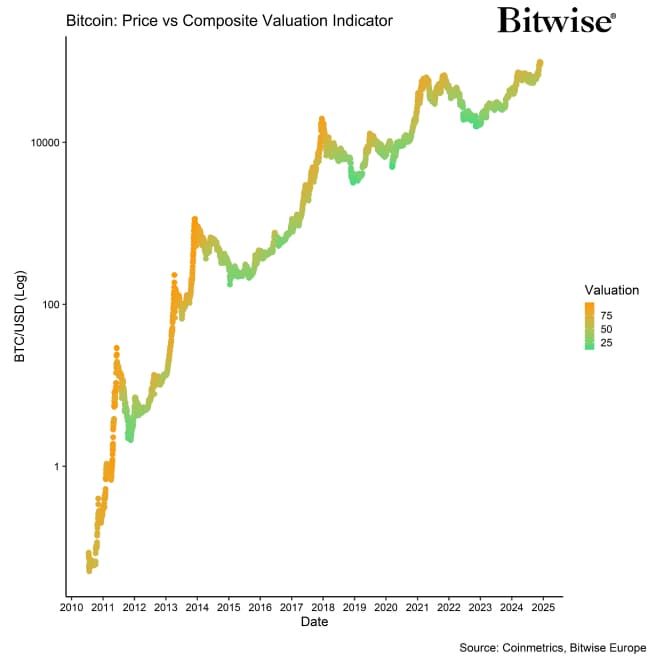

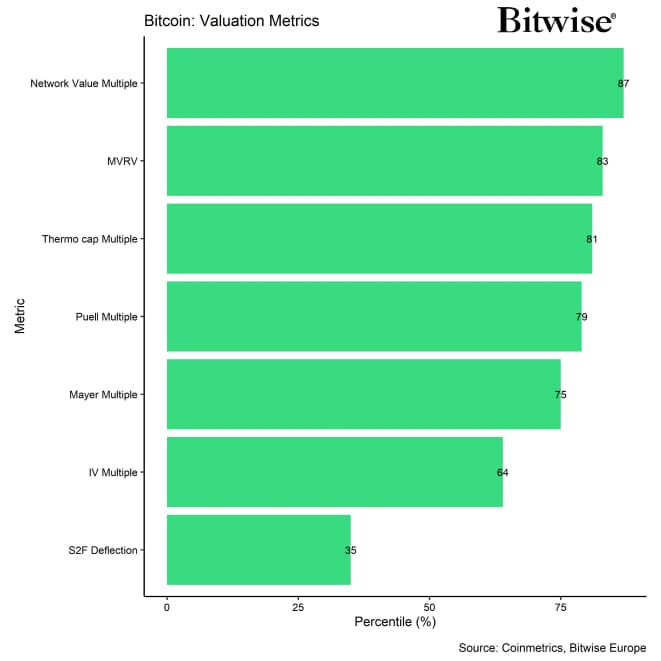

Nonetheless, there is a no indication that Bitcoin is already overvalued at 100k USD and most valuation metrics like the MVRV ratio suggest that there is still significant room for further price appreciations until bitcoin reaches valuation levels that have been associated with cycle tops in the past (Chart-of-the-Month).

To the contrary, current on-chain fundamentals suggest that the rally will most likely continue well into 2025.

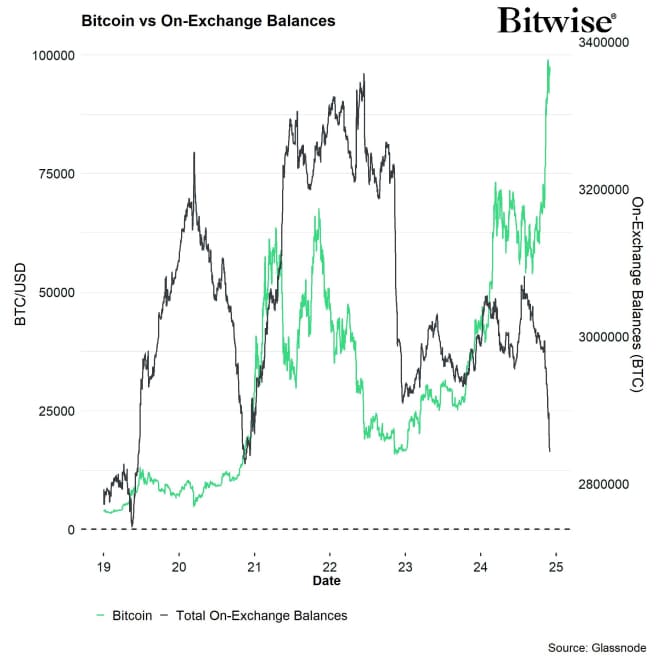

For instance, both the illiquid supply of bitcoins continues to reach new all-time highs and the available supply on exchanges has continued to drift lower, signalling a continuing demand overhang/supply deficit of bitcoins.

Key drivers are the high net inflows into global Bitcoin ETPs as well as the continued adoption of Bitcoin as a corporate treasury asset. Both types of demand have been a multiple of daily bitcoin production in November.

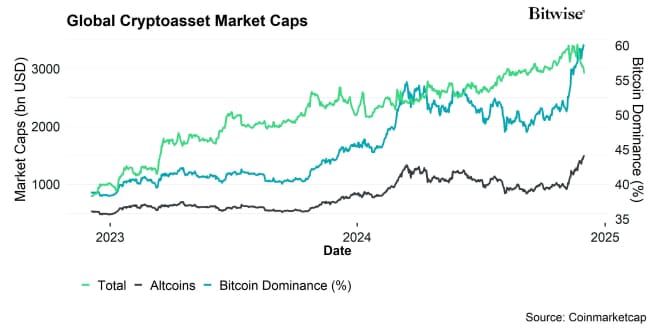

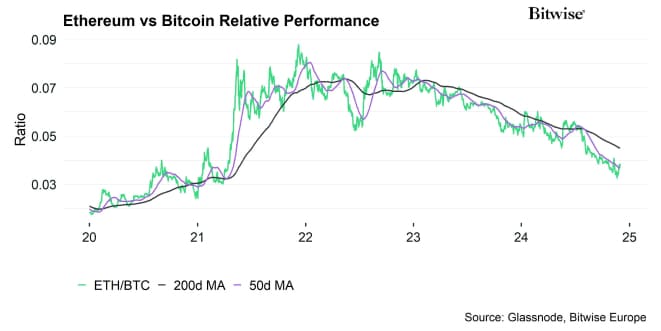

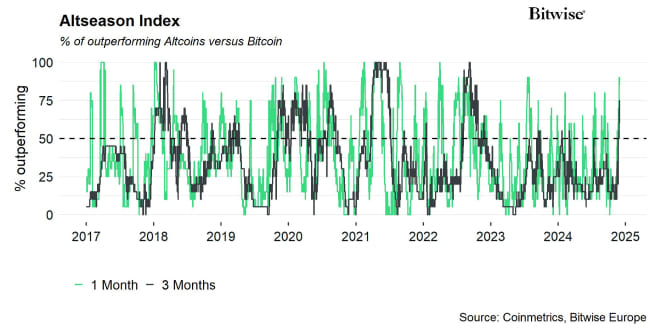

In this environment, altcoins generally performed very well, especially following Trump's election victory in early November which has served as a clear catalyst for an “altseason” in cryptoassets, i.e. a significant outperformance of other cryptoassets outside of Bitcoin.

