Litecoin betting hits all time high with halving days away

Bullish intent has gripped Litecoin traders with the blockchain's halving now just days away.

On 3 August the Litecoin block reward for miners will be cut in half, an event that occurs once every four years and has only happened twice before.

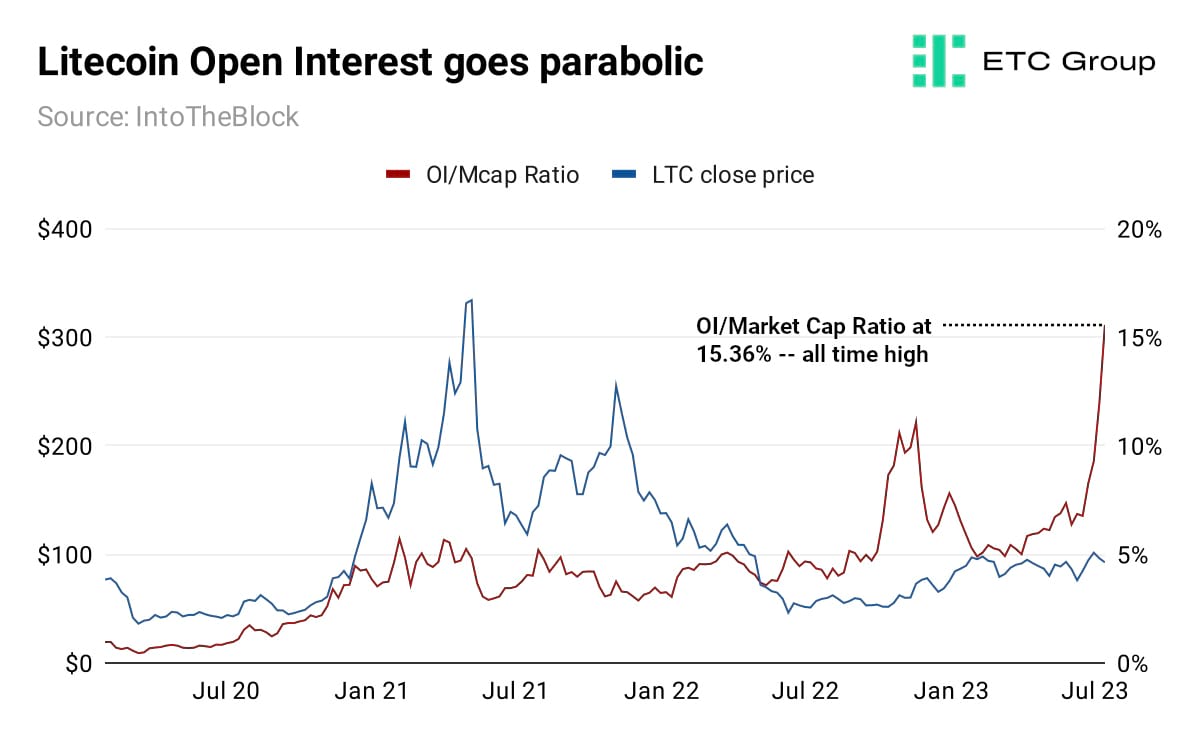

Open Interest (OI) as a percentage of Litecoin's market cap hit 15.36% on 24 July, an all time high. OI is the total sum of outstanding derivatives contracts (including options and futures) for a particular asset. OI increases as capital flows into traders' derivative positions, and declines as capital flows out.

IntoTheBlock data shows there are $1.06bn in outstanding Litecoin derivatives contracts, the highest since May 2021. In fact, there have only been nine days in Litecoin's entire trading history when OI was higher: 15-16 April 2021, and 5-12 May 2021.

Litecoin is the 12th largest cryptoasset by market cap, valued at $6.89bn.

