Markets

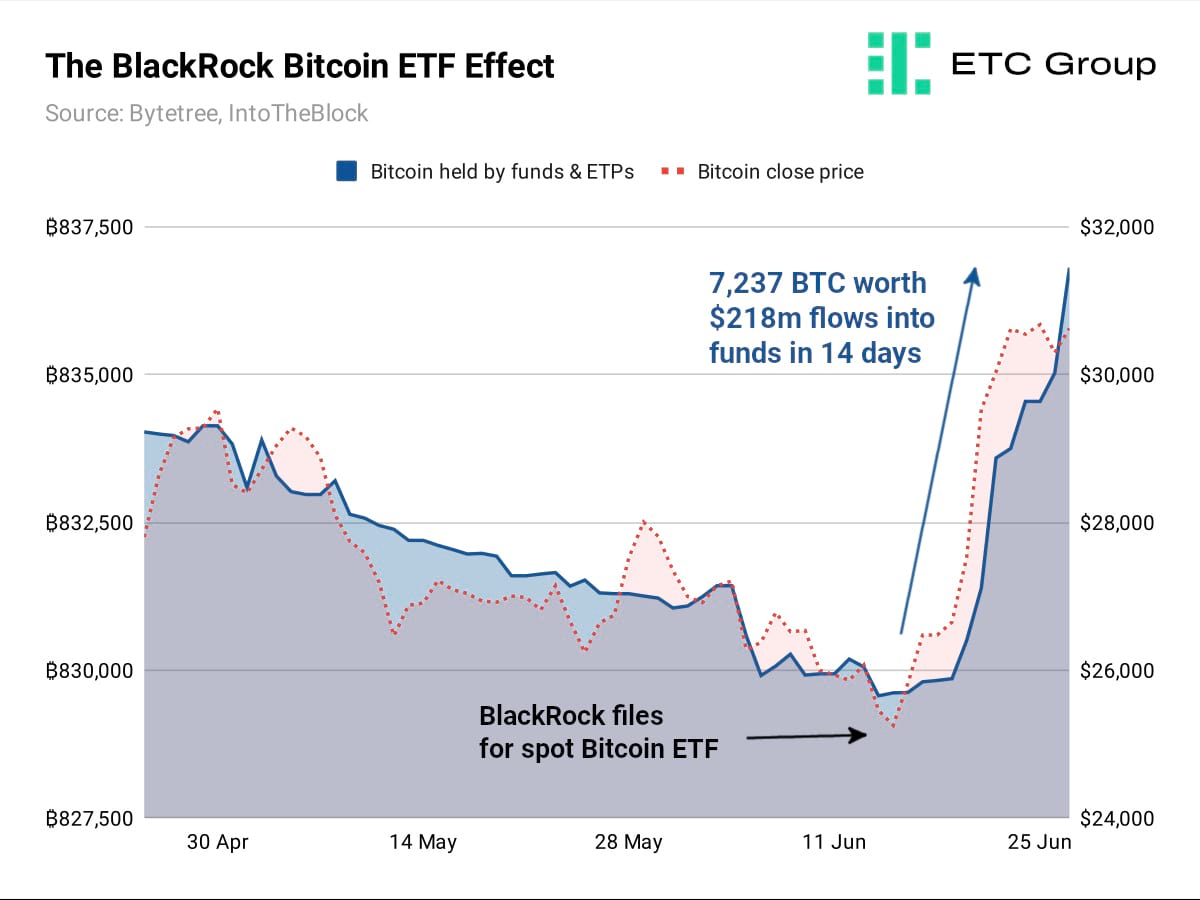

Markets took a turn for the better in the second half of June, buoyed by the announcement of BlackRock applying for a spot Bitcoin ETF in the United States.

More than 30 similar applications stretching back to 2013 have been dismissed by the Securities and Exchange Commission regulator, but the $10 trillion asset manager's move is widely seen as a marker of the overwhelming strength of institutional interest in Bitcoin.

It is also a validation of the European crypto asset investment products that have attracted more than $6bn in AUM since 2020.

The SEC has a maximum of 240 days to respond to BlackRock's filing, giving them an ultimate deadline of February 2024. But given BlackRock's overwhelming power in the American fund system (with a 575 to 1 record of getting ETFs approved by the regulator), many are suggesting that the approval could even come this year.

Coinbase is the proposed custodian for the BlackRock ETF, which somewhat complicates the SEC's case against the San Francisco crypto exchange for allegedly trading assets which should be registered as securities.

A slew of US-focused asset managers, including Invesco and WisdomTree each re-entered their own spot Bitcoin ETF applications on the proviso that BlackRock “must know something”, Bloomberg reported.

Many of the applications hinge on language around surveillance sharing of the Bitcoin spot market, given that the SEC has denied so many previous applications citing fears of market manipulation. Again, Coinbase is mentioned as the market policing partner for both the Fidelity and Cboe filings.