Our Altseason Index has increased to the highest level since mid-2022 signalling an increasing outperformance of altcoins vis-à-vis Bitcoin.

More specifically, 90% of our tracked altcoins managed to outperform Bitcoin in November 2024.

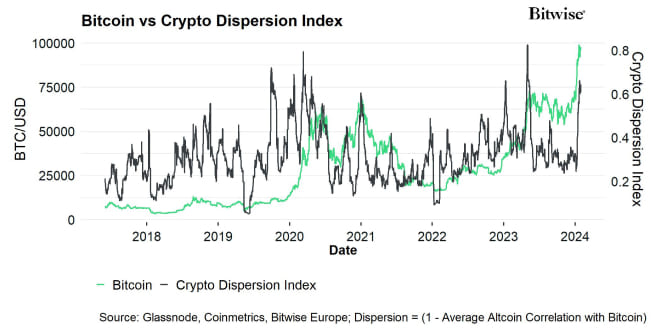

Performance dispersion among cryptoassets also remains relatively high, signalling that the market is driven by a more diverse set of different investment narratives and there is less performance correlation between altcoins and bitcoin.

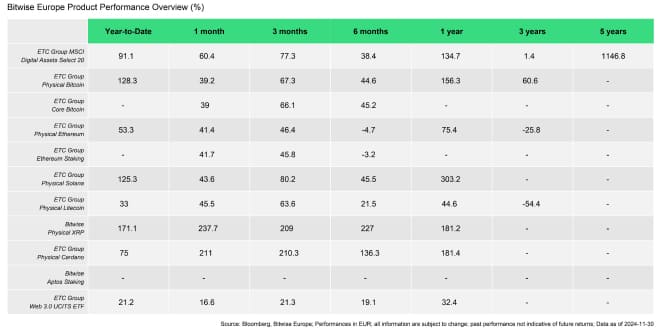

A closer look at our product performances also reveals that altcoins like Cardano or XRP has significantly outperformed Bitcoin in November. Especially XRP is considered to be one of the major beneficiaries of the recent US election outcome and the decline in regulatory uncertainty in the US as we have outlined in one of our recent Crypto Market Espresso reports.

Please note that we are still transitioning from ETC Group product names to Bitwise following the recent acquisition. In this context, the ETC Group Physical XRP ETP has been rebranded to Bitwise Physical XRP ETP. Read more about this rebranding here.

Besides, we have recently launched our new Bitwise Aptos Staking ETP as well. If you want to find out more about Aptos, we recommend reading our new deep dive report here.

Bottom Line: The US presidential election in November acted as a key catalyst for a crypto market rally, with Bitcoin reaching near 100k USD and altcoins, particularly XRP and Cardano, outperforming due to reduced regulatory uncertainty and increasing adoption narratives. Strong on-chain fundamentals, including supply constraints and institutional demand, suggest the rally could extend into 2025, while the altcoin market experienced its highest outperformance since mid-2022, driven by diverse investment themes.

Macro Environment

The macro bull case for 2025 centres around the hypothesis that the new US administration will have a very positive impact on “animal spirits” due to reduced regulation and taxes as well as government policies that foster domestic investments.

A prominent example is the business cycle upturn in the US in 2018 which was amplified by Trump's corporate tax cuts at the end of 2017. Donald Trump reduced corporate taxes during his first term as part of the Tax Cuts and Jobs Act (TCJA), which was signed into law on the 22 nd of December 2017. The TCJA lowered the corporate tax rate from 35% to 21%, effective starting from the 1st of January, 2018.

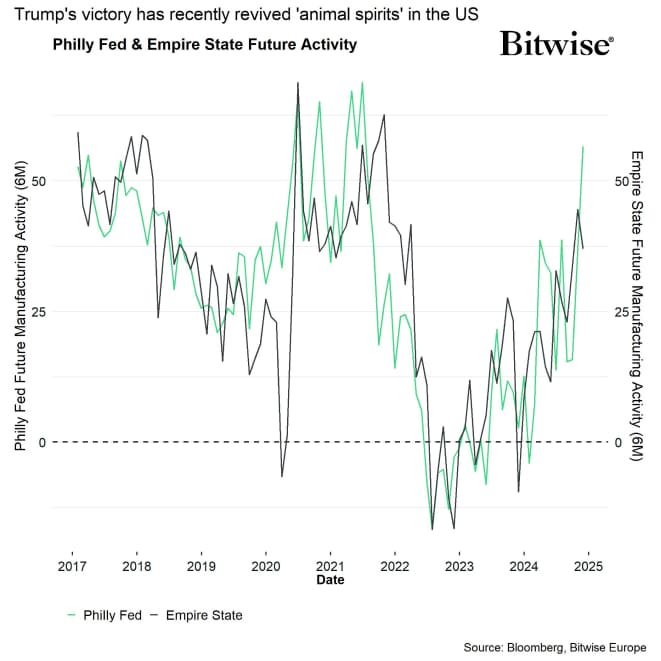

This scenario seems to materialise already as improving “animal spirits” are already showing up in regional future manufacturing expectations already such as the Philly Fed manufacturing future expectations over the next 6 months.

University of Michigan real household income expectations have also increased sharply in November which also implies that this “Trump effect” is becoming visible.

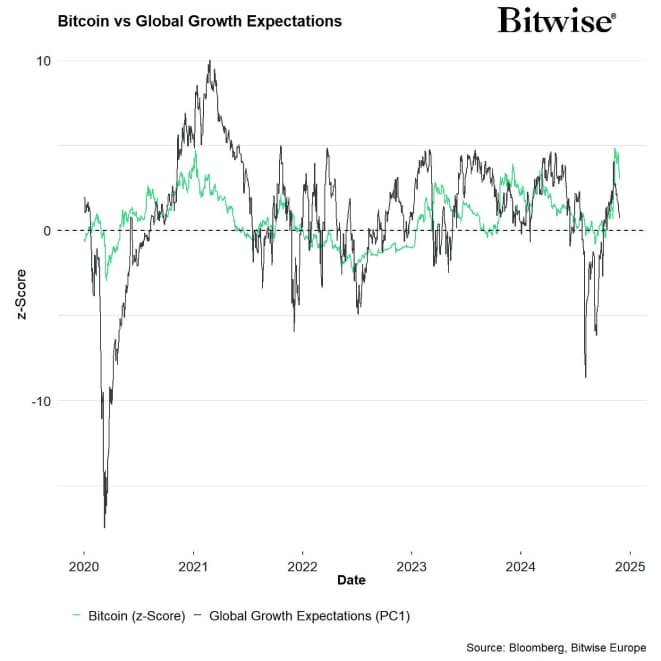

If we saw a prolongation of the current US business cycle well into 2025, this could increase global growth expectations and cross asset risk appetite which should also support Bitcoin & cryptoassets in 2025.

