What is Cardano?

Cardano is a Layer 1, smart contract Proof of Stake blockchain vying to become the home for thousands of decentralised applications in DeFi, gaming and NFTs.

Its main competitors are Ethereum, Solana, Tezos, Avalanche, Polkadot and Cosmos.

Cardano prides itself on being more technically sophisticated than its rivals, with its development predicated on peer-reviewed cryptographic research.

The network's internal currency is called ADA. Its main use is in staking, to verify blocks of transactions and secure the network.

Cardano first appeared on market data website Coinmarketcap.com in October 2017 [1] , coming straight in as the 16th highest-valued project with a market cap of $530m and a per-token price of $0.02.

It has grown to reach a market cap of $30bn+ and has consistently been one of the highest-valued crypto projects on the market.

But there is now a relatively saturated market for Layer 1 ‘Ethereum killers'. The question we will seek to answer in this report is: how does Cardano stack up in a crowded field?

History

The Cardano ecosystem is underpinned by three key stakeholders: The Cardano Foundation, Emurgo and Input Output Hong Kong (IOHK), each of which has varying roles in software development, testing, support and architecture provision.

Cardano itself was founded in 2015 by American computer scientist and mathematician Charles Hoskinson.

As one of the original co-founders of Ethereum [2] , Hoskinson brought with him some serious bona fides in the cryptocurrency world, albeit tempered by concerns around his somewhat spiky personality. Hoskinson is one of the more polarising figures in crypto and his public disagreements over the development of his protocol have been widely reported on.

He left Ethereum in June 2014 before that chain launched. History records [3] that it was a philosophical dispute with Ethereum figurehead Vitalik Buterin that was behind the split: the Cardano founder wanted to create a for-profit structure for the blockchain and to accept venture capital to grow Ethereum adoption, while Buterin preferred an open source, non-profit structure.

From here, Hoskinson went on to form software development company IOHK with his Ethereum colleague Jeremy Wood.

In 2015 IOHK was approached by a group of Japanese businesses seeking to back a project that could support both a cryptocurrency and function as a smart contract blockchain.

The group of backing companies were specifically focused on large-scale distribution in Asia as opposed to the Western market, which they saw as over-saturated with crypto projects.

To raise development funds to support the launch, the group hired IOHK to build software to help with compliance, while a local company called Attain co-ordinated the sale, and the Swiss non-profit Cardano Foundation dealt with auditing.

Cardano's ICO took place in four stages between September 2015 and January 2017, primarily directed at Asian markets, and specifically Japanese investors.

There were some regulatory advantages to offshoring [the token sale]

Hoskinson told Bitcoin Magazine at the time [4] . He added:

There were also some cultural advantages; mainly we had a blue sky, wide-open marketplace

The sale of ~30 billion ADA tokens raised $62m. Investing in the ICO at that stage would have yielded a not-inconsiderable 4,400% or 45x return [5] to date. Those ‘regulatory advantages' have become more clearly defined in recent years with the US market regulator charging Ripple (XRP) executives in November 2020 [6] with conducting an unregistered securities sale with regards to its ICO.

The Japanese group of backing businesses came to be called Emurgo. It now functions in the same way as Consensys does for Ethereum: as a studio for designing smart contracts and decentralised applications. In September 2021 Emurgo announced a $100m investment in Cardano [7] .

After launching its mainnet in September 2017 Cardano amassed a cult-like following.

At 693,000 members, the Cardano subreddit [8] is one of the largest in the crypto space, behind only r/Bitcoin, r/cryptocurrency, and r/Ethereum, and is 10 times larger than the likes of rivals Solana, Avalanche or Polkadot. That community may yet prove to be one of Cardano's biggest competitive advantages, amplifying the network effects of new product launches.

Tokenomics and Supply

Cardano's internal currency token is ADA. It can be used as a means of exchange, but its primary use is for staking to help validate blocks of transactions and secure the blockchain.

ADA has a maximum token supply of 45 billion, of which 32 billion are currently in circulation.

Unlike Bitcoin or Ethereum, Cardano has its own native wallets. Yoroi is a lightweight browser-based wallet aimed at casual or retail owners, while Daedalus is a more complex wallet aimed at node operators or staking pool operators.

When Cardano was launched, as described in its genesis block documentation [9] , 25,927,070,538 ADA was sold to investors, with 5,185,414,108 ADA distributed between the three main entities:

· Cardano Foundation: 648,176,761 ADA

· IOHK: 2,463,071,701 ADA

· Emurgo: 2,074,165,644 ADA

13,887,515,354 ADA were held in reserve to be used as staking reward incentives.

