Ferrari Accelerates Toward Digital Assets

Ferrari is now accepting Bitcoin and other digital assets, such as Ethereum and the stablecoin USDC, to purchase its luxury sports cars in the US before rolling the scheme out in Europe.

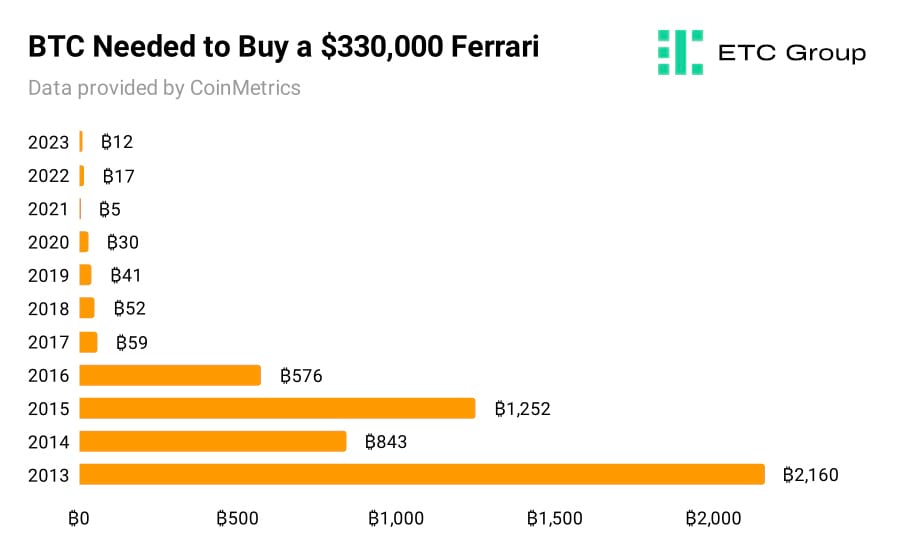

One of the most popular Ferrari models in the US is the 710 horsepower F8 Tributo which is priced at around $330,000. The value Bitcoin has accrued over the last decade means that customers can now buy the sports car with 12 Bitcoins.

The carmaker will use crypto payments company BitPay to manage the conversion of cryptocurrencies into fiat on behalf of stakeholders. This is necessary to shield buyers and sellers involved in the transaction from swings common to the emerging asset class.

Ferrari joins other blue-chip companies that have been accepting Bitcoin as a means of payment for years. Microsoft first allowed US-based users to buy Windows content with Bitcoin back in 2014 and is today considering allowing payments with the world's largest digital currency to go towards acquisitions on its Xbox gaming online store.

In 2019, telecom giant AT&T also began to accept cryptocurrencies in return for its services, using the same payments facilitator Ferrari does in BitPay. Two years ago, Tesla announced that it was processing Bitcoin payments until the facility was suspended because of environmental concerns surrounding Bitcoin mining.

A spokesperson for Ferrari said the decision to recognise selected digital assets as a form of payment came only after the company was confident in the efforts being made by the crypto industry to reduce its carbon footprint.

According to recent research, more than 52% of the energy used to create new Bitcoins and confirm transactions on the network now comes from sustainable sources of energy like hydro, wind, and solar.

Ferrari also underlined that the decision to embrace Bitcoin payments is a direct response to demands from a younger client base that has amassed significant wealth by investing in cryptocurrencies early and more traditional customers that have invested in crypto to diversify their portfolios.

To this end, a joint Finra-CFA Institute report demonstrated that 55% of American investors between the ages of 18 to 25 are crypto owners. Crypto is the dominant investment type for young Americans, with only 41% of the cohort investing in individual equities.

Meanwhile, a survey of traders, portfolio managers, and managing directors conducted by analytics firm Coalition Greenwich in September showed that 48% of individuals interviewed said that their firms had crypto as part of their AUMs.

There is a clear correlation between the rising ownership of crypto – among younger, traditional, and institutional investors – and the growing recognition of Bitcoin as a payment method by some of the largest companies. The momentum behind this adoption suggests that the role of cryptocurrencies in everyday transactions is set to expand in the coming times.