We have already seen a significant reacceleration in global growth expectations since the “Japanese Yen carry trade unwind” in early August which has also supported the appreciation in cryptoassets since then.

There is also the case to be made that the lagged effects of previous yield decreases that support a recovery in the ISM Manufacturing index over the coming 12 months. The reason is there tends to be a lagged positive effect from previous reductions in yields which also reflect easier financial conditions.

If the Fed continues to cut rates despite no recession, the renewed acceleration in inflation expectations could decrease real yields significantly. Financial conditions would like ease considerably in this kind of environment.

To put short, increase in cross asset risk appetite and global growth expectations due to revival in “animal spirits” and easy monetary policy in the US should provide a very significant tailwind for Bitcoin and cryptoassets.

As far as the macro bear case for 2025 is concerned, the abovementioned yield change has been largely reflected in traditional financial markets as well as long leading business cycle indicators like ZEW US growth expectations. What is more is that cyclical asset prices in traditional financial markets seem to reflect this “soft landing scenario” and economic recovery already to a large extent. In other words, this scenario already seems to be priced in.

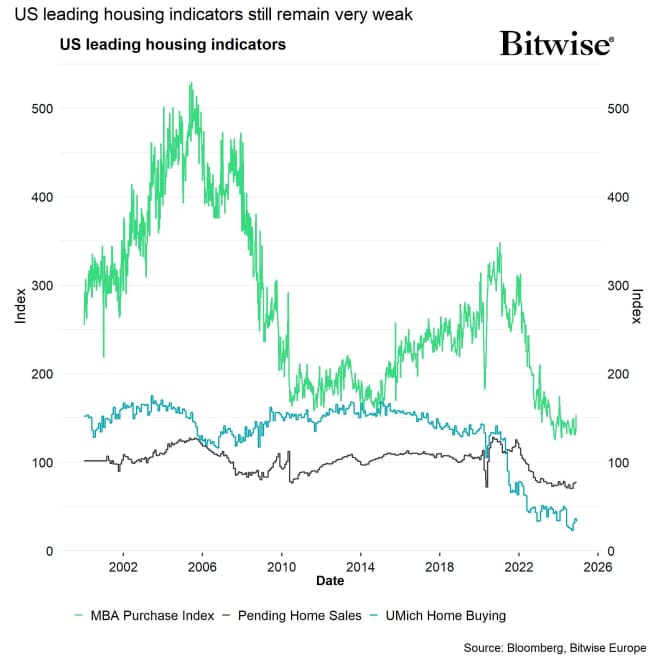

What is more is that long leading indicators from the US housing sector have continued to be weak, including indicators like building permits, pending home sales or the MBA purchase index, despite recent Fed rate cuts.

In fact, mortgage yields have risen since the Fed commenced its rate cutting cycle in September which is weighing on the US housing sector. Housing inventory continues to build up significantly which is bound to weigh on prices and future construction activity in the US.

The rise in yields has even been more pronounced by Trump's election victory. The anticipation of higher tariffs has led to higher US inflation expectations in US yields.

In other words, the risk to US and global growth repricing remains skewed to the downside , especially if US yields continue rising. This could be exacerbated by a sudden increase in geopolitical uncertainty due to hawkish trade rhetoric.

