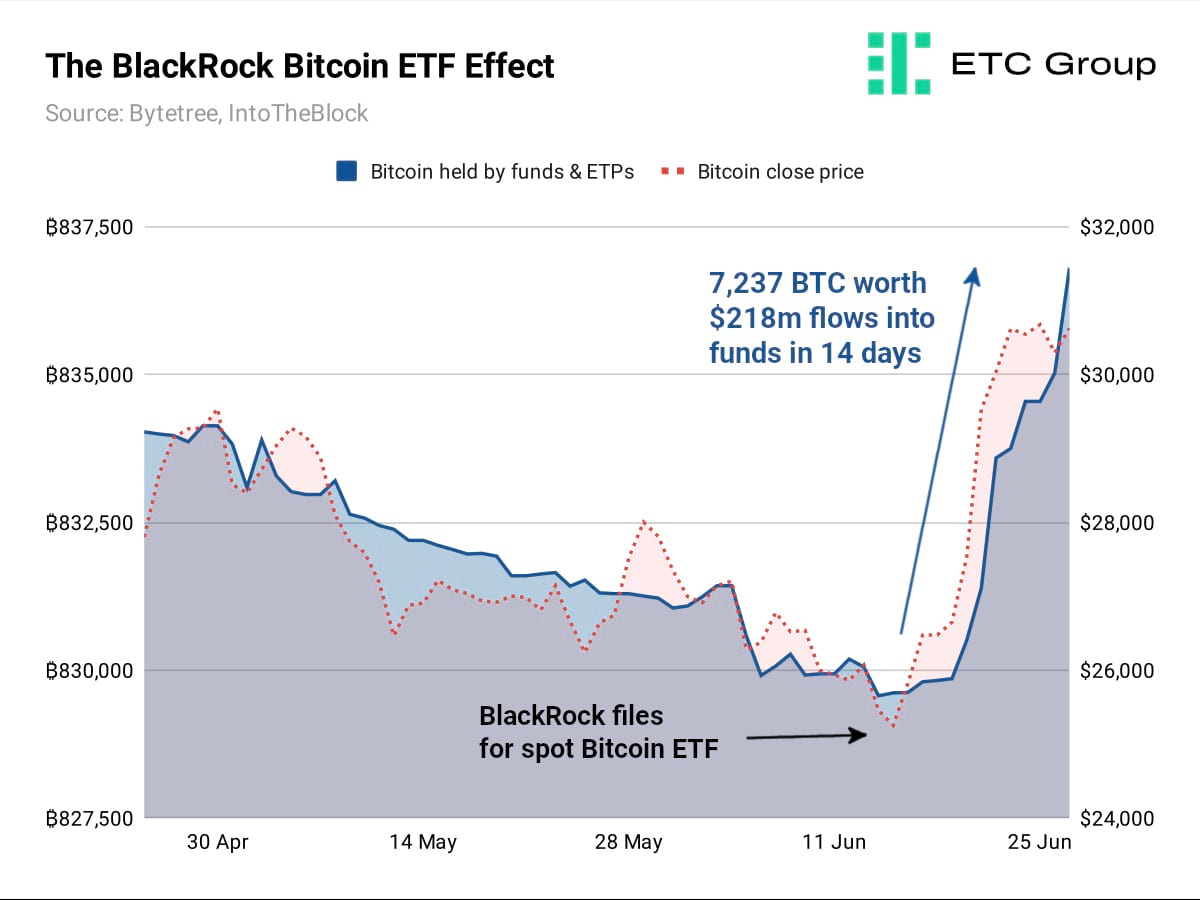

$218m flows into Bitcoin funds in 14 days: liquidity, futures spike

7,237 BTC worth $218m has flowed into Bitcoin funds since $10 trillion asset manager BlackRock filed to launch a spot Bitcoin ETF, ETC Group research shows. In the same period, the spot price of Bitcoin has appreciated 25.53%.

BlackRock's implicit stamp of approval for the capital asset - and rampant institutional interest - is not the only driver of the recent rally and a more bullish outlook for the original cryptocurrency.

We must briefly look again at the bombshell SEC cases against Binance and Coinbase in early June.

The notoriously crypto-unfriendly regulator came at the industry aggressively, attempting to make investing in these alternative assets as unpalatable as it could be, and yet markets shrugged it off.