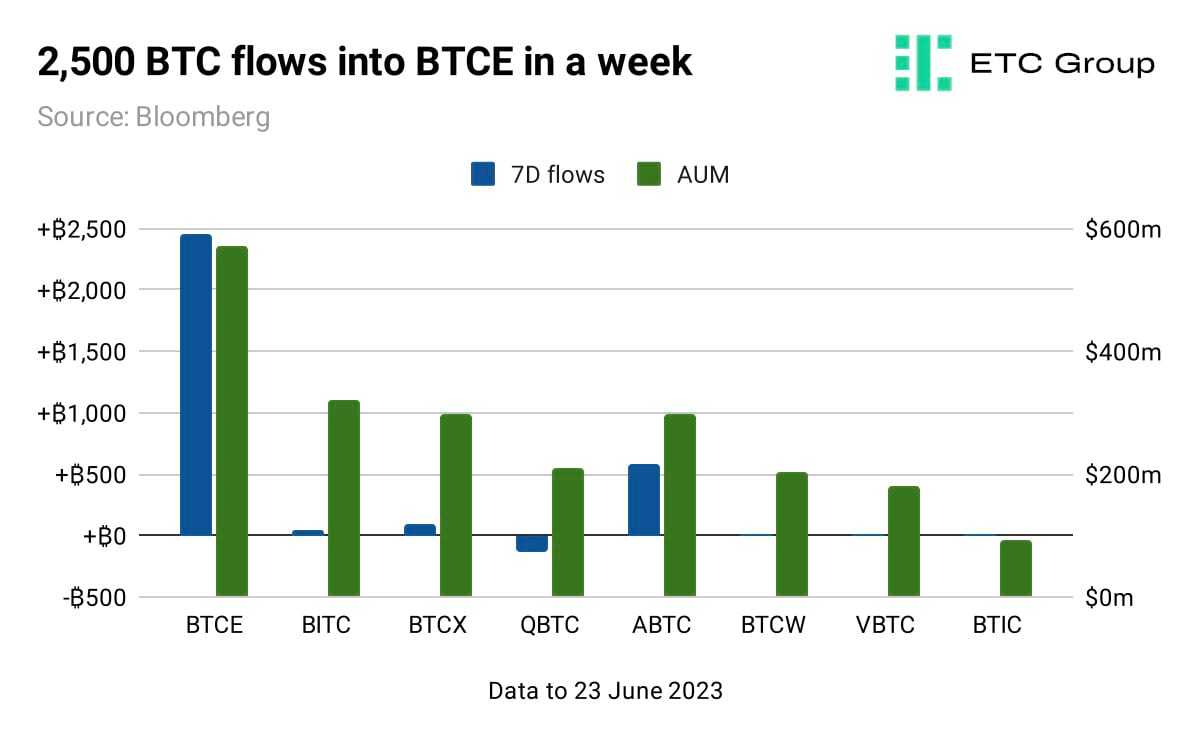

In the 14 days after BlackRock's 15 June ETF filing, the price of Bitcoin climbed by 17.7% to $30,627, while over 7,230 BTC worth $218m flowed into Bitcoin funds and ETPs.

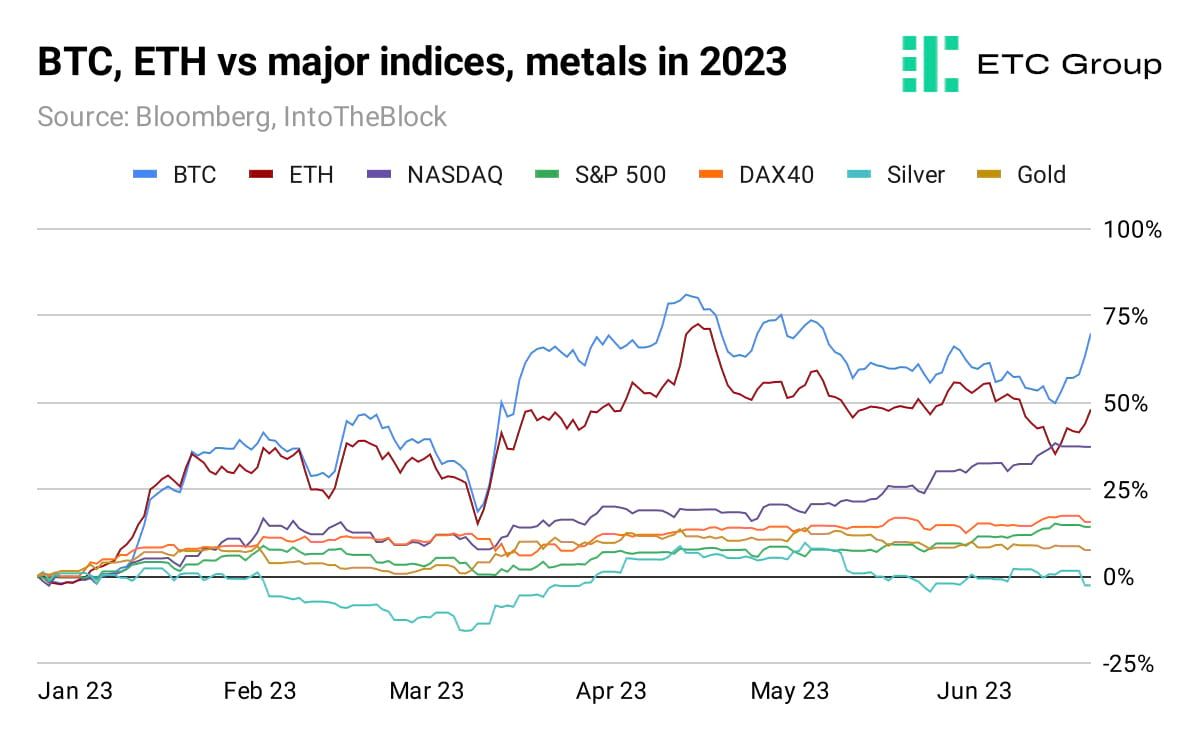

Bitcoin remains the best-performing asset of the year by a substantial margin (followed closely by Ethereum) and the data shows that mass BTC accumulation is underway.

On 28 June, the largest current publicly-traded holder of Bitcoin, MicroStrategy (NASDAQ:MSTR) announced it had purchased 12,333 BTC for $374m. In an earnings call from July 2020, CEO Michael Saylor explained that inflation would weaken the US dollar and: “it makes sense to shift our treasury assets into some investments that can't be inflated away.”

146,000 BTC per month is now moving into illiquid hands, according to Glassnode. The data provider also notes that 14.45m BTC, or more than 74% of circulating supply, remains in the hands of the stickiest cohort of long-term holders.