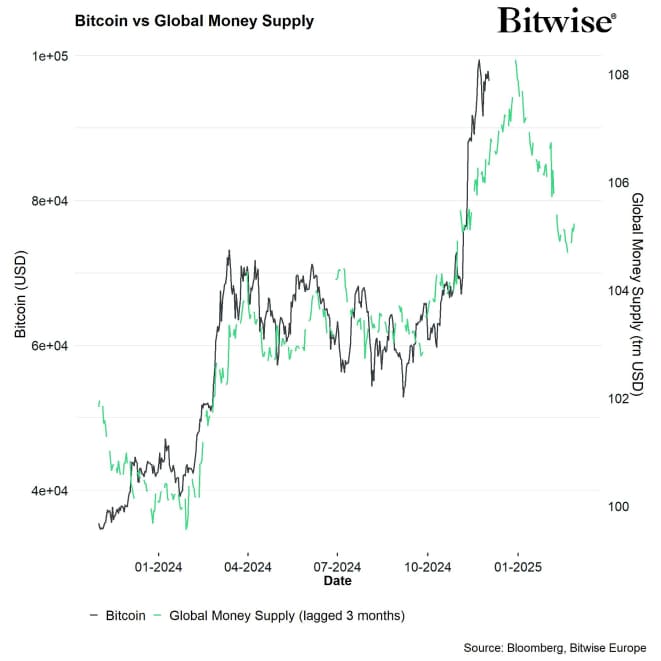

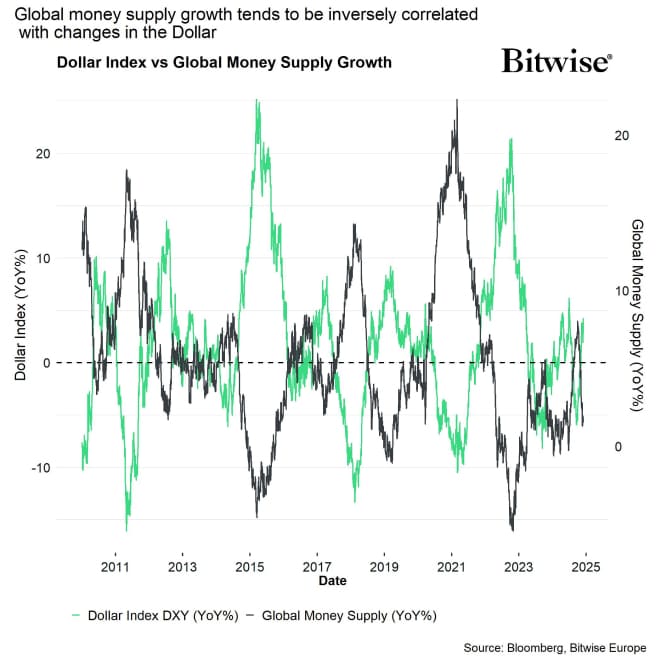

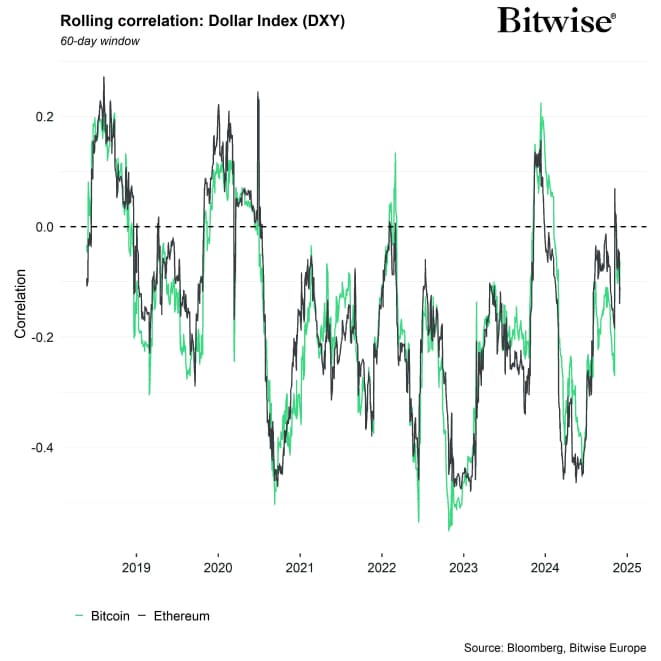

What is more is that the increase in yields has also propped up the US Dollar. This tends to lead to a contraction in global money supply which is usually a headwind for Bitcoin and cryptoassets.

We think that the recent Dollar appreciation is the probably worst part of the current macro equation for Bitcoin and is certainly contributing to the recent weakness.

Apart from housing, leading indicators for US employment remain weak. For instance, both the number of new job postings on Indeed as well as the LinkUp 10,000 index continue to drift lower.

A slower pace of hiring could lead to an acceleration in unemployment since both temporary and permanent job losses can't be absorbed by the number of job openings as quickly anymore.

This is particularly important because the US labour market is already close to the inflection point where a decline in job openings leads to an accelerated increase in the unemployment rate.

In Europe, economic growth woes persist as German industrial production appears to be in an outright depression already.

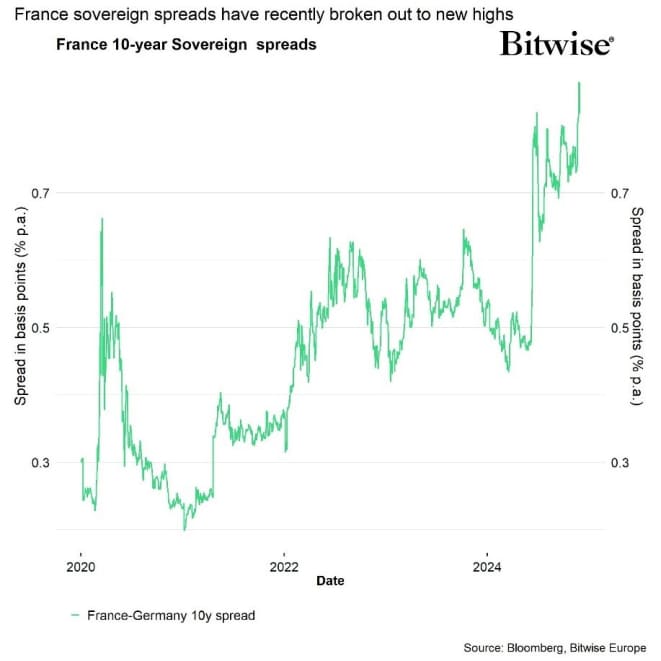

What is more is that French sovereign risks continue rising as the opposition threatens to topple the government. The spread between French and German 10-year government bond yields has just recently broken out to the highest level since the Eurozone debt crisis in 2012.

This is most likely going to support the current depreciation of the Euro/appreciation of the US Dollar which is the net bearish for Bitcoin in our view.