Yes, Bitcoin dipped 20% intraday, but it has taken less than a month to absorb the losses and make back all of those gains. This is a powerful demonstration of the staying power of crypto. If Invesco or any of the asset managers who also filed for spot Bitcoin ETFs post-BlackRock thought they could push markets down to $10k Bitcoin to start their funds, they have found a far more resilient market than first assumed.

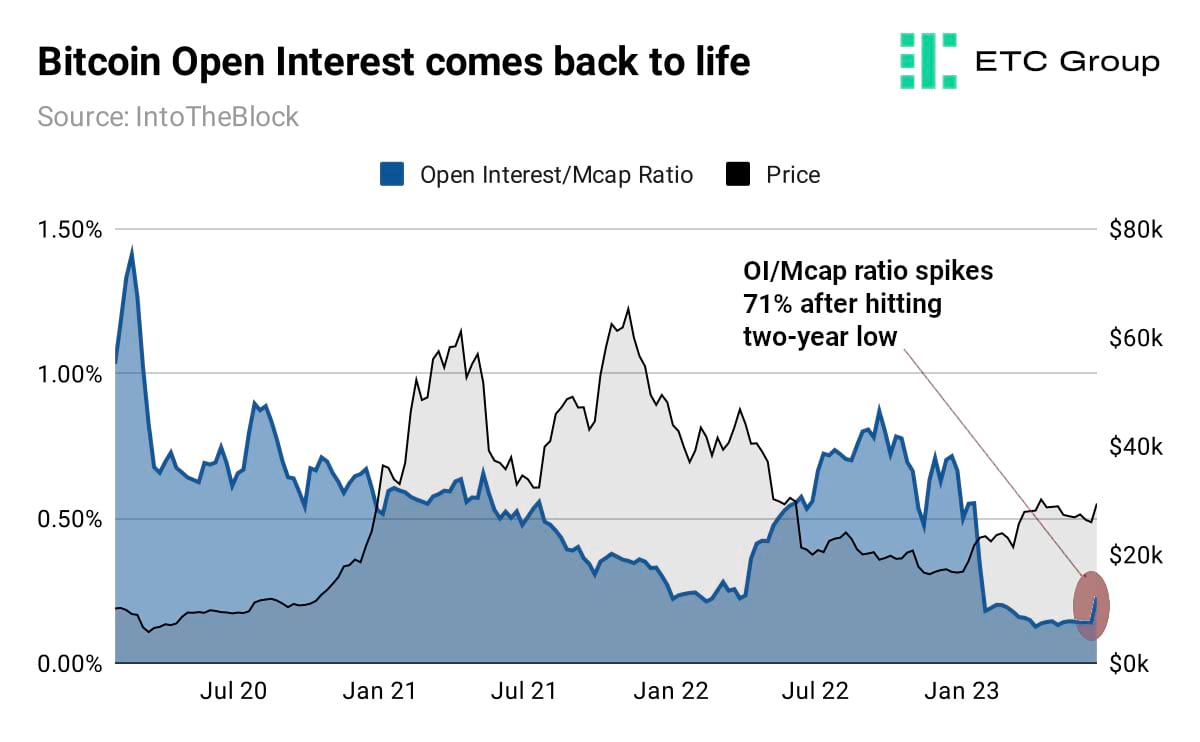

Derivatives markets have also picked up. BTC open interest as a proportion of market cap has risen by 71% after reaching a two-year low. More derivatives market activity suggests increased inflows and greater levels of speculation from traders.

Before the late-June spike, the Bitcoin OI/MCap ratio had declined to two-year lows.