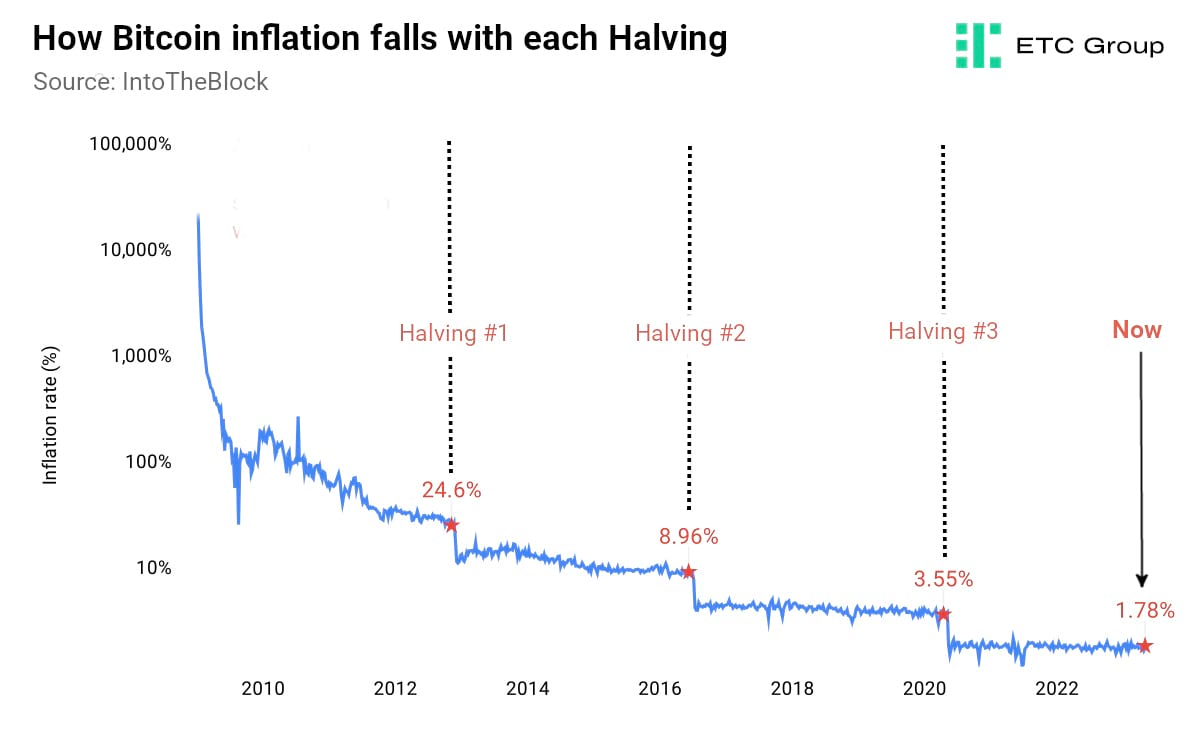

Investors of all stripes are starting to realise exactly how little of the Bitcoin supply is liquid and available to buy, and how much supply inflation has fallen over the years.

With less than 12 months to go until the Bitcoin Halving, this narrative is likely to accelerate.

It is also worth considering the bombshell SEC cases against Binance and Coinbase in early June.

The notoriously crypto-unfriendly regulator came at the industry aggressively, attempting to make investing in these alternative assets as unpalatable as it could be, and yet markets shrugged it off.

Bitcoin dipped 20% intraday, but it has taken less than a month to absorb those losses and regain parity: a powerful demonstration of the staying power of cryptoassets.

Between BlackRock, HSBC (which launched Bitcoin and Ethereum ETFs for sale in Hong Kong via its app this week), Germany's banking giant Deutsche Bank filing for a digital asset licence to be a crypto custodian and the 20 June launch of the Fidelity/Citadel/Charles Schwab-backed EDX Markets exchange there are approximately $25 trillion in assets under management that will be eligible to buy Bitcoin in the near future.

Additionally, more than 44% of the total Bitcoin supply has not moved in two years, Coinmetrics data shows. This means that those holders who bought before the run up to Bitcoin's all time high of $67k in November 2021 have held on all the way through to the bear market low of $15.5k and back up to where we sit now at around $30k. The implication is that these holders will hold out for a price point beyond $70k before they would even consider selling.

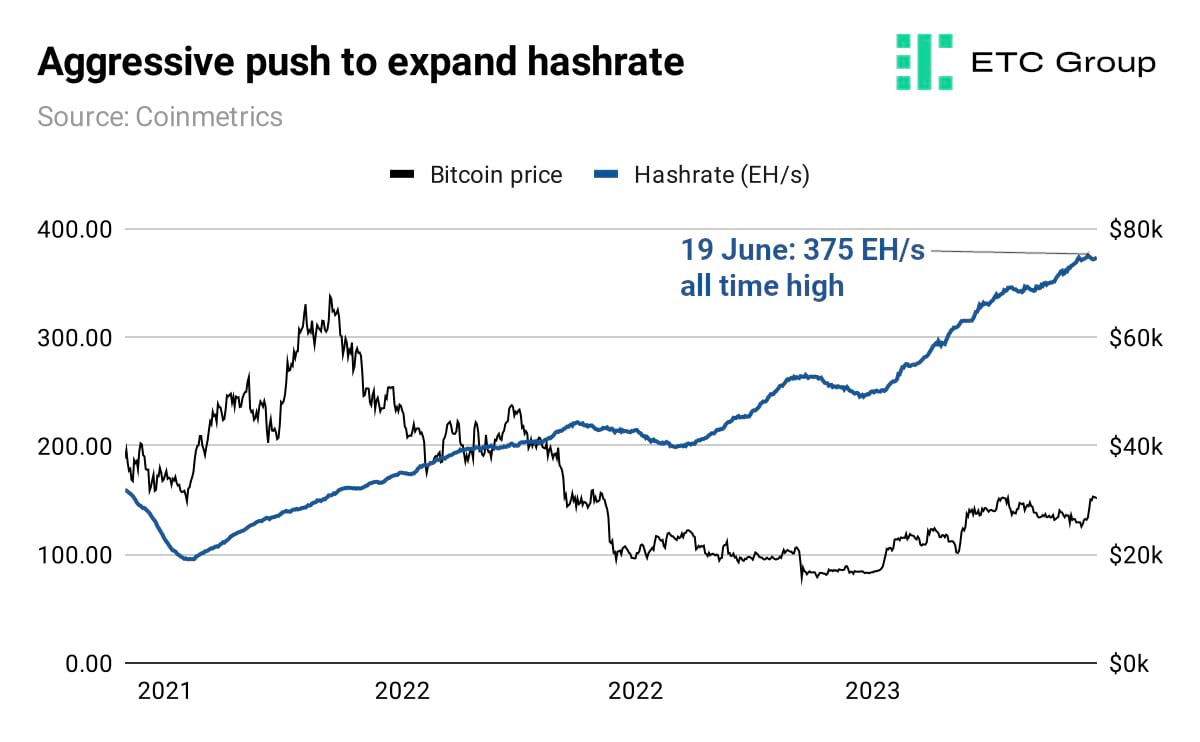

Despite the brutal 2022 bear market, and the Bitcoin halving now only 300 days away, miners have persevered with increasing aggression in their pursuit of more Bitcoin hashrate.

As of 27 June, the 30-day moving average of global computing power directed at mining Bitcoin had settled at 373.3 exahash per second (EH/s), less than 2 EH/s below its 19 June all time high.

In the final days of the month, CME Group also announced it would launch a new cash-settled futures product focused on the ETH to BTC ratio. CME Group was the first institutional venue to launch Bitcoin futures in December 2017, signalling growing support for portfolio managers to be able to subtly manage their allocation to the top two cryptoassets by market cap.