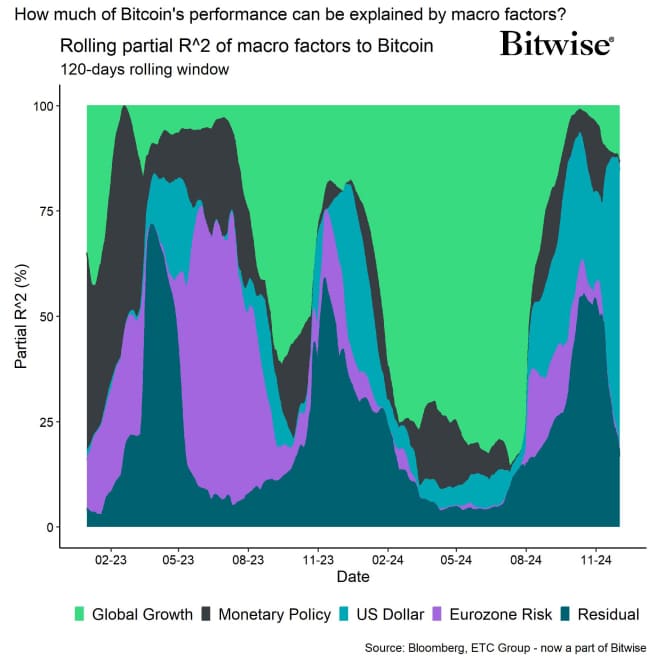

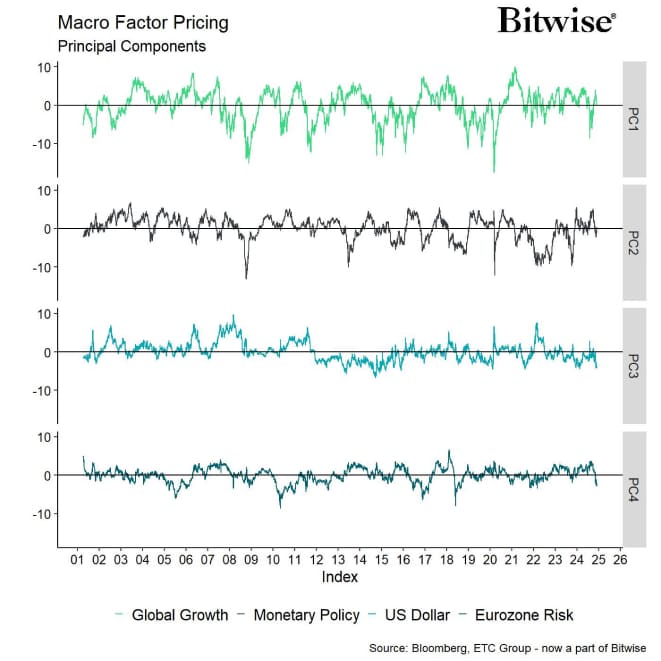

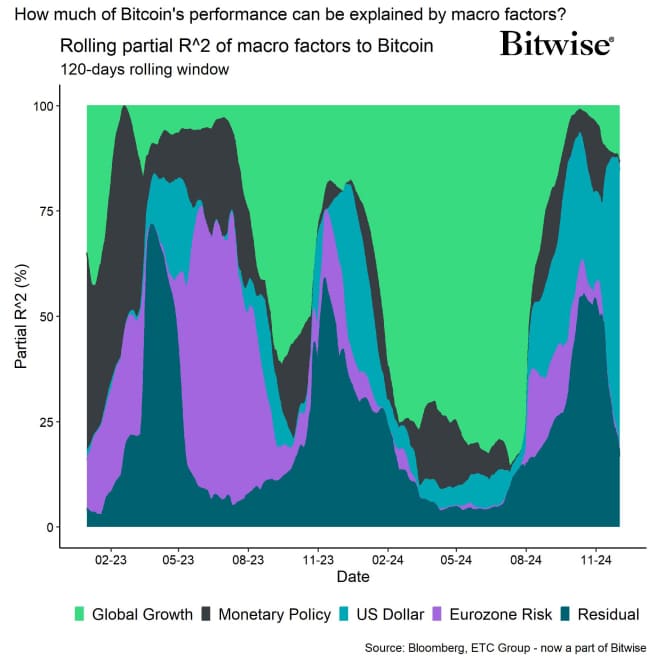

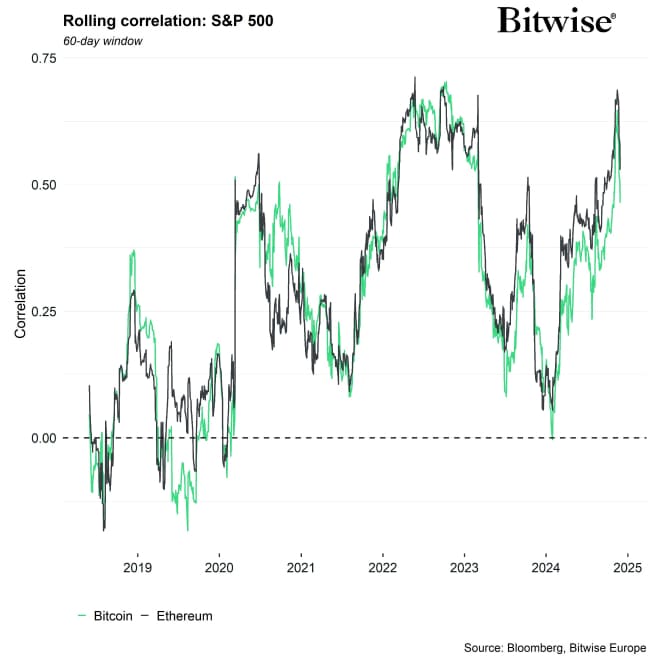

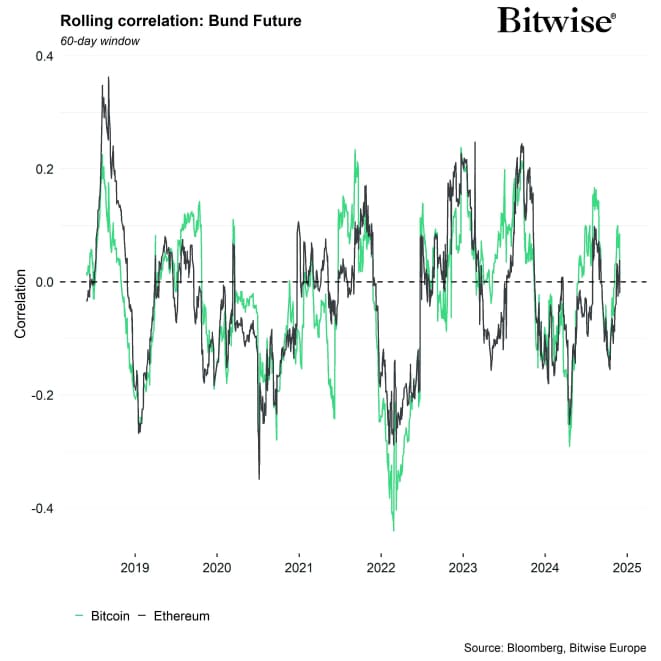

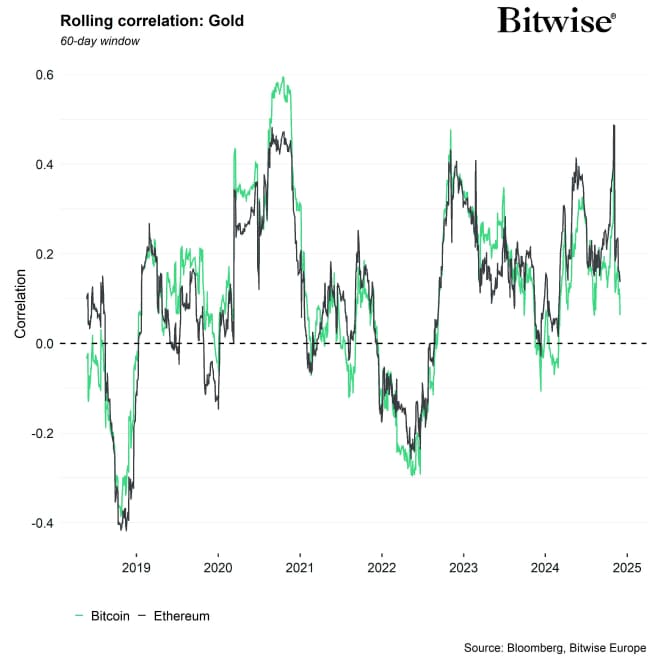

Generally speaking, we have seen that an increasing share of bitcoin's performance has been explained by non-macro factors in 2024.

As we are entering the most important stage of the bull market in 2025, it is quite likely that this share will remain high, i.e. macro will take a backseat especially during the first half of 2025 where we expect both new impulses from the US administration as well as the intensifying Bitcoin supply shock to play the major role. (More about this in the on-chain section of this report).

More specifically, the discussions around the Strategic Bitcoin Reserve should take shape in the first 100 days of Trump's office as well as first proposals for regulatory changes regarding the oversight, classification, taxation, trading, and mining of cryptoassets in the US will be enacted.

That being said, from a pure quantitative perspective, the US Dollar has continued to play a major role for Bitcoin's performance over the past 6 months.

More specifically, around 67% of bitcoin's performance variation over the past 6 months have been explained by changes in the US Dollar factor based on our quantitative macro factor model.

The recent rise in the US Dollar due to the anticipation of higher tariffs and higher domestic oil production, has most likely weighed on bitcoin's performance over the past few weeks and could turn out to be a macro risk in the short term.

Further Dollar appreciation could limit bitcoin's upside in the short term since Bitcoin usually performs best in weak Dollar environments.

The main reason behind this is the fact that changes in the US Dollar tend to be inversely correlated with global money supply growth:

However, there is also an element of reflexivity in this:

There is a limit to how much the Dollar can appreciate before inflicting significant damage to the US economy which results in higher rate cut expectations and a lower Dollar again.