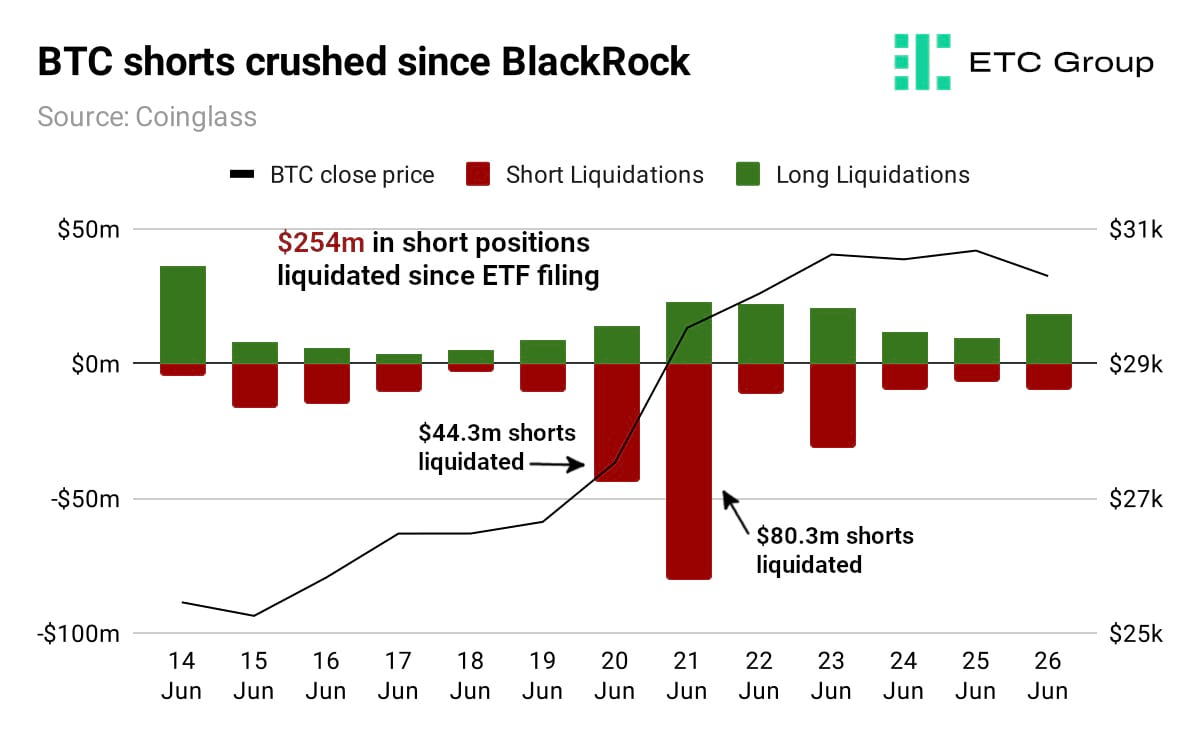

Markets also witnessed extreme levels of short liquidations as the price accelerated beyond resistance at $27k.

In total, $254m in short positions were liquidated between 14 June and 26 June, according to Coinglass data.