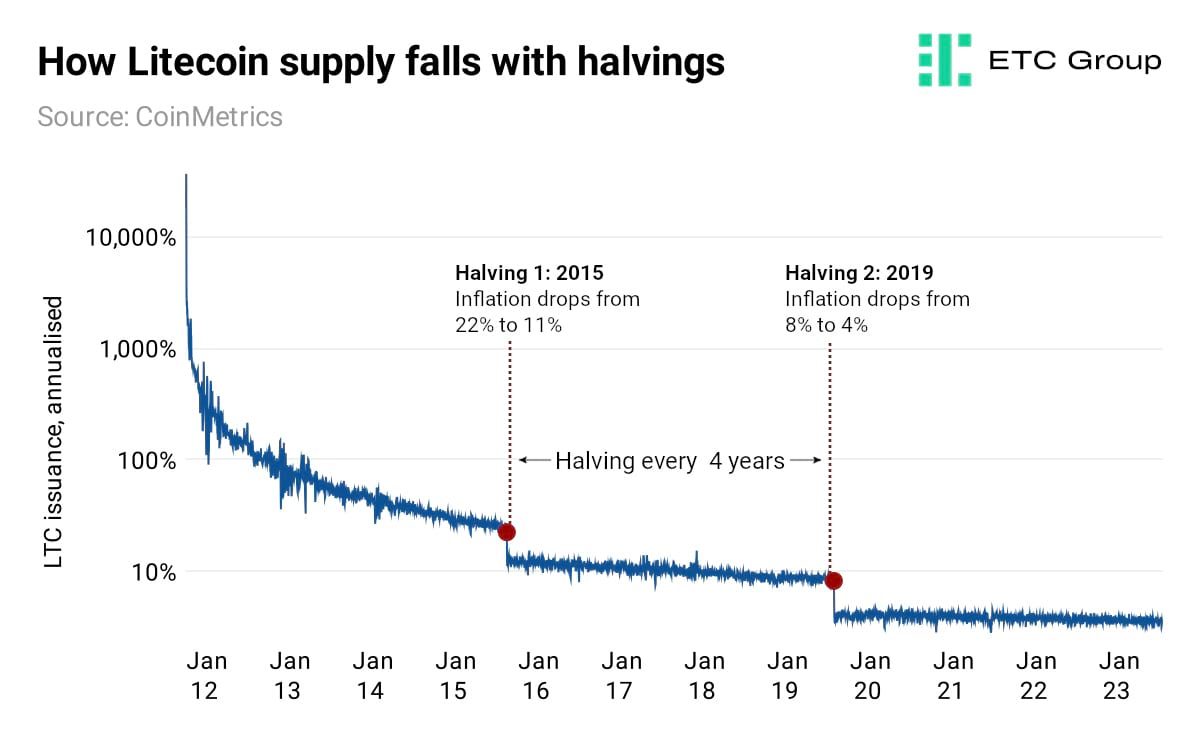

Just as with Bitcoin, this predefined halving event occurs once every four years, lowering the rate at which new LTC is created.

At launch in 2011, the Litecoin network paid a 50 LTC incentive to miners for processing each block of transactions. On 25 August 2015, Litecoin underwent its first halving with the block reward cut from 50 LTC to 25 LTC. Annualised supply inflation dropped from 22% to 11%. On 9 August 2019, the second Litecoin halving, with rewards cut from 25 LTC to 12.5 LTC, saw annualised supply inflation fall from 8% to 4%.

Litecoin was created in 2011 by the MIT-educated software engineer Charlie Lee, who helped develop some of the early iterations of Chrome OS and Youtube at Google, going on to become the Director of Engineering at Coinbase, leaving in 2017 to develop Litecoin full-time. As the name suggests, Lee's intention for Litecoin was to be a ‘light' version of Bitcoin: an altcoin more suited to internet payments than the original cryptocurrency, with faster transaction times and lower fees.

To account for these faster block times, Litecoin's block reward halving occurs once every 210,000 blocks, compared to Bitcoin's 840,000. Litecoin generates blocks at four times the speed of Bitcoin. This keeps both chains on a similar trajectory, with halvings occurring once every four years or so.

The moves being made by traders now are widely seen as a dry run for what will happen when Bitcoin's next halving occurs in April 2024. At that point, Bitcoin's annualised supply inflation will drop from 1.74% today to around 0.78%.

We expect heavy BTC accumulation, as well as futures and options volume to peak ahead of the Bitcoin halving. Certainly the addition of a swathe of new US spot Bitcoin ETFs would aid that move: If BlackRock were to invest 1% of its assets under management into Bitcoin, that would reckon on $800bn to $900bn of new assets coming into the space.