Macro

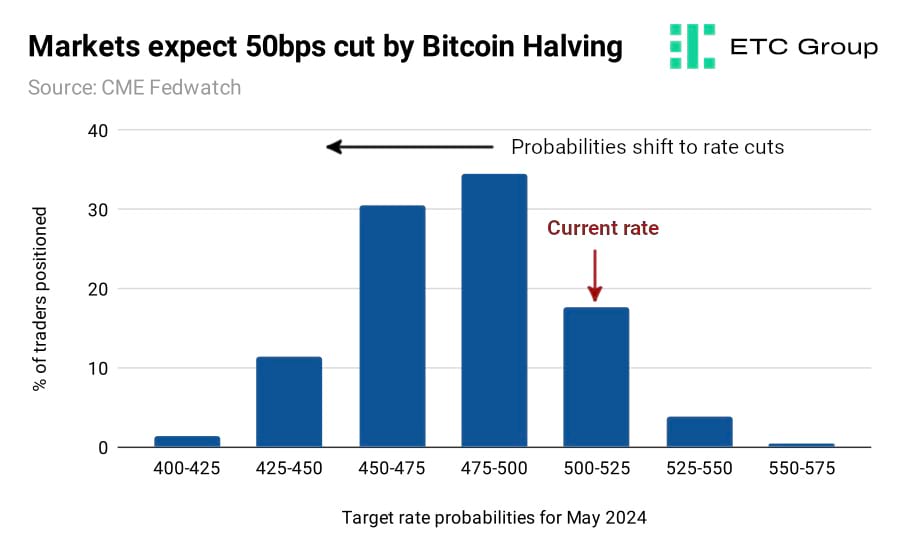

Central banks continued to raise rates around the world in June. And while the US Federal Reserve held interest rates at 5%, Chair Jerome Powell signalled more rate rises in 2023. Bond markets are pricing in the possibility of two more 25bps hikes this year, with a monetary policy pivot and 50bps of cuts by Q1 2024.

That point in time would coincide with the Bitcoin Halving. As such, investor interest in assets not linked to government balance sheets, such as crypto, is likely to be higher than average.

In June, the Swiss National Bank raised rates by 25 basis points, smaller than its 50 basis point hikes, but signalled more hikes to come. The European Central Bank also raised rates. Sweden's Riksbank hiked by 25 basis points and signalled more rises would follow. Ditto Norway's Norges Bank, which increased rates to 3.75%, their highest since January 2008.

China's central bank moved in the opposite direction, cutting short-term borrowing costs for the first time in 10 months to support the country's recovery “as demand and investor sentiment weaken, adding to the case for urgent policy stimulus to sustain growth”, Reuters reported.

The People's Bank of China then dropped interest rates on long-term borrowing in a bid to spur consumption as the post-pandemic recovery faltered. China's re-opening had been pointed to as an engine to drive global growth, so the evident concern has analysts reconfiguring their assumptions for the second half of 2023.

The Eurozone is now in technical recession, with data showing two consecutive quarters of negative growth.

But while macro has led crypto by the nose over the last two years, that narrative power is starting to break down in favour of 2023 being the year of the US spot Bitcoin ETF.

This means crypto market momentum will be weighted more heavily in favour of adoption and institutional interest as opposed to interest rates; metrics like retail trading volume, ETP market liquidity and net flows, and futures open interest are being most closely watched.

Bitcoin

The general level of positivity about institutional intent for crypto had soured after the collapse of the world's second-largest crypto derivatives exchange, FTX, in November 2022.

That point in time coincided with Bitcoin at $15,000, less than half its market value at the end of June, and the tide appears to have turned.

BlackRock's move has been judged as evidence that, in the United States at least, BTC is the institutional capital asset that it is safe for investors to hold.

ETC Group's Physical Bitcoin ETP (BTCE) extended its lead as the largest such Bitcoin investment product in the world, with a sharp $154.4m AUM jump to $606.7m as of 29 June.

With Bitcoin briefly touching a 12 month high at $30,670 on 25 June, it is worth considering the other drivers behind the recent price rally.

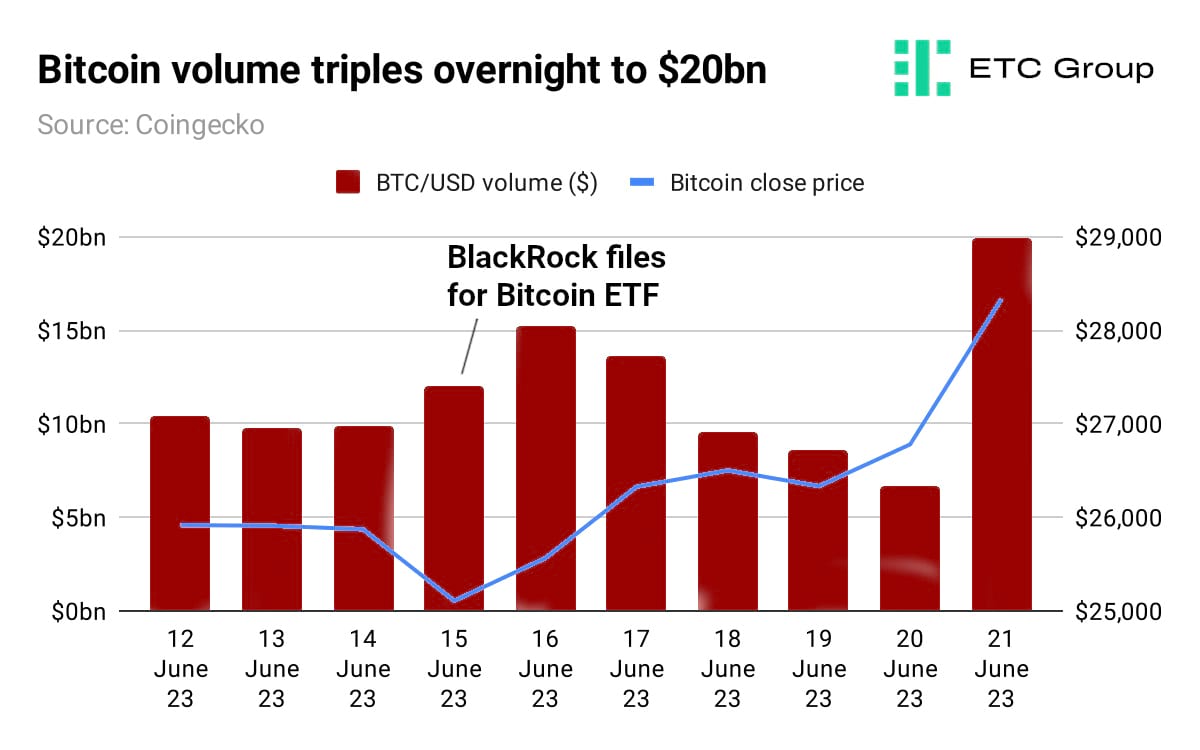

A short squeeze saw $155m of trader positions liquidated across all exchanges, spiking the spot price of Bitcoin. Retail liquidity also returned in the latter part of the month, crossing $20bn a day for the first time since April.

Trading volume, which had been crushed to two year lows amid US lawsuits against two of the largest crypto exchanges, Coinbase and Binance, rebounded strongly as more TradFi institutions laid out their stall to capture market share.