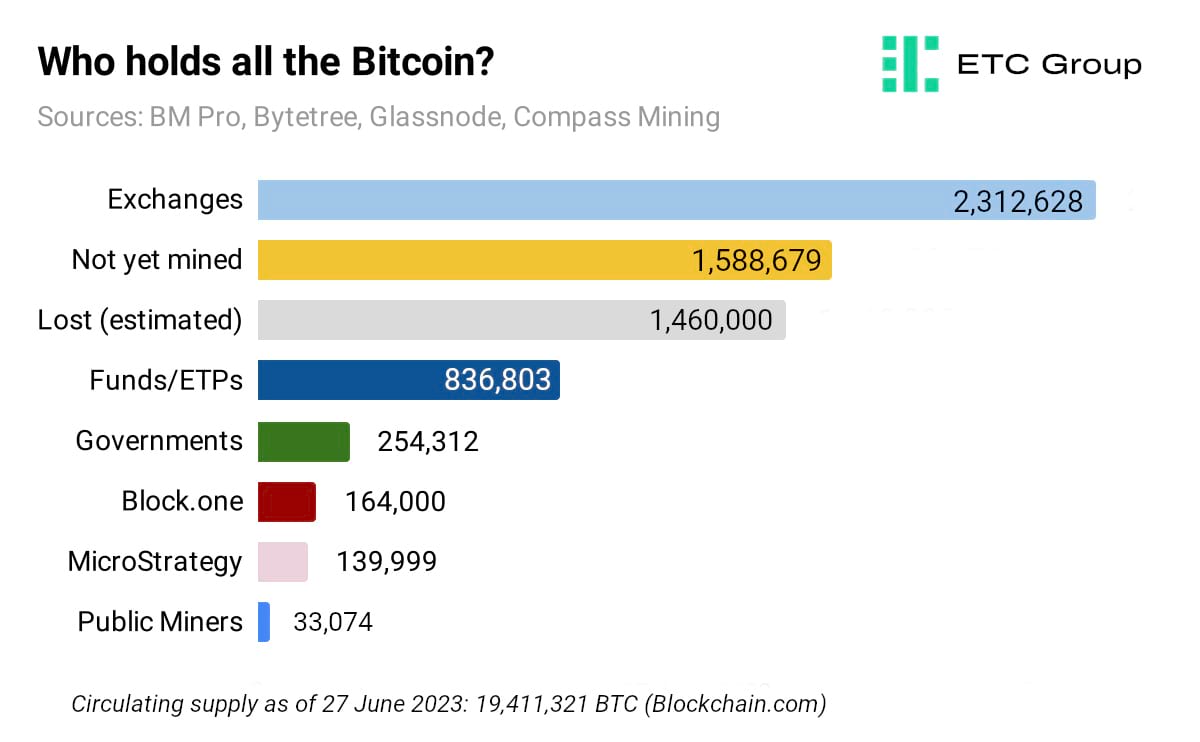

Who holds all the Bitcoin?

Recent research shows the relatively small and shrinking number of Bitcoin available for sale. By far, the largest cohort of Bitcoin holders are the long-term holders, who currently control more than 74.5% of total circulating supply.

Exchanges hold around 12% of total supply, but these figures have been falling as more long-term owners move balances off digital asset exchanges and into cold storage. Around 1.46m Bitcoin, or 7.5% of all the Bitcoin ever mined, is assumed to be lost, according to Glassnode.

Only 8.2% of the 21 million coins that will ever exist - 1,588, 679 BTC - remain to be mined.

Private and publicly-traded companies today hold roughly 3% of the total Bitcoin supply.

The largest relative recent increase has come from institutionally-focused Bitcoin funds and exchange-traded products, which now hold 4.4% of the Bitcoin supply at 836,803 BTC.

Publicly-traded Bitcoin miners are the largest net sellers of the commodity. Quarterly filings as collected by Compass Mining show this cohort hold 33,074 BTC.

