Goldman Sachs aims to strengthen its toehold in the blockchain sector

It's open season on blockchain companies and Goldman is bargain hunting.

Goldman Sachs has voiced its intention to spend tens of millions of dollars to acquire or invest in struggling crypto companies and exchanges after the unravelling of FTX floored valuations.

The investment banking giant earned $21.6 billion last year and its eagerness to invest in the sector illustrates the long-term value it sees in the integration of traditional finance houses with blockchain technology and digital assets.

FTX filed for Chapter 11 bankruptcy in the US in November and has left up to a million retail and institutional creditors with their funds either frozen or missing entirely after it was exposed that the exchange was illegally appropriating customer funds to make investments via its sister company Alameda Research.

Documents released by the Financial Times reveal that the bulk of the Web3 hedge fund's $5.4 billion investment portfolio was made up of equity in illiquid crypto projects but also included bizarre investments in a fertility clinic and vertical farming practice.

In light of this, Goldman's head of digital assets, Mathew McDermott, has emphasised that the digital asset space, now more than ever, needs the entry of better capitalised, trustworthy, and regulated counterparties.

He added that Goldman Sachs does “see some really interesting opportunities, priced much more sensibly” given that the underlying technology supporting digital assets remains unimpeded by malicious actors.

To this end, the CEO of Goldman, David Solomon wrote an article in the Wall Street Journal on 6 December titled “Blockchain Is More Than Crypto” that reaffirms his belief in the technology and explains why regulated financial institutions are best positioned to harness it. This view is already reflected in the bank's plans to build its own private blockchain to facilitate faster settlement times for bond transfers.

Goldman Sachs is unlikely to be the only industry name sizing up the chance to scale up its presence in the blockchain space. Eye-watering valuations after the most recent crypto drawdown will have garnered the attention of a host of companies with the financial runway to do so.

According to Arthur Cheong of crypto VC DeFiance Capital, the bankruptcies of FTX and Three Arrows Capital – earlier this year – have created a 50% discount on the valuations of more than two-thirds of the top venture deals struck over the past two years.

Goldman was the first major bank to make an over-the-counter (OTC) Bitcoin transaction back in March and has already dedicated $690 million in capital to blockchain companies that provide services such as cryptoasset data analytics, staking, and compliance. Last month, Goldman launched its own data service Datonomy – in collaboration with MSCI and Coin Metrics – to help institutional clients categorise the spectrum of digital assets in the space.

But some of Goldman Sachs' peers are more sceptical about what exactly digital assets can bring to traditional finance. The CEO of Morgan Stanley recently stated that he can't put “intrinsic value” on crypto while the head of HSBC said the bank has no plans to veer into crypto trading or investing for retail customers.

Nevertheless, Goldman looks adamant to sail across the old world of legacy finance to the virgin shores of digital assets to gain an edge over its competitors as it pioneers the intersection of traditional finance and blockchain technology.

Ethereum's Shanghai hard fork on the horizon

Ethereum developers are targeting March 2023 to roll out the Shanghai hard fork. Forks take place when the development team behind a blockchain want to upgrade the chain and are often necessary for smart contract platforms to stay in step with technological innovations.

For many market participants, the most important upgrade that will accompany the Shanghai fork will be a code known as EIP 4895 that will finally allow users to withdraw staked ETH from the Beacon Chain.

Since staking first began on Ethereum with the launch of the Beacon Chain in December 2020, users have been unable to withdraw the rewards they have earned in exchange for guaranteeing the security of the network.