So, the US Dollar appreciation should only weigh on Bitcoin and other cryptoassets in the short term.

Bottom Line: The US Dollar has become the most dominant macro factor for bitcoin recently and so recent Dollar appreciation have turned into a headwind for bitcoin and cryptoassets, especially since it implies a contraction in global money supply. Newly asserted US dominance with the new administration as well as increasing Euro sovereign risks could exacerbate Dollar strength over the coming months. However, increasing Dollar strength should lead to further rate cut odds for the Fed as a strong Dollar jeopardizes the current economic recovery in the US.

On-Chain Developments

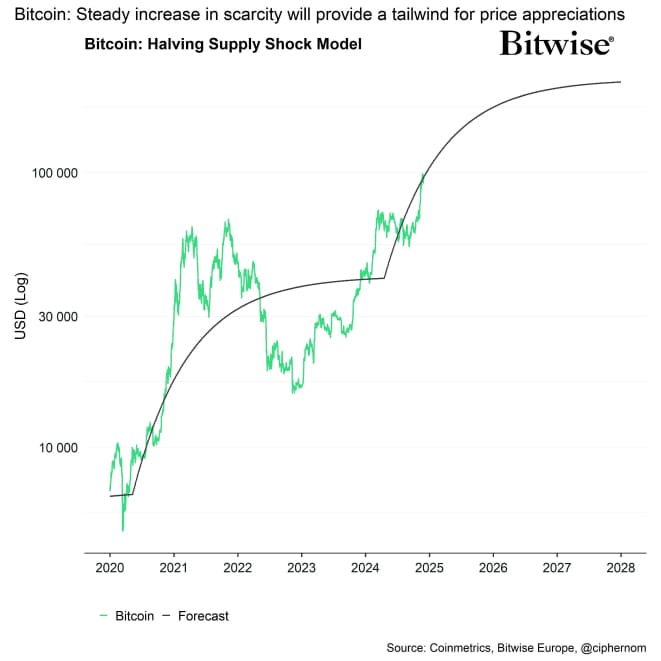

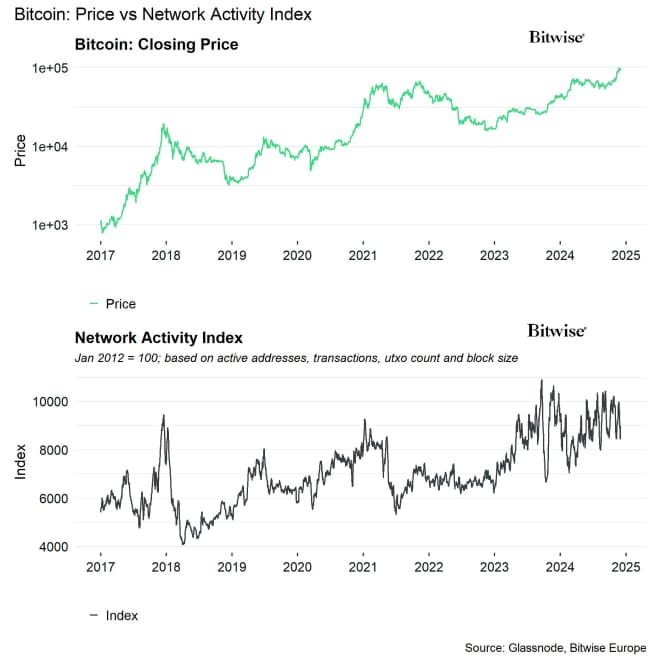

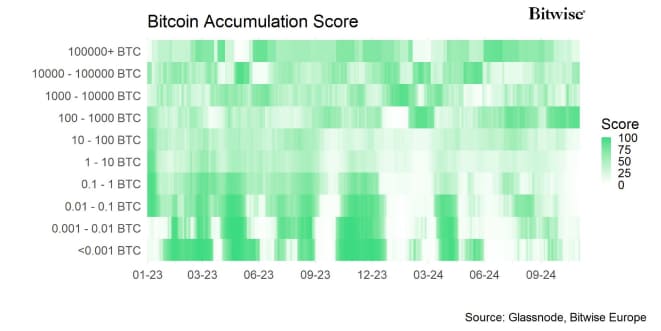

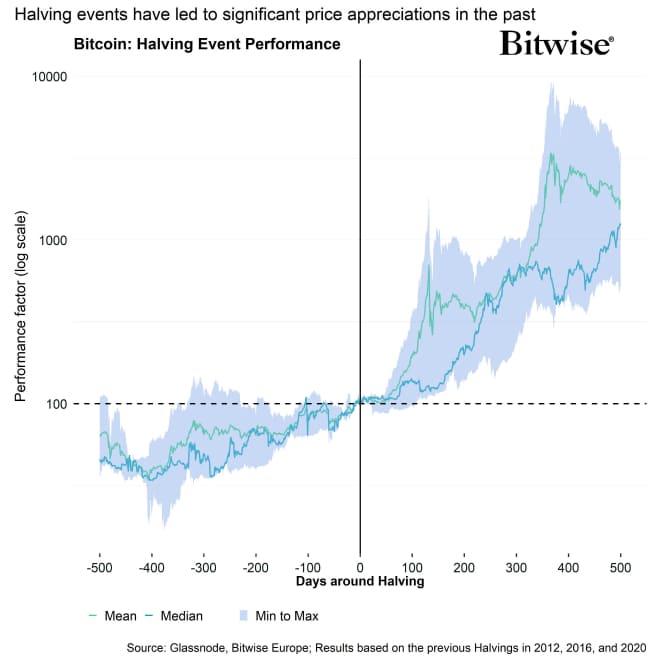

The on-chain bull case centres around the supply shock of bitcoin which is originally emanating from the halving in April 2024.

This supply shock has been exacerbated by ongoing purchases of global bitcoin ETPs, in particular US spot Bitcoin ETFs.

More specifically, the demand from US spot Bitcoin ETFs has outsized the amount of mined bitcoins by a factor of 2.5 times in 2024.

US spot Bitcoin ETFs will likely continue to maintain this ratio of buying in 2025 as existing passive investments in traditional financial assets will continue to be substituted with these US spot Bitcoin ETFs and wire houses will gain increasing access to these ETFs.

Moreover, the corporate treasury adoption of bitcoin likely starts to accelerate as the new accounting rules FASB take hold in January 2025.

What is even more is that sovereign adoption of bitcoin will likely accelerate due to the possible implementation of a strategic national stockpile in the US.

Classical game theory suggests that the optimal strategy for any nation-state is to buy Bitcoin earlier in order to “front-run” other competing nation-states.

In technical parlance: the “Nash Equilibrium” is for nation-states to buy earlier rather than later.

In this context, Brazil has recently paved the way for allocating part of its foreign exchange reserves into Bitcoin. Besides, Russia has recently passed legislation that recognises Bitcoin and cryptoassets as property. China has recently passed similar legislation.