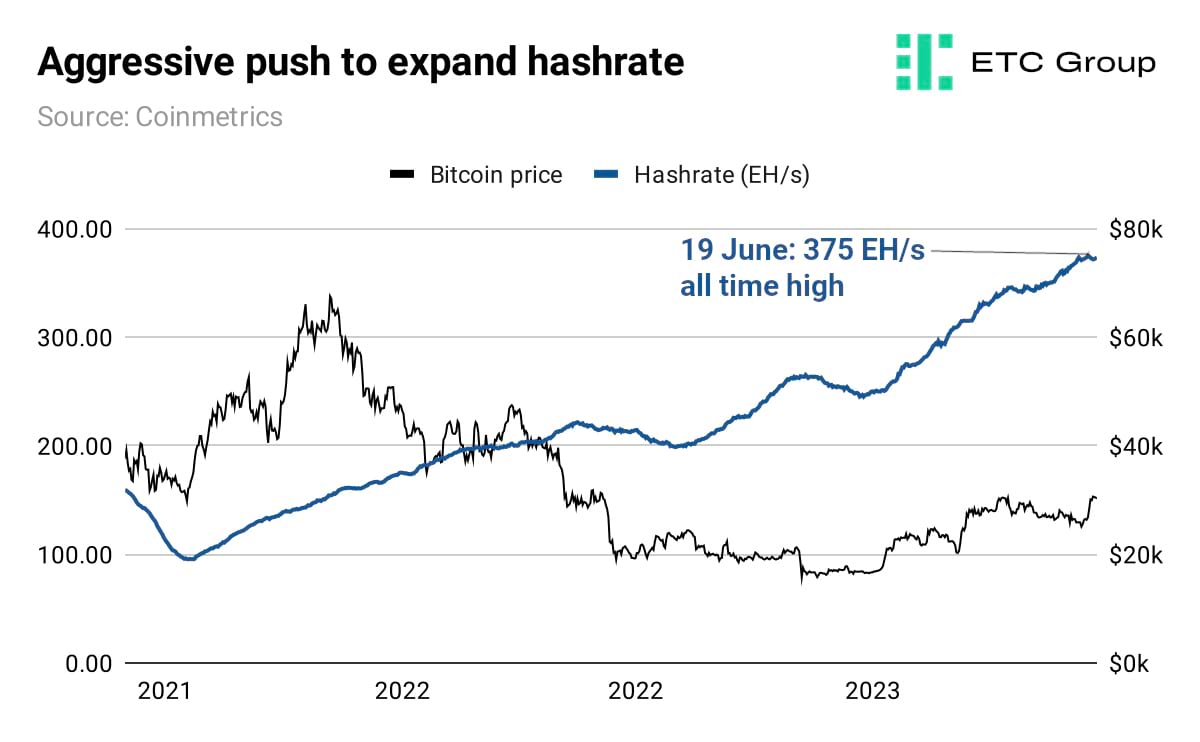

Despite the brutal 2022 bear market, and the Bitcoin halving now only 300 days away, miners have persevered with increasing aggression in their pursuit of more hashrate.

As of 27 June the 30-day moving average of global computing power directed at mining Bitcoin had settled at 373.3 exa-hash per second (EH/s), less than 2 EH/s below its 19 June all time high.

Between BlackRock, HSBC (which launched Bitcoin and Ethereum ETFs for sale in Hong Kong via its app this week), Germany's banking giant Deutsche Bank filing for a digital asset licence to be a crypto custodian and the 20 June launch of the Fidelity/Citadel/Charles Schwab-backed EDX Markets exchange there are approximately $25 trillion in assets under management that will be eligible to buy Bitcoin in the near future.

This increases the number of competing groups and entities that are moving to either initiate or improve their Bitcoin holdings.

This makes the second half of 2023 an opportunity for savvy investors to accumulate as multiple catalysing factors for Bitcoin price appreciation start to coalesce.

More than 44% of the total Bitcoin supply has not moved in two years, Coinmetrics data shows. This means that those holders who bought before the run up to Bitcoin's all time high of $67k in November 2021 have held on all the way through to the bear market low of $15.5k and back up to where we sit now at around $30k. The implication is that these holders will hold out for a price point beyond $70k before they would even consider selling.

With the 2024 Bitcoin halving less than a year away, and long-term holders gripping tightly to their accumulated stockpiles, this growing narrative that there are ever fewer coins available for sale is likely to strengthen.

Research suggests Bitcoin mining is one of world's cleanest industries

Research by independent analyst Daniel Batten suggests that the much-maligned Bitcoin mining industry is in fact, one of the world's cleanest when it comes to its share of renewable energy. Bitcoin mining has been roundly criticised for its energy intensiveness and misleading headlines that the industry uses more electricity than some countries.

Climate activist group Greenpeace notably called on financial institutions to support a wholesale change in the cryptocurrency's Proof of Work mining algorithm to the newer Proof of Stake model. But even the artist commissioned to support this ‘change the code' campaign has admitted after further research that he was mistaken.

In September 2022, the White House Office of Science and Technology called on the US to investigate the extent of Bitcoin mining's environmental impact. The report went on to stress that if the Bitcoin mining sector cannot reduce its carbon footprint, action must be taken to set a hard cap on activity or eliminate it altogether.

But mining emissions have been shrinking over the years and are now at their lowest ever level.

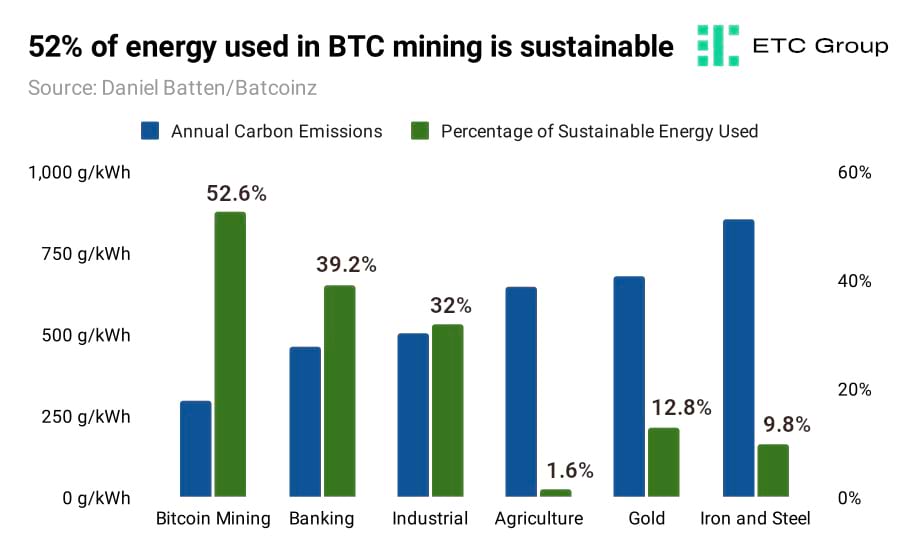

A report by ESG analyst Daniel Batten and Bitcoin mining monitor Batcoinz found Bitcoin emissions were cut in half between 2019 and 2023: from roughly 600 g/kWh to 296 g/kWh.