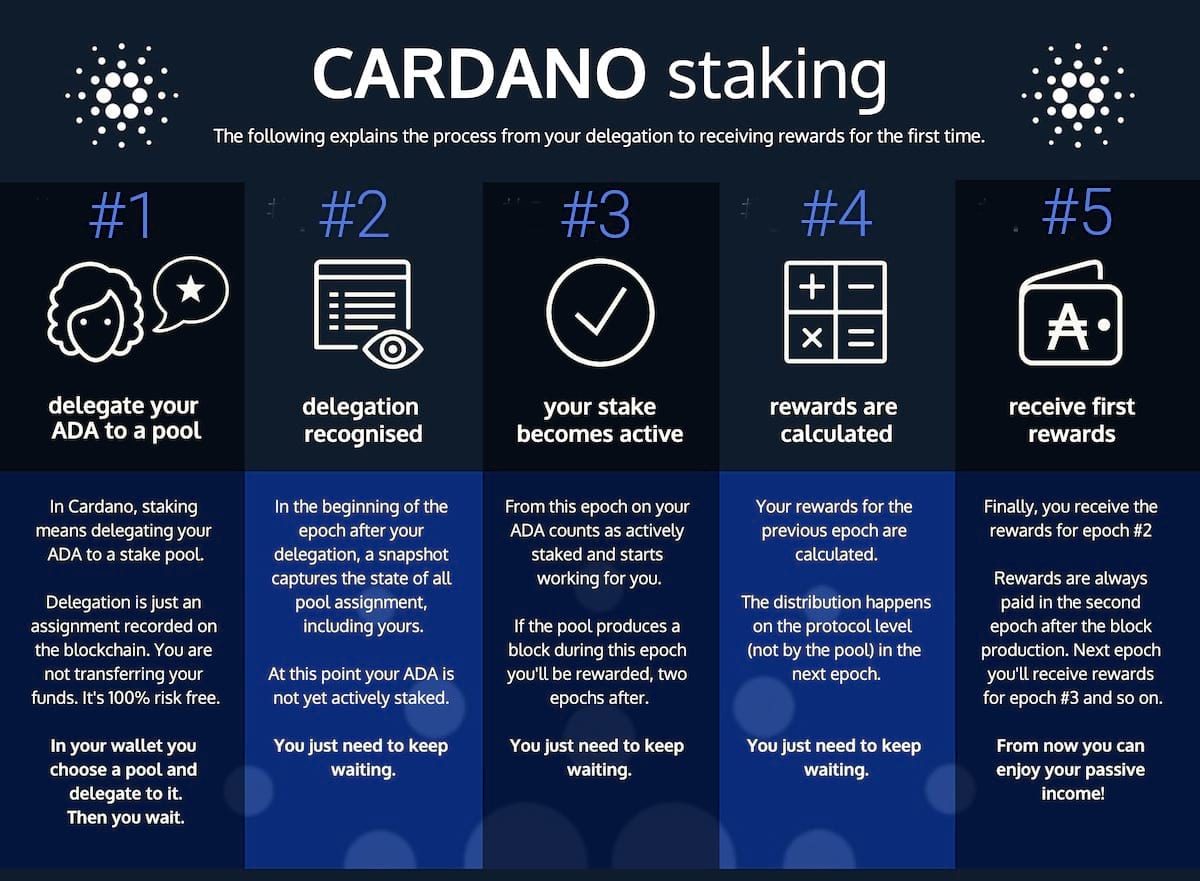

Cardano runs a form of delegated Proof of Stake. Holders can stake ADA tokens by depositing them into a wallet and then choosing to delegate those tokens to a staking pool [10] . For doing so they receive a reward in the form of a steady yield that is deposited into their wallet.

As of March 2022, the staking rewards for delegating tokens in this way are between 5.3% and 5.5% per annum. Taking network issuance into account, the adjusted rewards are around 1.3%, implying an annual inflation rate of around 4%.

Cardano is not deflationary, however, by 2030 Hoskinson believes it will be [11] .