These themes could continue to define investment narratives to a very large extent in 2025 as well.

On the other hand, the on-chain bear case centres around the hypothesis that valuations have become moderately expensive and that sentiment is still elevated following bitcoin's rallye towards 100k USD.

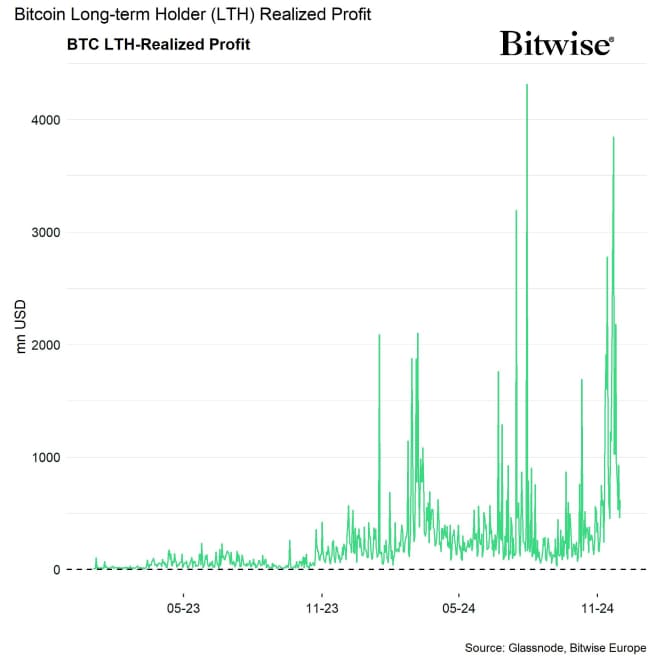

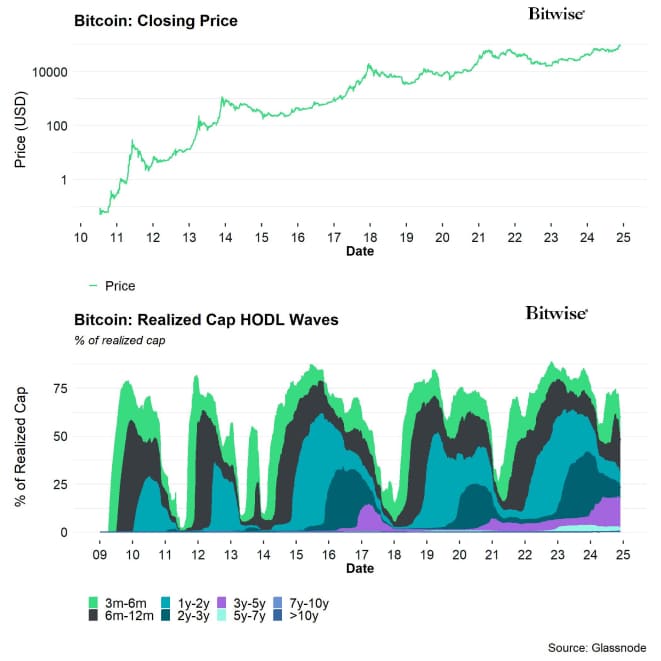

In fact, profit-taking by long-term holders of bitcoin has recently increased significantly as demonstrated in last week's Crypto Market Compass report which tends to be a bearish sign.

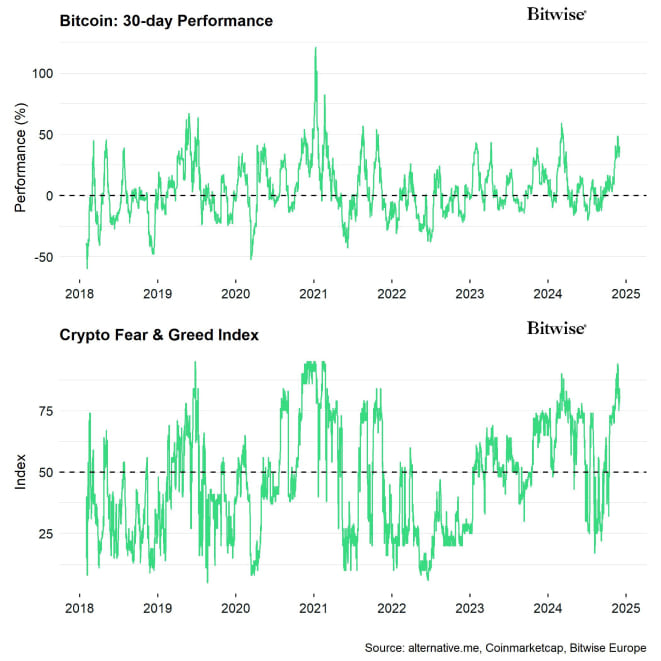

Moreover, sentiment remains relatively elevated which points towards more downside. Retail participation has significantly increased which is usually a sign for a cycle top. The Fear and Greed Index has recently reached the highest level since the cycle top in 2021.

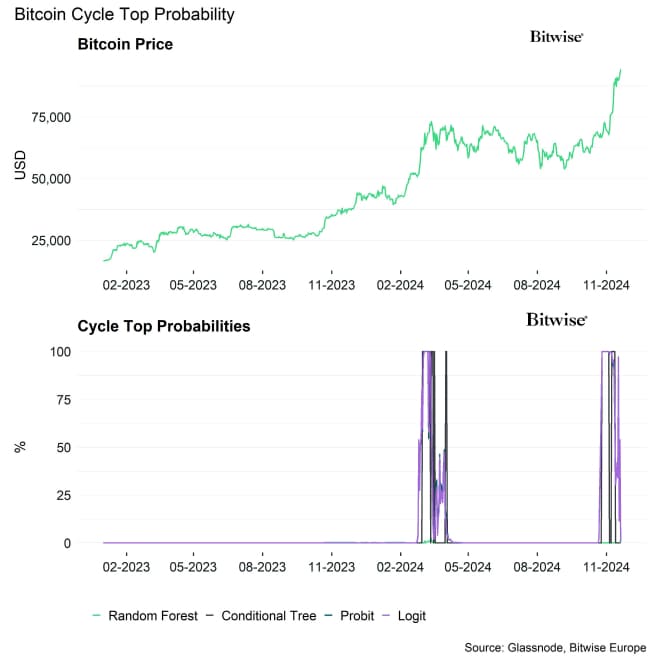

In fact, our cycle top probabilities have increased somewhat on account of increasing valuations more recently. The cycle top models shown below include 20 different on-chain metrics.

Polymarket still estimates a relatively low probability for a US strategic reserve to materialise so this could dampen bullish expectations for nation-state adoption in 2025.

Nonetheless, our base case remains that the lagged positive effects from the Bitcoin Halving should culminate in mid-2025 as demonstrated in our quantitative research piece here.

