- Bitcoin exchange inflows related to Grayscale have become a significant force in the market

- As simple rule-of-thumb, for every -600 mn USD (~15k BTC) outflows from GBTC, you should expect around -1%-point drawdown in the price of Bitcoin

- We think that this level of outflows will be hard to sustain which is why we rather expect this risk to be a short-term phenomenon

The Big Shift

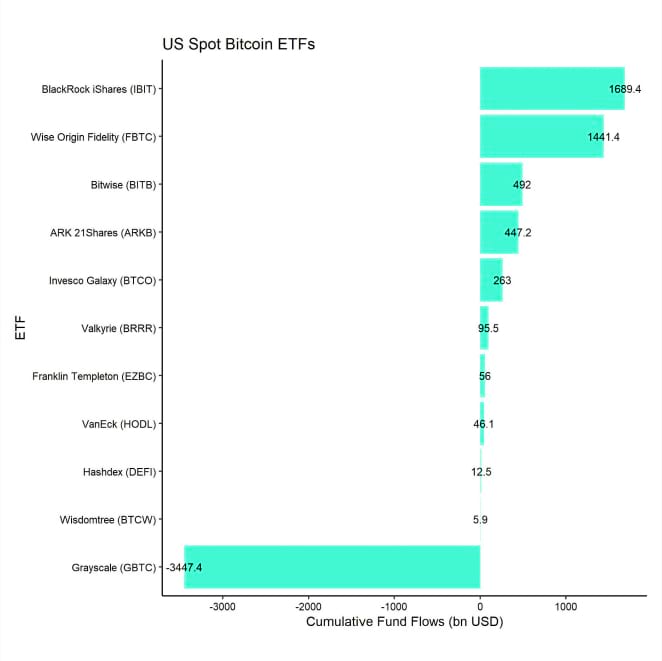

With the launch of the US spot Bitcoin ETFs on the 11 th of January we already saw clear patterns in terms of ETF fund flows.

One of these patterns was that funds flew out of Grayscale's flagship Grayscale Bitcoin Trust (GBTC) into new spot ETFs such as the iShares Bitcoin Trust (IBIT) and Wise Origin Fidelity Bitcoin Trust (FBTC). A certain amount of outflows was to be expected as other new US ETF issuers entered the market with aggressive (probably unsustainably-low) fees relative to GBTC.

At the time of writing, we saw net outflows of -3.45 bn USD from GBTC while other spot Bitcoin ETFs saw net inflows of +4.55 bn USD. So, GBTC's selling should have theoretically been absorbed by other ETF issuers.

Nonetheless, many market participants have seen GBTC's selling as a downside catalyst so far. We looked at Grayscale's fund flows and resulting on-chain transactions in order to shed more light on the question:

What impact is Grayscale's GBTC outflows having on the price of Bitcoin?

Follow the Money

The beauty of blockchains like Bitcoin is that it allows for unparalleled transparency in terms of money flows. Although wallets are semi-anonymous, many data providers have already tagged addresses so that it is able to attribute wallet address to specific entities and follow transactions in real-time.

Grayscale's GBTC uses Coinbase as a custodian and primarily Coinbase Prime as its trading desk for on-chain transactions. Authorized Participants (AP) in the US also tend to use Coinbase exchange as their main trading venue for trading the underlying bitcoins.

As far as fund outflows (share redemptions) are concerned, the process is usually as follows:

Cash Redemption Process

- Request by Authorized Participants:

When an AP wants to redeem ETF shares, they request a redemption from the ETF issuer, usually in multiples of a creation unit.

- Handover of ETF Shares:

The AP returns the ETF shares to the issuer.

- Sale of Bitcoins for Cash by ETF issuer:

After receiving the ETF shares, the ETF issuer sells Bitcoins via its prime broker such as Coinbase Prime in the open market, depending on their cash reserves. Bitcoin's will be sold from Grayscale wallets to its Prime Broker to liquidate Bitcoins in exchange for Cash. The prime broker usually sells these Bitcoins on centralized exchanges like Coinbase itself.

- Delivery of Cash from the Custodian:

In exchange for the returned shares, the AP receives an amount of Cash equivalent to the current value of those shares. The value of those shares is referenced to an underlying Bitcoin reference price that is determined at 4 pm NY and is linked to a volume-weighted average price of Bitcoin across several major crypto exchanges. This Cash is delivered from the custodian to the ETF issuer and from the ETF issuer to the AP.

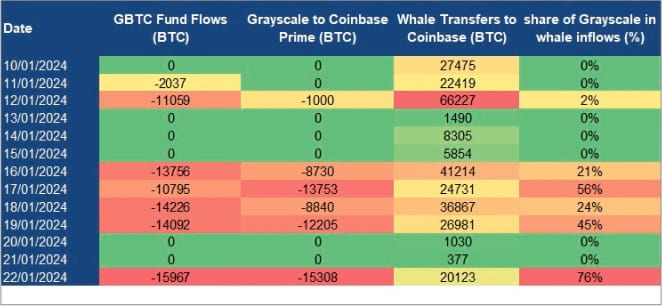

Let's have a look at Grayscale's GBTC net fund flows and the associated on-chain transactions for more context.

At the time of writing, Grayscale's GBTC experienced a cumulative net outflow of -3.45 bn USD (-81.9k BTC) since the ETF trading launch on 11 th of January 2024 according to data provided by Bloomberg.

In contrast, Grayscale has so far sent around -59.8k BTC to Coinbase Prime Bitcoin wallets according to data provided by Arkham Intelligence.

Moreover, Glassnode data show that overall BTC (whale) exchange inflows into Coinbase amounted to 283.1k BTC during that same time period. The share of GBTC's transfers to Coinbase Prime ranged from 2% to 76% of total whale exchange inflows into Coinbase.