Hoskinson has repeatedly resisted calls to introduce the kind of token burning mechanism employed by BNB or Ethereum -- through its EIP-1559 update in August 2021 -- to reduce supply and potentially improve the per-token market value of ADA. In the past the founder has said deflationary mechanics are unsuitable for long-term projects, and while it may produce a short-term hike in token prices, this would contribute little to the overall health of the ecosystem or the ability for developers to build applications on Cardano.

As one poster in the Cardano subreddit noted [12] :

Cardano is at a stage where it needs to keep gaining users and network activity, has no network congestion issues like Ethereum, and so would not benefit from [burning] fees. It will also not benefit from burning treasury funds because they are a small portion of total supply, the funds are not excessive and are being used well

Transaction fees fund both the treasury (a fund to provide ongoing development for the Cardano ecosystem) and staking rewards [13] .

Technology

From the beginning Hoskinson has attempted to build a blockchain based on high-level academic and scientific principles. He based Cardano on the Haskell programming language, which is widely used in academia and software engineering for its security, but is not currently shared by any other blockchain on the market.

This research-driven approach to protocol design has produced some major benefits and also some major drawbacks. It does provide the blockchain with a sound base to build from and its “right first time” approach is laudable.

The security of the Haskell language is not in doubt: it has been employed by global corporations for this reason, most notably by Facebook (Meta) as long ago as 2015 for its applications in combatting spam [14] .

But Hoskinson's insistence on formal development methods (rigorous mathematical techniques for testing that usually only employed in high-stakes applications such as systems for space flight, or high-volume banking software) has resulted in a relatively slow pace of development for Cardano over the last half-decade. This has opened the door to faster-moving blockchain rivals.

Newer protocols such as Solana and Avalanche have been able to grab market share from Cardano with a focus on launching decentralised apps like DeFi and NFT markets, and employing a “fix-as-we-go" model. Cardano has been somewhat left behind in this regard. Critics point out that the blockchain has iterated too slowly to capture fast-growth new verticals in blockchain, thereby giving up its potential for first- or even second-mover advantage.

A near three-year wait between the 2017 mainnet launch and the appearance of promised roadmap upgrades clearly dampened enthusiasm among Cardano investors.

The Shelley hard fork in July 2020 managed to revitalise momentum. That backwards-incompatible software update introduced Proof of Stake to Cardano, giving ADA token holders the ability to earn yield on their holdings.

As the Cardano Foundation Communications Director Bakyt Azimkanov explained [15] at the time:

Cardano enthusiasts can now register as stake pool operators and ADA holders may delegate their stake to pools, earning rewards for participating in the consensus and block production of the Cardano network for the first time.

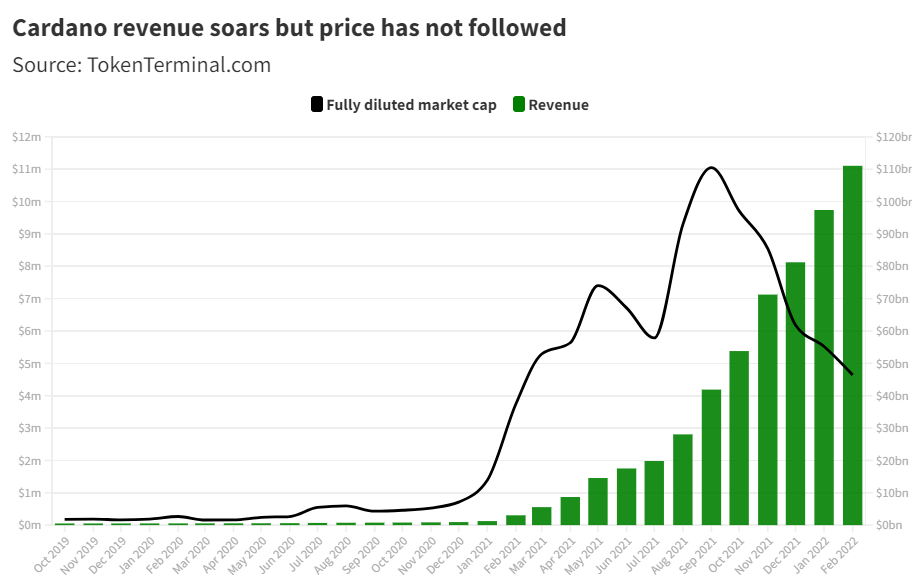

Supported by the September 2021 Alonzo hard fork, which introduced smart contract functionality to the blockchain, and the subsequent launch of DeFi and DEXes on Cardano, the blockchain's revenue potential has skyrocketed.