The second half looks a bit more challenging to predict as valuations could become more stretched during the late stage of the bull market, especially if the price of bitcoin overshoots above what we think could be the “fair value” at the end of 2025 at around 180k USD to 200k USD.

In fact, looking at general BTC supply dynamics, we are continuing to see that the supply shock emanating from the Halving continues to intensify.

Despite the recent increase in profit-taking, overall BTC exchange balances continue to drift lower largely supported by increased whale transfers off exchanges. Measures of (highly) liquid have also continued to drift lower unabated.

In other words, the supply shock has continued to intensify despite the recent increase in profit-taking by both short- and long-term holders.

We think that this supply shock will continue to build up over the coming months, at least until the second half of 2025.

Despite recent all-time high prices, Bitcoin valuations still only remain moderately expensive. One of the most popular valuation metrics – the Market Value to Realized Value (MVRV) Ratio – even suggests that Bitcoin is at “fair value” right now.

Based on our composite valuation metric which summarises Bitcoin valuations across 7 different metrics, bitcoin's valuation only remains at the 67% percentile which was historically not indicative of a cycle top.

Bottom Line: Cycle top probabilities have increased somewhat as sentiment appears to be stretched, and long-term holders have increasingly taken profits. Nonetheless, the Bitcoin supply shock continues to intensify as evidenced by the continuing decline in exchange balances and liquid supply. We expect this to be a major tailwind in 2025, at least until the second half of next year. Moreover, valuations that are only moderately expensive still leave more room for further price appreciations over the coming months.

Bottom Line

- Performance: The US presidential election in November acted as a key catalyst for a crypto market rally, with Bitcoin reaching near 100k USD and altcoins, particularly XRP and Cardano, outperforming due to reduced regulatory uncertainty and increasing adoption narratives. Strong on-chain fundamentals, including supply constraints and institutional demand, suggest the rally could extend into 2025, while the altcoin market experienced its highest outperformance since mid-2022, driven by diverse investment themes.

- Macro: The US Dollar has become the most dominant macro factor for bitcoin recently and so the recent Dollar appreciation has turned into a headwind for bitcoin and cryptoassets, especially since it implies a contraction in global money supply. Newly asserted US dominance with the new administration as well as increasing Euro sovereign risks could exacerbate Dollar strength over the coming months. However, increasing Dollar strength should lead to further rate cut odds for the Fed as a strong Dollar jeopardizes the current economic recovery in the US.

- On-Chain: Cycle top probabilities have increased somewhat as sentiment appears to be stretched, and long-term holders have increasingly taken profits. Nonetheless, the Bitcoin supply shock continues to intensify as evidenced by the continuing decline in exchange balances and liquid supply. We expect this to be a major tailwind in 2025, at least until the second half of next year. Moreover, valuations that are only moderately expensive still leave more room for further price appreciations over the coming months.

Appendix

Cryptoasset Market Overview

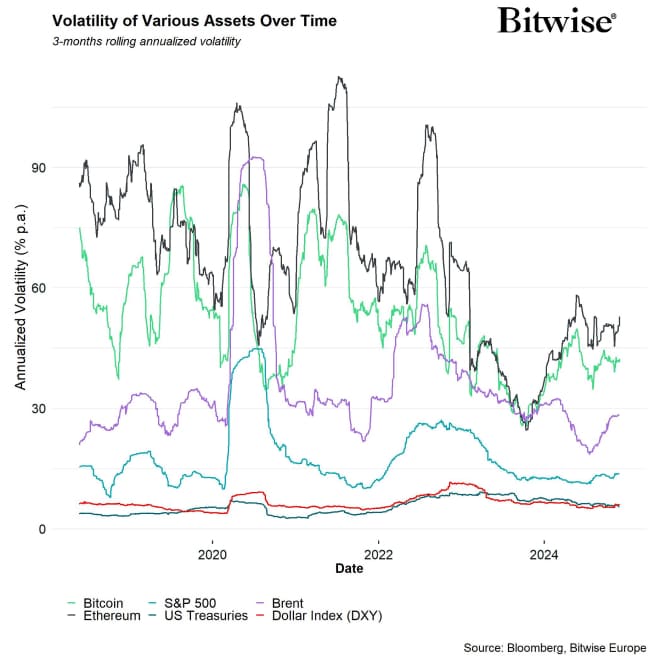

Cryptoassets & Macroeconomy

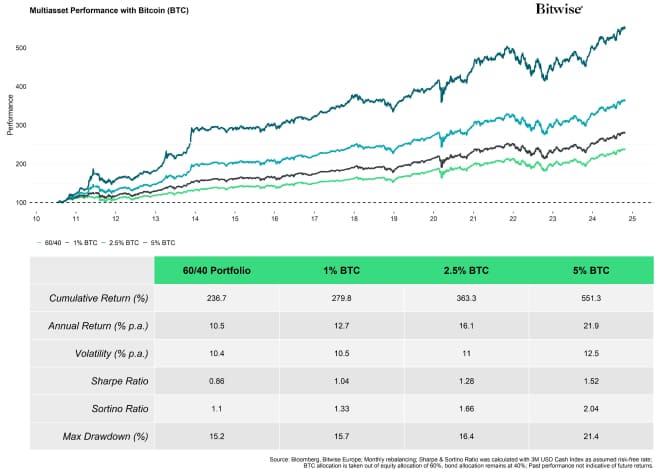

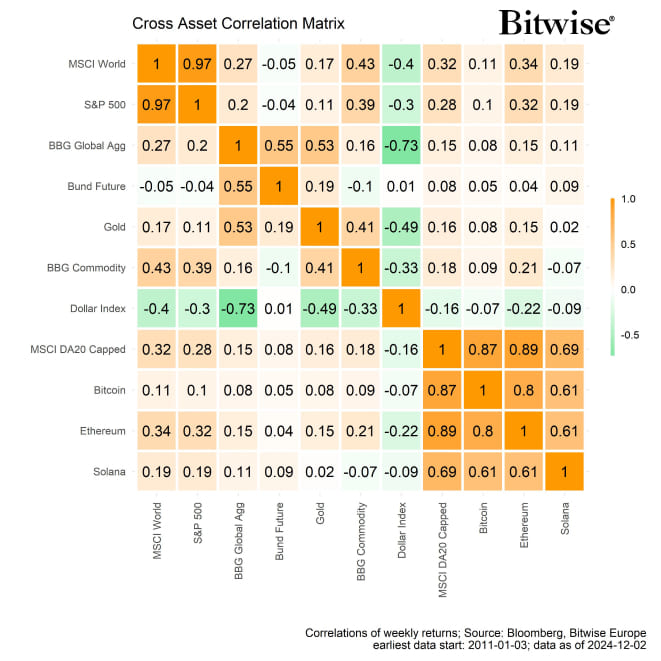

Cryptoassets & Multiasset Portfolios

Cryptoasset Valuations

On-Chain Fundamentals

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

En

En  Fr

Fr  De

De