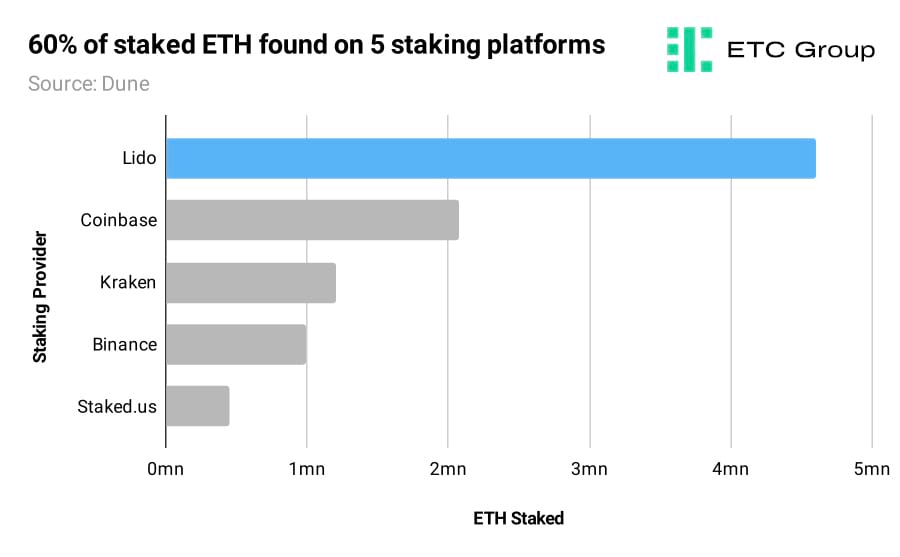

At this time, 15.6 million ETH is currently staked on the network and it constitutes 13% of the total circulating supply of Ethereum. Users can deposit the digital asset onto the Beacon Chain by using the services of a number of staking platforms.

The liquid staking protocol Lido is the favoured portal of choice for most users while the top five staking providers are responsible for more than half of the ETH deposited on the network.

During the 151st All Core Developers call on 8 December, Ethereum engineers signalled their willingness to prioritise making withdrawals from the mainnet a reality as soon as possible.

But this decision may come at the cost of other potentially necessary upgrades that could be put on pause as developers channel their energy toward the labyrinthine task of safely releasing staking rewards.

Other upgrades that could be deemed auxiliary include a proposal to implement the EVM Object Format (EOF). This would constitute an update to the Ethereum Virtual Machine (EVM), the environment where Ethereum is able to execute smart contracts and where all its transactions are processed.

There have been no major upgrades to the EVM in years despite the deepening need for maintenance work on it – especially given the hefty technological changes that came with the Merge.

Developers are also at odds over whether they should introduce proto-danksharding during the Shanghai fork or during another hard fork that is scheduled for a later date in 2023. The introduction of sharding would split the Ethereum network into “shards” and thereby bolster its transaction speeds and lower gas fees by reducing congestion.

The Shanghai hard fork will be the sequel to the Merge that saw the Ethereum network switch from Proof of Work (PoW) to the energy-efficient Proof of Stake (PoS) consensus mechanism in autumn.

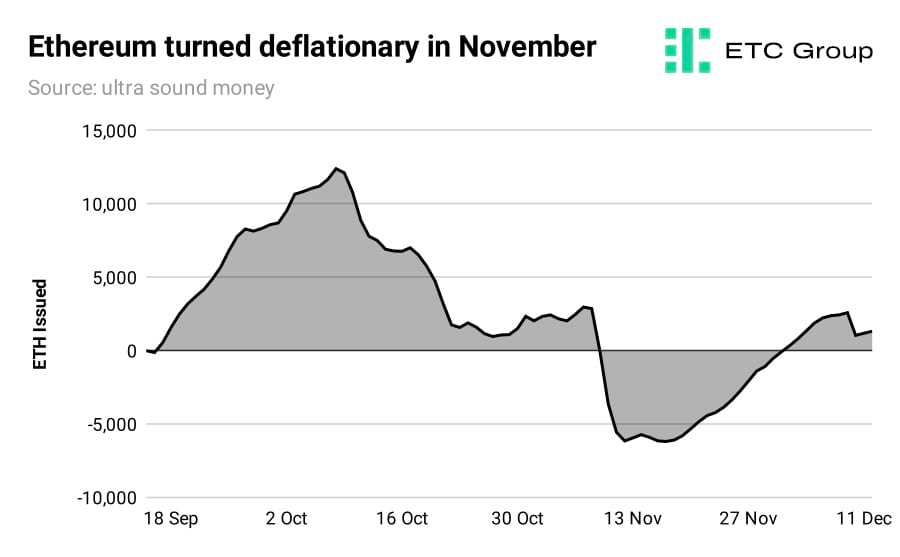

One of the most successful achievements of the Merge has been the reduction in the inflation rate of Ethereum. Gas fees paid for transactions on the network are being burnt and removed from circulation at a faster pace than ever before.

In November, this led the supply of Ethereum to briefly turn deflationary for the first time. This meant that the amount of ETH being burnt on a daily basis surpassed the amount of ETH being created as rewards for validators.

However, Ethereum became inflationary in December again due to a lack of user demand. Large volumes of transactions on the Ethereum network lead to more ETH being removed from the system while muted network activity translates into less ETH being burnt in the form of gas fees.