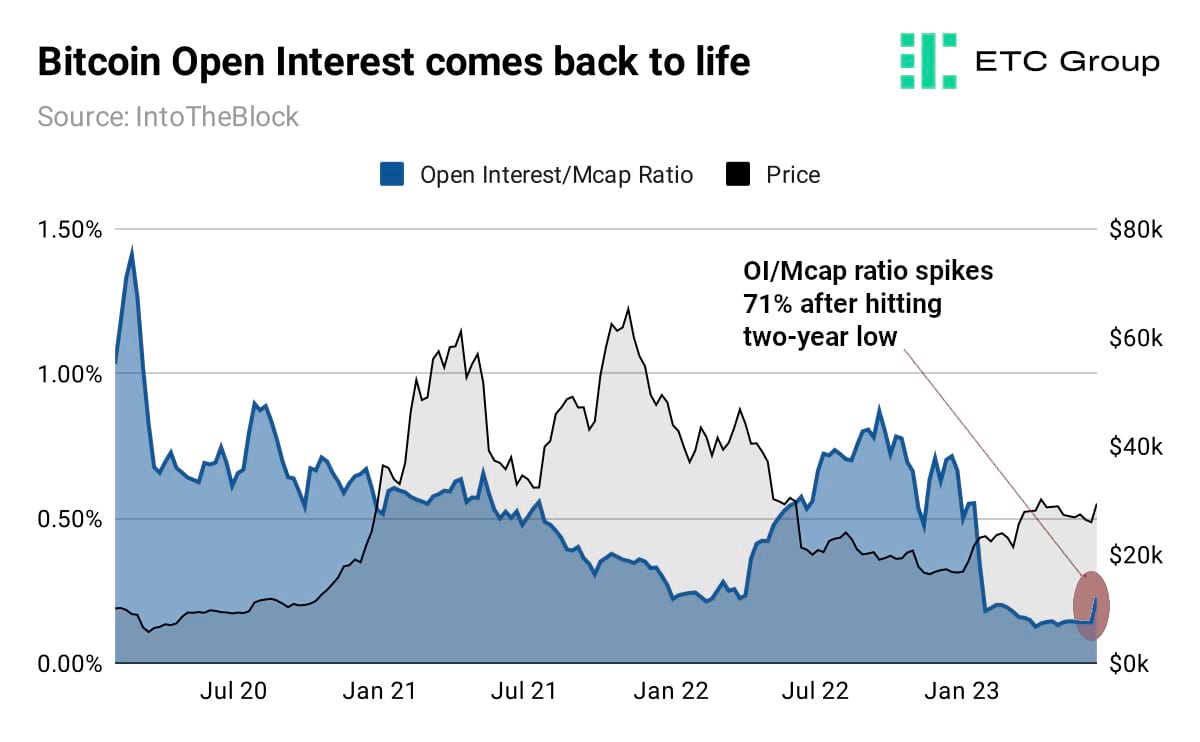

And after declining to a more than two-year low by May, in June, derivatives Open Interest as a proportion of Bitcoin's market cap jumped by 71%. Open Interest is the value of all outstanding derivatives contracts (futures and options).

More derivatives market activity suggests increased inflows and greater levels of speculation from traders.

Before the late-June spike, the Bitcoin OI/MCap ratio had declined to two-year lows.

Ethereum

Ethereum had a relatively quieter month, with the institutional spotlight firmly on Bitcoin. In the final days of June some capital rotation favoured Ether, with the price of the second-largest blockchain token climbing around 5% to its highest point since early May, with the psychologically important $2k barrier potentially on the cards.

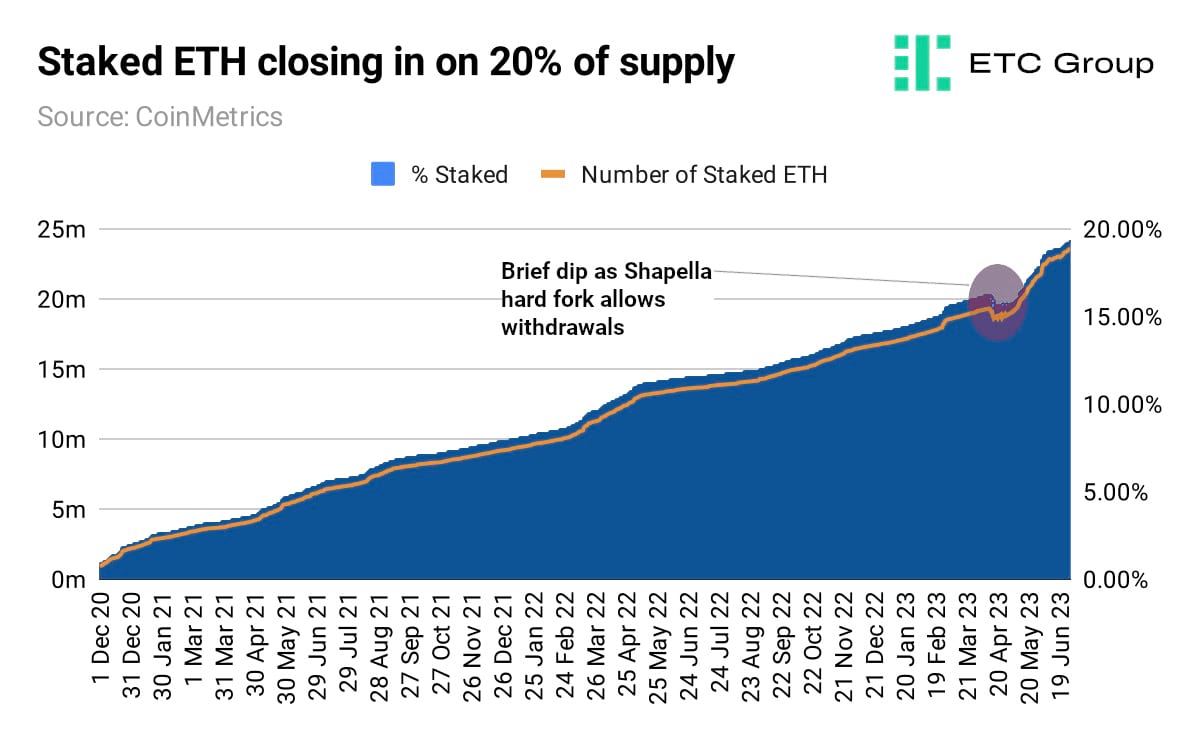

Ethereum staking on the network continued to breach all-time highs after April's Shapella upgrade allowed users to withdraw stake Ether. More than 23.5 million ETH ($44 billion) – representing 17.2% of staked supply – has been locked on the network. This figure is still well below rival blockchains such as Cardano and Solana, which boast 62% and 71% of total supply staked respectively.

Data provider Nansen's average staked ETH price comes in at $2,075, suggesting that market participants will (on aggregate) not look to withdraw ETH from the network until they reach that profit point.