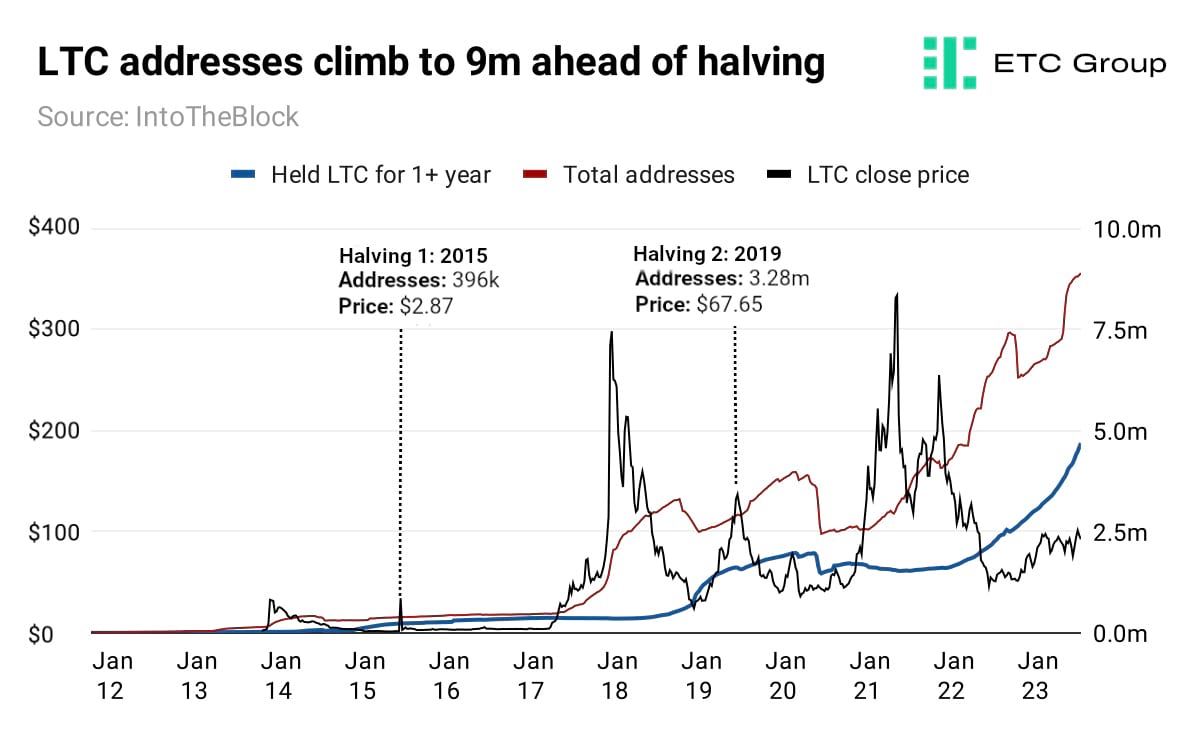

The number of addresses holding Litecoin continues to grow at pace. The total is now on the verge of 9 million, having only crossed the 8 million mark two months earlier.

Some of this comes from Litecoin's institutional kudos. When PayPal announced in October 2020 it would start supporting cryptoassets, only four of the most recognised projects were chosen: Bitcoin, Litecoin, Ethereum and Bitcoin Cash. Similarly, the Fidelity/Citadel-backed EDX Markets listed the same four cryptos at its launch in mid-June 2023.

While the spot price of Litecoin remains some 74% below its record $347 high at the peak of the last bull market, prices have been climbing steadily since the middle of last year. And investor interest in the 12th-largest cryptoasset by market cap is careering upwards with the quadrennial halving now firmly in sight.

Polygon ups pressure on Ethereum Layer 2s with POL whitepaper

Ethereum scaling solution Polygon has released a whitepaper proposing to reinvigorate its network and replace native token MATIC with a new ERC-20 token called POL.

POL will be capable of being staked across multiple chains within the Polygon ecosystem and serve as a single token for all of Polygon's interoperable chains: Polygon Proof of Stake (PoS), zero-knowledge Ethereum Virtual Machine (zkEVM), and Supernets.

This will allow Polygon's blockchain infrastructure to boast greater connectivity by being connected by a single token.

Traditionally, Polygon's primary goal is to improve speeds and reduce the costs of transactions on Ethereum by acting as a Layer 2 (L2) – a decentralised platform built on the main Ethereum chain.

Ethereum's token standards and developer tooling have become adopted as the industry standard for blockchain infrastructure. There are currently many developer teams vying to make their L2 the industry standard method of interacting with Ethereum.