For example: cumultative revenue on Cardano crossed a total of $1m for the first time in May 2021.

With the introduction of smart contracts in Alonzo in September 2021, the blockchain is now producing revenues of $1m+ per month.

IOHK initially set the release of smart contracts on Cardano for March 2021. That was pushed back six months to September. Such delays are not uncommon in the crypto development world, as anyone following Ethereum's shift to Proof of Stake will be able to recount. Smart contracts on Cardano are written in the Plutus programming language [16] .

By the summer of last year, excitement for the launch of this new functionality on Cardano reached fever pitch, and the ADA price climbed to an all-time high of $2.96. Cardano leapfrogged its rivals to capture the third-highest market capitalisation in cryptocurrency [17] , behind only Bitcoin and Ethereum. As shown in the chart, that momentum has not continued. At time of writing the price of the ADA token is down 70% from its all-time high, suggesting quite a wide disconnect between Cardano's improved utility and its current token price. At a market price of $0.84 as of 9 March 2022 [18] , only 8.8% of ADA holders are in profit, compared to 82.6% that are holding at a loss [19] .

What we have been seeing in recent months is with the growth of revenue, and value locked in decentralised apps, Cardano is starting to execute on its promise. As mentioned above, the very large size of its communities on social media built up over the past five years may also accelerate the network effects as new DeFi products come online.

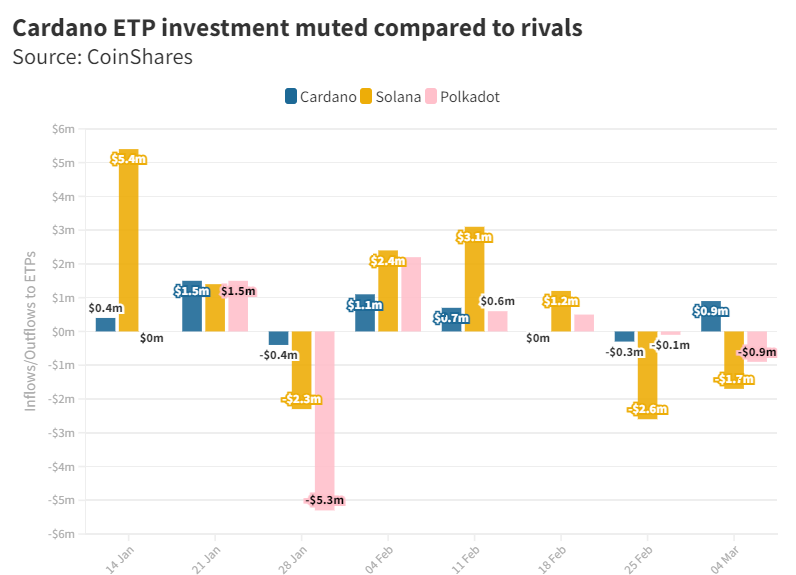

Institutional investment options

The landscape for institutional investment in ADA is relatively limited. While Grayscale, the world's largest digital asset manager, does include Cardano in its Digital Large Cap Fund [20] , it comprises only 2.46% of assets under management (AUM), with Bitcoin and Ethereum by far the largest components. Institutions invested in this fund have scant real exposure to the price of ADA, and as of March 2022 private placement in the Digital Large Cap Fund is unavailable. Grayscale also does not have an ADA-specific investment product, making Cardano notable by its absence amid products for much smaller assets such as Basic Attention Token, Horizen and Ethereum Classic.

Similarly, the Bitcoin 10 Crypto Index Fund (BITW) holds Cardano as its fourth-largest asset [21] , behind Bitcoin, Ethereum and Solana, but as with Grayscale it only represents 2.29% of AUM in the fund. BITW is also closed to private placements as of March 2022.

21Shares and ETC Group were the first digital asset managers to offer pure-play, 100% physically-backed ADA ETPs on recognised stock exchanges.

ETC Group launched its ADAetc (RDAN) on Deutsche Borse Xetra in December 2021 (ISIN: DE000A3GVKY4). Access to ADA-focused products is slowly starting to improve: on 14 February 2022 Valour followed, listing a Cardano ETP on the Frankfurt Stock Exchange [22] . In terms of investment amounts, ADA appears out of sync with the rest of the market.

While in general, inflows into Cardano products have been steady at an average of ~$1m per week, they are muted compared to newer rivals like Polkadot and Solana.