Ethereum gas fees have regained equilibrium from the elevated levels witnessed in May when a single transaction cost $13.20 on average. Gas fees instead averaged $4.90 in June as network congestion cooled.

Ethereum developers have agreed the full scope of the network's “Dencun” upgrade taking place later this year. Dencun encompasses a number of upgrades to the Ethereum network including the introduction of ‘proto-danksharding' to reduce gas fees, updating the code of the Ethereum Virtual Machine (EVM), and improving the architecture of cross-chain bridges.

Altcoins

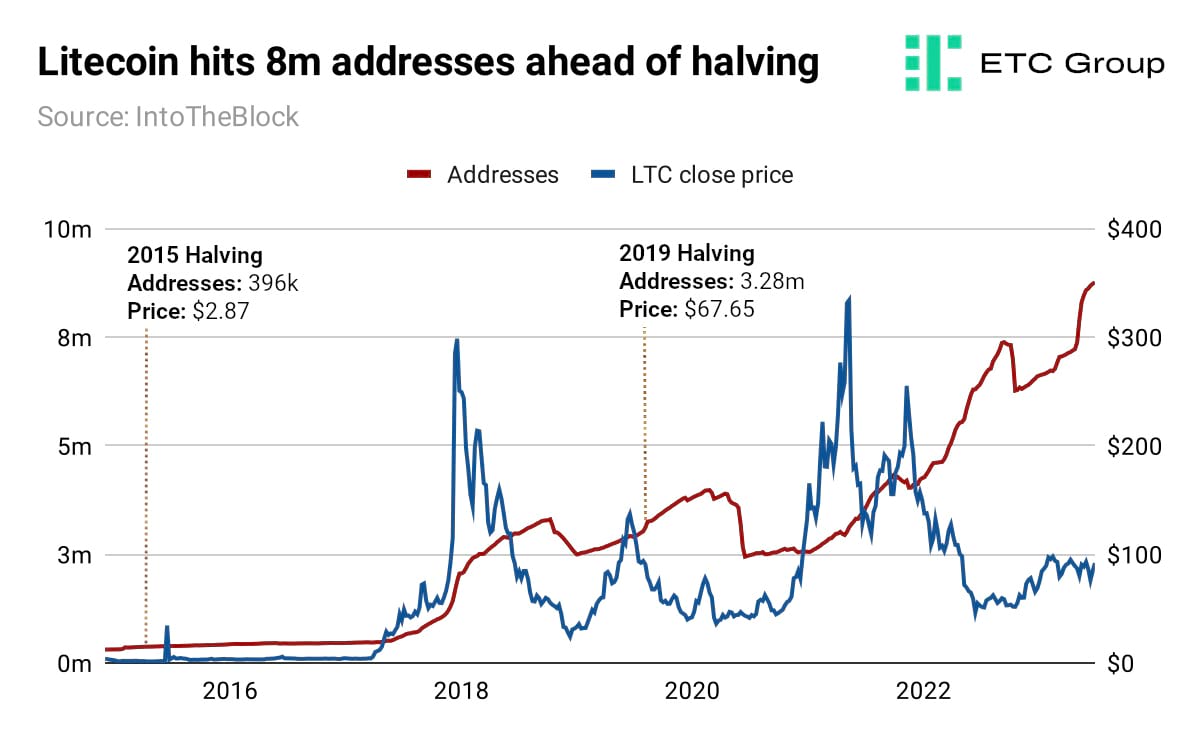

With just 30 days left until the next Litecoin halving, capital flows have been entering LTC.

The Litecoin supply has halved twice before. Firstly, on 25 August 2015, when the price of one LTC was $2.87, and secondly on 5 August 2019, when the price of one LTC was $67.65.

With each halving event, the reward paid to miners halved from the original 50 LTC per block, to 25 LTC per block. The upcoming halving will see that subsidy reduced again to 12.5 LTC per block. As it stands, LTC is trading at $108, its highest point since April 2022.

Litecoin has not enjoyed the same uplift in network activity as Bitcoin has from the introduction of Ordinals - Bitcoin based NFTs. The weekly average fees paid on the network have ranged between 85 and 140 LTC since the turn of 2021. But many in the industry see Litecoin's price moves and increased network activity as a dry run for the Bitcoin halving, which is scheduled for May 2024.

Elsewhere in altcoins, the legal action by the SEC against Binance and Coinbase - the two largest retail-focused cryptoexchanges - named 18 digital assets as securities, causing sharp dips in their market value.

The regulatory clampdown which started on 5 and 6 June caused the price of most cryptocurrencies other than Bitcoin and Ethereum to grind lower, with coins like Solana (SOL), Cardano (ADA), and Poliygon (MATIC) shedding up to 25% of their value.

The fall in their value was compounded by popular trading apps like Robinhood and eToro ending support for these tokens classed as securities by the SEC.

The resilience of the market was firmly on display as most of these losses retraced over the course of the month.

Institutional blockchain

June saw the publication of the annual Trackinsight Global ETF Survey - supported by J.P. Morgan and State Street - which surveyed 549 professional investors that allocate roughly $900bn across ETF strategies. It found that 48% were considering single asset crypto ETPs.

This may not be surprising, given Bitcoin has achieved annualised 78.1% returns over the last seven years at the cost of similar annualised volatility.

Interbank messaging service SWIFT announced it was trialling the transfer of tokenised assets on Ethereum. SWIFT processes nearly $5 trillion in daily volume and is responsible for half of all cross-border transactions.

More than a dozen financial institutions – including Citi, BNY Mellon, and BNP Paribas – will participate.

The initial phase will see SWIFT explore token transfers between the Ethereum mainnet, the Sepolia testnet, and a custom permissioned blockchain.

This application of blockchain is a compelling instrument in private markets that often wrestle with liquidity constraints. Tokenisation can involve the fractionalisation of illiquid assets into smaller units that can be traded more freely to enhance liquidity.