Nevertheless, it is estimated that Ethereum's transition to PoS has reduced its annual inflation rate to 0.005% as opposed to the issuance rate of 3.6% it would still hold if it relied on its former PoW model.

In contrast, Bitcoin has a yearly issuance rate of 1.7% and its supply will remain inherently inflationary until all 21 million BTC is mined some time in 2140.

Bitcoin Miner Distress

A combination of elevated energy prices, tightening credit conditions, and precipitous dips in the price of Bitcoin have left miners in a state of disarray with the share price of most public miners down 80%-90% YTD.

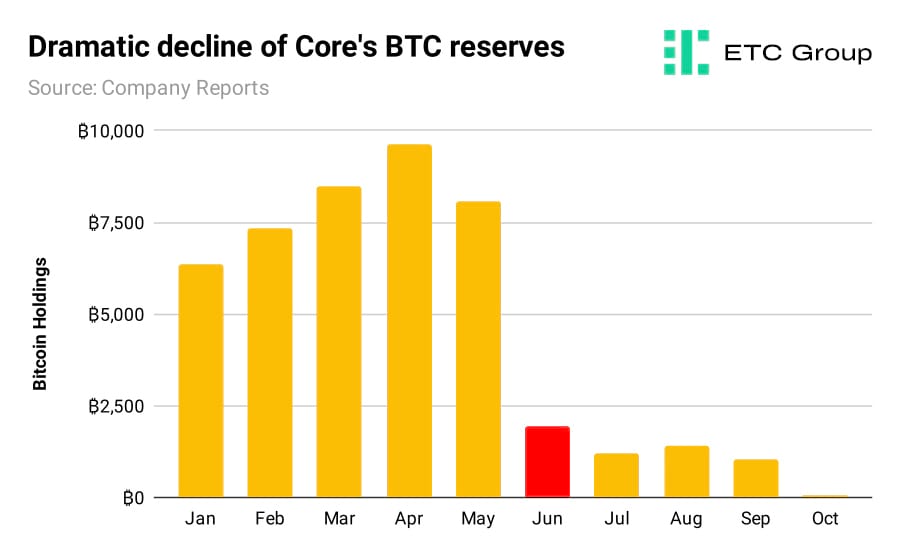

Severely impacted operating performances have led to some high-profile liquidity crunches. Core Scientific (NASDAQ: CORZ) has cautioned that its cash may dry up by the end of the year and that it could seek shelter through bankruptcy protection.

A range of once-profitable miners are struggling to raise capital and pay back high-interest loans they took out at the height of the bull market in 2021.

Core Scientific was once the largest public holders of Bitcoin in the mining arena. But fortunes turned in June when it was forced to sell the majority of its reserves for $23,000 per Bitcoin – about one-third of the price Core could have sold for in November 2021.

Since then, the company has been offloading more Bitcoin than it has been generating. The proceeds from the sales have gone toward retiring debit and maintaining liquidity, but the miner still held only $32 million in cash by the end of October according to a company report.

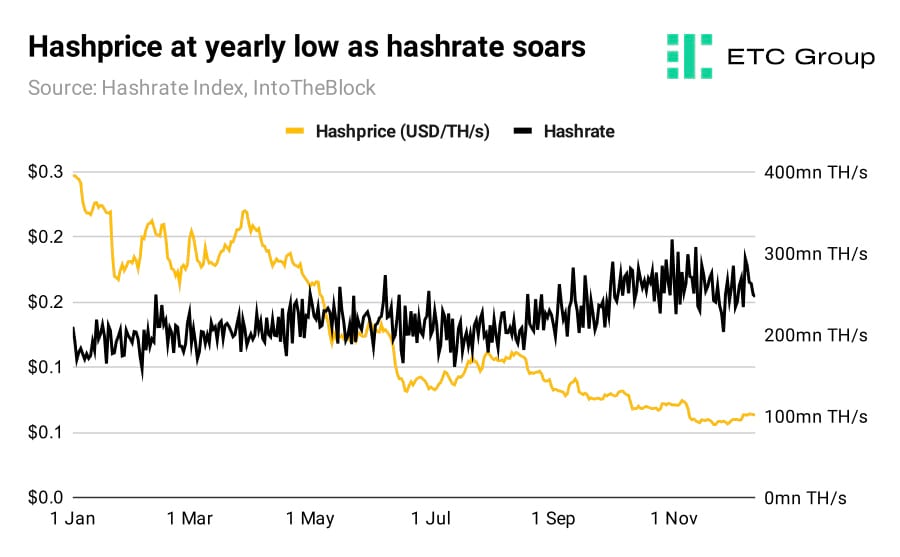

The decline in Bitcoin's hashprice – the amount of dollars earned from computing energy used to earn block rewards – has not made life any easier for miners.