It may be that the market needs time to digest that Cardano development is now moving swiftly, rather than slowly. This points to what could be a general undervaluation of Cardano by institutional investors.

Architecture

The Cardano blockchain is split into two core layers. The Cardano Settlement Layer (CSL) acts as the platform venue where token holders can send and receive ADA with minimal transaction fees. Above that is the Cardano Computational Layer (CCL), where smart contracts are run as well as where advanced functions like identify recognition are performed. As mentioned above, Cardano operates with a form of delegated Proof of Stake, called Ouroboros. This consensus mechanism allows ADA to be sent and received securely at all times, while also securing the safety of Cardano smart contracts.

How Staking works on Cardano

Staking eliminates the need for the kinds of computational power necessary to secure the Proof of Work blockchains like Bitcoin.

Instead of miners on Proof of Work systems validating blocks of transactions by expending computing power, validators on Proof of Stake systems validate blocks of transactions by setting aside the native token of the network as kind of security deposit and proof of ownership.

The consensus mechanism provides rewards for ADA holders who choose to delegate their staking to stake pool operators (SPOs), for example Tokhun.io [23] . The blockchain is split into 5-day sections called epochs, with each epoch representing the reward cycle for stakers.

At the higher level the network randomly selects SPOs to be in with a chance of verifying blocks of transactions. These SPOs are called ‘slot leaders'.

Slot leaders can validate their epoch, or a smaller partition of an epoch if they so choose. Any participant who helps to validate an epoch (or part of an epoch) receives a reward in ADA for expending their stake in this way.

Any epoch can be partitioned or split infinitely: what this means in theory is that Cardano is infinitely scalable at its root, enabling the possibility of computing as many transactions as are required without hitting congestive bottlenecks.

Competing Proof of Stake blockchains also claim to choose their block validators at random. Cardano's Ouroboros differentiates itself by offers a mathematical proof of randomness. In this way Cardano says it is a provably fairer way to ensure that any SPOs that stake ADA to the blockchain have an equal chance of receiving staking rewards.

At an individual holder level, ADA holders receive rewards paid in ADA every epoch, which again is every five days. The process is relatively simple: they only need to keep their ADA tokens in a wallet that supports staking. The two most popular of these are the full-node Daedalus wallet, and Yoroi, which is a simpler browser-based wallet. In the wallet, users choose an SPO from the list and delegate their ADA to that SPO. Delegation does not require the transfer of those assets: it is more akin to an assignment. The ADA stays in the user's wallet and can be utilised at any time.

See for reference the explainer below from the SPO Lacepool [24] , which has 200+ delegators and an active stake of 29.39M ADA.

At time of writing approximately 71% of ADA coins in circulation are used for staking.

The DeFi Factor

One factor supporting recent bullishness for Cardano is likely the long-awaited development of its decentralised finance (DeFi) ecosystem.

With the introduction of smart contracts in September 2021's hard fork, we are now starting to see Cardano gain traction among users.

The first DeFi applications began launching at the turn of 2022: in this initial tranche are potentially high-value marketplaces focused on the growing blockchain verticals of NFTs and decentralised exchanges (DEXes).

DEXes are one of the key foundations of the DeFi ecosystem: they are platforms where users can trade cryptocurrency directly with one another, without using a middleman like one of the popular centralised exchanges (CEXes), for example Coinbase or Binance. Instead of CEXes acting as custodians on behalf of the user with trading taking place on their internal systems, DEX trading takes place directly on the blockchain itself.

SundaeSwap was the first DEX to launch on Cardano, with its beta going live on 20 January 2022. It hopes to ape the success of Ethereum-based DEXes such as Uniswap, Curve and Sushiswap, which dominate the market for users, revenue and trading volume. Uniswap, for example, has four times the number of traders than any other Ethereum-based protocol, with 112,450 daily active traders, according to Dune Analytics [25] . Its trading volume is also 10 times larger than its nearest rival. If Cardano-based applications can cut into this market share there is a very large opportunity awaiting them.

According to industry data site DeFiLlama, the Cardano DeFi ecosystem is small, but growing rapidly. Cardano has only six DeFi protocols running at time of writing [26] : SundaeSwap, MinSwap, MuesliSwap, ADAX Pro, VyFinance and MELD.

The standard metric measuring the popularity of DeFi protocols is called TVL, or Total Value Locked in a blockchain's smart contracts.