More than 50% of the Bitcoin network is powered by sustainable energy with the mining industry's energy, mix now cleaner than a range of sectors.

The iron and steel sector's heavy dependence on fossil fuels means that only 10% of its energy is considered green. The figure for the gold extraction and refining industry sits at 13%.

Bitcoin mining also produces 36% fewer carbon emissions than the sector it was designed to challenge: banking. Electricity used to power ATMs, physical bank branches and office buildings means that the banking sector releases 464 g/kWh of carbon into the environment annually.

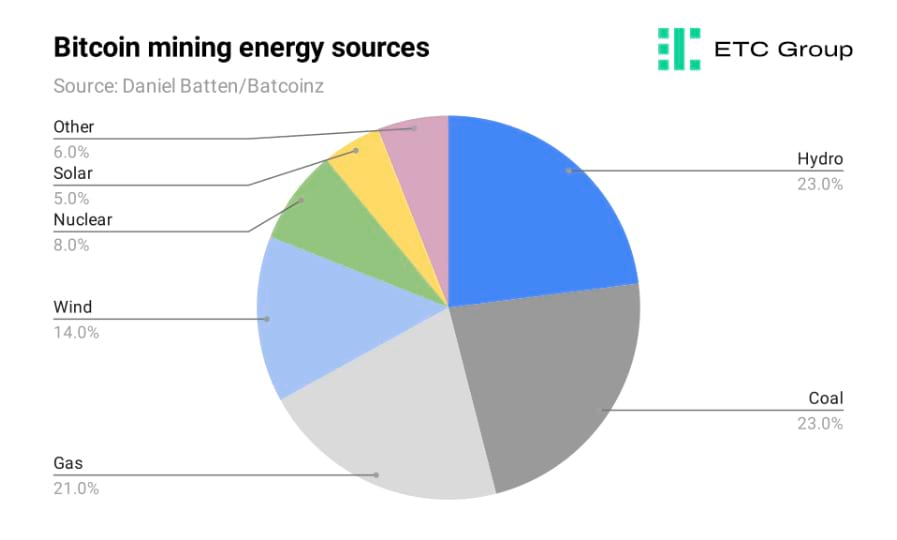

The strongest contributor to Bitcoin mining's diverse energy mix is hydropower, that is used for 23% of the sector's activities. This is followed by wind, nuclear, solar, and trace amounts of geothermal energy.

Pollutants like natural gas and coal still comprise 44% of demands. But fossil fuels make up less and less of Bitcoin mining energy consumption every year, with efforts underway by some of the largest mining companies to go net-zero.

Miners like Marathon Digital, Riot, and Hive Blockchain have all made partial or complete transitions to carbon neutrality over the past few years by using renewable energy sources and carbon offsets.

Britain's only listed Bitcoin miner, Argo Blockchain, also has a facility near Lubbock, Texas that is powered mostly by wind and solar energy.

Many institutional investors are also shifting their attention to renewable Bitcoin mining in Latin America in light of the abundant natural resources the continent has to offer, accommodating regulatory regimes and diminishing opportunities in the oversaturated North American mining market.

Tether, the issuer of the world's largest stablecoin USDT, announced plans to invest in sustainable Bitcoin mining facilities in Uruguay in May. More than 90% of electricity generation in the nation comes from wind farms, solar parks, and hydropower plants, making it an optimal site to set up sustainable Bitcoin mining farms.

The point to be made is that, because of the transparency of the Bitcoin blockchain, researchers can tell with a degree of confidence exactly how much renewable energy is being used.

This is not the case with, say, gold mining or iron and steel, which rely on self-reported statistics. Continued progress may mean that the maintenance of security and integrity on the Bitcoin network could shift to complete reliance on sustainable sources of energy in the coming decade.

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.