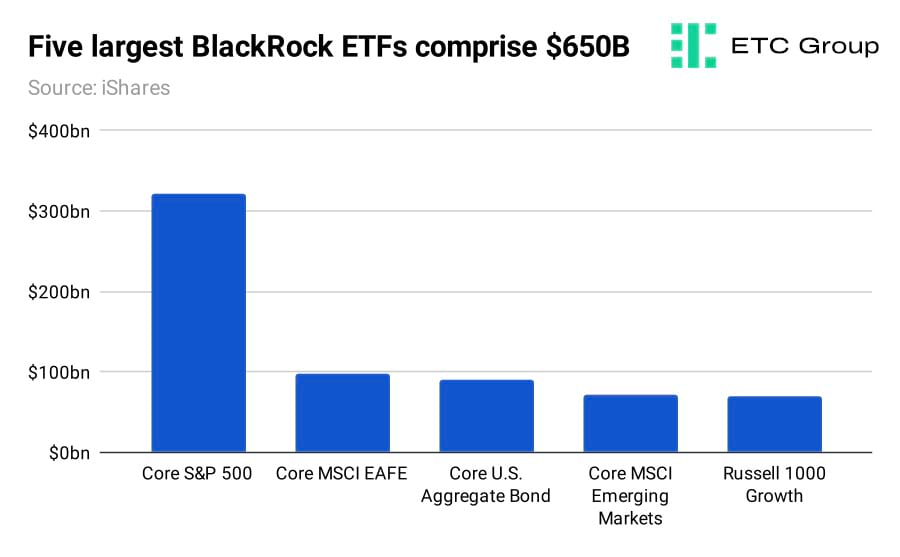

The theoretical market size for tokenised securities is vast. For example, if BlackRock's five biggest ETFs were tokenised, it would mean an additional $650 billion of assets would be available on the blockchain.

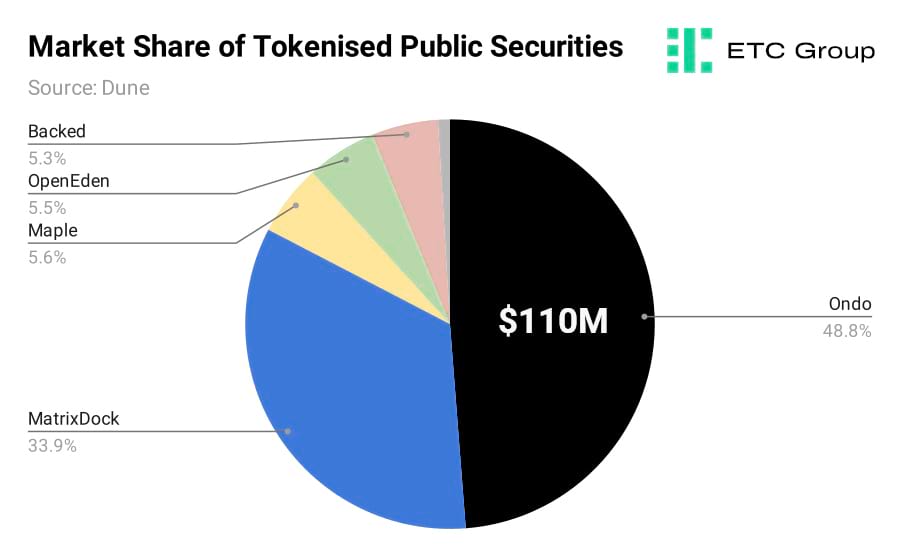

2023 has been marked by exploding interest in tokenised public securities tracking financial instruments like bonds, equities, and ETFs. The market cap for tokenised public securities has ballooned to $240 million – a 115% increase from Q1 2023.

Crypto-native issuers like Ondo Finance, MatrixDock, and Maple Finance issue tokens as ERC-20 tokens on Ethereum that are fully collateralised by their underlying assets. Ondo products dominate the tokenised asset space with a market cap of $110 million that accounts for nearly 50% of the market share.

Ondo has issued more than one million units of tokenised bonds benchmarked to the iShares Short Treasury Bond ETF (NASDAQ: SHV ). Meanwhile, providers like Swarm offer synthetic exposure to Apple stock while Backed tracks the iShares Core S&P 500 ETF (NASDAQ: CSPX).

Tyrone Lobban, head of J.P. Morgan's Onyx digital assets platform, has said that “tokenisation is a killer app for traditional finance”. Onyx has processed almost $700 billion in transactions in short-term loans using a permissioned version of the Ethereum blockchain.

More than half of the companies in the Fortune 100 are now developing blockchain initiatives in a bid to stay competitive, Coinbase reported.

The Fidelity/Charles Schwab/Citadel Securities-backed EDX Markets crypto exchange also launched on 20 June. The inclusion of Bitcoin Cash as a tradable token sent the price of the Bitcoin fork spiralling upwards by more than 100%, such is the weight afforded to tokens implicitly backed by Tradfi crypto venues.

The world's largest crypto VC fund, a16z, showed its hand in June by announcing a move to base its new European offices in London. This appeared a curious decision at the time, given the tensions at the heart of the UK crypto scene.

And certainly given the earlier proclamation made by the UK Treasury Select Committee which recommended to regulate crypto products in Britain as gambling products, rather than as financial services, as urged by the IOSCO.

However, the passing into law of the Financial Services and Markets Act 2023 (see below) may prove a gamechanger for crypto in the UK.

Regulation

Global

The IMF is working on a cross-border CBDC platform that enables transactions between countries. They want central banks to commit to a unified framework for digital currencies that allows for global interoperability. There are currently 114 central banks that are trialing or rolling out CBDCs.

Americas

In the first few days of June, the SEC took regulatory action against both Binance and Coinbase. The SEC filed 13 charges against Binance and its founder Changpeng Zhao (CZ). The charges include mishandling of customer funds, misleading investors, and failing to register under securities laws.

The enforcement body also accused Coinbase of operating as an unregistered broker, exchange, and clearing agency since 2019. To that end, the SEC deemed a range of crypto tokens to meet the criteria of the Howey Test, signifying their status as securities.

Against this backdrop, Federal Reserve Chair Jerome Powell said, during a hearing on monetary policy at Capitol Hill, that crypto appears to have “staying power” and intimated that he views stablecoins as a viable medium of payments.

Powell's remarks on digital assets in Washington are a marked change from suspicions toward the sector voiced by sections of the federal government – notably the SEC – and business leaders in recent years. In 2017, BlackRock CEO Larry Fink vilified Bitcoin as an “index of money laundering”. This month, BlackRock applied to become the first issuer of a spot Bitcoin ETF in the US under the stewardship of Fink.

Europe

In late June the Law Commission of England and Wales released its final report on cryptoassets, making several key recommendations. The Law Commission made waves in November 2021 when it asserted that smart contracts did not require additional legislation to be enforceable and could be treated under current English and Welsh law.

The Commission's main findings were that

a) The definition of a crypto token is “a type of digital asset that uses cryptography - the process of coding information so that it can be transferred securely.”

b) There should be a third type of personal property that specifically references crypto - defined as a “digital object” - alongside existing British property laws that recognise ‘a thing in possession' and ‘a thing in action', such as a legal claim.

c) Crypto collateral should be subject to a new and bespoke legal framework.

d) Rishi Sunak's government should create a panel of industry experts to keep up with the relentless pace of crypto and blockchain opportunities.

The Financial Services and Markets Act 2023 has passed through the House of Commons and House of Lords and as of 28 June is now law.