These DeFi products crossed $1m in TVL for the first time on 4 January 2022, with the beta launch of SundaeSwap on 20 January 2022 helping this metric to soar 80x by the end of the month.

SundaeSwap currently has a TVL of $122m [27] . That means it sits outside the top 150 DeFi protocols. It must be recognised, however, that these are early days.

And with $173m of TVL (the Total Value Locked in blockchain smart contracts), Cardano applications account for around one-tenth of one percent of the overall value locked in all blockchain DeFi smart contracts. That figure today stands at more than $200bn [28] .

This would suggest that there is much further for Cardano-based DeFi to expand. According to data insights [29] shared by one Cardano stake pool, the blockchain has processed over 30 million transactions, and the number of daily active addresses varies between 150,000 and 200,000. The same source shows that the number of smart contracts on Cardano reached 1,000 by the end of January 2022. These latter figures remain small compared to Ethereum, where the number of smart contracts peaked at 2.5 million in June 2021, with new contracts added at a rate of approximately 450,000 per month [30] .

2022 is expected to be a key inflection point proving the revenue-generating potential of the blockchain and analysts are watching closely as to how comfortable users are with depositing assets into DEXes and NFT platforms and making use of Cardano in general.

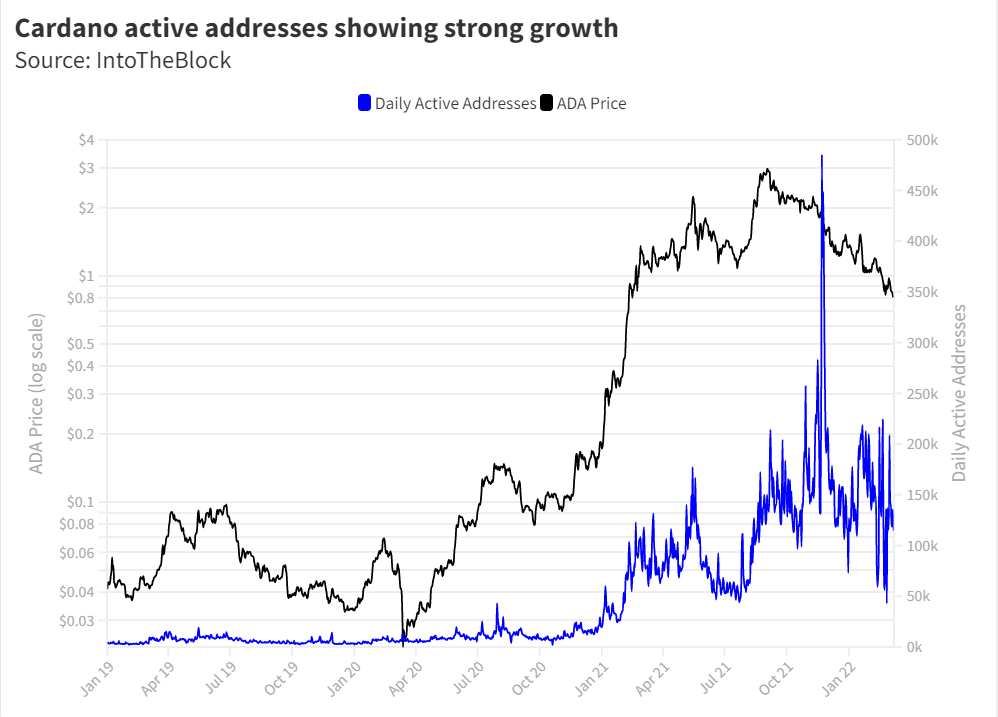

User adoption growing strongly

Active addressses are also a useful metric we must consider, as they represent a proxy for the number of daily active users of a blockchain.

As active addresses have grown, per-transaction fees have remained stable at an annual average of $0.30. That suggests that even as more users come on board, Cardano remains a relatively cheap blockchain to use.

Validating our thesis that Cardano blockchain development was far too slow to attract and specifically retain new users, we can see via data site IntoTheBlock that daily active addresses first crossed the 20,000 threshold in December 2017. It would take a full two-and-a-half years for the number of active addresses to again breach this number, coming in July 2020 [31] around the time of the Shelley hard fork.

By contrast, the number of daily active addresses crossed the 100,000 barrier for the first time in February 2021, breaking that record just six days later.