Bitcoin's hashprice has dropped by 76% since the opening of the year – from $0.25 TH/s to $0.06 TH/s. Meanwhile, the hashrate has grown by almost a third this year. This means new mining rigs are still coming online and competing with older miners for rewards.

Compute North Holdings, a data service provider for miners and blockchain companies, has been another victim of discouraging macroeconomic conditions. It had to file for bankruptcy in September after it couldn't meet obligations to creditors and keep up with soaring energy prices.

With this in mind, Bitcoin miners that go insolvent and shut down operations present an opportunity for better-positioned miners to acquire struggling rivals. The green miner Crusoe Energy capitalised on this buying opportunity in November when it purchased $1.5 million of distressed assets from Compute North.

Mining giant Marathon Digital (NASDAQ: MARA) is also considering securing assets like ASIC miners and other hardware from Compute North. Marathon was one of Compute North's biggest lenders and is also looking to recover $22 million worth of deposits from the company.

Marathon is one of the most capitalised players in the market and has over 11,000 BTC in its treasury. Its CEO, Fred Thiel, has said that Marathon is parsing out strategic buying opportunities as its competitors continue to feel the sting of Crypto Winter. In a similar vein, Riot Blockchain (NASDAQ: RIOT) is also eyeing expansion in 2023 as it looks to snuff out deals at fire sale prices.

Marathon Digital and Riot Blockchain are both part of ETC Group's blockchain ETF (KOIN>) that offers investors exposure to the most innovative global companies making use of and advancing blockchain technology.

Markets

The FOMC meeting on 14 December demonstrated a loosening to a tightening cycle that saw the Federal Reserve raise rates by 75bps on four consecutive occasions this year. The lower rate of 50bps announced by the central bank was welcomed news for some market participants.

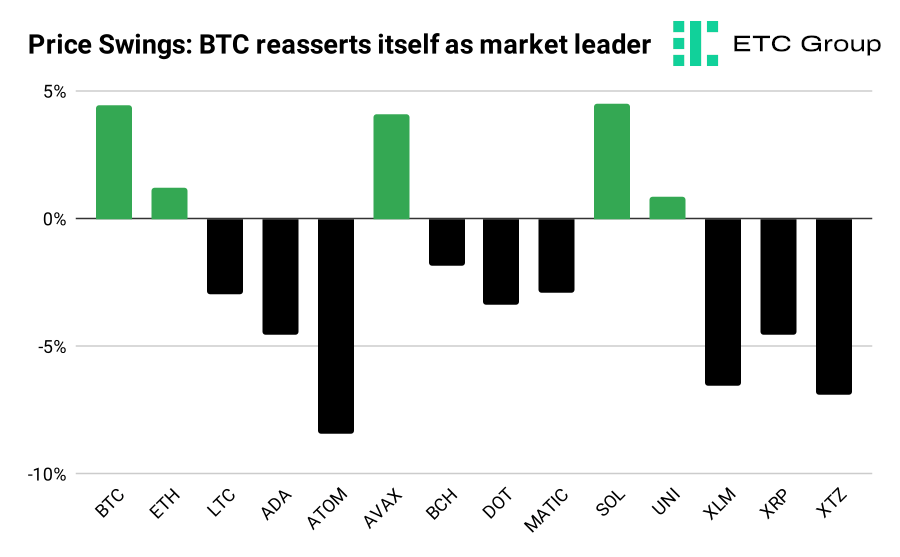

Many traders had already priced in the probability of a smaller interest rate bump before the meeting. This fuelled substantial gains for smart contract platforms like Solana (SOL) and Avalanche (AVAX).

Other altcoins like Polkadot (DOT) and Polygon (MATIC) withstood modest losses despite the bullish news that car manufacturer BMW will be on the lookout for a chain on which to mint NFTs and set up a virtual reality store.

Bitcoin re-established its position as the flagship of the market as its price climbed by 4.5% from $16,900 to $17,700 on the back of the news. Investor confidence in the digital asset space's safe haven asset is returning as concerns over FTX contagion begin to wane.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.