A Spot Bitcoin ETF Approval Dry Run

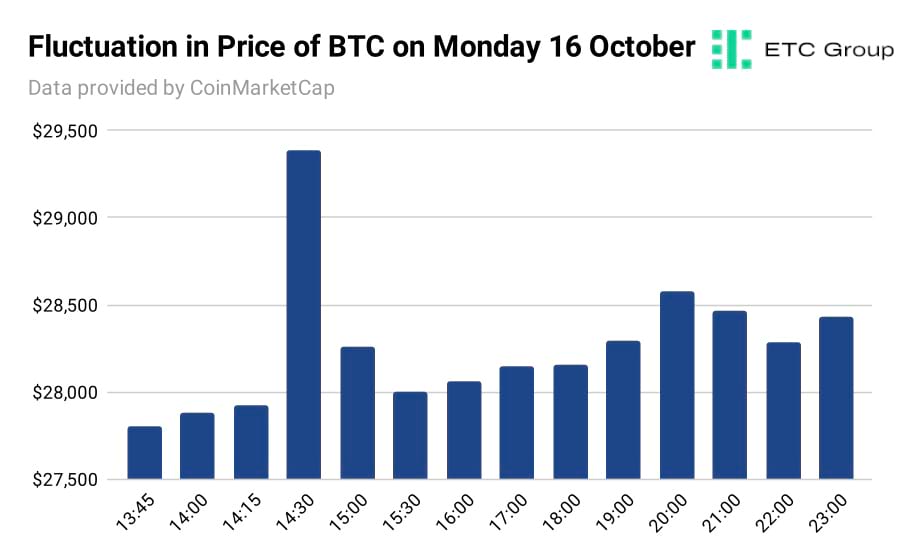

An unsubstantiated tweet from a crypto media agency confirming the approval of BlackRock's spot Bitcoin ETF application sent the market into a momentary frenzy on Monday.

Bitcoin soared by 10% to almost $30,000 within the first minutes of the news breaking on X, formerly Twitter, with trading volume reaching a fever pitch. However, the rally was a flash in the pan.

Observers quickly pointed out that the news of the SEC approving a Bitcoin ETF was unfounded, and the price of Bitcoin and other digital assets saw swift corrections. The media outlet that initially broke the news issued a retraction and apology for the spread of misinformation not long after.

But it was too late, and the damage had been done. The extreme market volatility saw $105 million in trading positions liquidated: $73 million in shorts and $32 million in longs.

The incident highlighted stark flaws in the crypto journalism sector. A baseless tweet about Bitcoin ETF approval sparked market interest, but the hastiness of other media outlets to amplify this unverified news without due diligence created a snowball effect that led to a flash rally and an even faster crash.

The episode was also a sobering reminder of how infantile the digital asset market can still be. It took one tweet to move a $550 billion market cap asset like Bitcoin by 10% before reversing course.

The most damaging consequence of the incident would be if it is used as evidence against the approval of a spot Bitcoin ETF by the SEC. Gary Gensler could use the wild volatility seen on Monday – and the potential market manipulation – as ammunition to argue that the sanctioning of a spot Bitcoin ETF would endanger investors.

Conversely, the flash rally and crash could be seen as a dry run for the price trajectory of Bitcoin when ETFs collateralised by the asset are actually approved.

It is likely that the price rally was caused mostly by vigilant retail investors trying to load up on Bitcoin as fast as they could. In contrast, the CEO of BlackRock, Larry Fink, only found out about the fake news regarding his firm's Bitcoin ETF application much later in the day.

It is hard to gauge where the price of Bitcoin would have landed once pension funds, family offices, and hedge funds around the US got time to factor in and digest the news – had it been true.

Fink asserted that the rally was “an example of the pent-up interest in crypto” that saw sidelined investors jump on a “flight to quality”.

In spite of Monday's volatility, all indications suggest that we are near the eve of a spot Bitcoin ETF coming to market. For one thing, the SEC and its Chair Gary Gensler have lately been rebuked in the courtroom and by the House Financial Services Committee for the unaccommodating approach taken towards digital asset regulation.

This was apparent on 13 October when the SEC decided against appealing a district court ruling that said it must reconsider Grayscale's application to convert its $16.7 billion Bitcoin Trust, GBTC, into a spot Bitcoin ETF.

It appears that the SEC is also actively interacting with the dozen or so asset managers that have filed for Bitcoin ETFs on the basis of the rolling amendments being made to their applications.

The changes to applications focus on bringing more transparency to themes like custodial arrangements, pricing sources, and risk disclosures, with Fidelity being the latest party to resubmit an amended application along these lines.