[NB: ADA Price shown on a log scale]

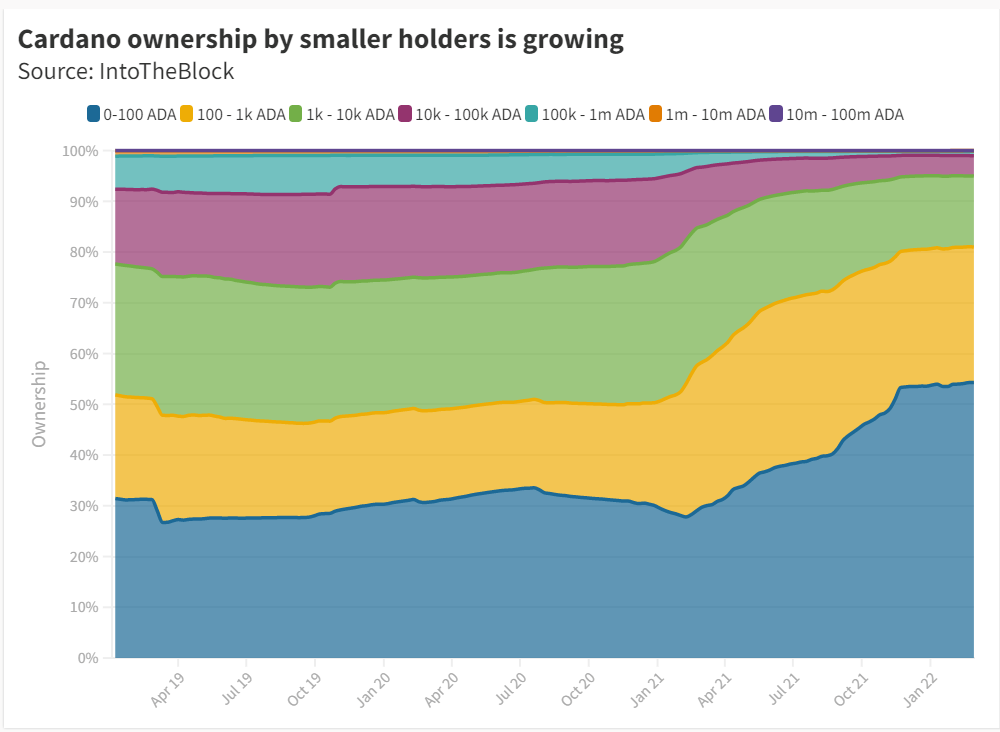

A generalised upswing in the smallest holders of ADA, those that own up to 100 ADA (worth ~$80) or fewer, also suggests that ownership is shifting away from whales – the richest holders – and towards day-to-day users of the blockchain.

The data show that this trend began at the start of 2021 and has continued strongly since then. This bodes well for broader retail adoption and usage of Cardano products.

As Cardano Foundation CEO Frederick Gregaard noted in a recent blog post [32] , Cardano's priorities for this year are to promote adoption globally and increase the commercial use of the blockchain in non-crypto industries,

On a technological level the key priorities for 2022 include the Hydra upgrade [33] , which will introduce a Layer 2 scaling solution for Cardano - in the same way as Lightning Network for Bitcoin or Polygon for Ethereum - to potentially increase transaction throughput and finality.

Hoskinson has noted that Hydra is a high commercial priority for Cardano given that decentralised apps are starting to gain traction on the platform.

He noted in an October AMA (Ask Me Anything) session [34] with Cardano supporters:

We are going to keep adding resources to Hydra, and we've been trying to identify some teams so we can parallelise the workstream because it's such a high commercial priority. And it's going to be very important that we'll be able to offload a large [amount] of the transaction traffic that's going to come from all the apps that are coming

It is a matter of public record that each of Cardano's smart contract rivals has experienced severe scaling and congesting issues from the massive upswing in the numbers of transactions produced by DeFi, smart contracts and NFTs. The ability to process transactions away from the main chain, therefore, will be a critical update.

Further updates for 2022 include grouping together multiple code releases, which should provide more predictability in terms of when users can expect blockchain upgrades. One of the less-well covered upgrades coming up on Cardano which will be of major importance is the ability to sign multi-signature (multi-sig) transactions in incremental stages.

Multi-sig wallets are important for a host of reasons, but not least for institutional fund treasury management. It is currently possible to have a Cardano transactions signed by multiple entities, but as IOHK Marketing Director Tim Harrison writes in a February 2022 blog post [35] :

This update makes it possible to sign a transaction incrementally. Now, for example, one party can sign the transaction first, then send it over to someone else, instead of having to sign it together

Risks

The main ongoing risks for Cardano remain around its technological architecture. As mentioned above, the Haskell programming language is only employed by Cardano and is not shared by any other blockchain protocol. Alternatives like Rust, used by the Solana blockchain, are consistently rated more highly by app developers [36] .