It is important to note that Grayscale's transfers to Coinbase Prime's trading desk do not have to show up 1-to-1 in Coinbase exchange inflows. The reason is that Coinbase Prime may decide to trade these newly acquired Bitcoin over-the-counter (OTC) with other counterparties without forwarding these coins to Coinbase exchange. So, there is some friction there.

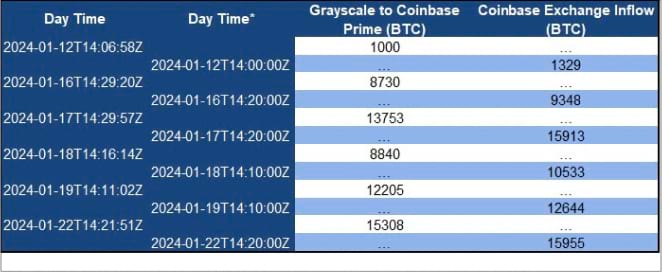

Grayscale's transactions show the ‘habit' of sending over bitcoins to Coinbase Prime just minutes (sometimes only seconds) before the US market open. This tends to be the time of day when APs are also looking for bitcoins to hedge their positions. It is quite possible that Coinbase is trading many of these newly-acquired Bitcoins with APs OTC directly.

That being said, we have been observing significant exchange inflows into Coinbase that coincided with transfers from Grayscale's wallets to Coinbase Prime. So, it seems as if Coinbase Prime is in fact redirecting the majority of these transfers to its exchange.

Here's an overview of those flows by time of day:

The table above shows that Grayscale's transfers to Coinbase Prime wallets tends to coincide with similar inflows to Coinbase exchange in the same 10-minute interval. Hence, we conclude that Grayscale's transfers to Coinbase Prime are almost immediately forwarded to the exchange.

The key takeaway is that the impact of Grayscale's distribution on overall Coinbase exchange inflows is becoming clearly visible. It is quite likely that this will continue to exert some downside pressure on prices via increased exchange inflows in the short-term.

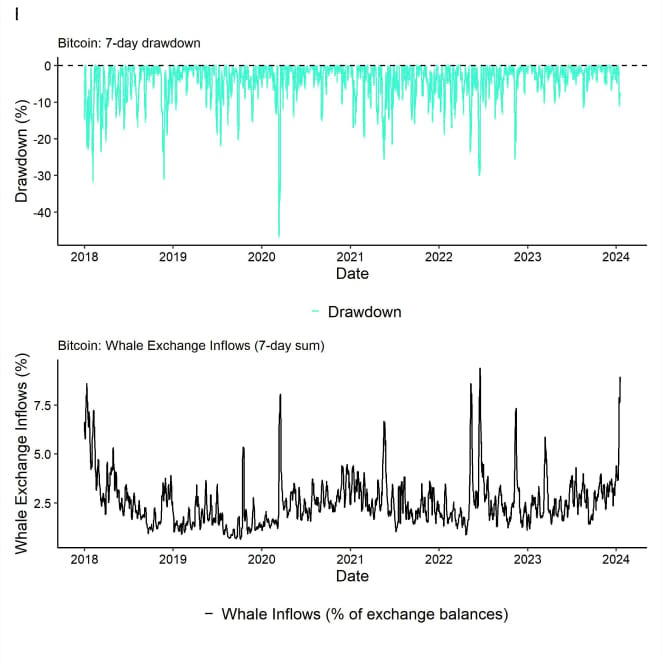

In fact, with the launch of the ETF trading on the 11 th of January 2024 we have seen a significant pick-up in whale exchange inflows with the majority of these happening on Coinbase. Whales are defined as network entities (cluster of addresses) that hold at least 1,000 BTC which is certainly true for Grayscale's Bitcoin Trust with holdings of approximately 553.8k BTC as per the latest data provided by Glassnode.

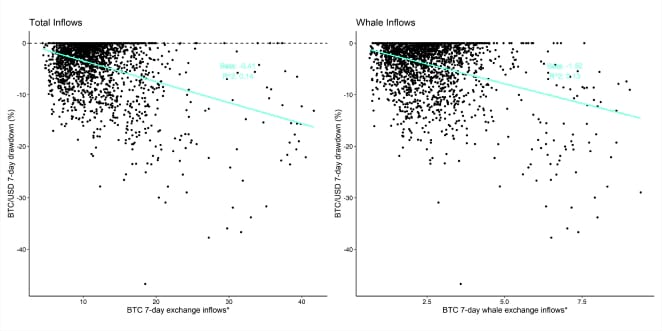

The reason why that is relevant is the fact that Bitcoin has been highly sensitive to exchange inflows in general and whale exchange inflows in particular.

More specifically, we estimate that a 1% exchange inflow in terms of aggregate exchange balances has been associated with a -0.41% drawdown over a 7-day period. In this context, Bitcoin seems to be more sensitive to whale exchange inflows with an average sensitivity of -1.52% drawdown for 1% in whale exchange inflows.

As simple rule-of-thumb, for every 600 mn USD (~15k BTC) outflows from GBTC, you should expect around -1%-point drawdown in the price of Bitcoin.

On a positive note, this level of outflows will be hard to sustain since, at this run rate, GBTC “would run out of bitcoins” within 37 days which we think is rather unlikely. So, this will rather be a short-term phenomenon.

Bottom Line

- Bitcoin exchange inflows related to Grayscale have become a significant force in the market

- As simple rule-of-thumb, for every -600 mn USD (~15k BTC) outflows from GBTC, you should expect around -1%-point drawdown in the price of Bitcoin

- We think that this level of outflows will be hard to sustain which is why we rather expect this risk to be a short-term phenomenon

Copyright © 2024 ETC Group. All rights reserved