A spot Bitcoin ETF gives professional and institutional investors in America exposure to Bitcoin through a familiar product structure without having to take custody of it. In Europe, products with structures akin to spot Bitcoin ETFs already exist.

For instance, ETC Group Physical Bitcoin (BTCE) is fully backed by the underlying asset, trades on several European exchanges, and boasts $1.3 billion in value traded this year - making it the continent's most liquid Bitcoin ETP.

The SEC delayed its decision to render judgment on the fate of a raft of Bitcoin ETF applications on 17 October. It will get another chance to do so in January 2024, with the final deadline for its decision set for March next year.

Tokenisation: Finance's Quiet Digital Revolution

Last week, JPMorgan launched its blockchain-based collateral settlement platform, known as the Tokenized Collateral Network (TCN). The platform is built on the bank's in-house Onyx blockchain.

JPMorgan aims for its clients to use assets like equities and fixed income as collateral on TCN so that it can be transferred between parties using a more secure method.

The tokenisation of assets is characterised by rapid settlement times and less friction between counterparties because they take place on blockchains – the same technology underpinning digital assets like Bitcoin.

The first transaction on TCN saw BlackRock successfully convert shares in one of its money market funds into digital tokens. The tokens were transferred to Barclays as collateral for an OTC derivatives trade between the two financial institutions.

In April, JPMorgan disclosed that it had already processed close to USD $700 billion in tokenised short-term loan transactions executed on its Onyx blockchain. But it isn't the only bank rushing to tokenise traditional finance.

Last year, Goldman Sachs unveiled its digital asset platform that allows institutional clients to issue financial securities in the form of digital assets, while Citi introduced similar services last month.

Most financial institutions are currently tokenising securities on permissioned blockchains, which means only whitelisted clients can access these products and services. However, there are also firms issuing tokenised securities on public blockchains that can be accessed by the wider public.

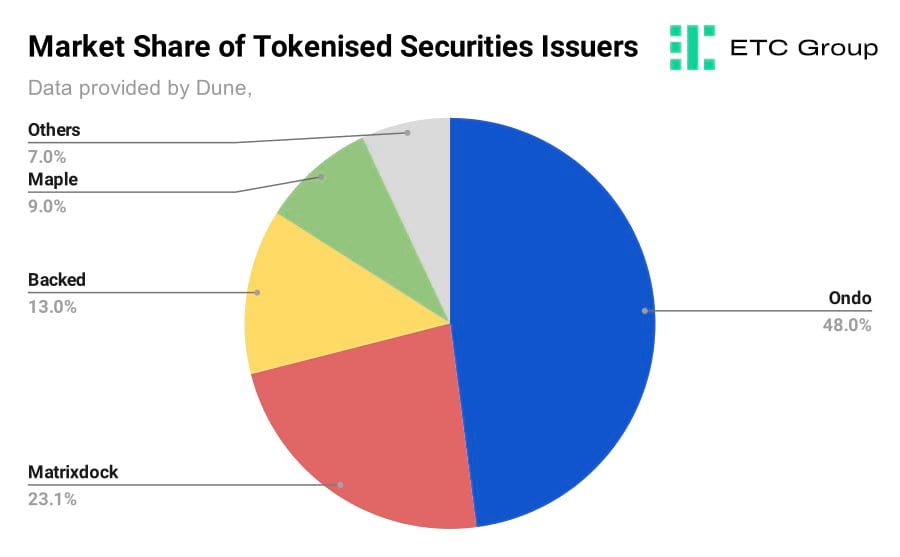

Tokenised public securities are fully collateralised and are growing in popularity. The market cap for tokenised public securities, like equities and bonds transacted on blockchains, stands at $358 million – accounting for a 113% increase in the last six months alone.

Franklin Templeton became the first asset manager in the US to use a public blockchain to execute transactions and record share ownership when it launched its Franklin OnChain US Government Money Fund (FOBXX) on the Polygon chain.

Crypto company Ondo Finance is the largest issuer of tokenised public securities and controls 48% of market share with a market cap of $172 million (Pie Chart). Ondo's main product is its Ondo Short-Term US Government Bond, which is backed by the iShares Short Treasury Bond ETF.

Outside cheaper and faster settlement times for transactions, tokenisation also provides more liquidity to securities because they become available to trade around the clock and tap into global markets, inviting a broader range of investors. The tokenisation of real-world assets is expected to be an ever-growing trend over the next decade, with the industry estimated to exceed $10 trillion by 2030.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.