The decision to base Cardano on Haskell does attract academics and scientists to the project but it appears to have saddled Cardano with some intractable difficulties. Africa-focused web company 3air notably abandoned Cardano for the SKALE network in February 2022 citing the difficulty of recruiting enough talented Haskell developers to work on its projects [37] .

3air reportedly spent months actively recruiting for senior Haskell coders to build on Cardano but was only able to source two entry-level part time developers. There are many issues we have faced , 3air CEO Sandi Bitenc told Cointelegraph. One is for sure a total lack of talented Haskell and even more so Plutus developers [for Cardano smart contracts] on the market. Other criticisms remain around a lack of proper developer tooling, guides and documentation that makes developing on Cardano more difficult than it needs to be.

Additional risks include the ICO. A Japanese tax audit from October 2021 found that Cardano investors had under-reported gains on ADA by around $6m [38] .

Outlook

The peer-reviewed, academic approach that Hoskinson and Cardano developers have taken thus far – along with the use of the Haskell programming language as a base – has produced some major benefits and some major drawbacks for the blockchain. The pace of development to date has been glacial, as evidenced by the inability to retain active users in the past. That now appears now to be speeding up.

Hoskinson remains a polarising figure, and public opinion of the founder behind the blockchain may figure into investment calculations more highly than current holders would like.

It has certainly been a frustrating wait for early adopters to see the promise of Cardano come to fruition. However, Cardano is starting to see some traction in its application layer, with launch of multiple DEXes and DeFi applications. TVL is small, but growing, and there remains a very large market for Cardano to tap into.

It does appear that the best days for Cardano, and hence ADA, are in front and not behind it. By every standard industry metric: from daily active addresses to decentralised apps and revenue, the protocol is undergoing rapid adoption and growth.

Cardano has traditionally soared in price ahead of large protocol updates: first the Shelley hard fork in July 2020 which brought Proof of Stake online, then the addition of smart contracts through the Alonzo hard fork in September 2021.

The upcoming addition of Layer 2 scaling solution Hydra – expected by mid 2022 – should add more scaling potential and could give Cardano a leading position in terms of transaction throughput. With that in mind, now may be a good time for newer investors to investigate the chain in more detail.

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

Über Bitwise

Bitwise ist einer der global führenden Krypto-Vermögensverwalter. Tausende von Finanzberatern, Family Offices und institutionellen Anlegern auf der ganzen Welt haben sich mit uns zusammengetan, um die Chancen von Kryptowährungen zu erfassen und zu nutzen. Seit 2017 hat Bitwise eine beeindruckende Erfolgsbilanz vorzuweisen bei der Verwaltung einer breiten Palette von Index- und aktiven Lösungen für ETPs, separat verwalteten Konten, Privatfonds und Hedge-Fonds-Strategien - sowohl in den USA als auch in Europa.

In Europa hat Bitwise (vormals ETC Group) in den letzten vier Jahren eine der umfangreichsten und innovativsten Produktfamilien von Krypto-ETPs entwickelt, darunter Europas größtes und liquides Bitcoin-ETP. Diese Produktfamilie von Krypto-ETPs ist in Deutschland domiziliert und von der BaFin zugelassen. Wir arbeiten ausschließlich mit renommierten Unternehmen aus der traditionellen Finanzbranche zusammen und stellen sicher, dass 100 % der Vermögenswerte sicher offline (Cold Storage) bei regulierten Verwahrern gelagert werden.

Unsere europäischen Produkte umfassen eine Palette von sorgfältig strukturierten Finanzinstrumenten, die sich nahtlos in jedes professionelle Portfolio einfügen und ein ganzheitliches Exposure zur Anlageklasse Krypto bieten. Der Zugang erfolgt unkompliziert über die wichtigsten europäischen Börsen, wobei die Hauptnotierung auf Xetra erfolgt, der liquidesten Börse für den ETF-Handel in Europa. Privatanleger profitieren von einem einfachen Zugang über zahlreiche DIY-Broker in Verbindung mit unserer robusten und sicheren physischen ETP-Struktur, die auch eine Auszahlfunktion beinhaltet.