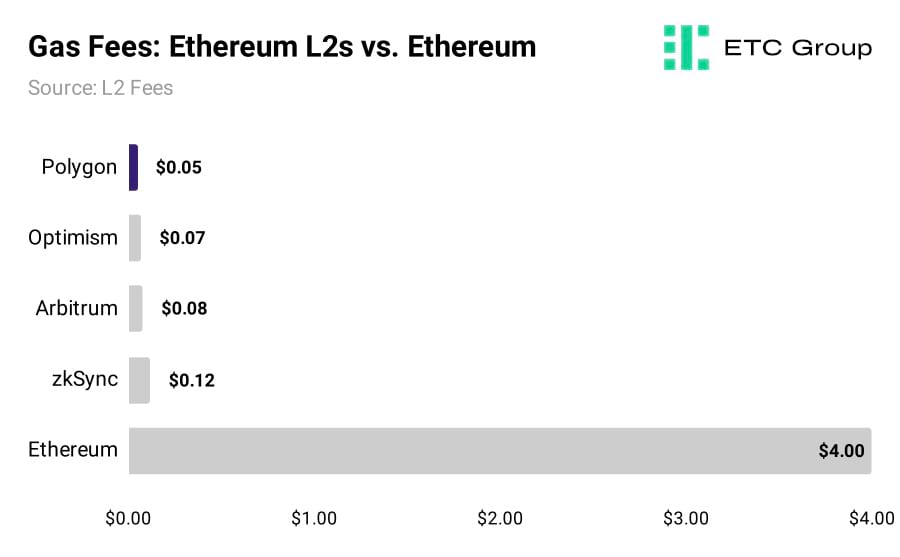

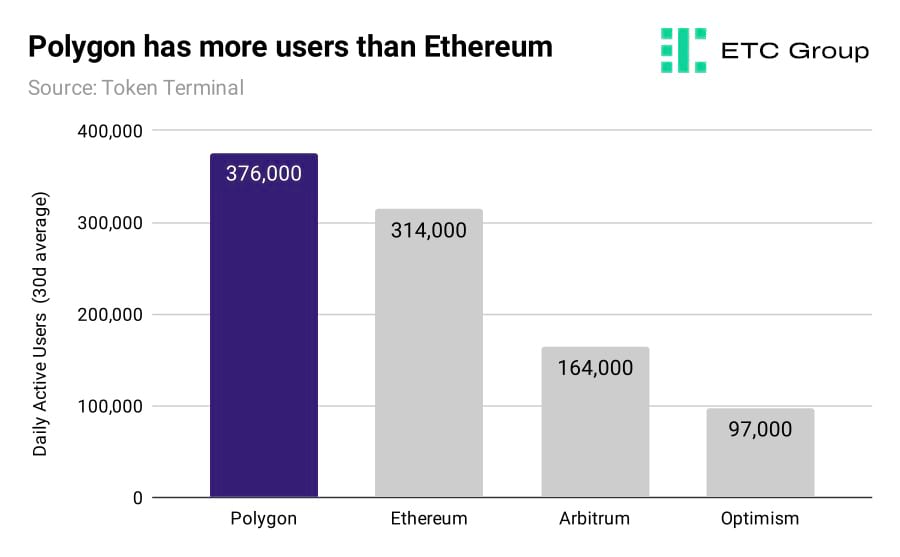

It is presently cheaper to use Polygon than its primary rivals for market share like Optimism and Arbitrum.

Ethereum L2s like Polygon, Optimism, and Arbitrum act as safety valves for the base layer by relieving pressure on the Ethereum network. Transaction fees on Polygon are almost 100x cheaper than sending ETH on the Ethereum network

Taking an analogy for a moment: if Ethereum is the crypto motorway for transporting tokens to and from the places they need to go, L2s are the bypass roads that avoid costly tolls. Neither bypass roads nor L2s have any economic value without their primary transportation route, and each works to improve traffic flows and alleviate congestion.

If the Polygon community passes the proposal, MATIC will be deprecated and MATIC holders will gain POL in exchange on a 1:1 basis.

Token holders would be required to send their MATIC tokens to a specific smart contract, which would then return an equivalent number of POL tokens. MATIC token holders will have four years to do this, the whitepaper notes.

There may be more competition coming to Polygon, Optimism and Arbitrum soon, too. Mobile-first blockchain Celo has proposed to end development of its own Layer 1 blockchain and pivot towards becoming a Layer 2 for Ethereum.

Blockchain VCs return to blow cobwebs from summer vol doldrums

While trading volumes have dulled and market prices remain in tight ranges in the weeks after BlackRock's Bitcoin ETF filing, there is one part of the space that has picked up again after a long layoff: venture capital funding.

As with any other market, crypto traders prefer periods of higher activity and higher volatility, as it creates more opportunity for mispricings and arbitrage, and more opportunity for profit.