As CityAM reported, the fine print means that crypto will for the first time in the UK be recognised as a regulated financial activity. It will eventually allow for regulated stablecoins to be used as a payment mechanism.

The Treasury is consulting with industry on the best way to approach crypto regulation, with a main set of regulations now expected in 2024.

The bill should address the policy black hole surrounding the digital asset sector by mandating the government tailor regulations for service providers like crypto exchanges, brokers, and custodians by extending the authority of the Banking Act of 2009.

It is a welcome development for policymakers, regulators, and stakeholders that all agree on the need for a coherent framework in the United Kingdom - in direct contrast to the United States that has suffered a loss of market confidence in its absence.

The advent of the bill entering law will be an important leap for the UK in trying to establish itself as a global digital asset hub and keep pace with the European Union. The EU officially adopted its landmark Markets in Crypto Assets (MiCA) legislation in May 2023.

Asia Pacific

The Monetary Authority of Singapore published a whitepaper on 21 June investigating the use cases of programmable money and payments referred to as Purpose-Bound Money (PBM). The Singaporean regulator is exploring the creation of a custom blockchain protocol that can be used by financial institutions to interact with virtual assets.

HSBC has become the first bank in Hong Kong to allow its clients to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong stock exchange. The move builds on last month's decision to allow retail traders to trade crypto on licensed venues in Hong Kong.

The trickle of headlines around the US falling behind Asia in terms of crypto policy has become a flood. The Japan Times notably lead with: “Crypto tumult in US may be a boon for Japan”, noting that “the US downturn could be an opportunity for the nation to grow its presence in the field…US regulators are increasingly tightening controls, but that doesn't mean the same thing will happen in Japan.”

Friendlier tax regulations could be the first way Japan will attempt to attract crypto businesses to its shores. It has work to do, since profits from cryptoasset trading are classed as miscellaneous income and as such are taxed at a maximum 55%, compared to the 20% paid on capital gains and dividends from equities. The country's tax office this month confirmed that issuers will not pay taxes on unrealised gains.

Even mainland China (the same government that banned crypto transactions and Bitcoin mining) has hinted at a looser policy towards cryptoassets. The investment arm of the Bank of China in June issued $28m of tokenised debt on Ethereum.

Into the Metaverse

There has been renewed interest in the virtual reality (VR) space since Apple released its Vision Pro headset at the WorldWide Developers Conference in early June. This is the $2.9 trillion company's first major foray into the metaverse with a mixed reality headset that combines VR and augmented reality (AR).

A recent survey by PayPal showed that an estimated 38 million people now spend $28 billion a year on metaverse gaming. Apple's AR future could be the crossover device that brings the first 100 million users into the metaverse.

The efforts of blue chip tech companies like Apple, Meta, and Microsoft, to facilitate virtual immersion have cast the spotlight back on the metaverse industry at a time when companies participating within it have been benefiting from the AI stock boom.

This is because a number of firms building metaverse gateways also have a hand in AI.

Nvidia is the best example of this, with the semiconductor giant making graphic processing units (GPUs) for both metaverse headsets and the supercomputers needed to power AI language models like ChatGPT.

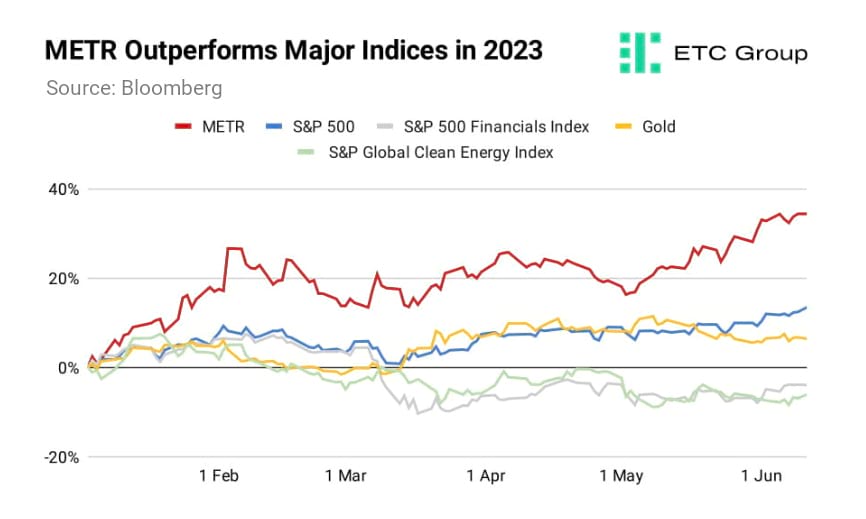

ETC Group's metaverse ETF (LSE:METR) has reaped the reward of these background events and has outperformed most sectors this year. The ETF has risen 34% this year, with its gains almost triple the 13% achieved by the S&P 500 this year. METR has also bolted ahead of gold's 6% gains this year.

Thematic indices like the S&P 500 Financials Index, that represents banking stocks, and the S&P Global Clean Energy Index, also had contrasting performances to ETC Group's Metaverse ETF.

The constituents of METR are rebalanced on a quarterly basis and the investment vehicle provides exposure to 51 leading companies including Nvidia, Apple, and Meta.

These companies have spearheaded gains for the ETF this year with their pivots toward AI. Consequently, METR arguably doubles as an AI ETF by providing exposure to this year's zeitgeist.

Outlook

From a price perspective, Bitcoin has consolidated in the $30k to $31k region after a run up that has seen it add 85% to its market cap since the turn of 2023. The next major resistance level sits at $32.5k, and if there is a retrace to the $28k region, analysts would want to see a strong bounce from here to confirm this bullish trend.

Between BlackRock, HSBC, Deutsche Bank and the 20 June launch of the Fidelity/Citadel/Charles Schwab-backed EDX Markets exchange there are approximately $25 trillion in assets under management that will be eligible to buy Bitcoin in the near future.

This increases the number of competing groups and entities that are moving to either initiate or improve their Bitcoin holdings. This makes the second half of 2023 an opportunity for savvy investors to accumulate as multiple catalysing factors for Bitcoin price appreciation start to coalesce.

With the 2024 Bitcoin halving less than a year away, and long-term holders gripping tightly to their accumulated stockpiles, this growing narrative that there are ever fewer coins available for sale is likely to strengthen.

The SEC vs Coinbase case, which will have far-reaching implications, will be heard on 13 July. We expect this case to run for several months at the very least, well beyond the 2024 Presidential elections.

But with accelerating institutional focus, not simply on ETFs, but on the myriad trading and arbitrage opportunities available, and the positive regulatory developments in almost every country outside the United States, the upside for Bitcoin and crypto markets in general appears unshackled as we head into the second half of the year.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.