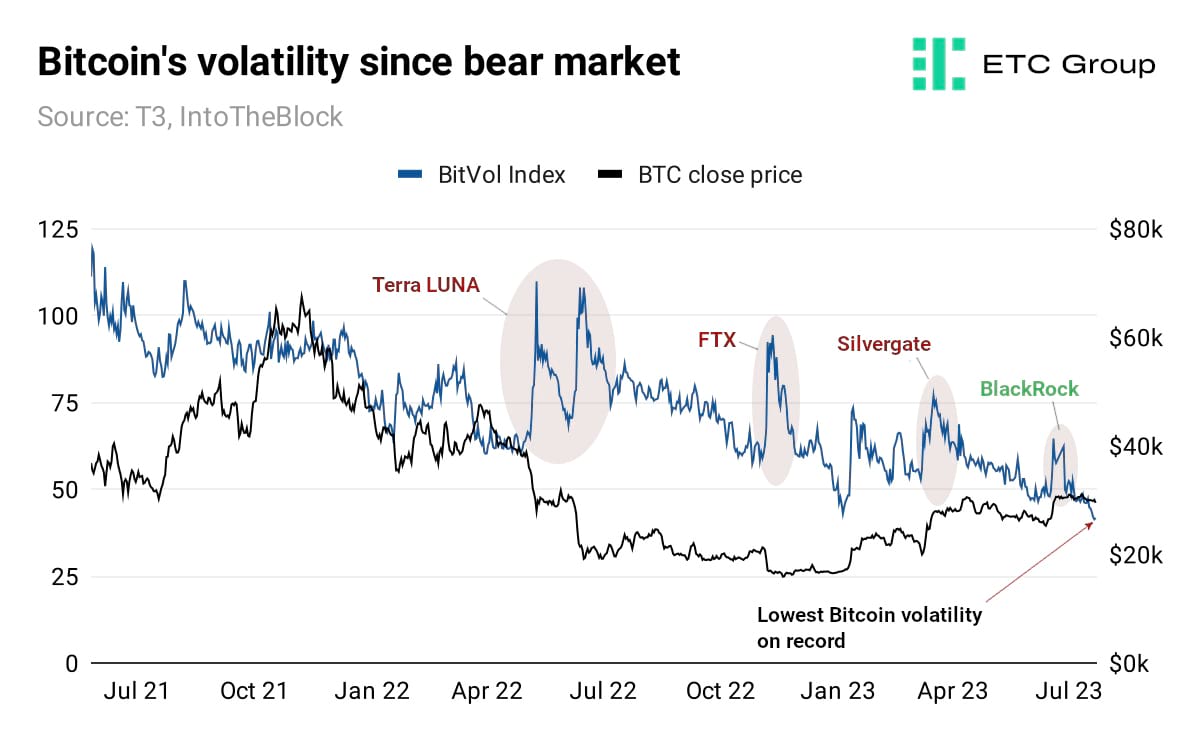

The T3 BitVol index measures the expected 30-day ahead volatility by using BTC option pricing, linearly interpolating between the expected variances of the two closest expiry dates.

Spikes in market volatility tend to be event-driven and are reactions to both perceived positive and negative situations: as with FTX in November last year; the collapse of Silvergate Bank in March; and BlackRock filing for US spot Bitcoin ETFs in mid-June.

We can see that volatility - by any measure - is the lowest on record for Bitcoin markets. Periods of extreme low volatility are like a coiled spring, and the longer volatility remains low, the more violently it tends to expand upwards when a market-driven event occurs. This is the position we find ourselves in currently.

One part of the market however is gaining pace: crypto venture funding. After being crushed throughout 2022's brutal bear market, institutional investor activity is starting to pick up again.

Futureverse, the AI and metaverse startup, closed a $54m Series A this week, making it the biggest recent funding recipient in the crypto and Web3 space.

Crypto stalwarts Polychain Capital closed an initial $200m raise, with reports suggesting the total figure could rise as high as $400m. CoinFund closed a $158m Web3 investment fund to invest in early-stage crypto startups, telling Bloomberg that the fund size was larger than the one the investment fund initially set out to raise.

While in Q1 2023 funding for crypto projects was down some 80% from Q1 2022, according to Crunchbase, VCs have plenty of dry powder waiting to be deployed, and lower market valuations for startups mean that

funders can be more discerning with applicants compared to previous cycles…raising the quality of entrepreneurs competing for more limited funds,

CoinFund's chief investment officer Alex Felix said.

These crypto-native institutional moves suggest that interest and funding rounds are starting to pick up ahead of year-end macro narratives around a more positive macro environment, chains shifting towards Ethereum and the Bitcoin halving.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.